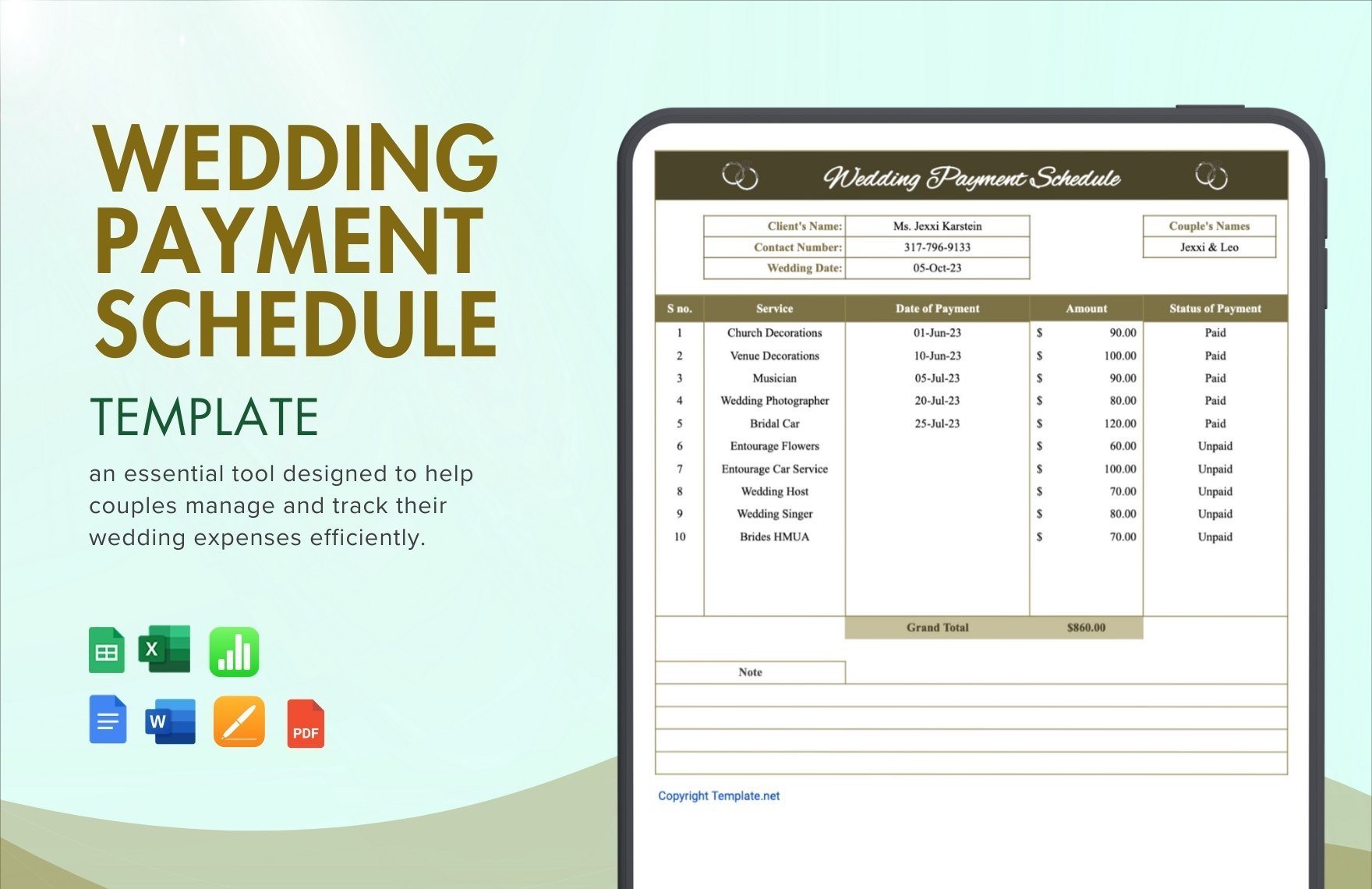

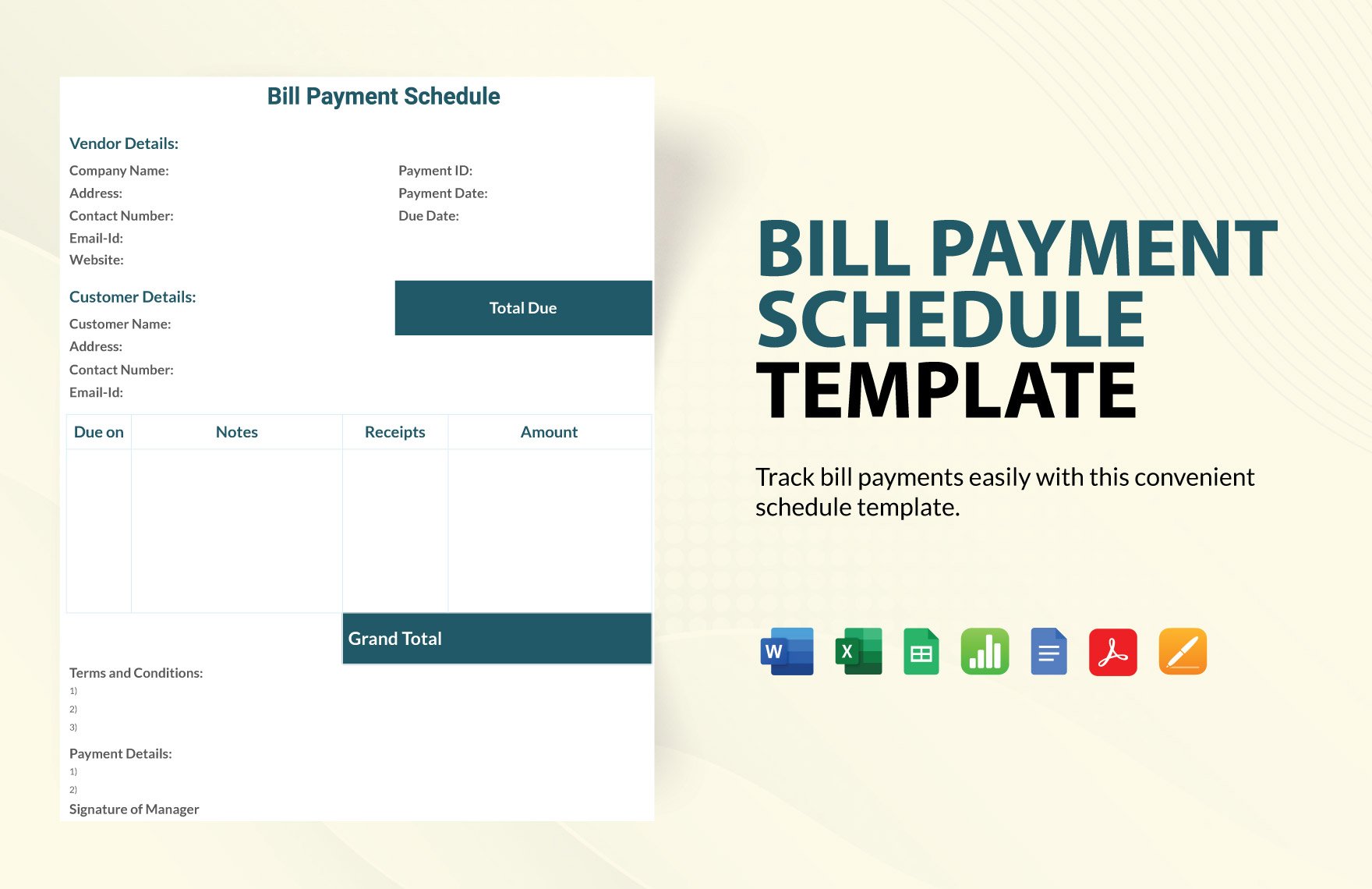

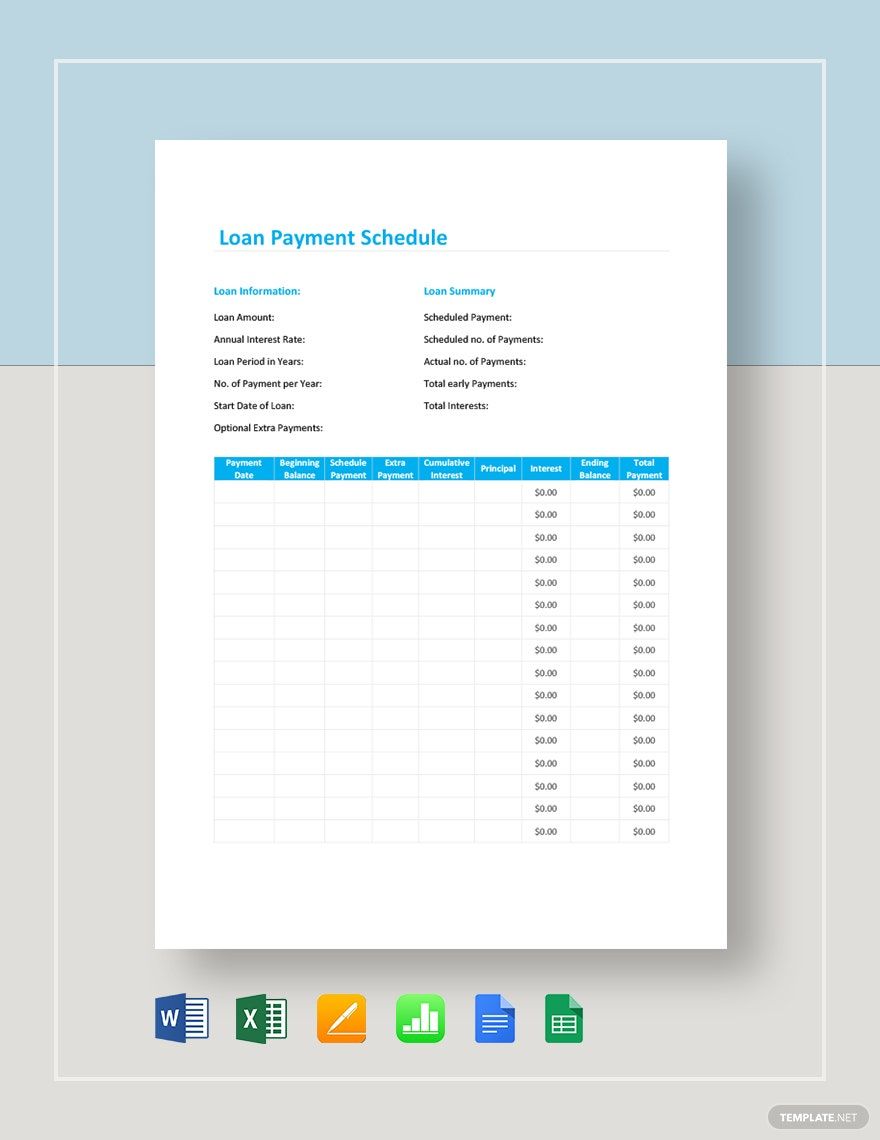

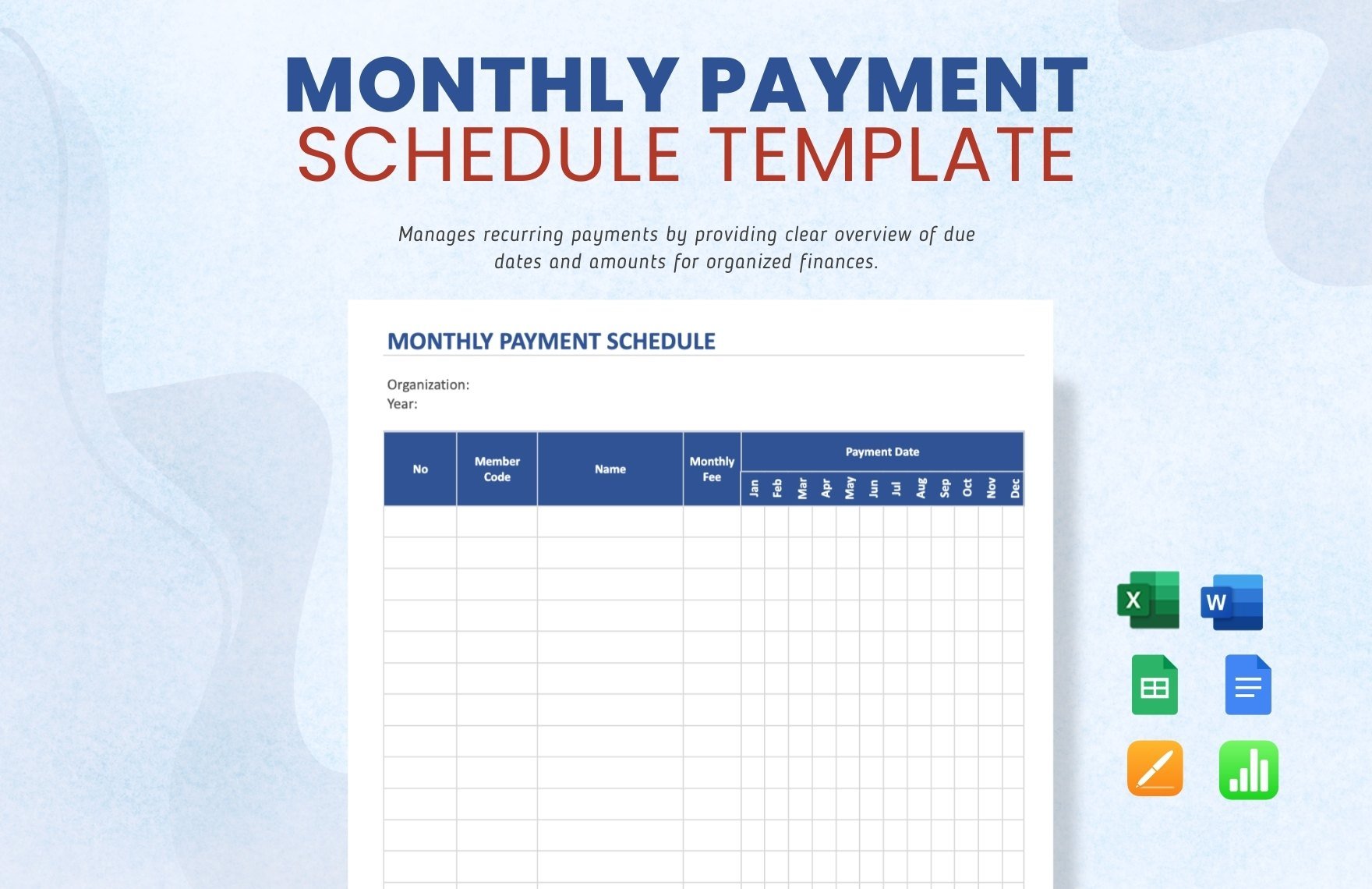

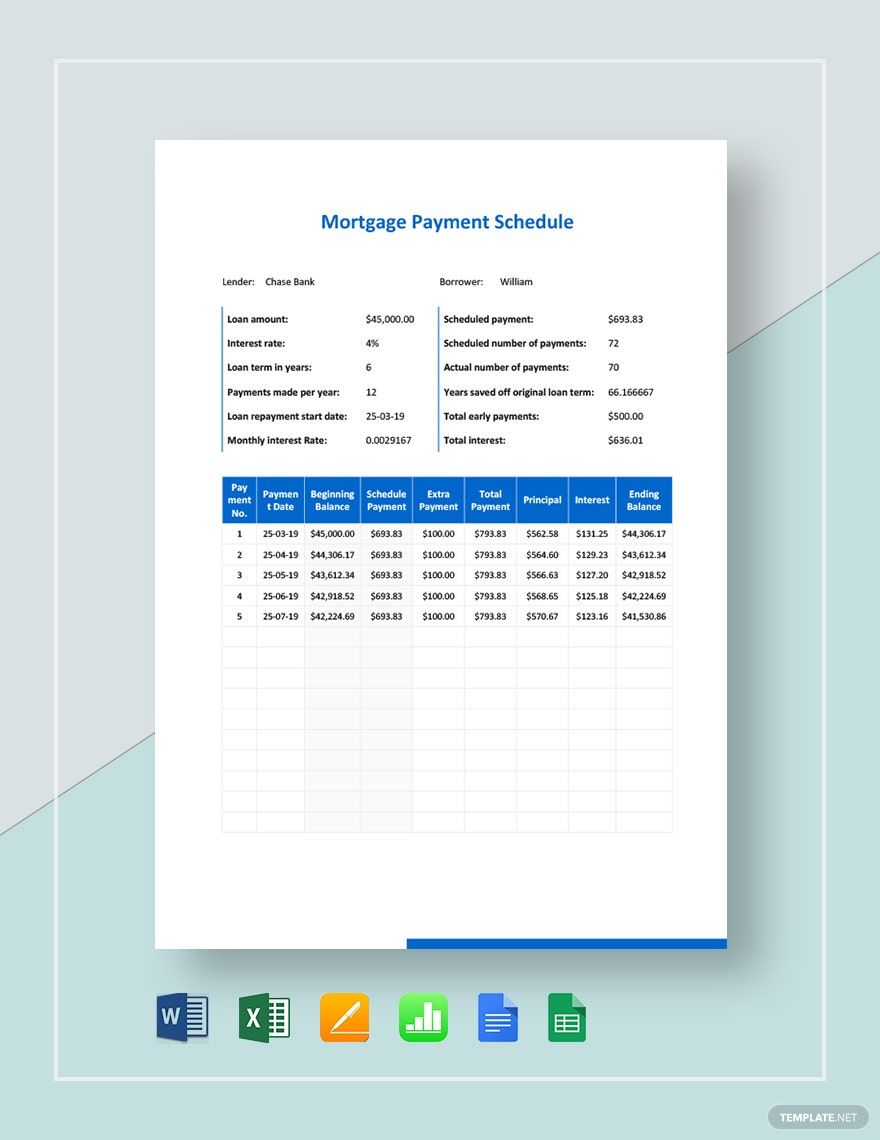

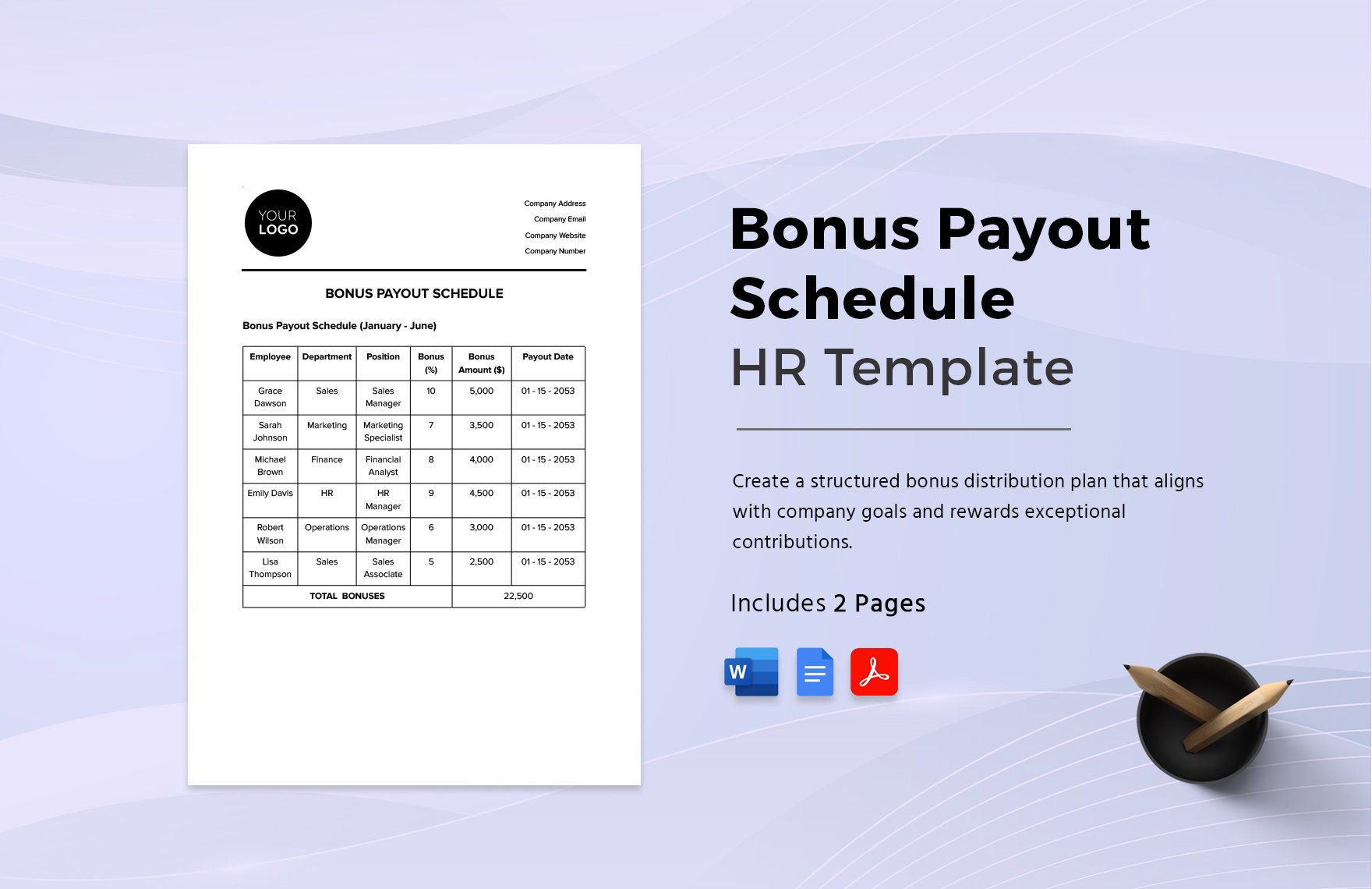

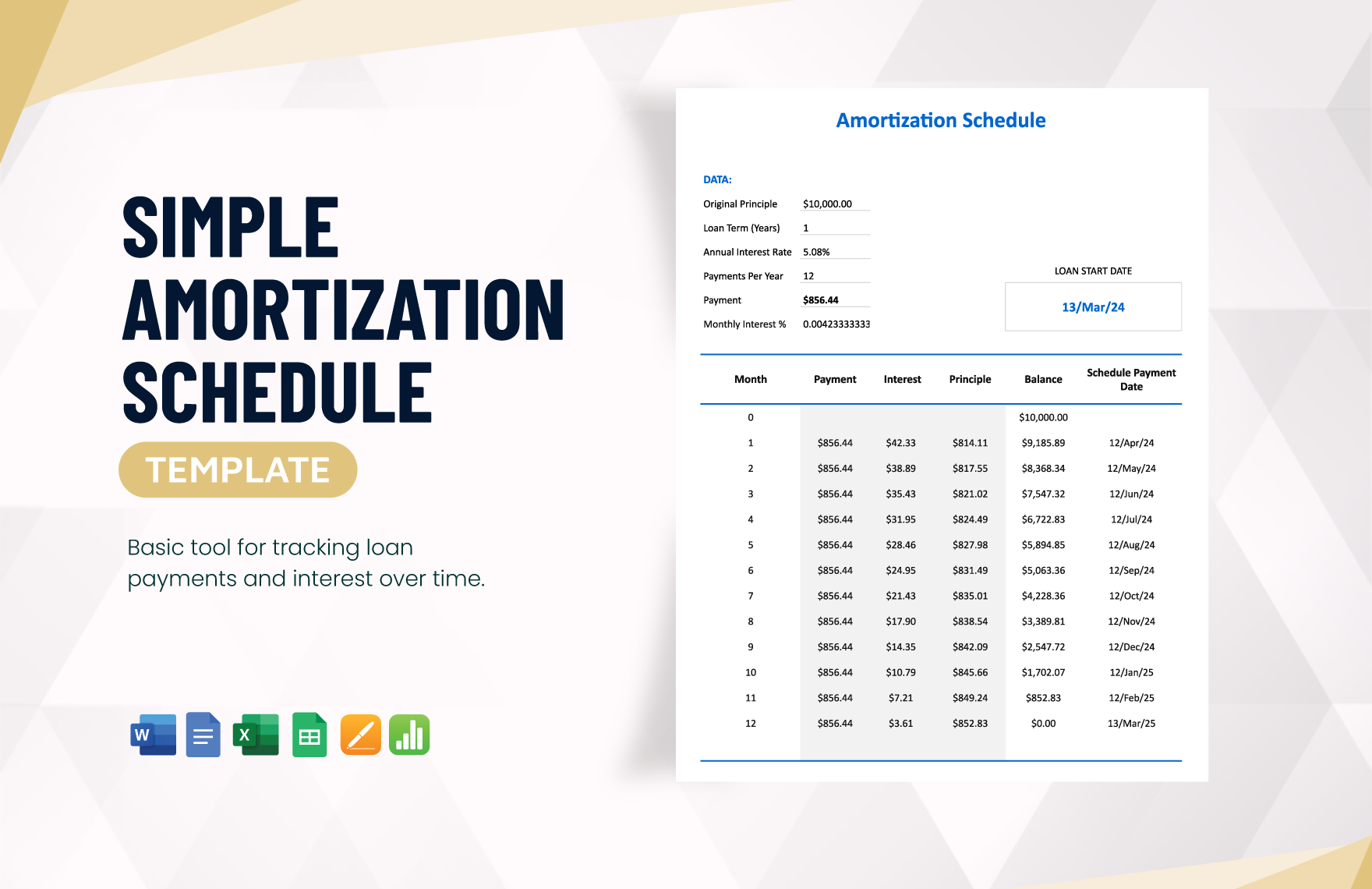

