Bring Your Financial Planning to Life with Payment Schedule Templates from Template.net

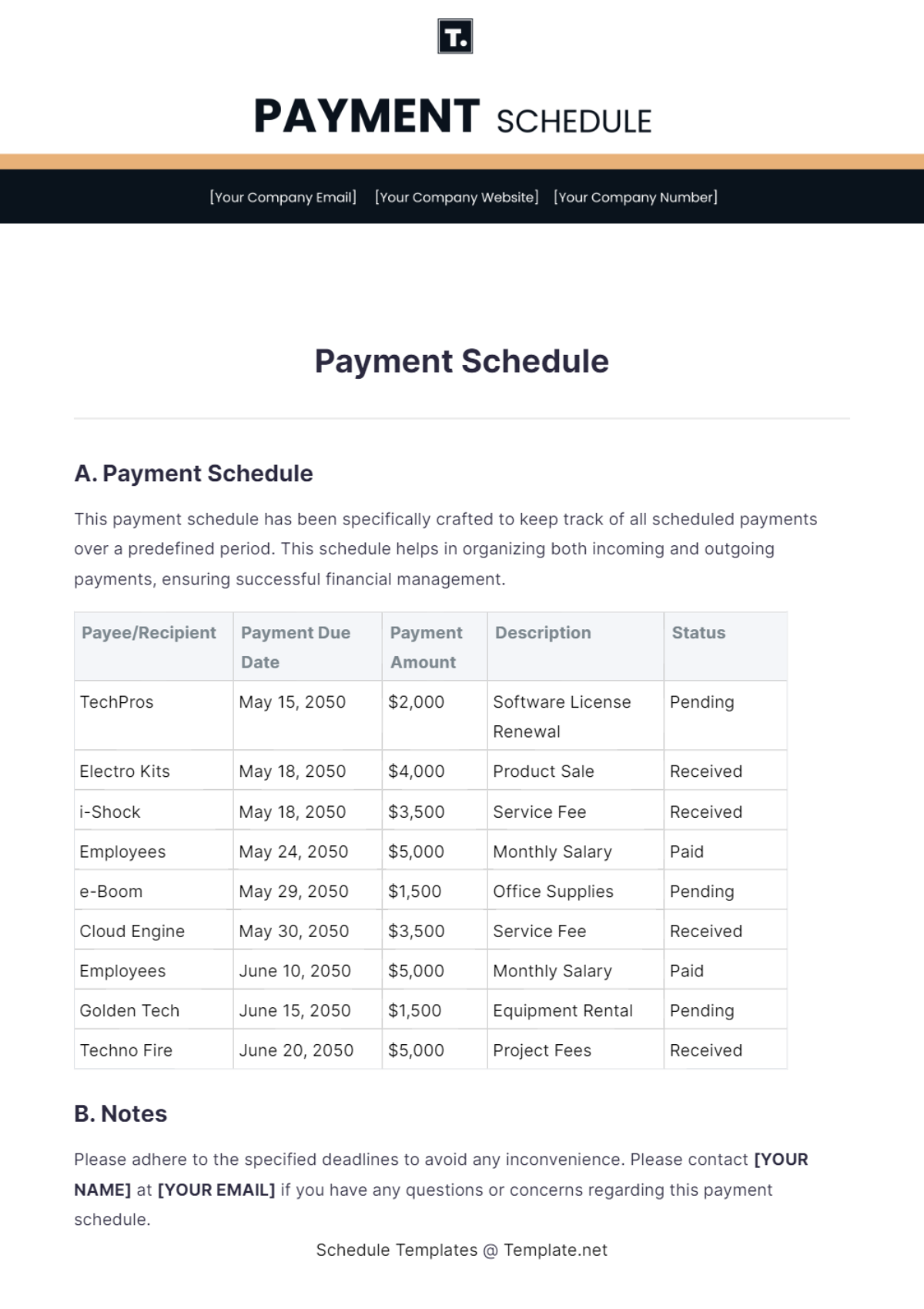

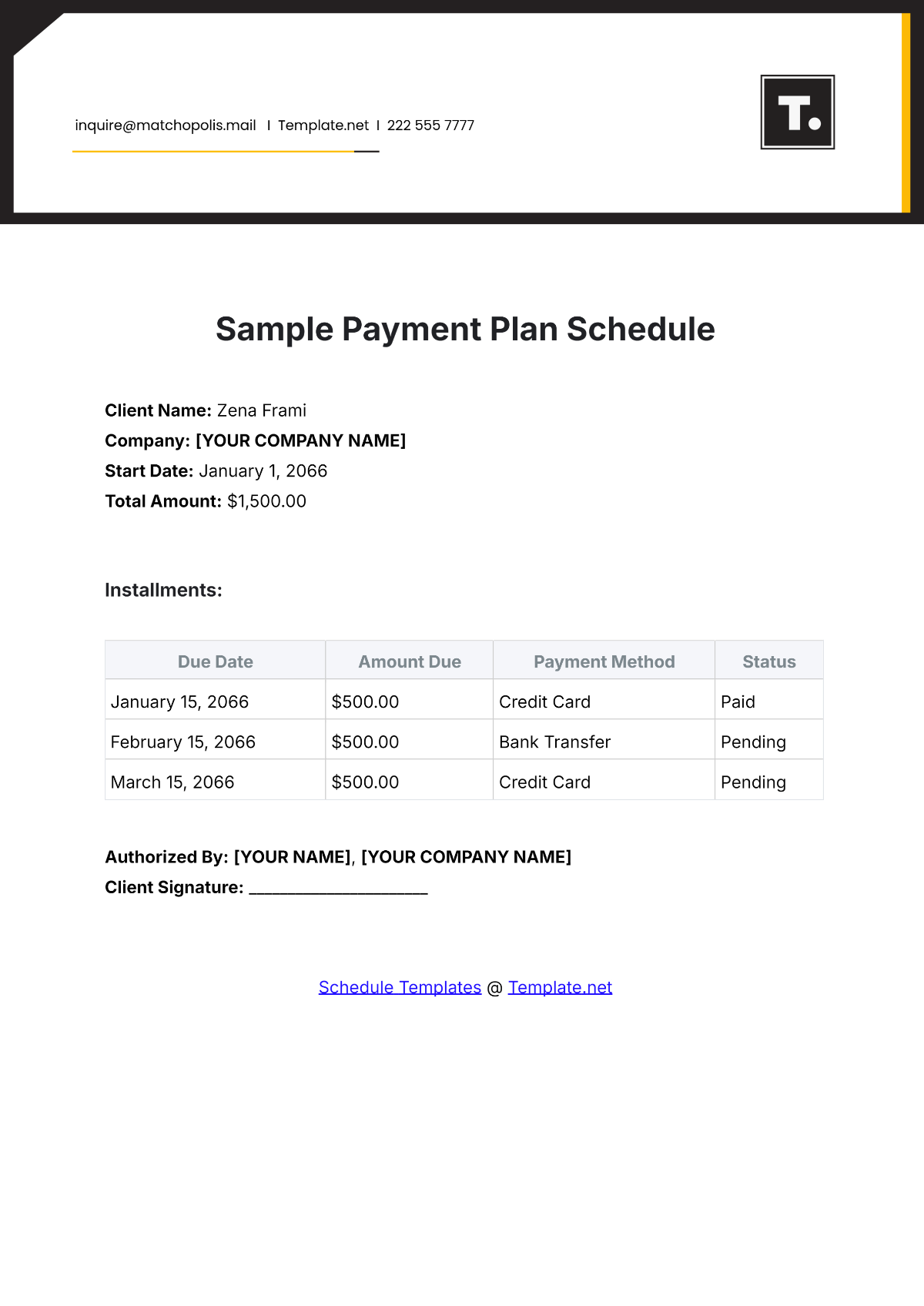

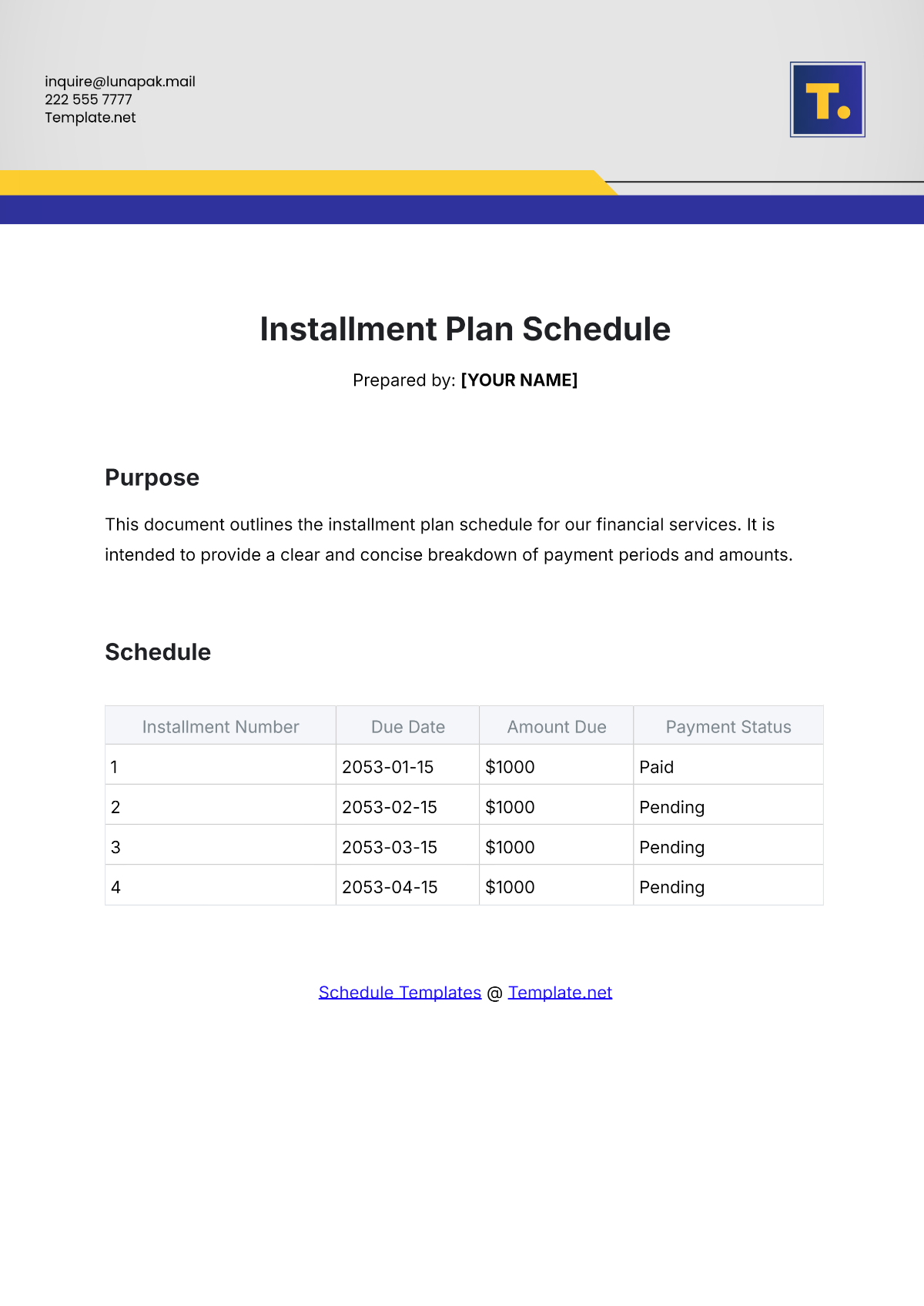

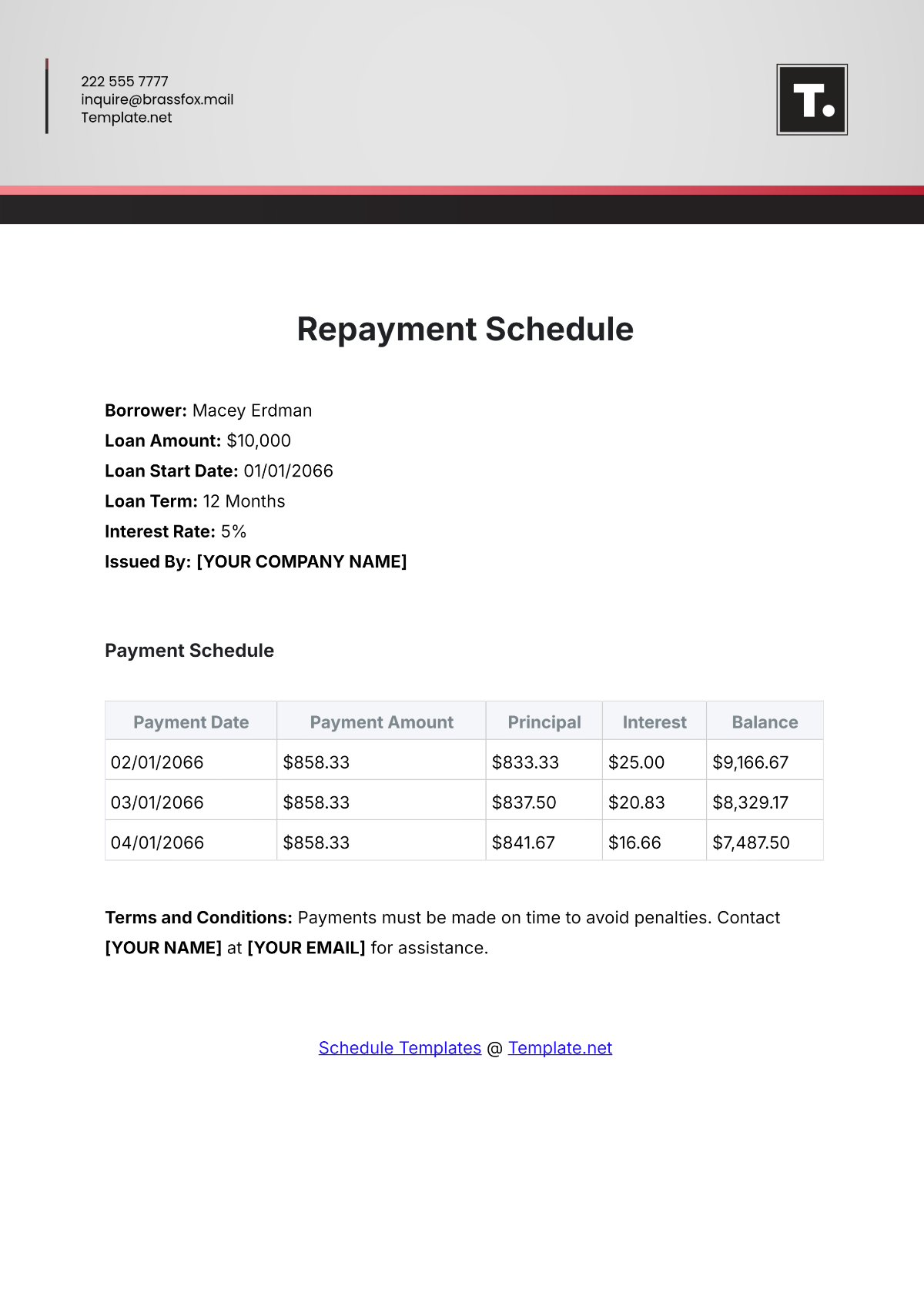

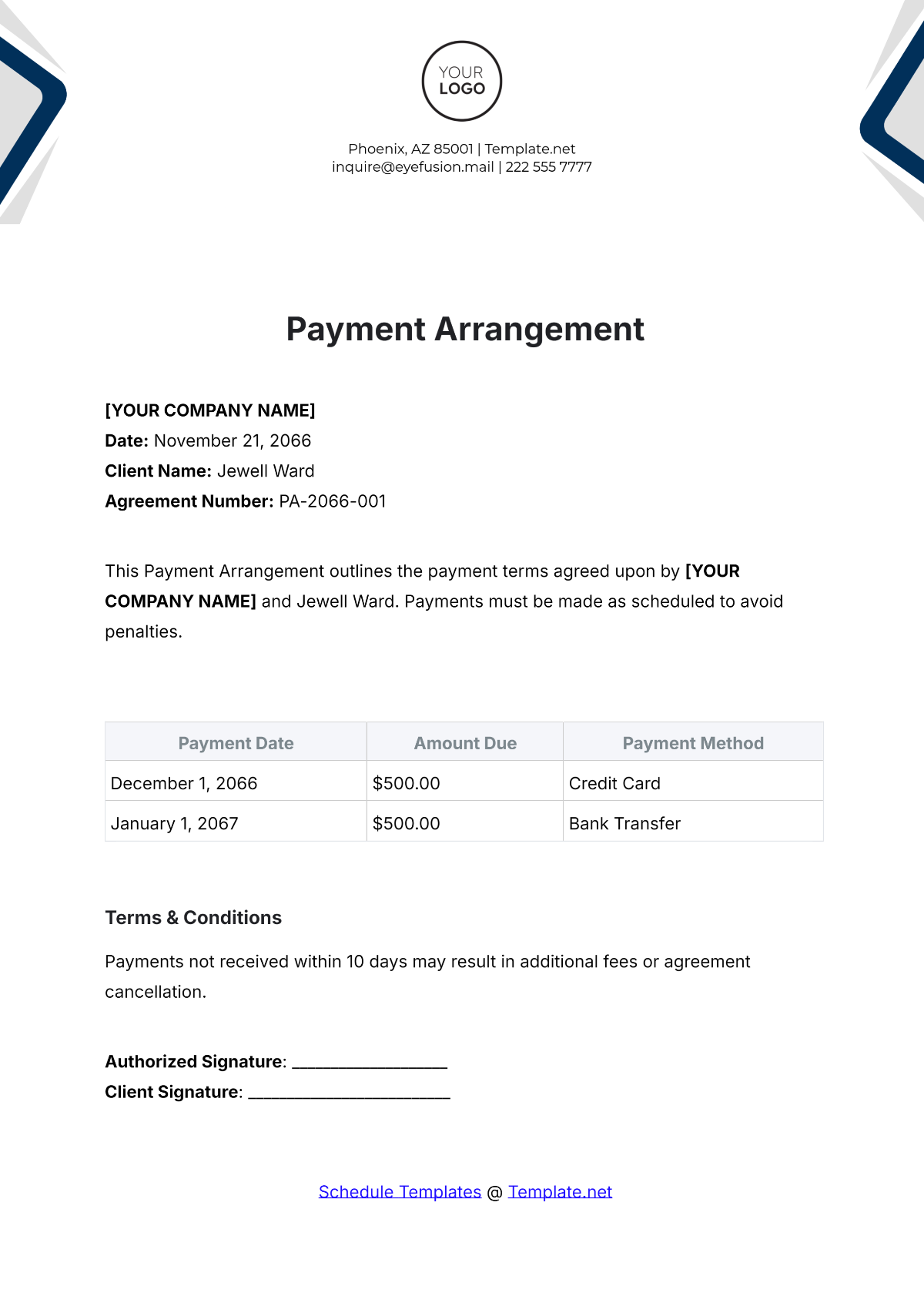

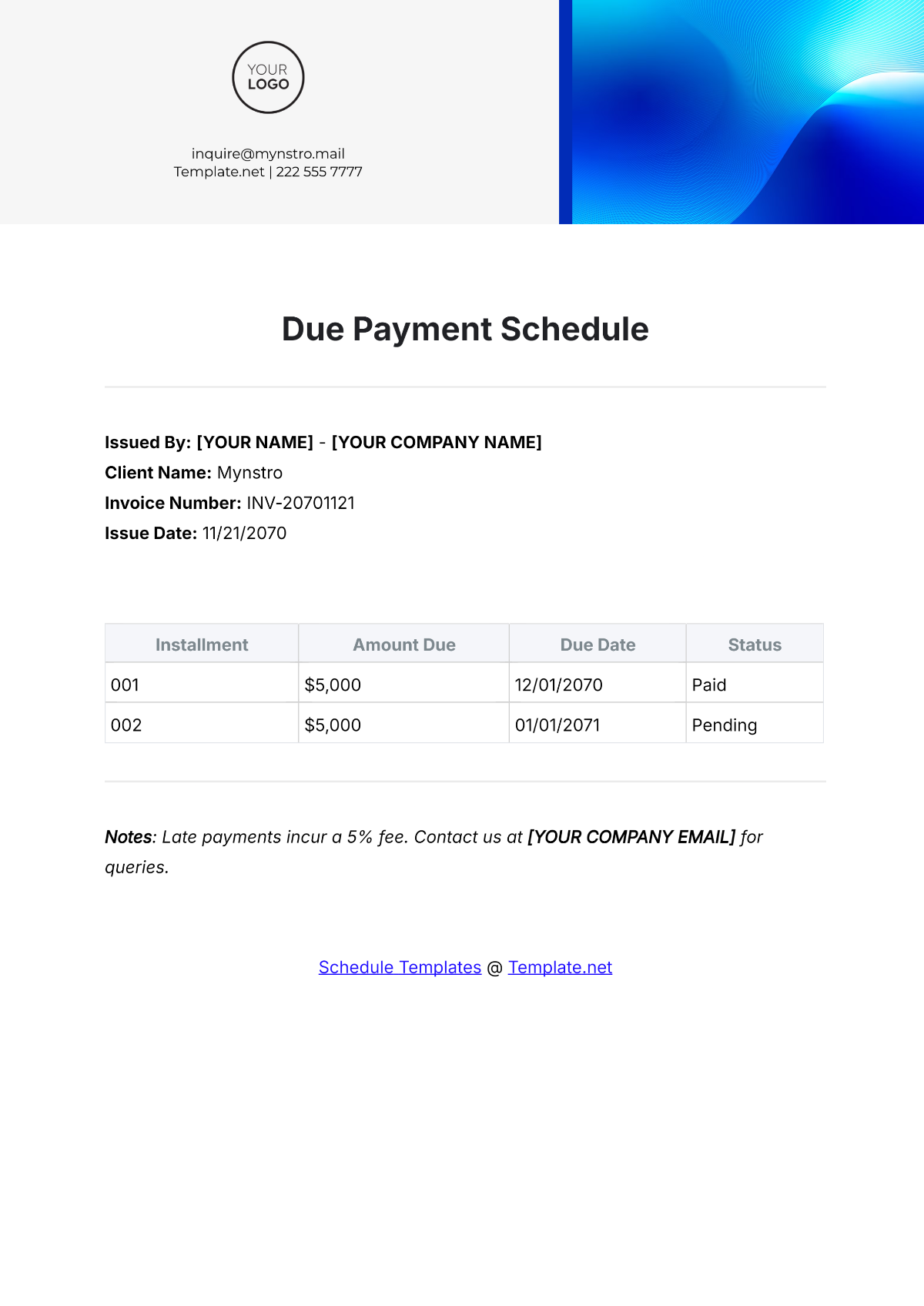

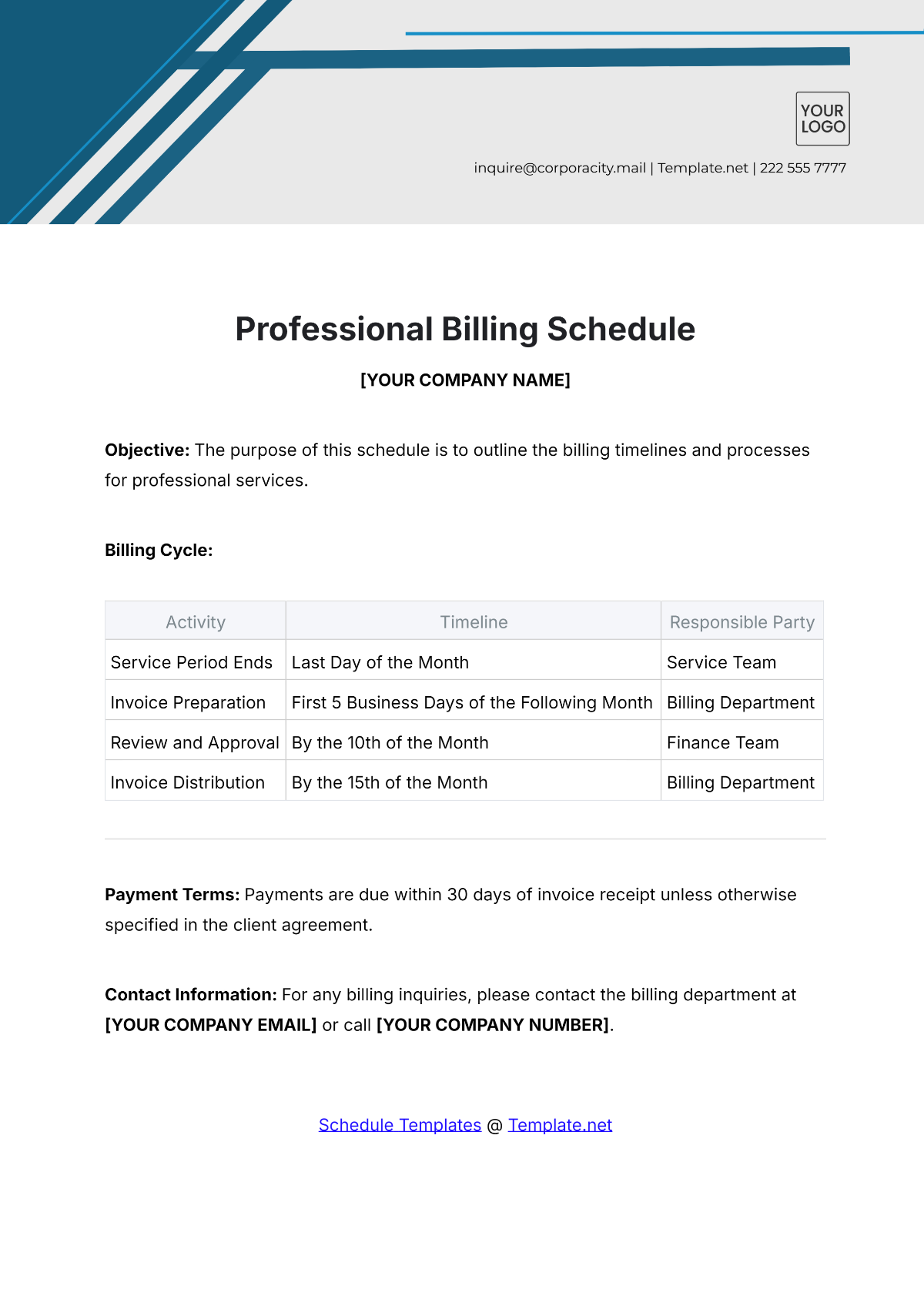

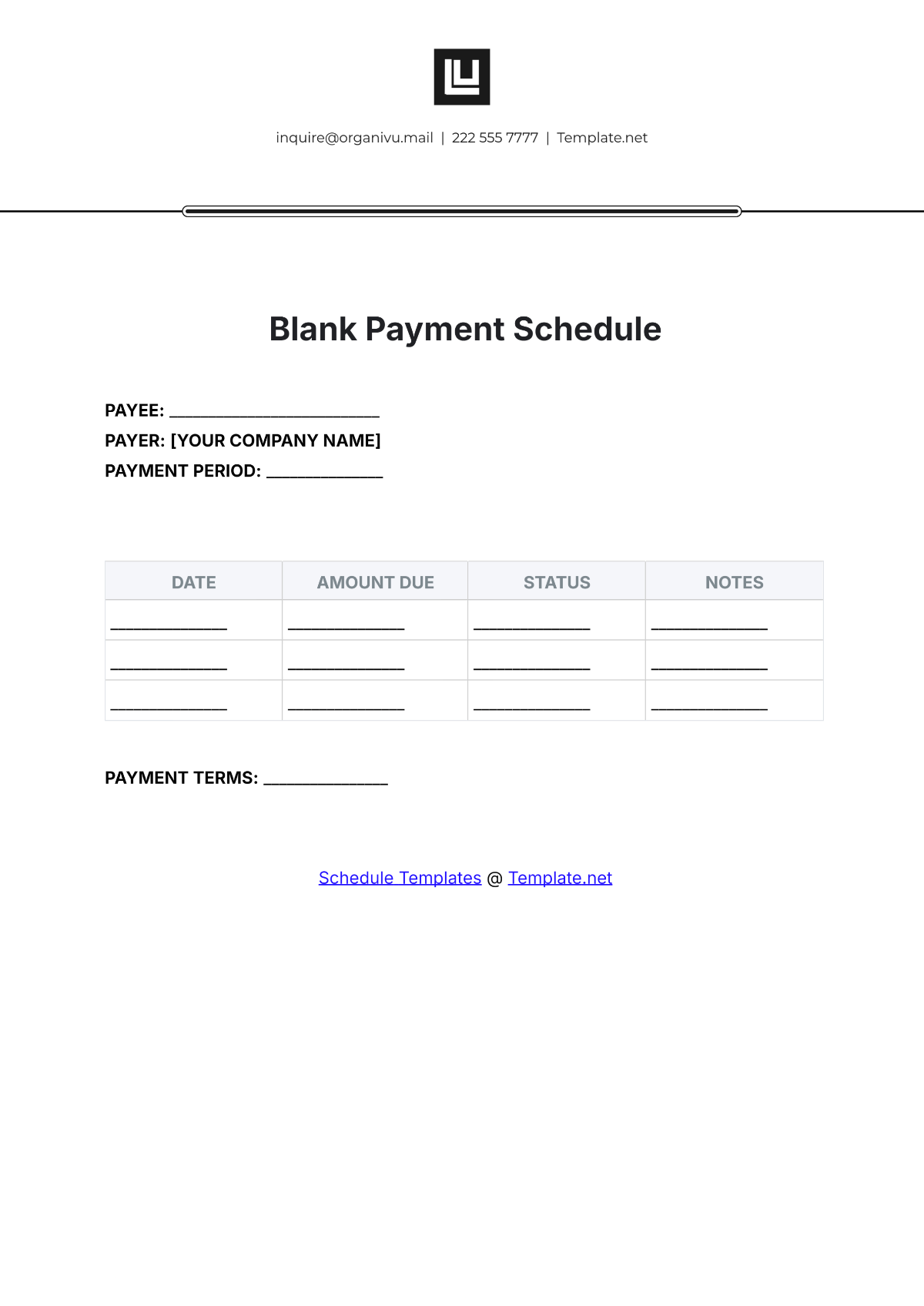

