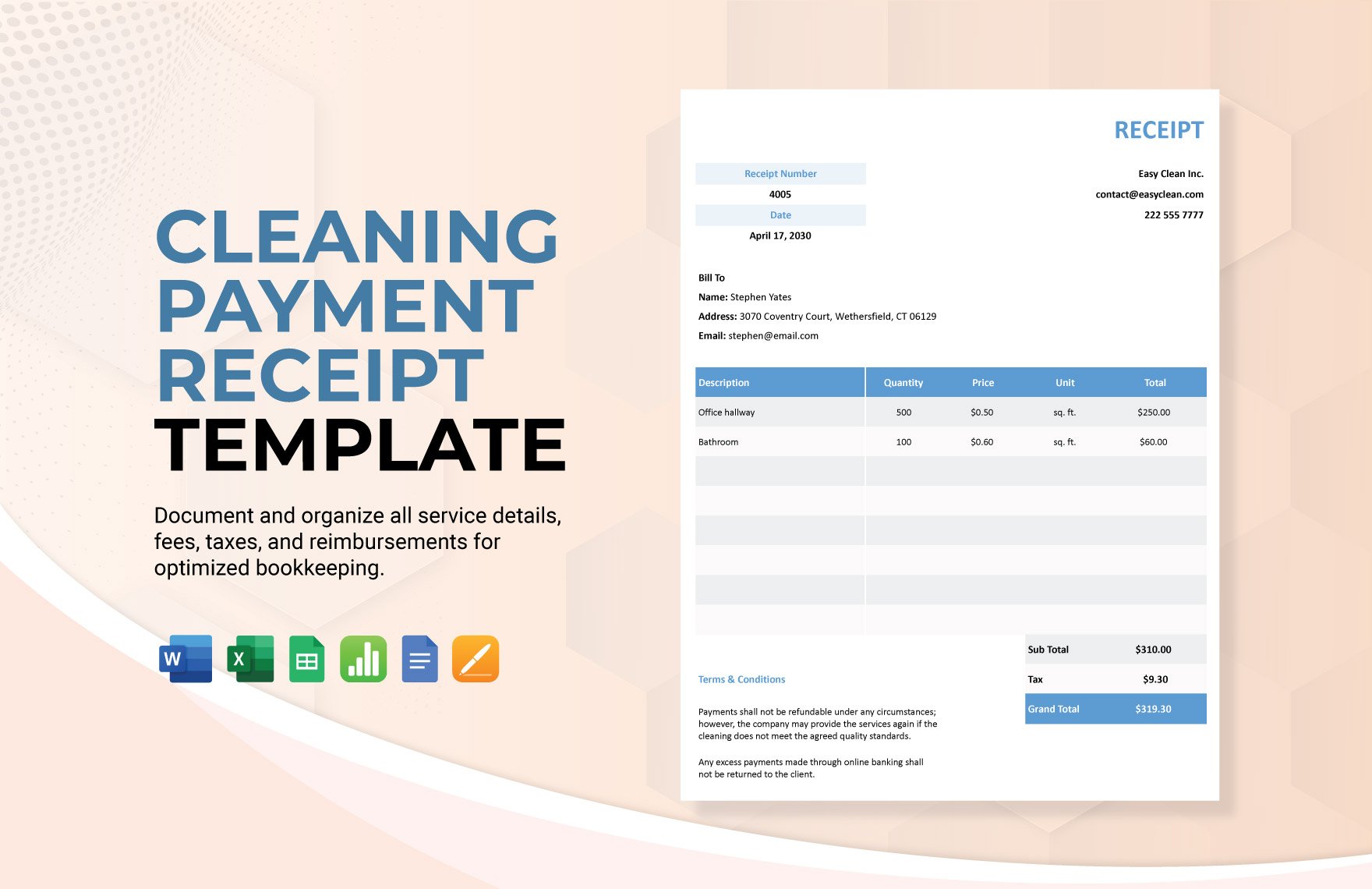

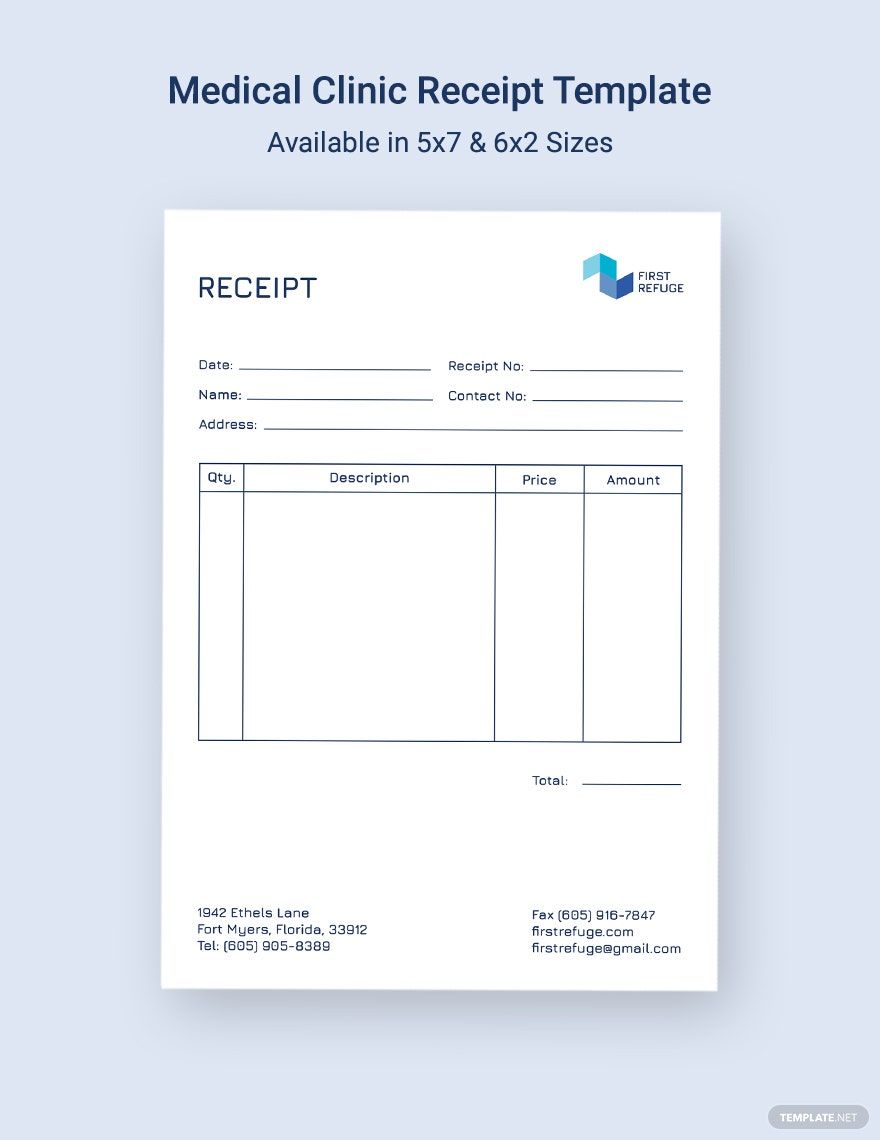

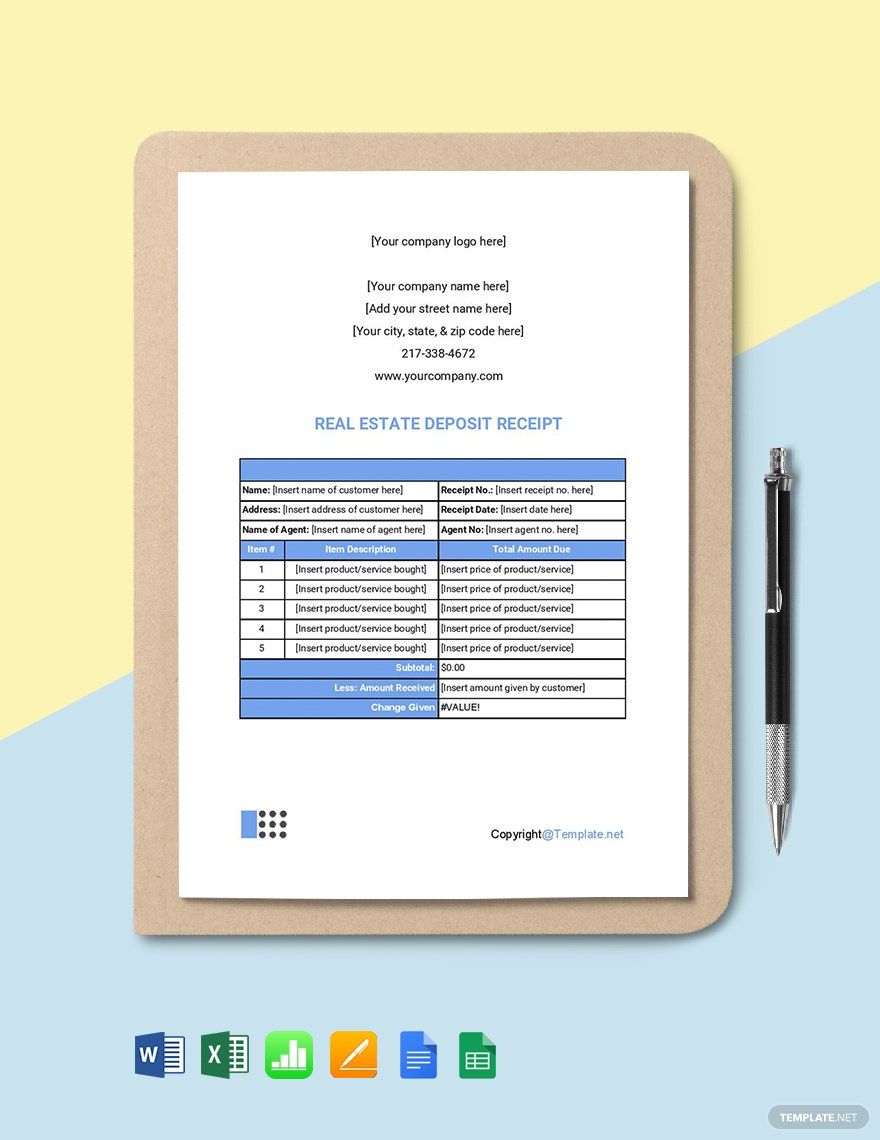

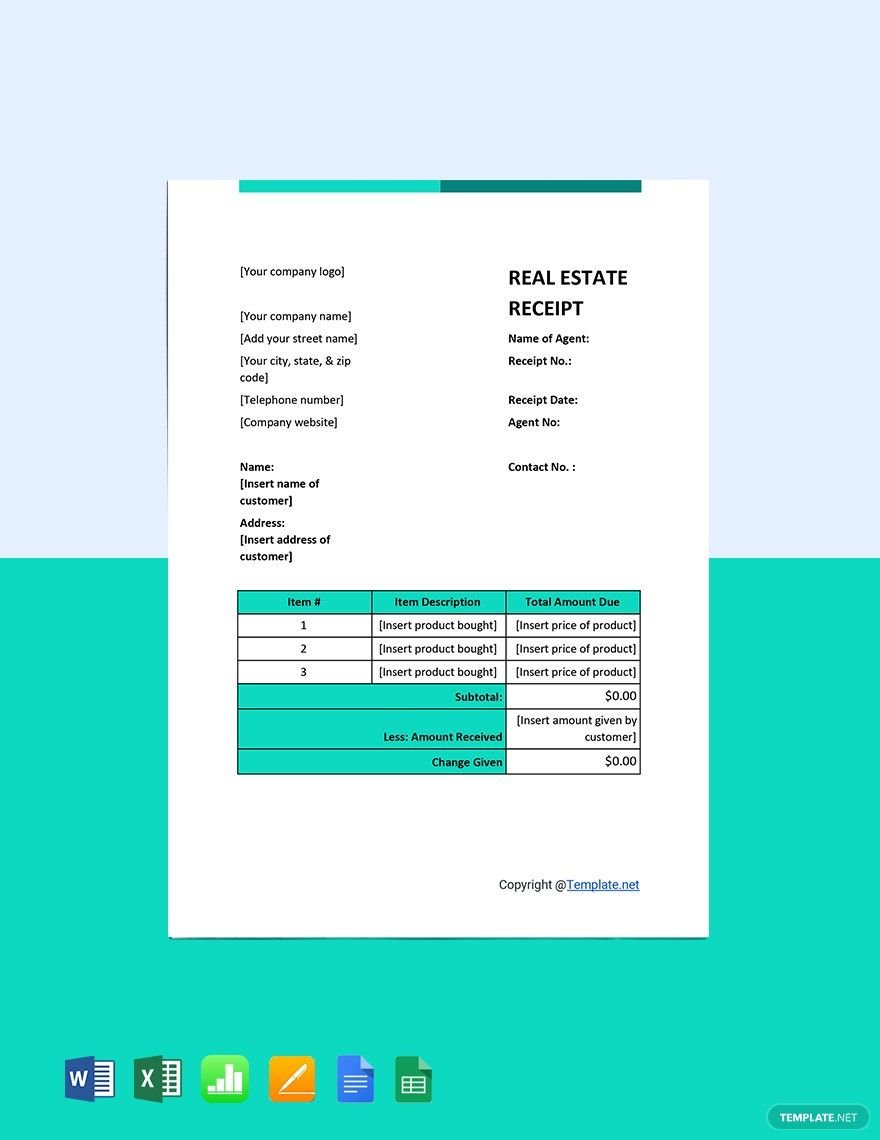

