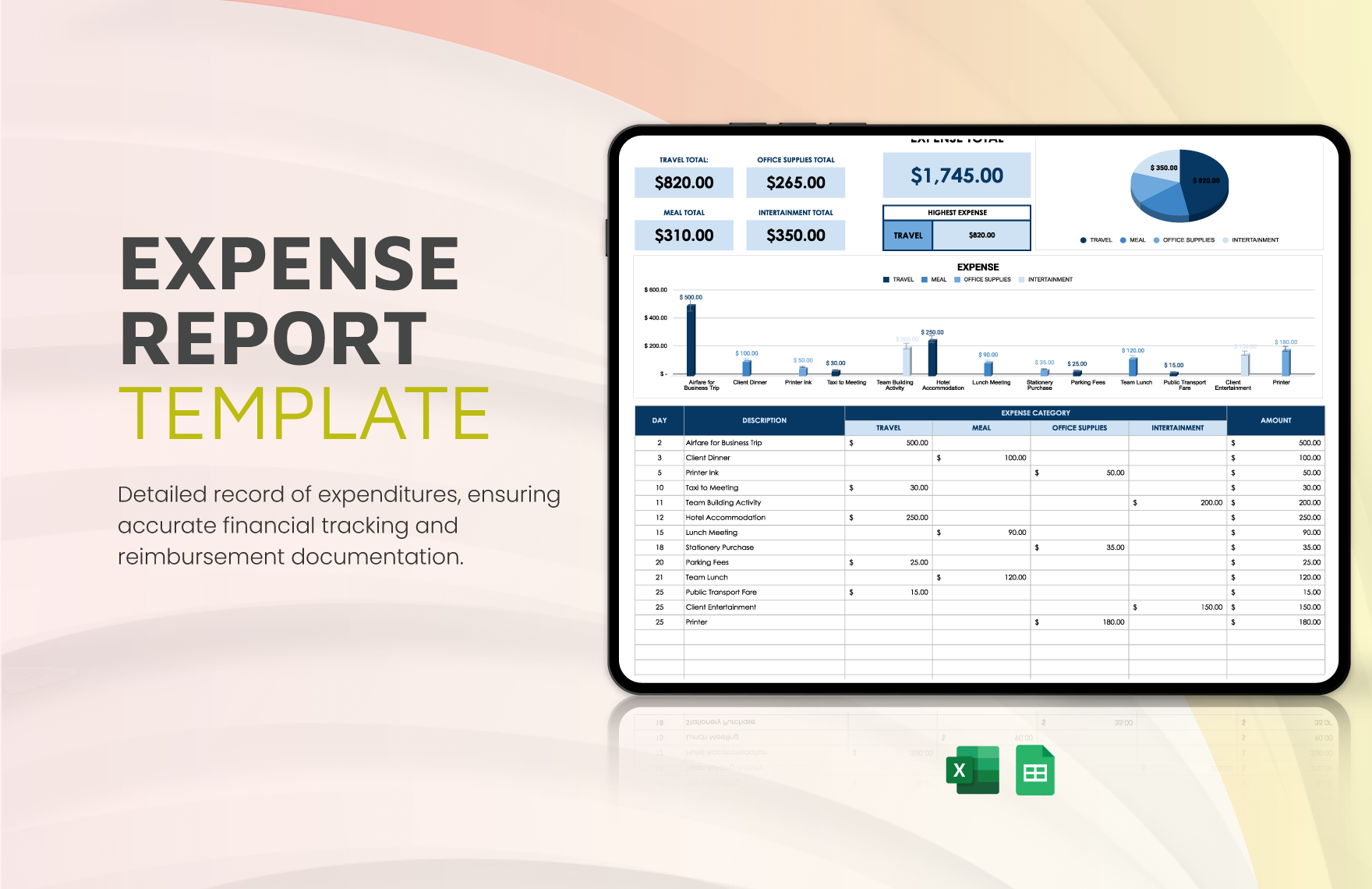

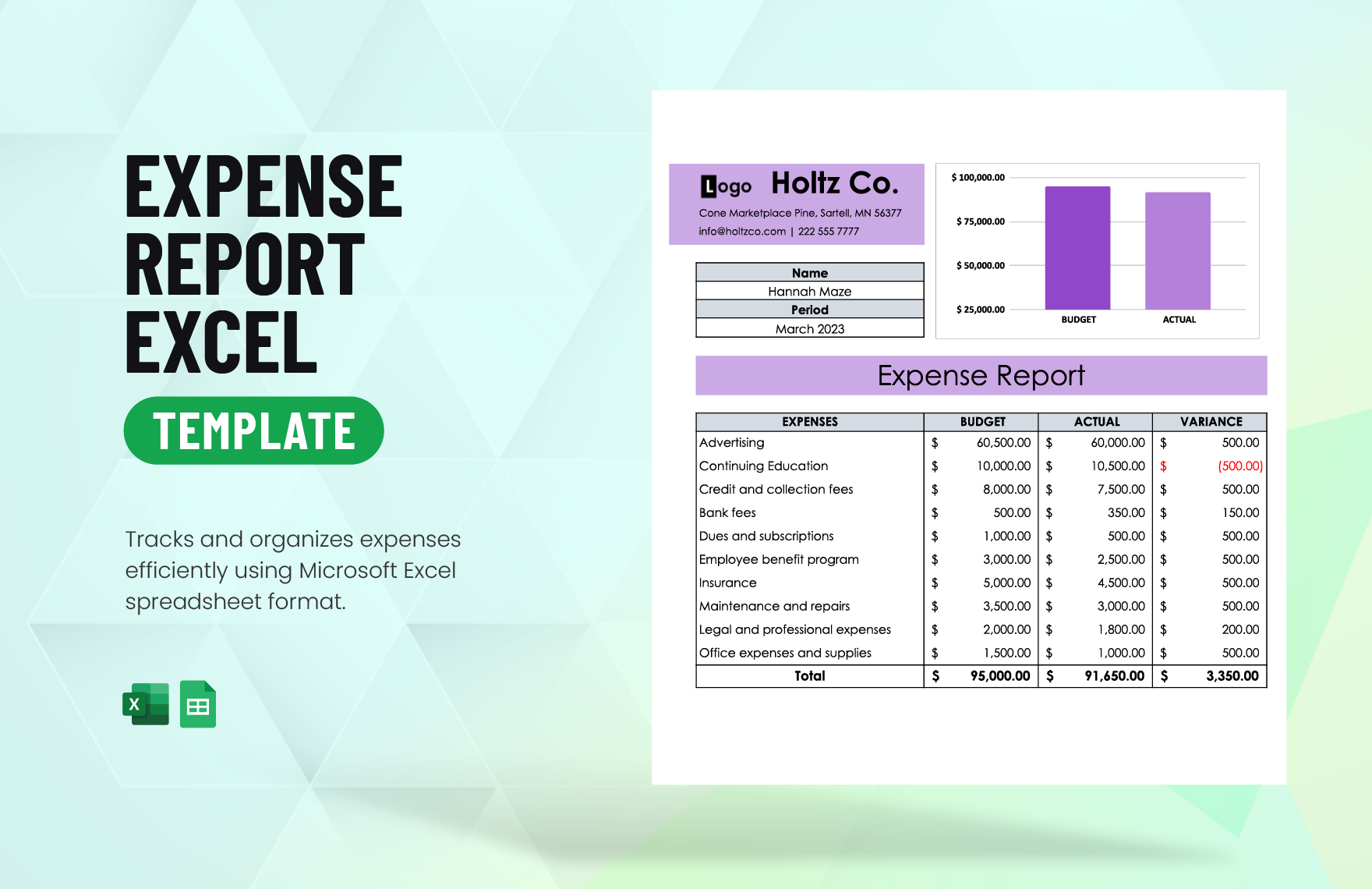

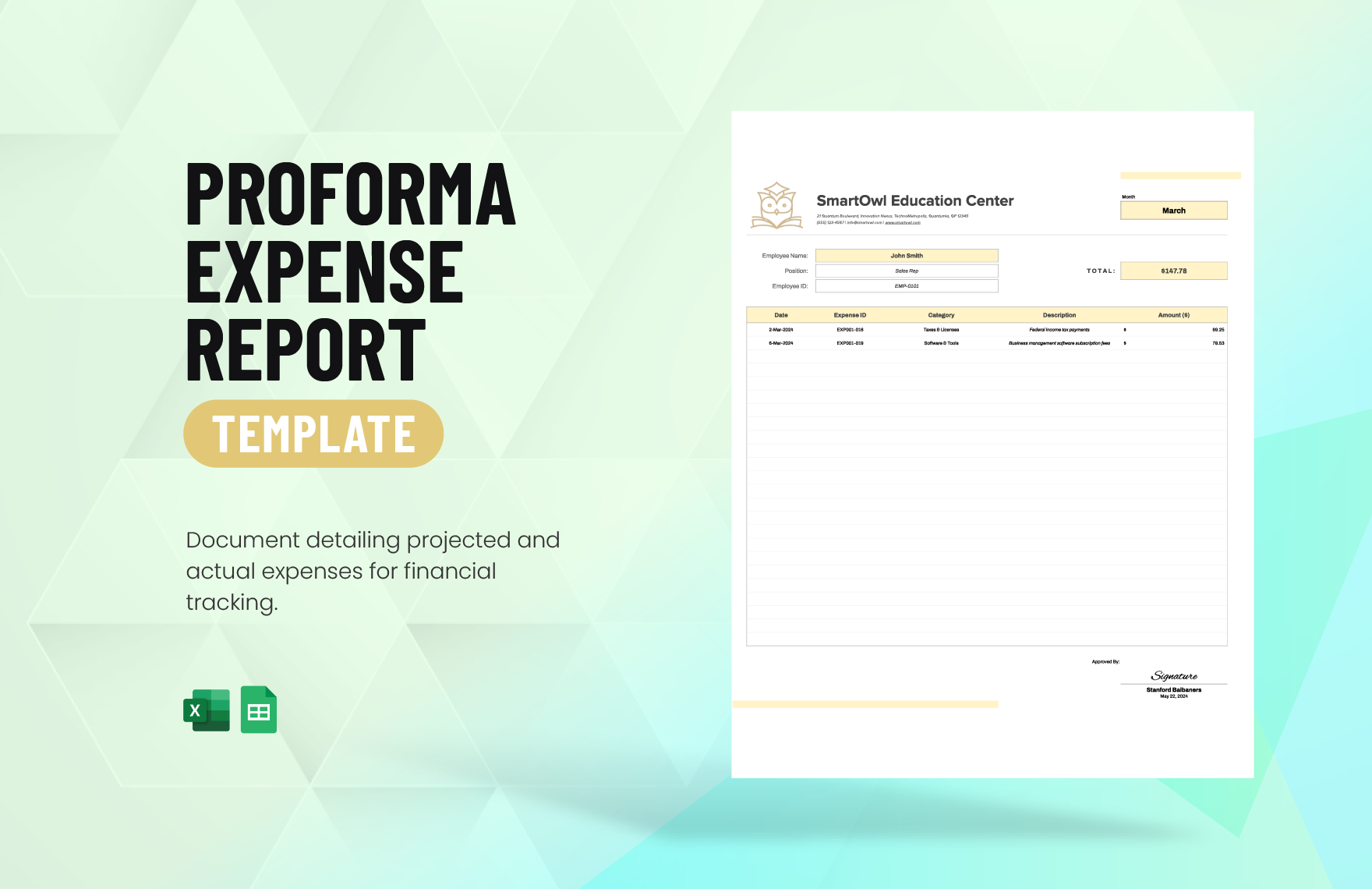

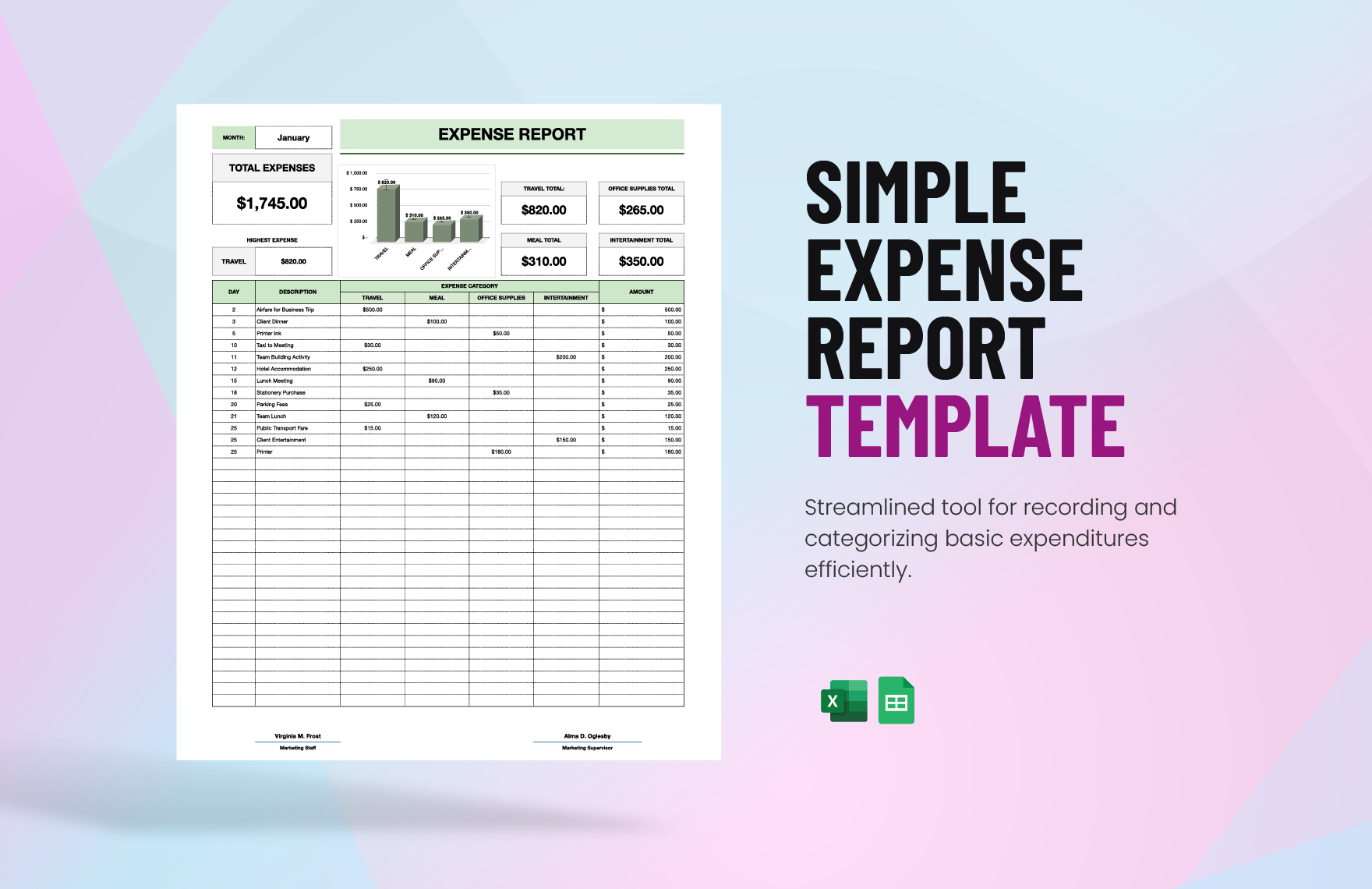

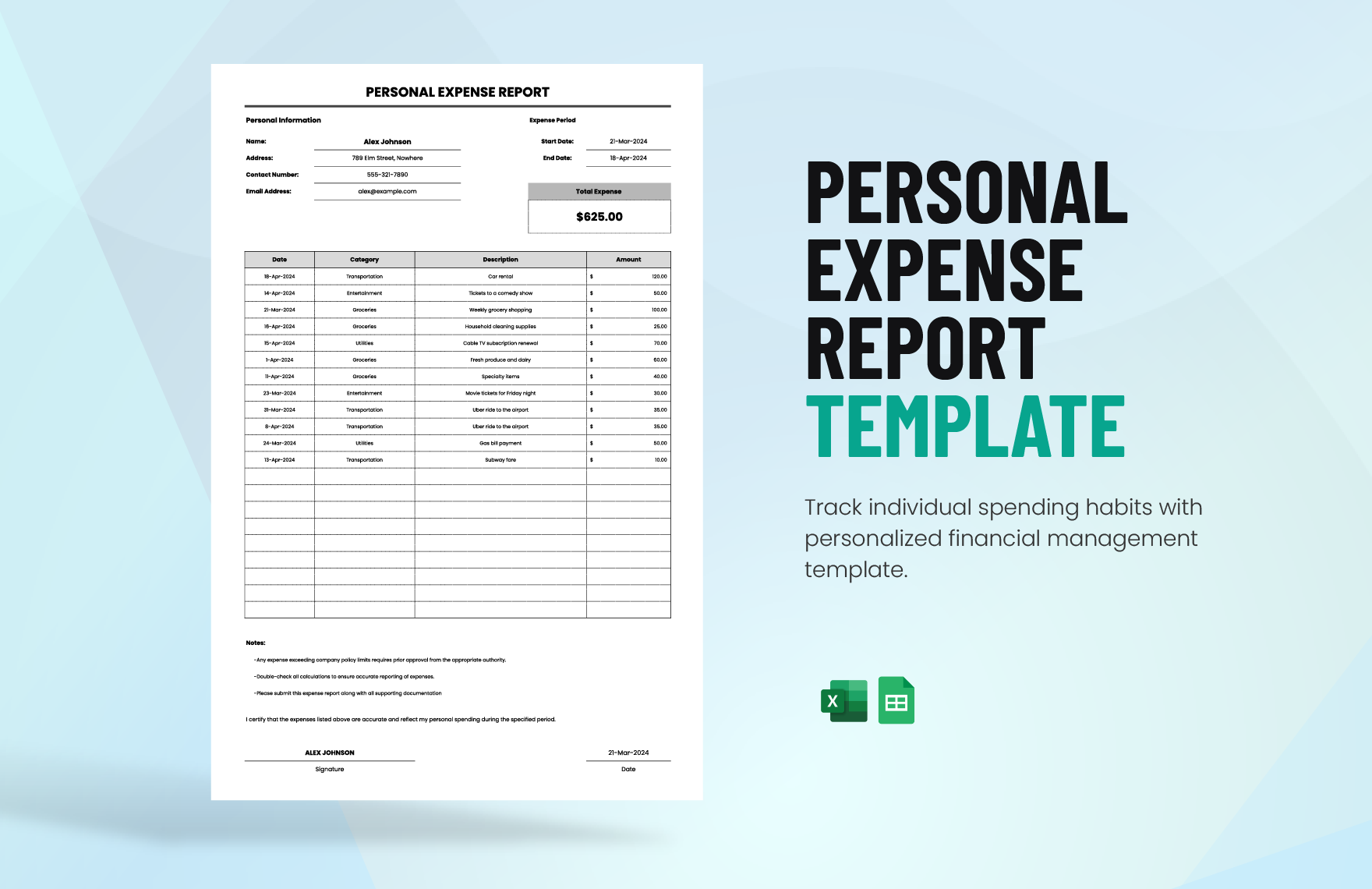

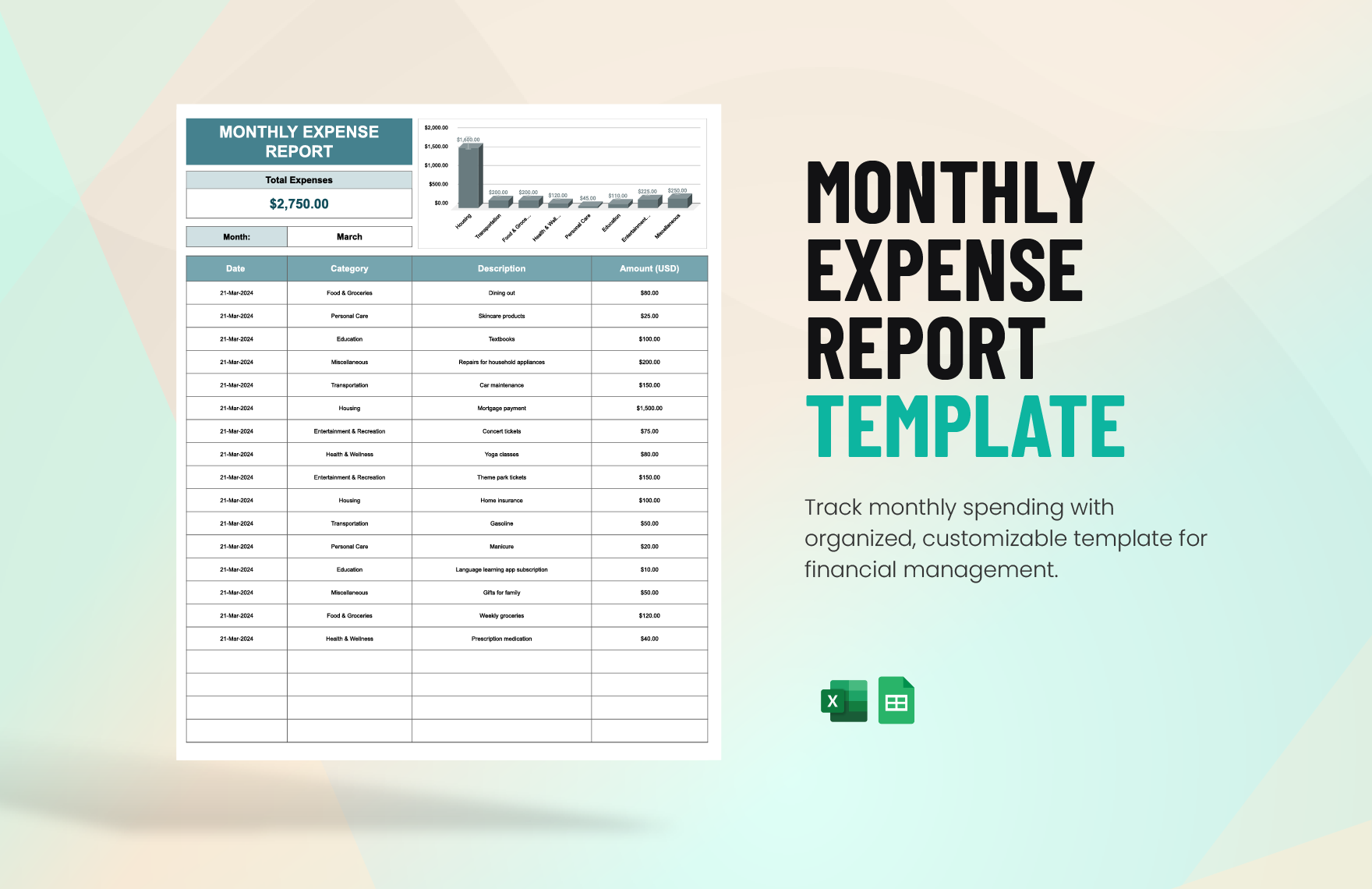

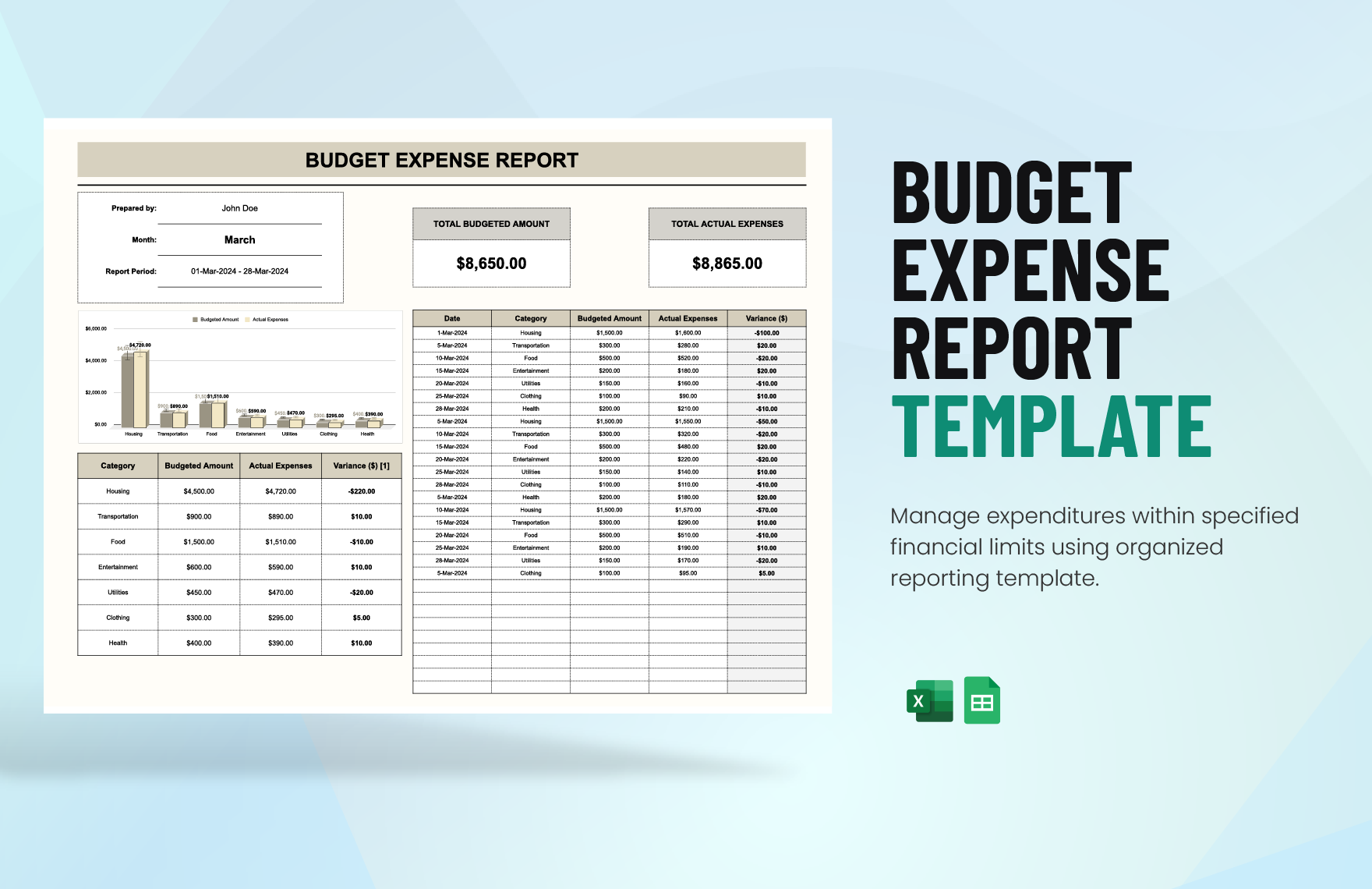

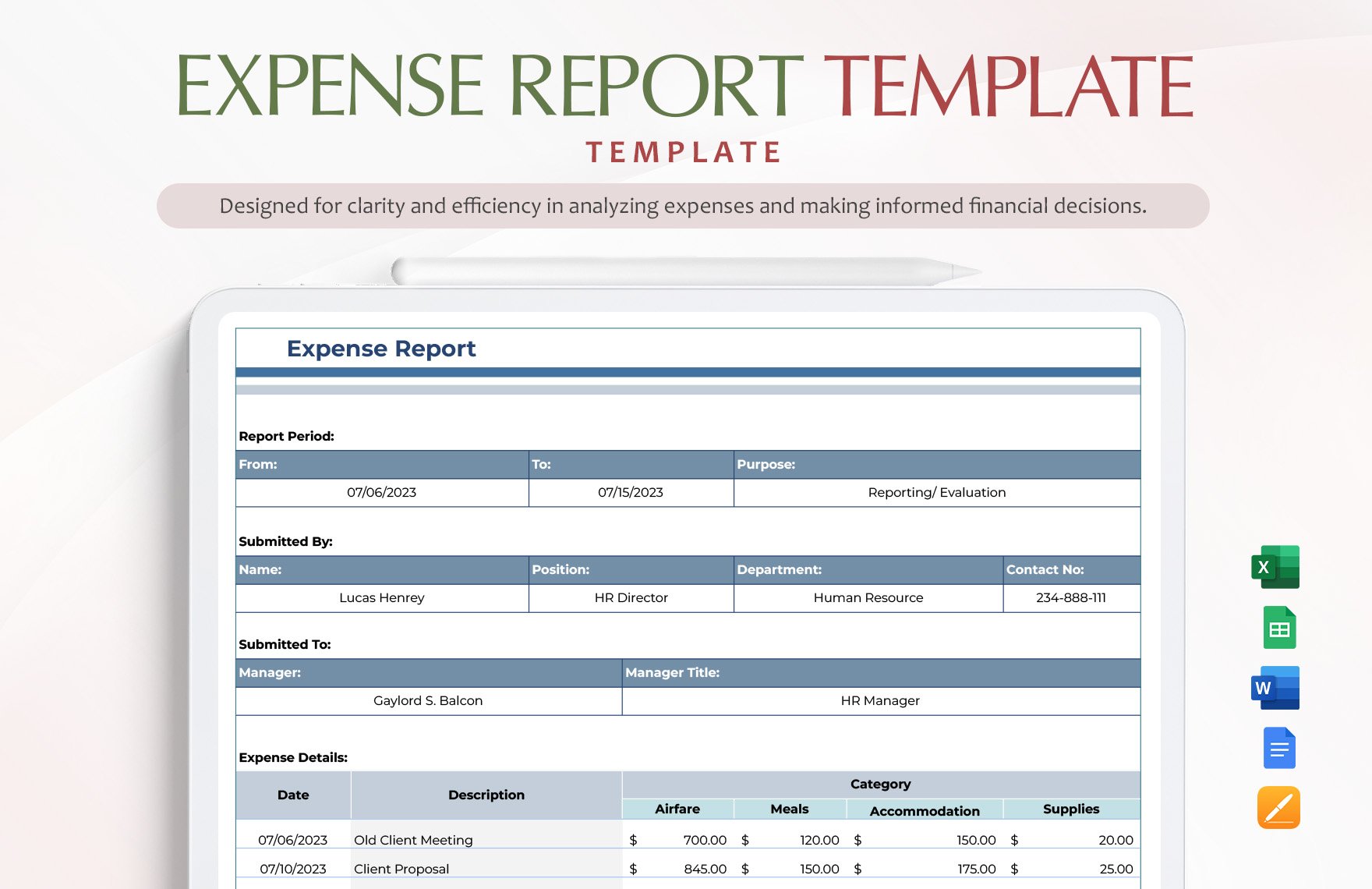

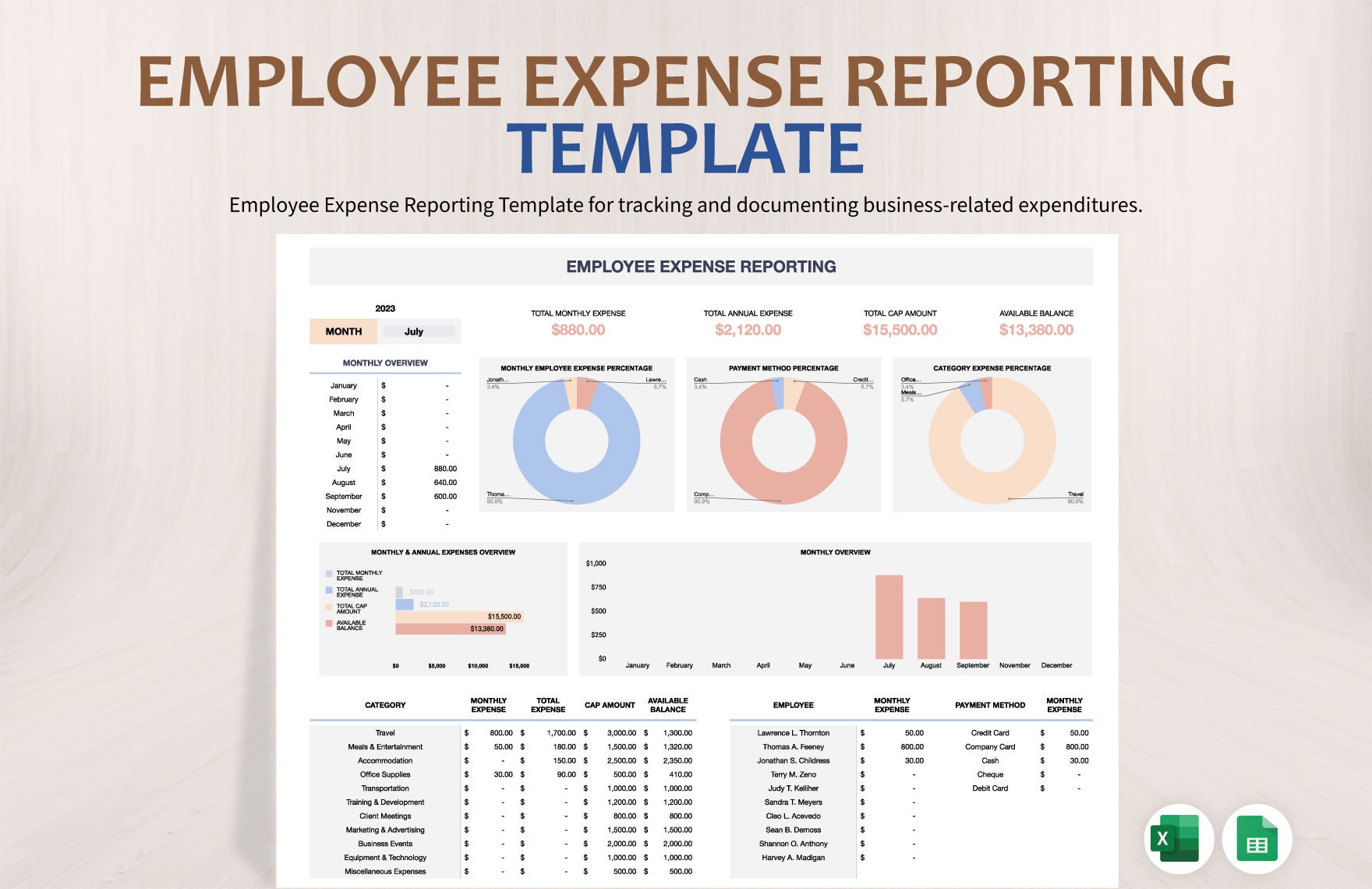

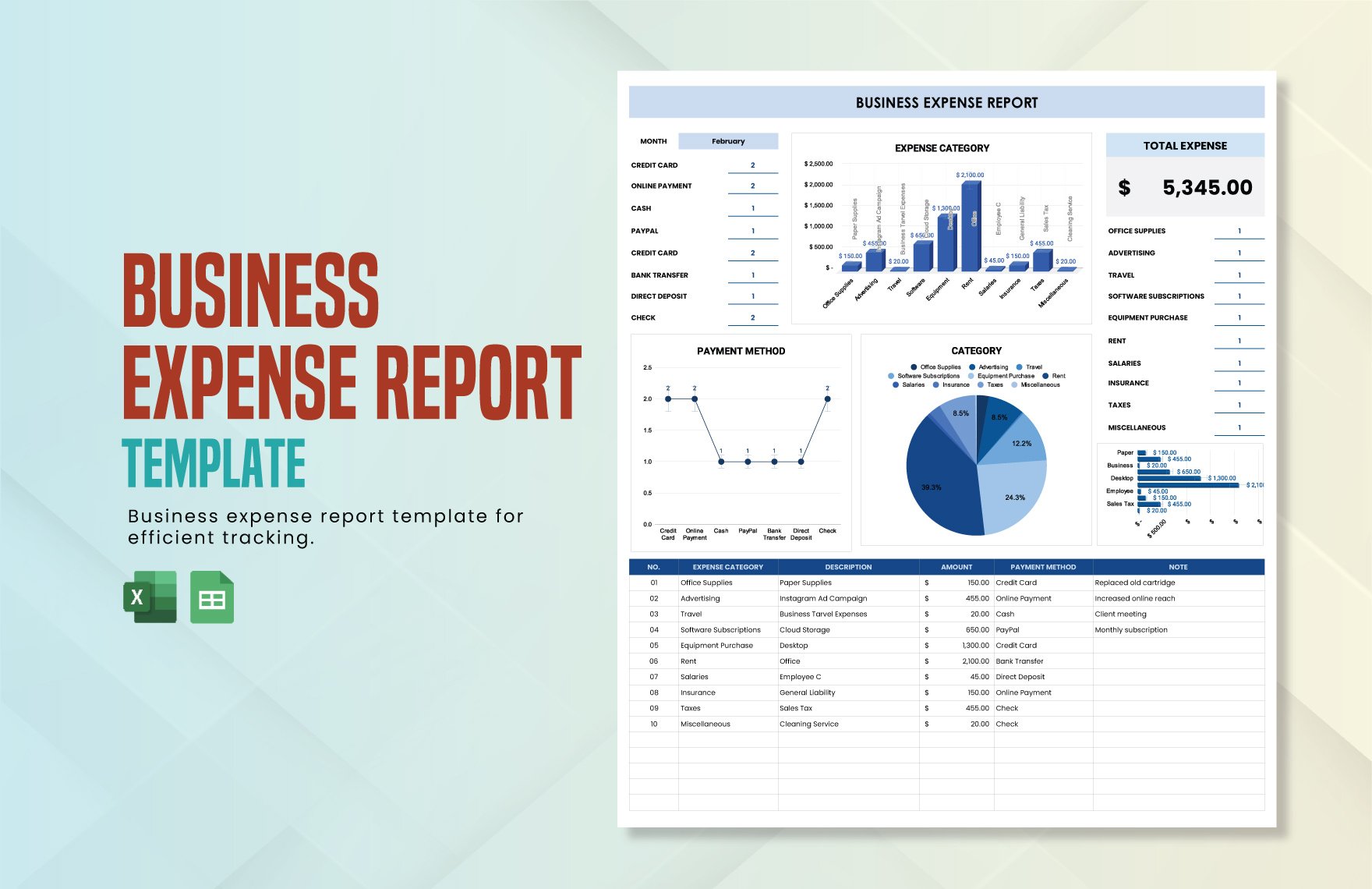

