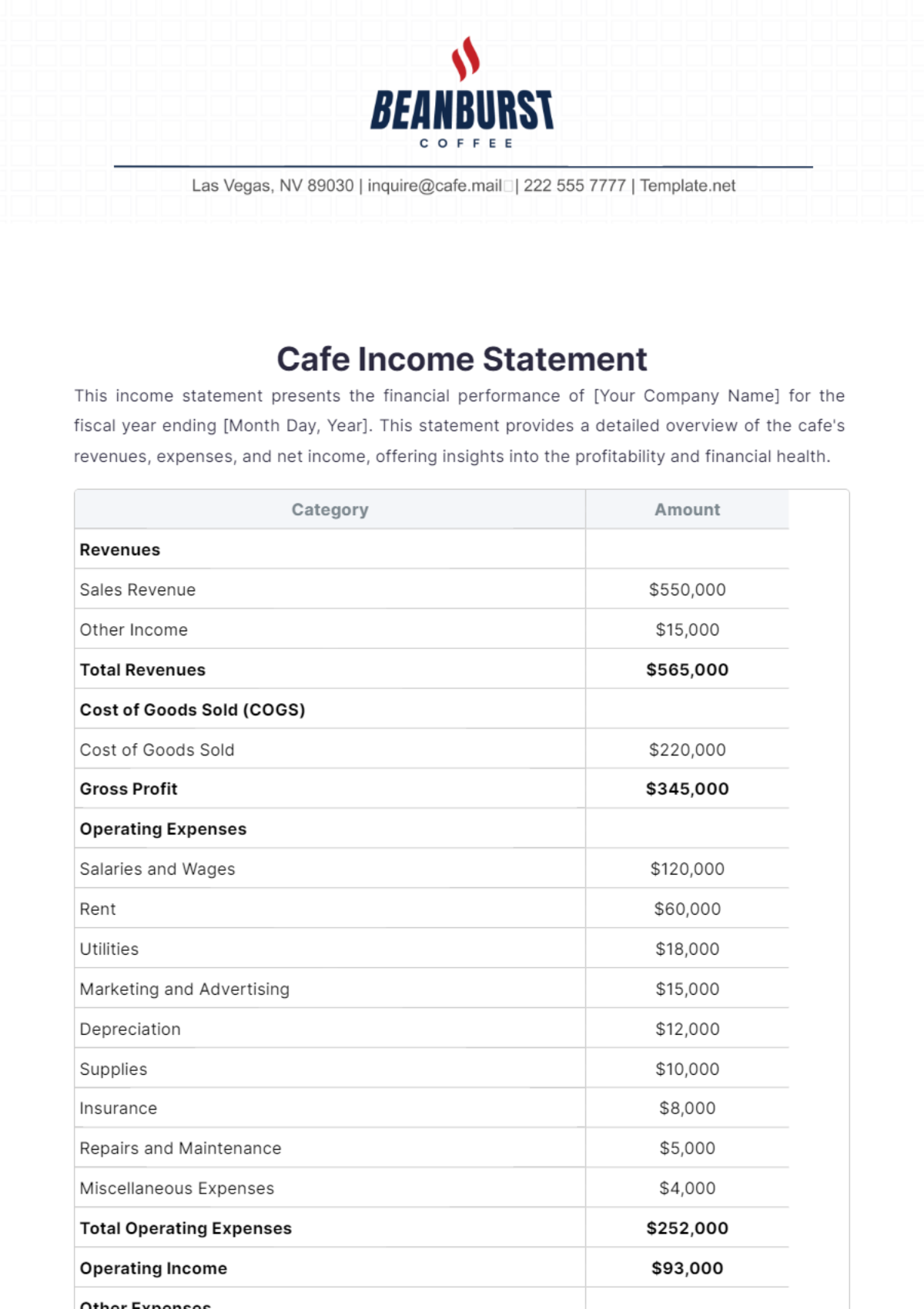

