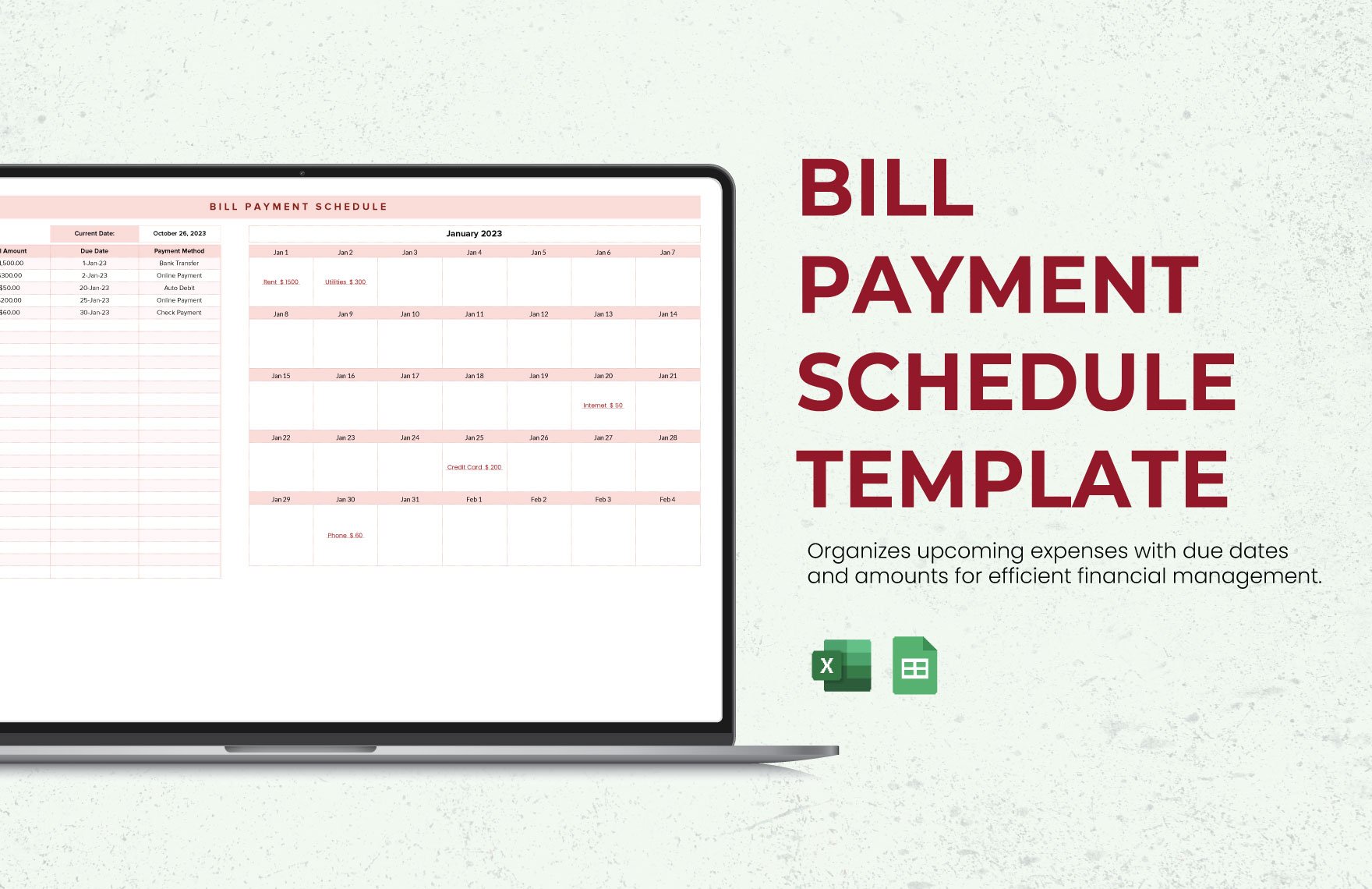

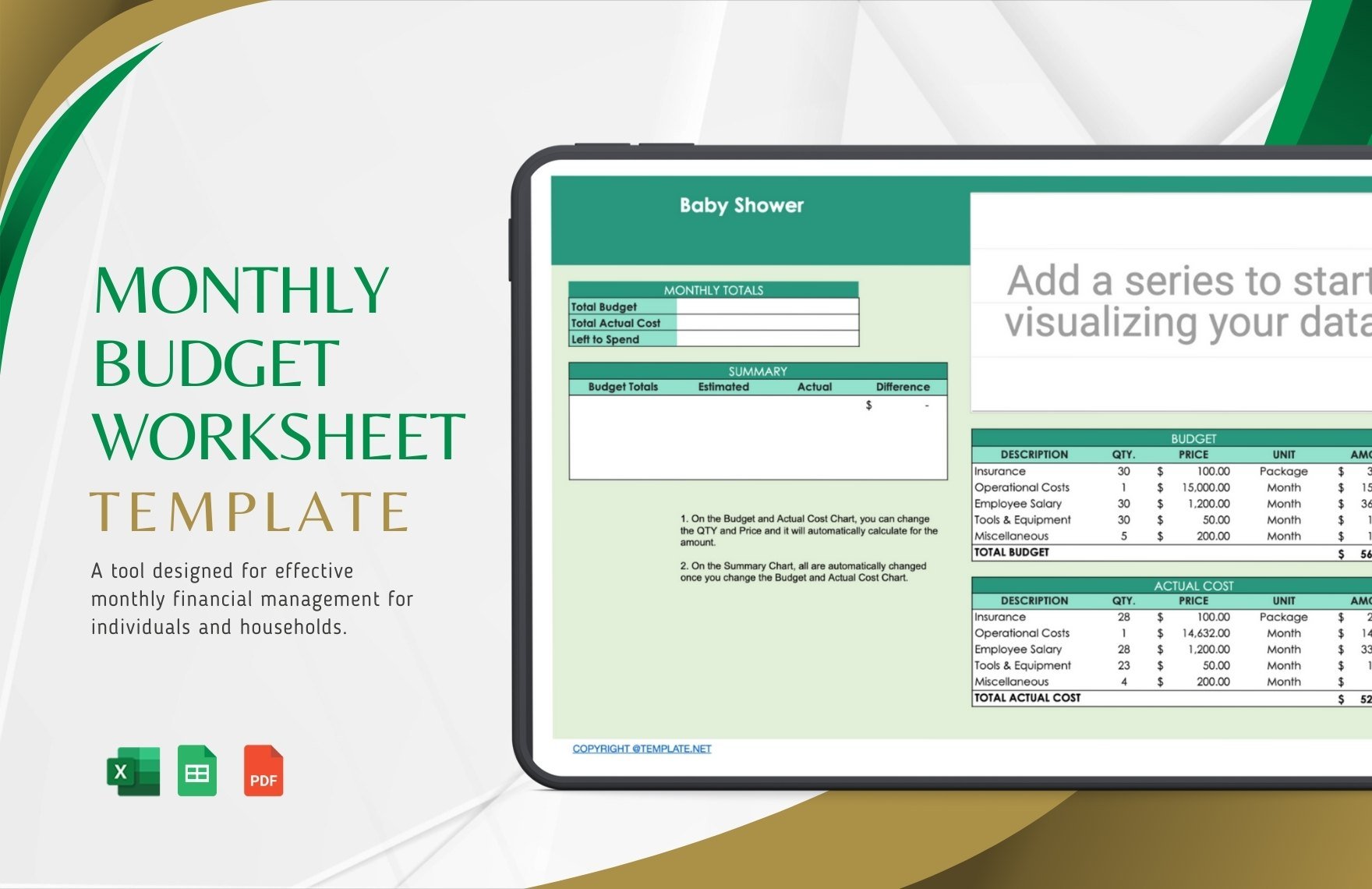

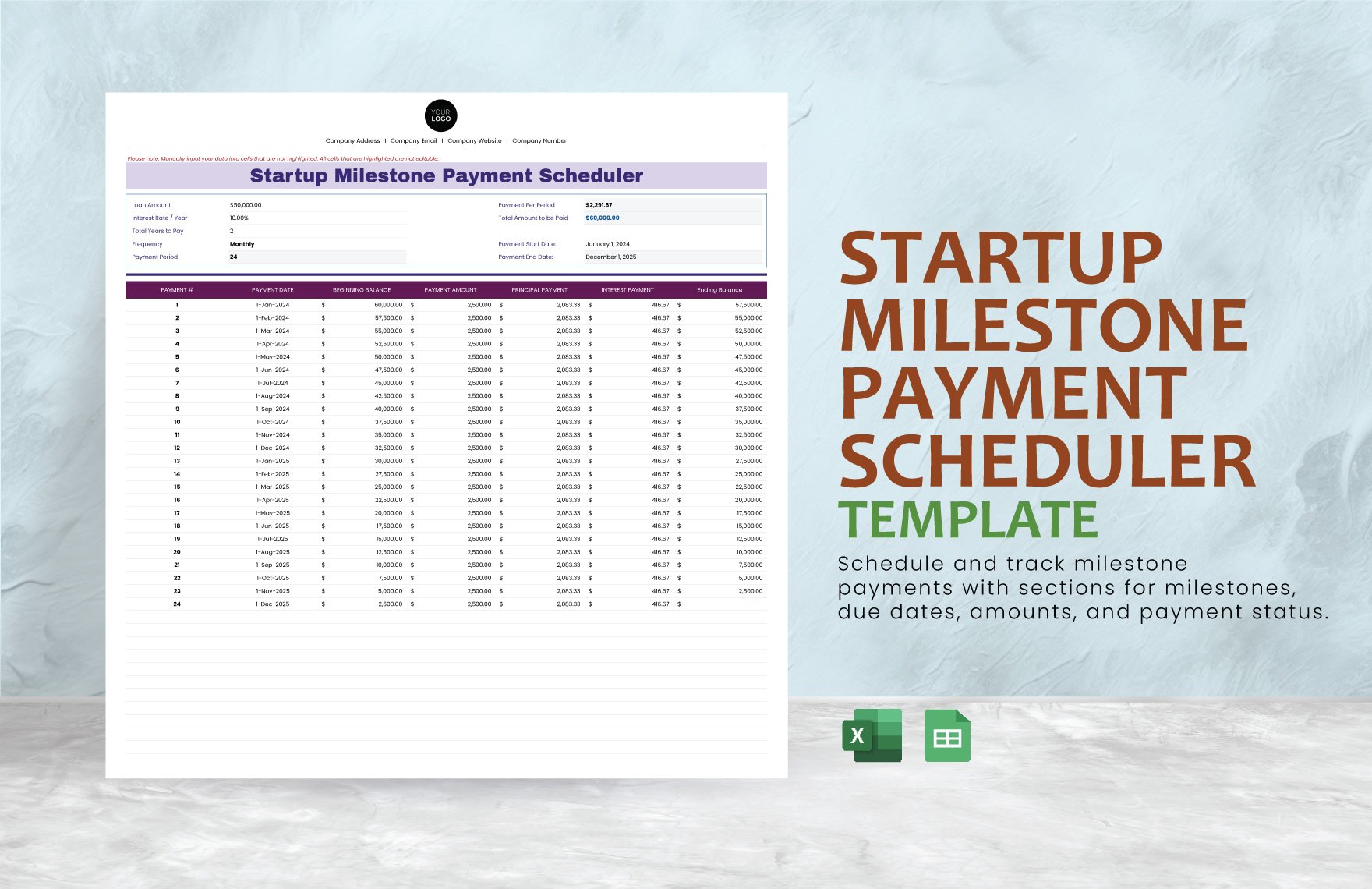

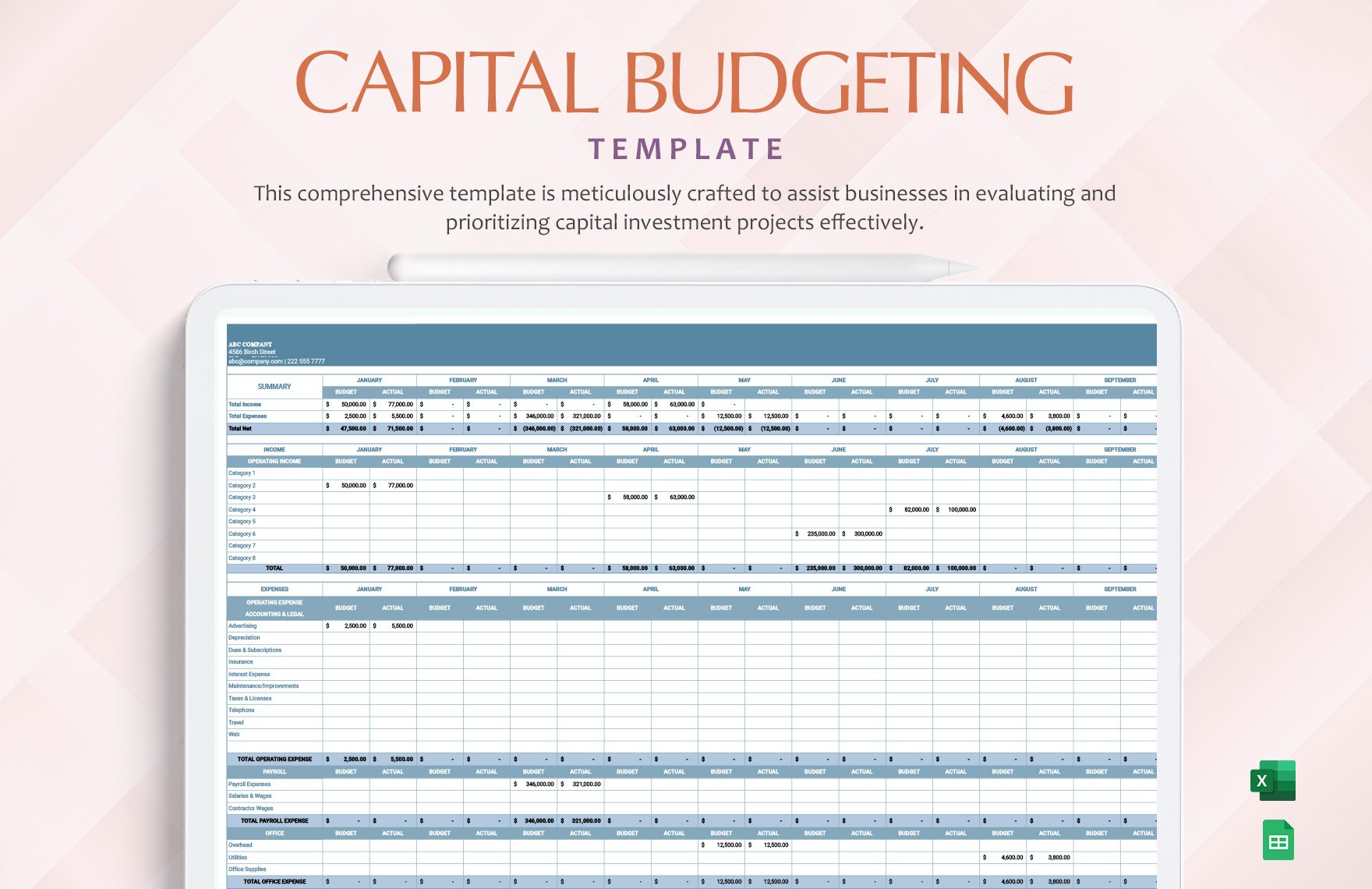

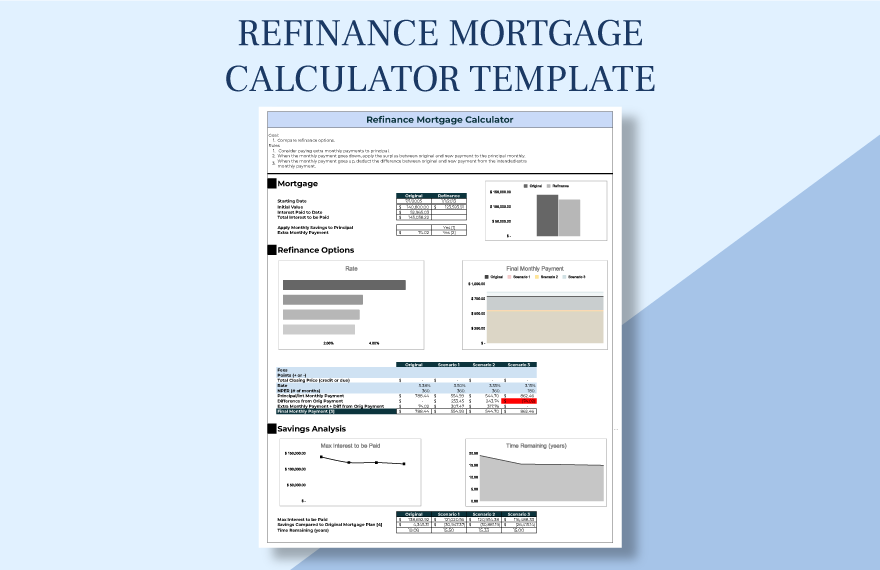

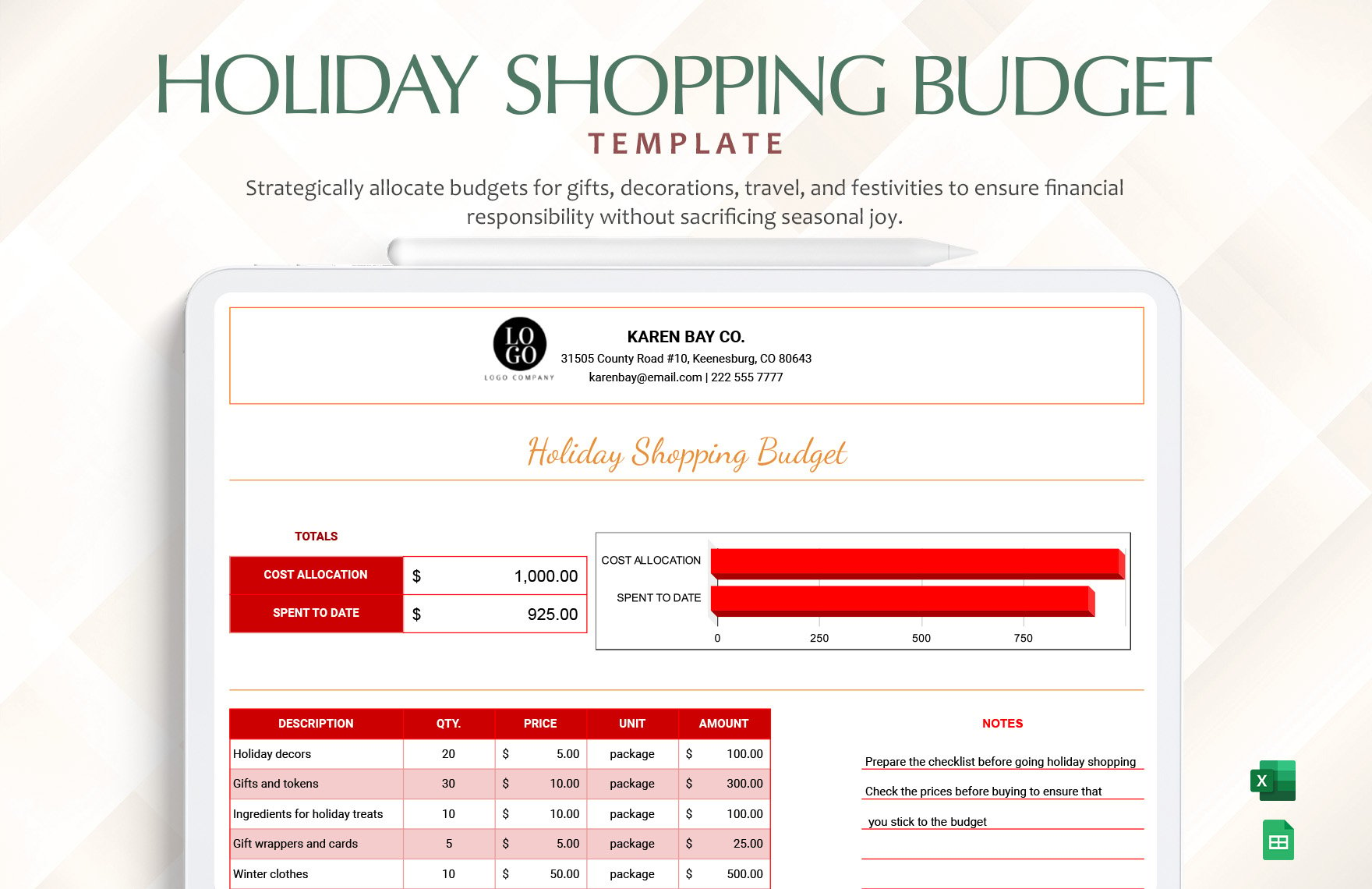

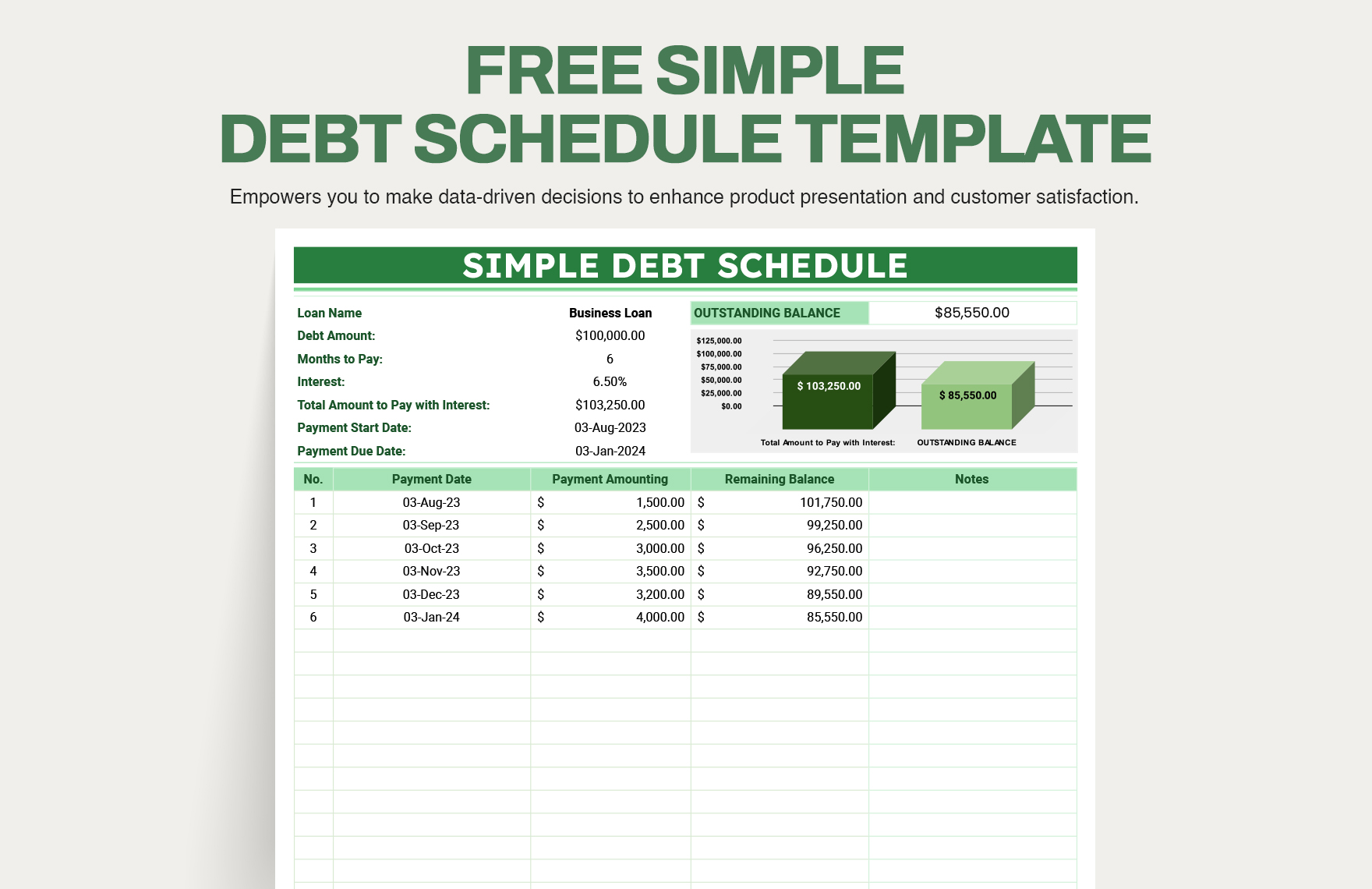

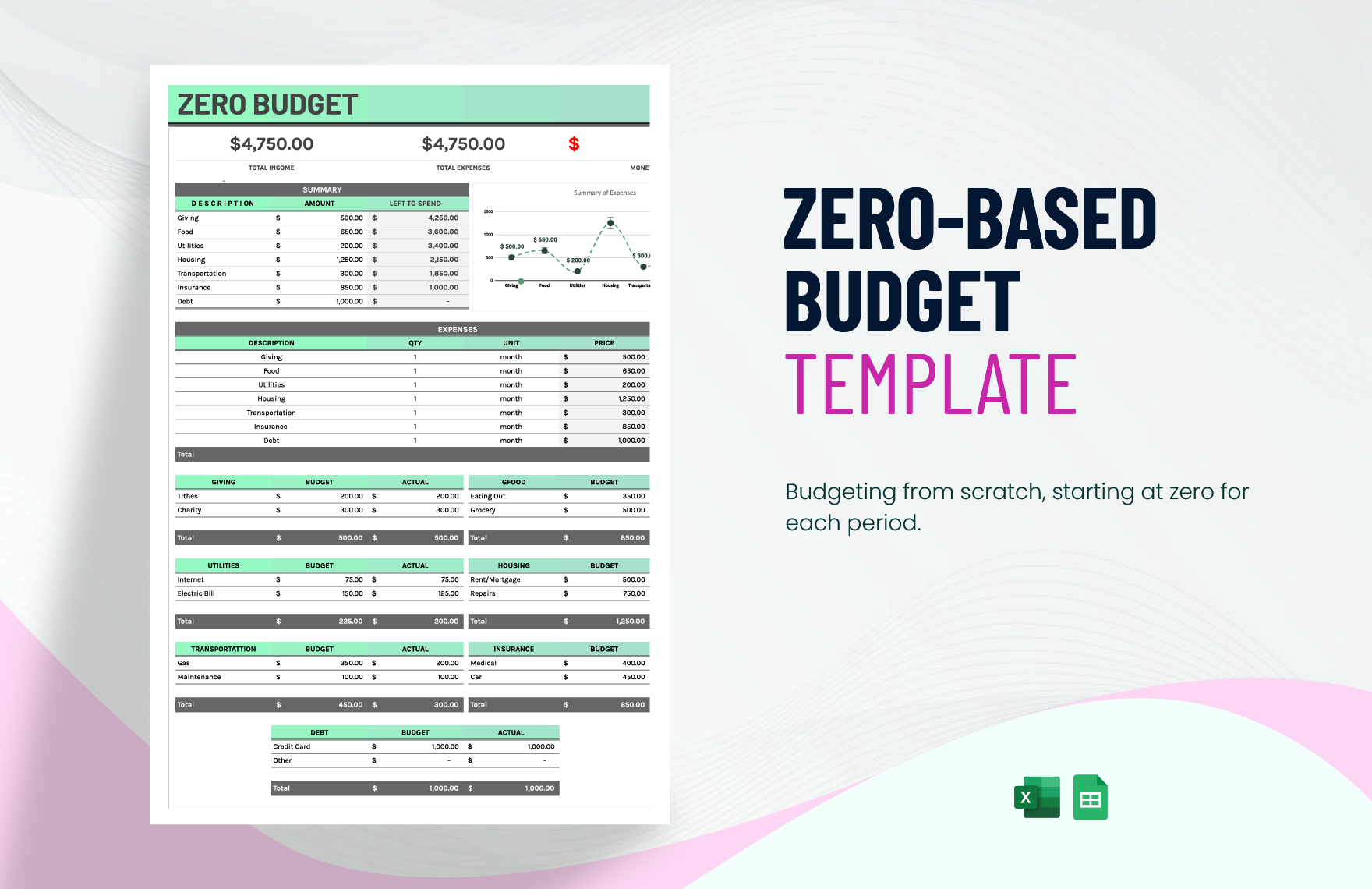

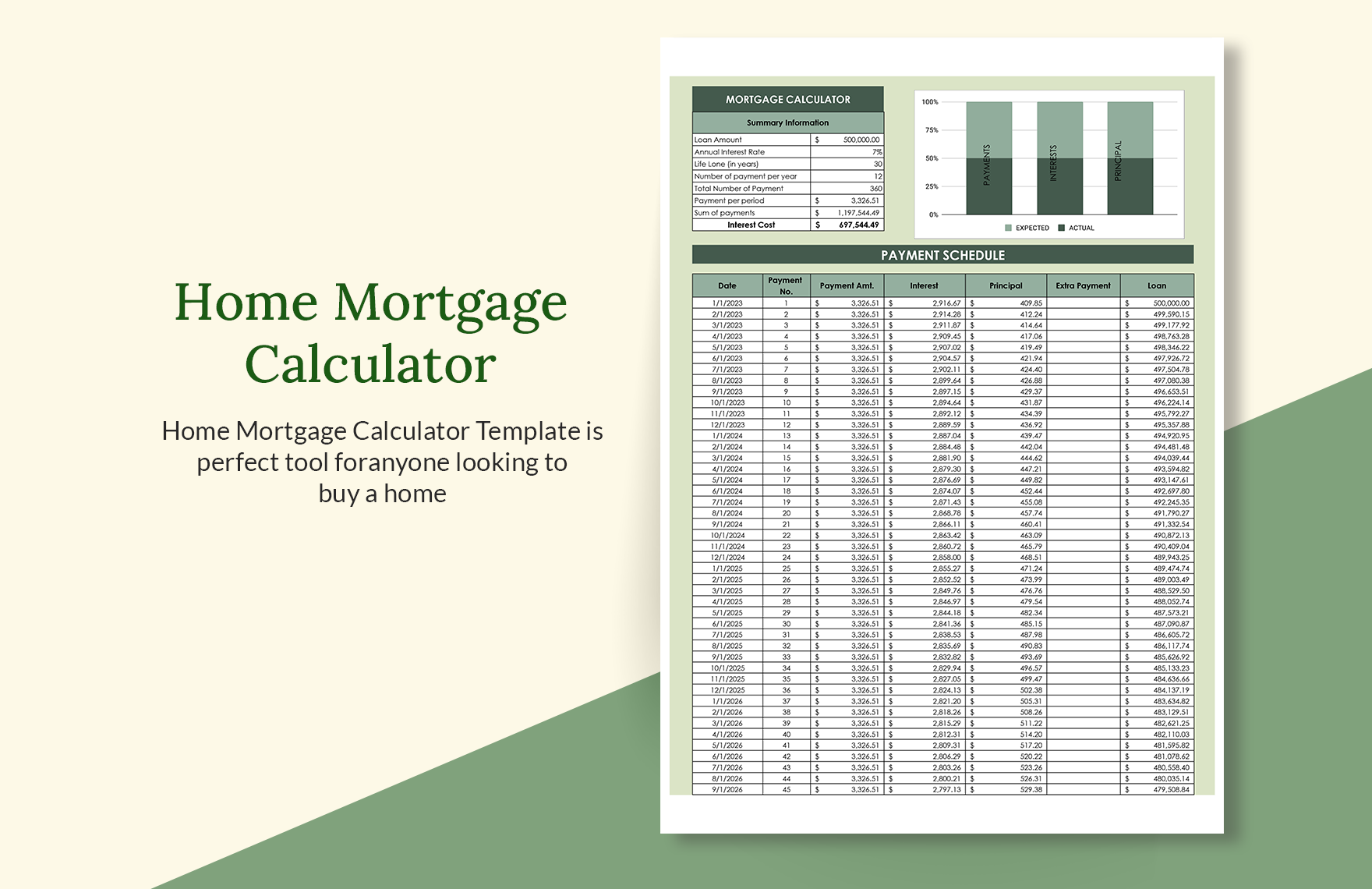

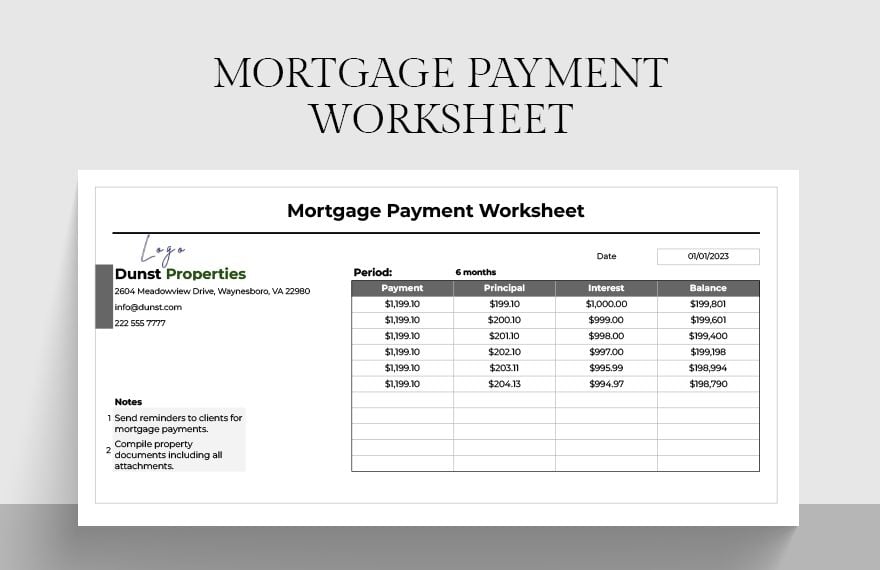

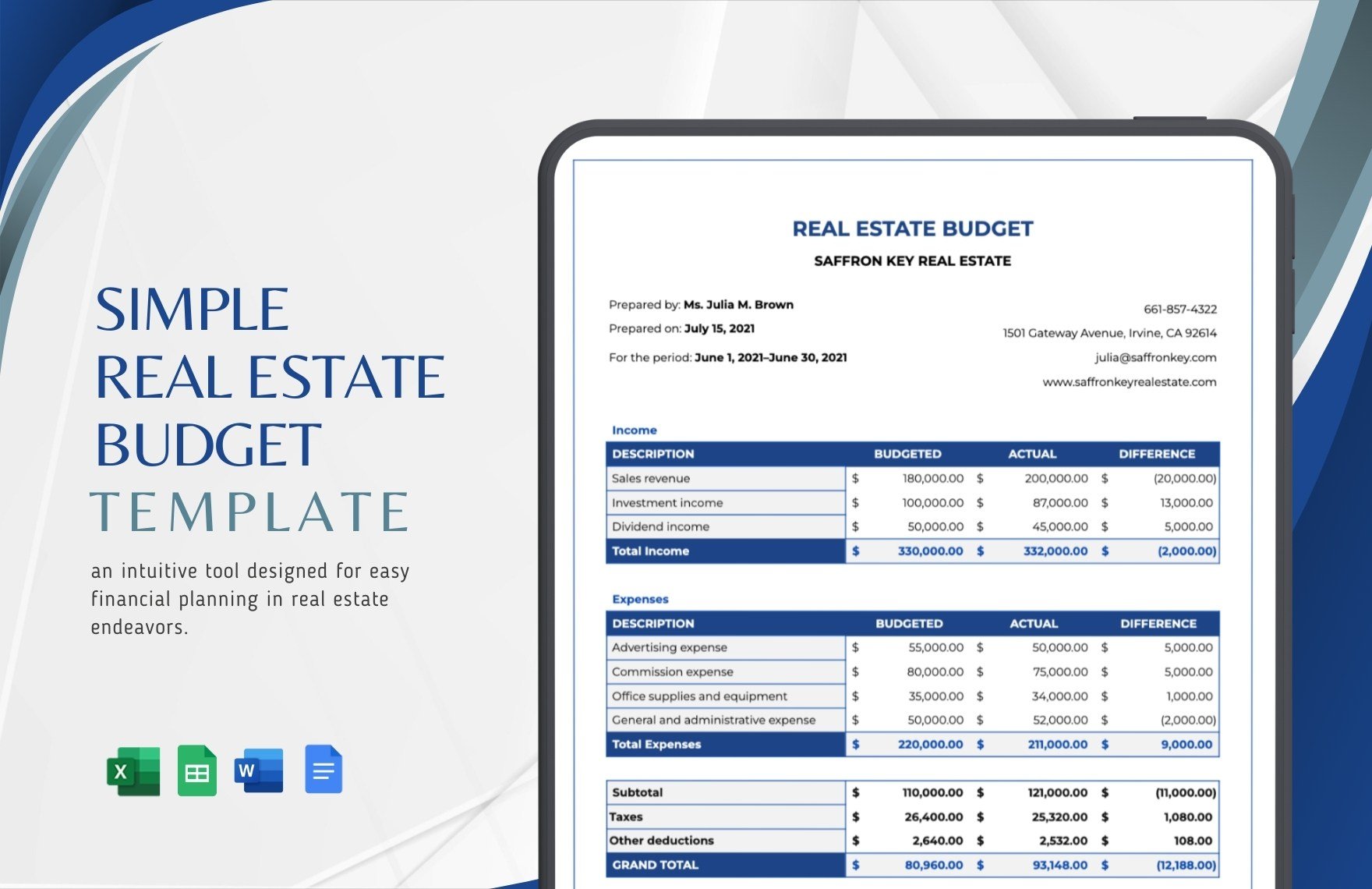