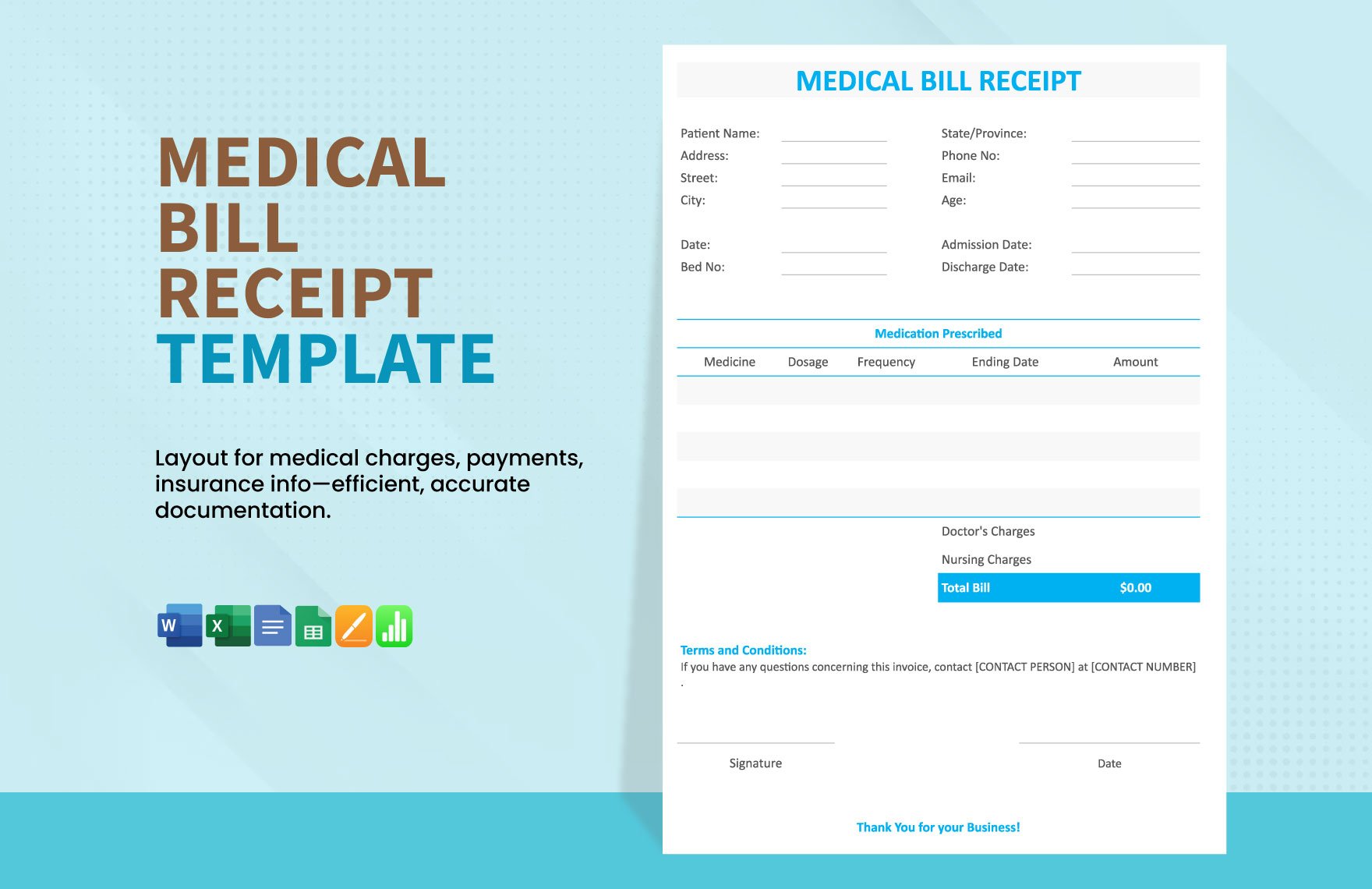

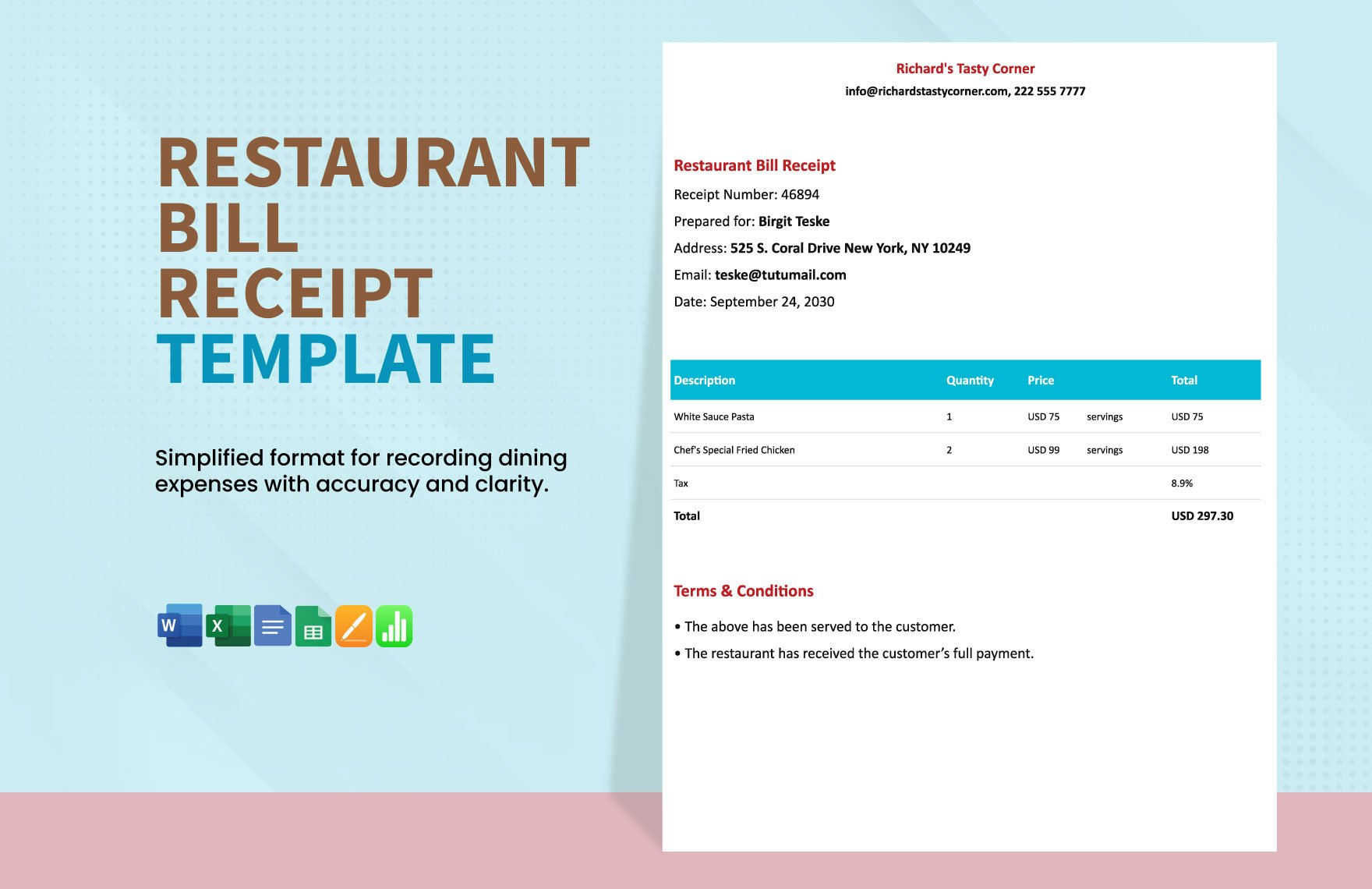

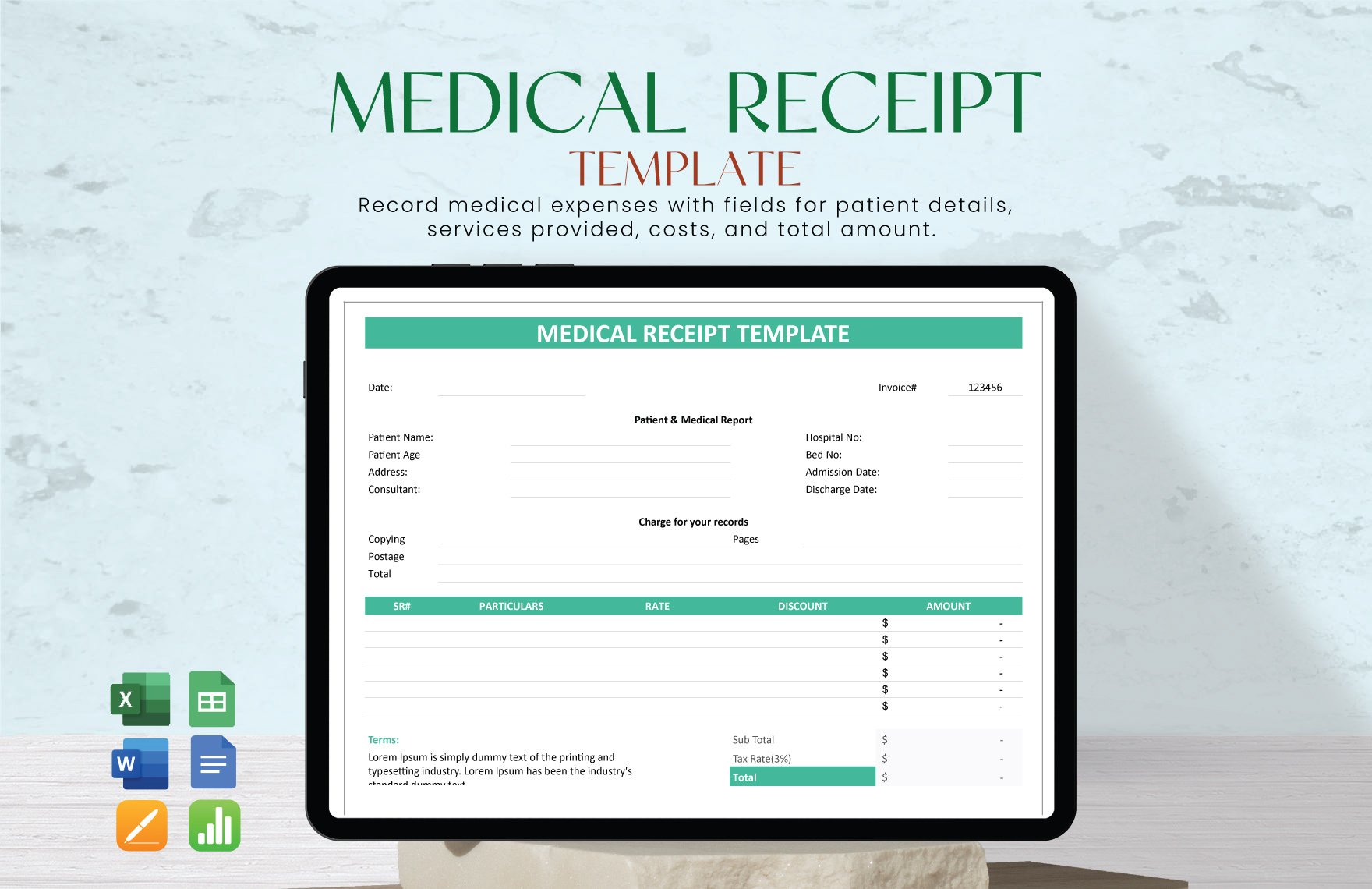

