Running businesses means providing products and services to customers and earning a profit from these transactions. Without proper accounting, final account statements can become misreported and may end in serious court litigations. So, if you own a construction company, get access to our library of Construction Statement Templates in Google Docs and save your time from extensive paperwork. They're ready with pre-made content that you can personalize. Whether you are preparing for a contractor's audit or creating a billing statement, we have everything prepared for you! Subscribe now to save your capital. Join our membership and start downloading now!

How to Make a Construction Statement Template Using Google Docs?

When making a statement, we want to make it accurate and correctly done by following safe methods and data. A careful analysis of financial reports is the basis of this activity. However, creating documents from scratch may be a daunting task, even for experts and professionals. With our collection, forget about making a document from scratch and focus on creating accurate financial calculations. You can also refer to our steps below for a DIY approach to building your construction business or company's statement templates.

1. Create a New File and Add Company Overview

Visit the Google Docs site and choose a "blank" document. Double-click on the top of the page, and set an appropriate title for the paper and a company overview. Make a description as comprehensive as you can.

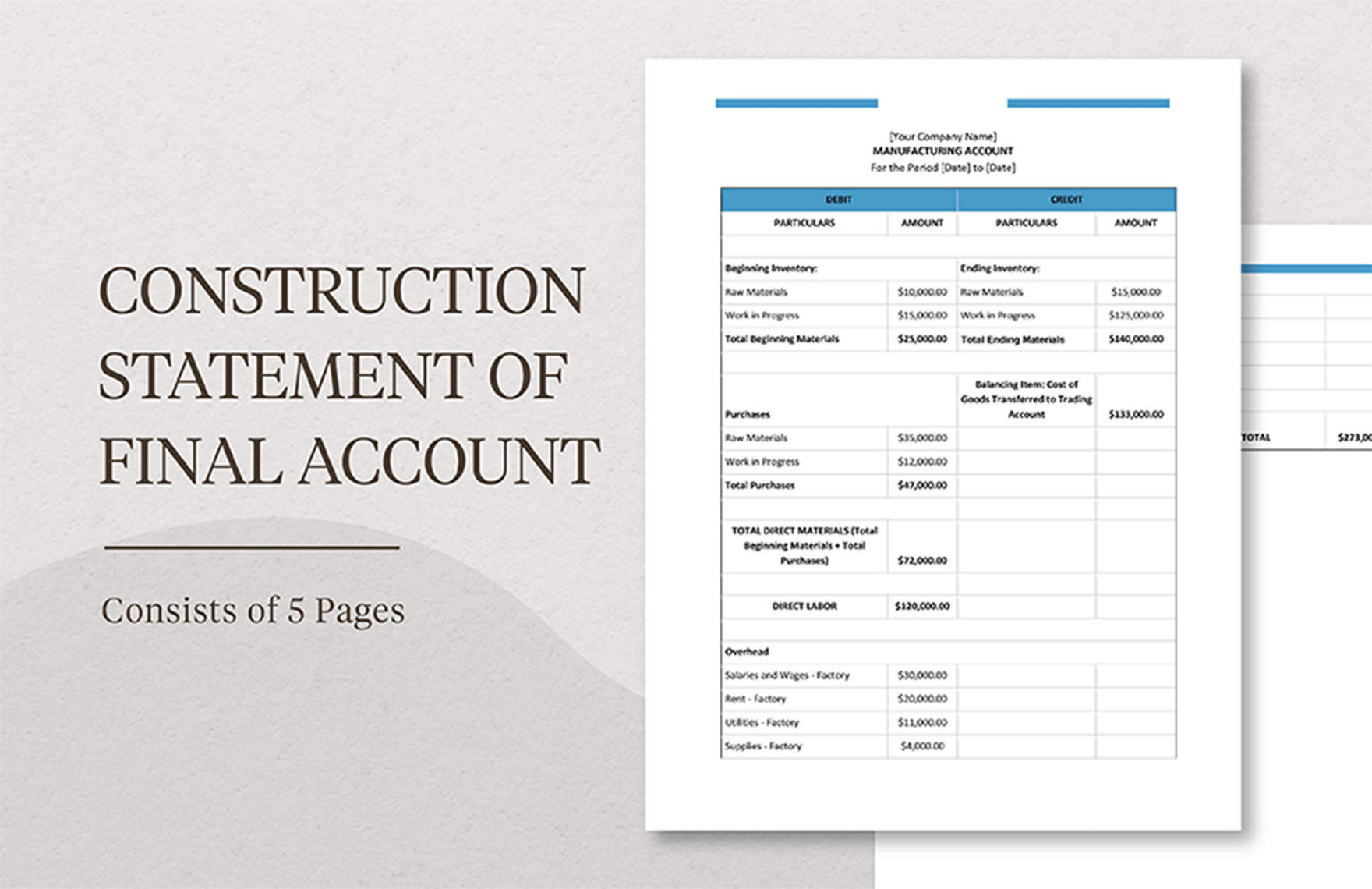

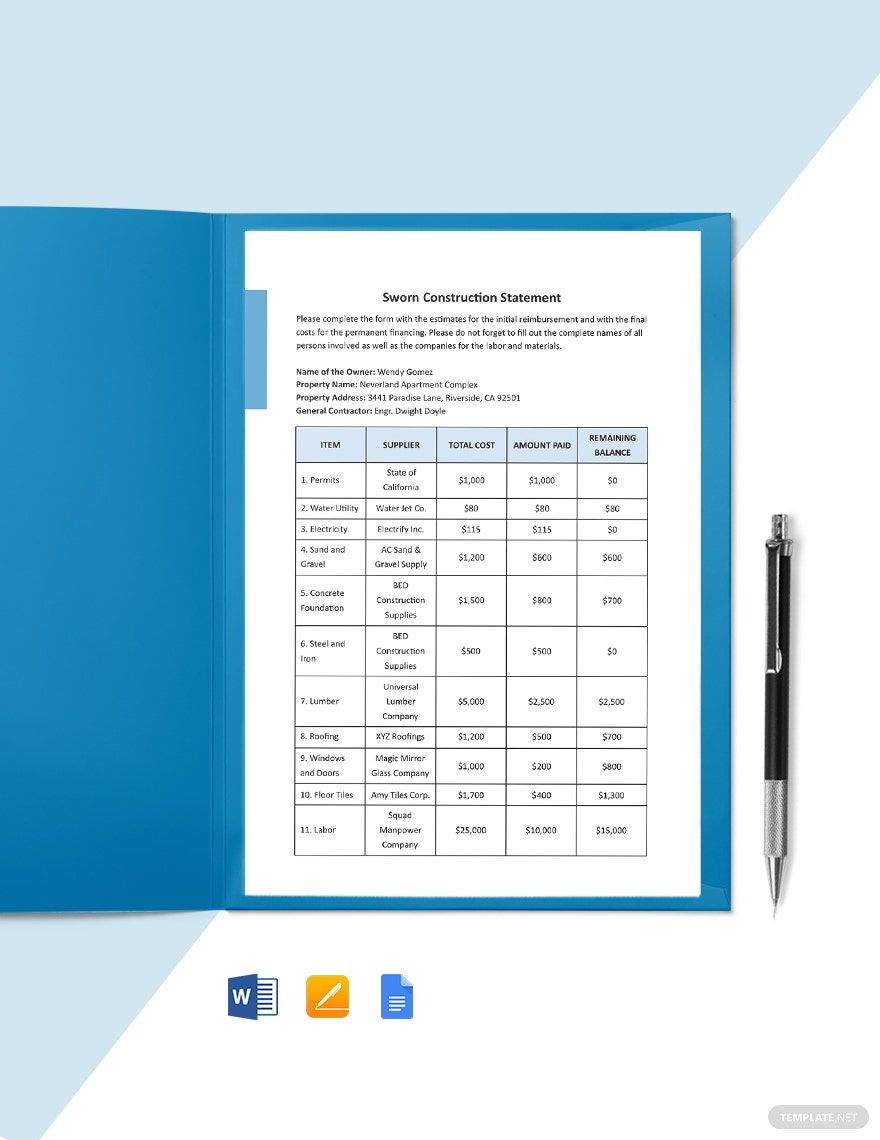

2. Gather All Balance Sheets

Collect all of the essential financial documents gathered throughout the fiscal year. Ask for access to your company's financial records such as receipts, assets and liabilities, profit and loss statements, and more. Get ahold of these essential documents, so you can sufficiently report them in your income statement.