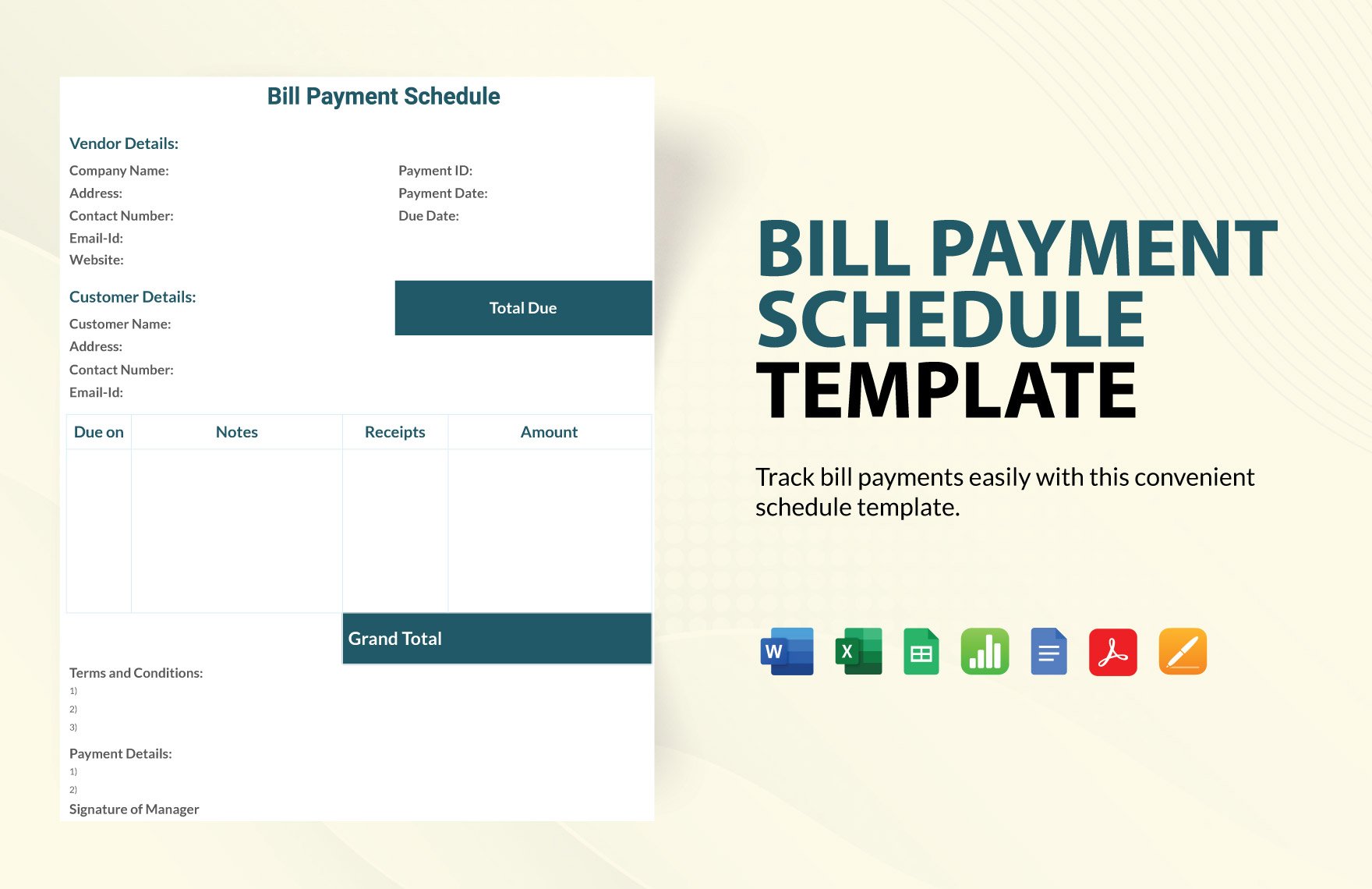

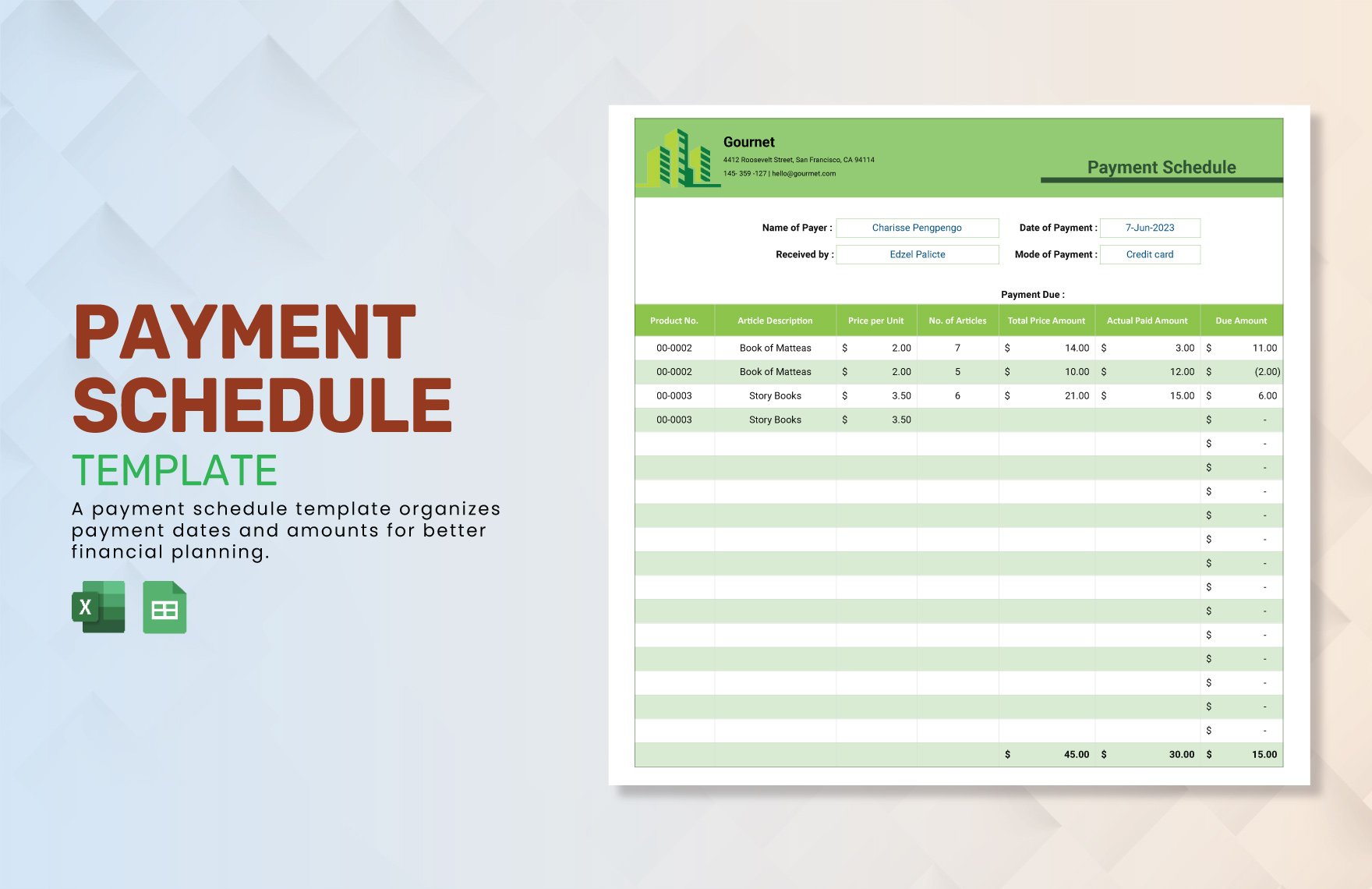

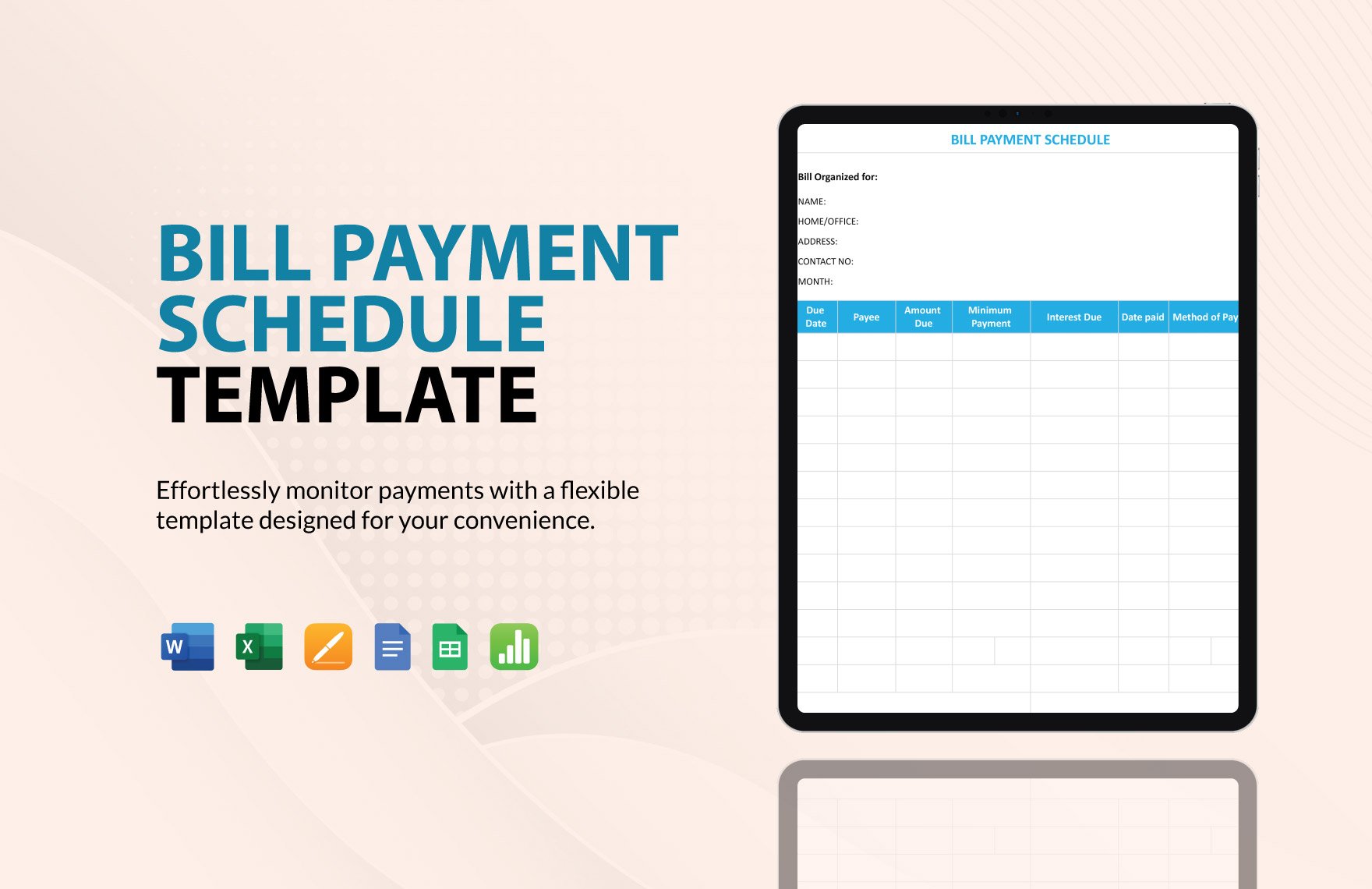

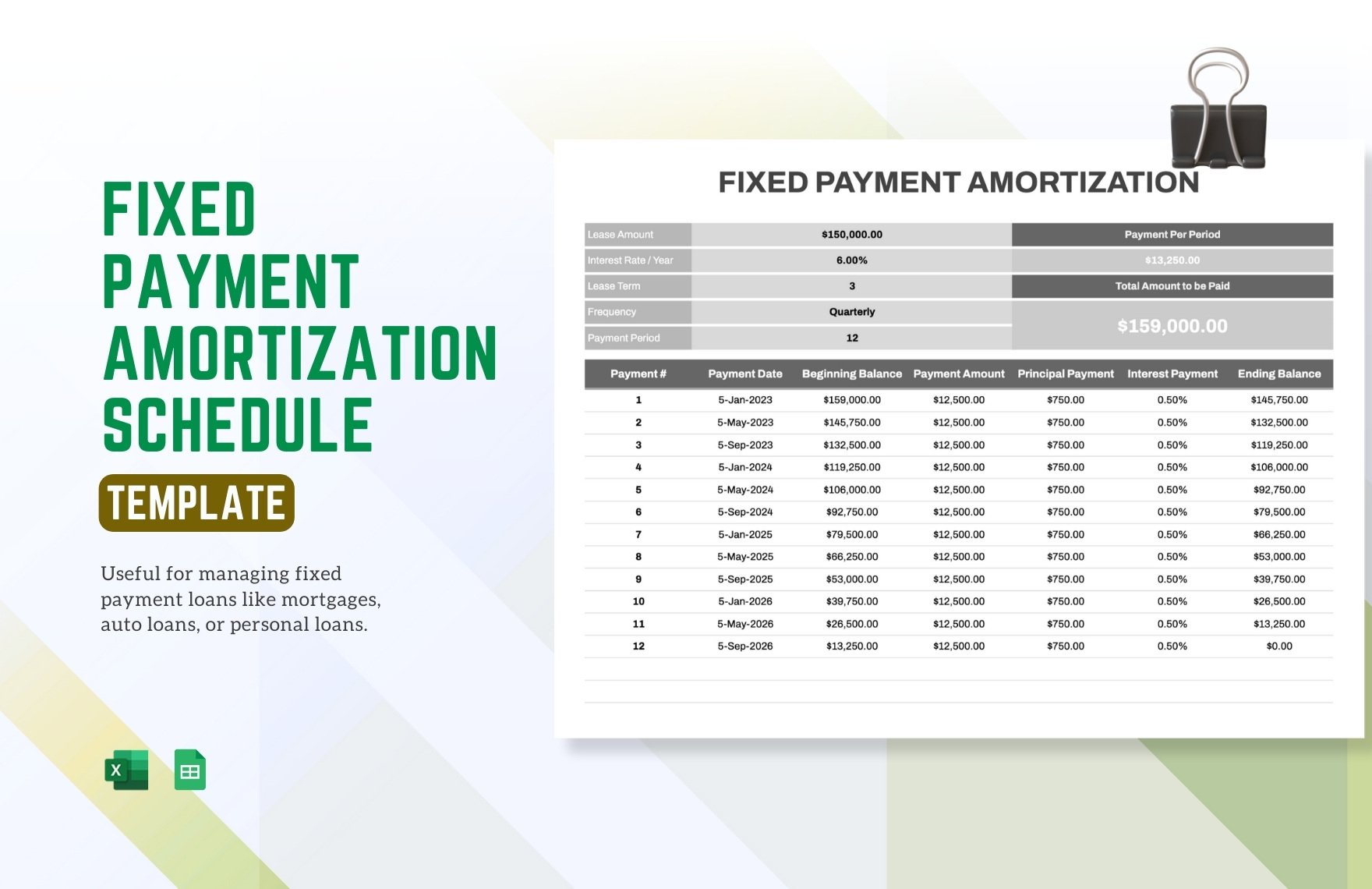

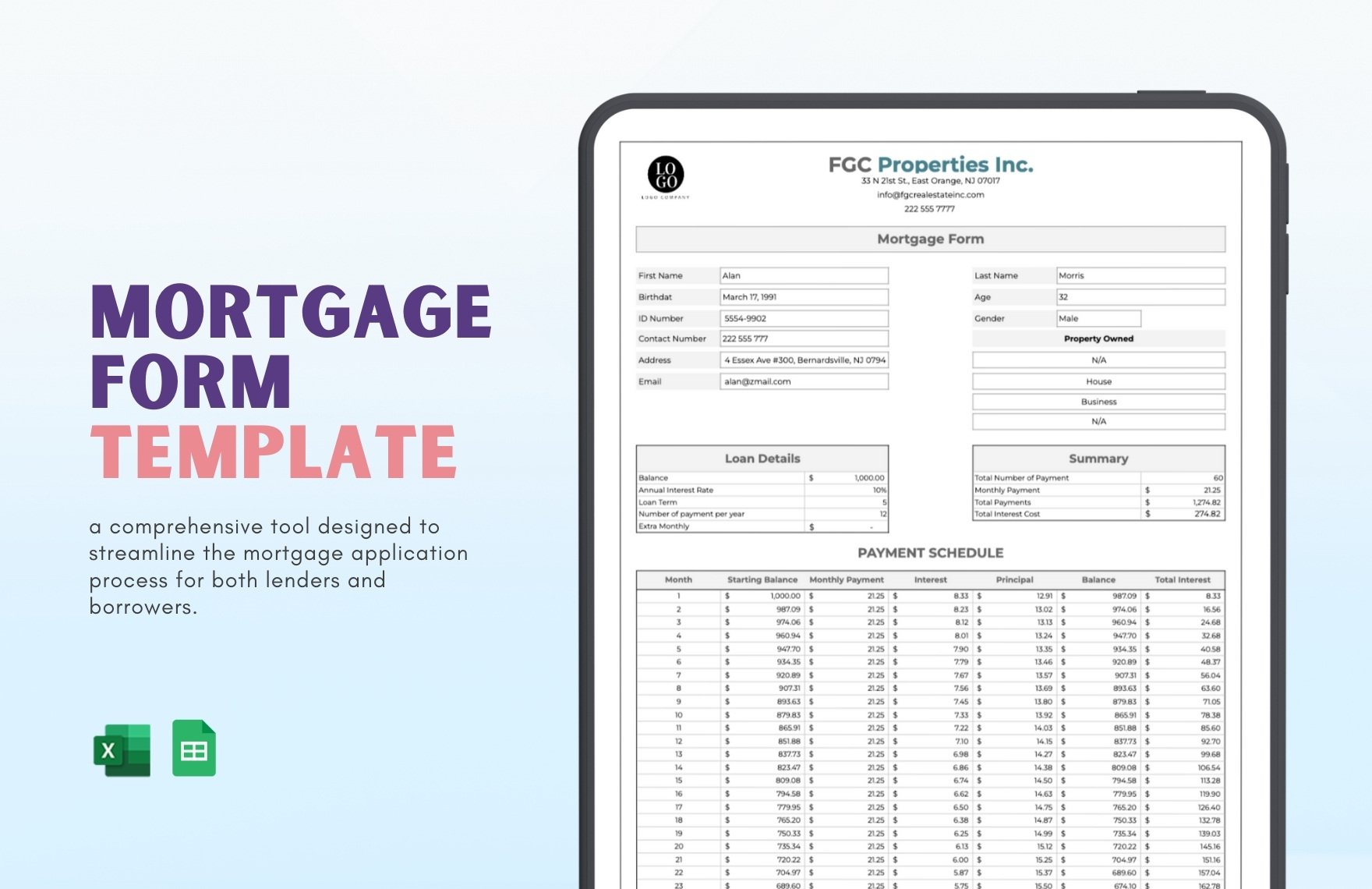

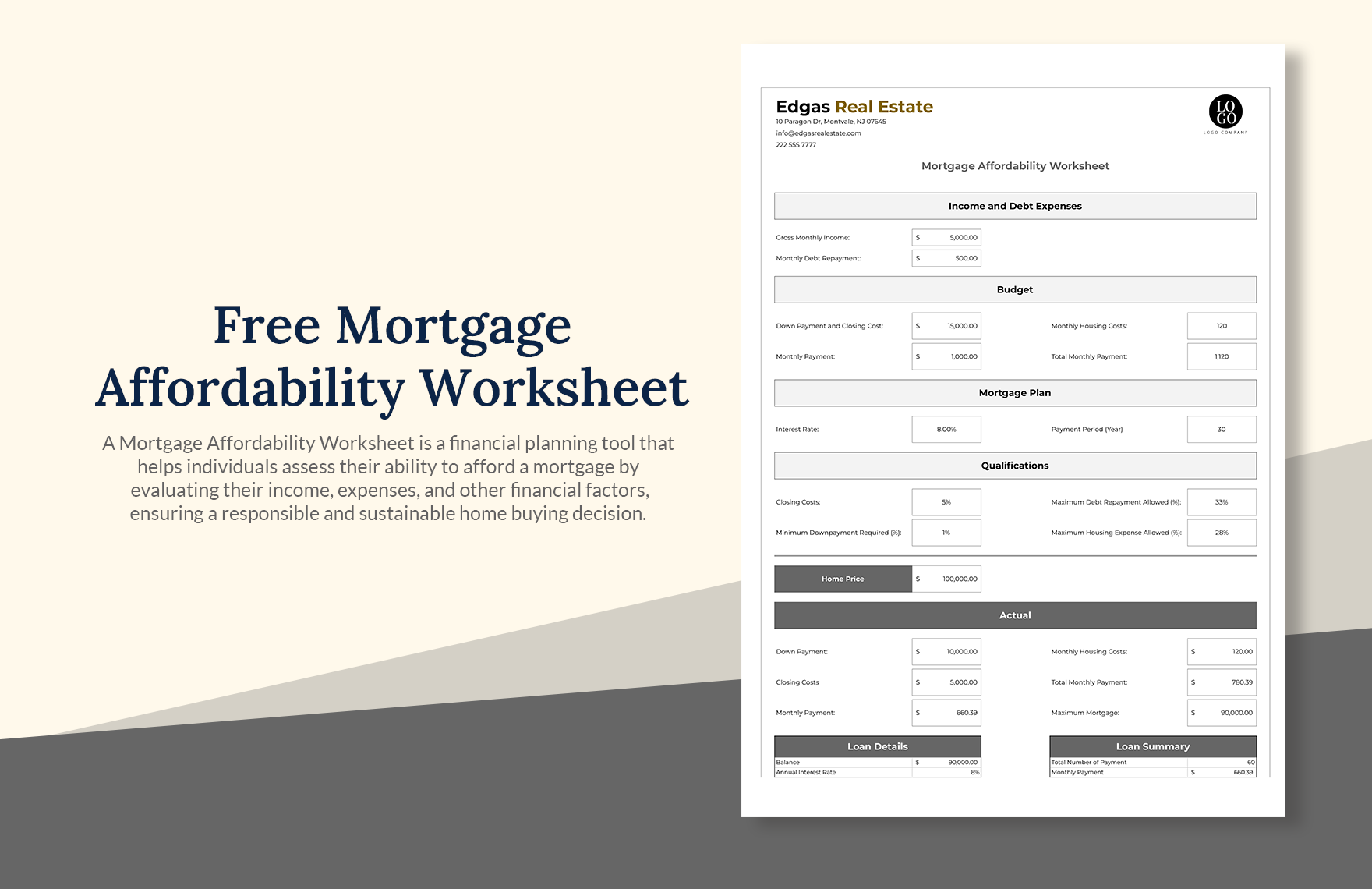

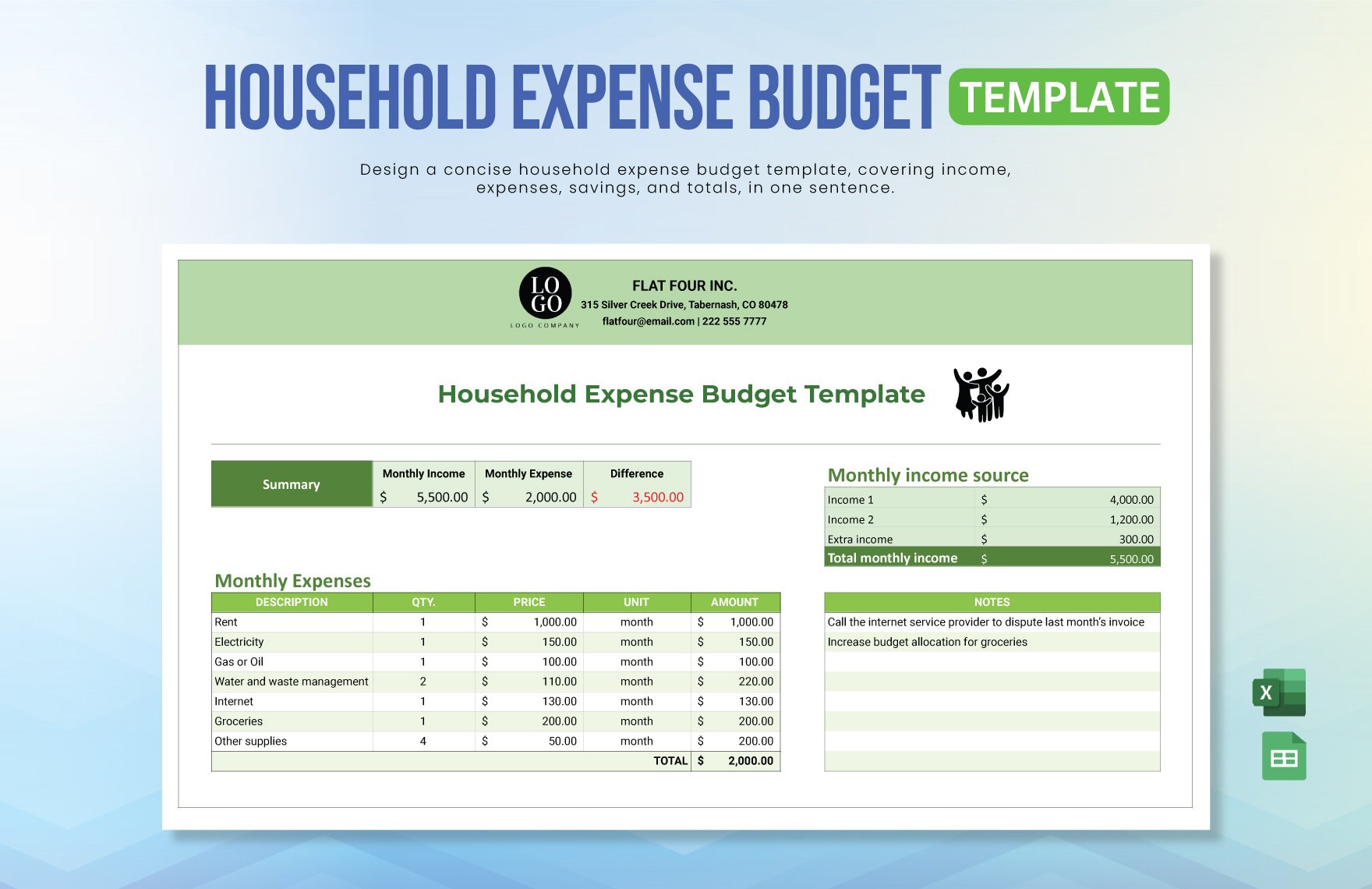

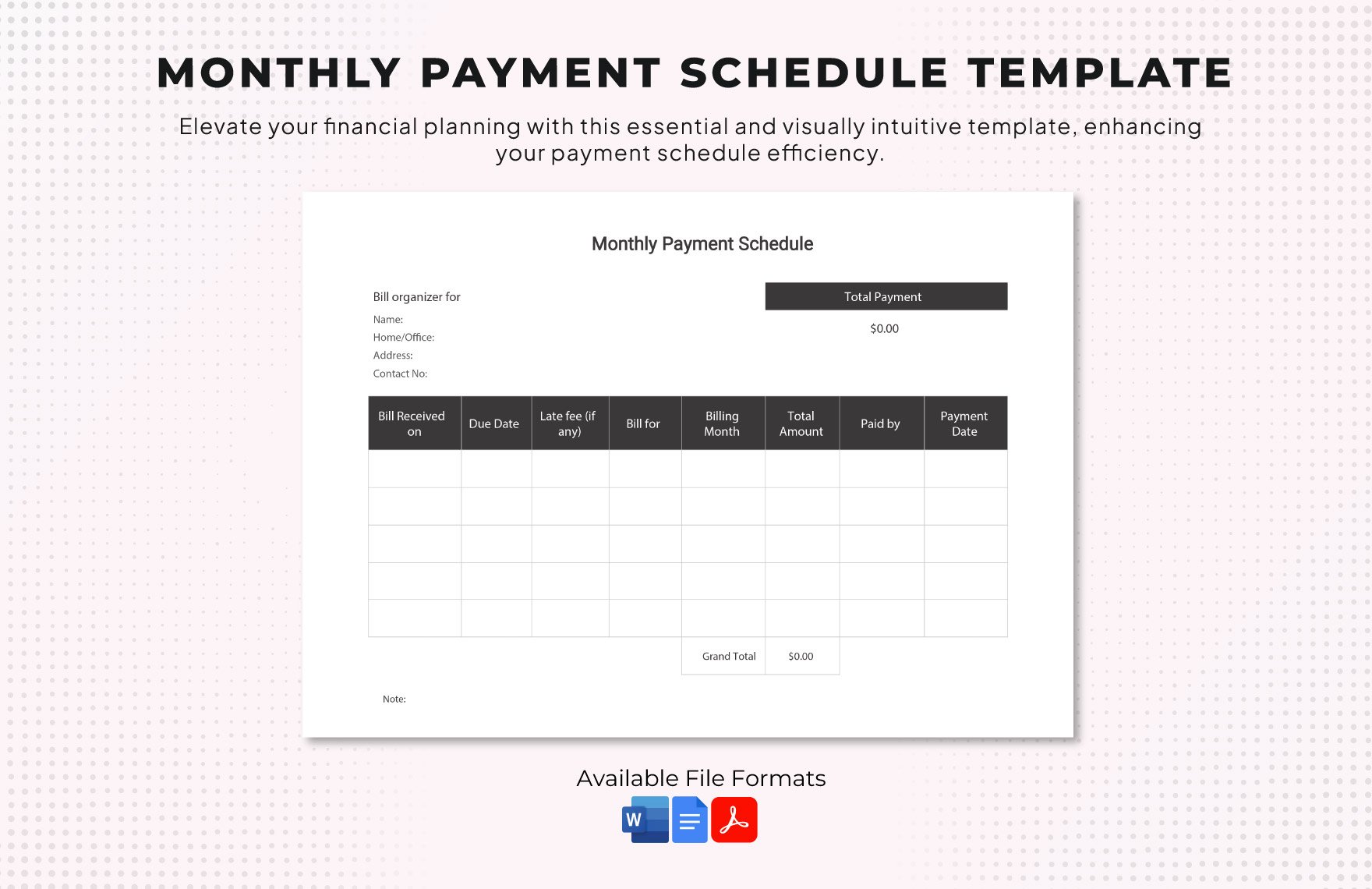

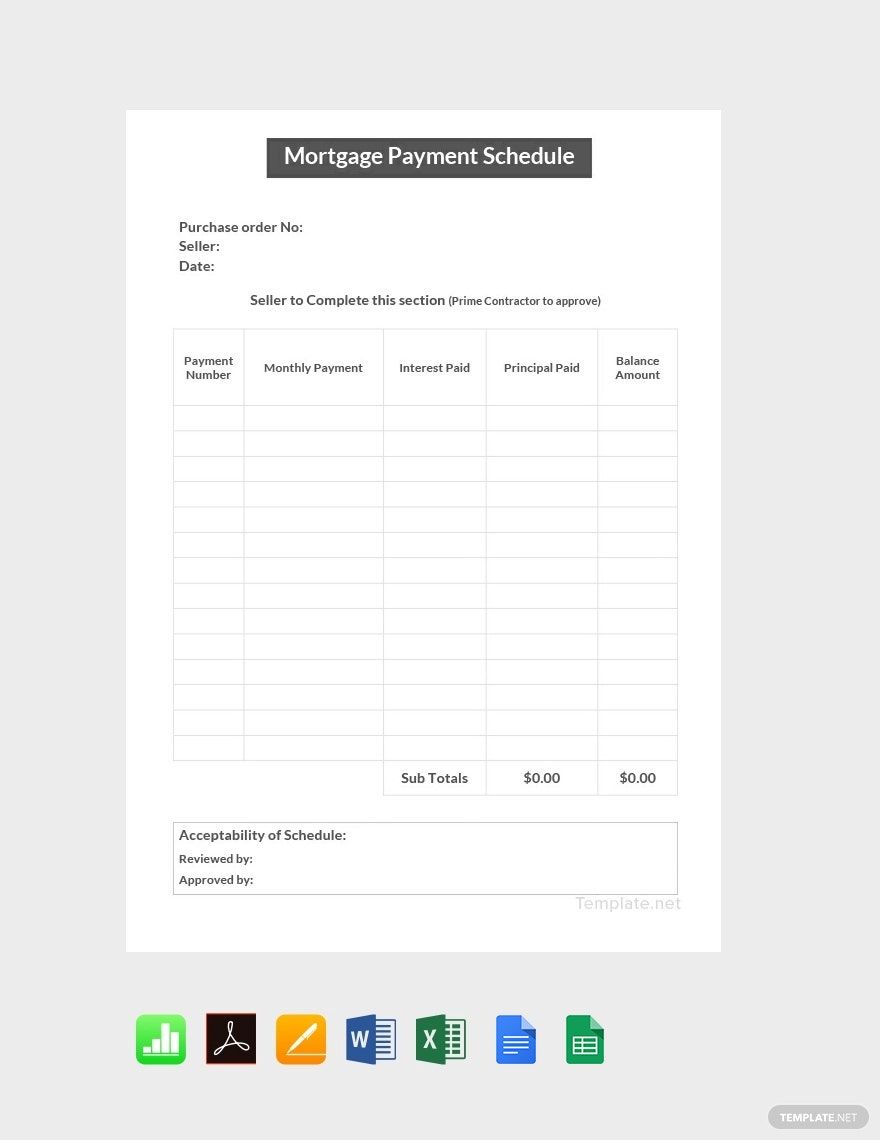

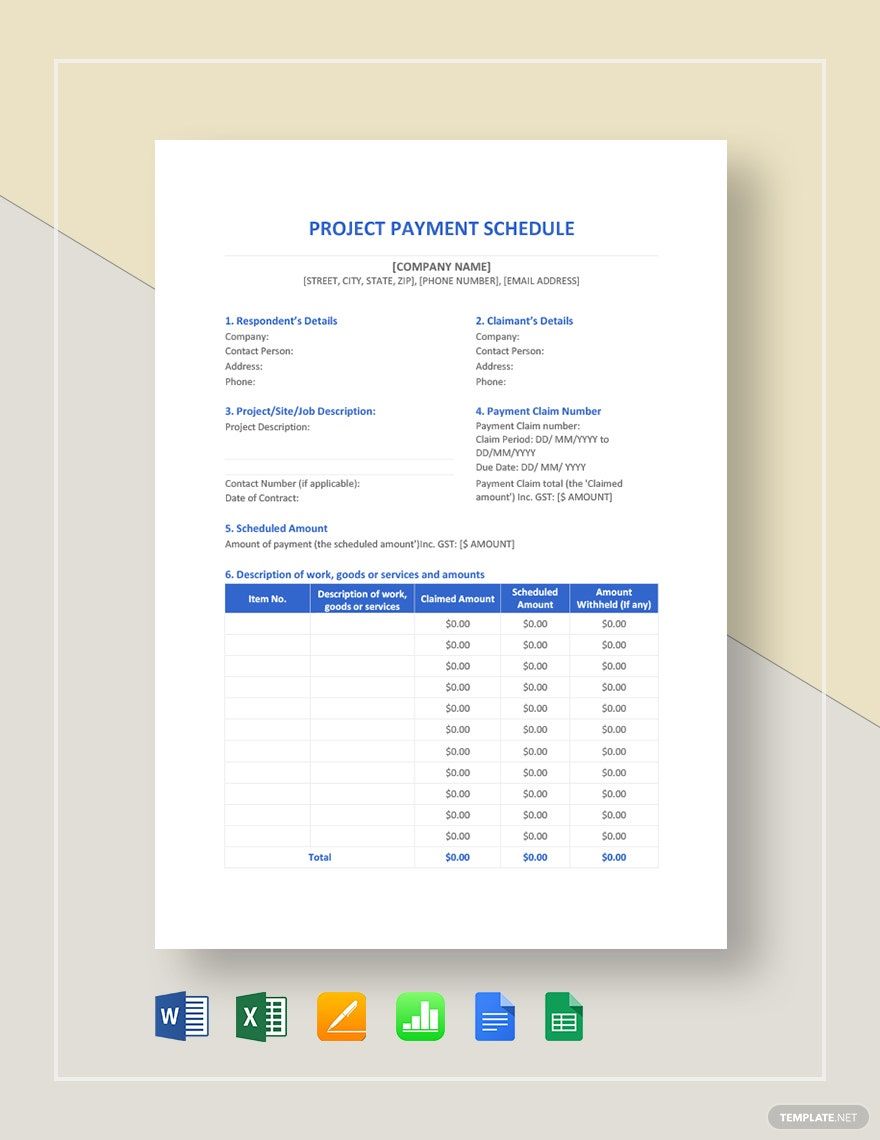