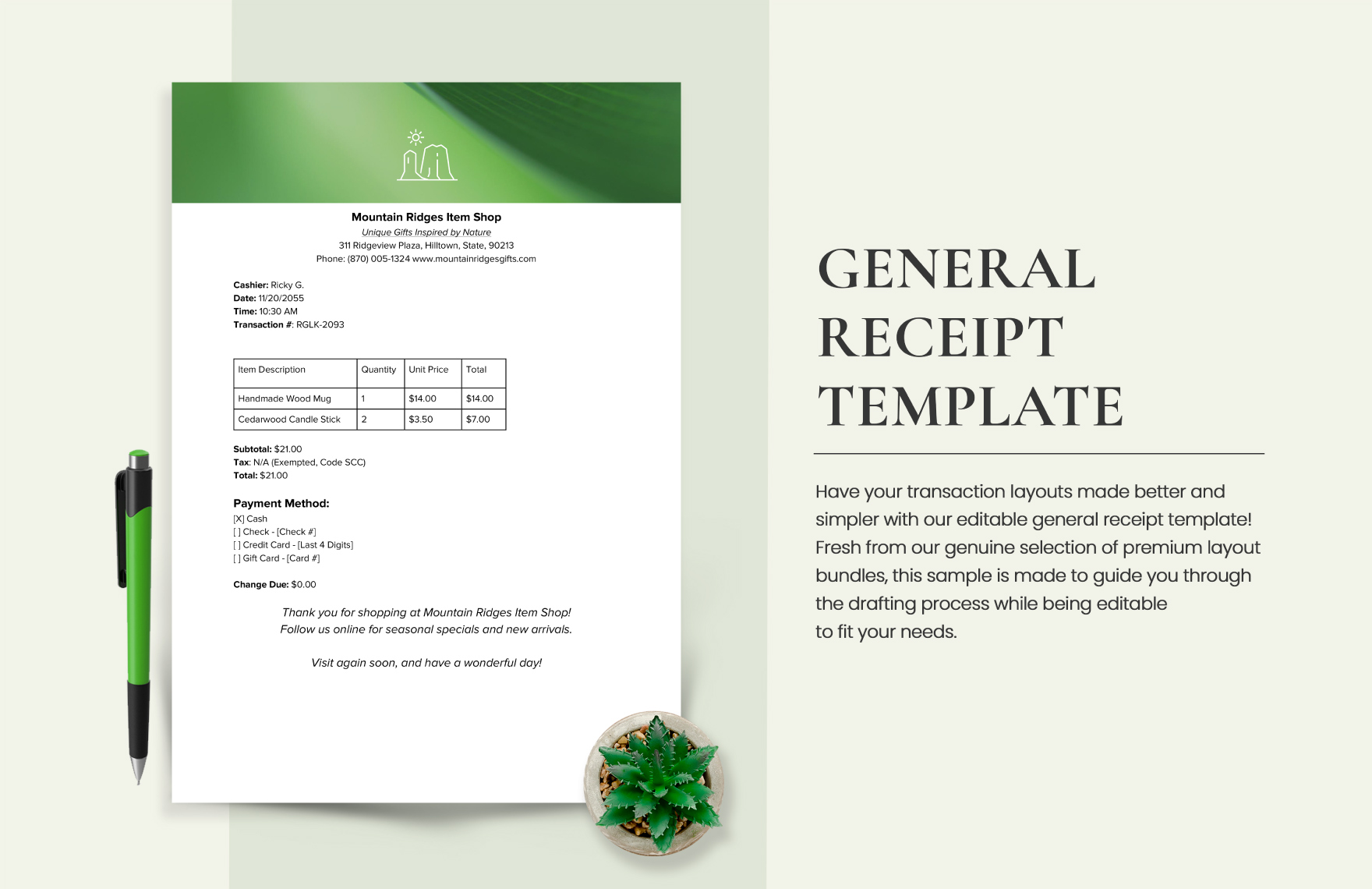

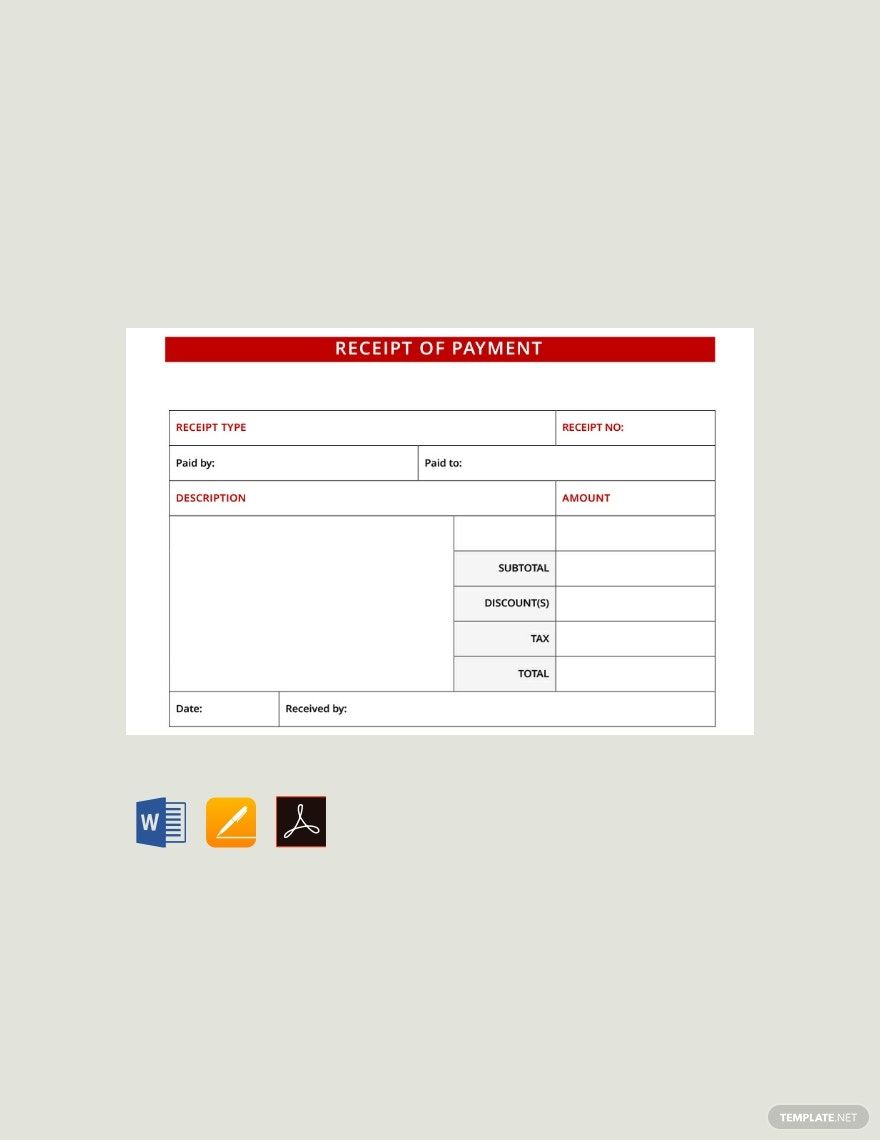

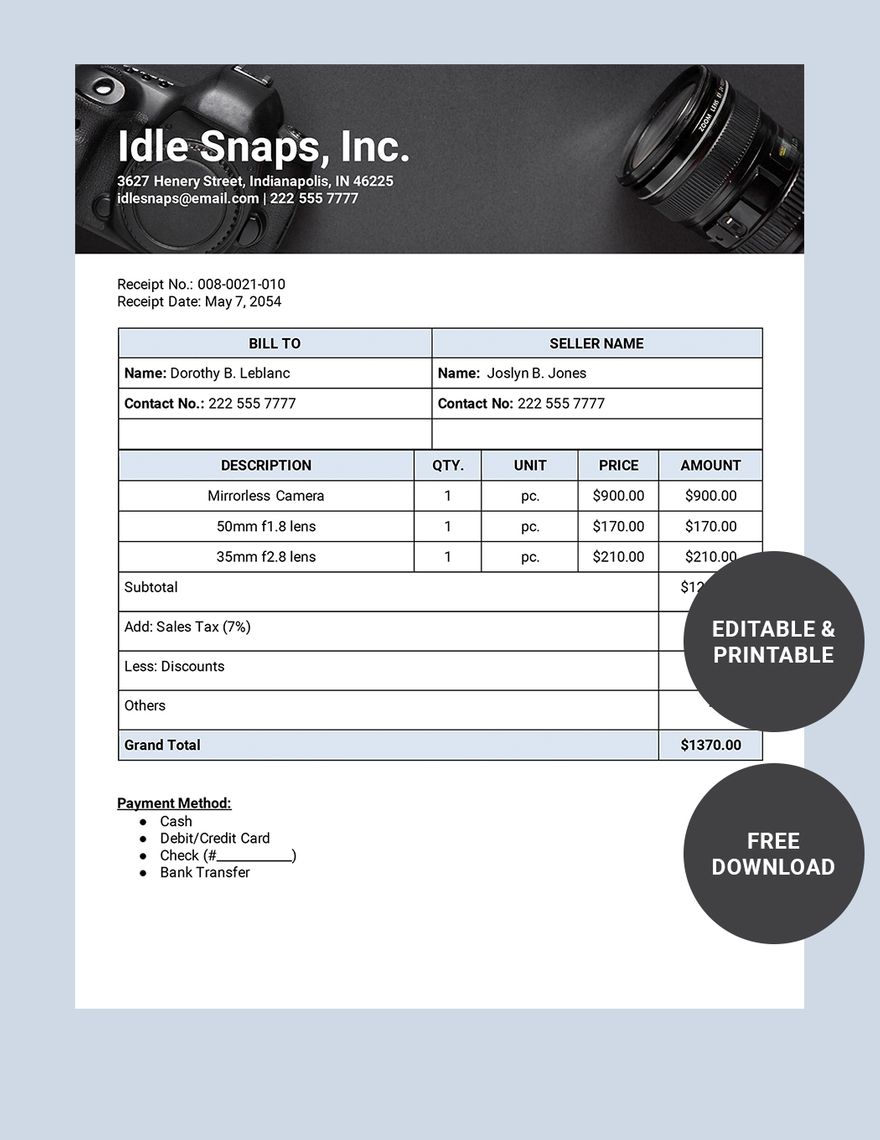

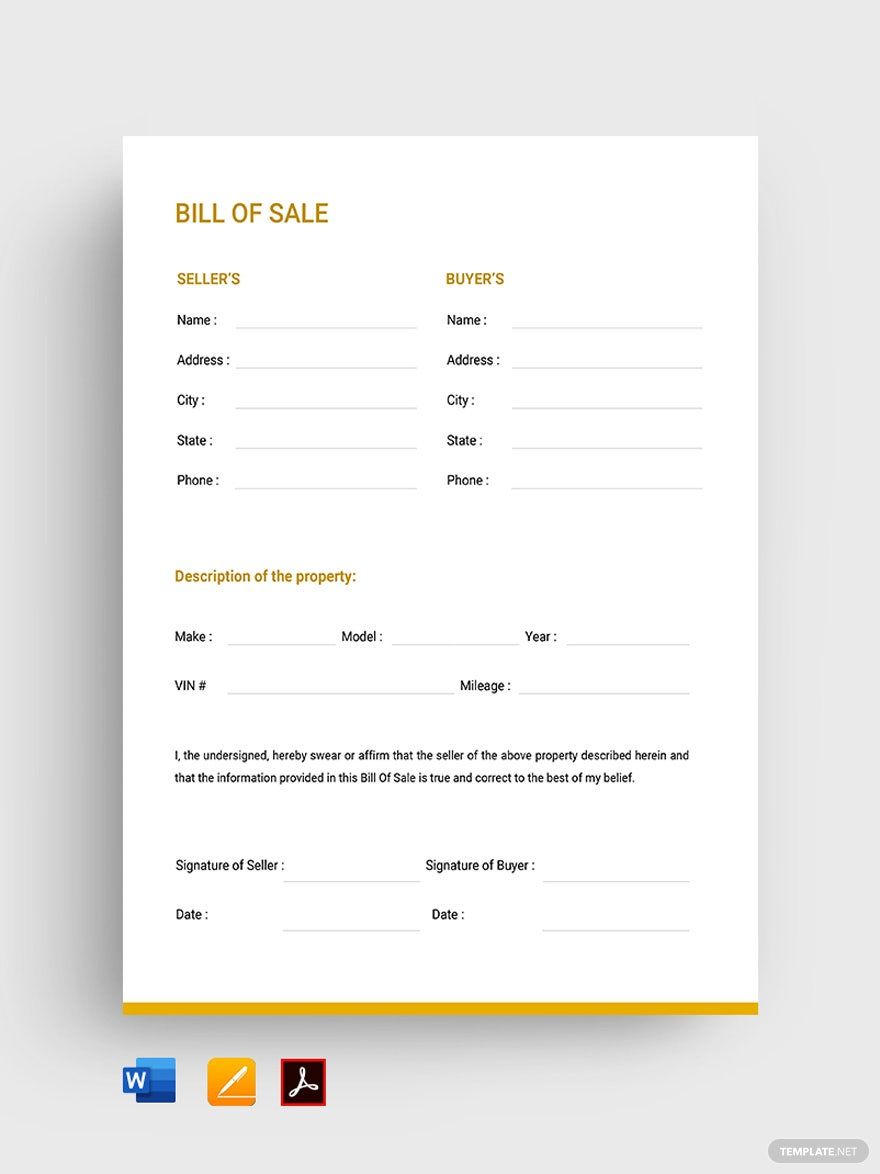