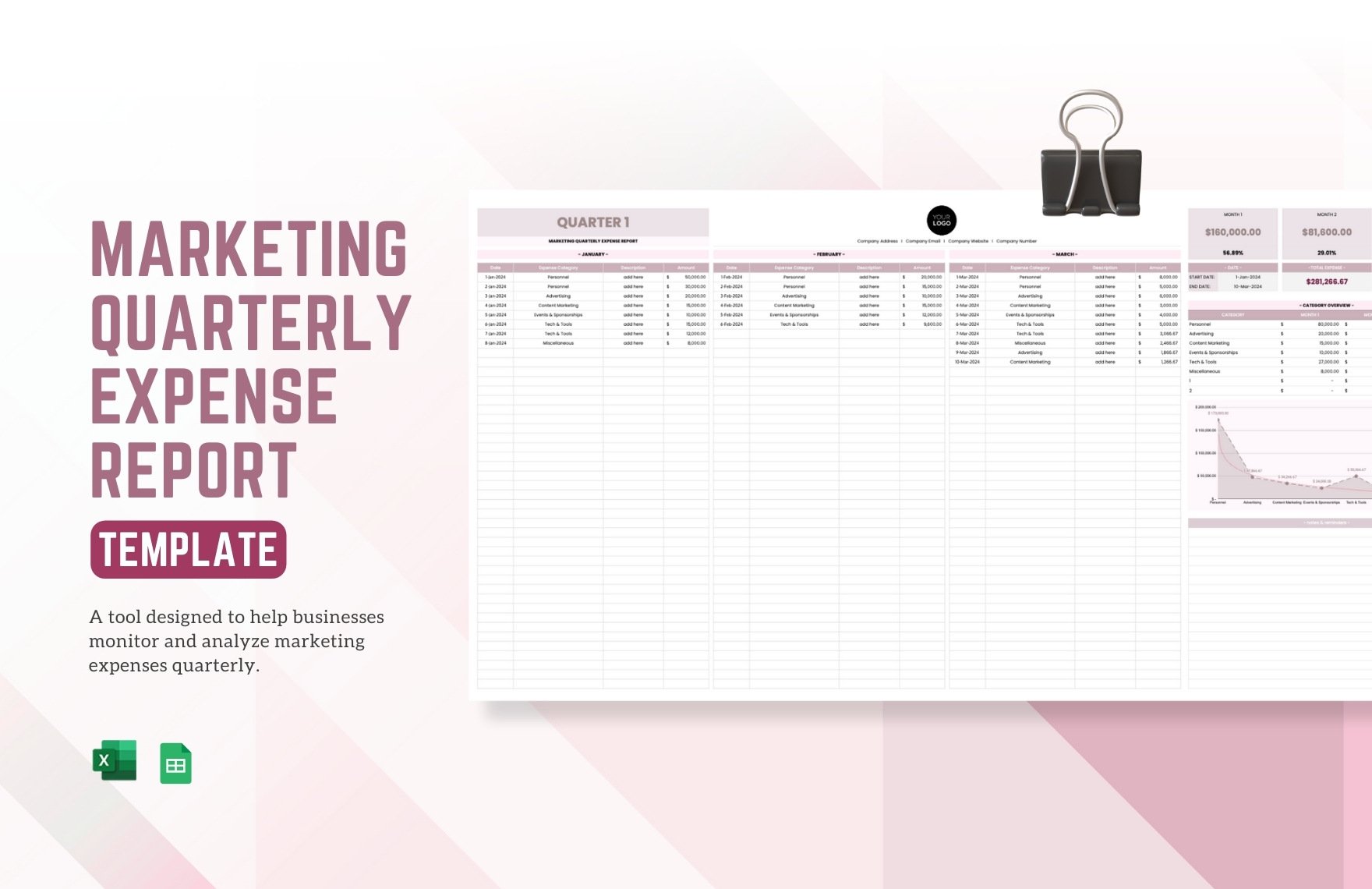

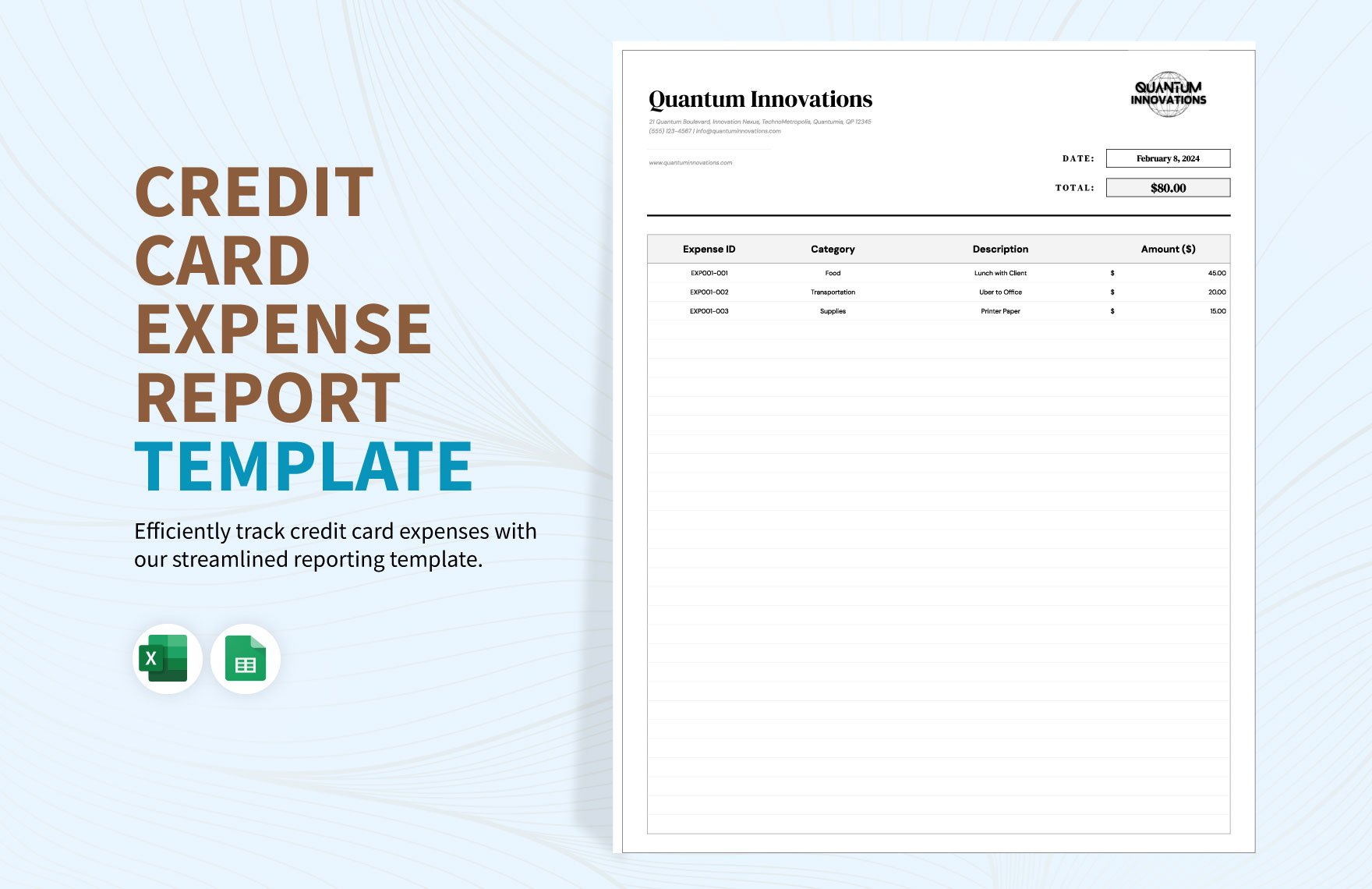

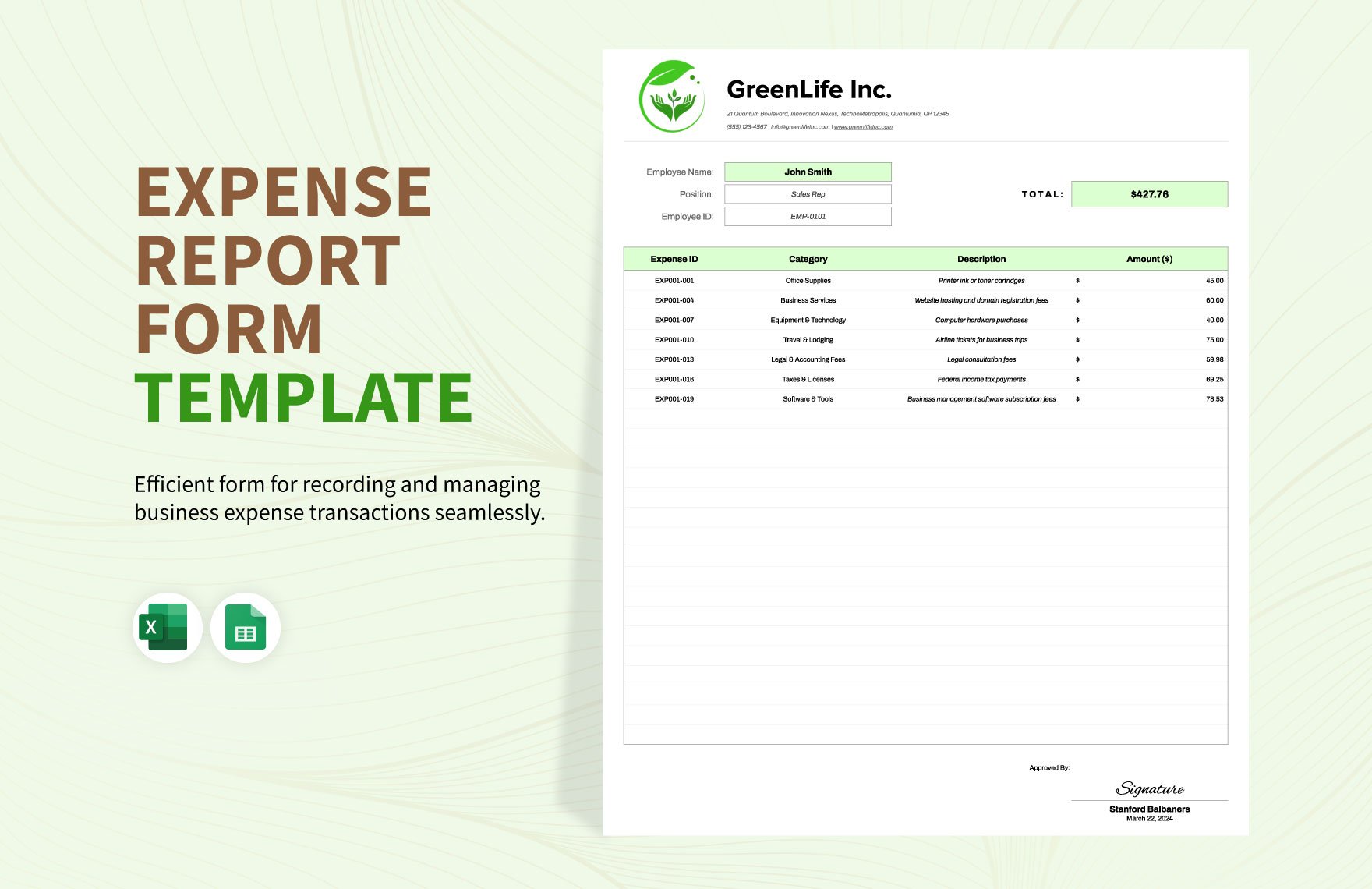

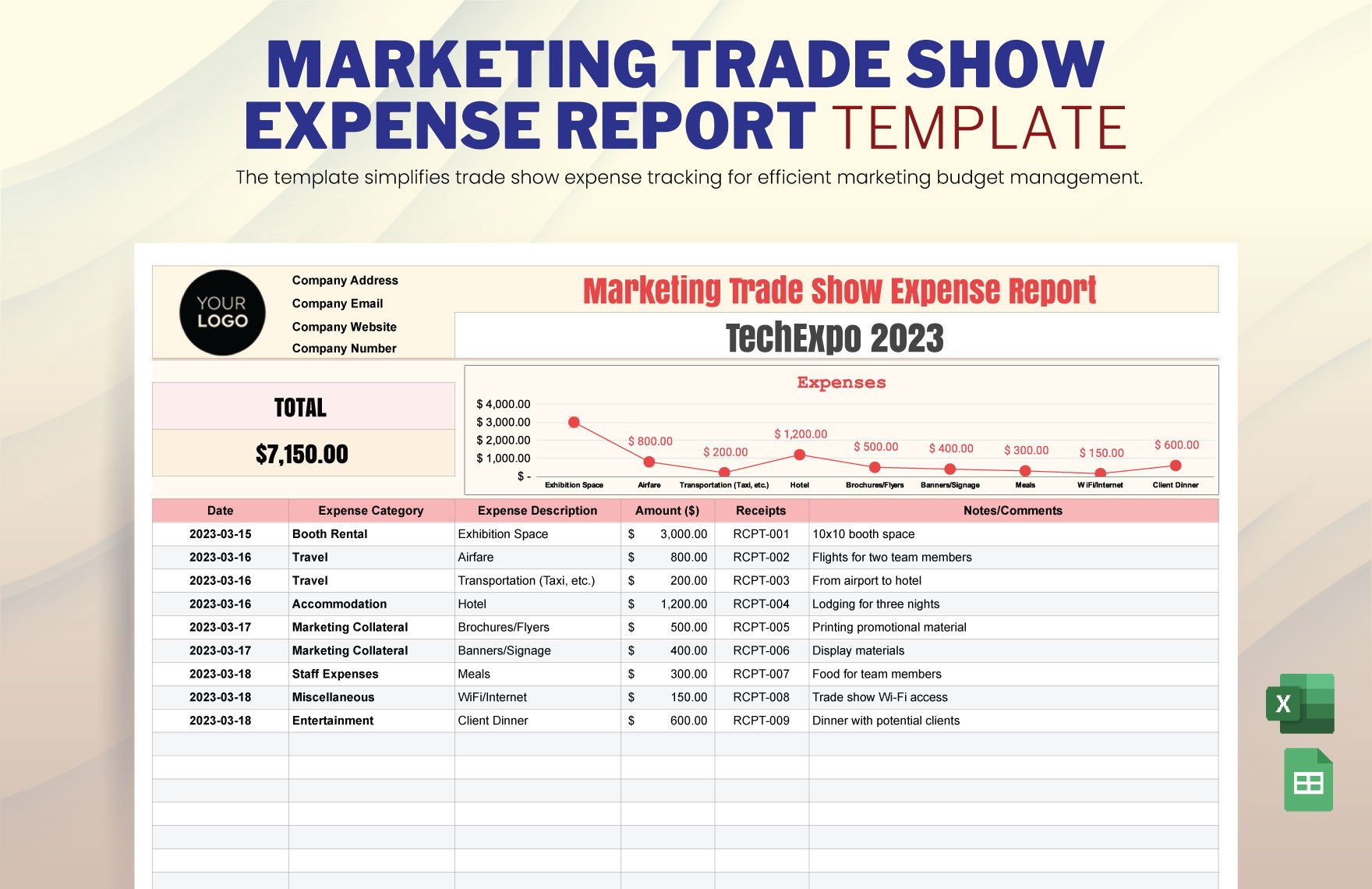

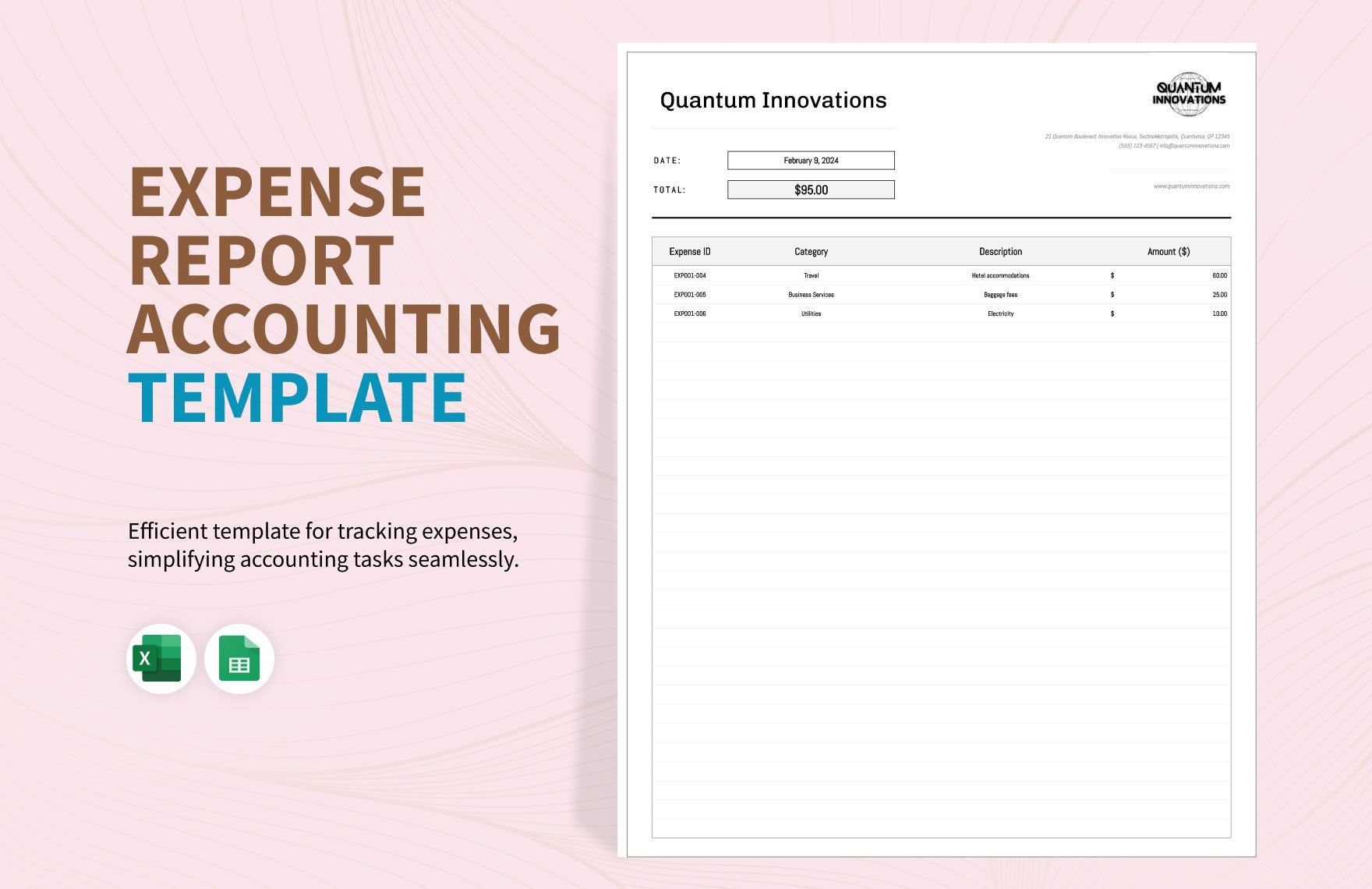

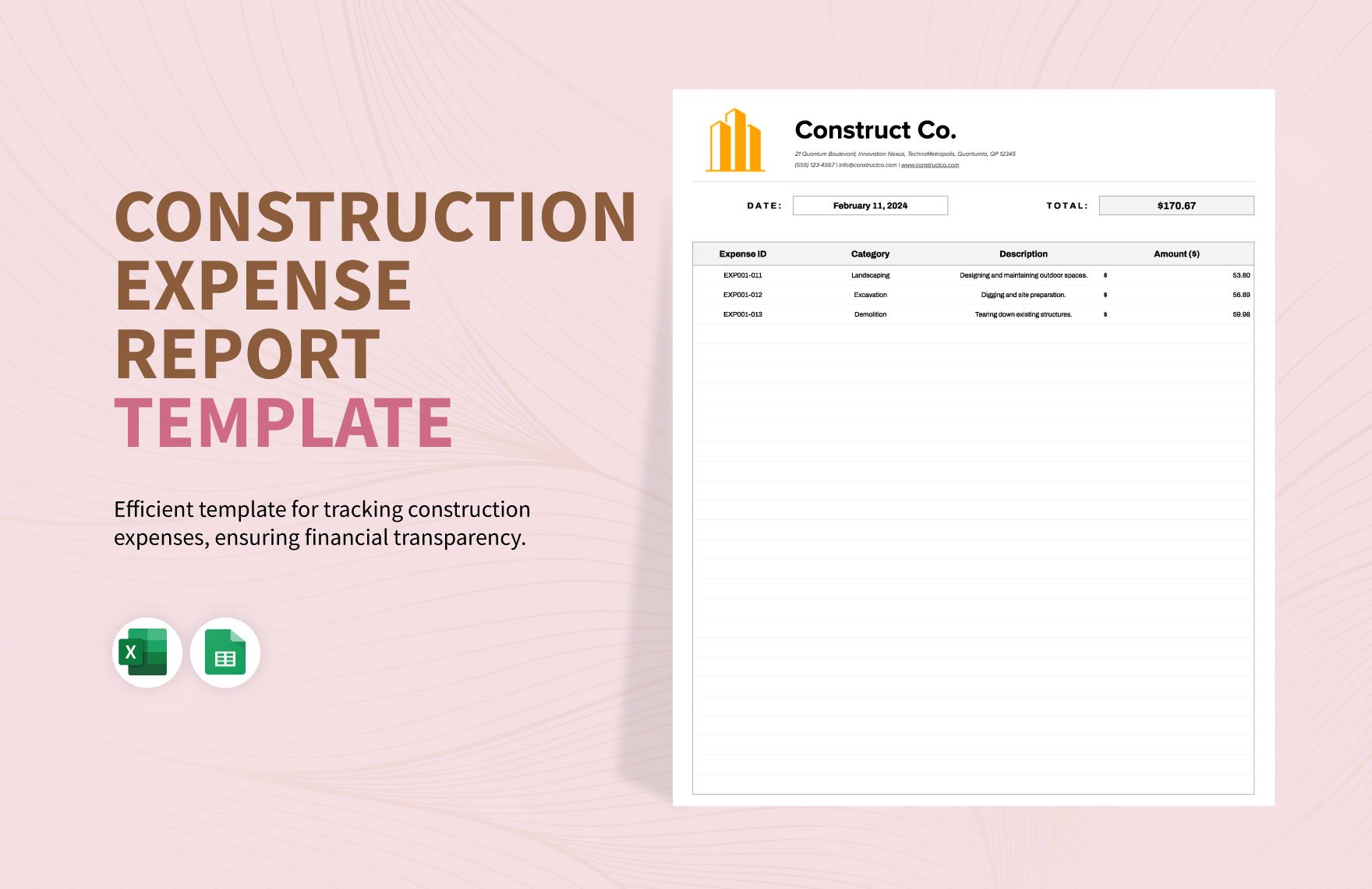

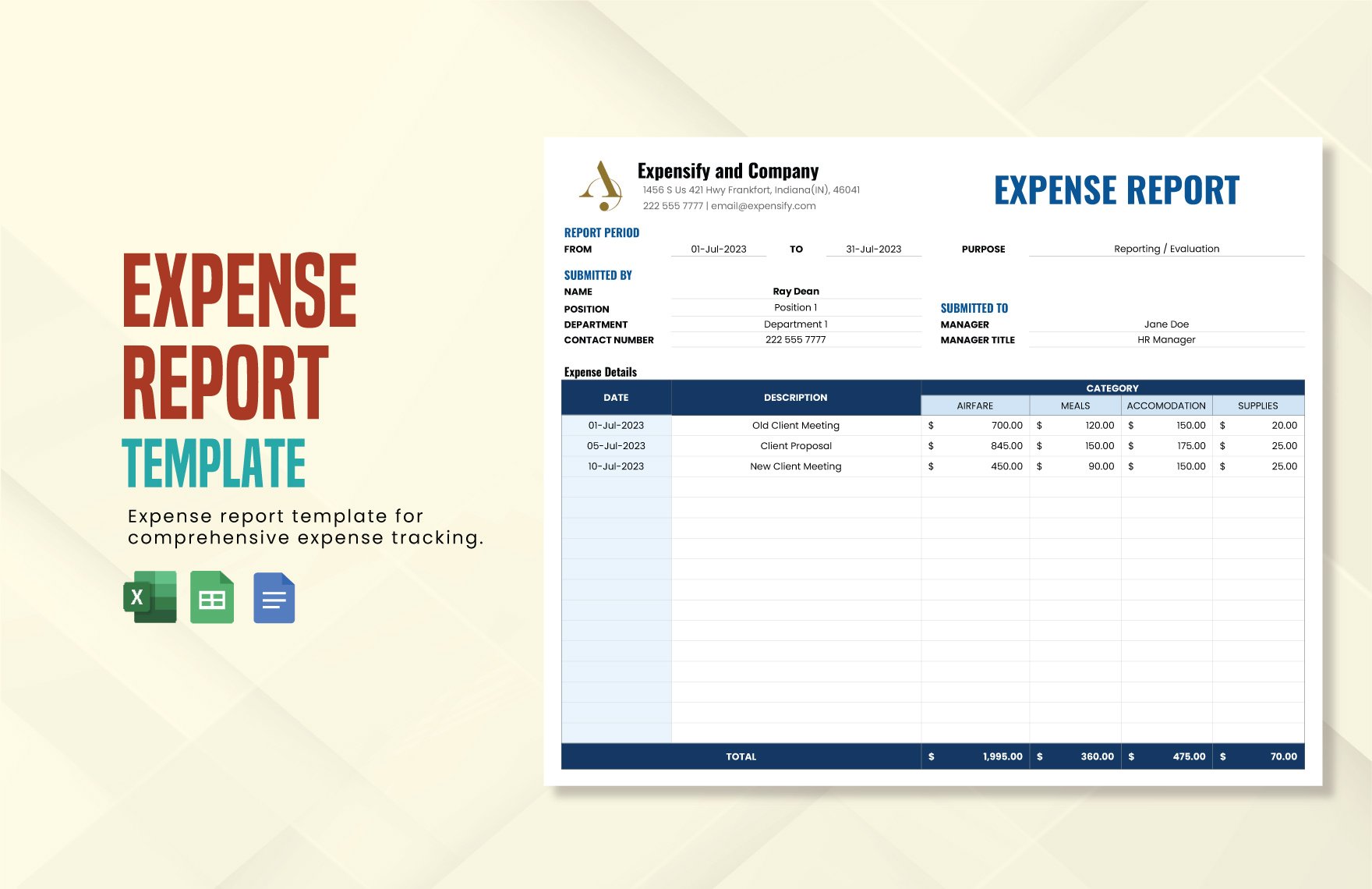

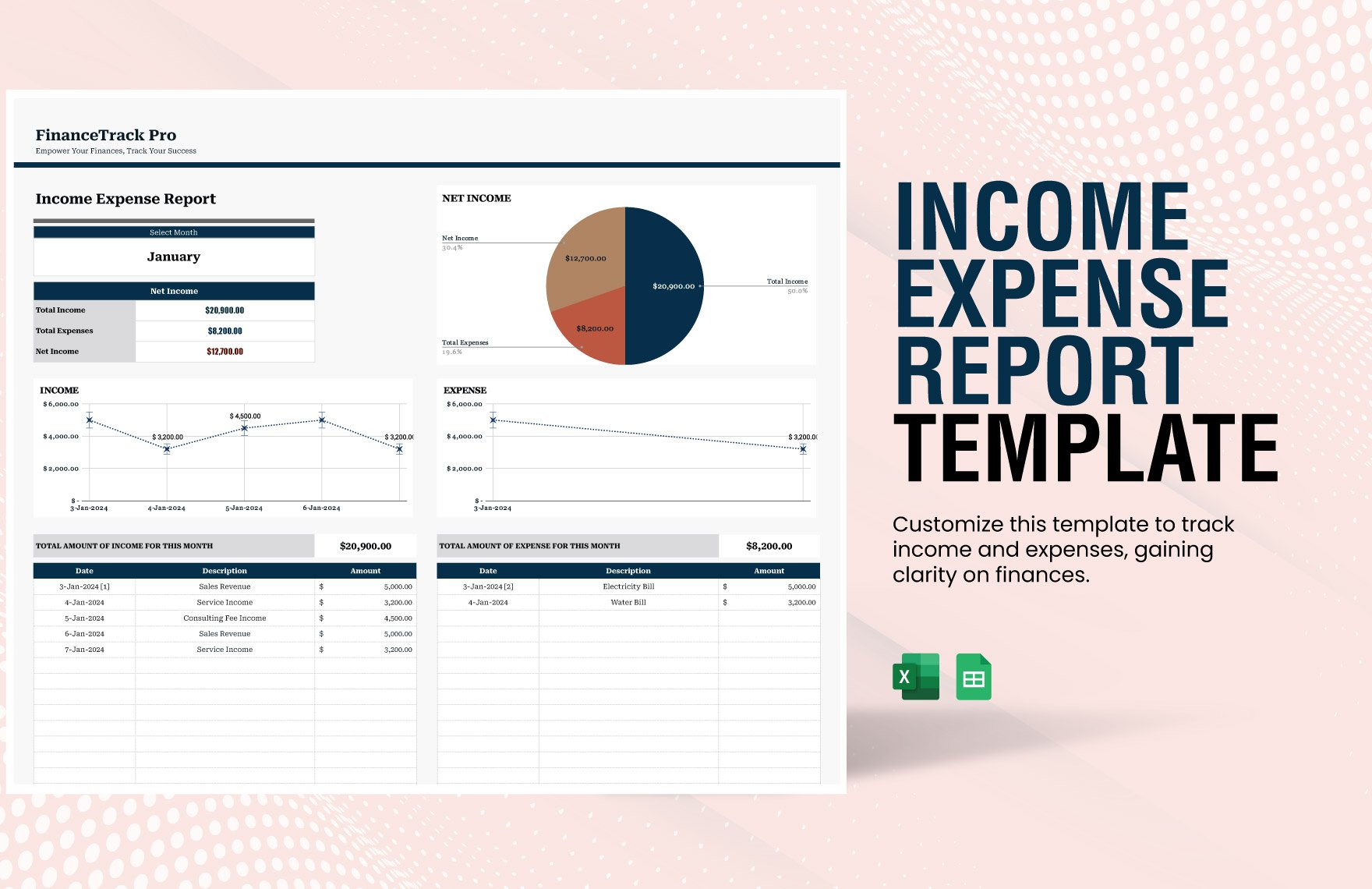

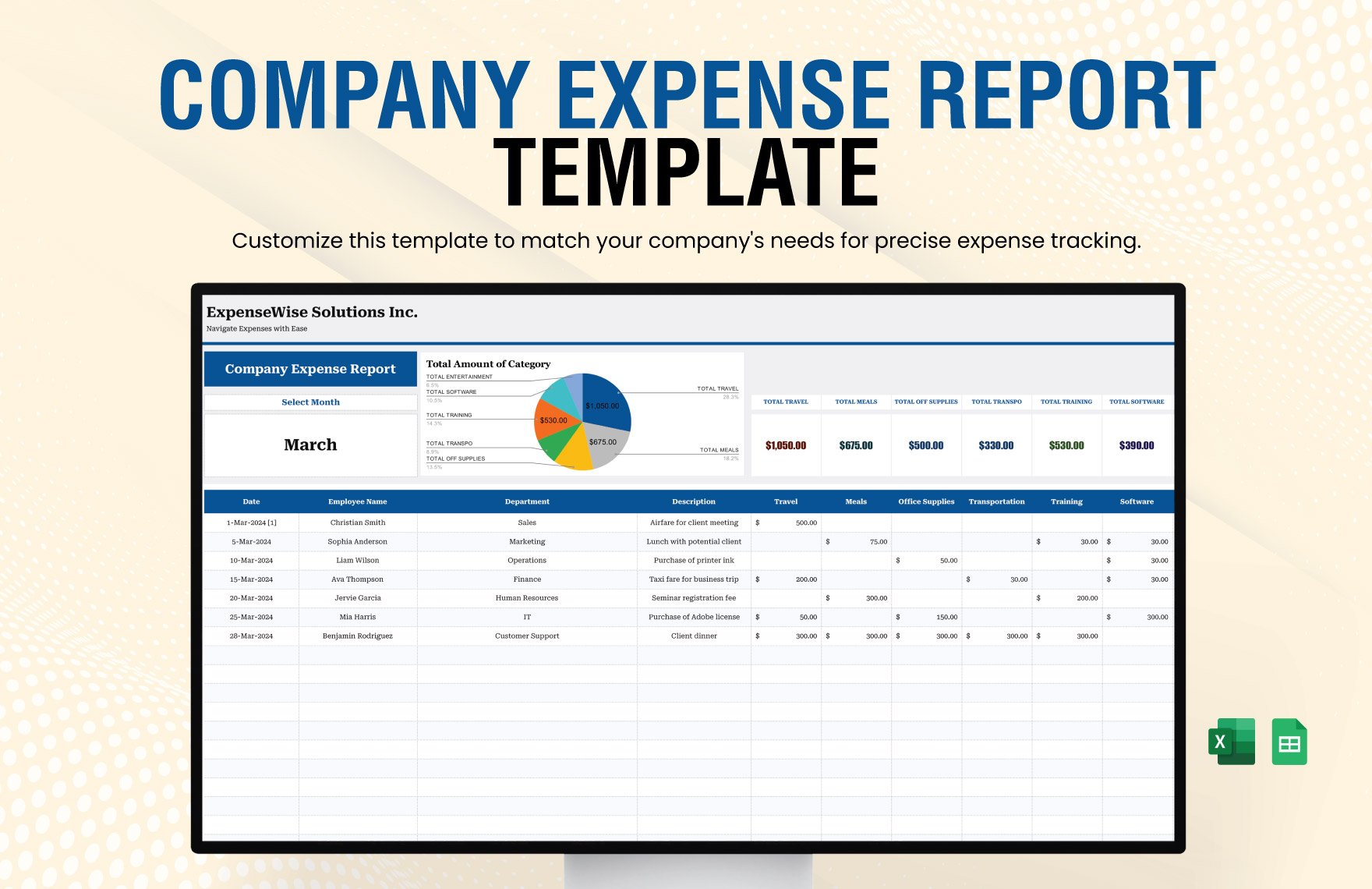