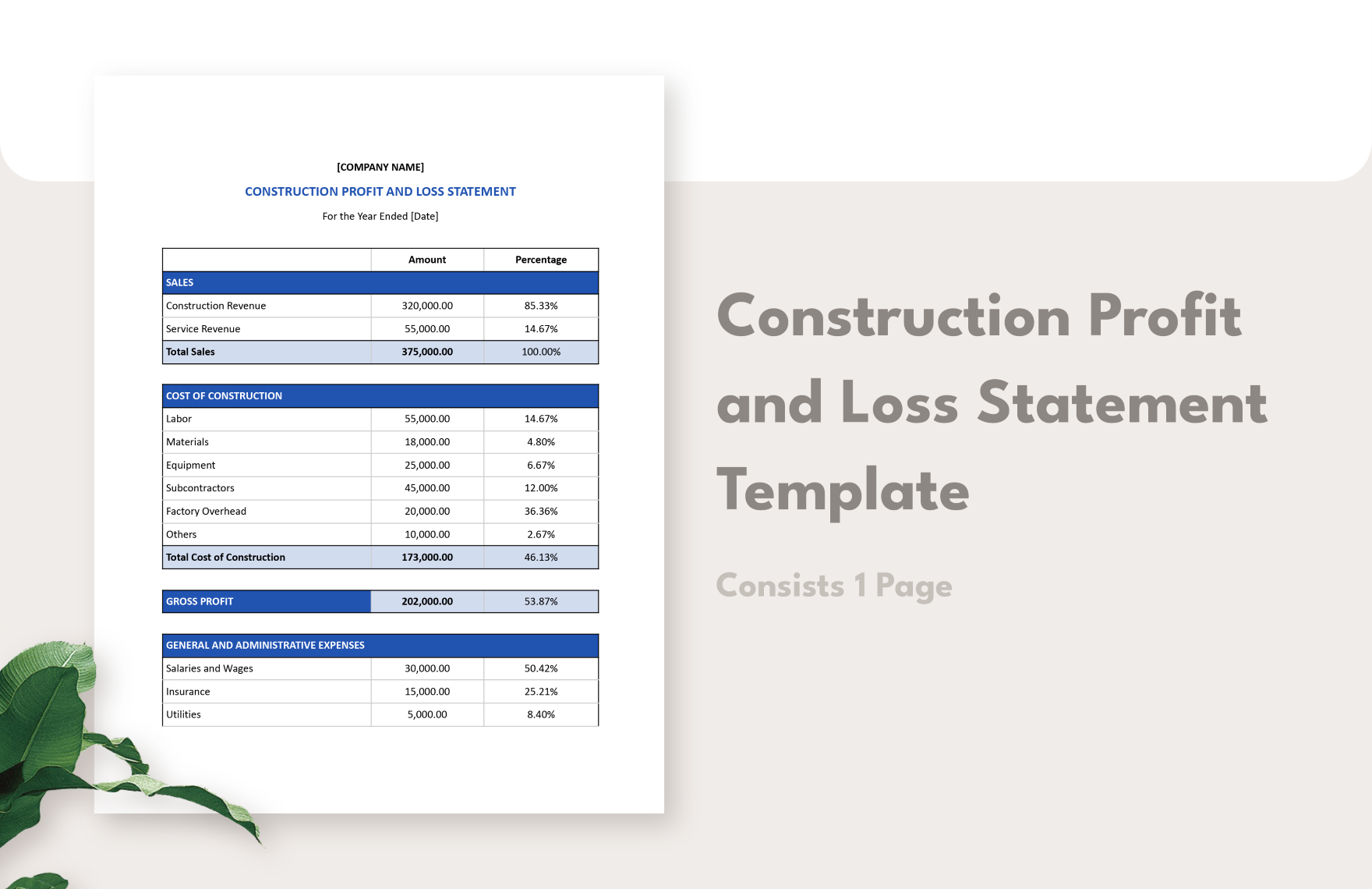

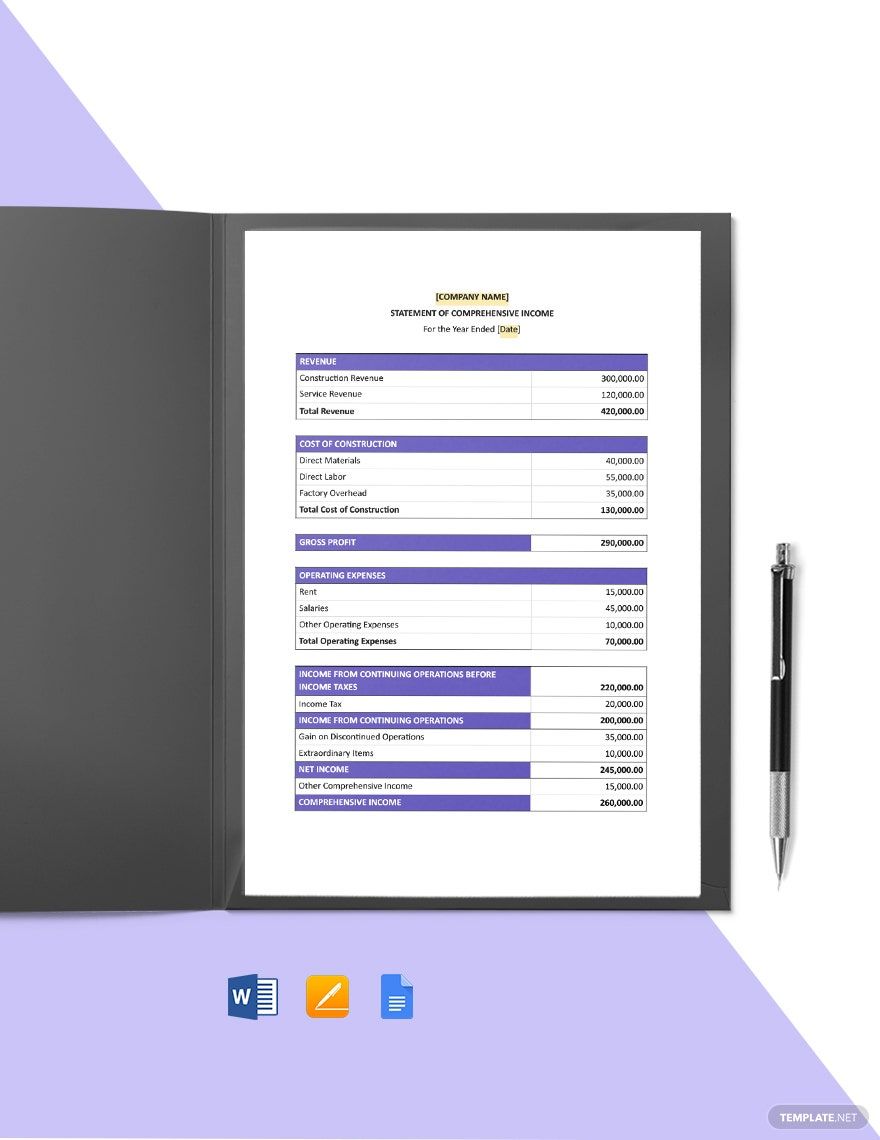

3. Draft Your Income Statement

Before you can create a financial statement, you have to make an income statement for each month or quarter first. With the essential documents that you have gathered, meticulously write them in your income statement.

4. Calculate Your Income Tax

Now that you know the company's income, the next thing you need to do is calculate your company's income tax. Adjust your gross income to the adjusted gross income. Remember that each country and each state has different calculations for these, so do your research. You can then create itemized or standard deductions that your company may qualify for to get the taxable income.

5. Draft Your Cash Flow Statement

Identify the operating, investing, and financing activities. Then, itemize each deduction and net increases under each activity. Once you get the net change in cash and cash equivalent, you should now be ready to create your financial statement.