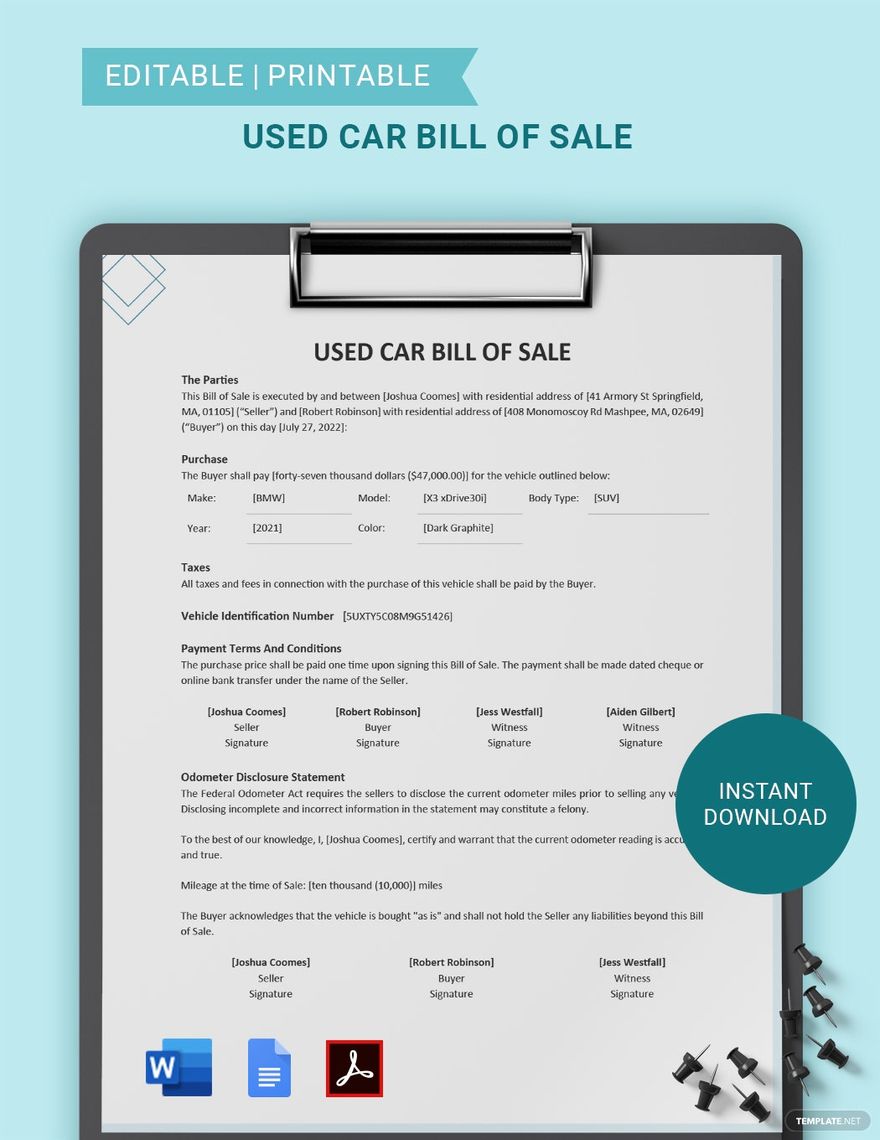

Make Your Billing Process More Efficient with Bill Receipt Templates from Template.net