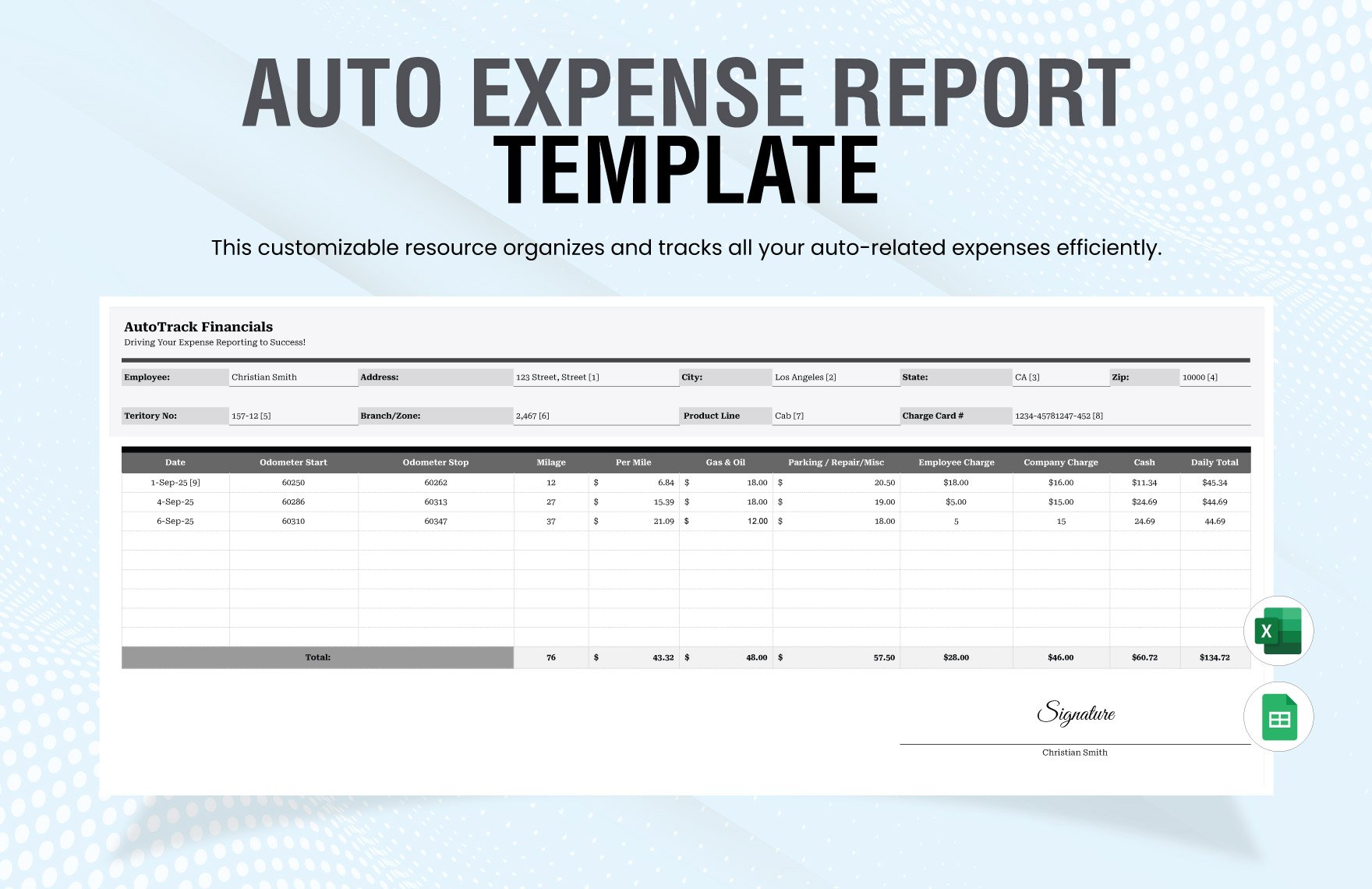

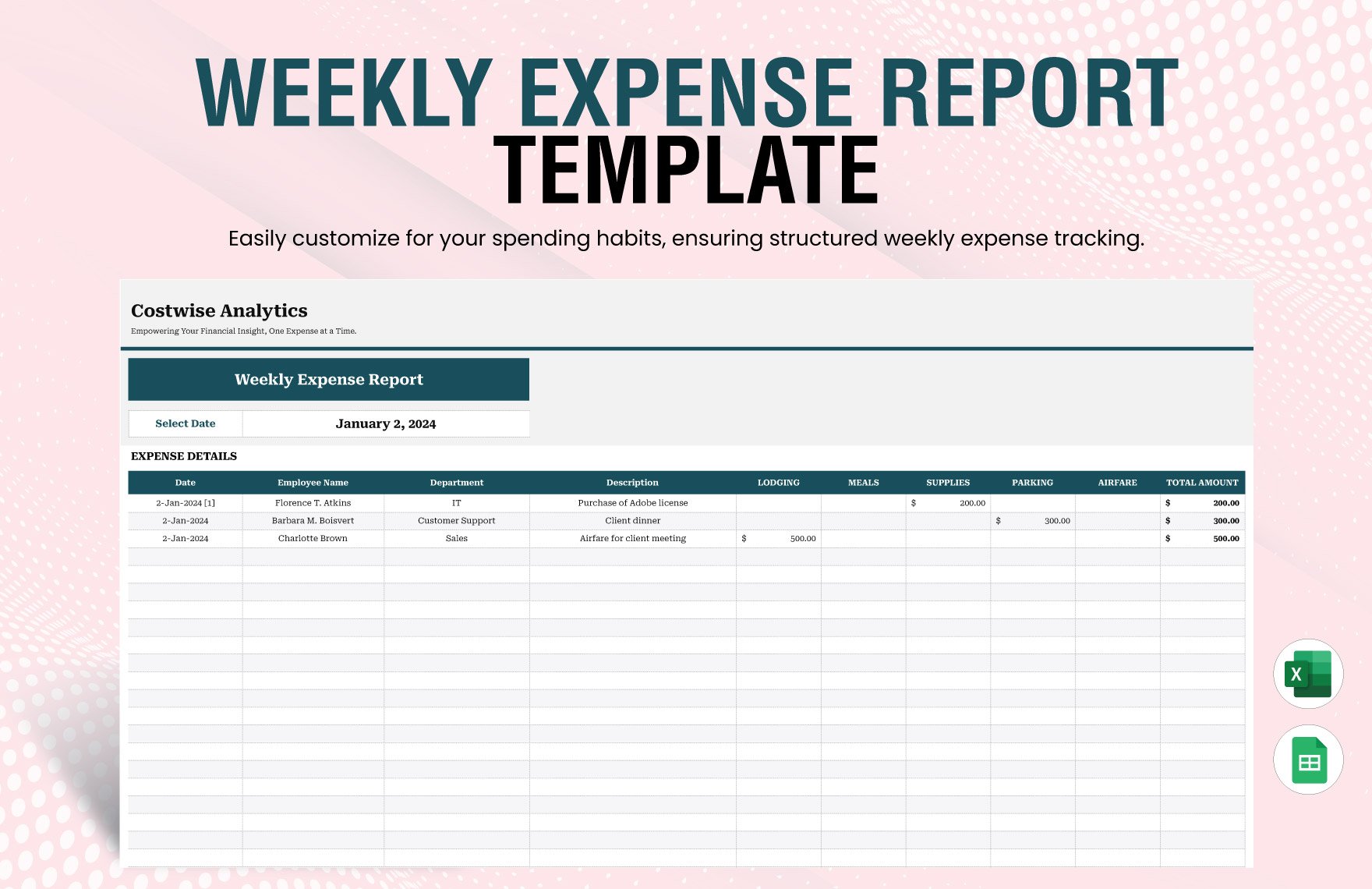

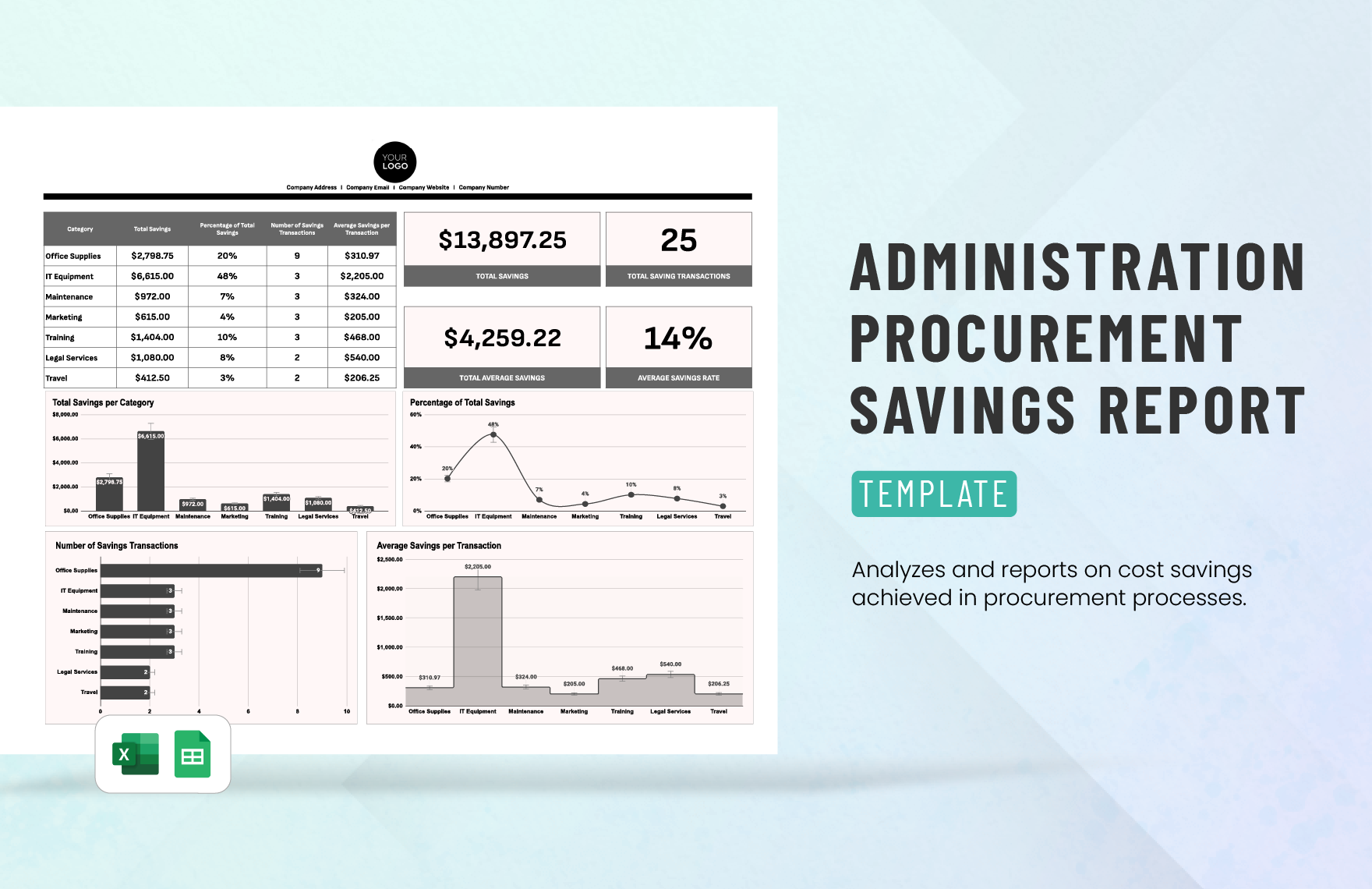

You don’t have to worry about creating an expense report from scratch anymore because of our easy to use Expense Report Templates. These templates are perfect for those wanting to create an effective document that details the expenses made during the course of performing necessary job functions outside the workplace. The templates are ready-made and can be downloaded instantly in Microsoft Excel. Choose from our wide variety of options including templates for business expenses, project expenses, travel expenses, annual sales expenses, contractor expenses, construction expenses, vehicle expenses, and many more. These printable templates are available in A4 and US print sizes. Download a template now!

How To Create An Expense Report in Excel

Running a corporation or small business can be a bit tedious, especially in the financial aspect. This is where expense reports come in handy. An expense report helps businesses and employees document their total expenditures, which you'll find useful for budgeting and the calculation of tax liability. This type of report tallies all the money spent on trips, meals, incidents, lodgings, or anything regarding your business that was bought using your own money.

If you're new in the business world and you need help build up your business, you're in the right place. We're here to educate you on creating an expense report through the spreadsheet program, Microsoft Excel. Here are five steps you can follow.

1. Set Up An Expense Policy

Before you can create an expense report, you need to have an expense policy that you can use when you're going to reimburse. Having an expense policy will give you an expense guideline on the policies and procedures to get reimbursement over the expenditures. Topics like what type of documentation you'll need in order to get a refund or the timespan for the filing of reimbursements.