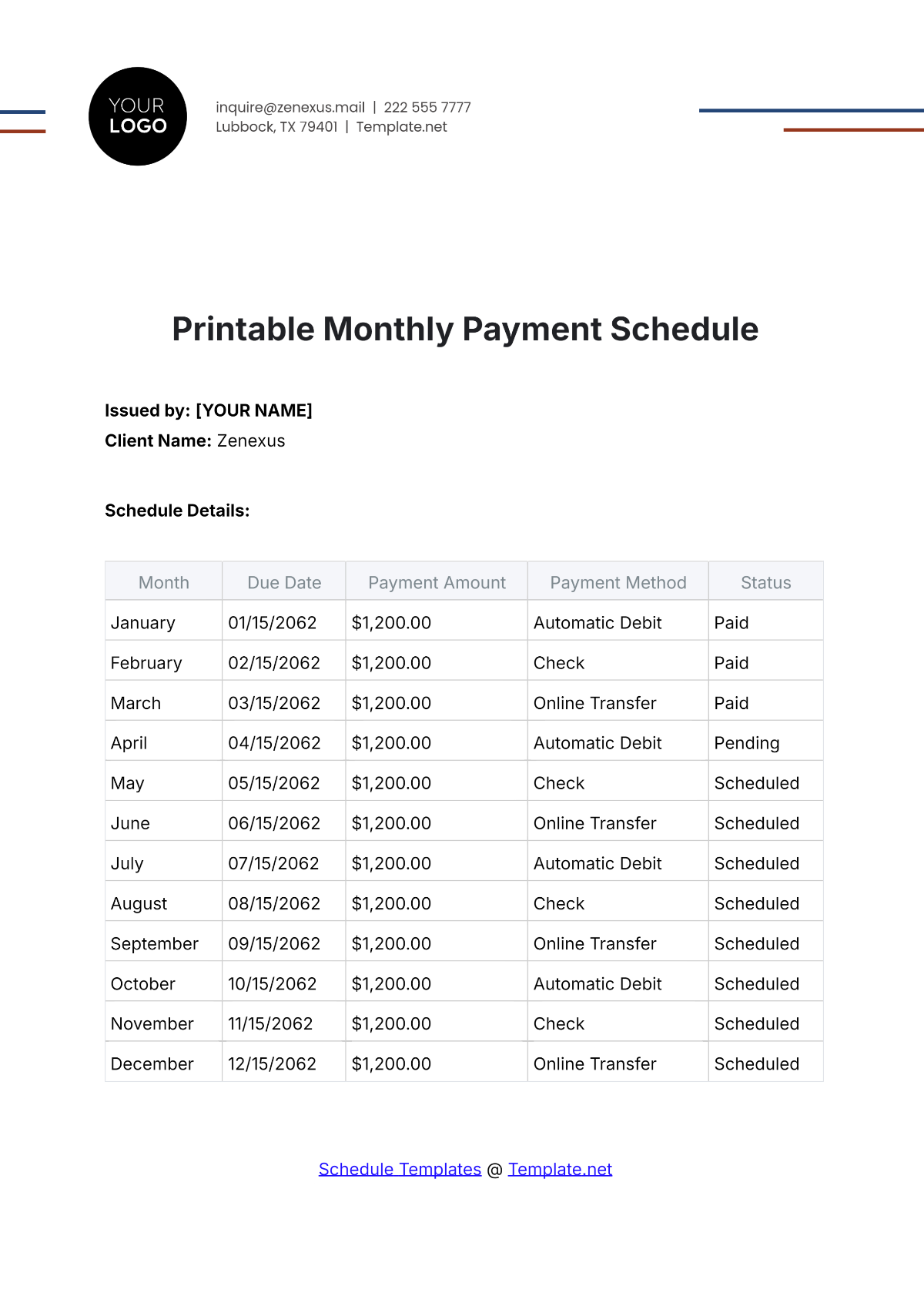

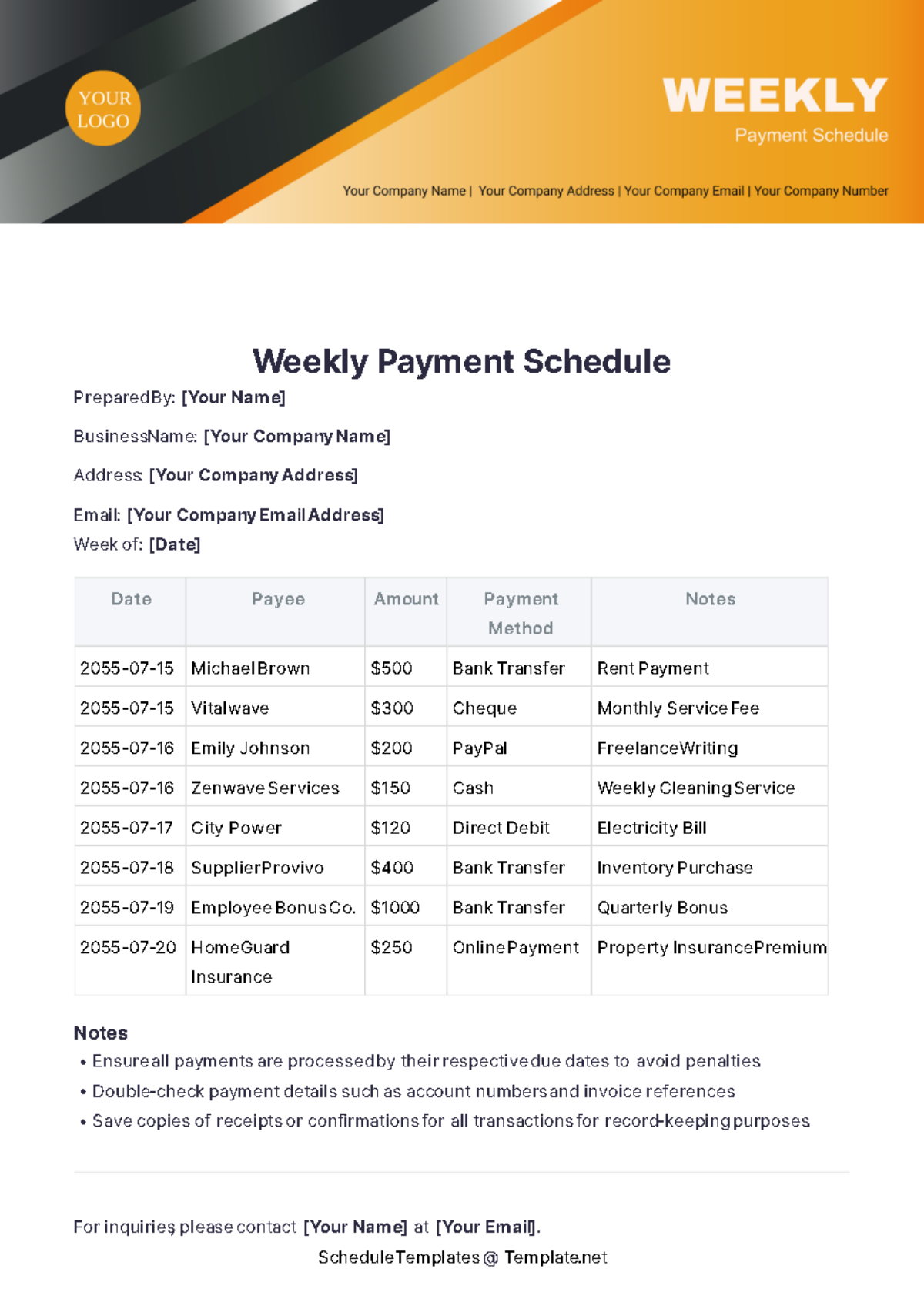

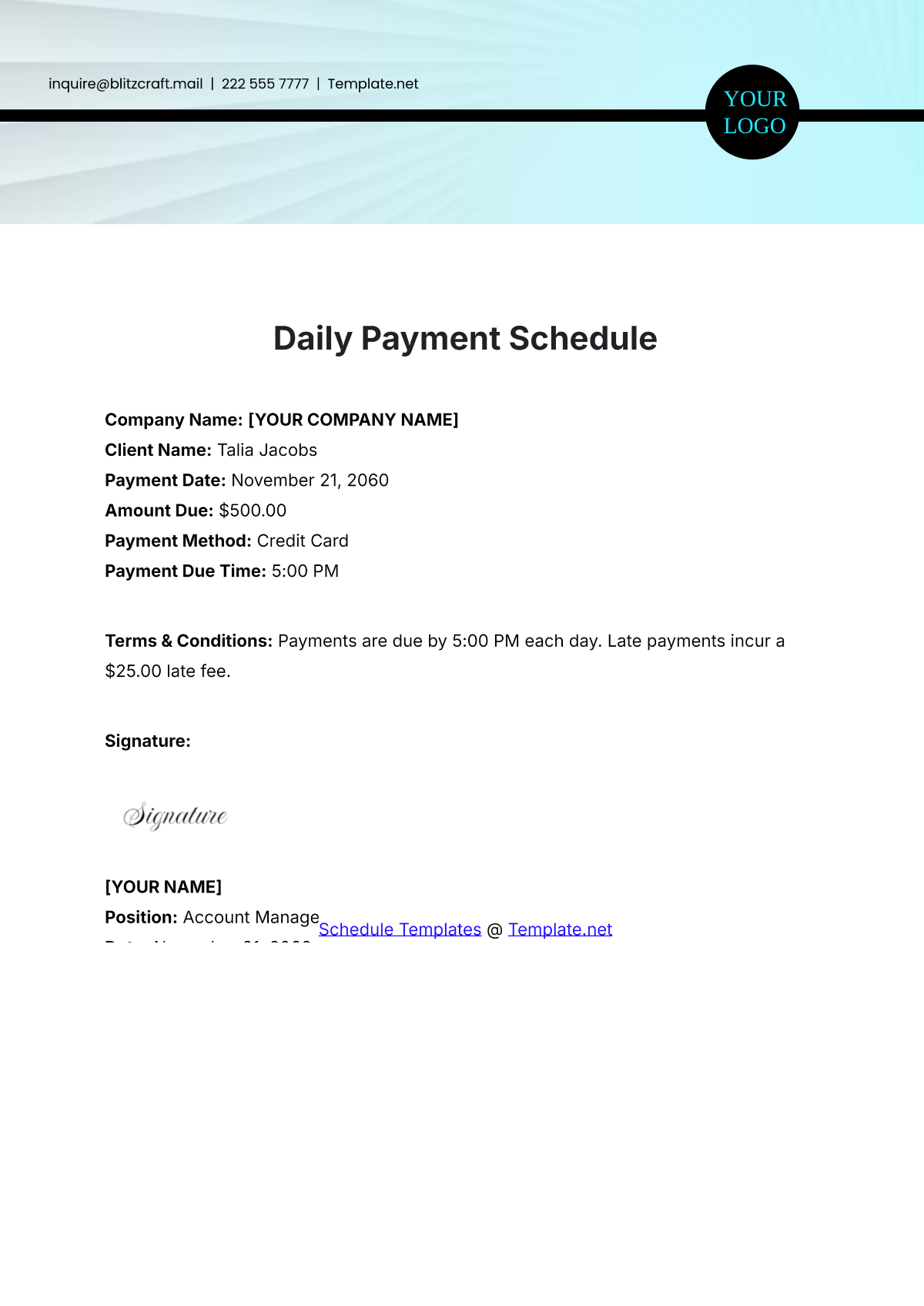

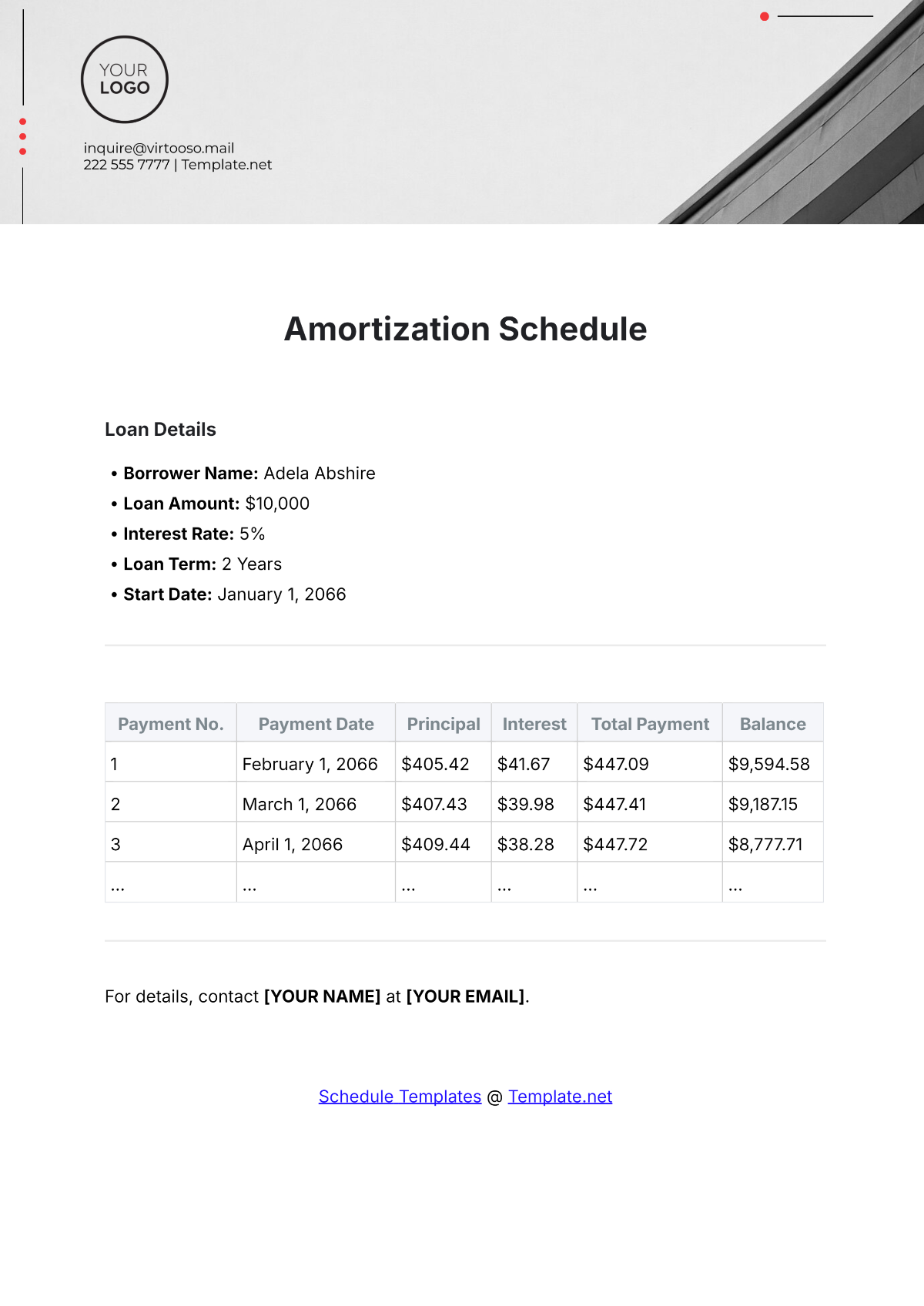

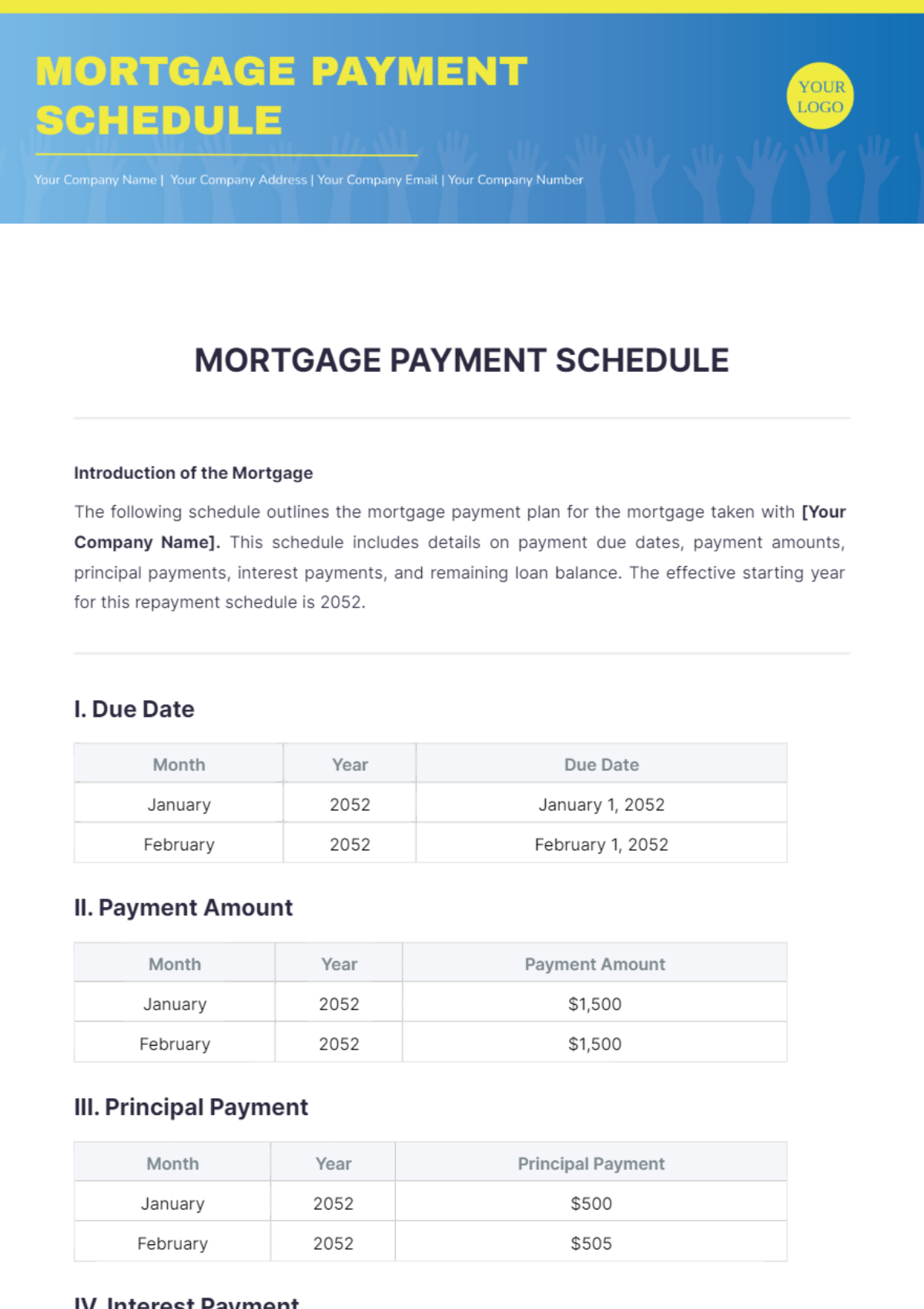

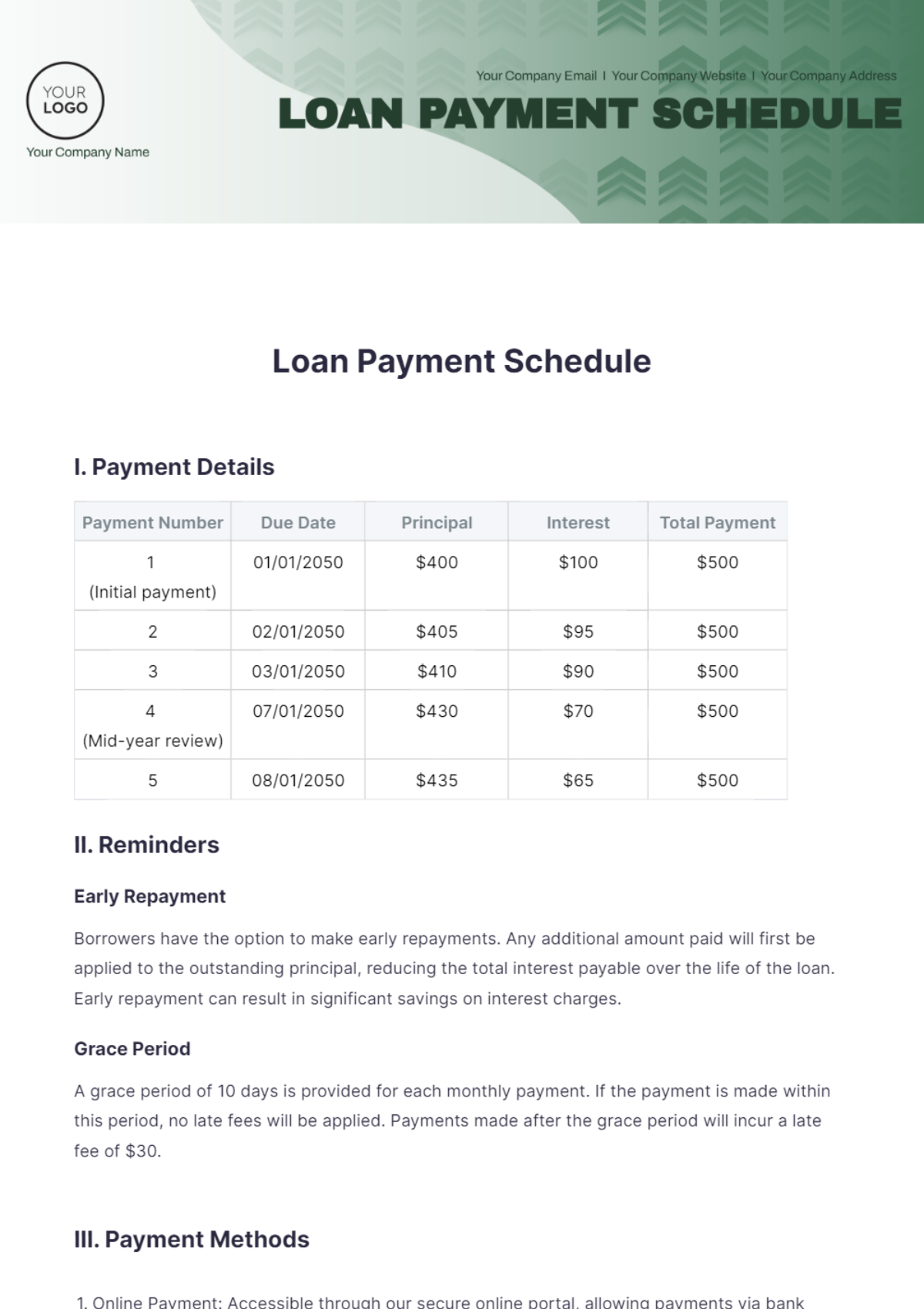

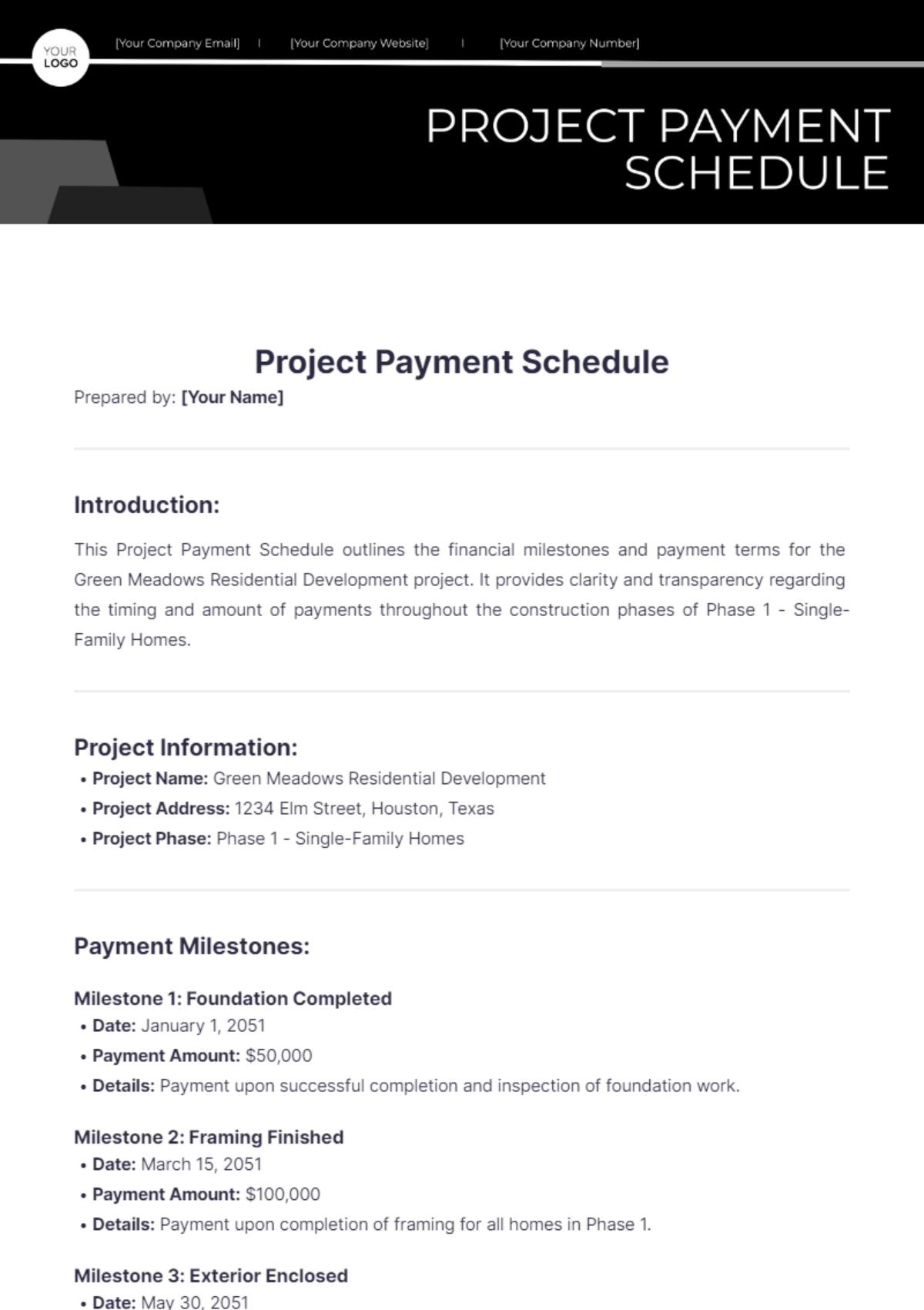

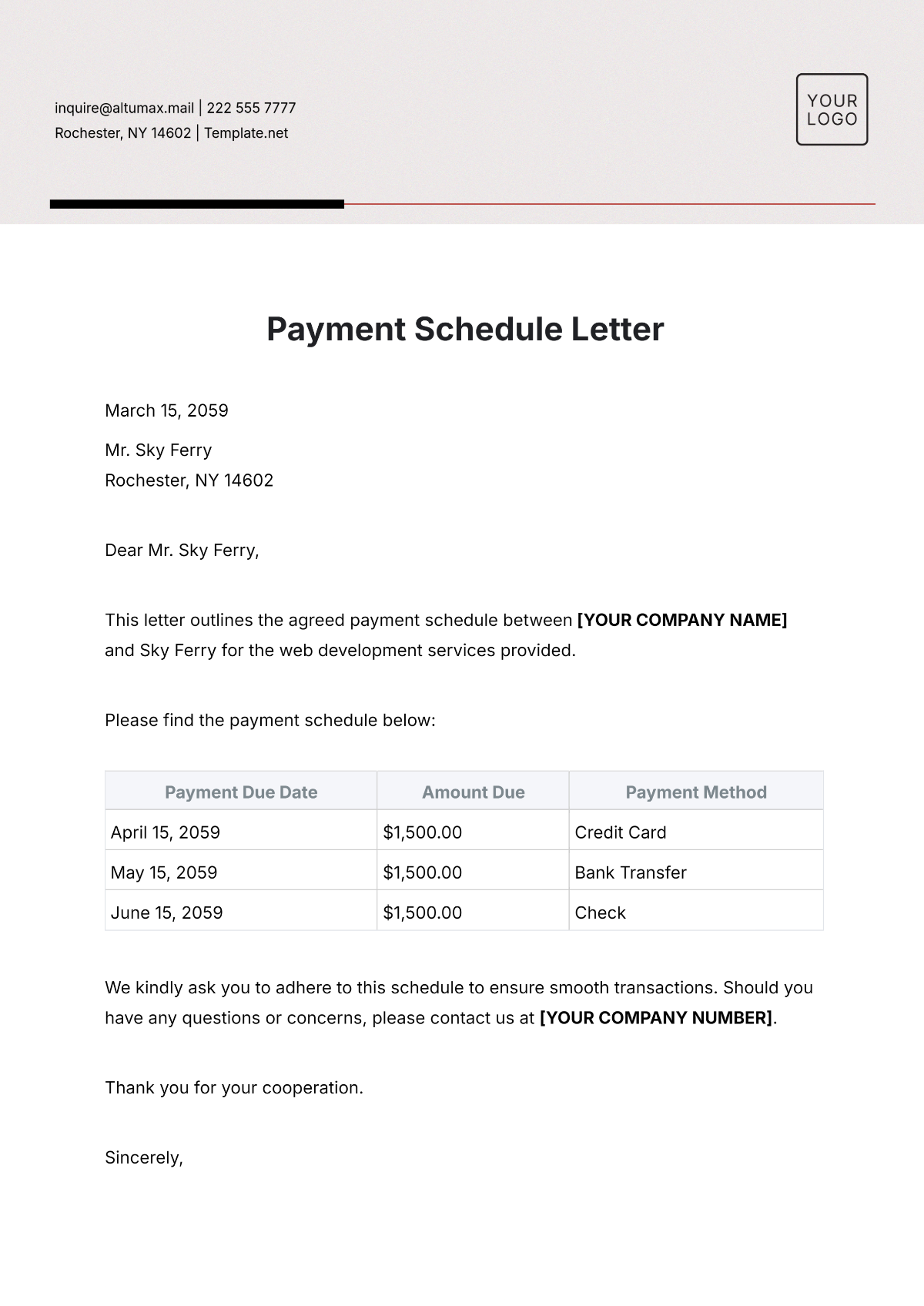

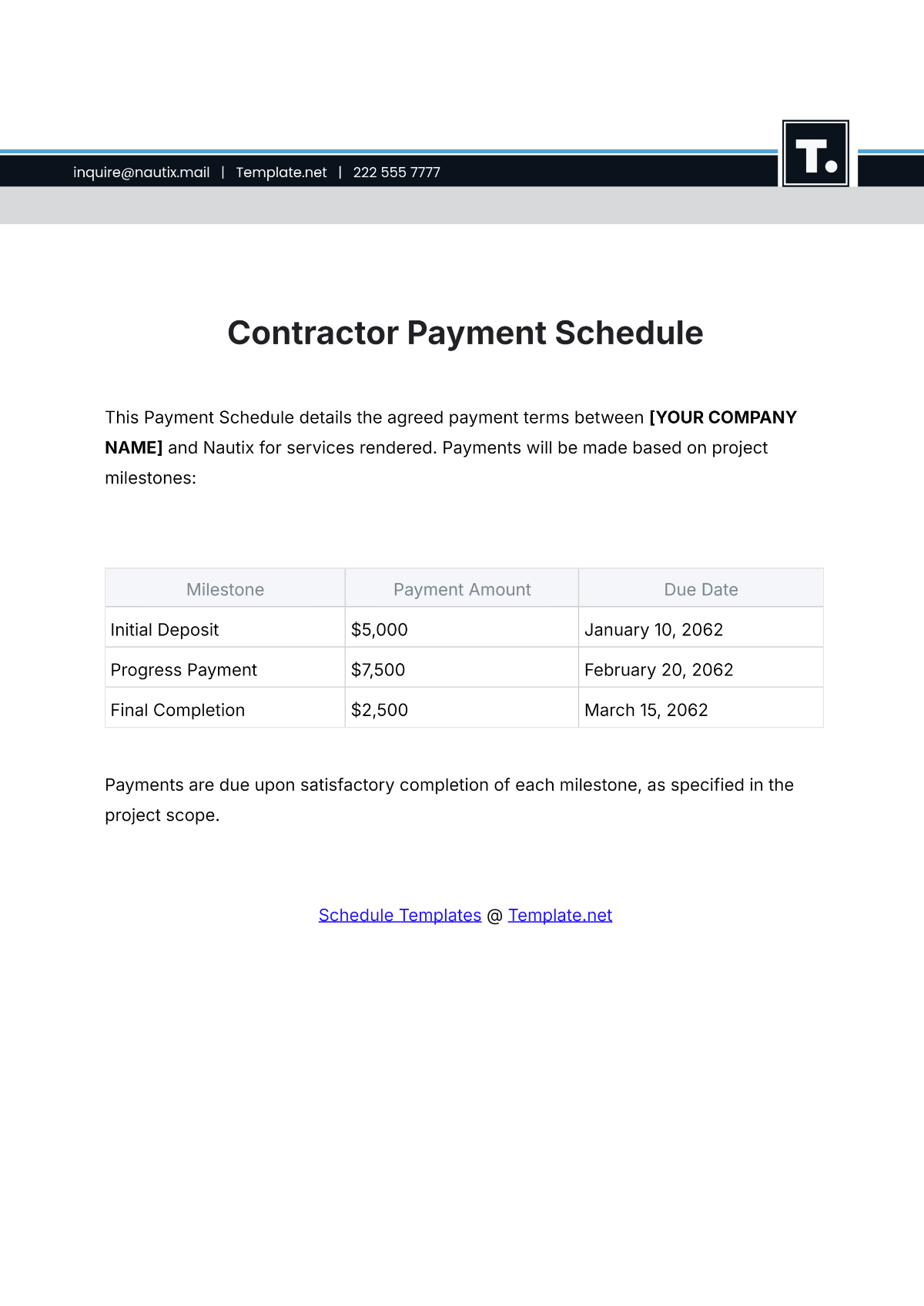

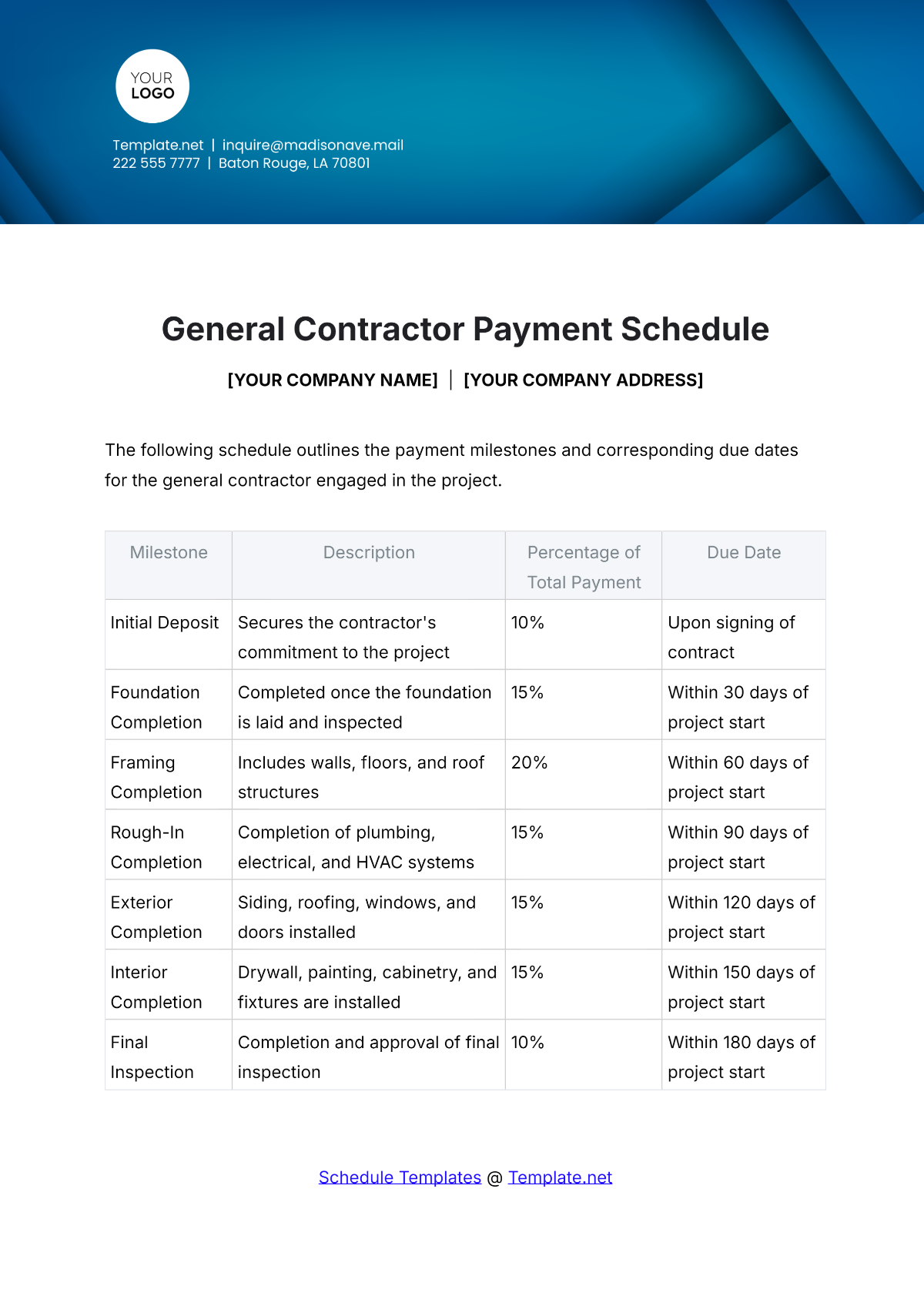

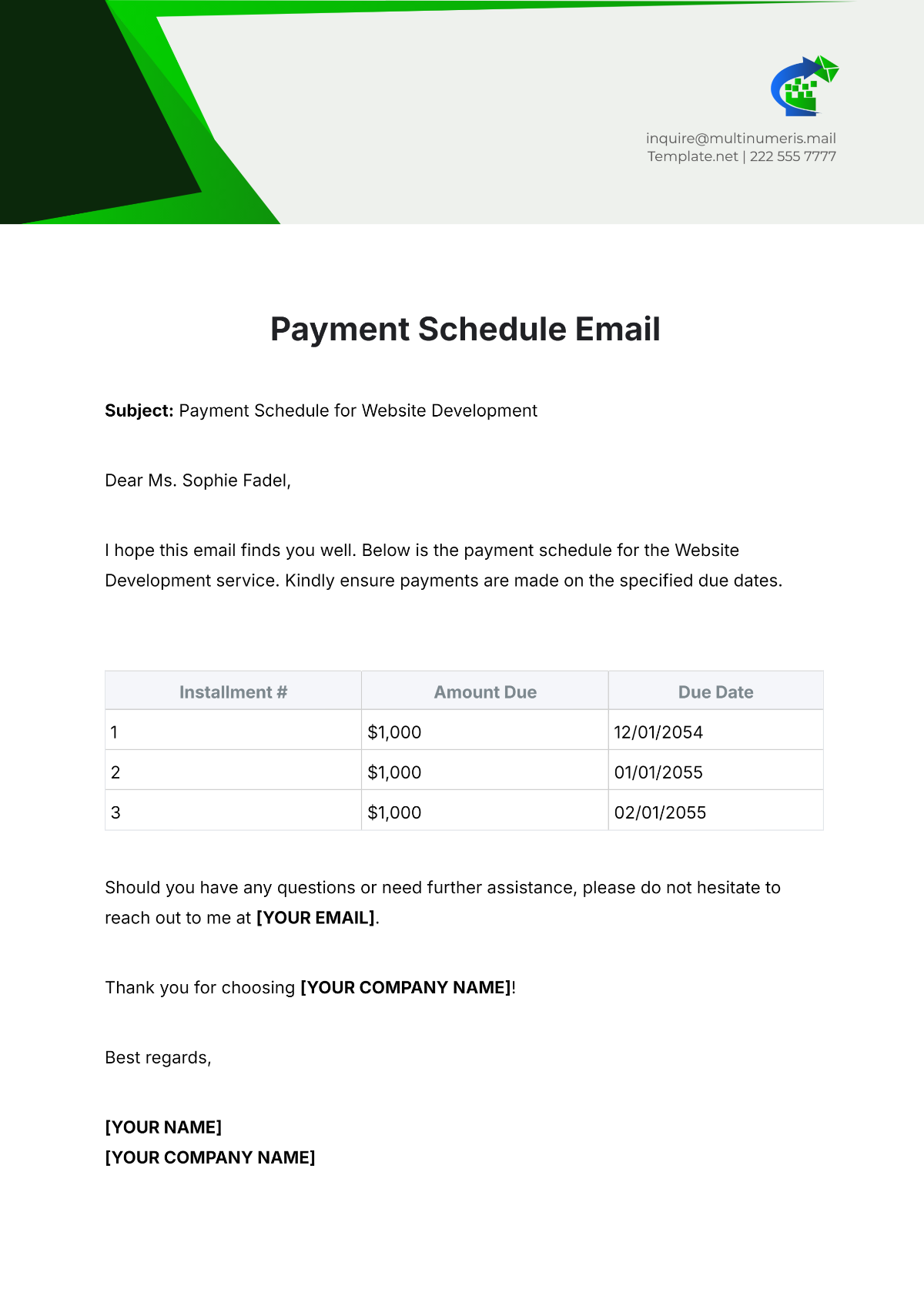