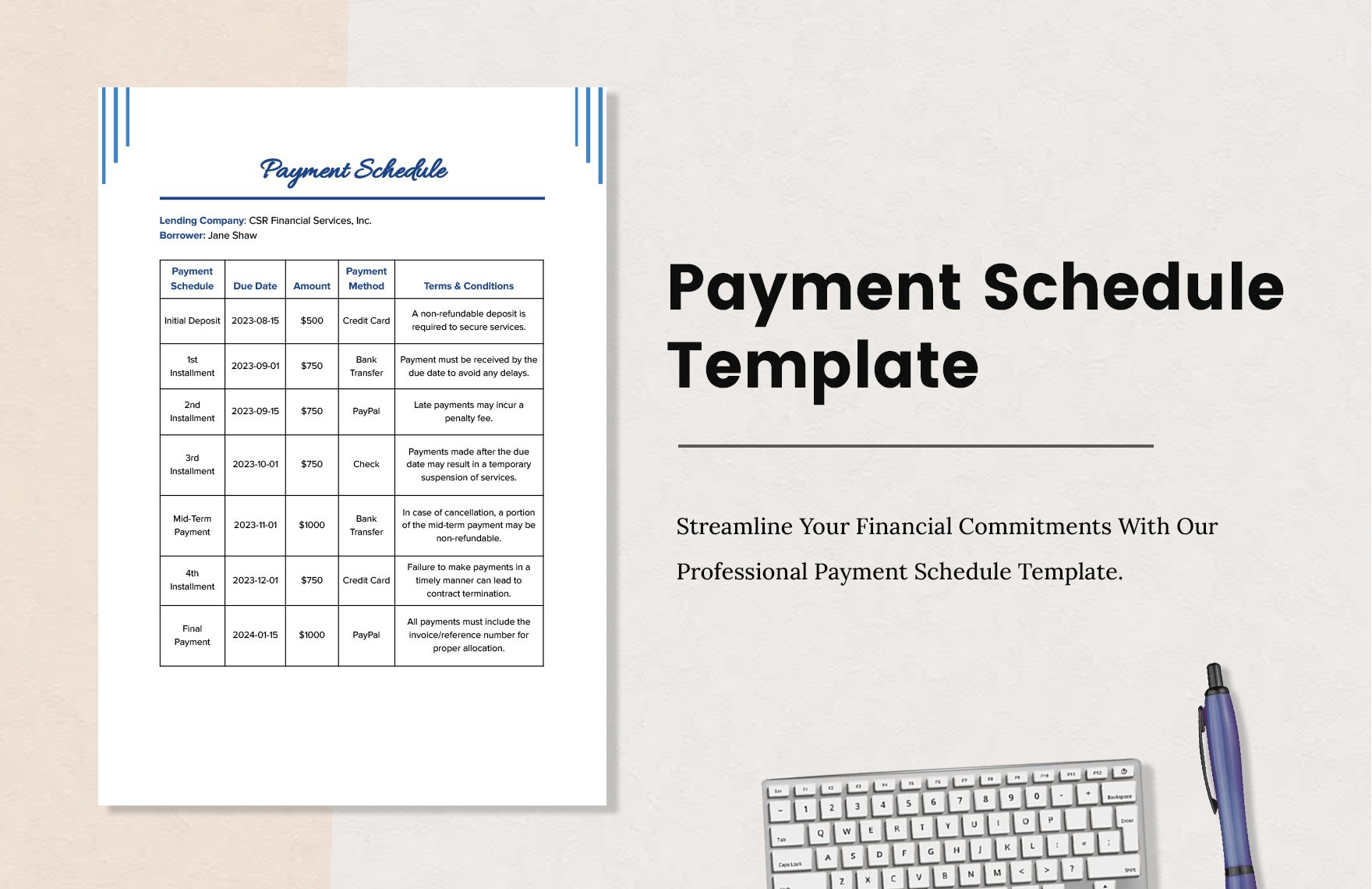

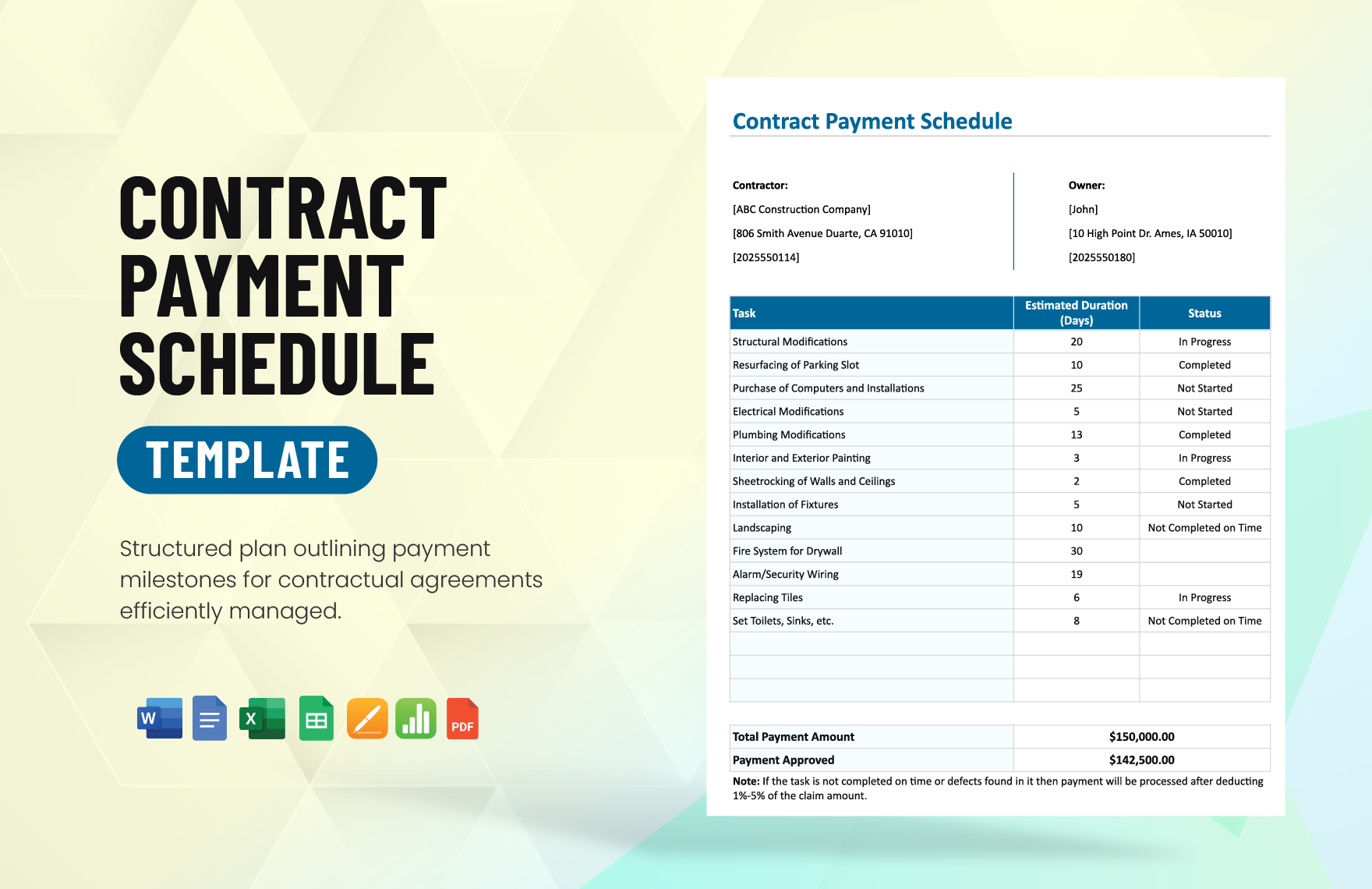

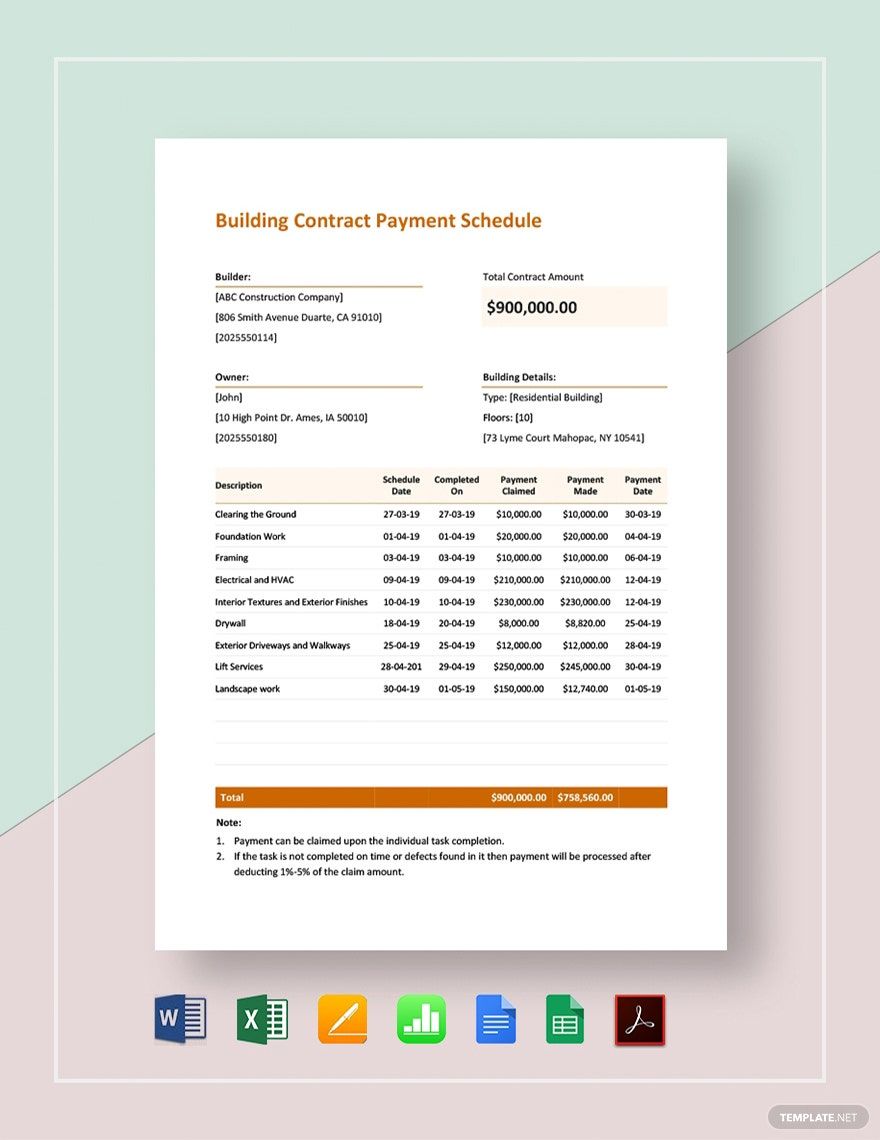

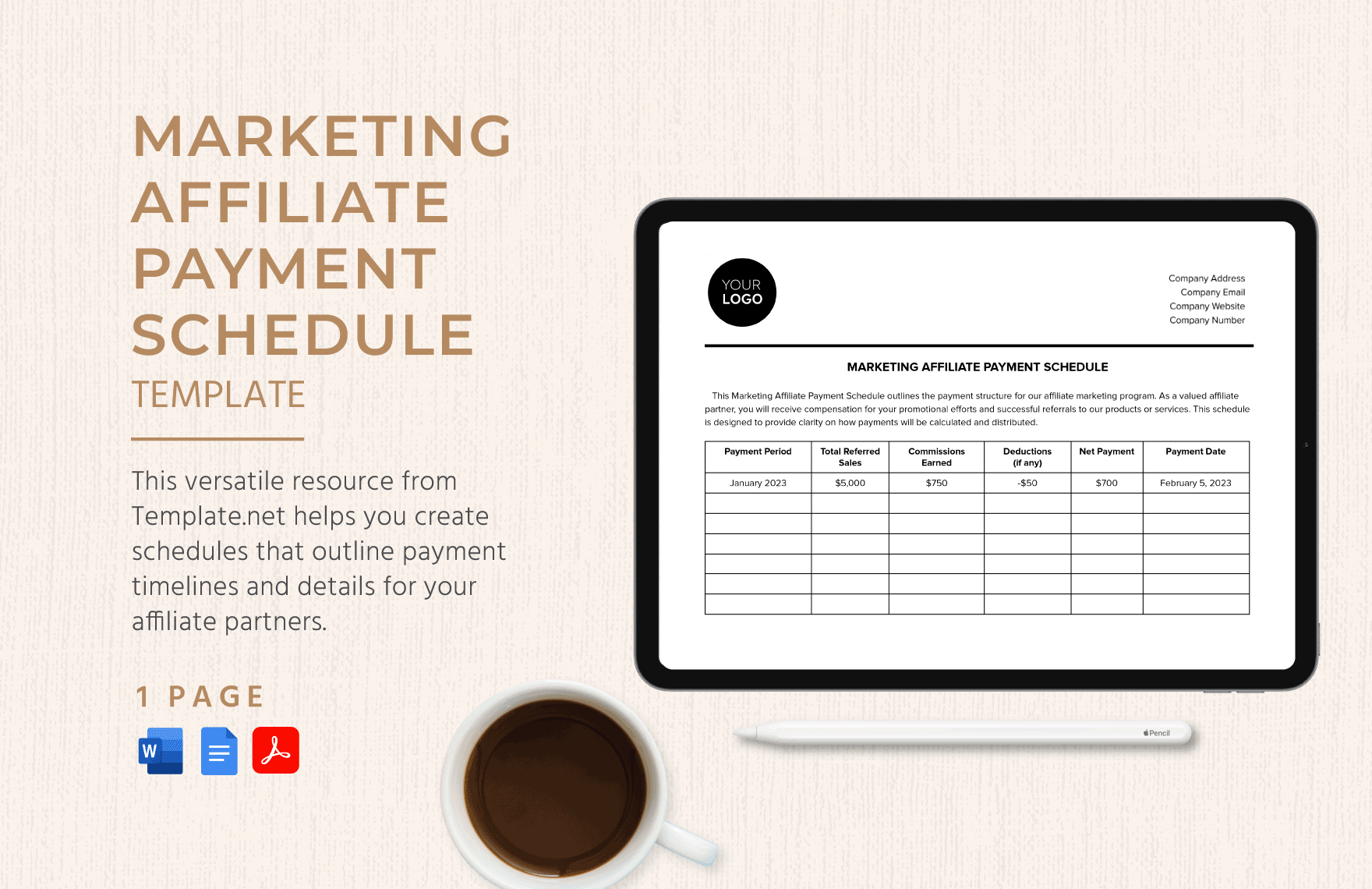

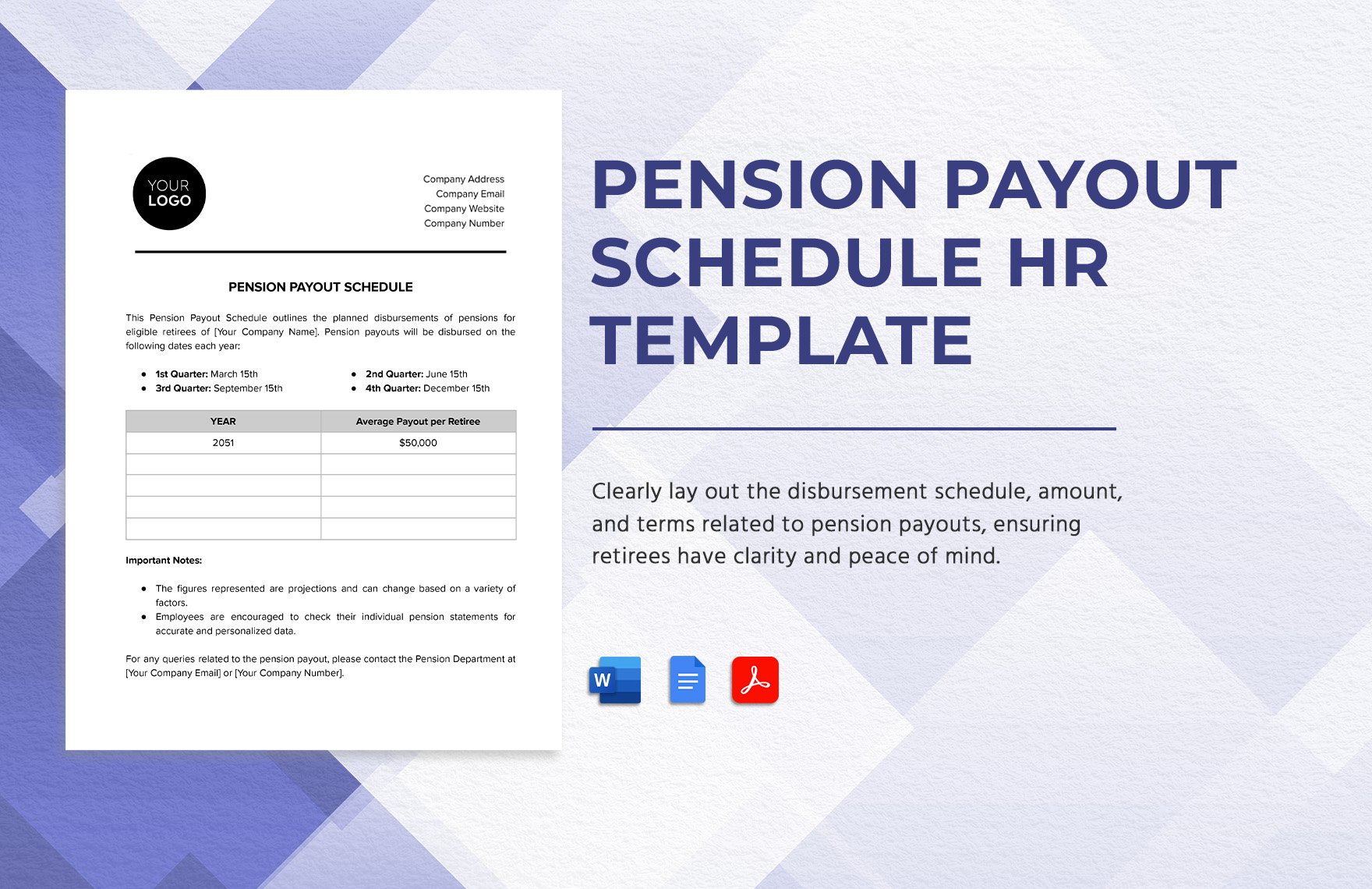

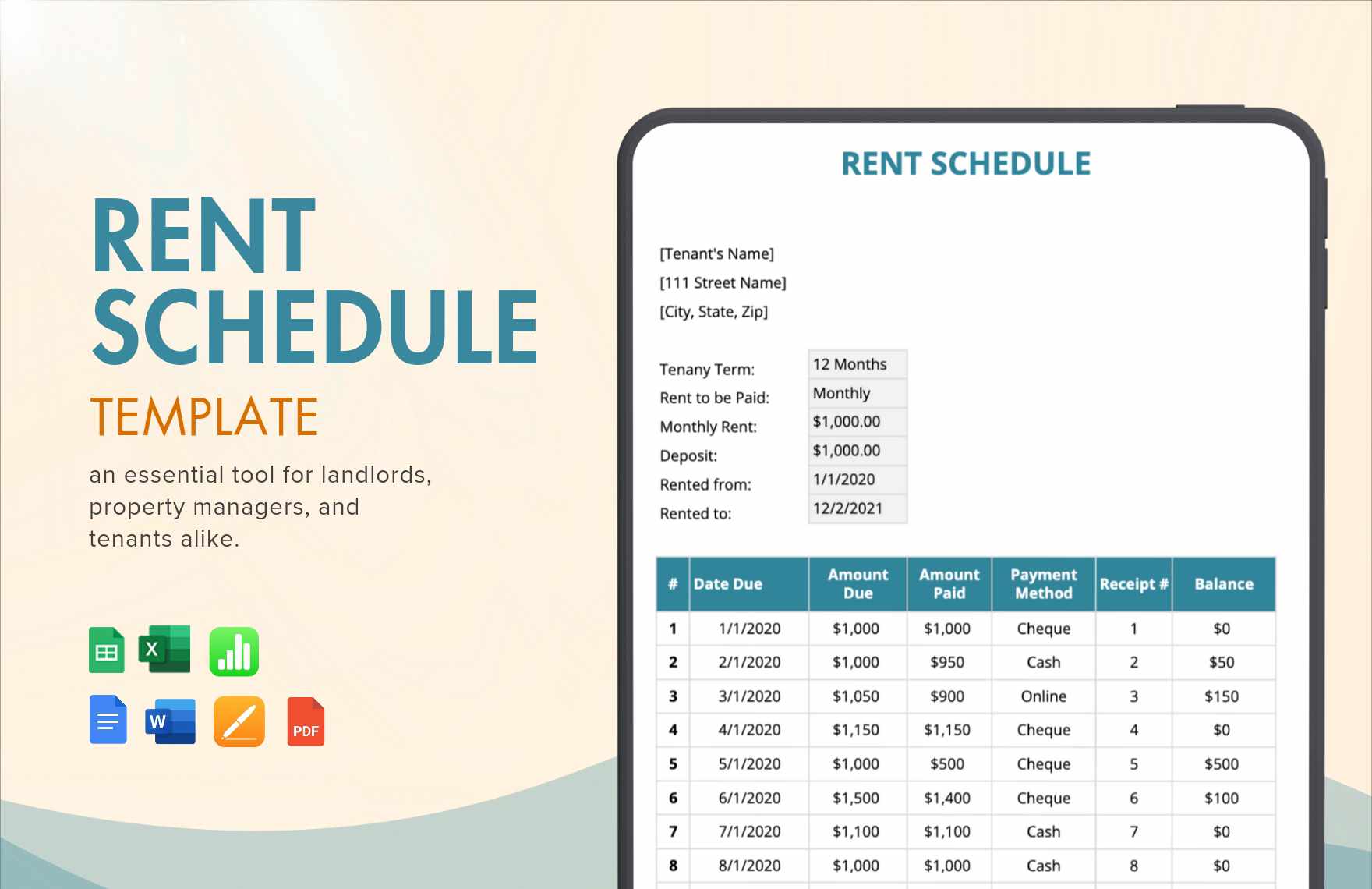

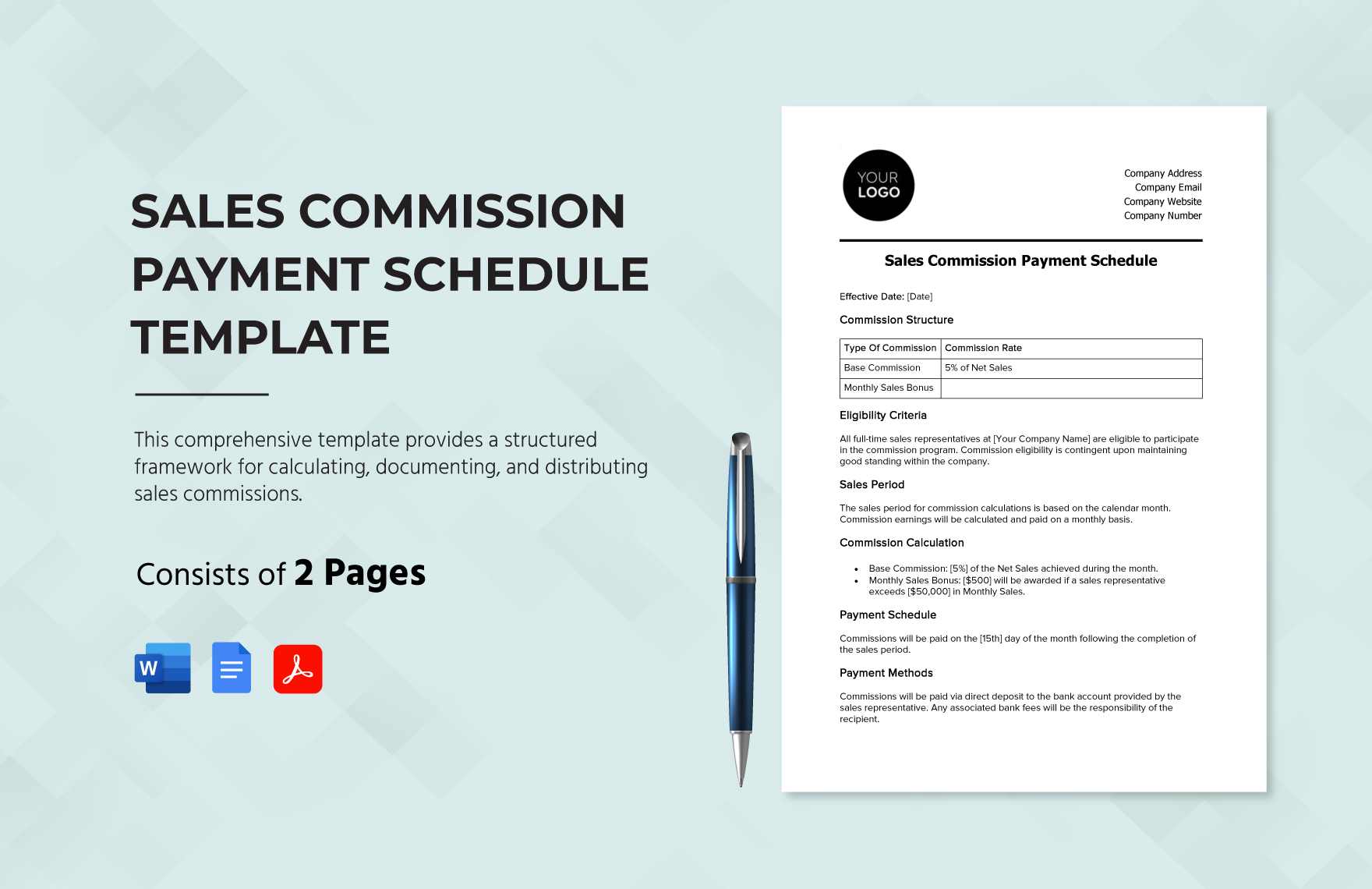

