Table of Contents

- 12+ Tax Return Questionnaire Templates in PDF | MS Word

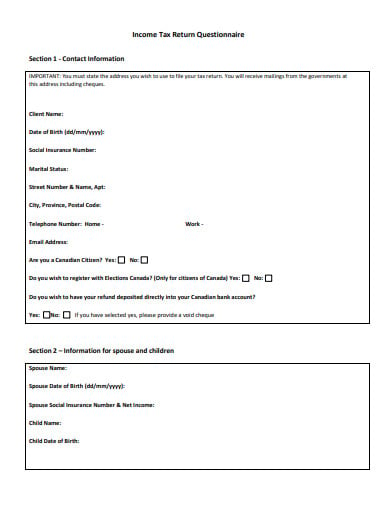

- 1. Tax Return Questionnaire in PDF

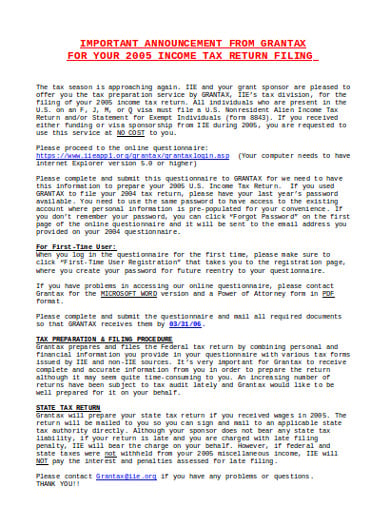

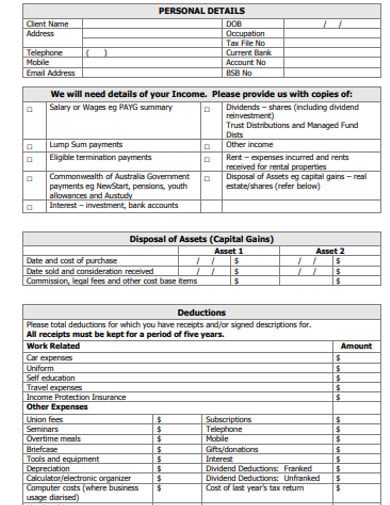

- 2. Personal Income Tax Return Questionnaire

- 3. Paying Taxes Return Questionnaire Template

- 4. Business Tax Return Questionnaire

- 5. Sample Tax Return Questionnaire Template

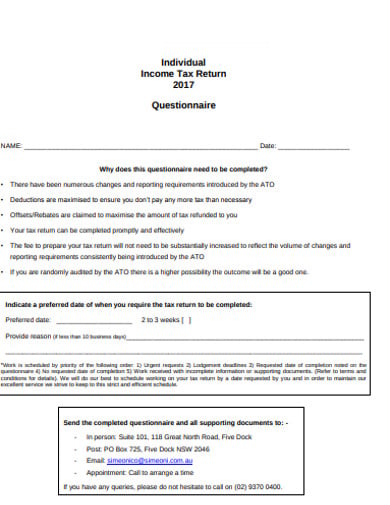

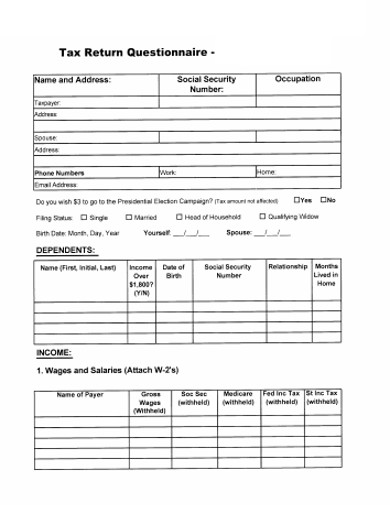

- 6. Individual Tax Return Questionnaire

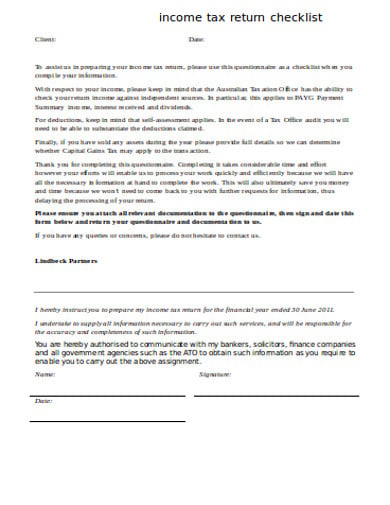

- 7. Basic Income Tax Return Questionnaire

- 8. Confirming Tax Return Questionniare

- 9. Information Tax Return Questionnaire

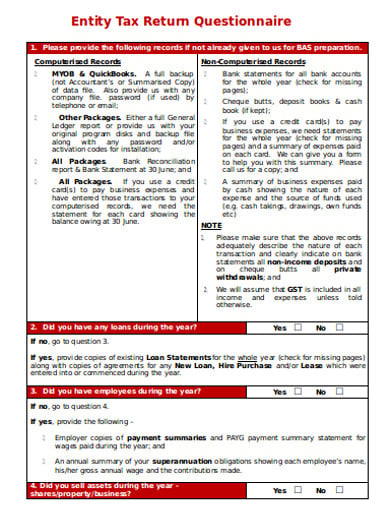

- 10. Entity Tax Return Questionnaire Template

- 11. Self Assessment Tax Return Questionnaire

- 12. Tax Organizer Return Questionnaire Template

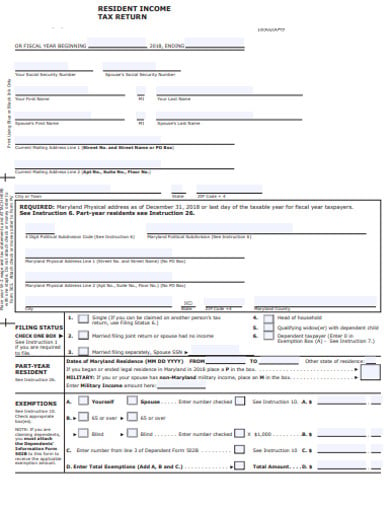

- 13. Resident Tax Return Questionniare Template

- What do you determine by Tax Return?