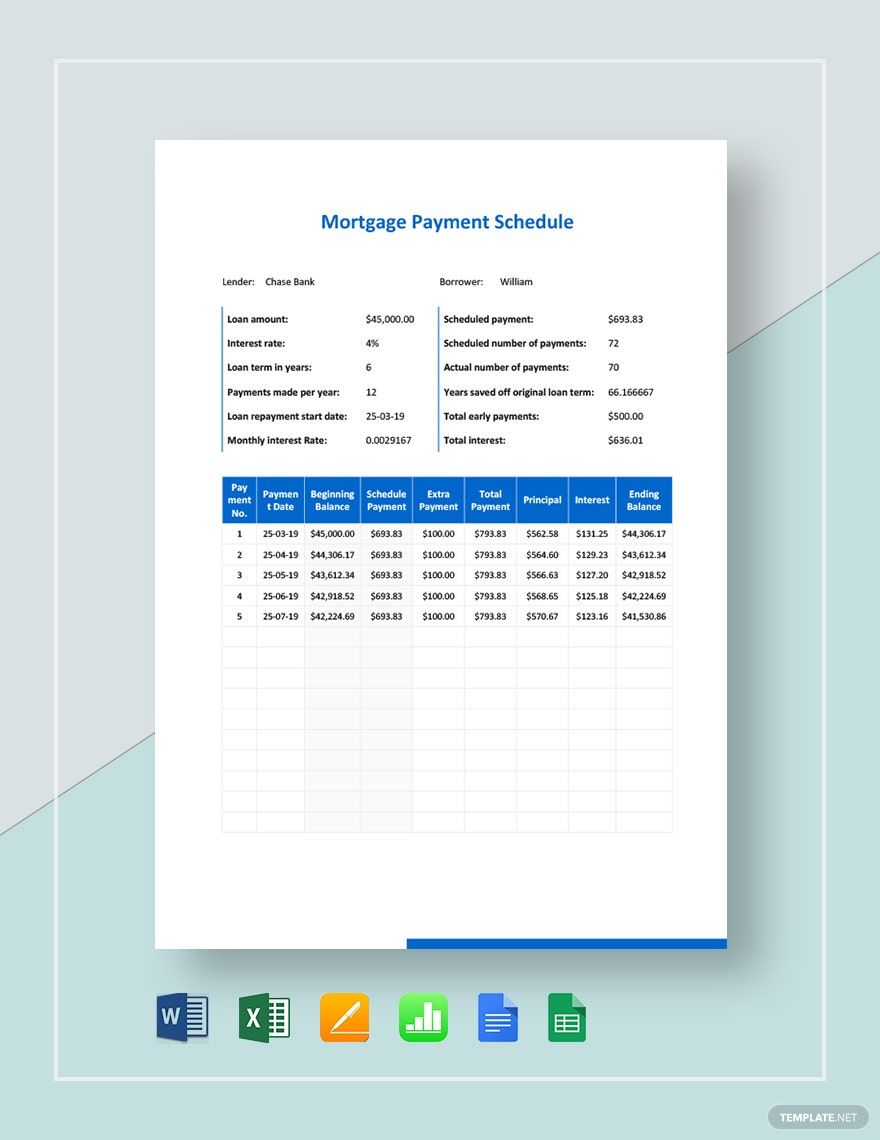

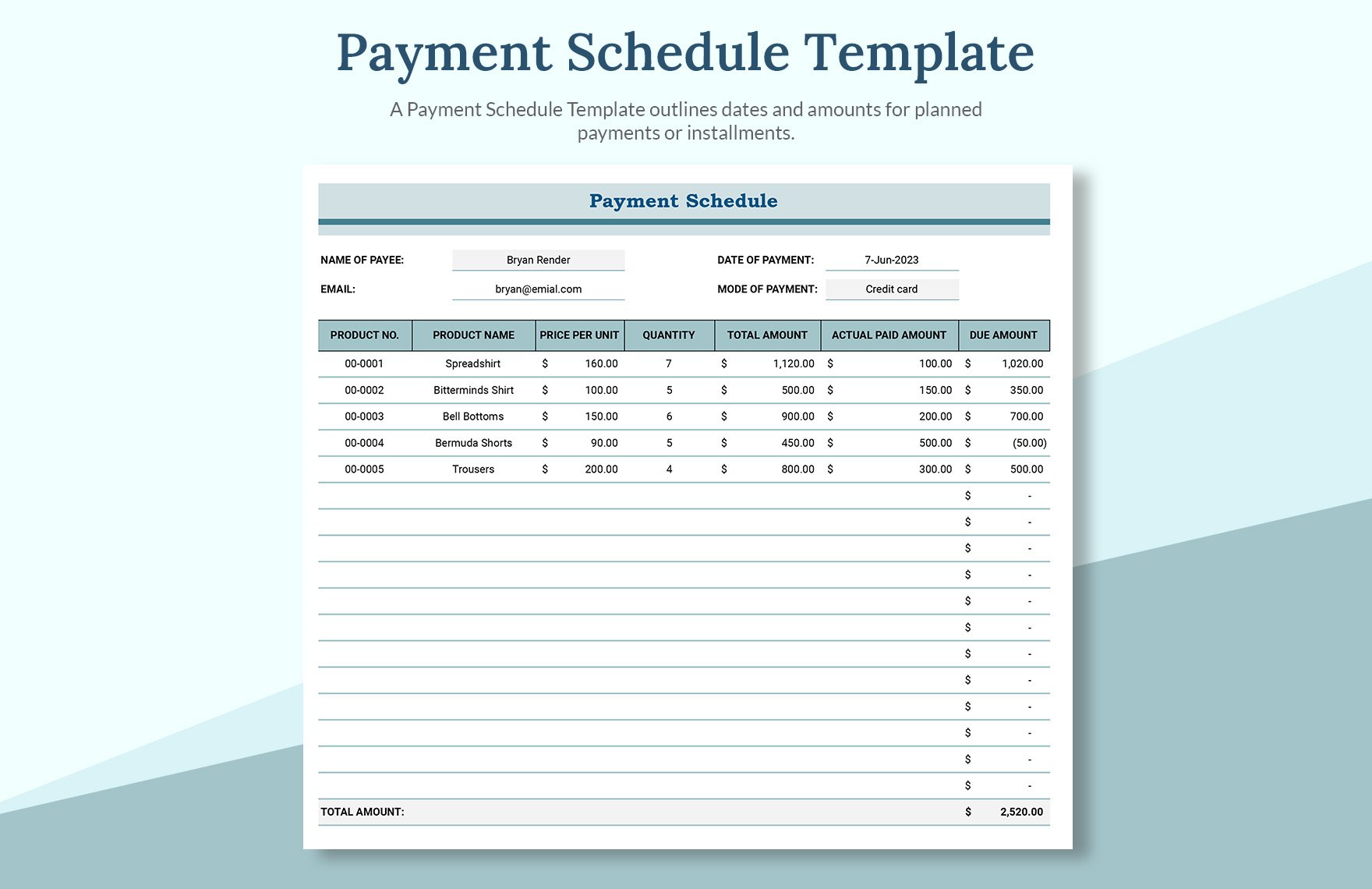

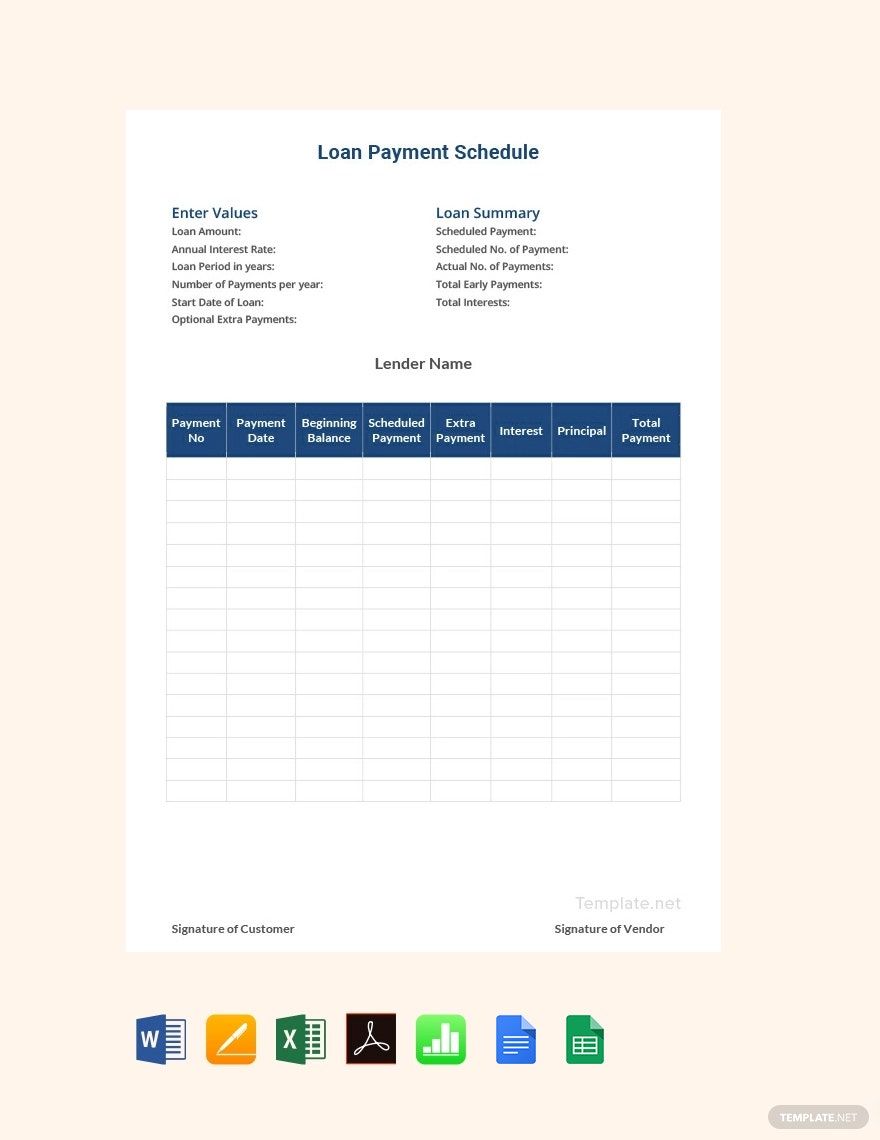

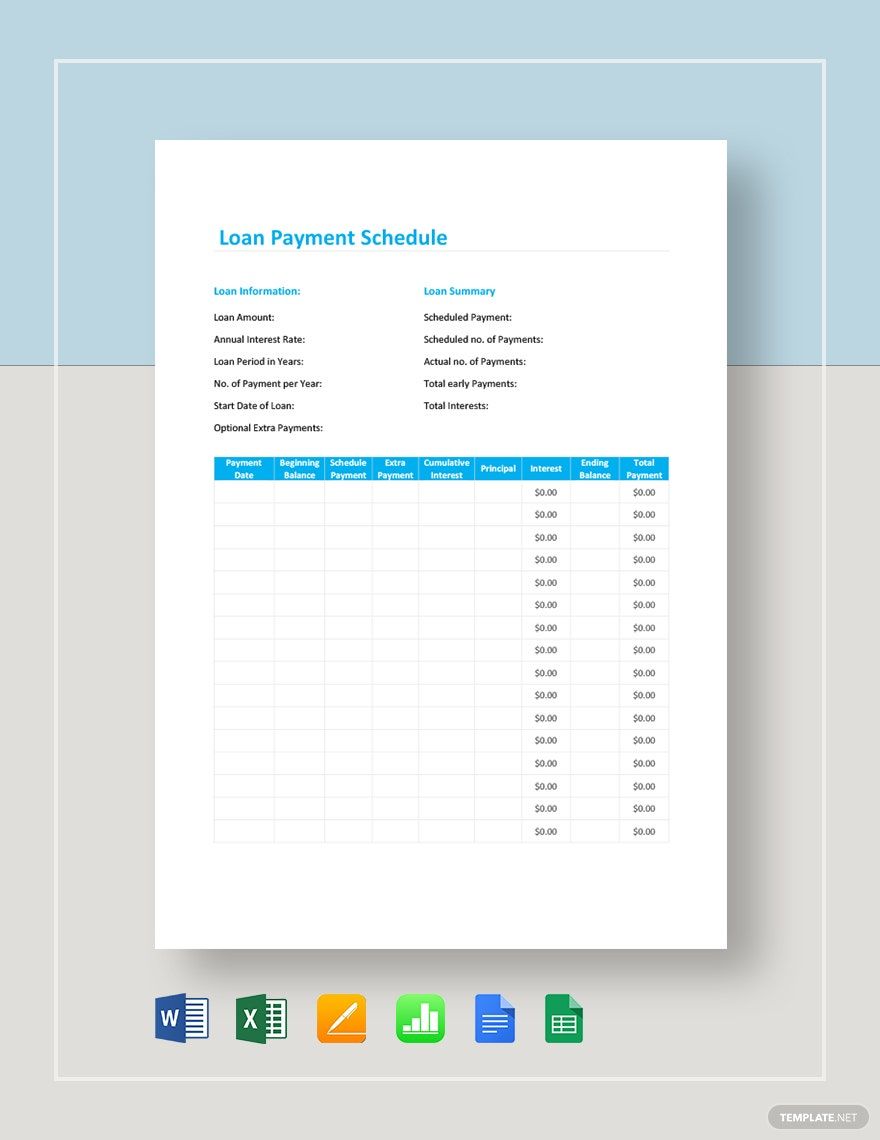

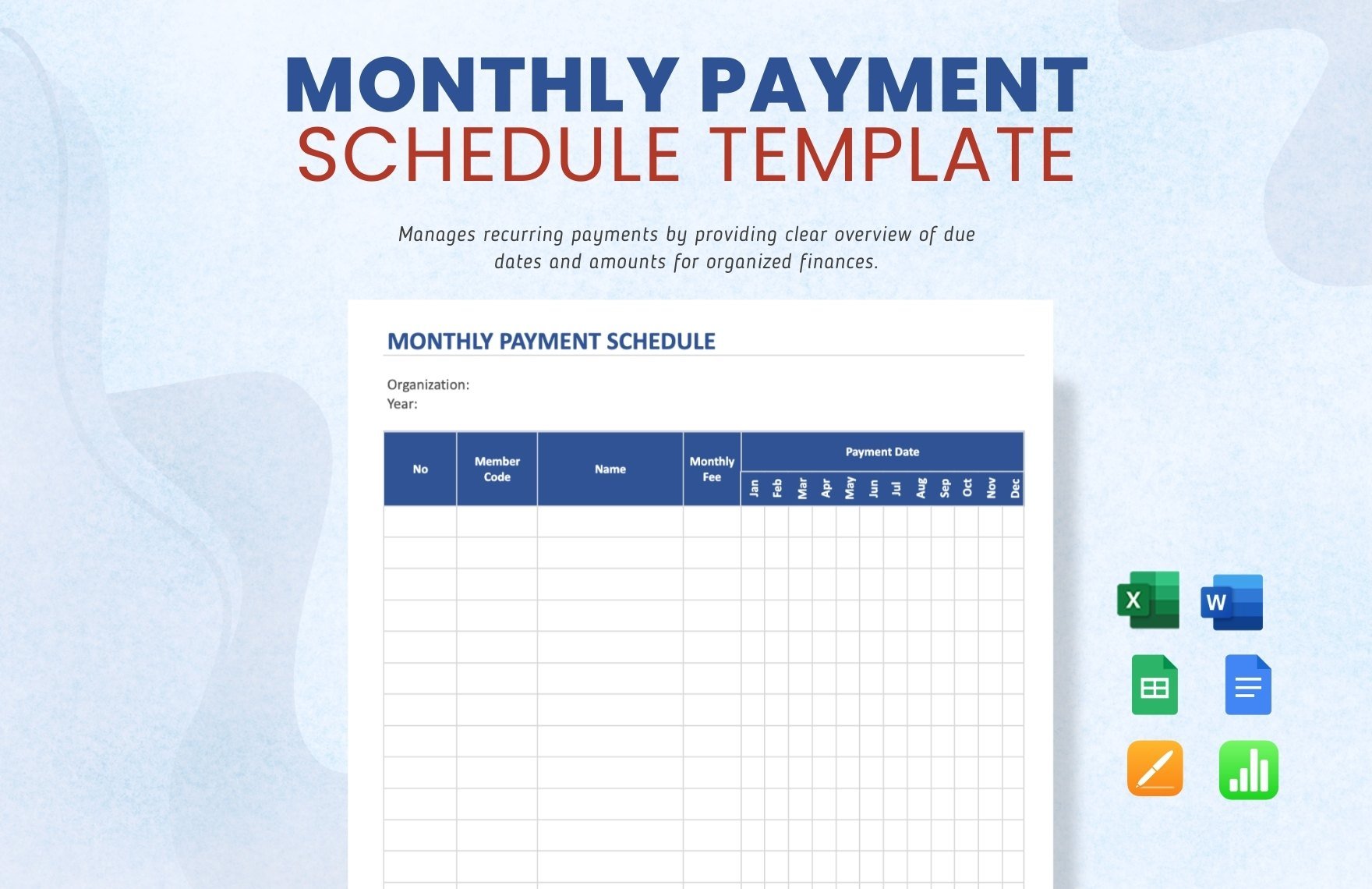

Humans as we are, we have been bound to the necessary cost of livings. Moreso, our certain life demands, both needs and wants, are most likely do not come to us for free. From the shelter, food, and water, to clothing, gadgets, trips, and