Make Your Financial Transparency Strategies Come to Life with Credit Report Templates from Template.net.

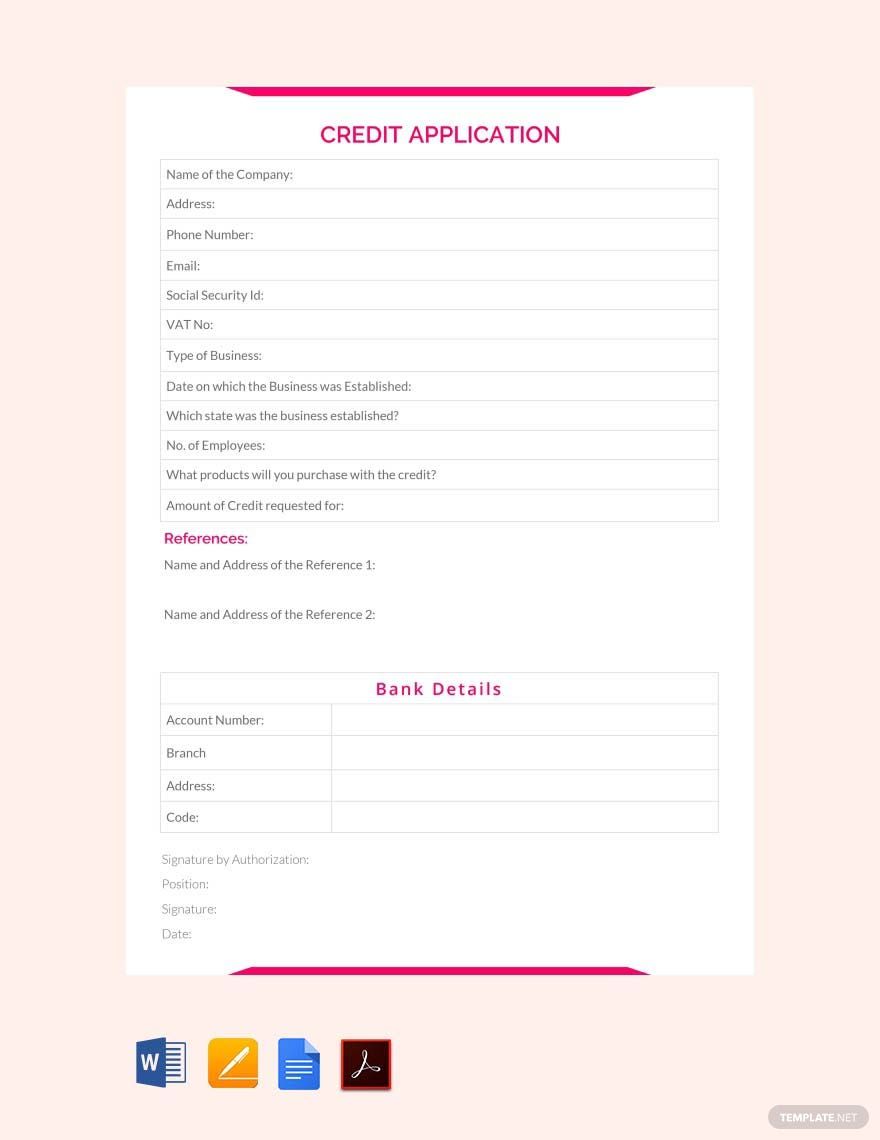

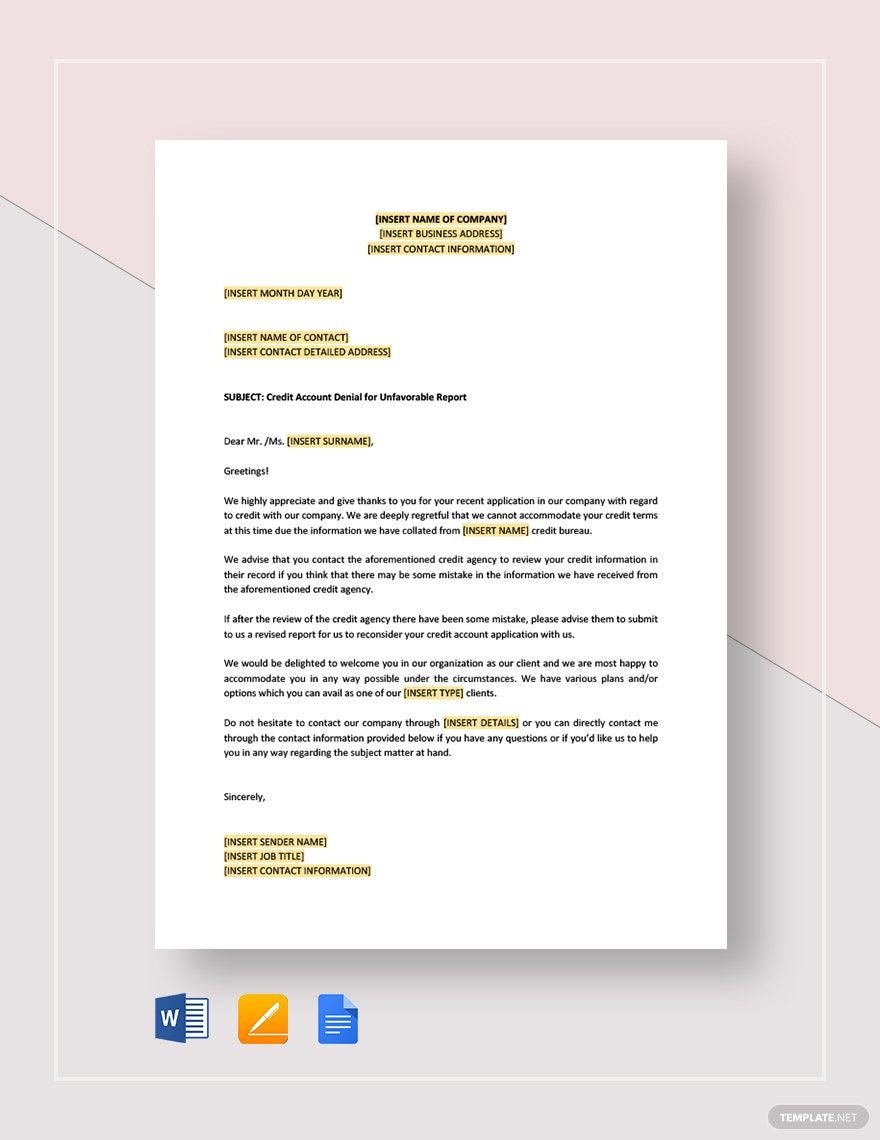

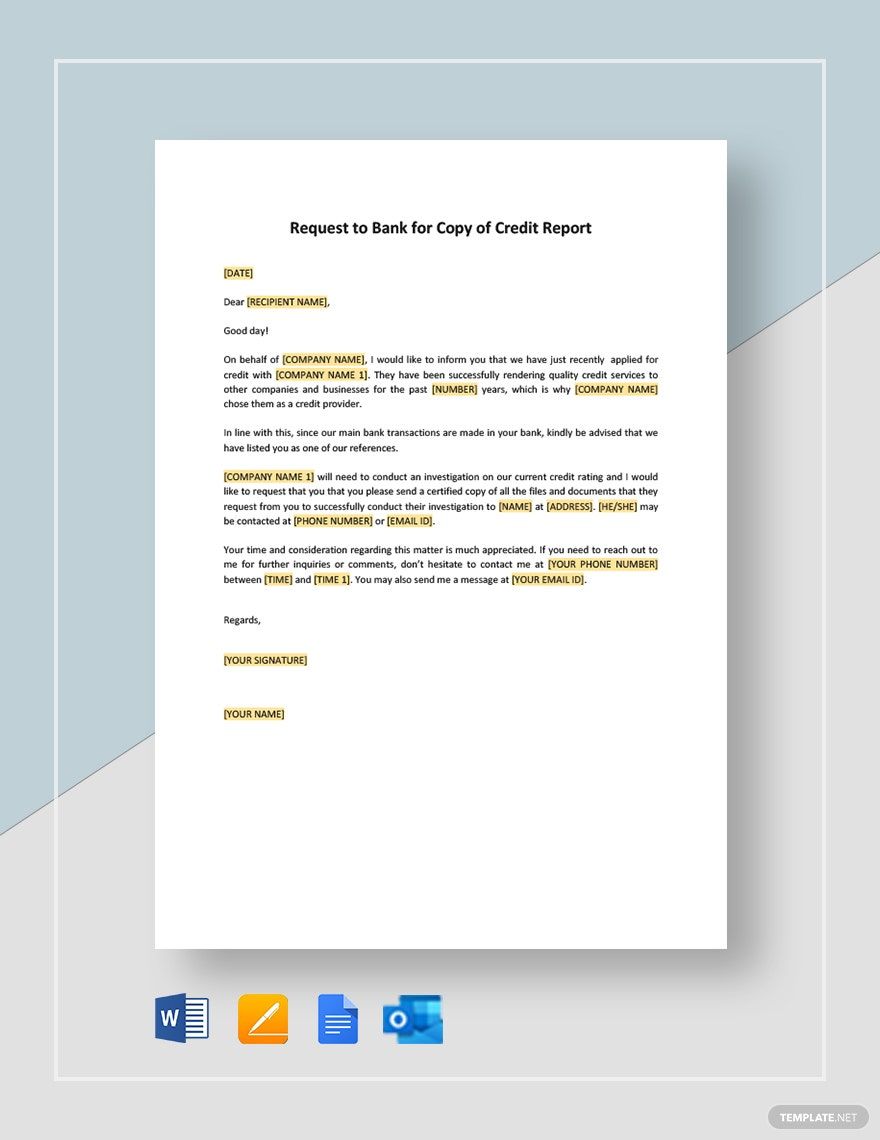

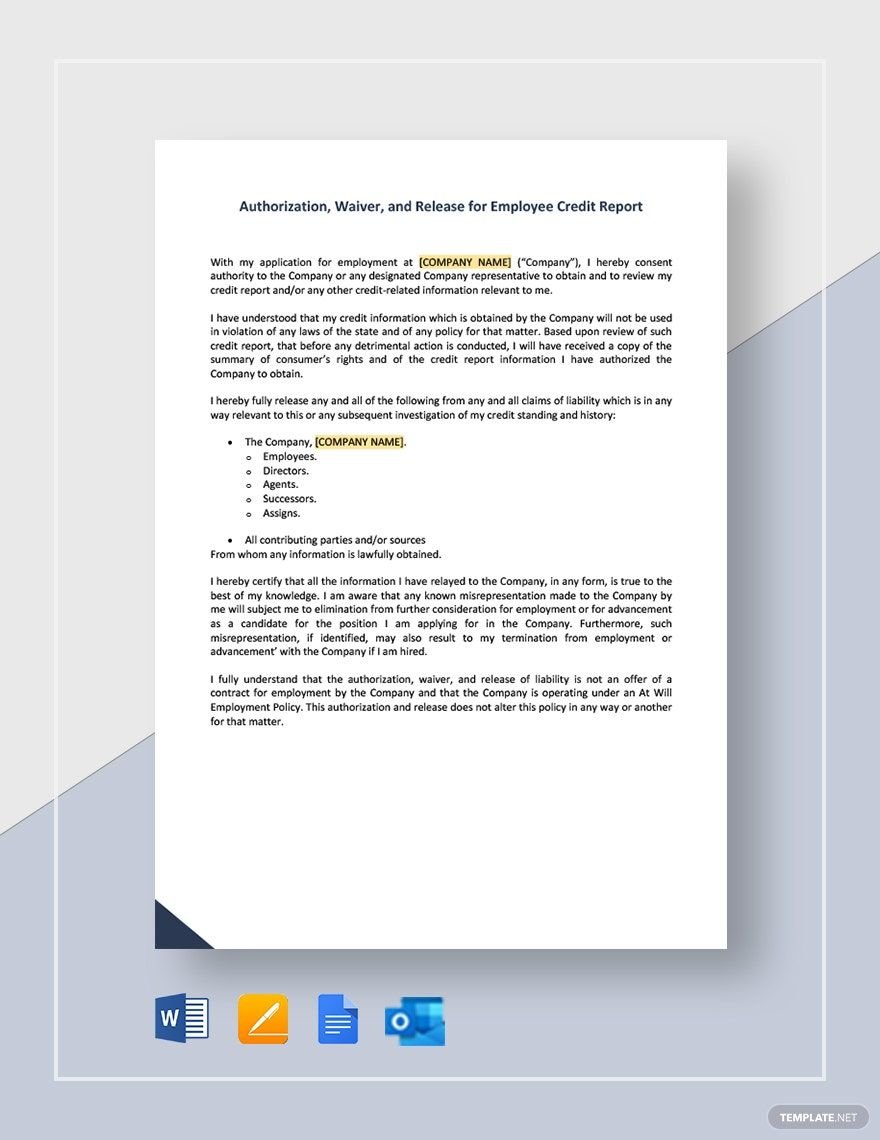

Keep your financial experts engaged, foster better decision-making, and enhance data accuracy with Credit Report Templates from Template.net. Designed for financial consultants, loan officers, and individual users, these templates enable you to present clear and concise financial data effortlessly. Whether you're preparing a detailed analysis report for a loan application or generating a monthly credit summary for internal use, these templates are your go-to resource. Each template includes sections for vital financial details and analysis points, ensuring comprehensive coverage of all necessary information. With professionally crafted designs, you can now create stunning credit reports with no technical skills required, saving both time and resources. Plus, customizable layouts support both print and digital distribution, making it easier than ever to share your insights.

Discover the many credit report templates we have on hand, each designed to meet unique analytical and reporting needs. Begin by selecting a template that fits your purpose, then easily swap in your financial data, tweaking colors and fonts to match your brand identity. Enhance your reports further by dragging and dropping icons or graphics and adding animated effects to bring attention to key findings. With our ever-expanding library of templates, you'll have access to new designs added regularly, ensuring your reports are always fresh and engaging. When you're finished, download or share your polished reports via email, print, or digital export, helping you reach your audience through multiple channels. The possibilities are endless and require no particular skill, making financial reporting a seamless and even enjoyable task.