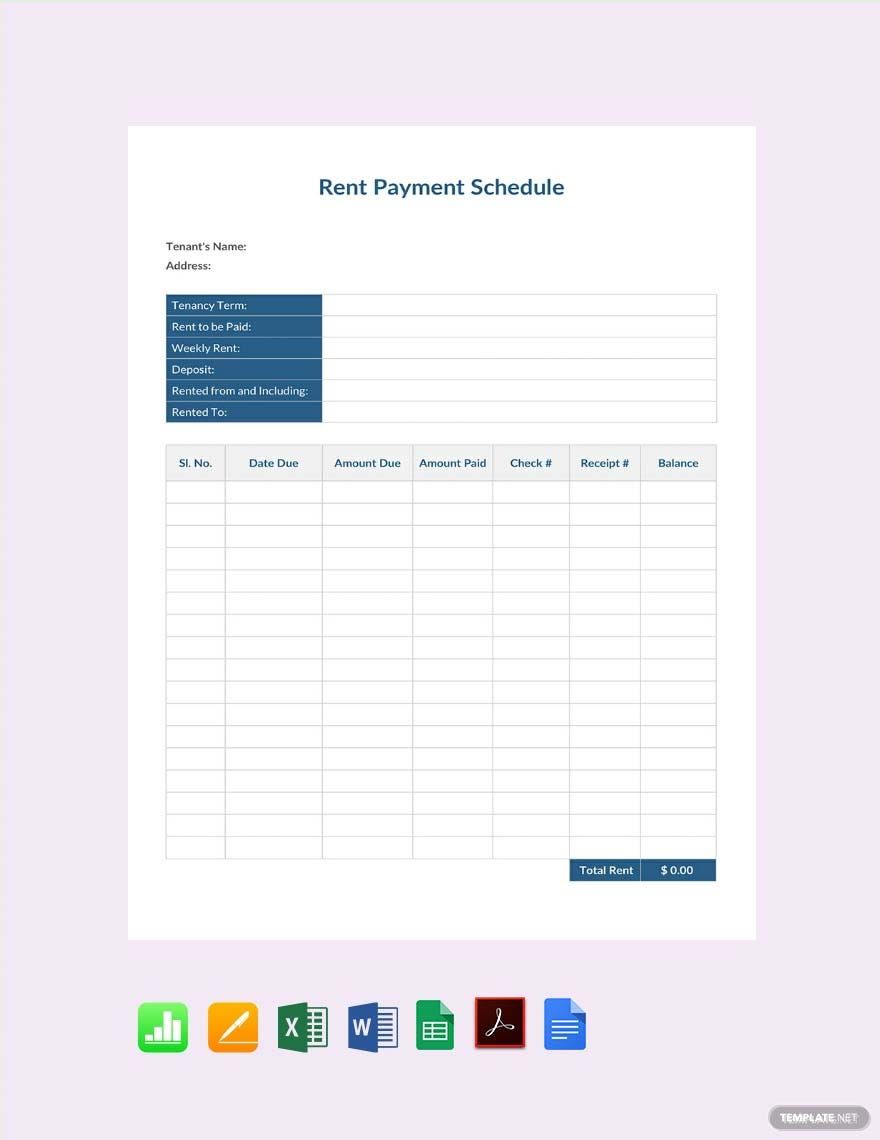

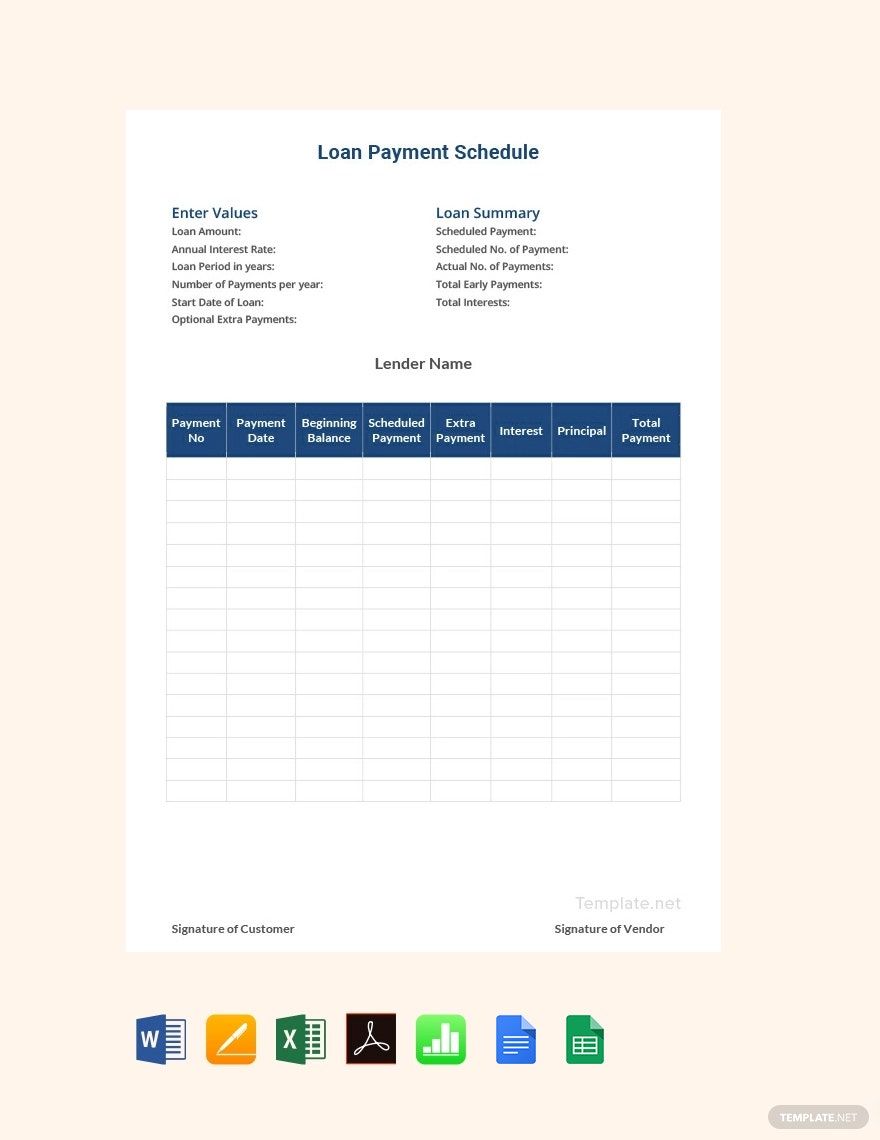

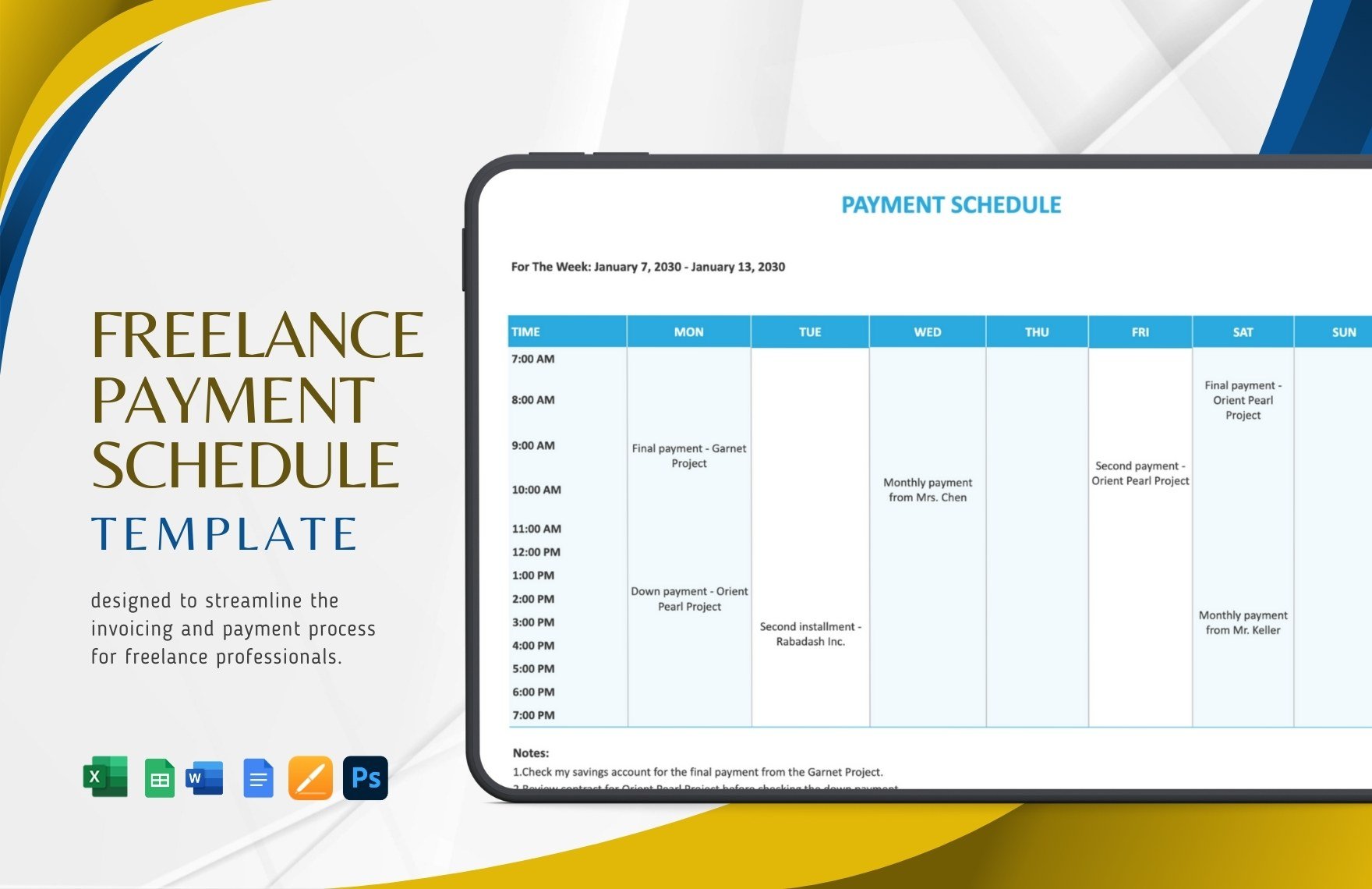

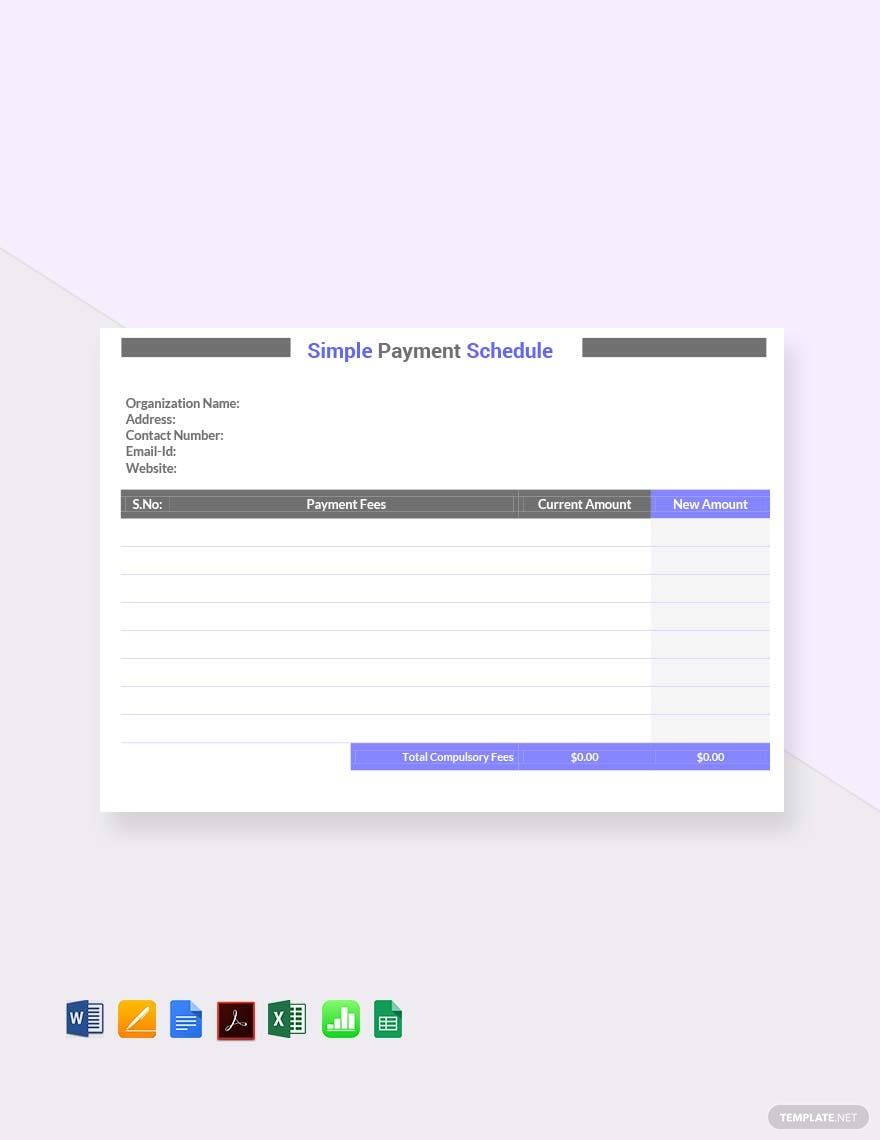

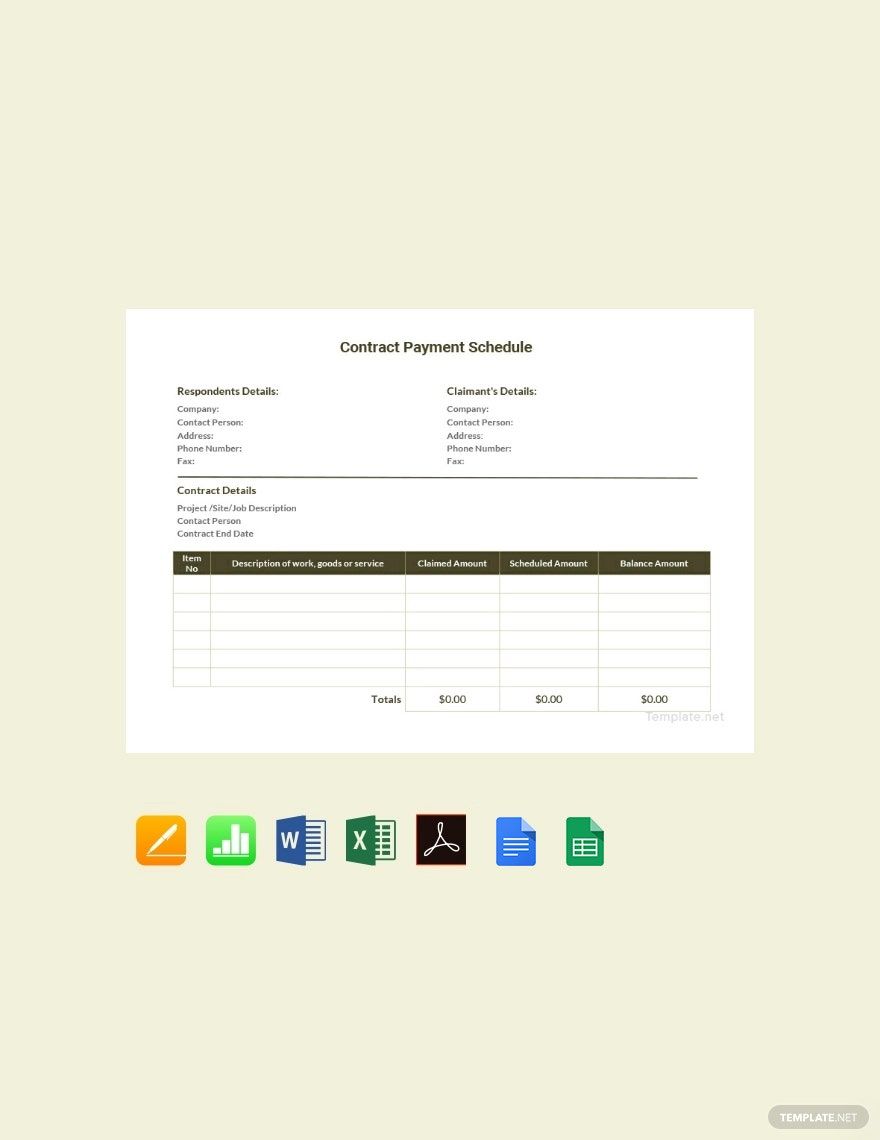

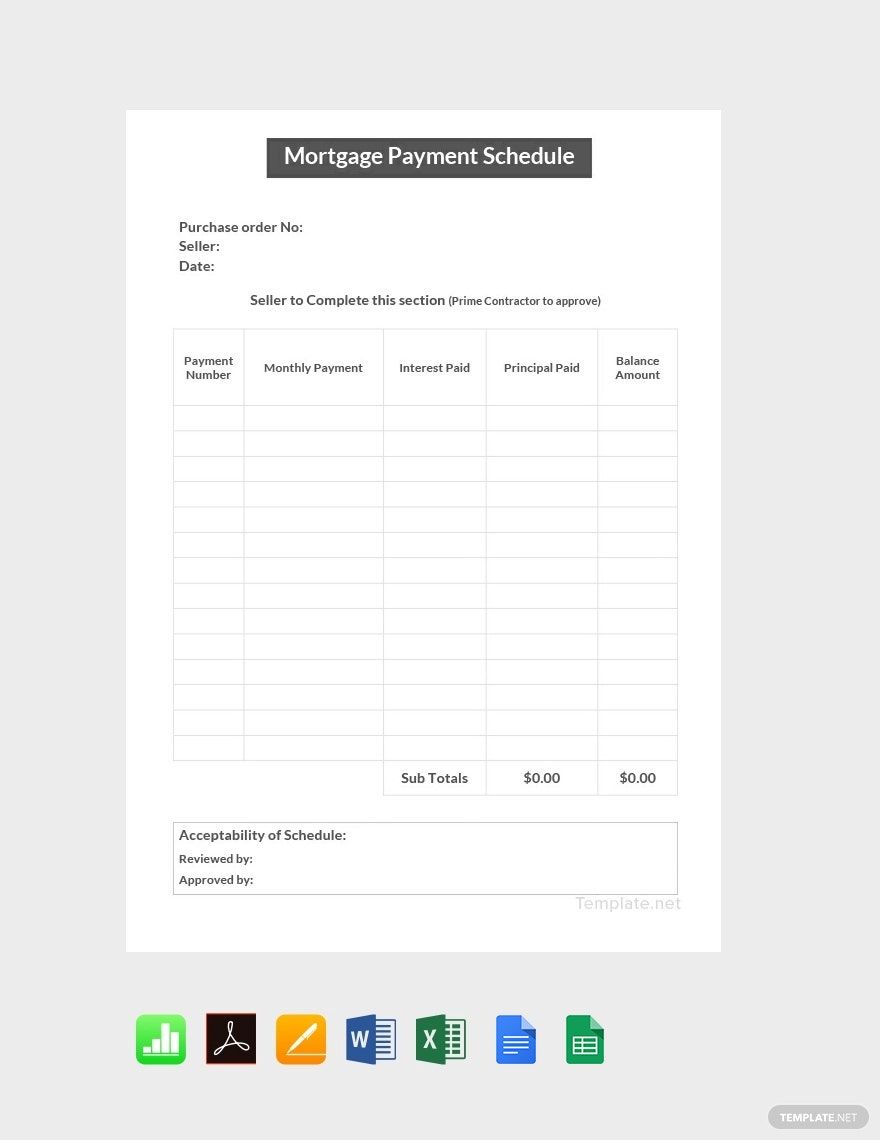

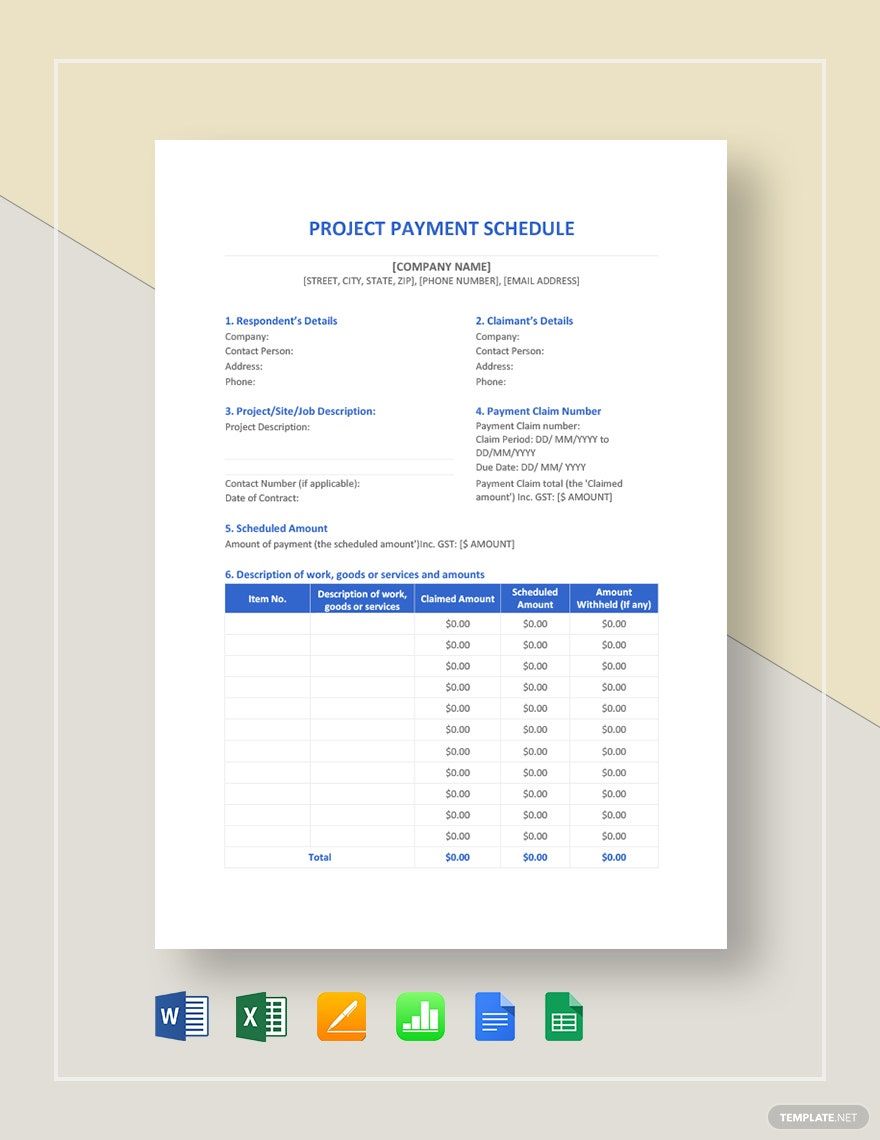