insurances, etc., these billings should be paid on time to avoid additional costs or, worse, termination of services. We offer you these Ready-Made Payment Schedule Templates in Google Sheets (SPREADSHEETS) to help you track and monitor your essential payments with its professionally preformatted layout. Easily modify it with your certain payment specifics through the user-friendly editable features. Miss not any of your payment schemes, download now!

How to Create a Payment Schedule in Google Sheets

Payment schedules are vital legal documents in binding an official transaction of the consumer to the supplier or provider. When one is issued, commonly, a down payment is required. The total payment is set with the specific billing due date. Hence, it practically helps the business to go smooth wherein the consumer is notified accordingly of the transaction and payment before the due date to avoid misinformation and forgetfulness.

According to the National Institute of Aging, it is part of a human’s natural aging process to miss or forget monthly bills and payments. Further, in a national survey conducted by Creditcards.com, the most common reason for missed or late payments among the 1000 participants was due to forgetfulness. Even so with this natural phenomenon, It is important to note that these missed or late payment behavior is highly unencouraged and may result in unfavorable consequences.

On a positive note, there are still numerous ways to keep intact with these responsibilities to your customers or clients. And one of which that you can efficiently do is through keeping a payment schedule. In this article, we present to you the fundamental guidelines in creating your own payment schedule in Google Sheets for your convenient referencing.