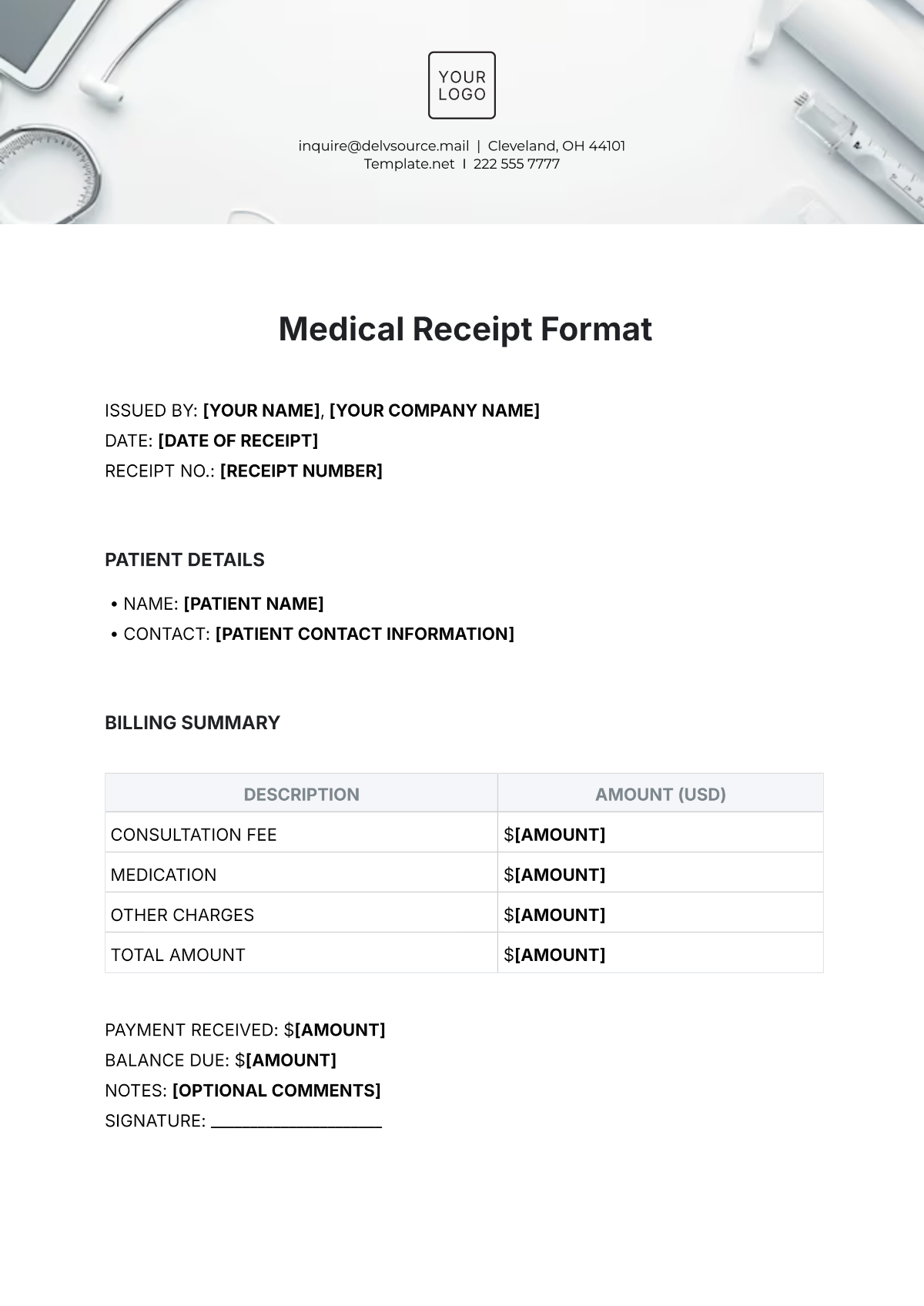

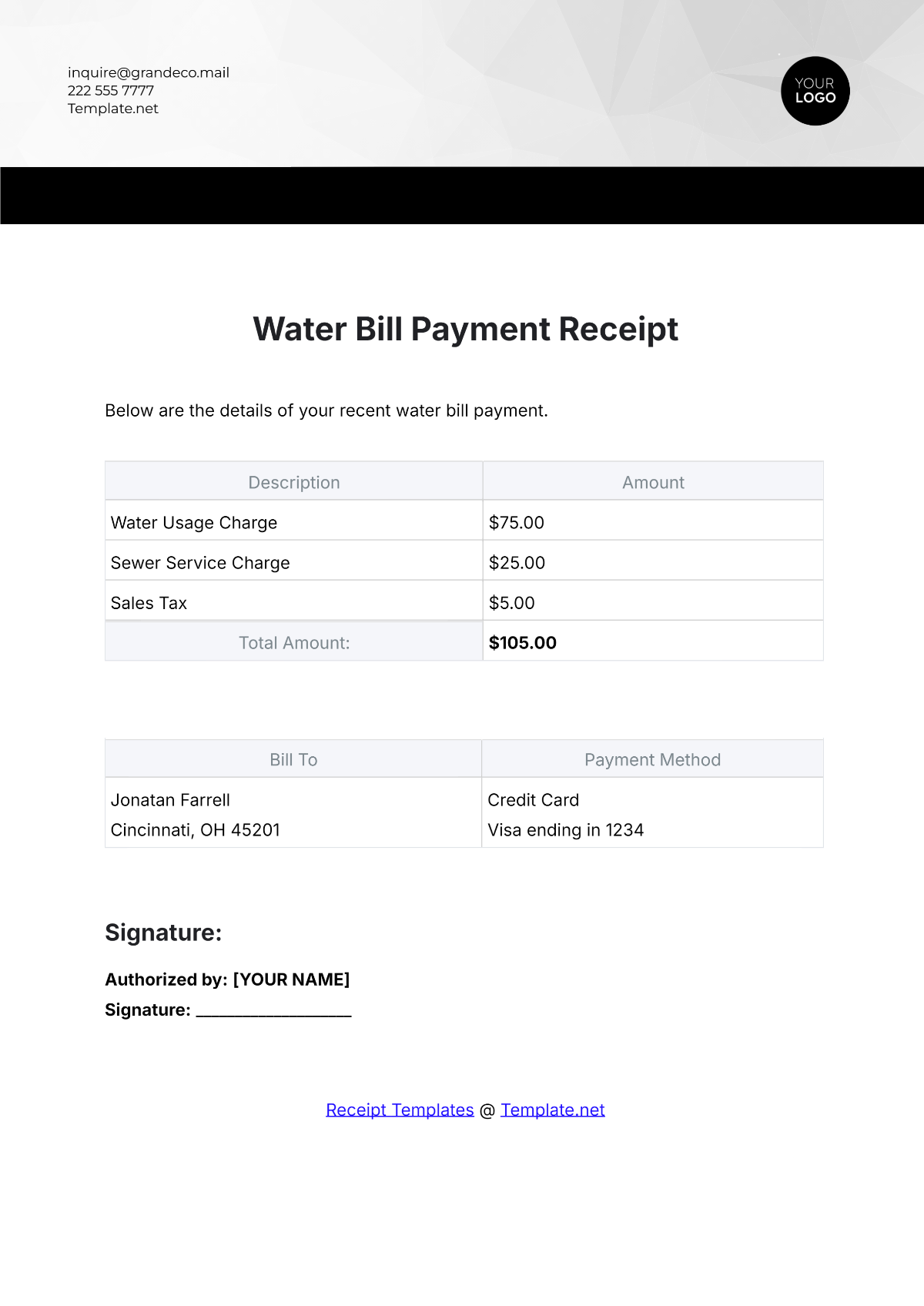

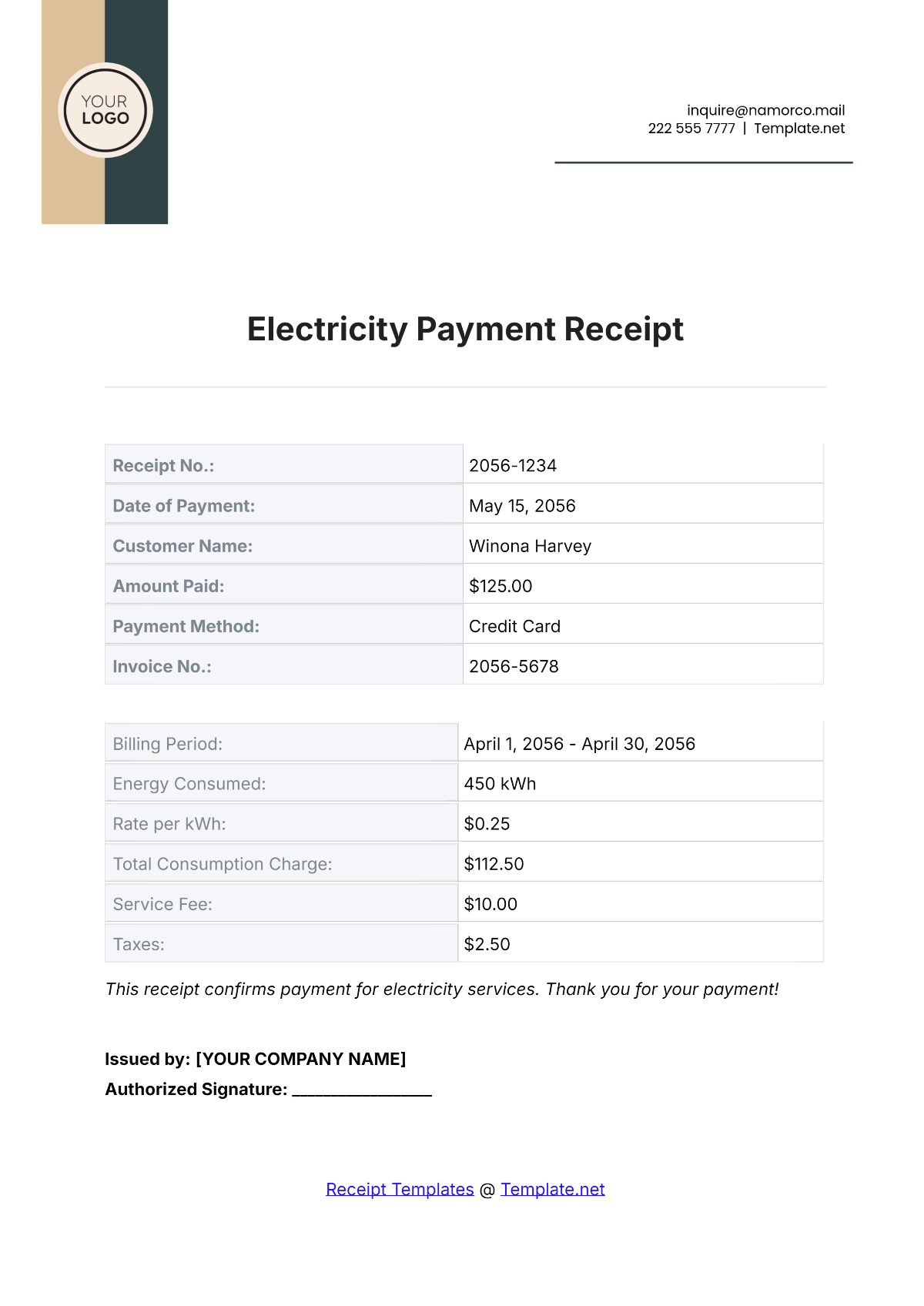

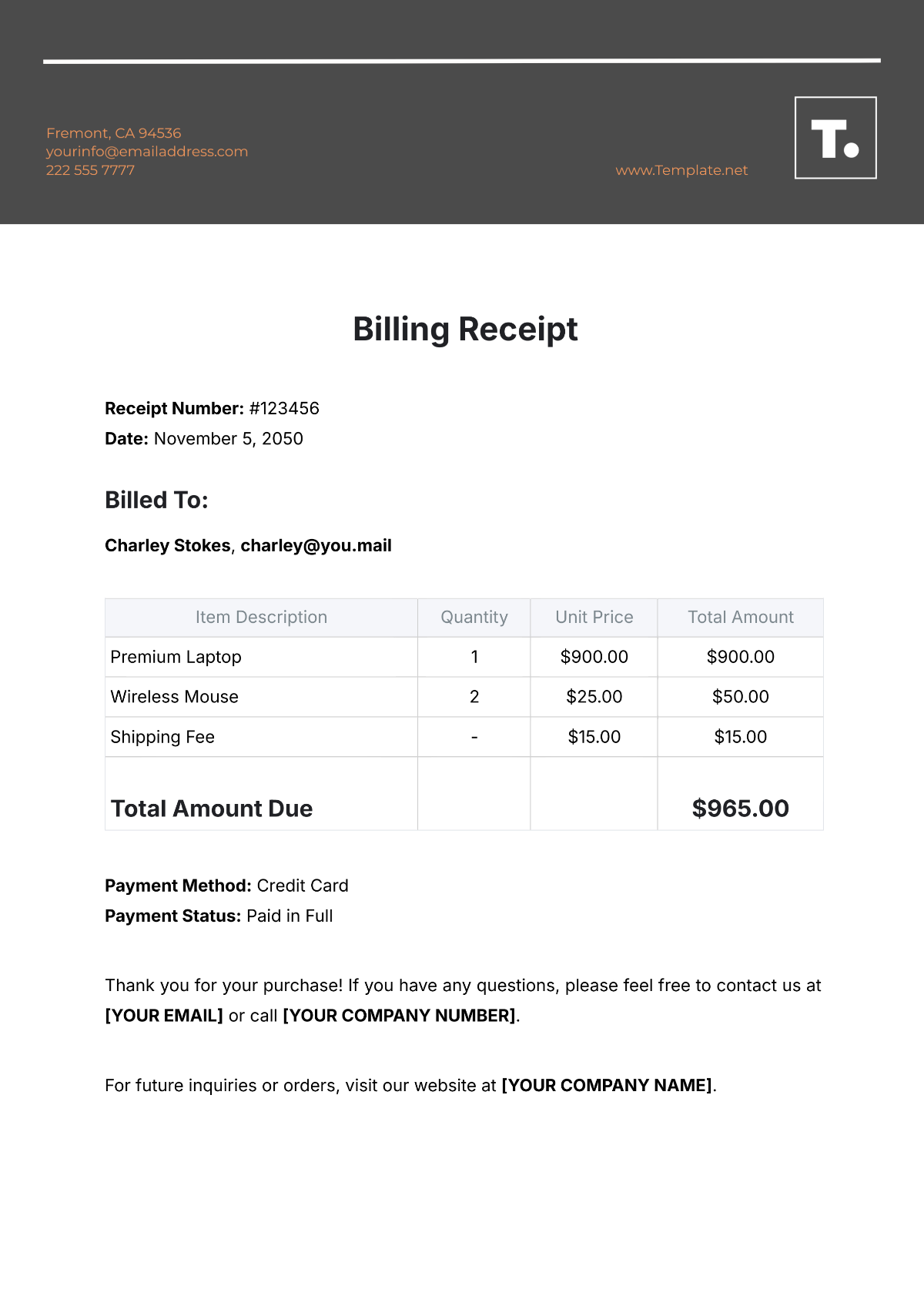

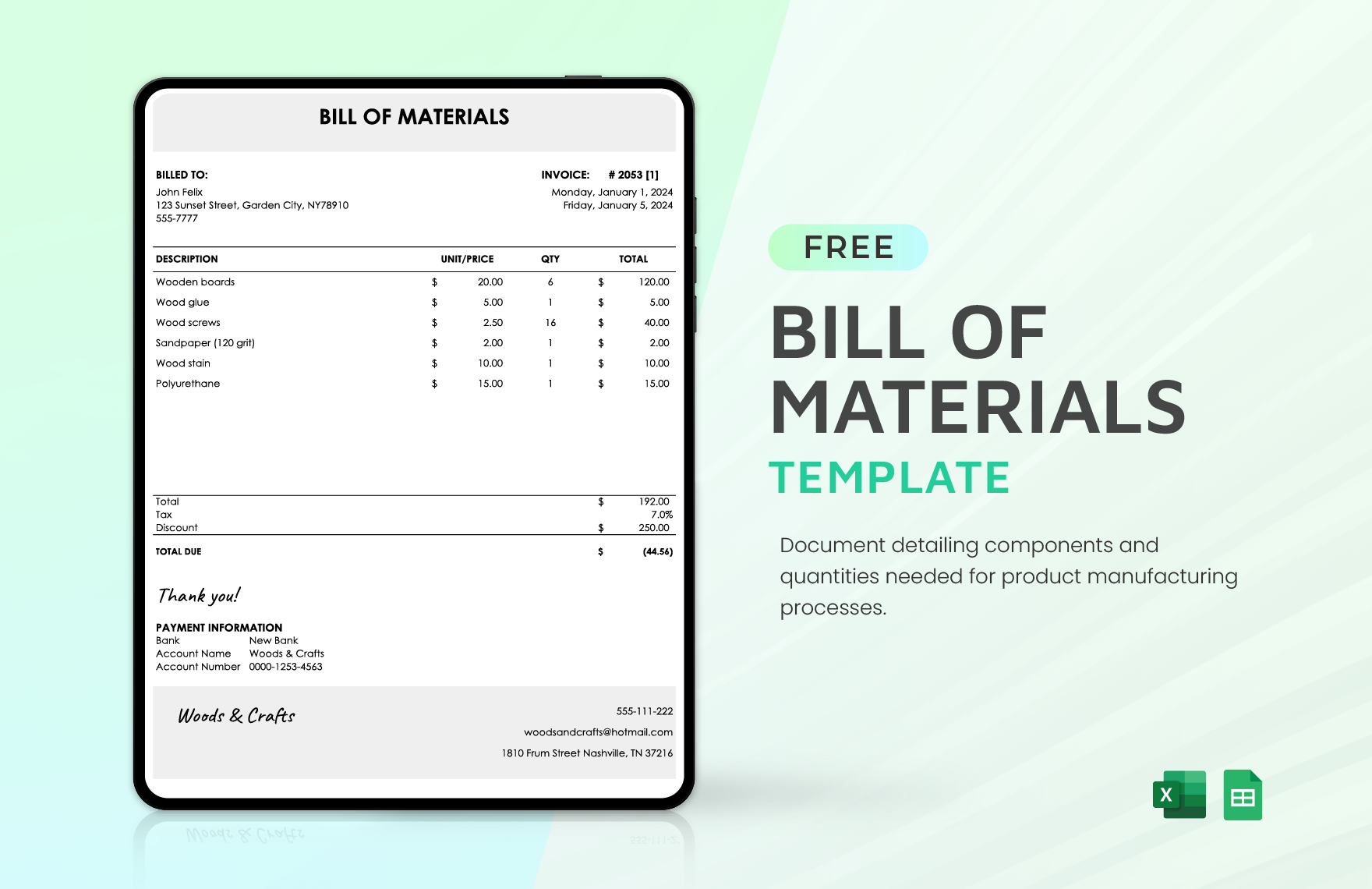

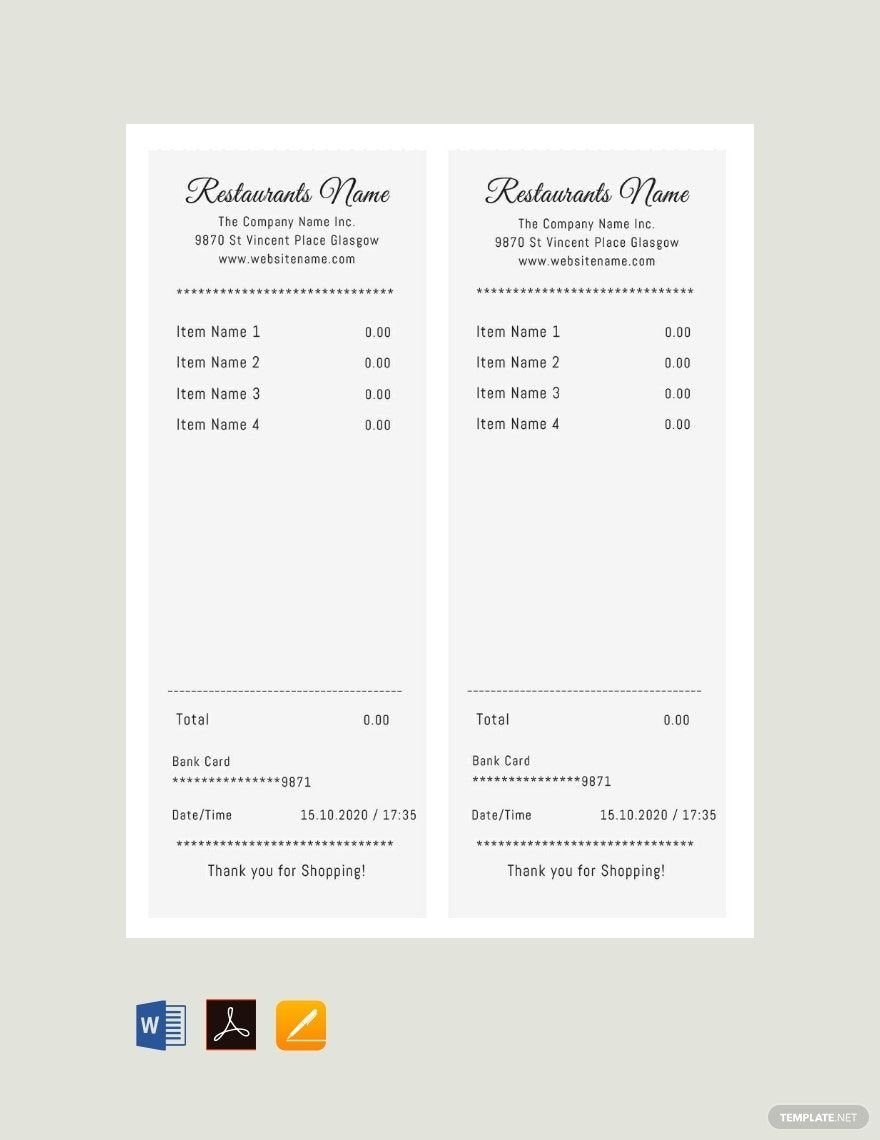

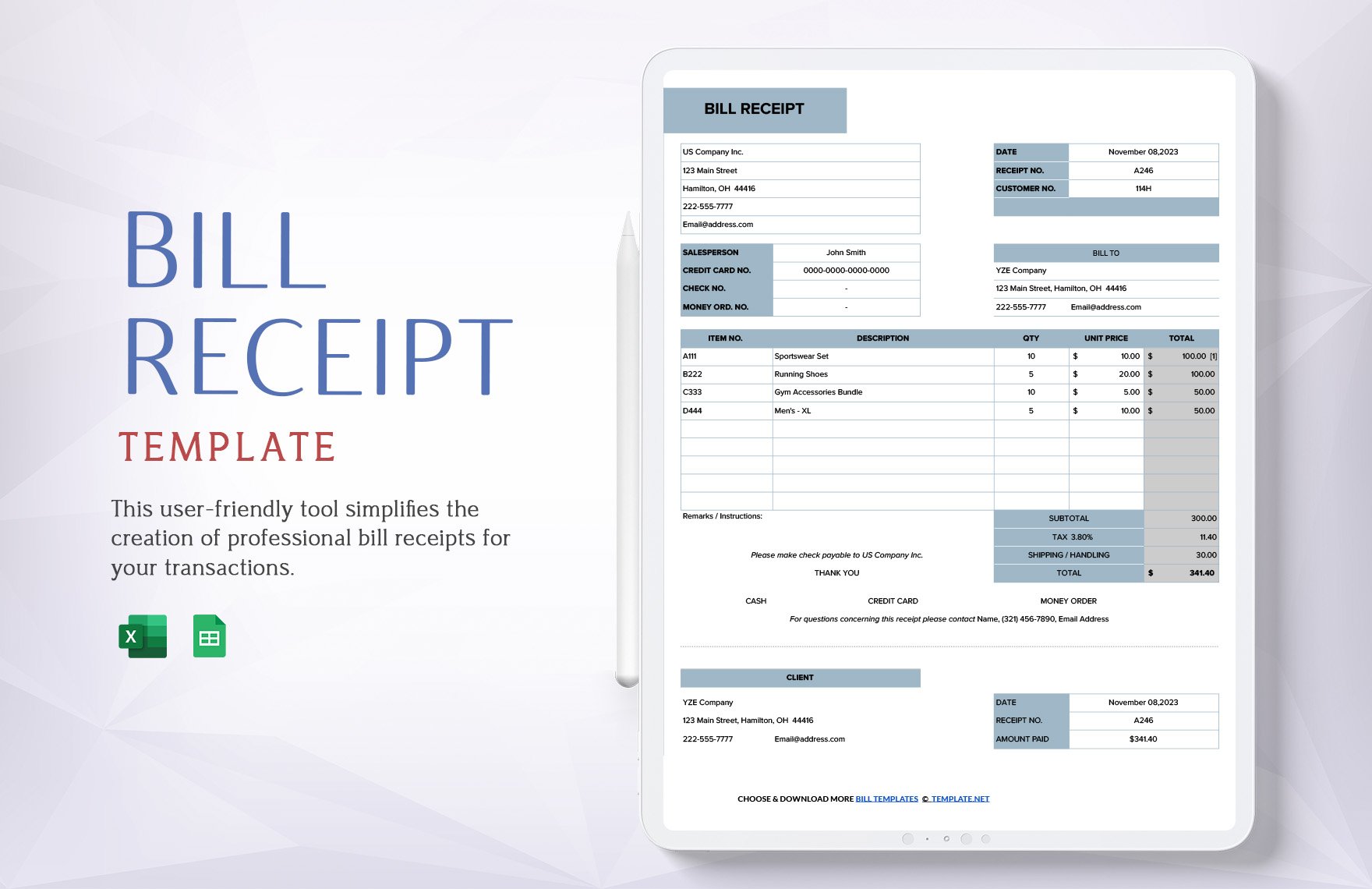

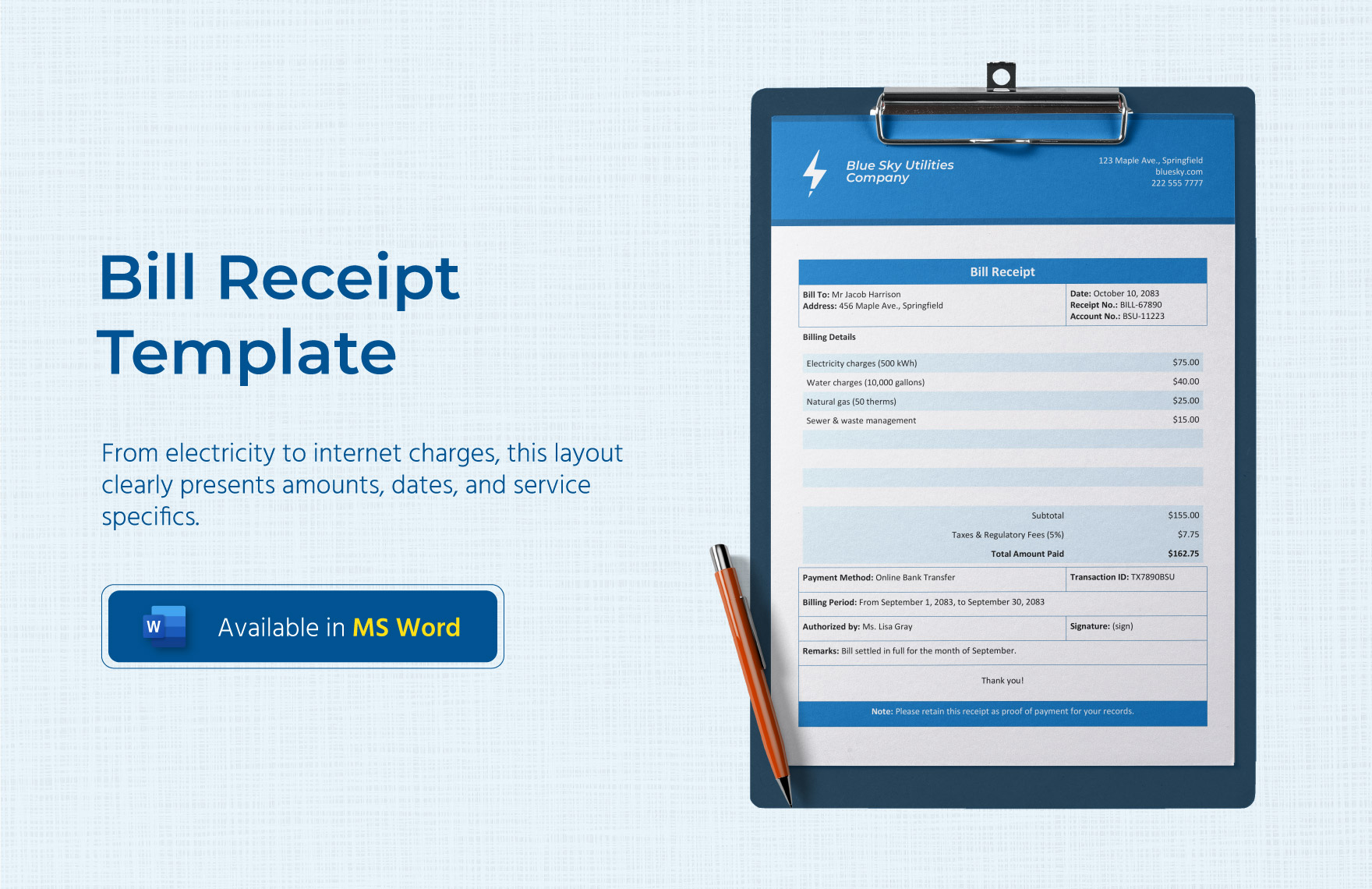

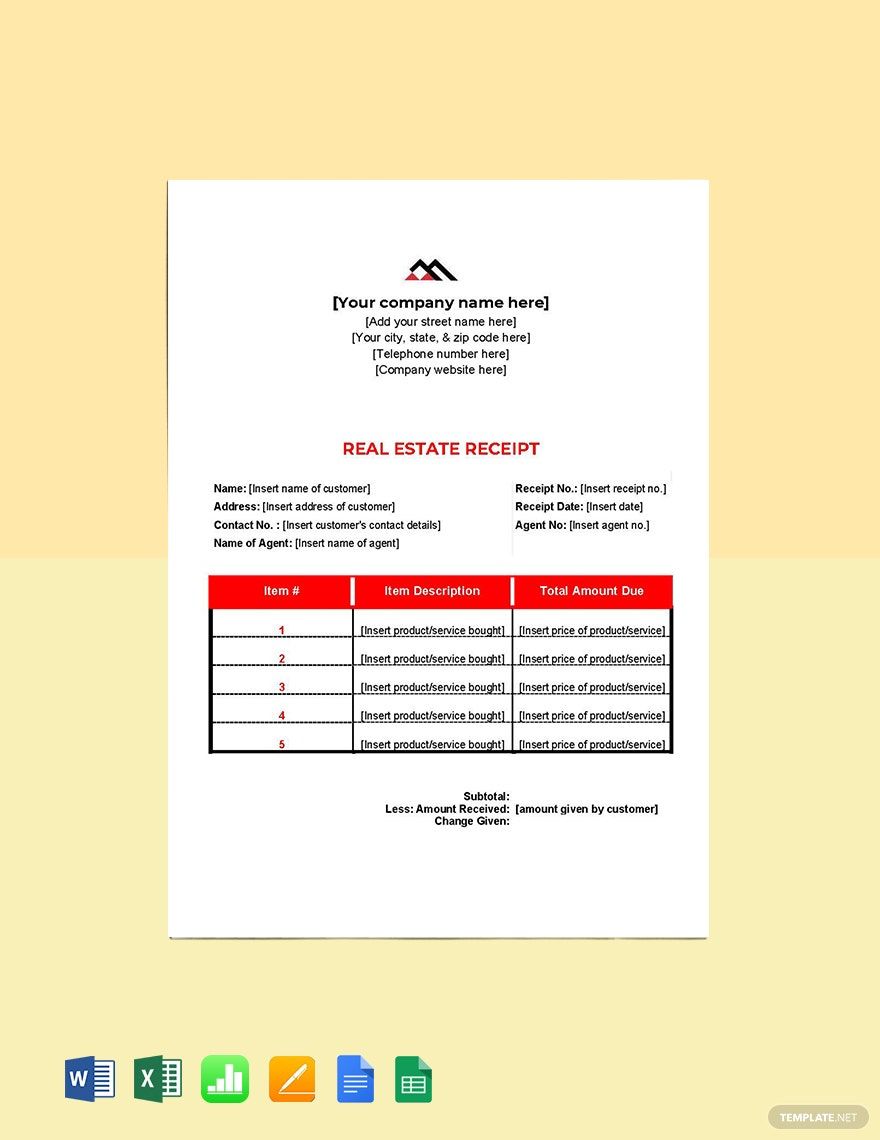

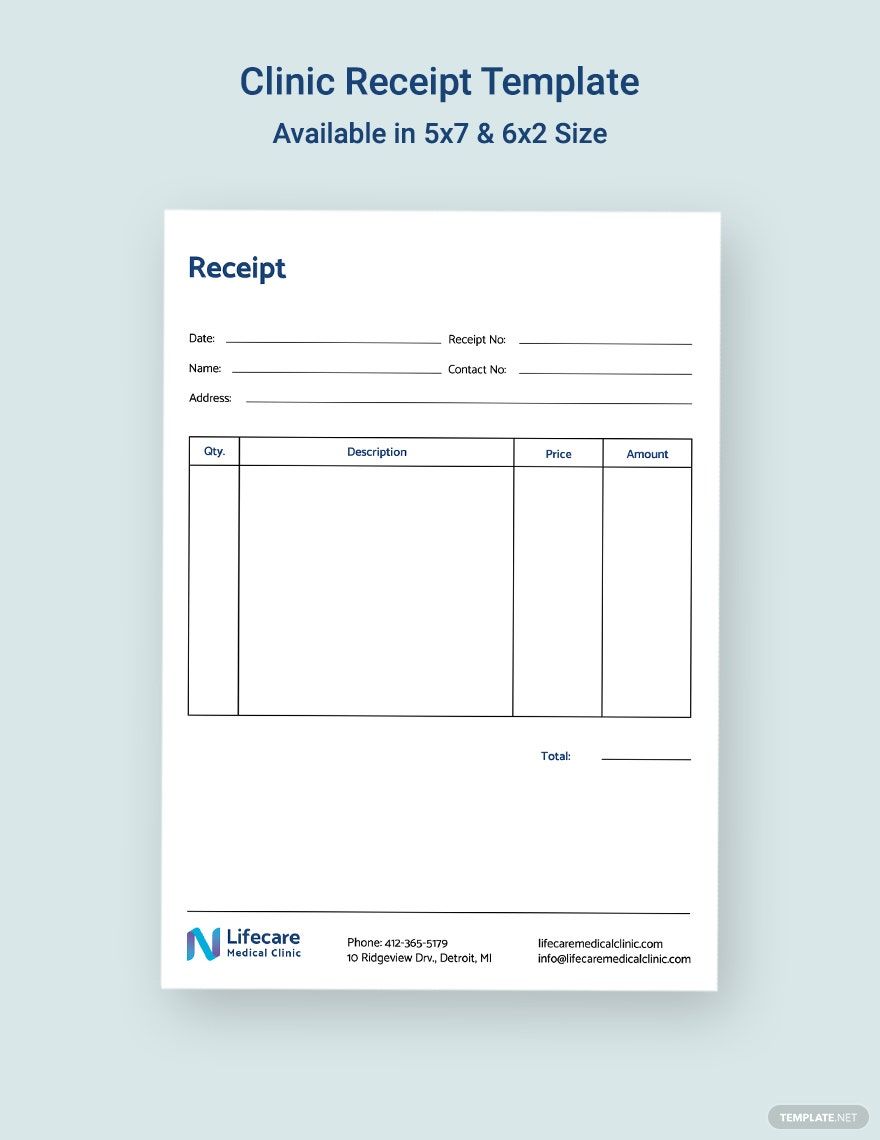

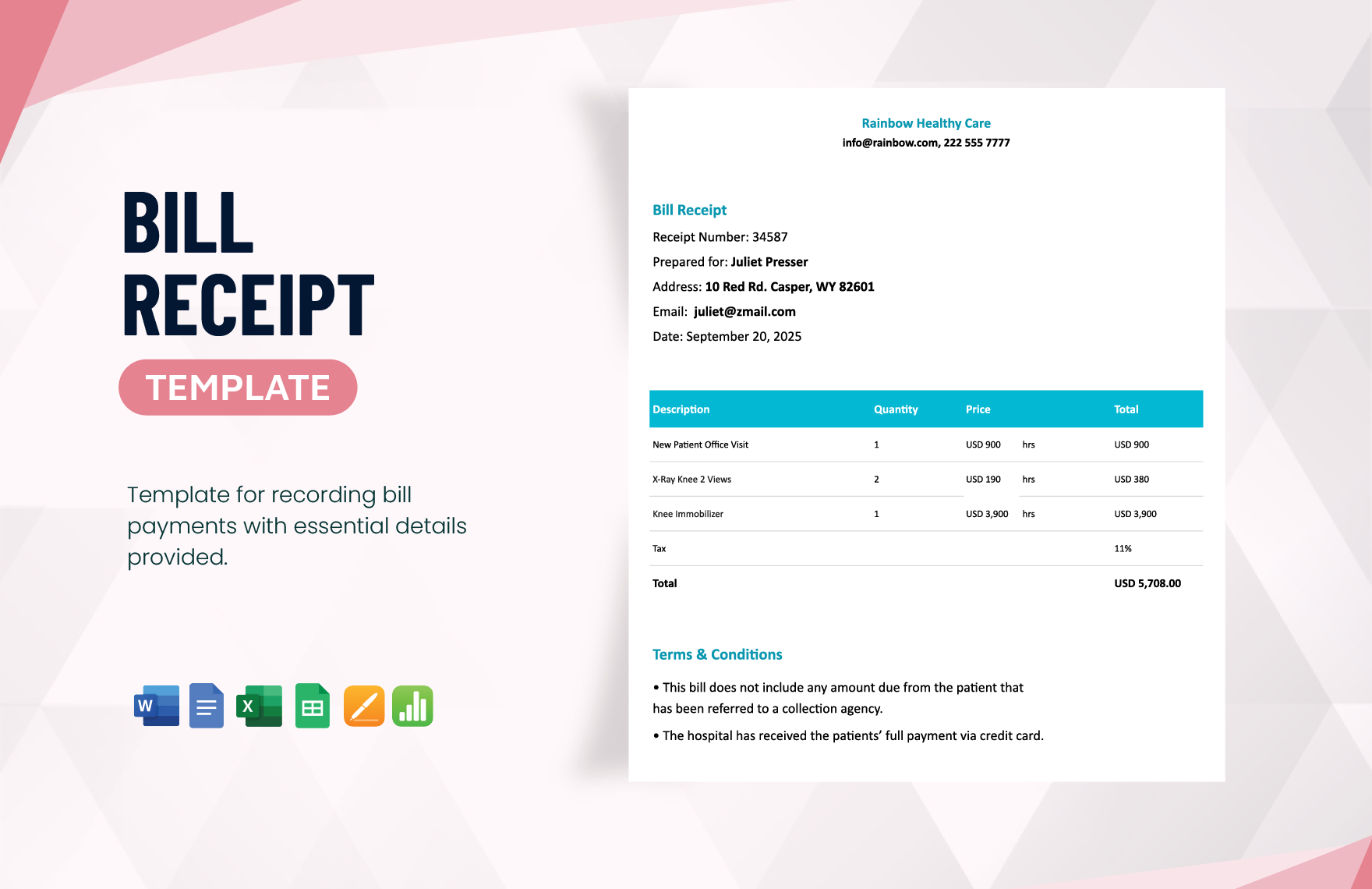

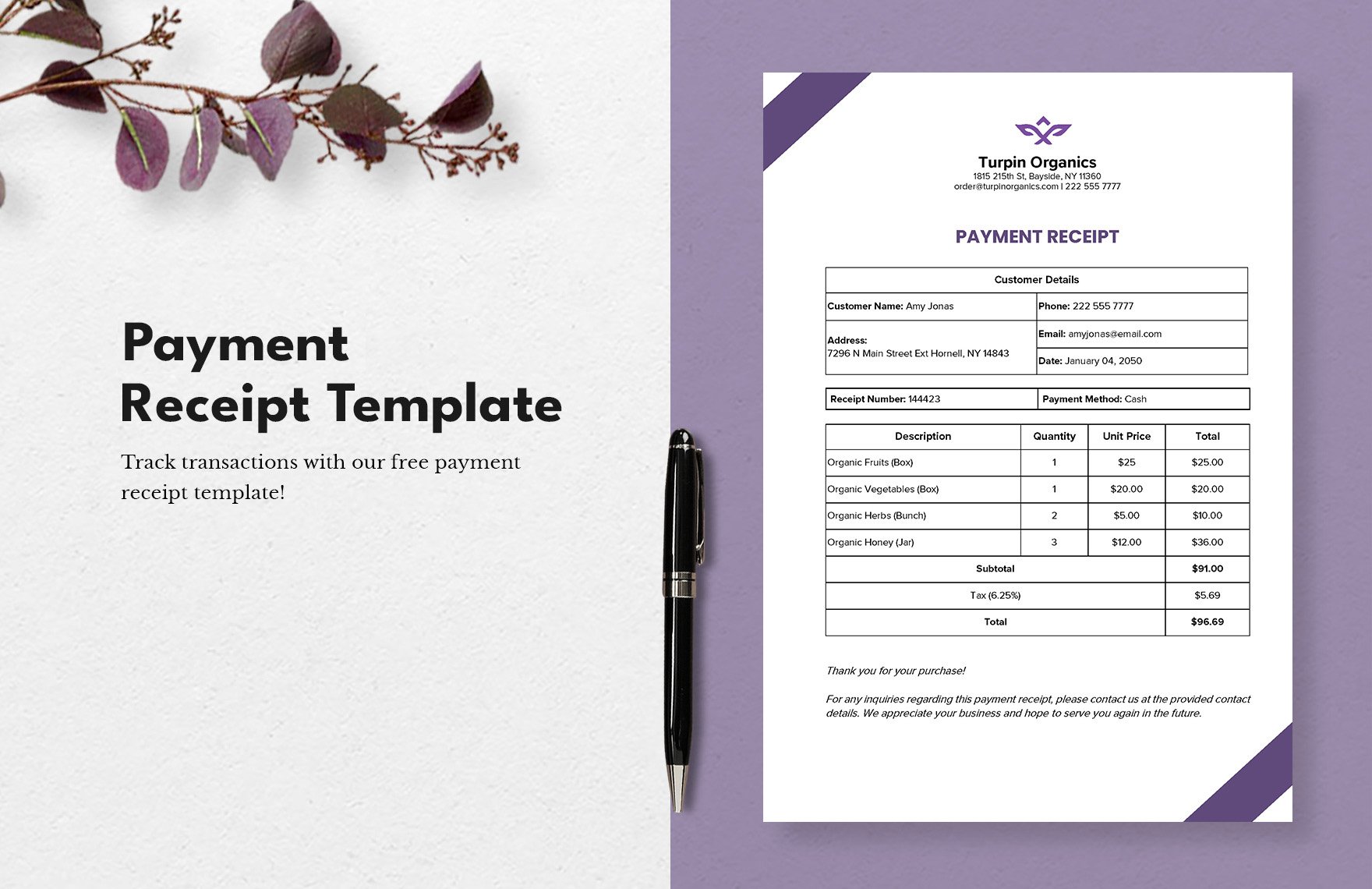

Keep your accounting team organized, streamline your invoicing workflow, and enhance your brand’s professionalism with Bill Receipt Templates from Template.net. Designed for businesses of all sizes who are looking to improve their billing systems, these templates provide a quick and easy solution for generating professional-grade receipts. Whether you want to promote a discount for early payments or provide a detailed summary of charges at a company event, these templates are an ideal solution. Each one can include essential details like dates, billing addresses, and even promotional information such as discount codes. With no design skills required, you can enjoy customizable layouts suitable for both print and digital distribution, enhancing brand consistency effortlessly.

Discover the many bill receipt templates we have on hand, tailored to suit various business needs. Simply choose a design that aligns with your brand, swap in your company logo, and customize colors and fonts to match your corporate identity. For a more personalized touch, add icons or graphics with easy drag-and-drop functionality, or introduce subtle animated effects to make online receipts more engaging. Thanks to AI-powered text tools, creating receipts is a fun and skill-free task, with endless possibilities. Our library is regularly updated with new designs, so you always have fresh options at your fingertips. When you're finished, easily download your receipt or share it directly via email, ensuring seamless client communication every time.