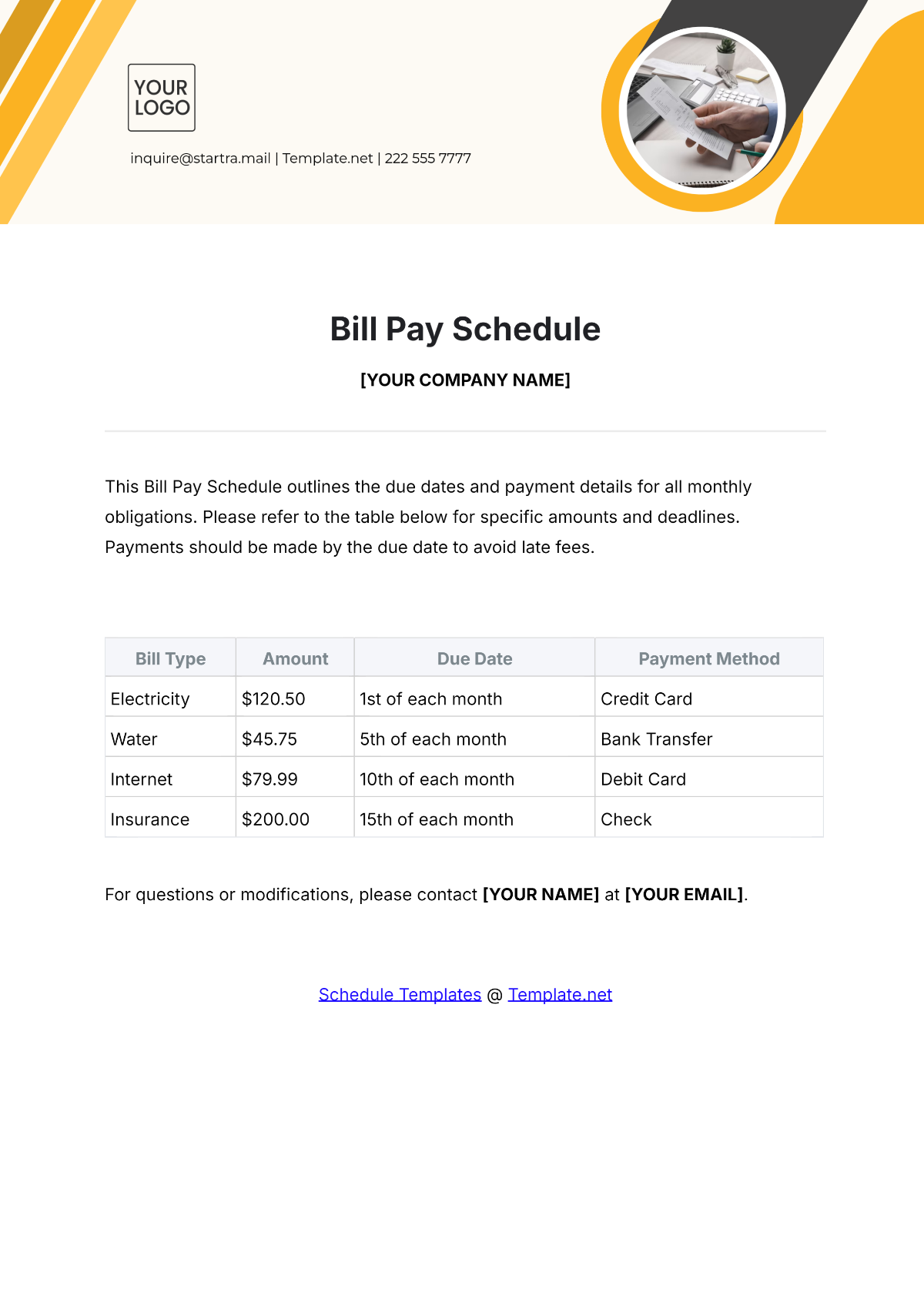

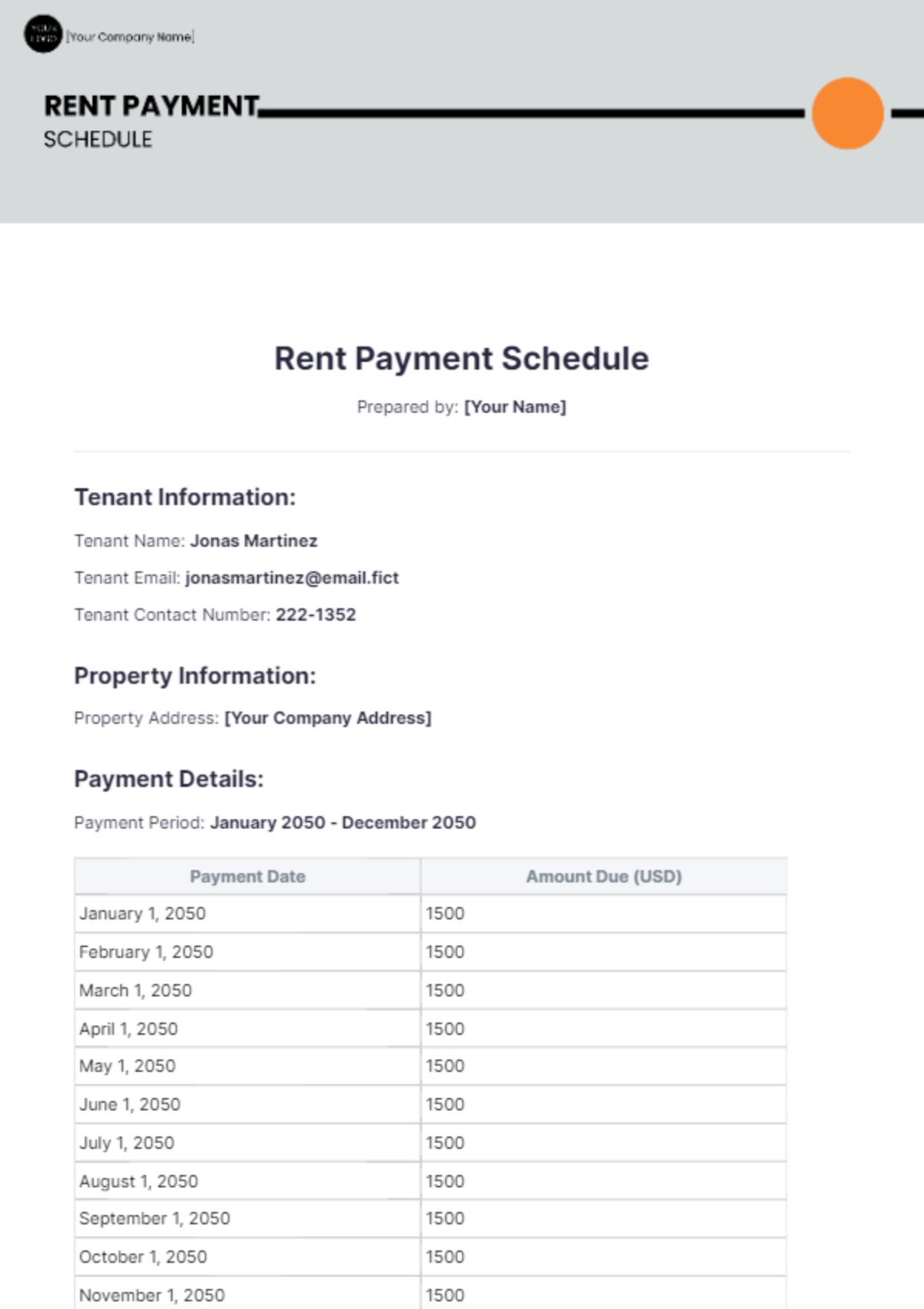

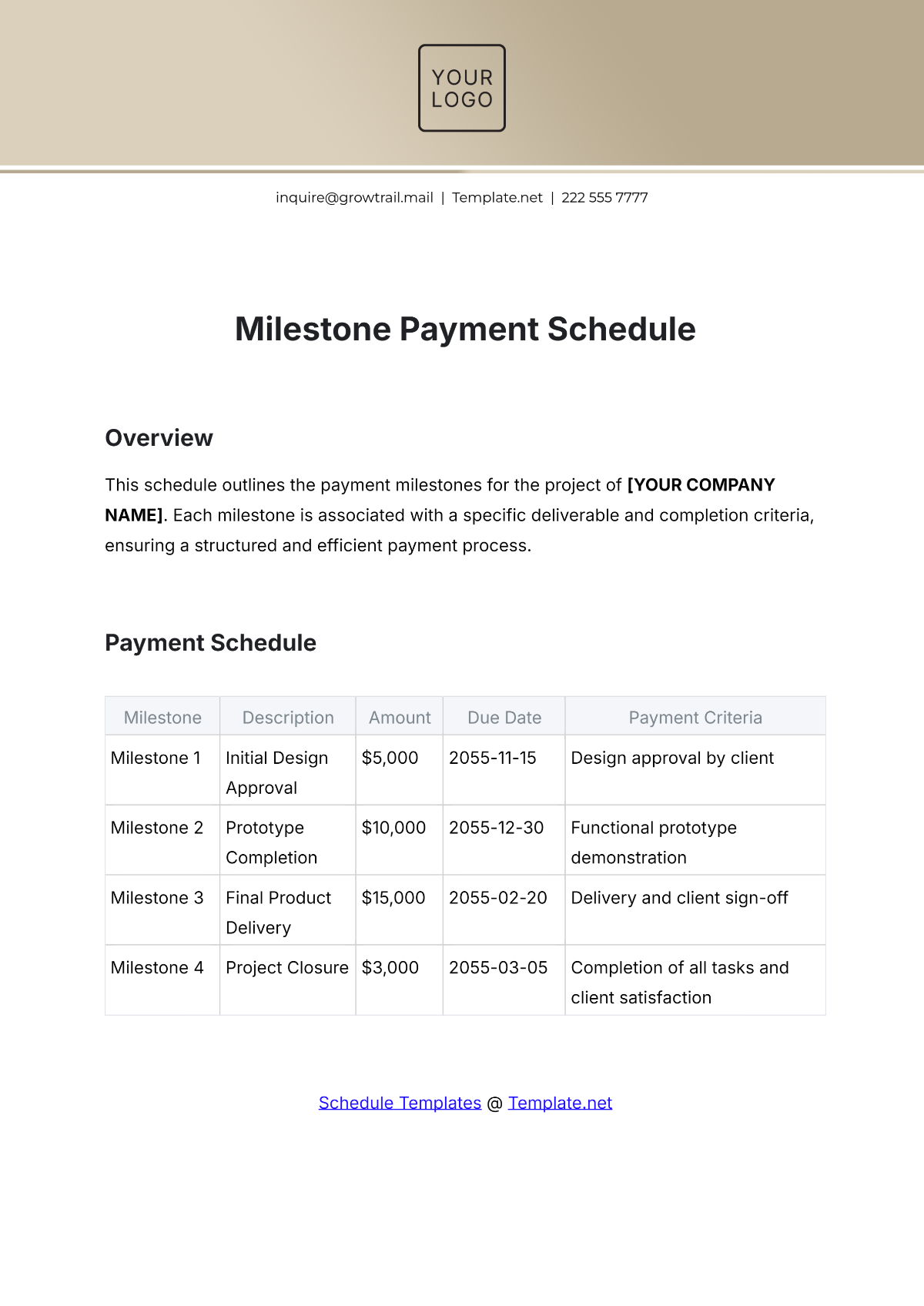

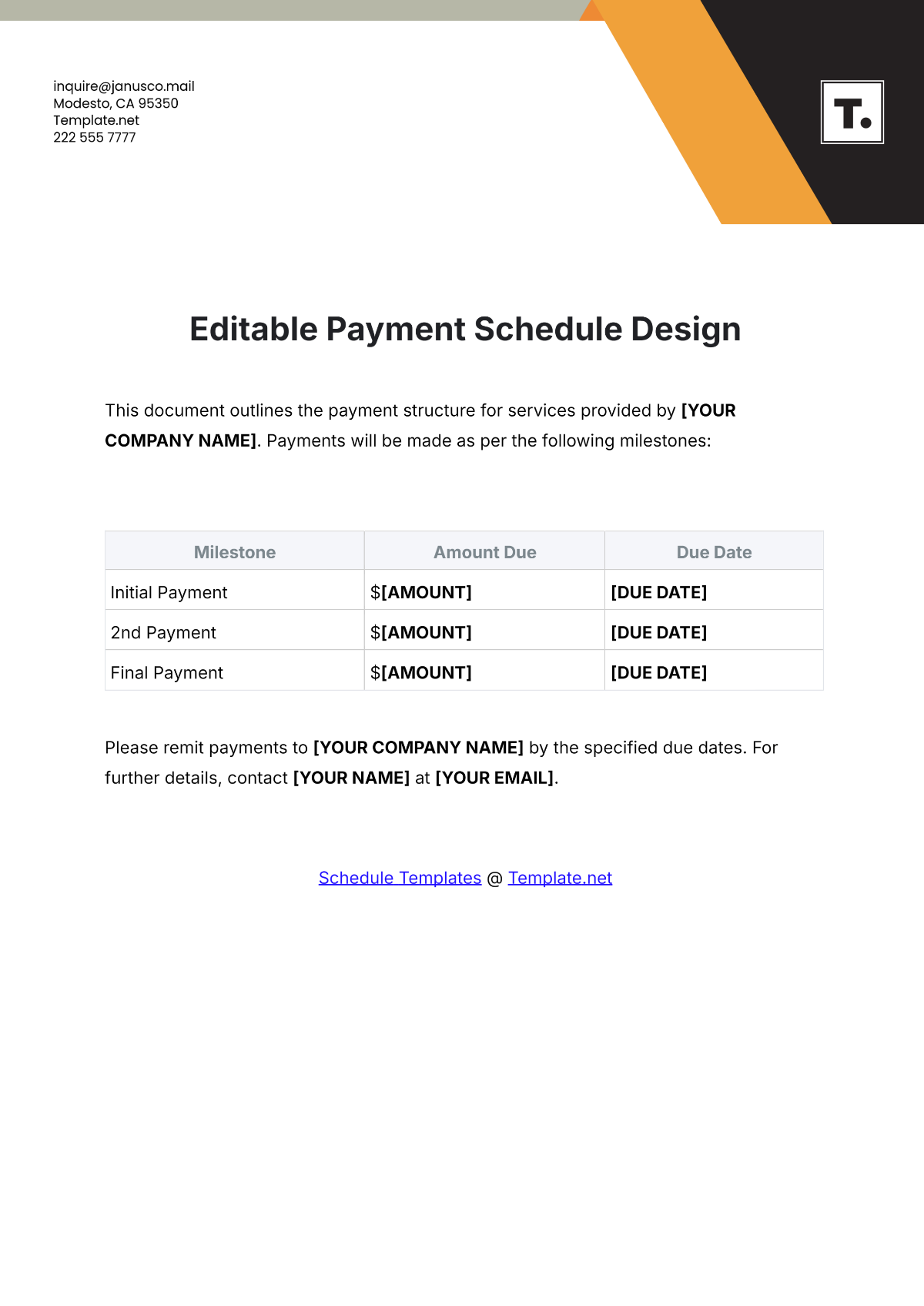

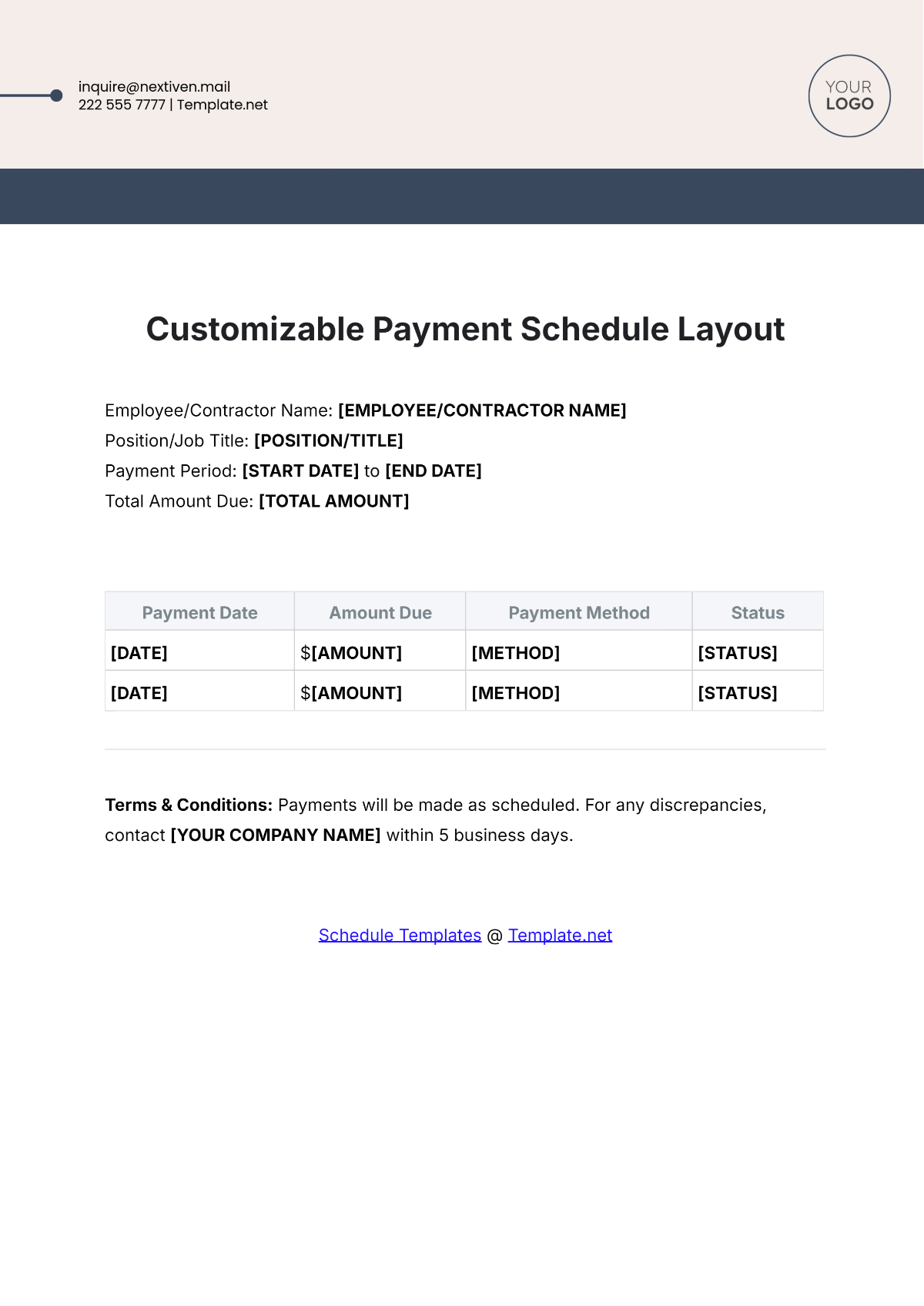

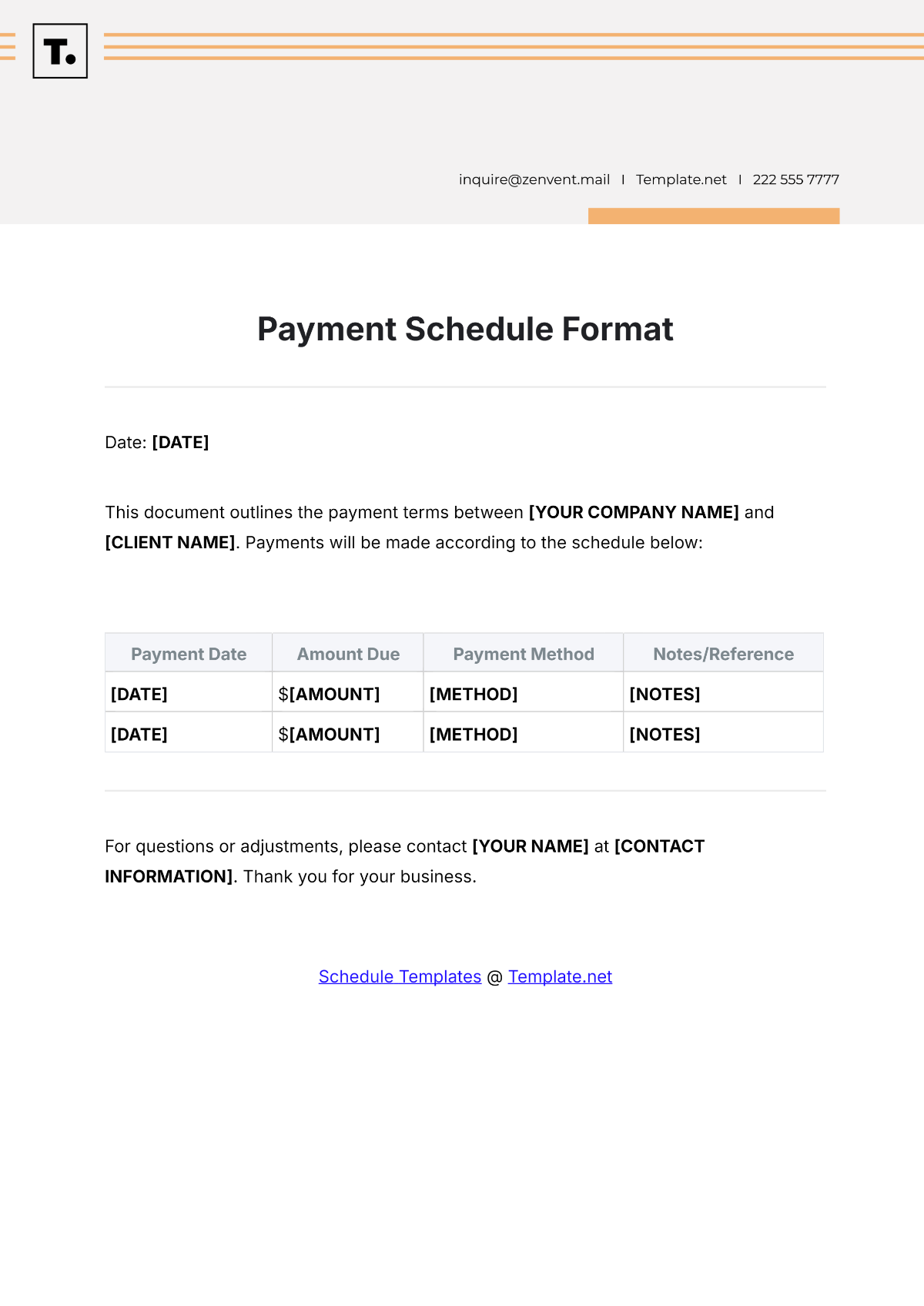

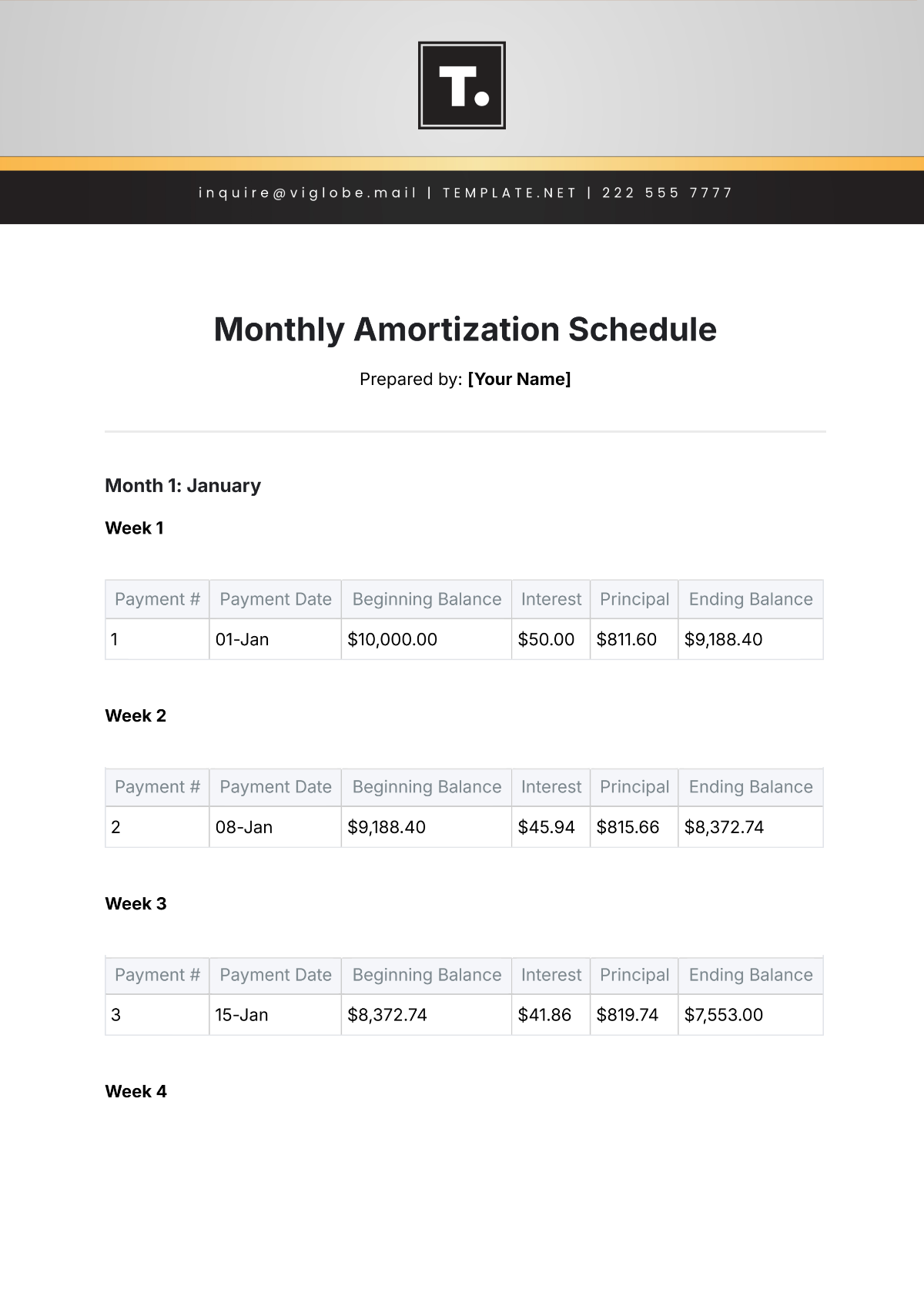

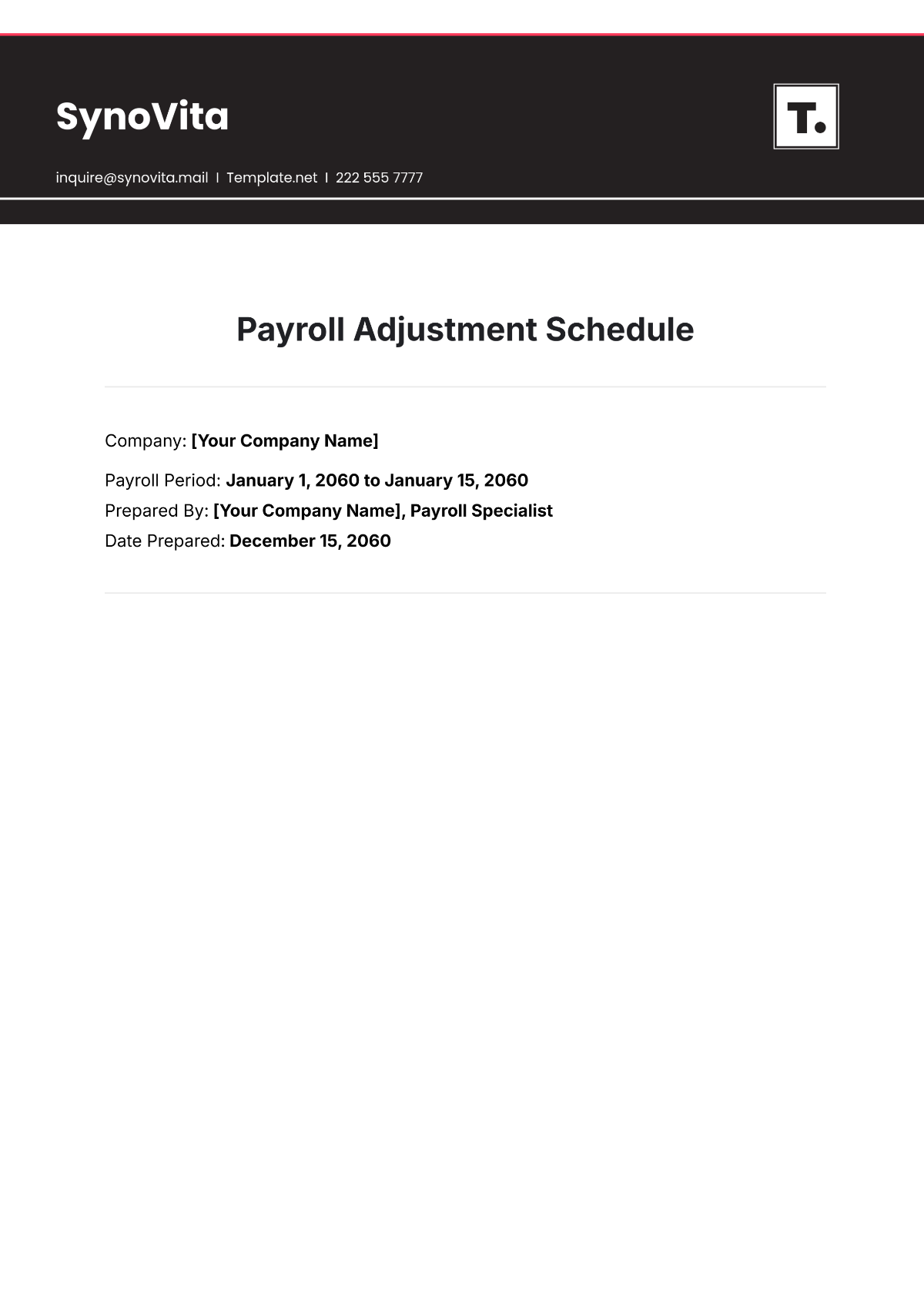

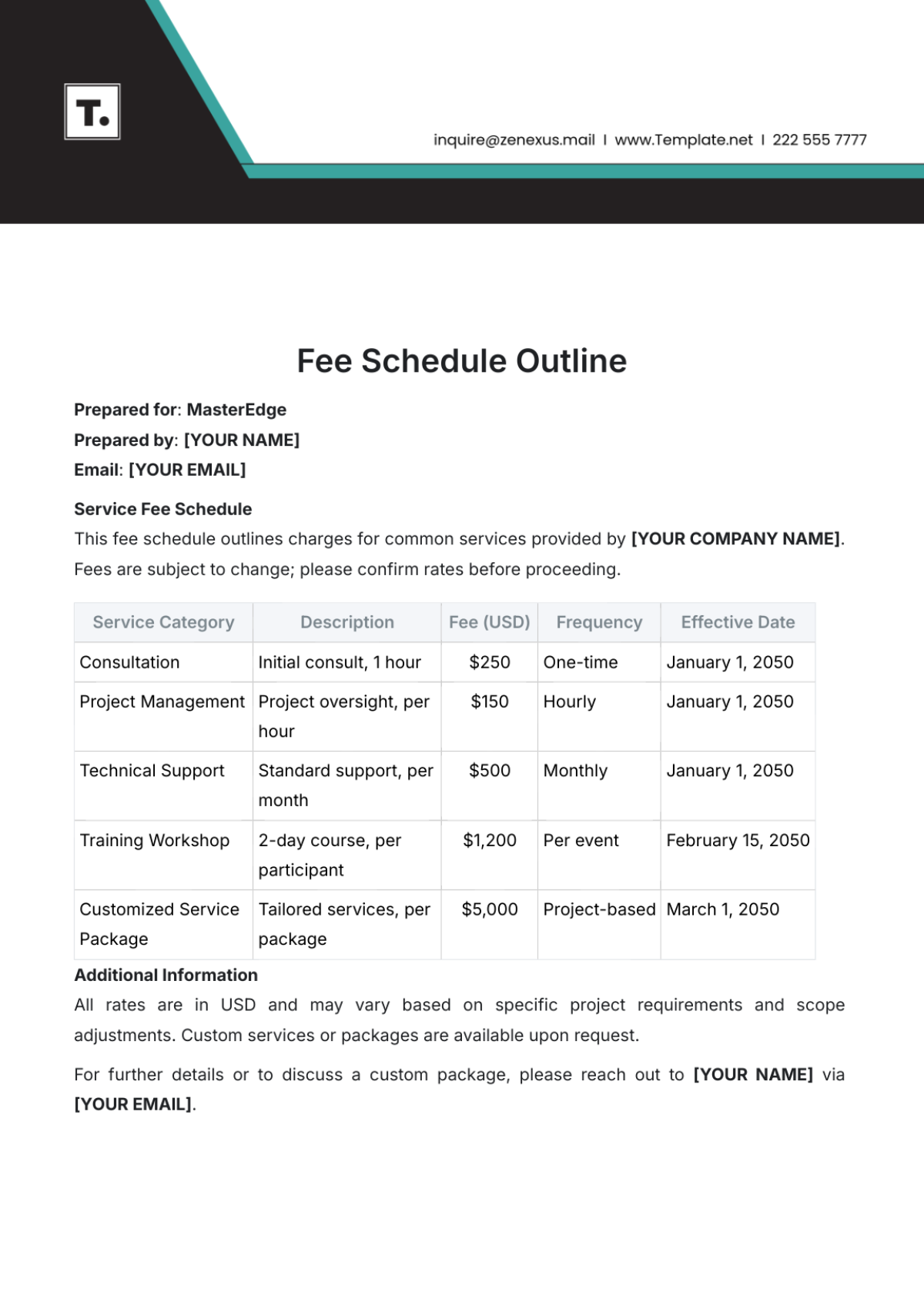

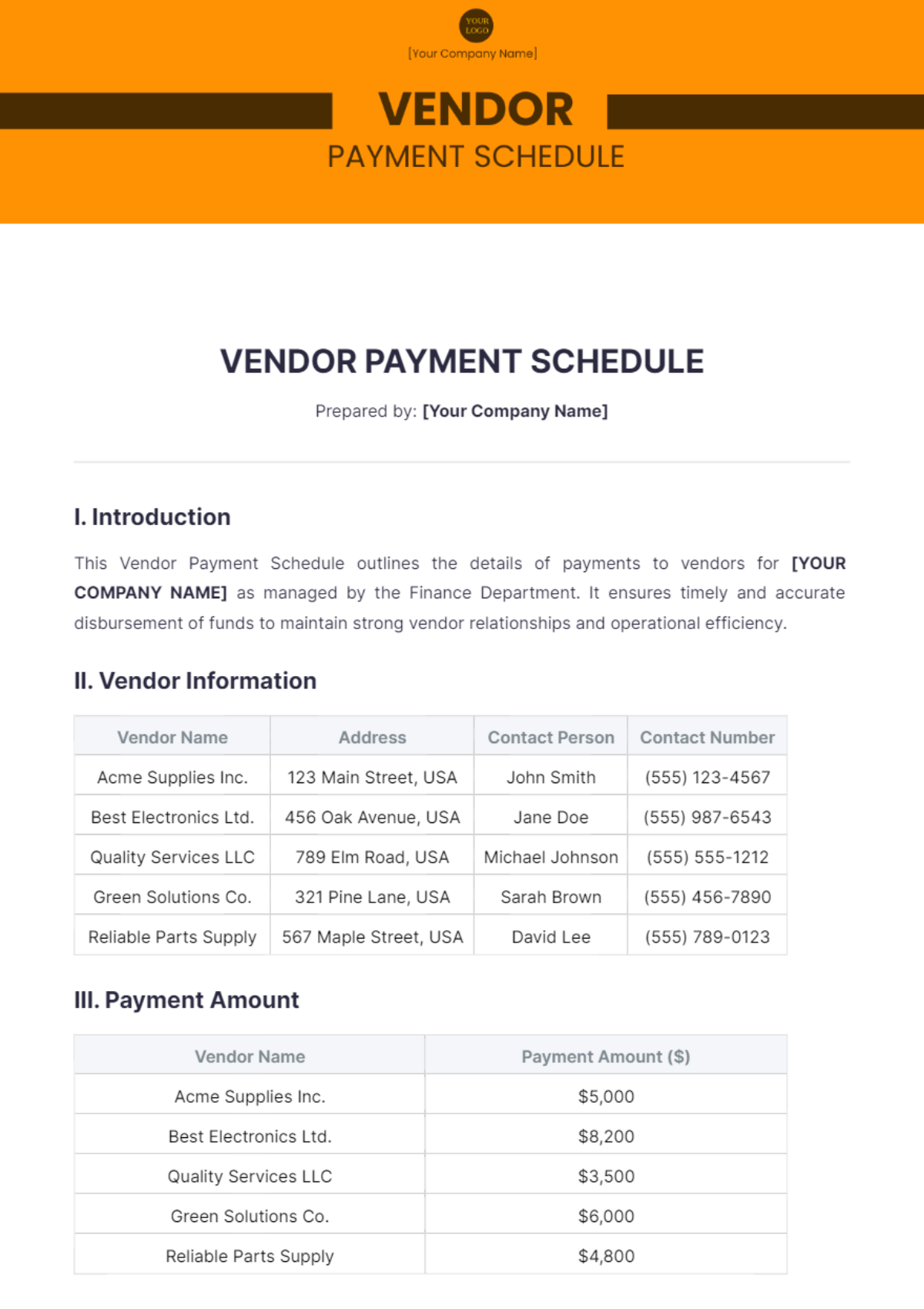