1. Aim for the Professional Look

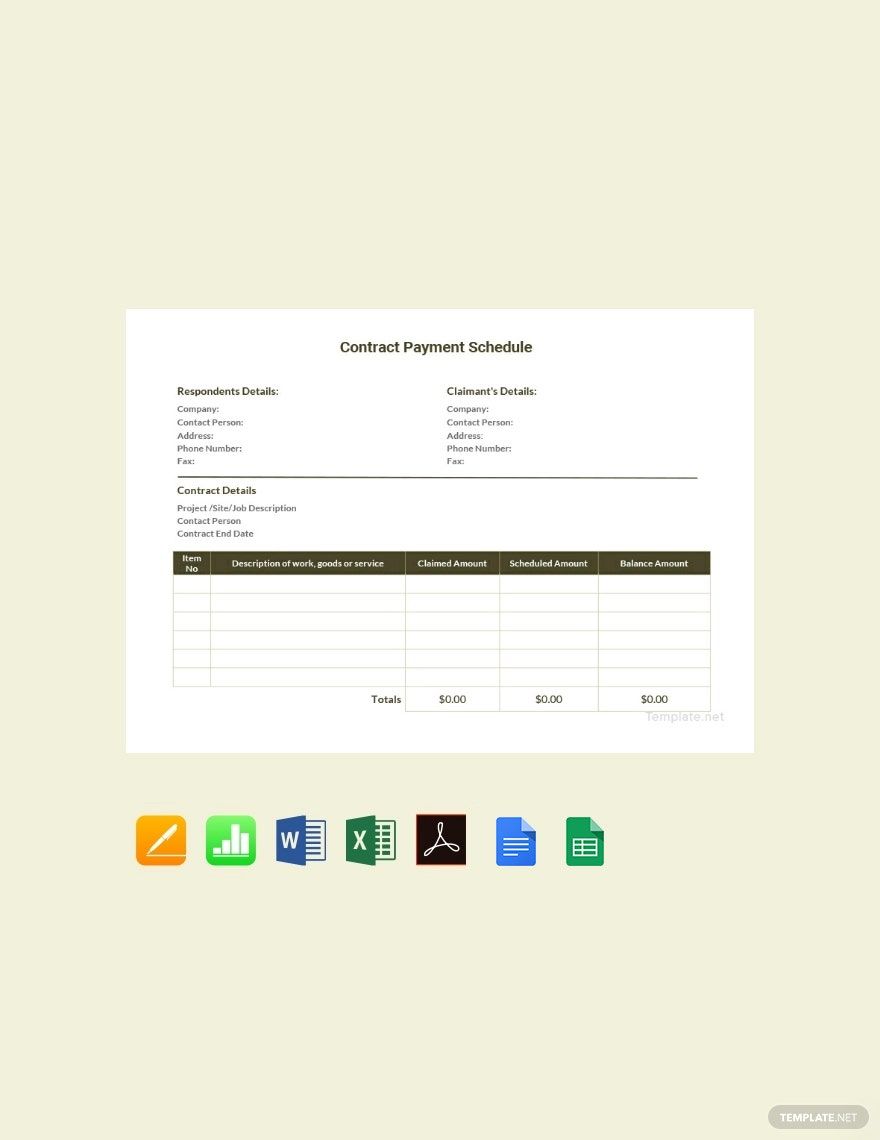

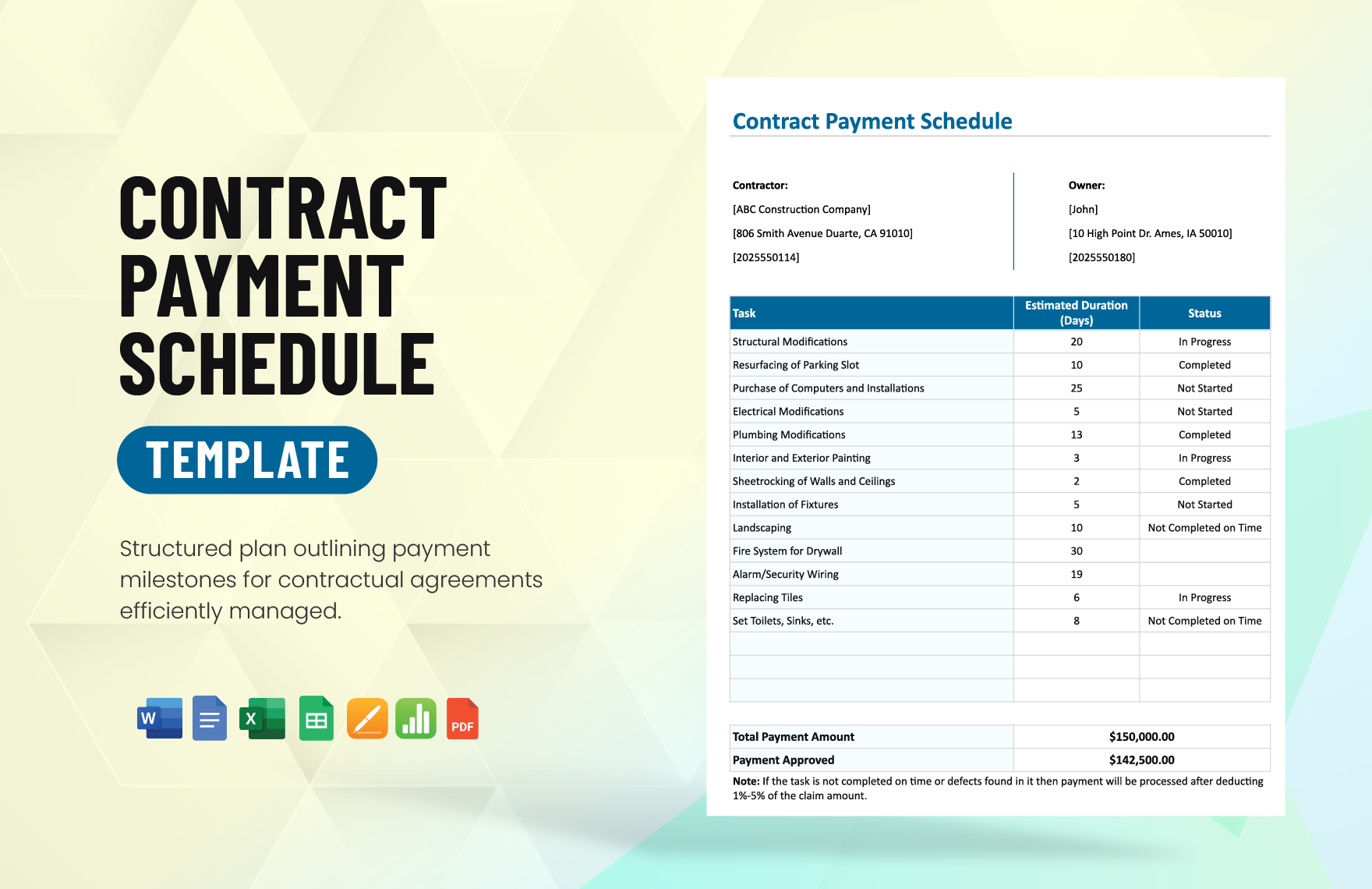

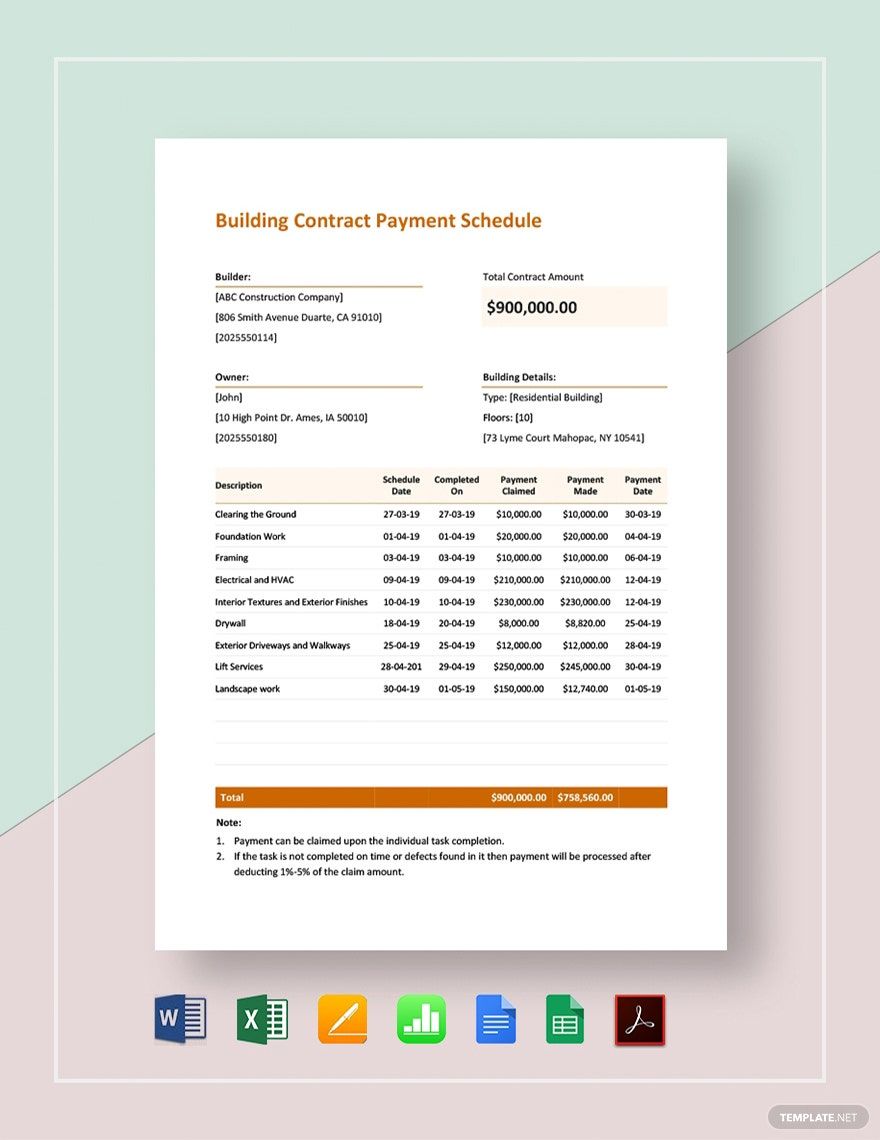

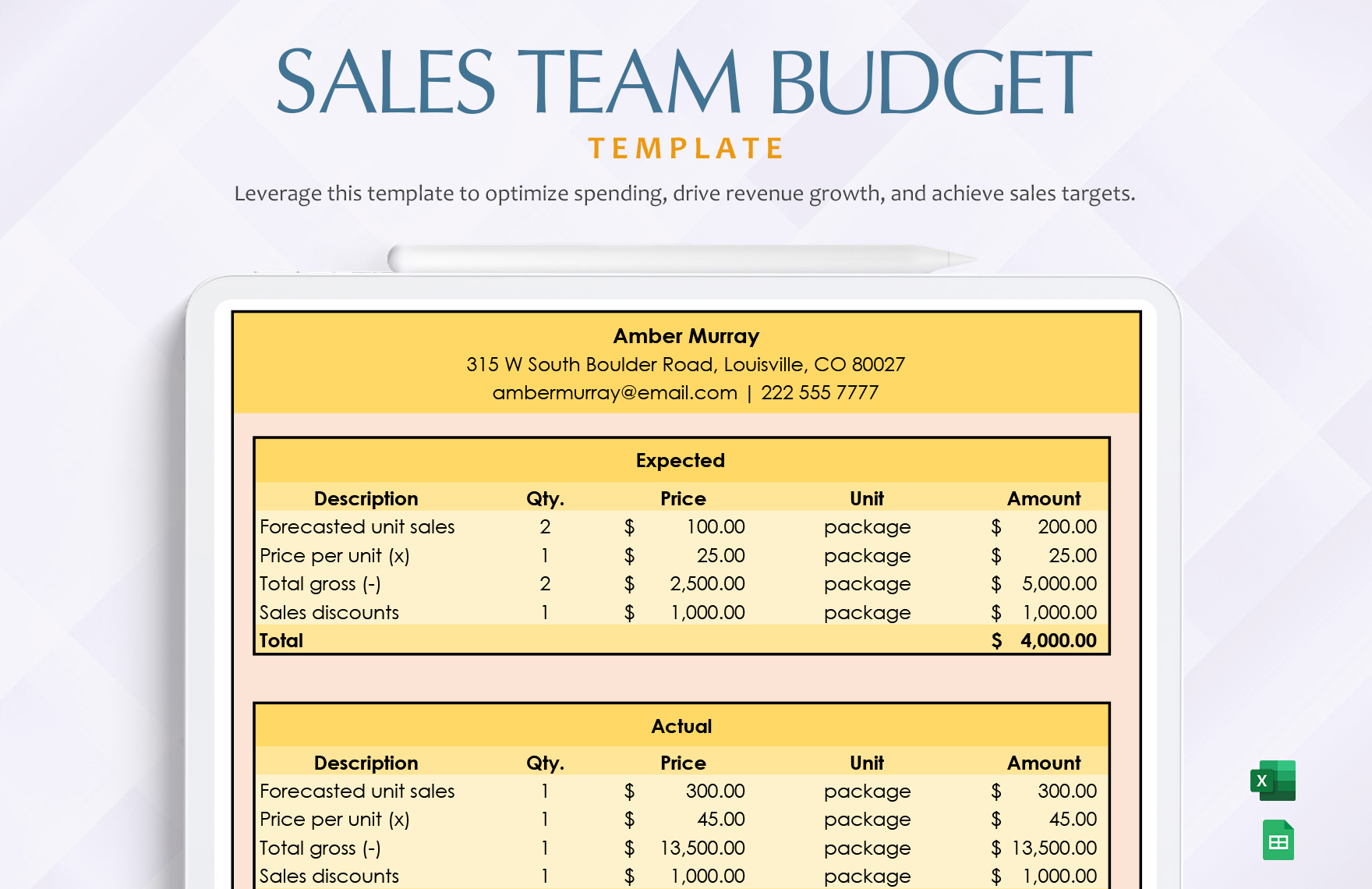

From the very beginning, you should aim your payment schedule to be compelling and professional-looking. Ensure to use the relevant legal payment schedule format. If you’re new or so you don’t have to structure your own from scratch, we strongly suggest opting for a template. Make sure to get a very versatile one that can be easily customized for your specific details — just like our deals above!

2. Establish the Parties

Supply all the relevant information that can effectively establish the identities of both parties: payee and payor. Make sure these details, like names, addresses, contact numbers, companies (if applicable), etc., are clearly and correctly spelled out.

3. Clarify the Figures

Since money plays a big role in this transaction, it is vitally pivotal to clarify the monetary figures in your payment schedule. Tabulate in tables for a more comprehensive look. Label each cost. Specify the currency.

4. Signify the Terms and Conditions

It is best to allocate a space in your payment schedule also to compose your concise and cohesive terms and conditions. Apart from relevant dates, jot down the important details such as your unique payment schedule policies, mode of payment, or more others.