2. Identify The Type Of Expense Report

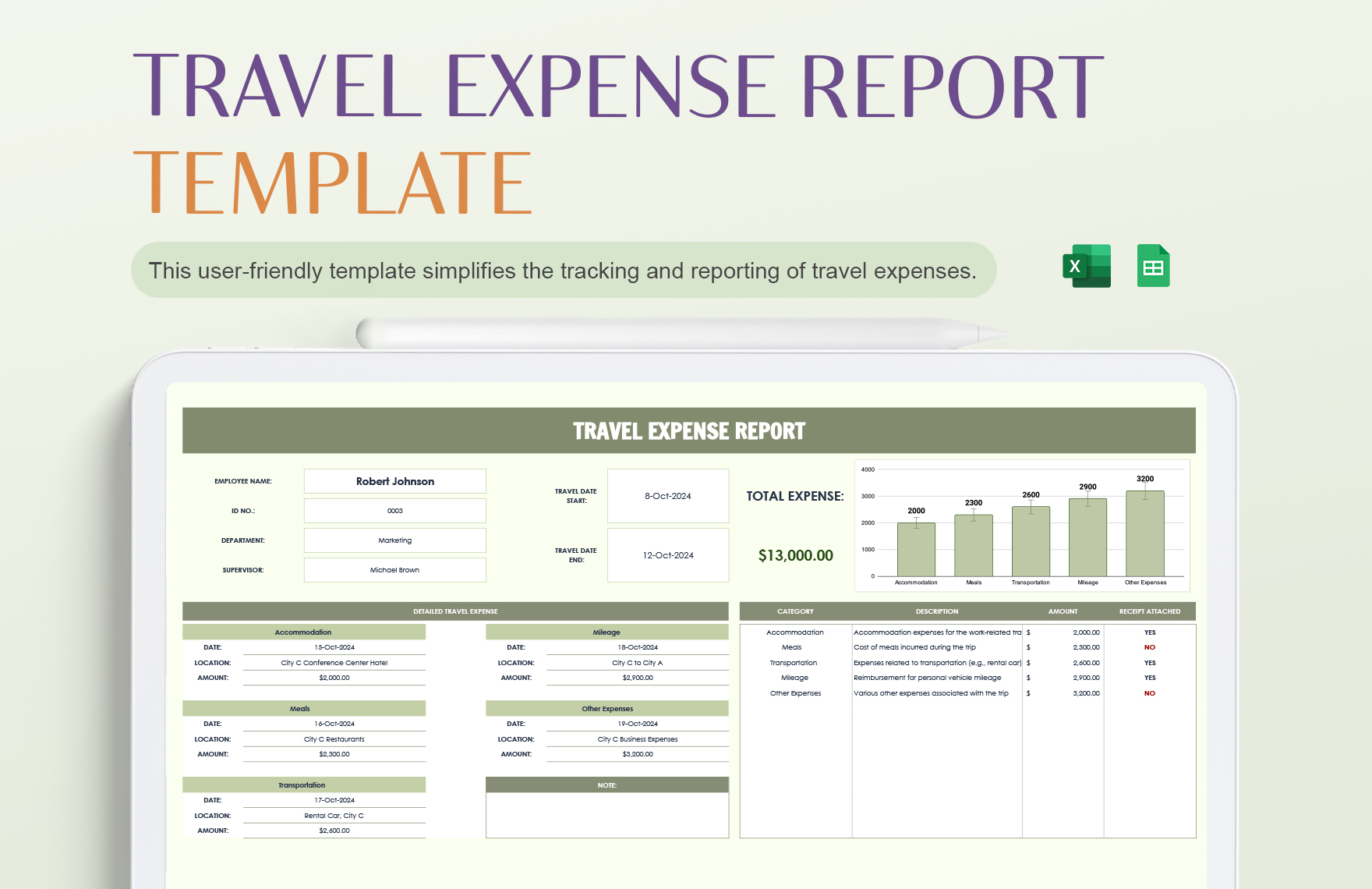

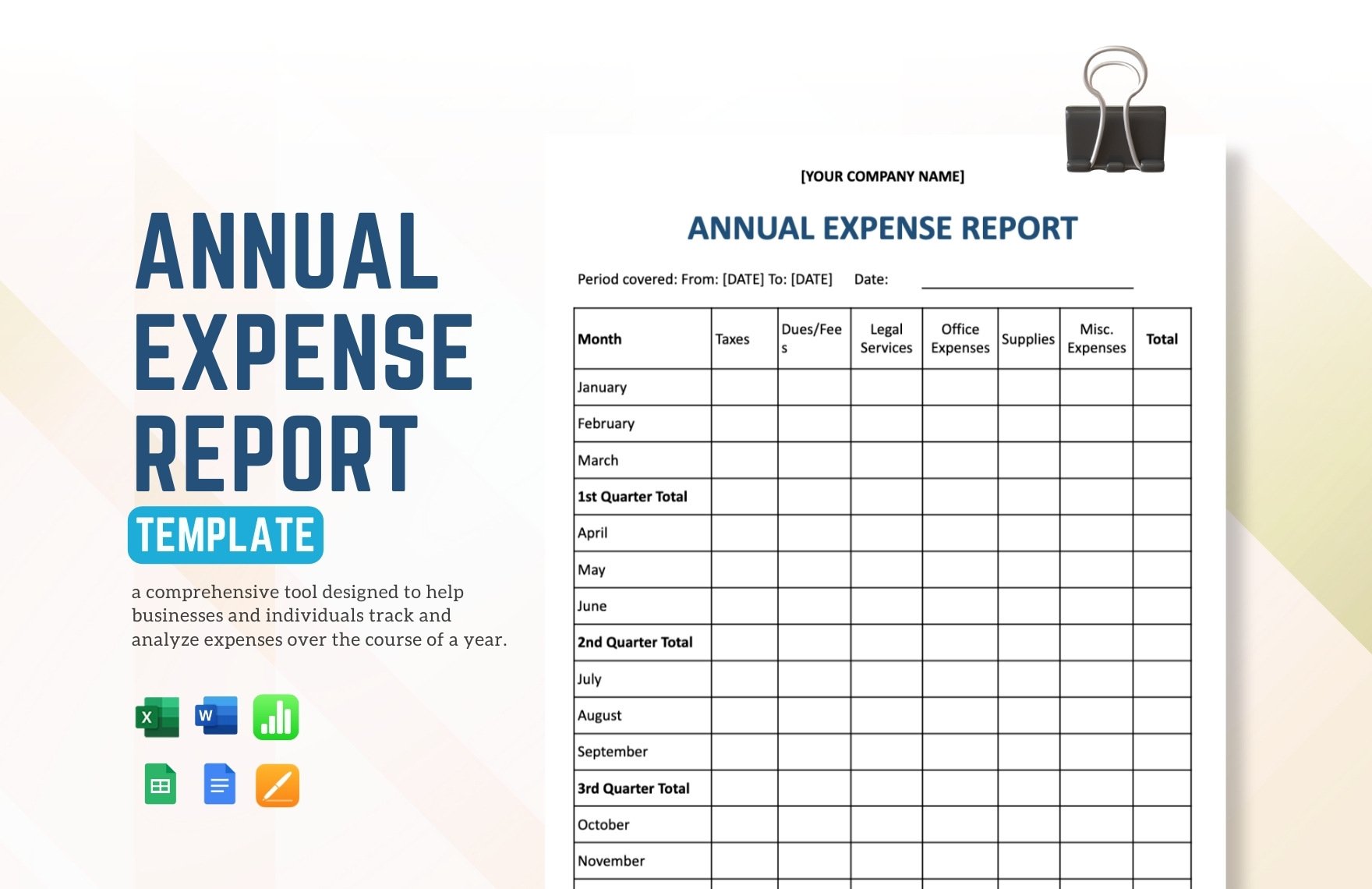

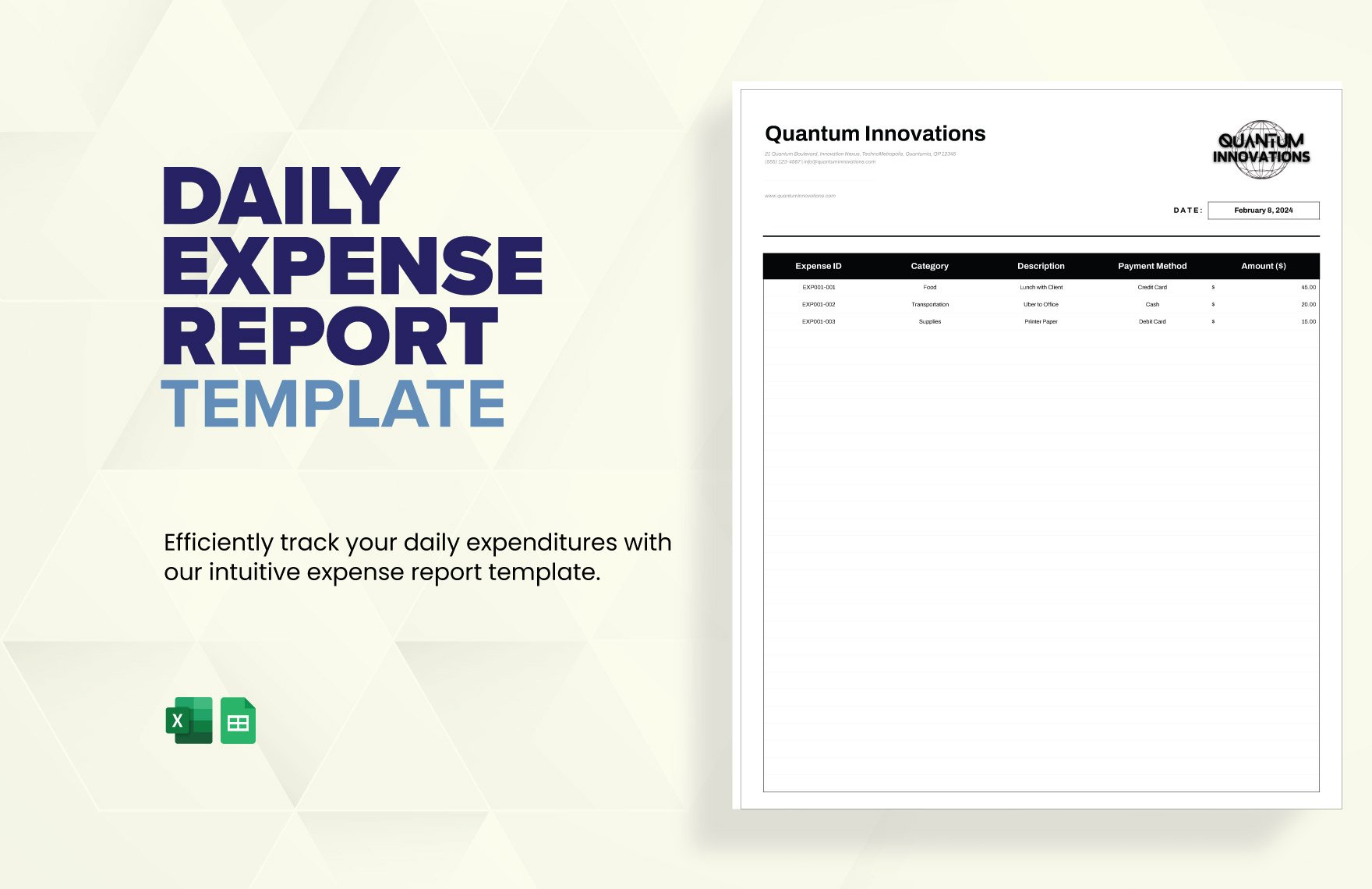

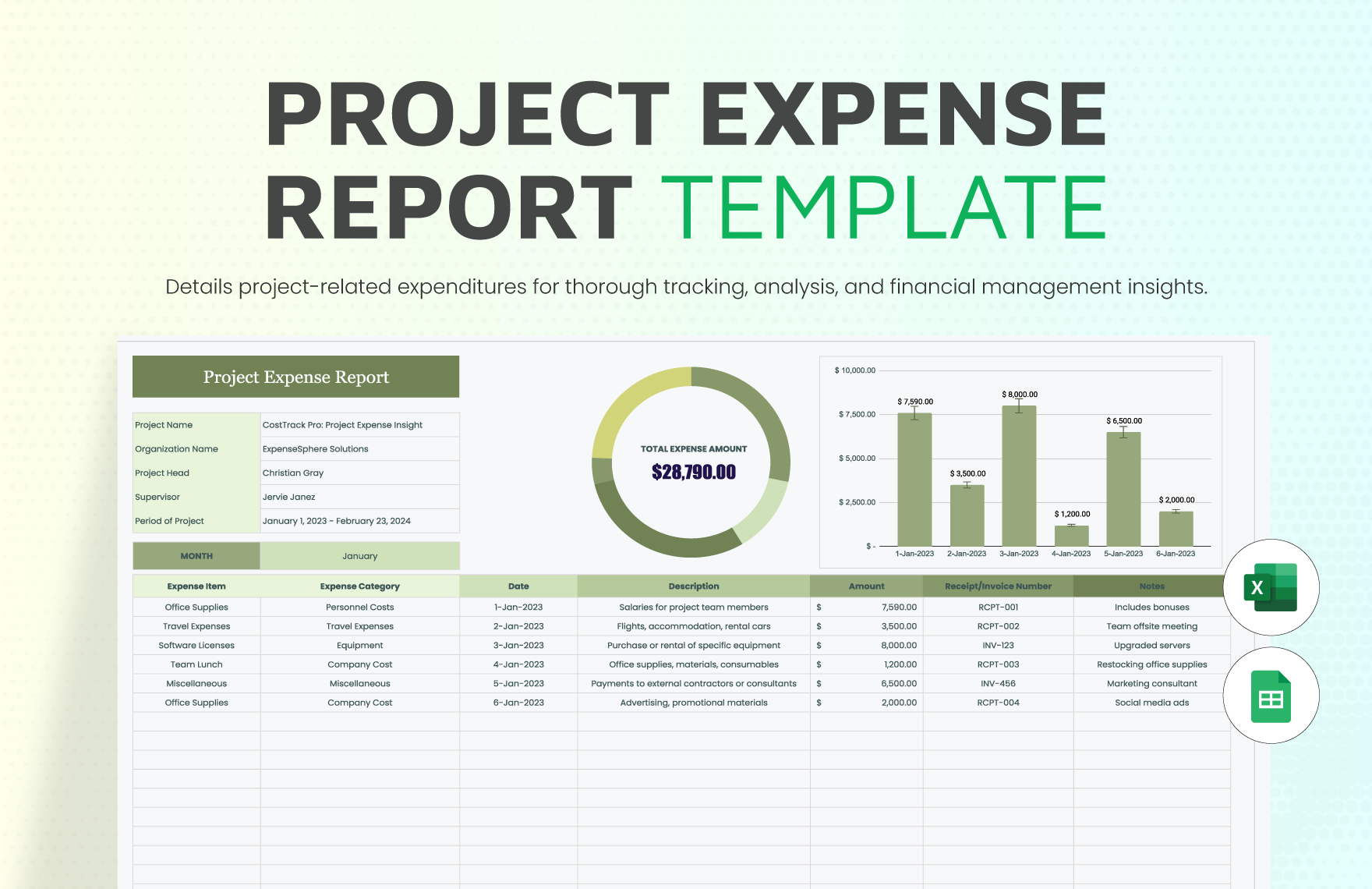

To produce the perfect expense report, you'll need to identify what type of expense report you need. The format, layout, and content will significantly depend on the type of expense report you're going to make. To illustrate, you want to have a form for the expenses your employee spent during a business trip. Then, you need a travel expense report. Another type of expense report is the mileage expense report. This type of document is used in the case where employees use their personal vehicles when going to an appointment or anything company-related affairs.

3. Make Use Of Expense Report Template

Don't bother creating your expense report from scratch. We have loads of specialized expense report templates for varied utilization such as annual sales expense report template, project expense report template, and construction expense report. Expense reports need to be unique for every business. For that reason, we proudly offer you our templates with a fully customizable feature so that you can personalize the template however you want. Just browse our website for a qualified expense report template you can immediately use. After downloading a template, open it through Microsoft Excel so that you can easily organize large amounts of data.

4. Prepare Proper Documentation

It is a requirement to have valid documentation when you or your employee is filling out the form. Documentations like invoices, receipts, and bills are at all costs required for reimbursement. Preparing proper documentation will support and justify the purchases. Without the proper documentation, the money you pulled out from your wallet will not be refunded.

5. Provide A Description

Once you've listed out the expenses, you need to provide a description of the itemized items on your simple report. Keep the description short and straightforward. Your description can be about the specifications of the items. For instance, you wrote "transportation" as your item. Your description can be the type of vehicle you rode and how much is the rent for that ride.