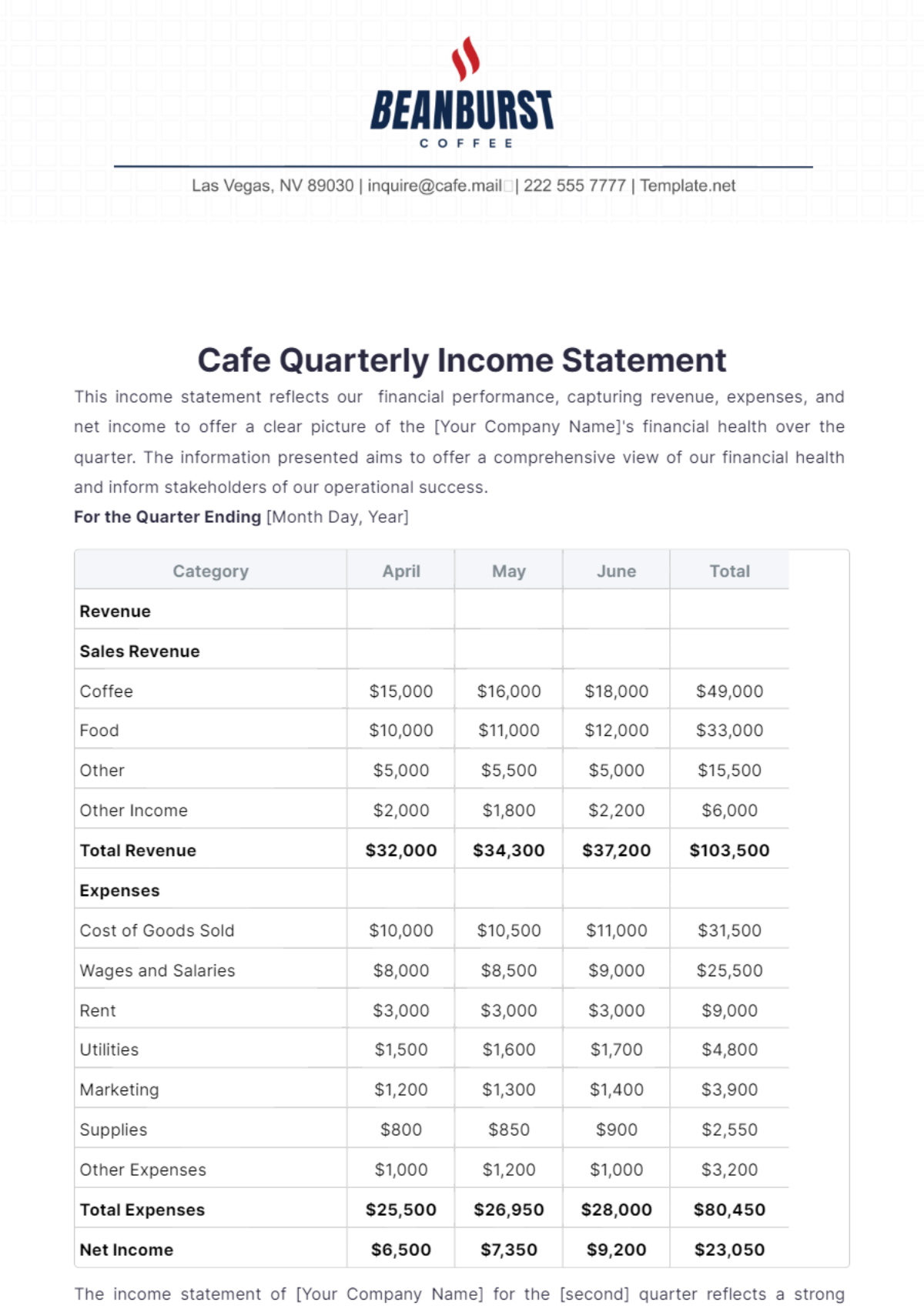