- Why do you get a Tax Refund?

- What is Income Tax Return in plain words?

- What is the Income Tax utilized for?

- What is the contrast between Income Tax and an Income Tax Return?

- What is the Submission Mode in an Income Tax Return?

- What is Tax Money known as?

12+ Tax Return Questionnaire Templates in PDF | MS Word

By finishing the tax return questionnaire you can giving details to your dedicated accountant to permit them to make your personal tax return. It is also known as a self-assessment tax return. All you need to do is complete each segment of the questionnaire by verifying your personal income details. Have a look at the tax return questionnaire templates provided down below and choose the one that best fits your purpose.

12+ Tax Return Questionnaire Templates in PDF | MS Word

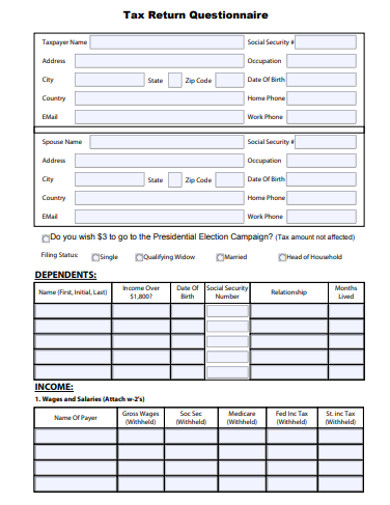

1. Tax Return Questionnaire in PDF

americansincometaxservice.com

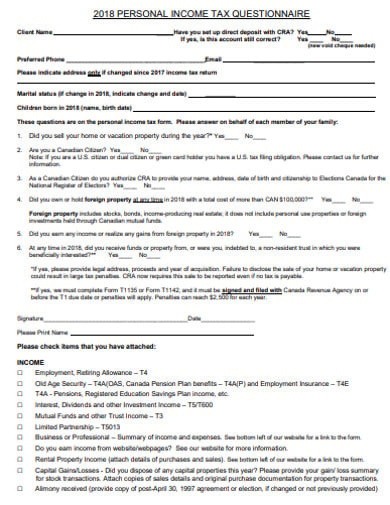

americansincometaxservice.com2. Personal Income Tax Return Questionnaire

rstaccountants.ca

rstaccountants.ca3. Paying Taxes Return Questionnaire Template

doingbusiness.org

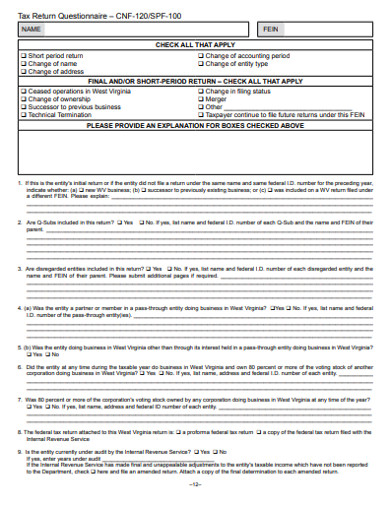

doingbusiness.org4. Business Tax Return Questionnaire

tax.wv.gov

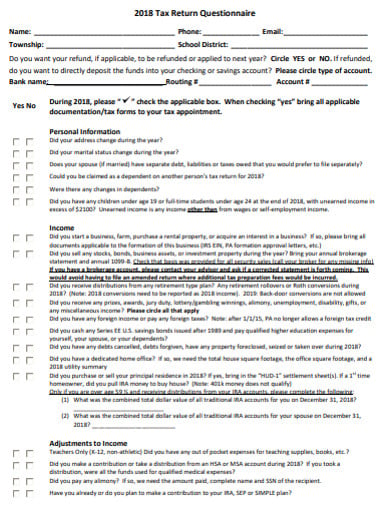

tax.wv.gov5. Sample Tax Return Questionnaire Template

mrcpa.net

mrcpa.net6. Individual Tax Return Questionnaire

simeoni.com

simeoni.com7. Basic Income Tax Return Questionnaire

dlc.library.columbia.edu

dlc.library.columbia.edu8. Confirming Tax Return Questionniare

lindbeckpartners.com

lindbeckpartners.com9. Information Tax Return Questionnaire

politaxpro.com

politaxpro.com10. Entity Tax Return Questionnaire Template

bsapartnership.com

bsapartnership.com11. Self Assessment Tax Return Questionnaire

lifestrategies.net

lifestrategies.net12. Tax Organizer Return Questionnaire Template

myersaccountingandtax.com

myersaccountingandtax.com13. Resident Tax Return Questionniare Template

forms.marylandtaxes.gov

forms.marylandtaxes.govWhat do you determine by Tax Return?

A form filed with a taxing authority that states income, expenses, and other relevant tax details or data is referred to as a tax return. Tax returns permit taxpayers to assess their tax liability, schedule tax payments, or request reimbursements for the overpayment of taxes.

Why do you get a Tax Refund?

Taxpayers can frequently get a tax refund on their income tax if the tax they owe is less than the total of the cumulative amount of the withholding taxes and expected taxes that they paid, along with the refundable tax credits that they require. Tax refunds are usually paid after the completion of the tax year.

What is Income Tax Return in plain words?

The law says that tax returns should be filed every year for a person or company that acquired income during the year, whether through regular income or earnings, shares, interest, capital gains or other causes.