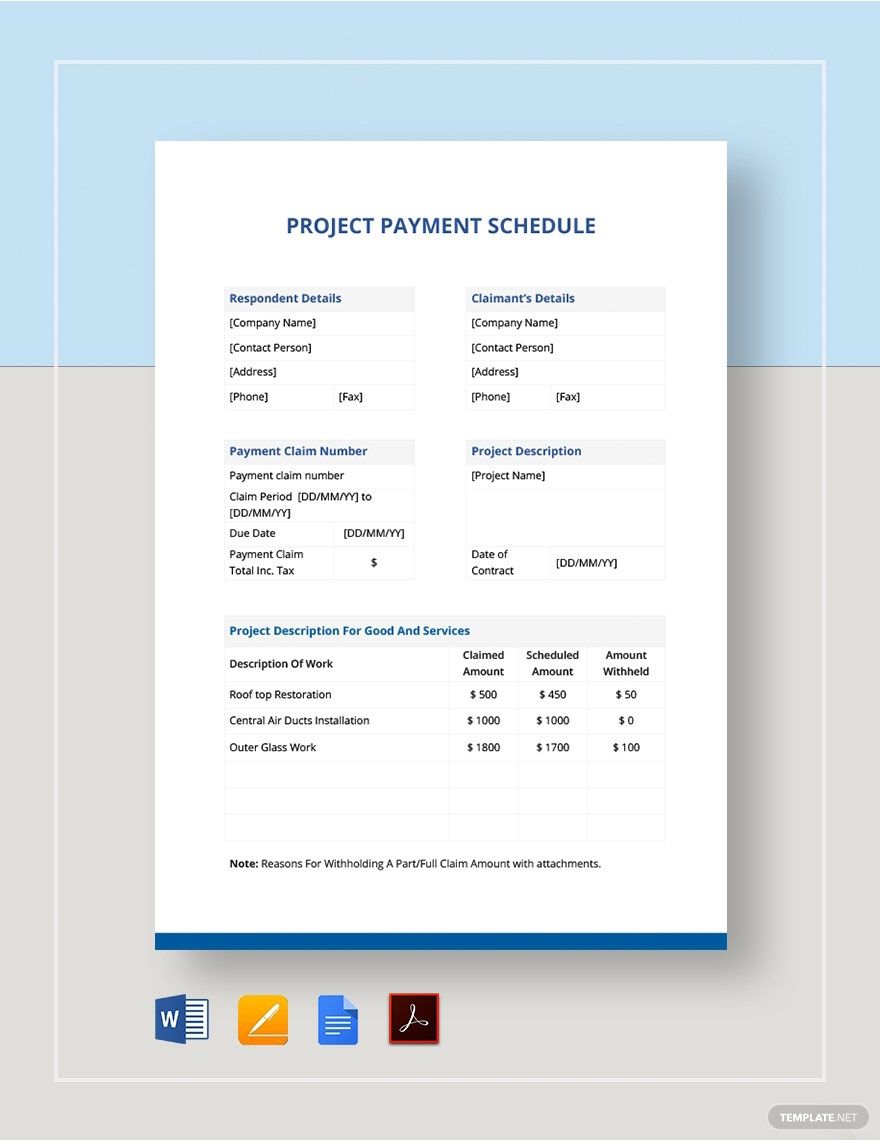

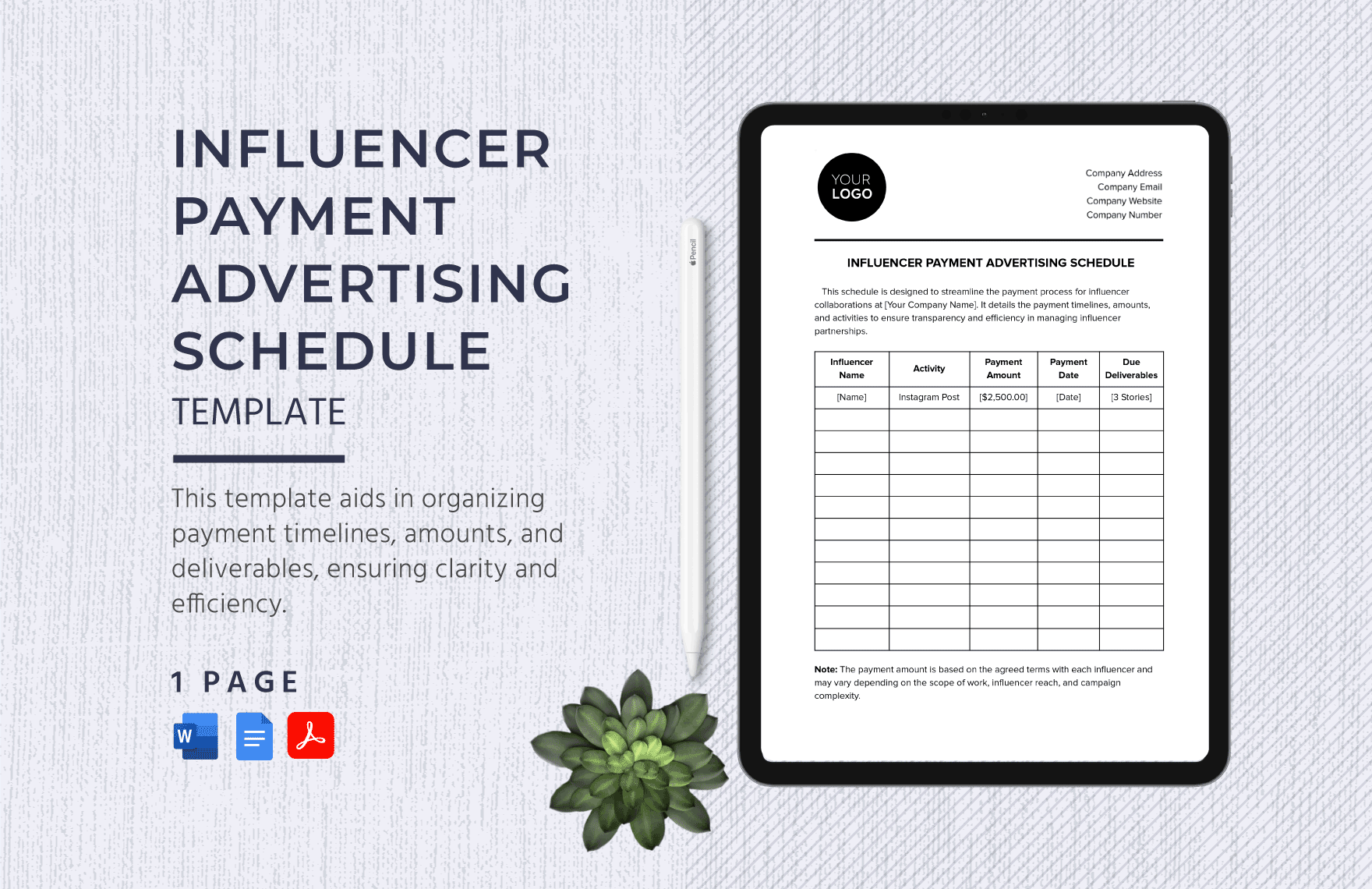

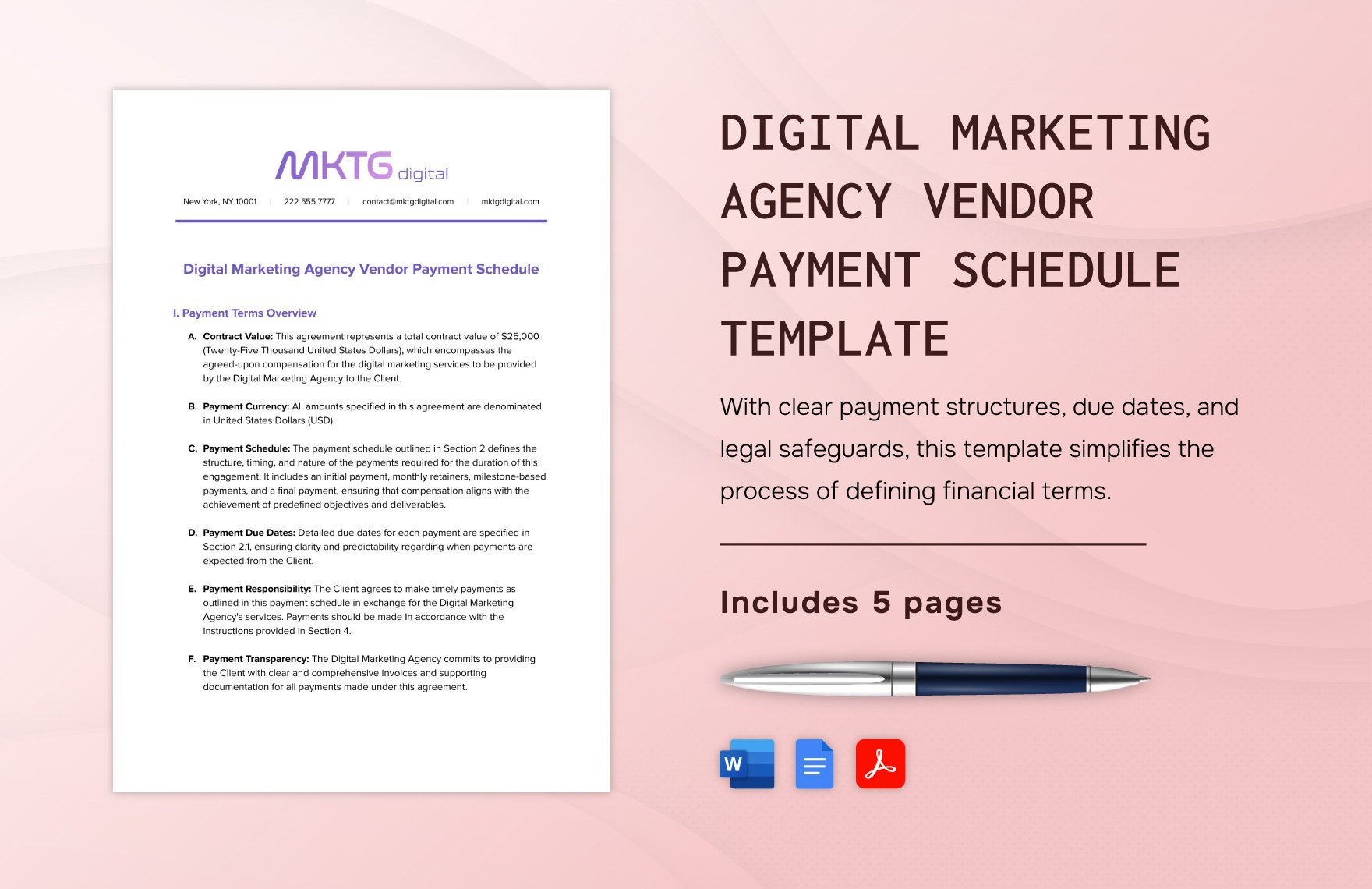

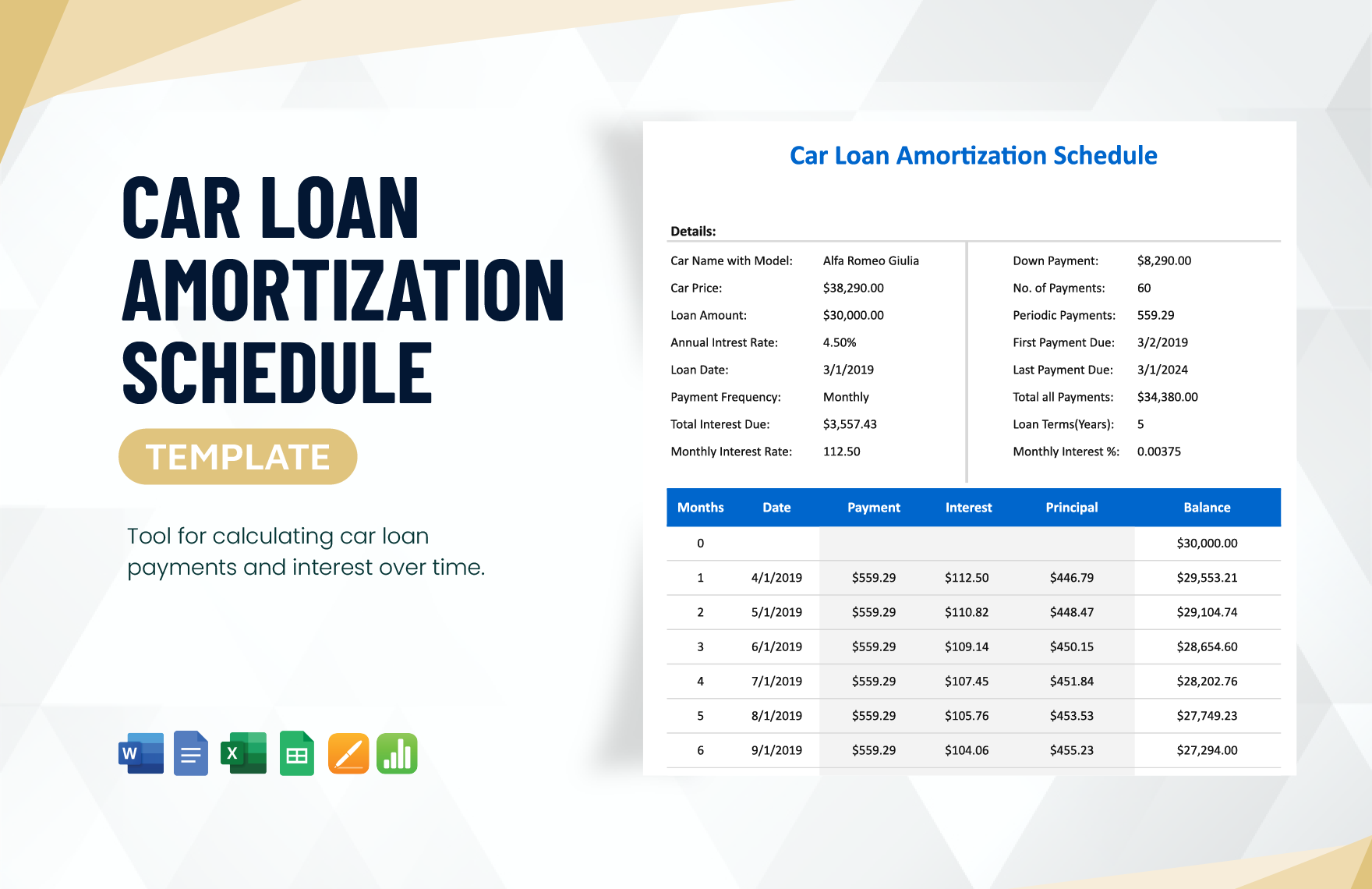

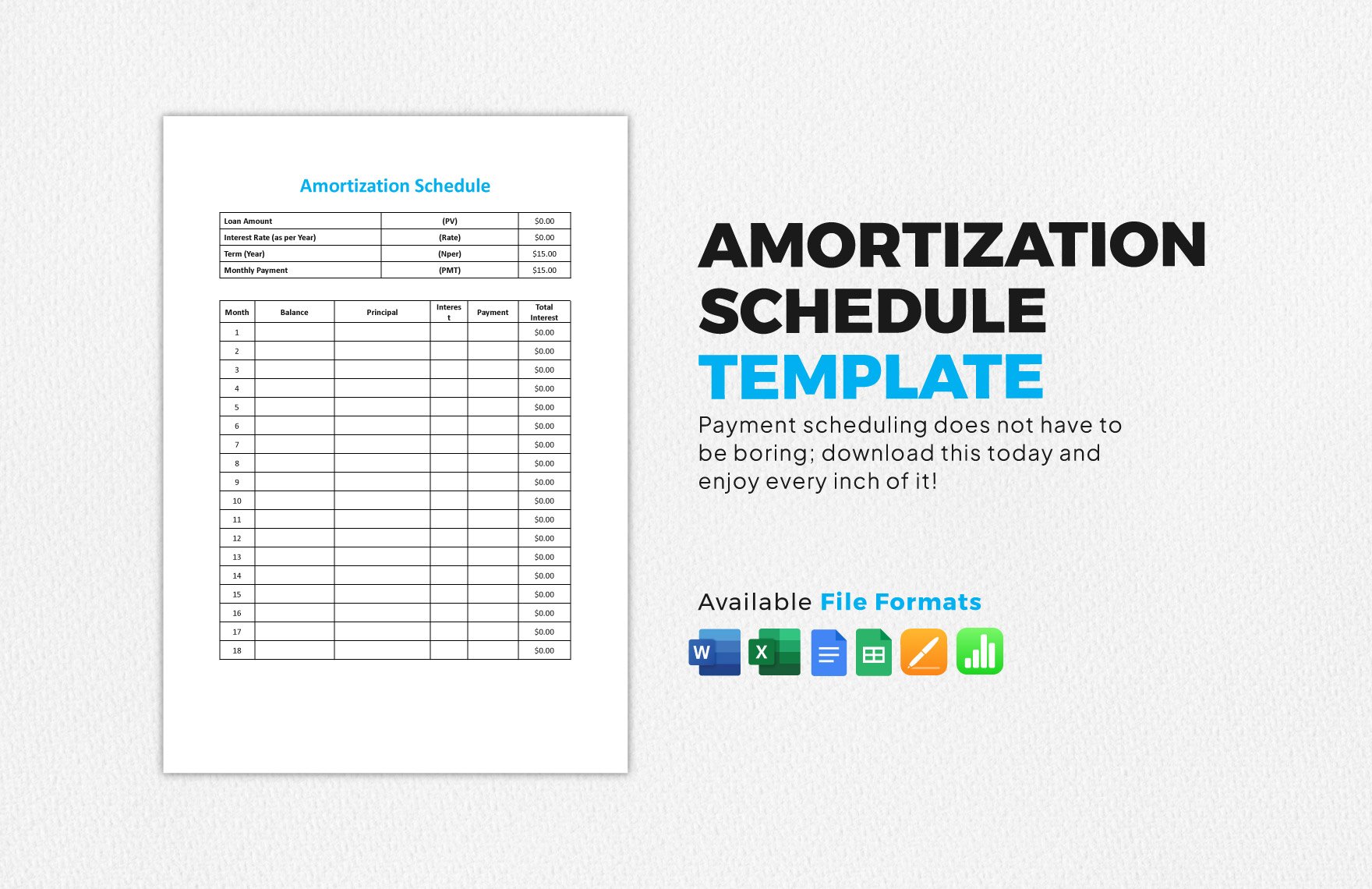

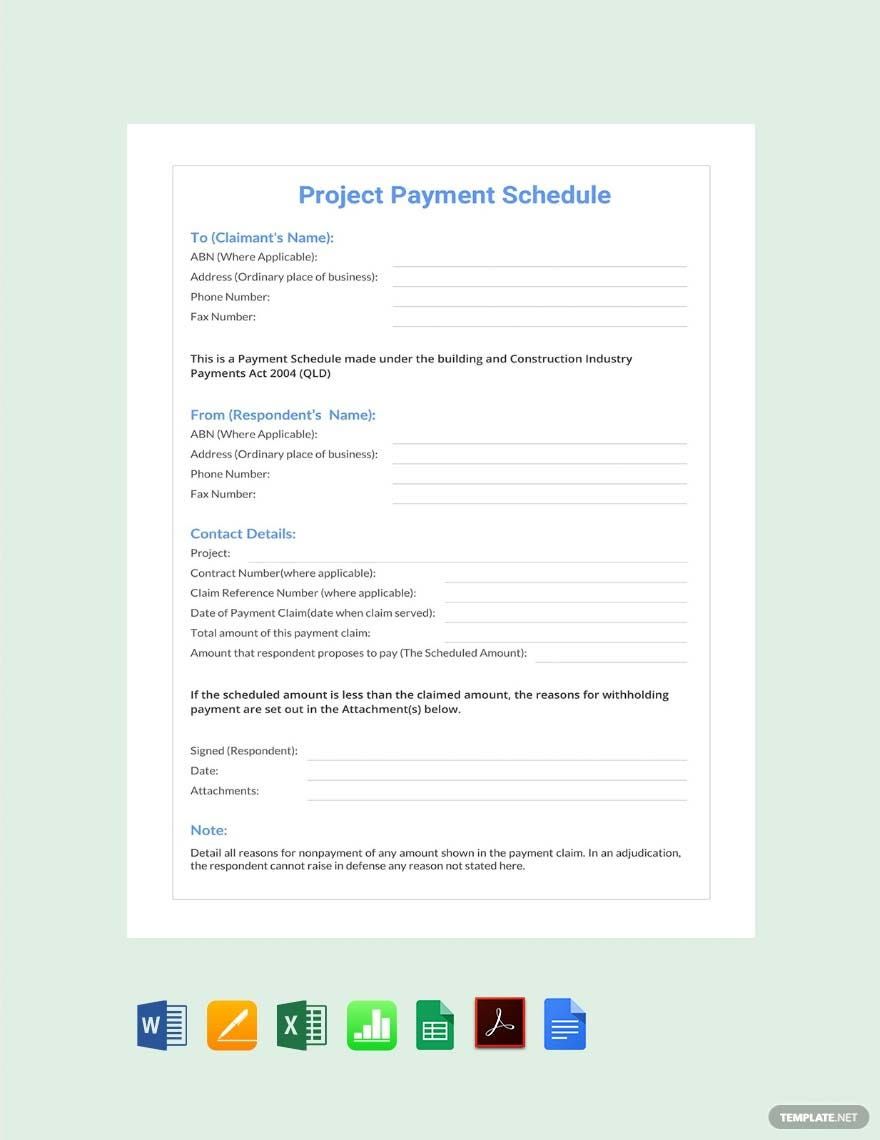

Payments are one of the most difficult things to settle when it comes to business transactions. According to statistics, Americans usually pay seven days late after their payment due dates. To avoid this from happening to you and your business, you need to make sure that you have a record of each unsettled payment. You can do this by downloading our premium, industry-compliant and professionally written Payment Schedule Templates. These templates are easily editable and are customizable to ensure that your needs are met. Moreover, they can be edited in Google Docs and other programs compatible with the Doc format. So what are you waiting for? Download one today!