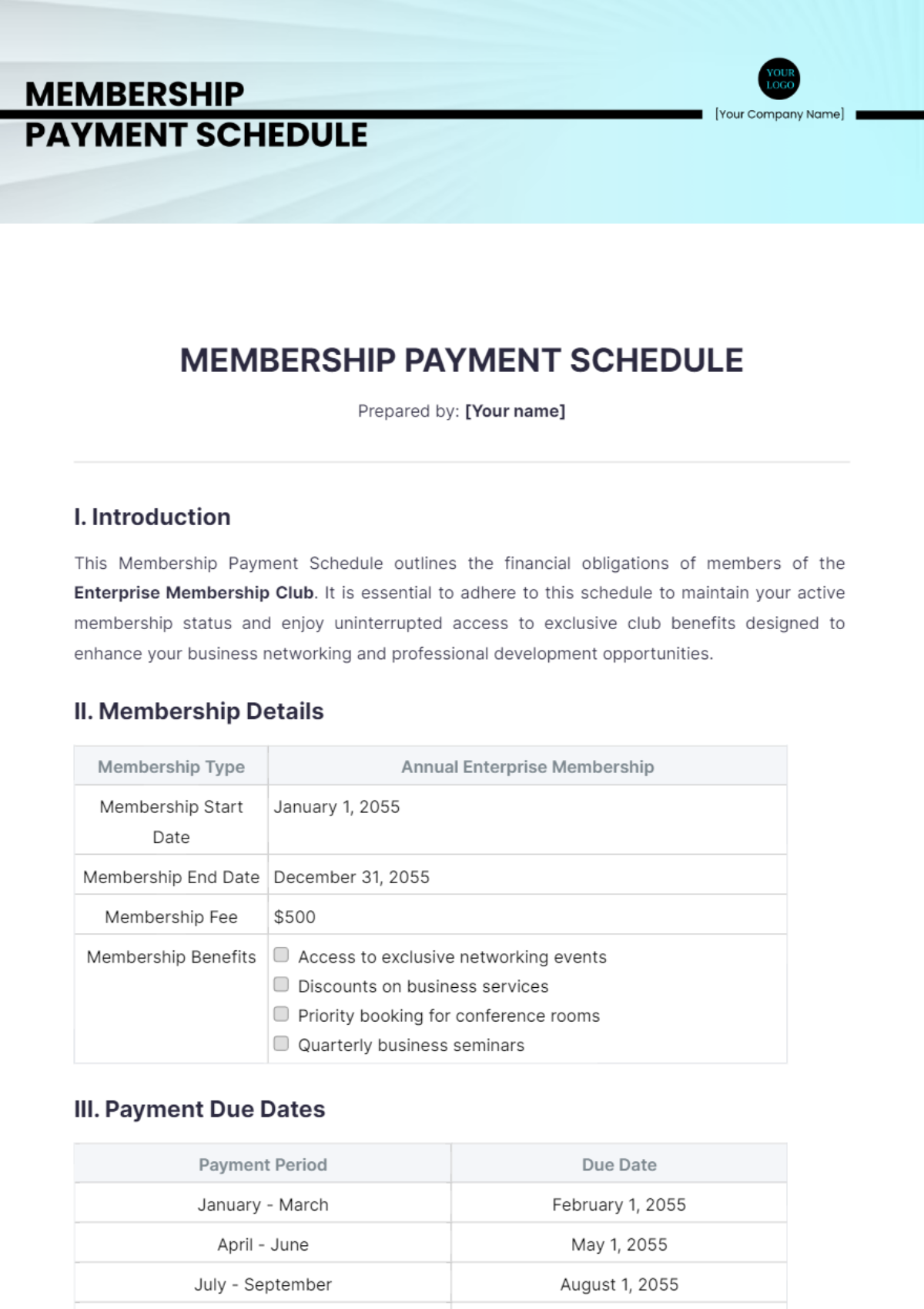

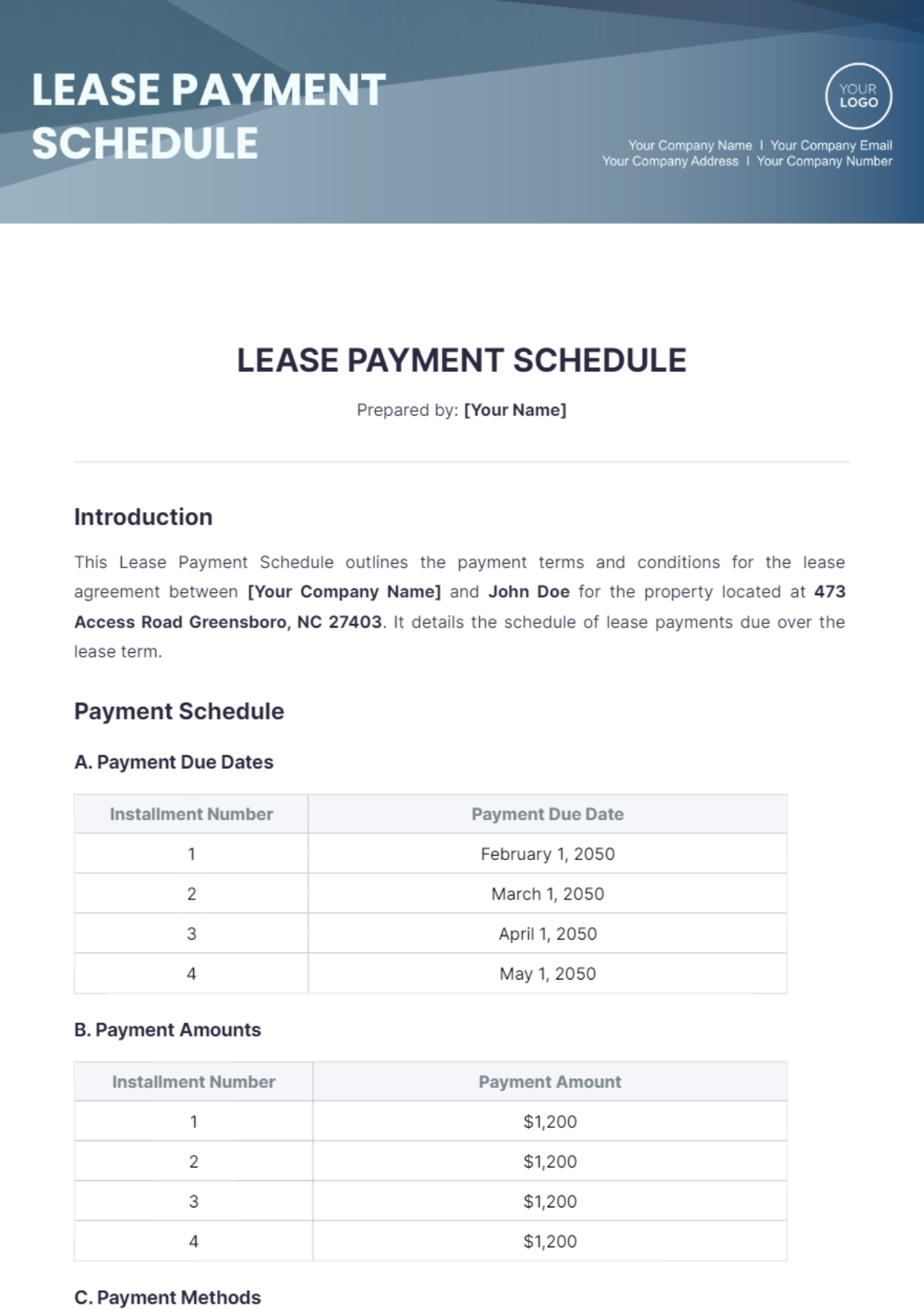

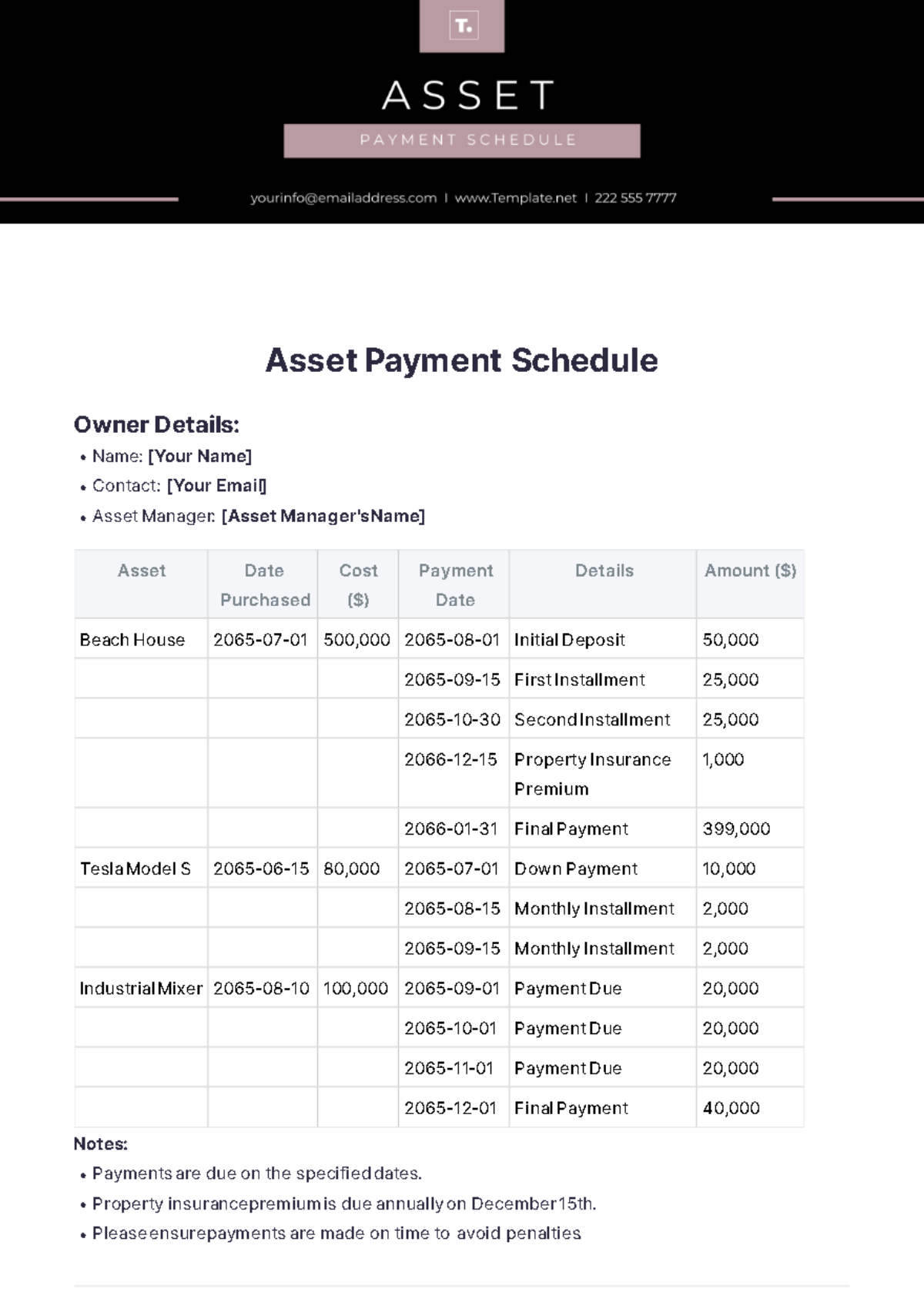

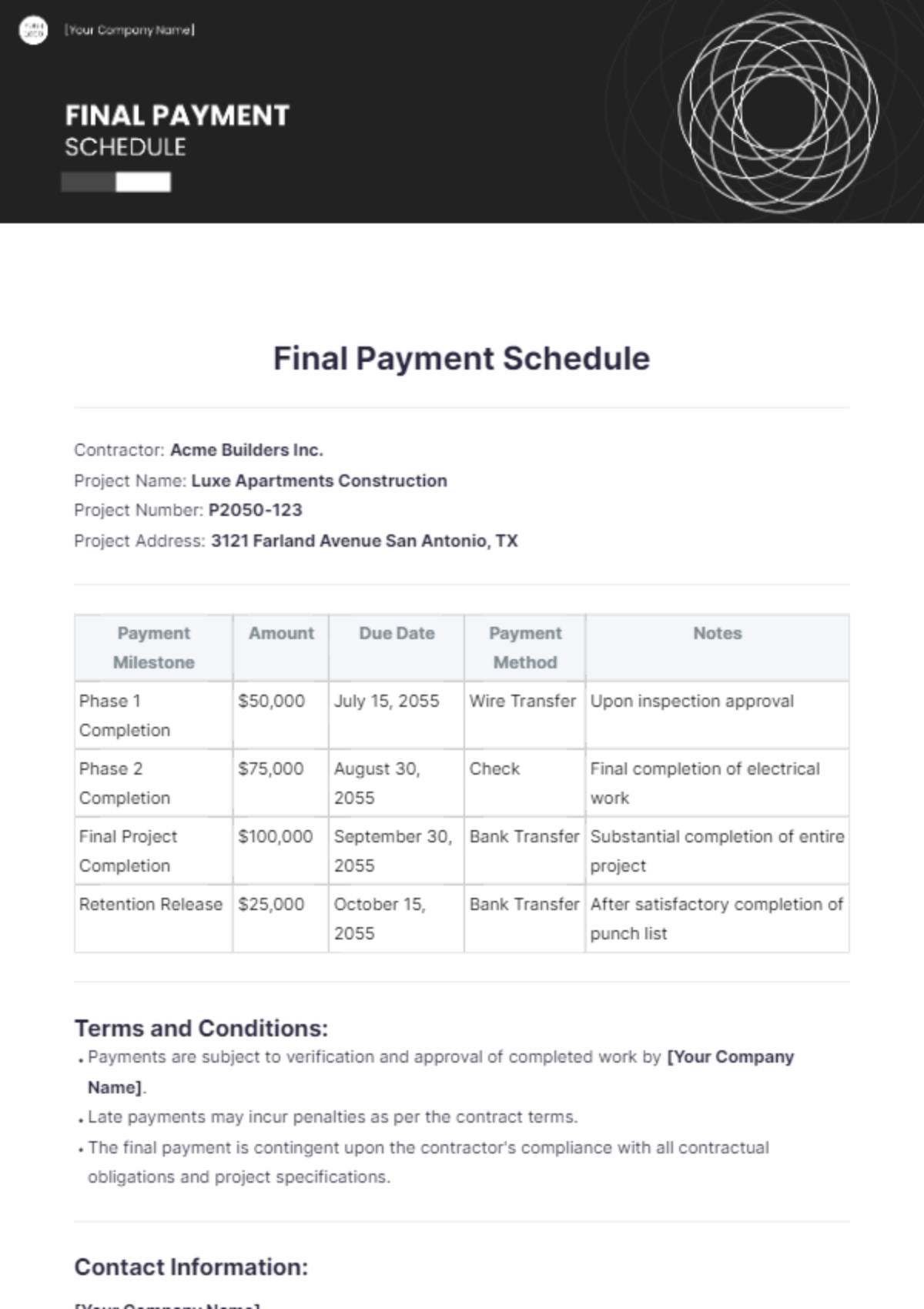

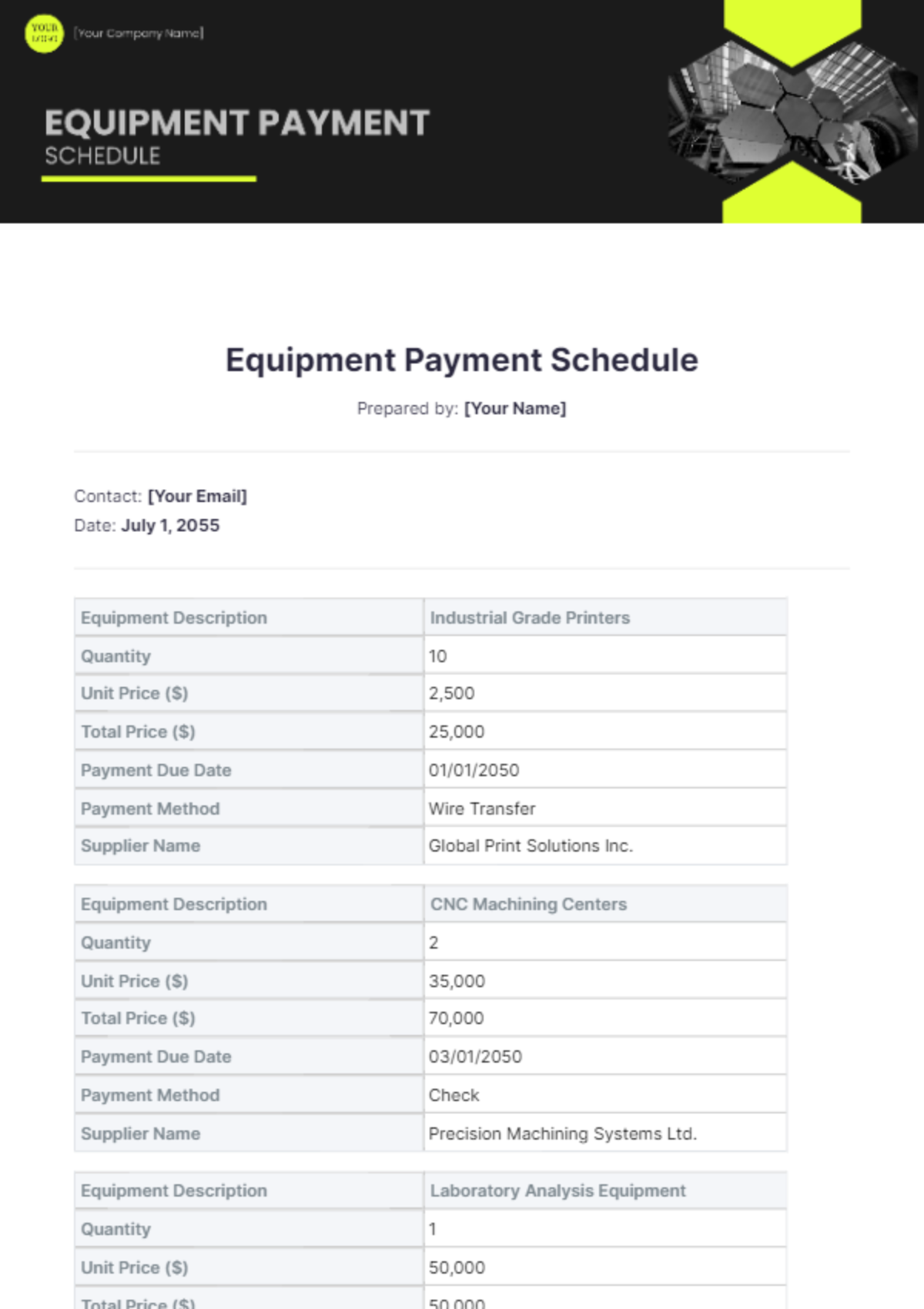

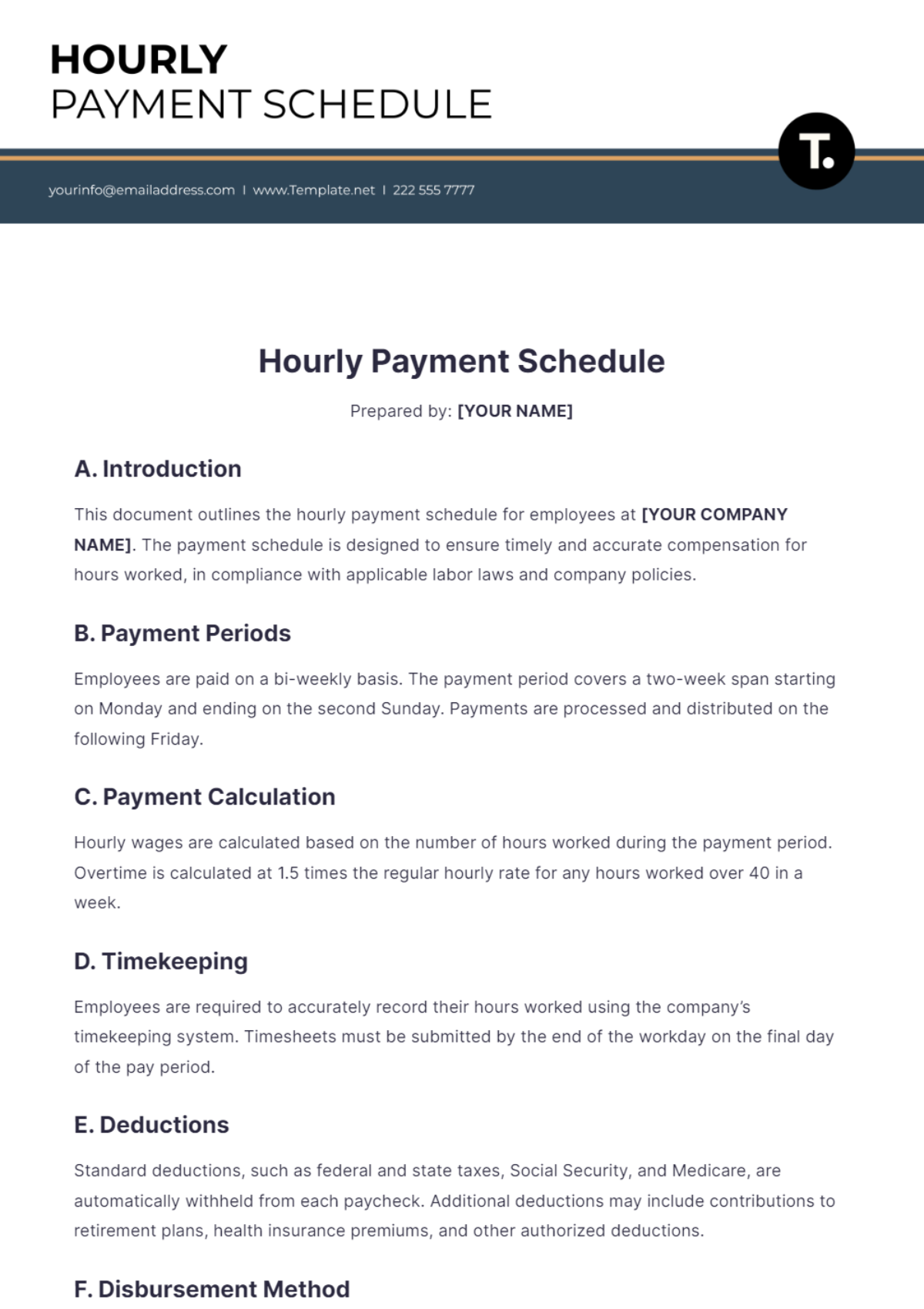

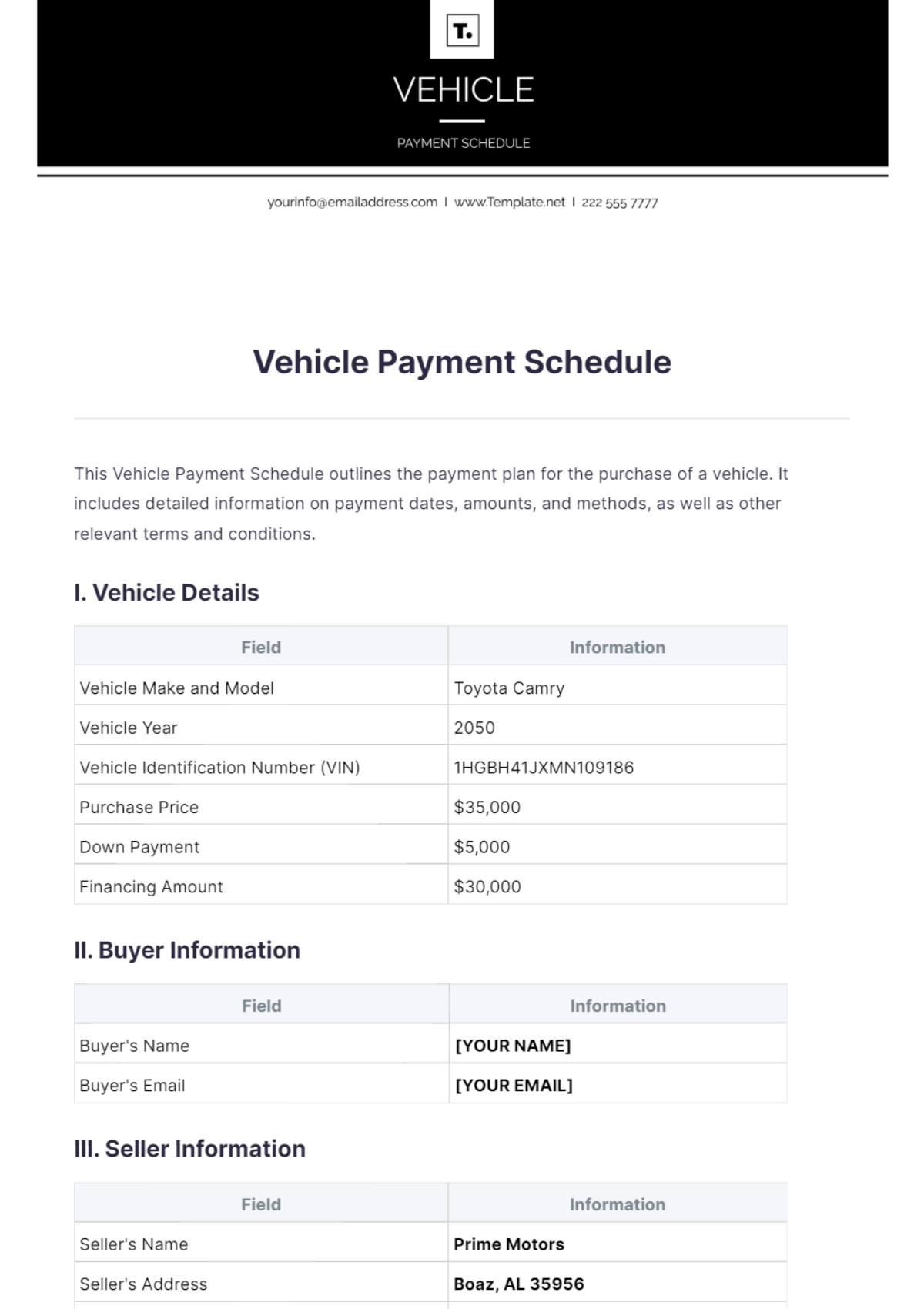

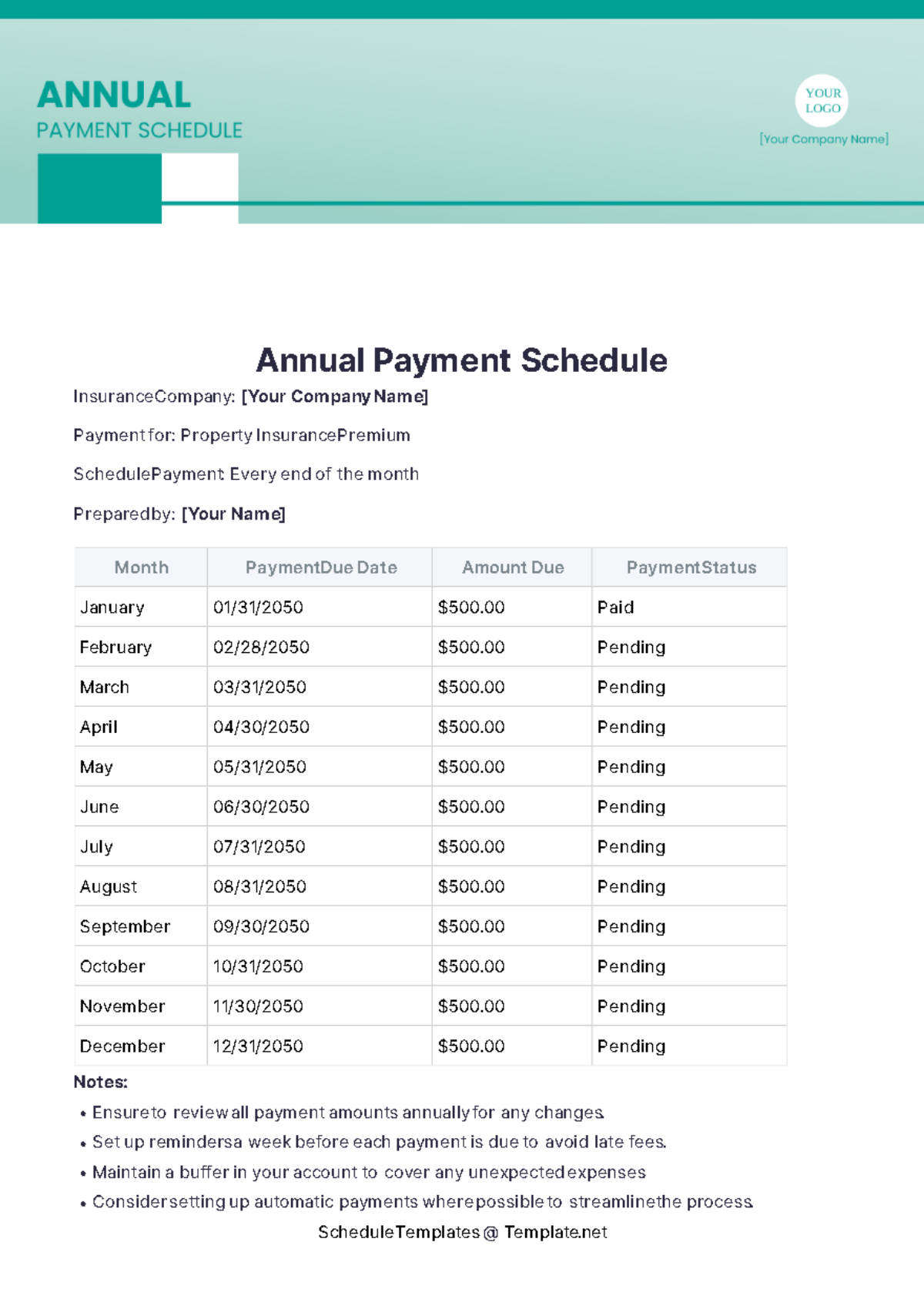

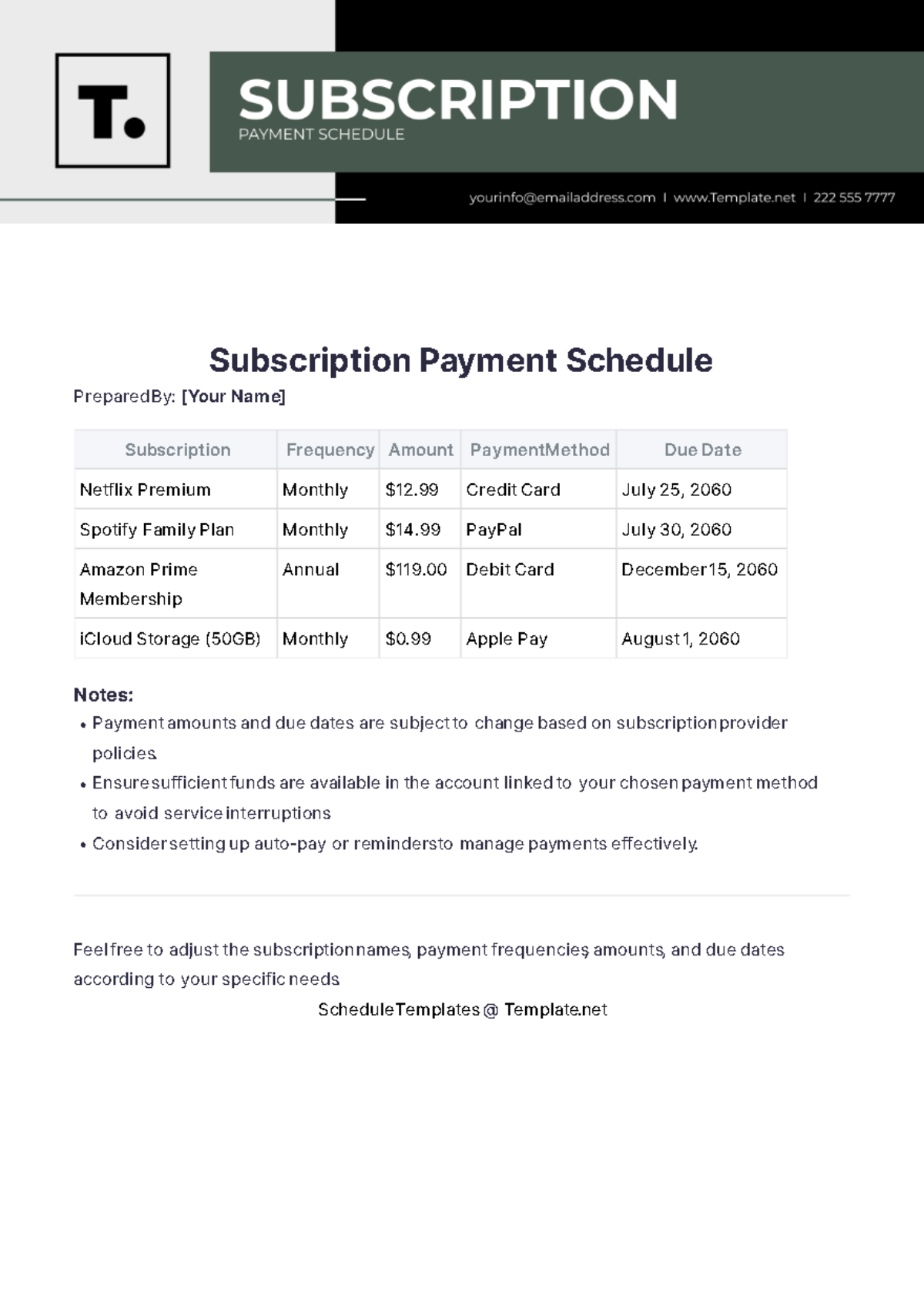

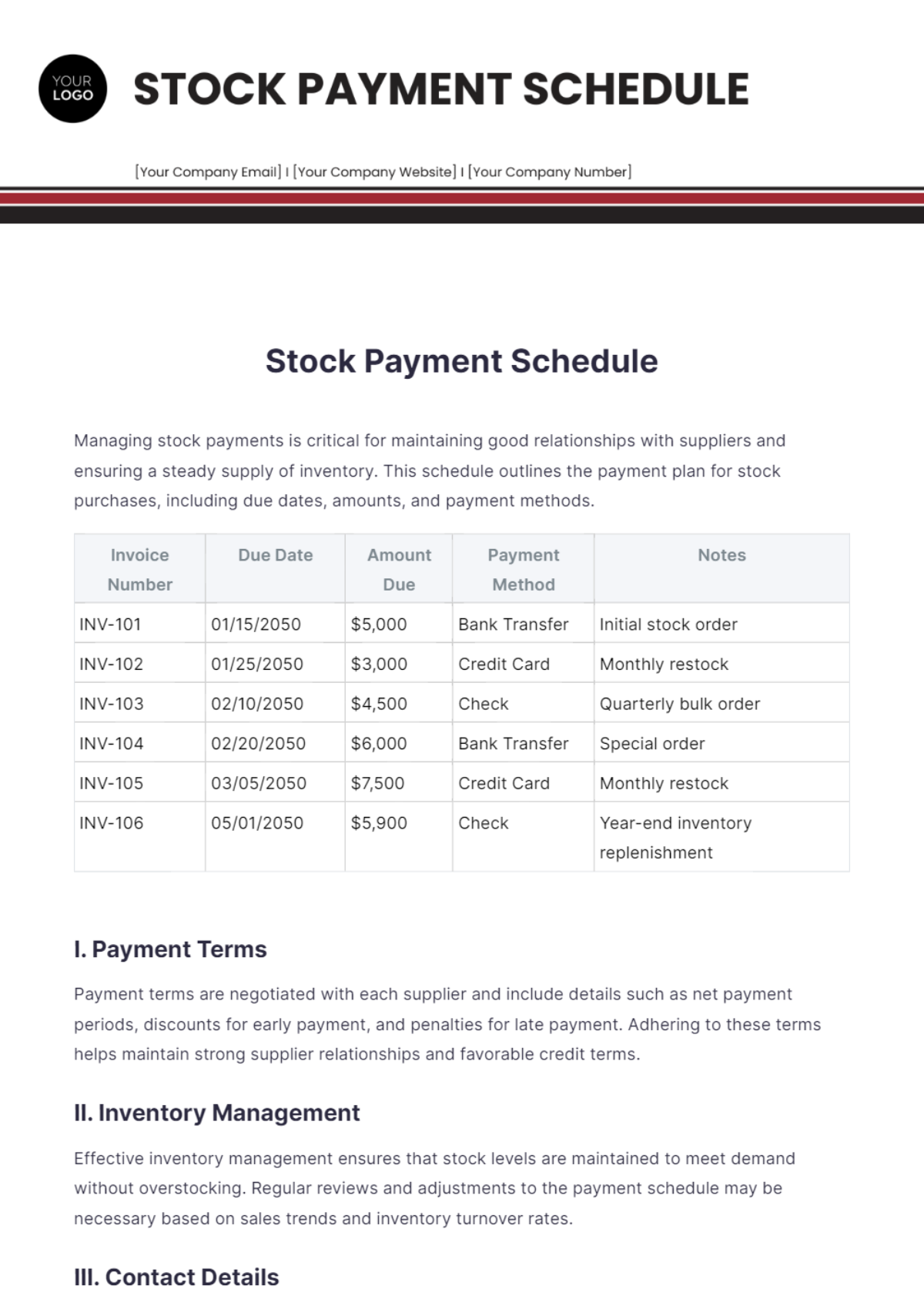