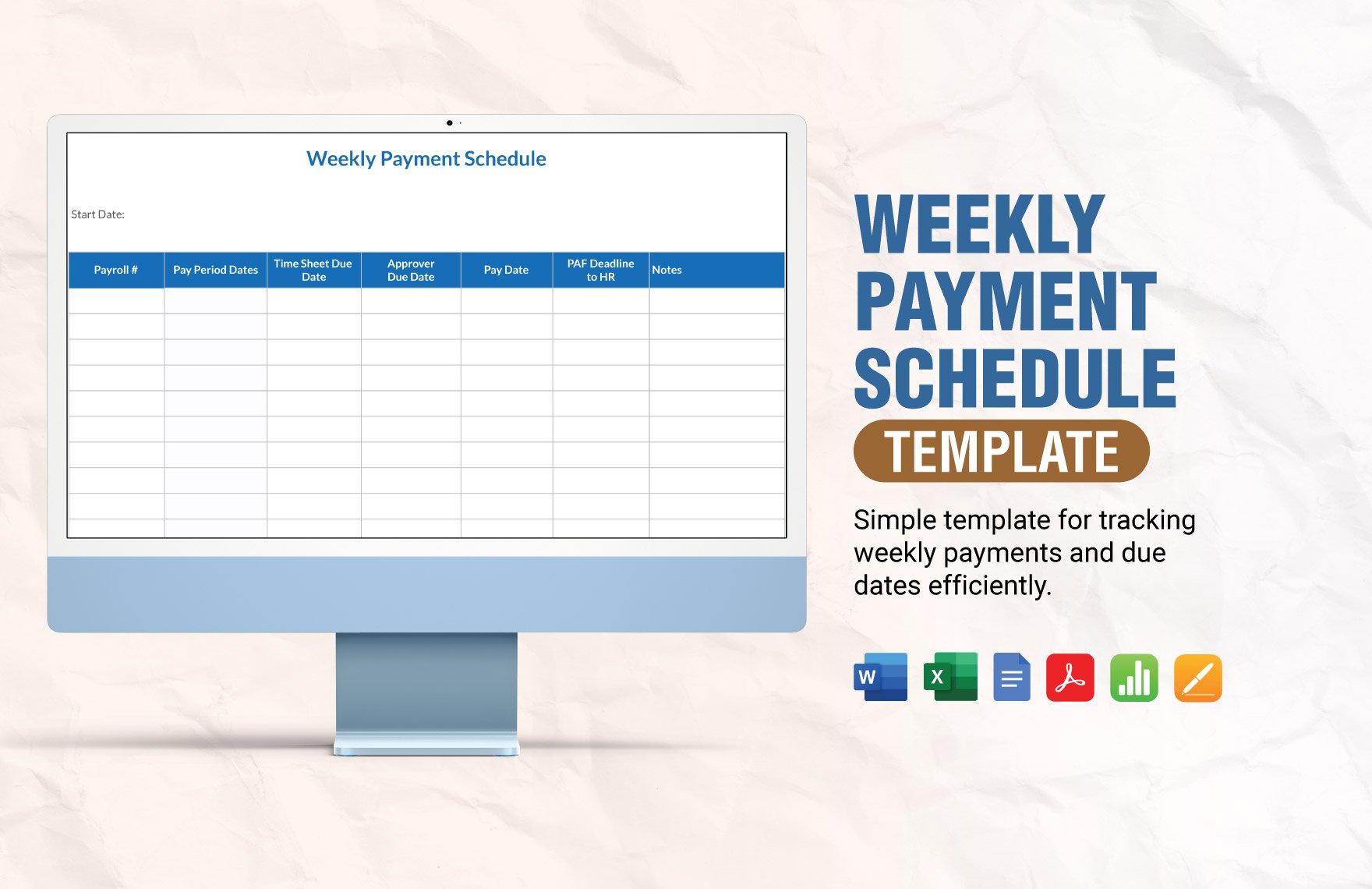

How to Make a Payment Schedule in Google Docs

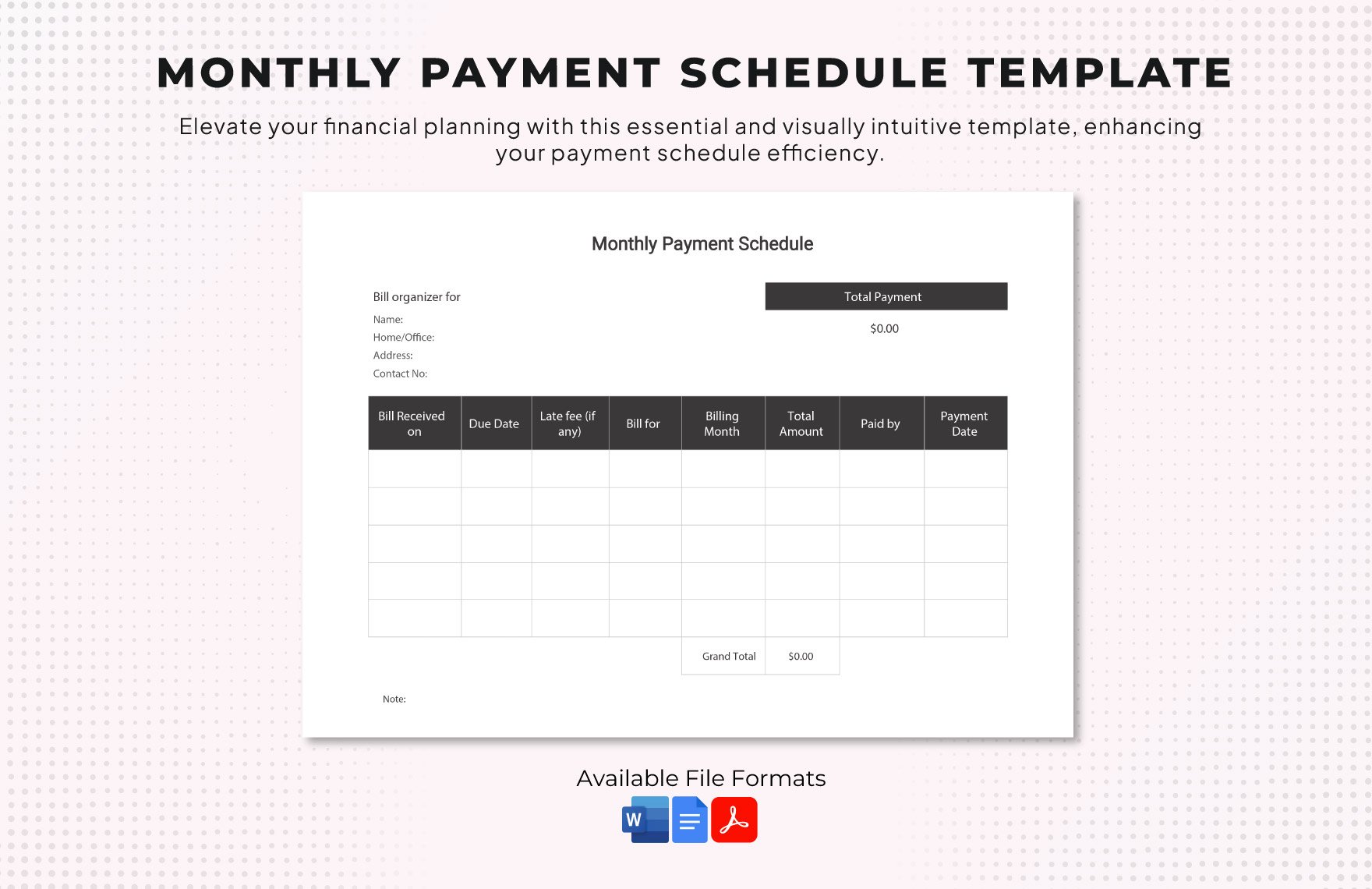

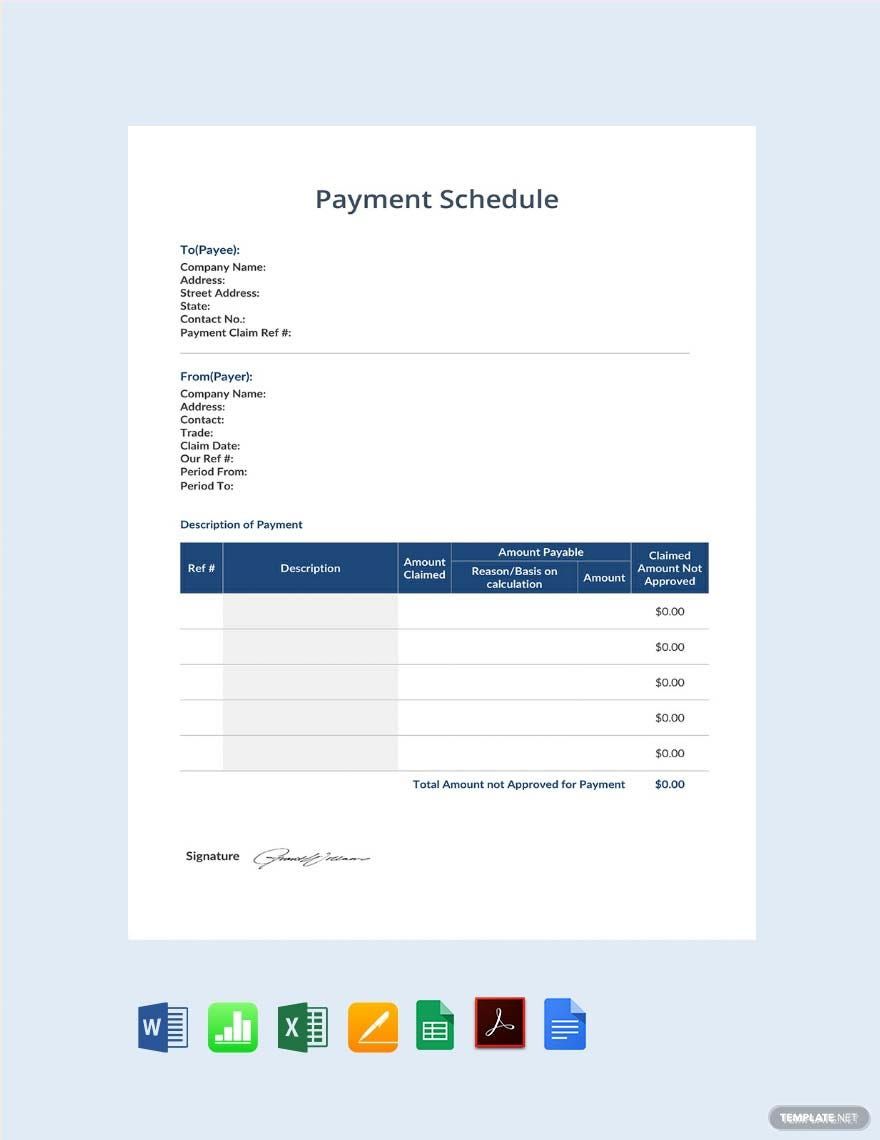

Having a payment schedule is essential for just about any person as it can help point what needs to be paid or what has yet to be. Moreover, it can be used for better computing your financial statements. So no matter what type of payment schedule you want to make, then here are a few tips that you can follow:

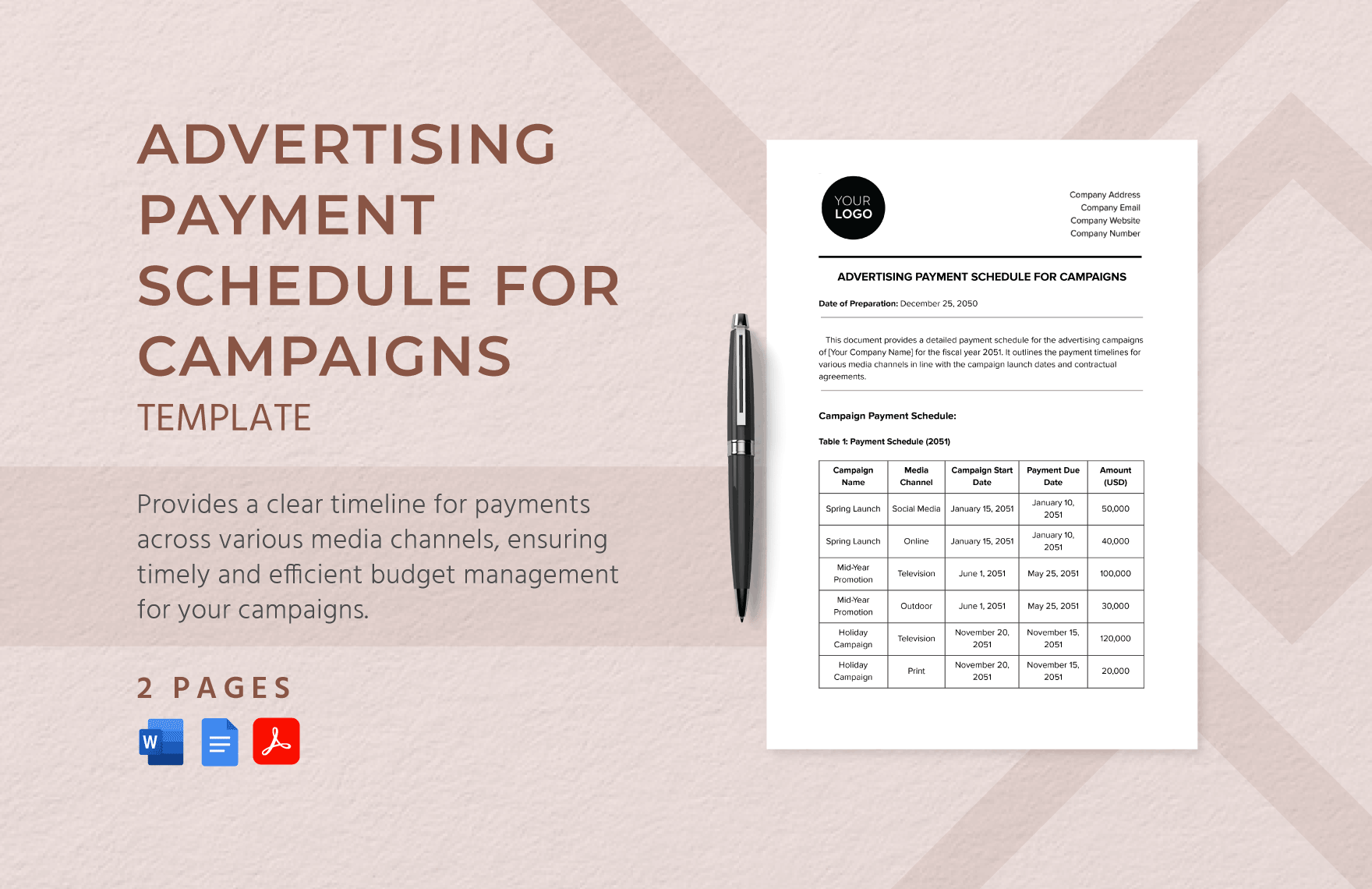

1. Analyze What You Need to Spend On

The first thing that you need to do is to sit down and take a look at everything that you need to pay for. Whether for business or personal reasons, doing this ensures that you are able to make a schedule that covers all your payments. Be sure to provide a brief description of each one.

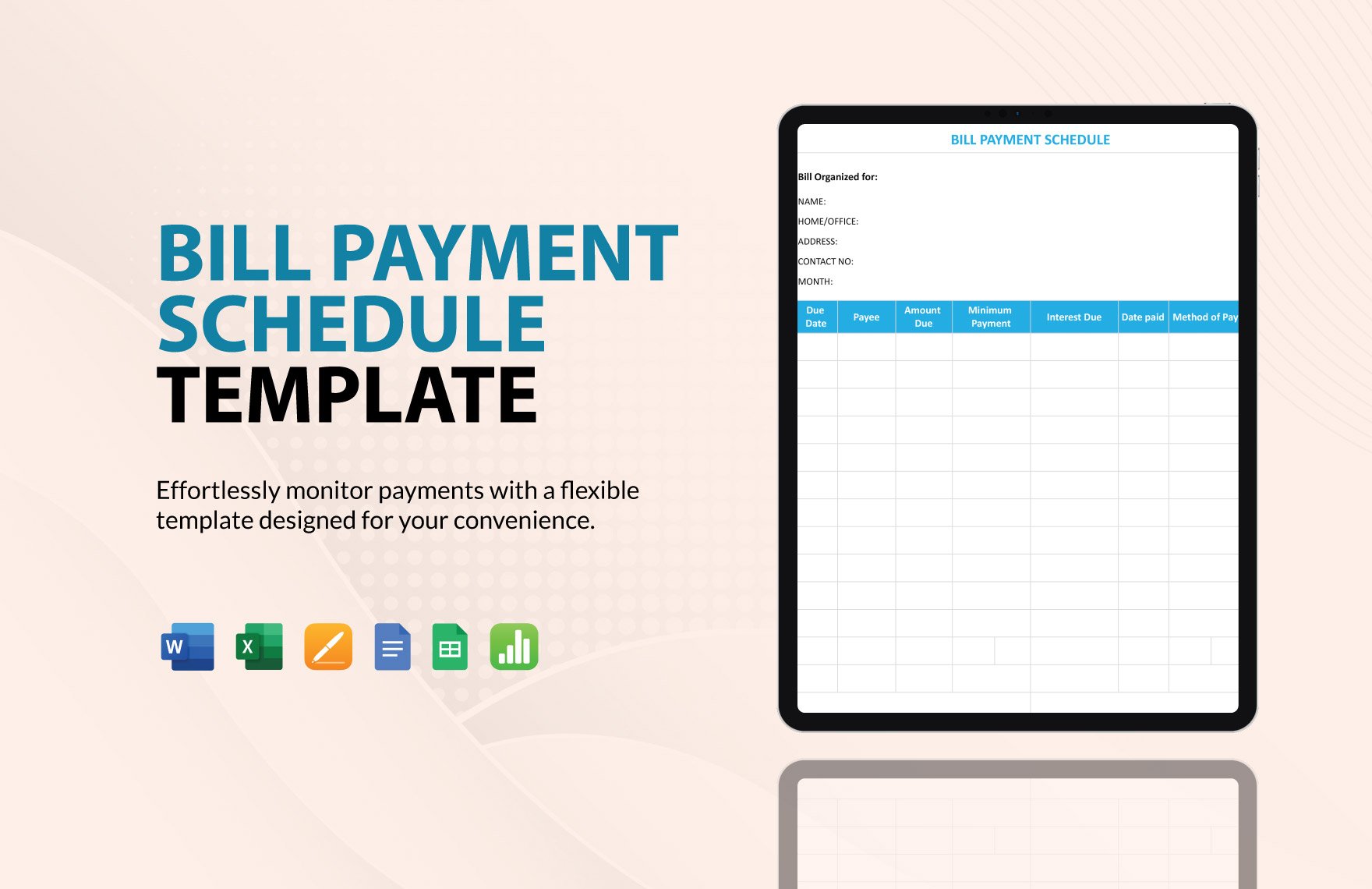

2. Perform Time Inventory