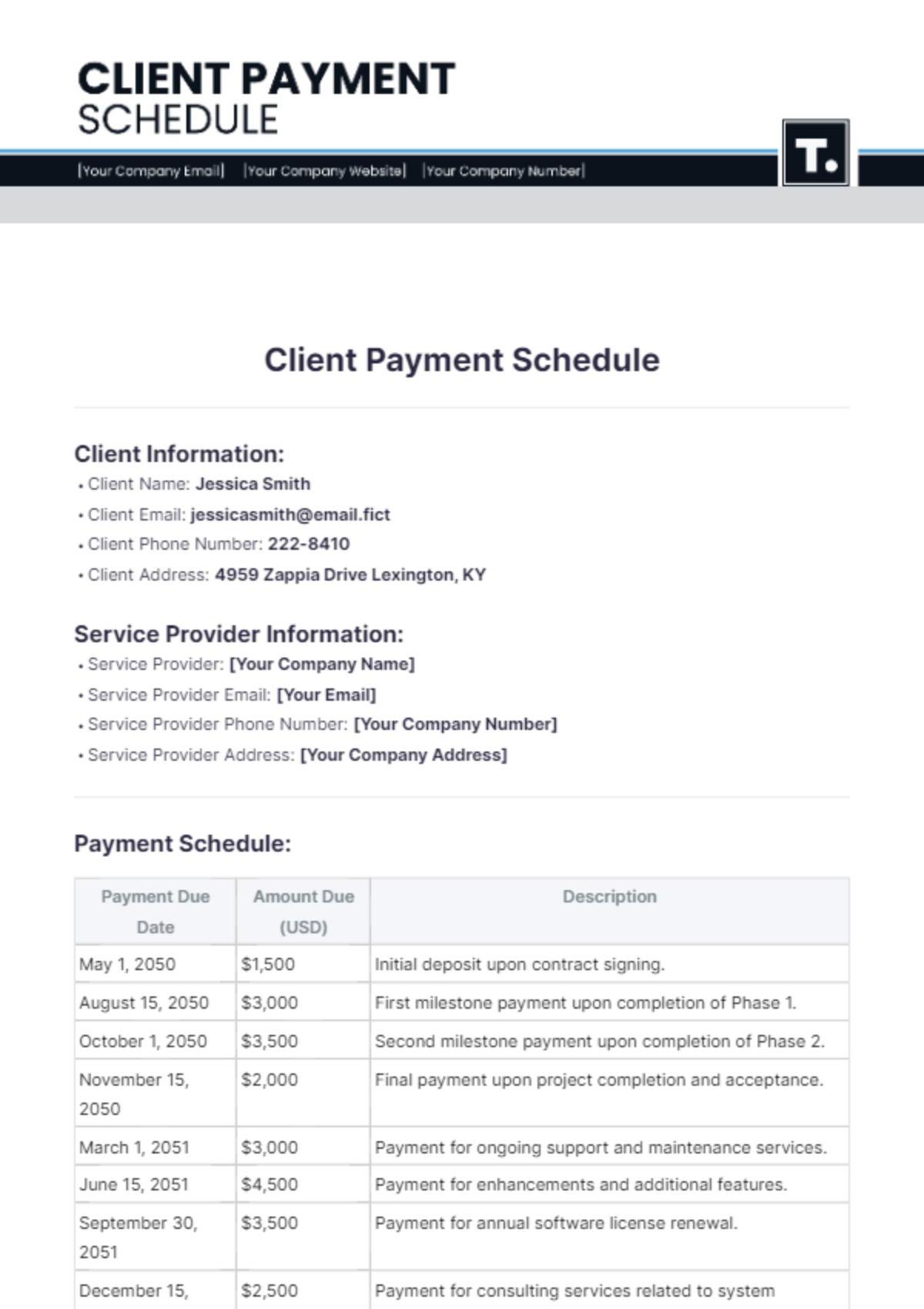

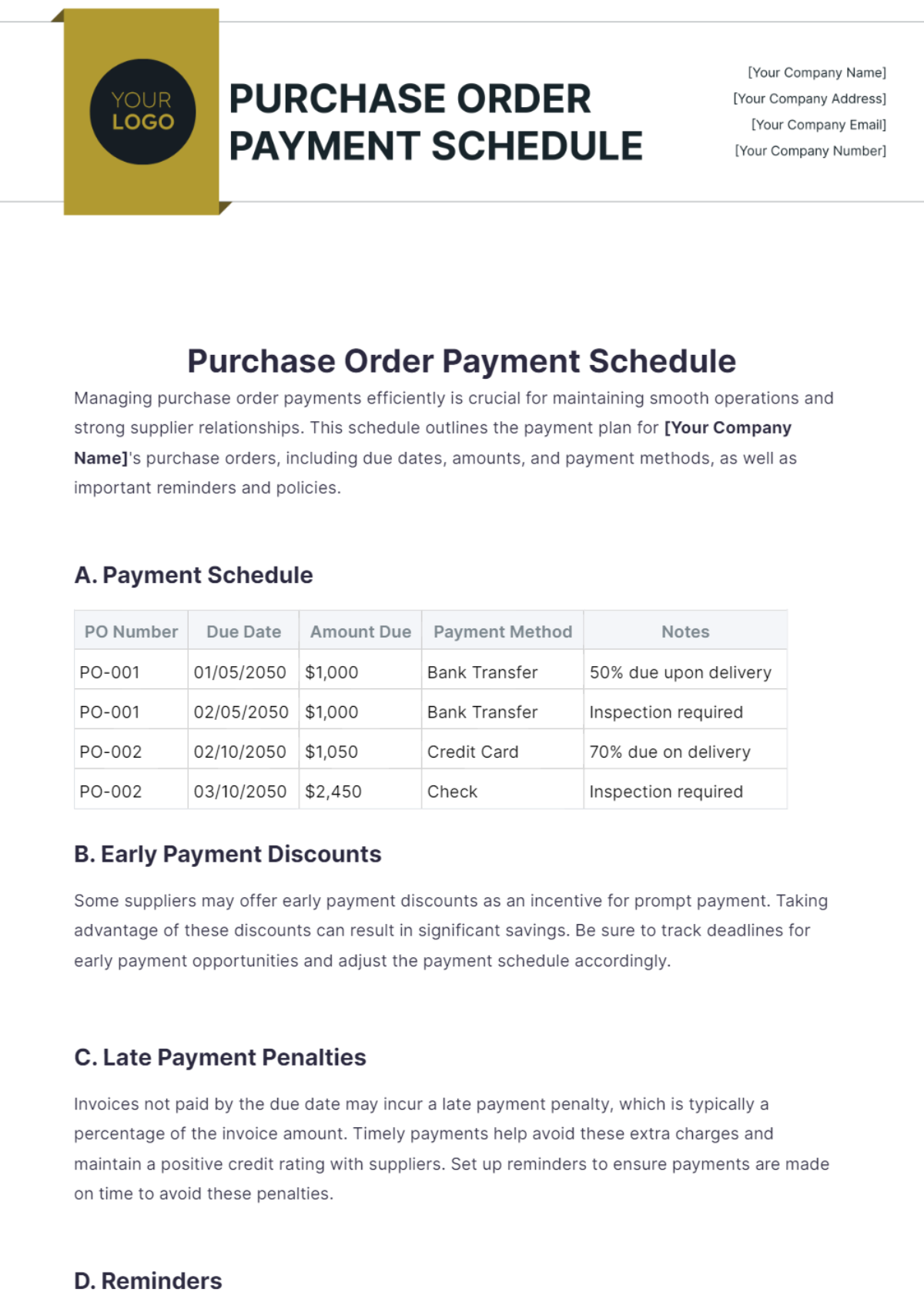

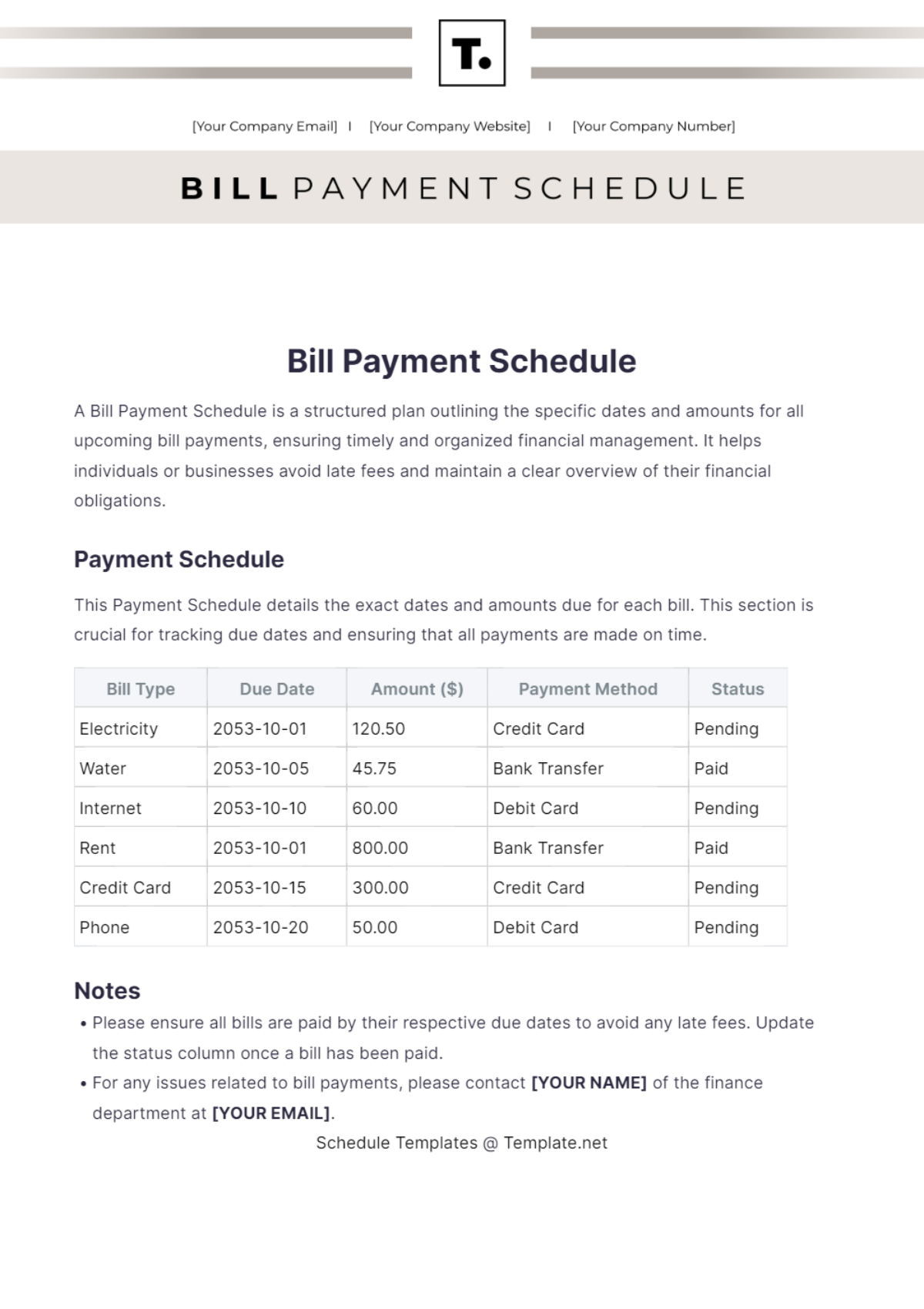

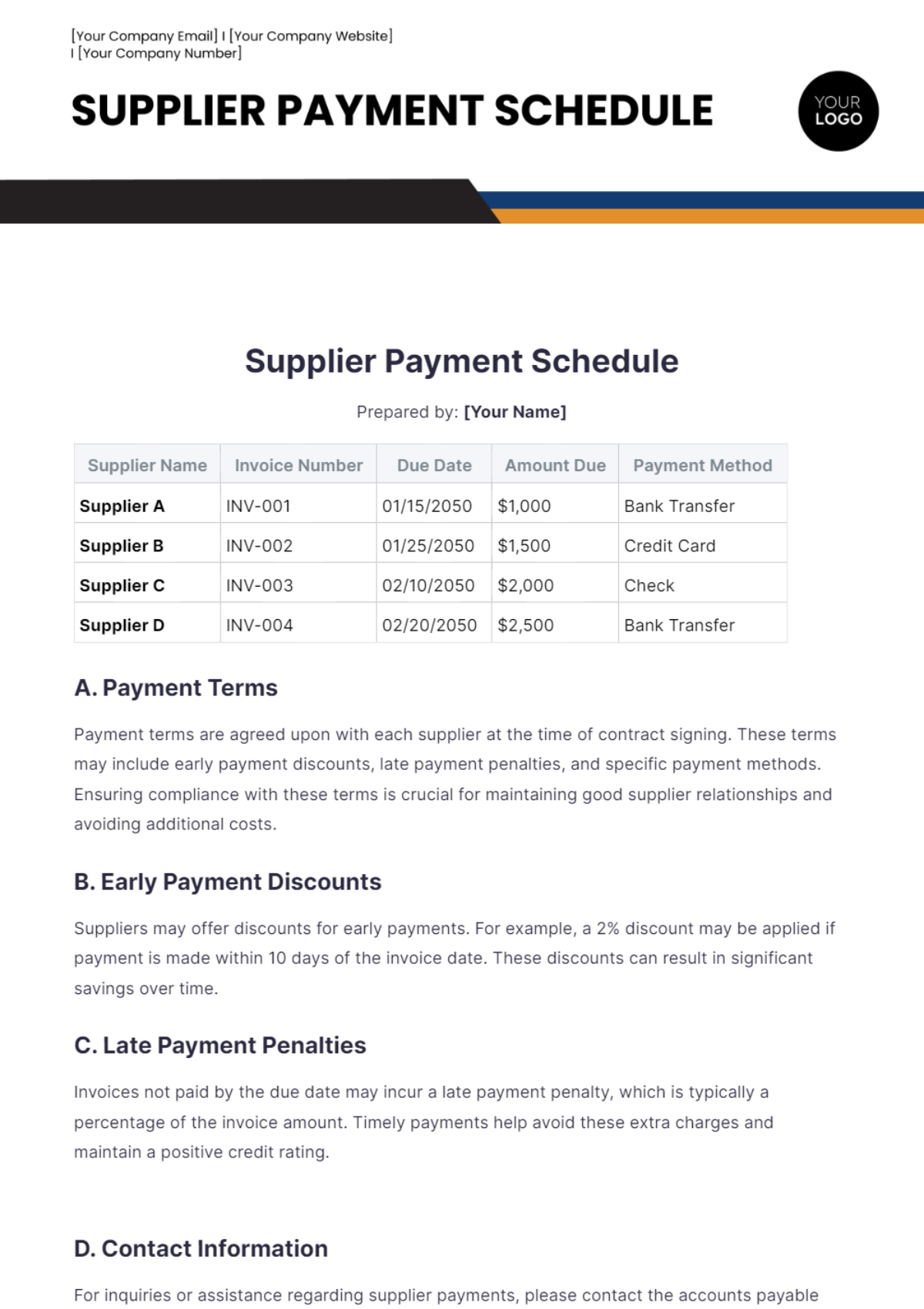

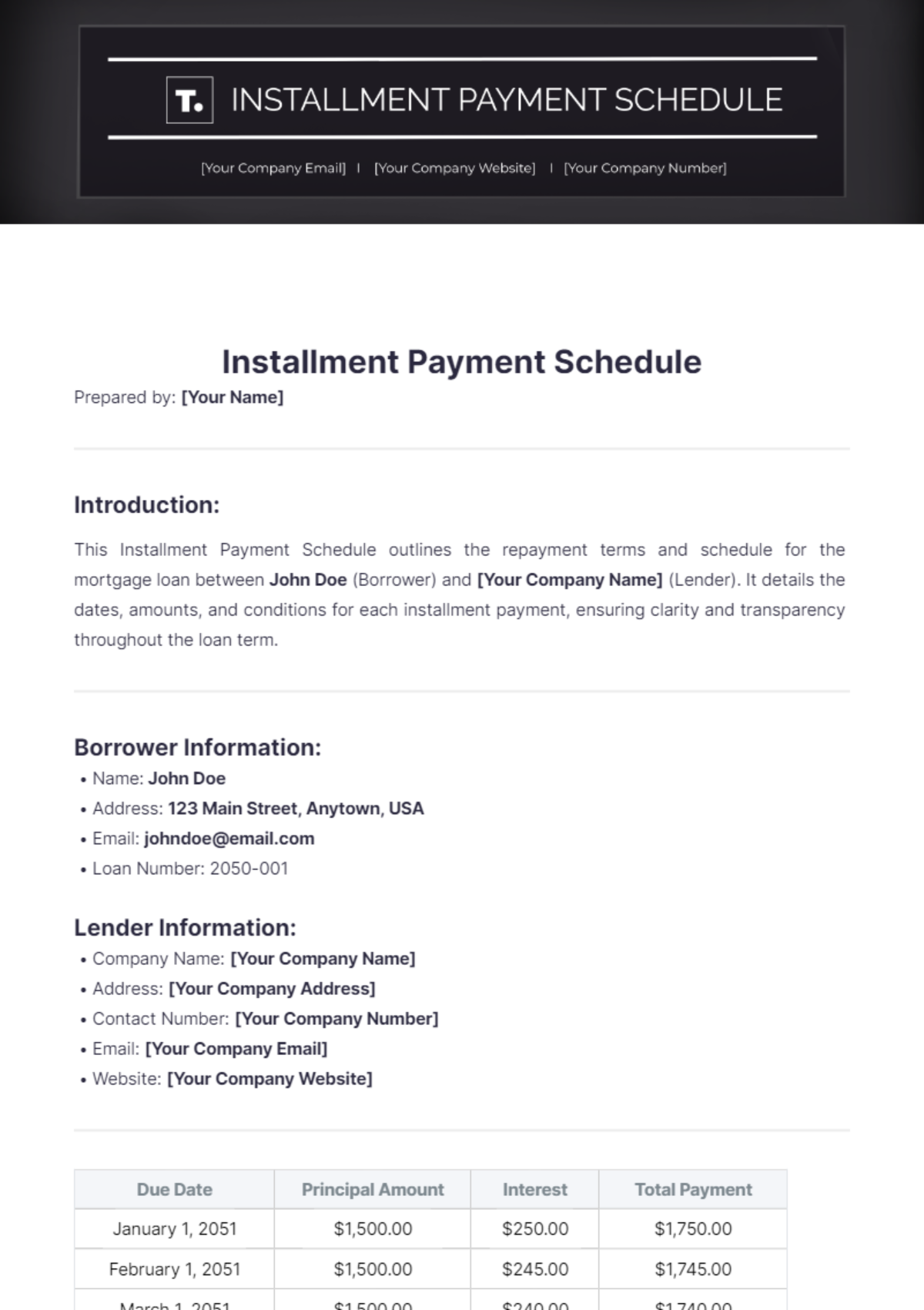

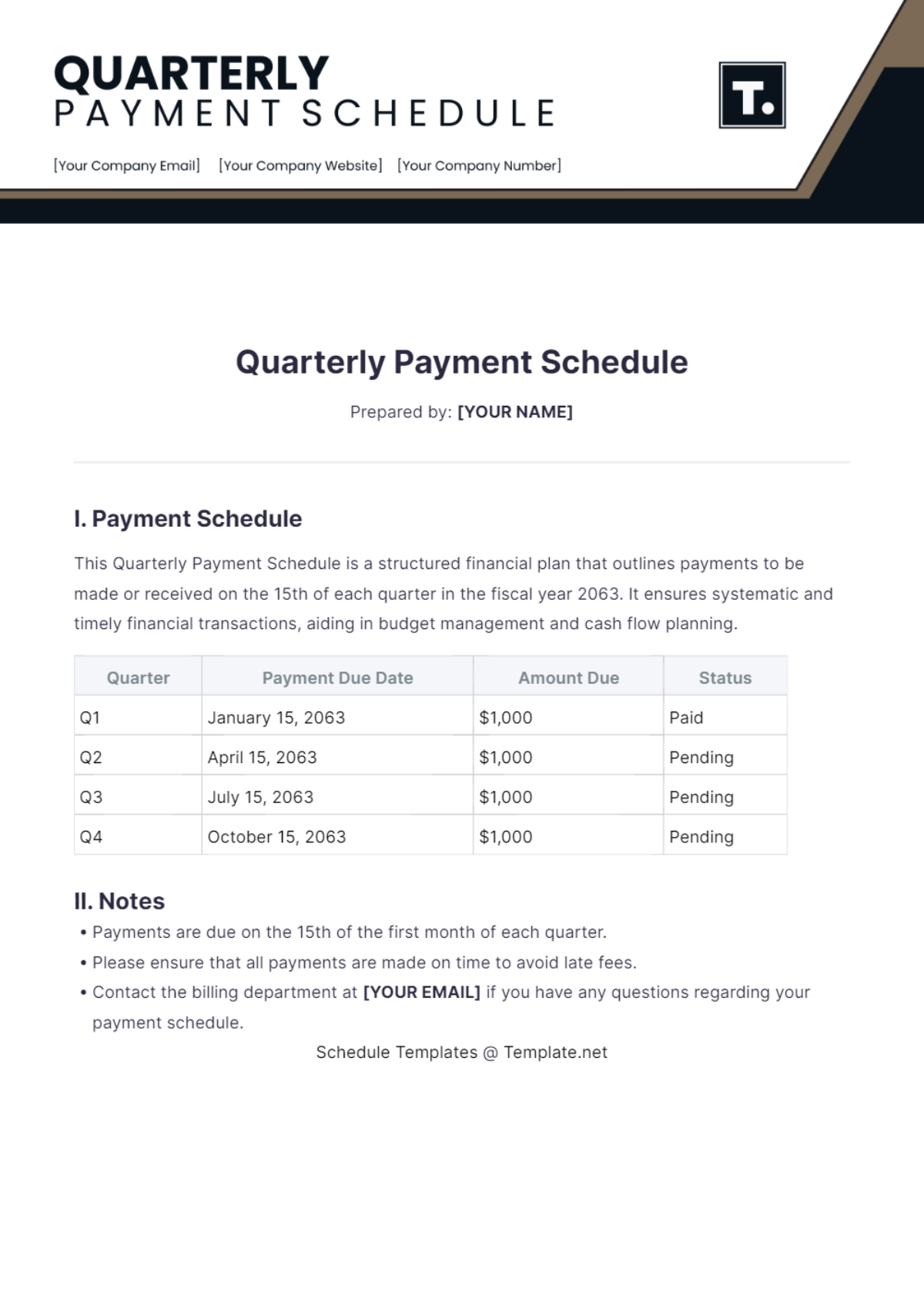

Keep your cash flow management efficient and organized with Payment Schedule Templates from Template.net. Designed for business owners, financial planners, and freelancers, these templates enable you to create clear payment schedules effortlessly. Whether you're looking to promote a special financial service or organize your own billing dates, these templates are perfect for your needs. Additionally, they include spaces for key details like due dates, payment amounts, and contact information. No advanced financial skills are required, and you’ll benefit from professional-grade design without any added cost. These templates are customizable for online or print distribution, ensuring you can reach your audience wherever they are.

Discover the many payment schedule templates we have on hand, each crafted to address a range of financial needs. Begin by selecting a template that suits your requirements, then swap in your own data and tweak colors and fonts to match your brand. Add advanced touches with drag-and-drop icons, graphics, and even animated effects for a more dynamic presentation. With AI-powered text tools, the possibilities are endless, ensuring your payment schedules are both visually striking and effective without requiring any special skills. Our regularly updated templates mean you’ll always have access to fresh designs. When you're finished, download or share via link, print, or email, making it ideal for multiple channels and seamless collaboration in real time.