Time plays a vital role when making a payment schedule as it points out when each payment should be settled. You need to keep track of the due date of each of the unsettled payments that's on your list. Take a look at which ones are due to be paid for and which ones you can pay for whenever. That way, you'll know which ones you need to prioritize.

3. Sort Everything Out

Once you have all the information you need, you'll want to plan everything accordingly. Remember that you want to prioritize each payment in accordance with which ones you need to pay and which ones you can hold off. You'll want to consider placing the exact date for each payment so you'll have an easy time knowing when they need to be paid.

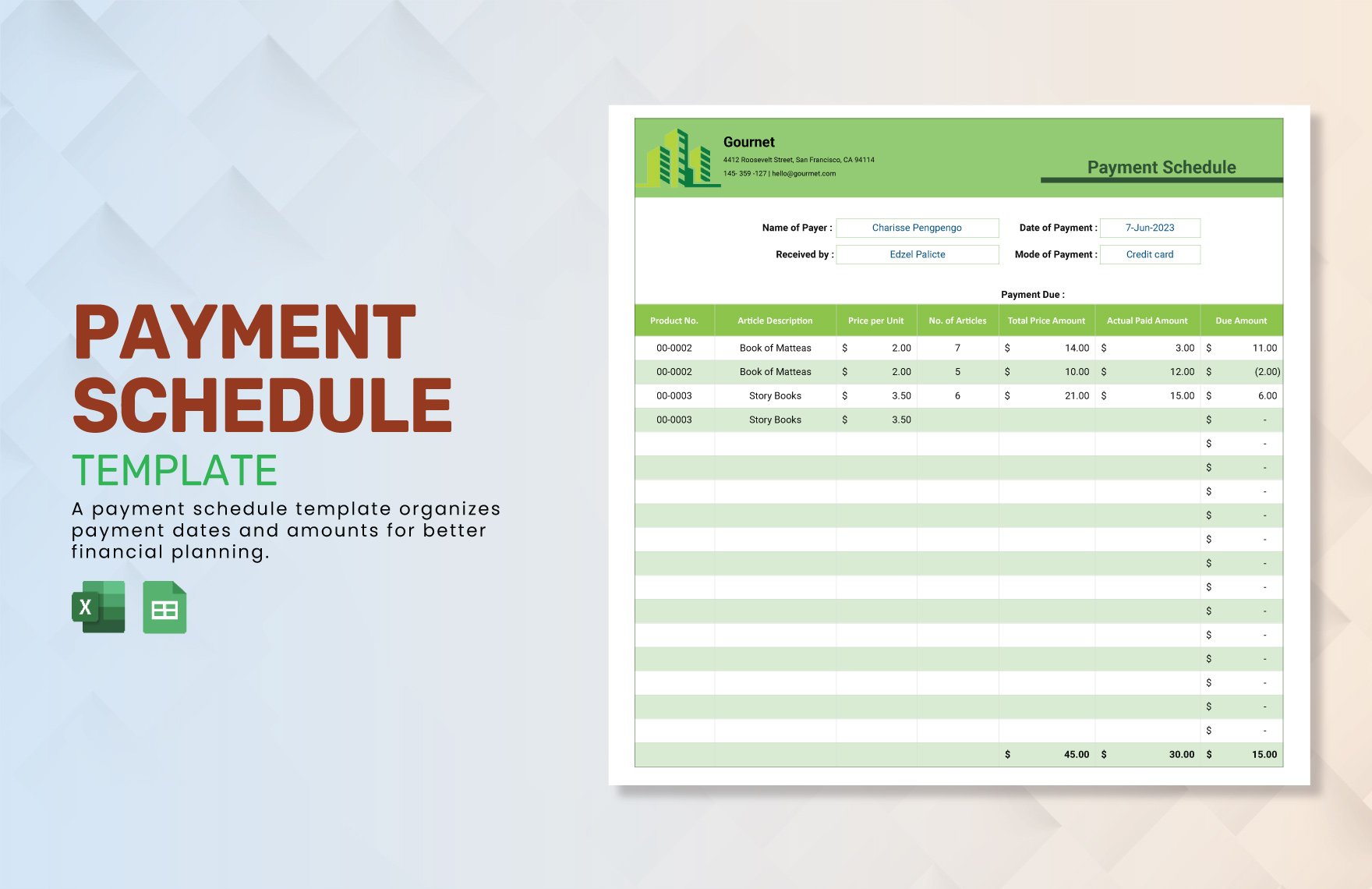

4. Include Payment Methods

You should definitely consider placing how you're going to make each payment as it's possible that you have different methods for each one. Decide as to which ones you want to pay with cash, check, credit card, etc. This should make things easier when you need to pay those bills.