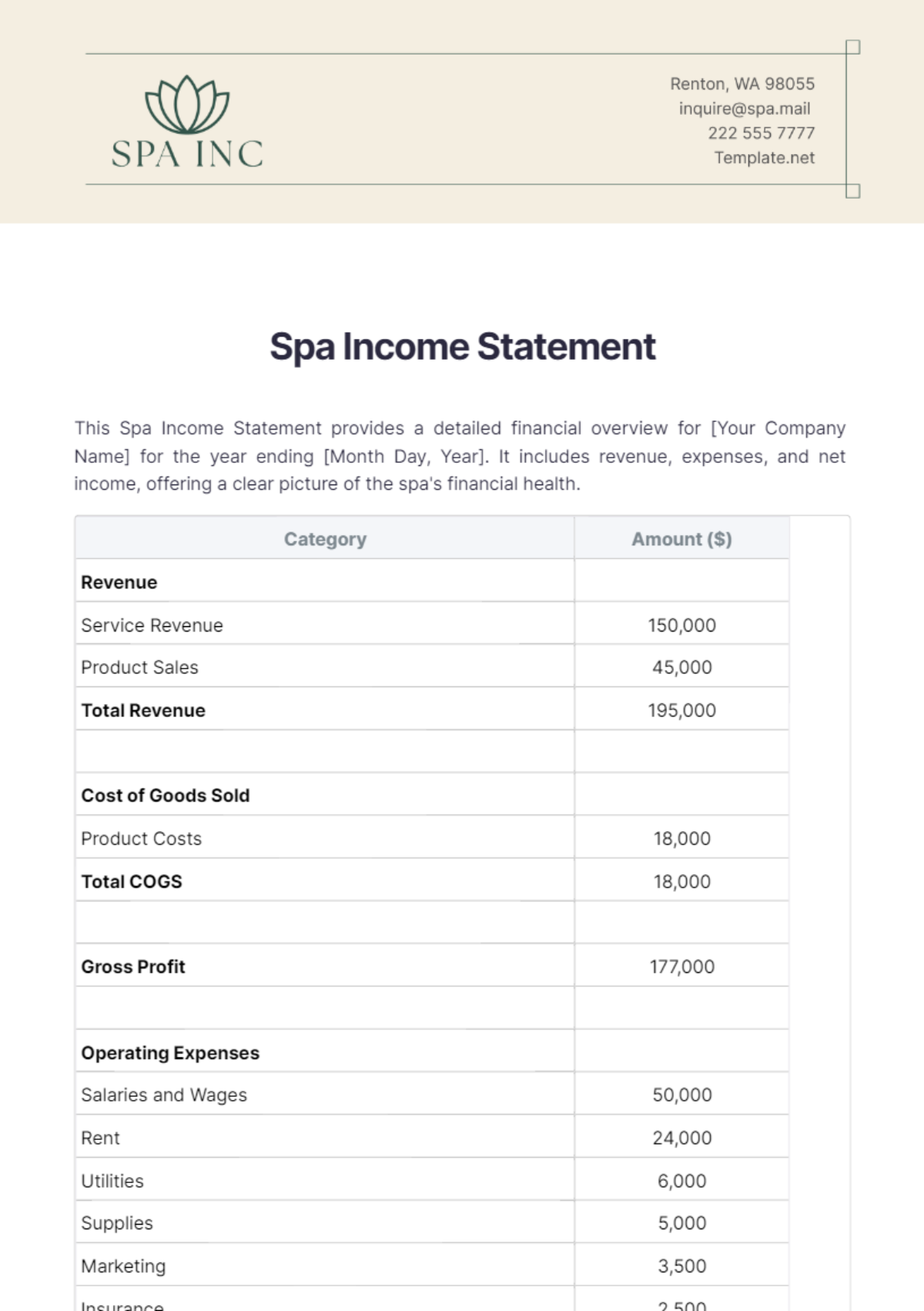

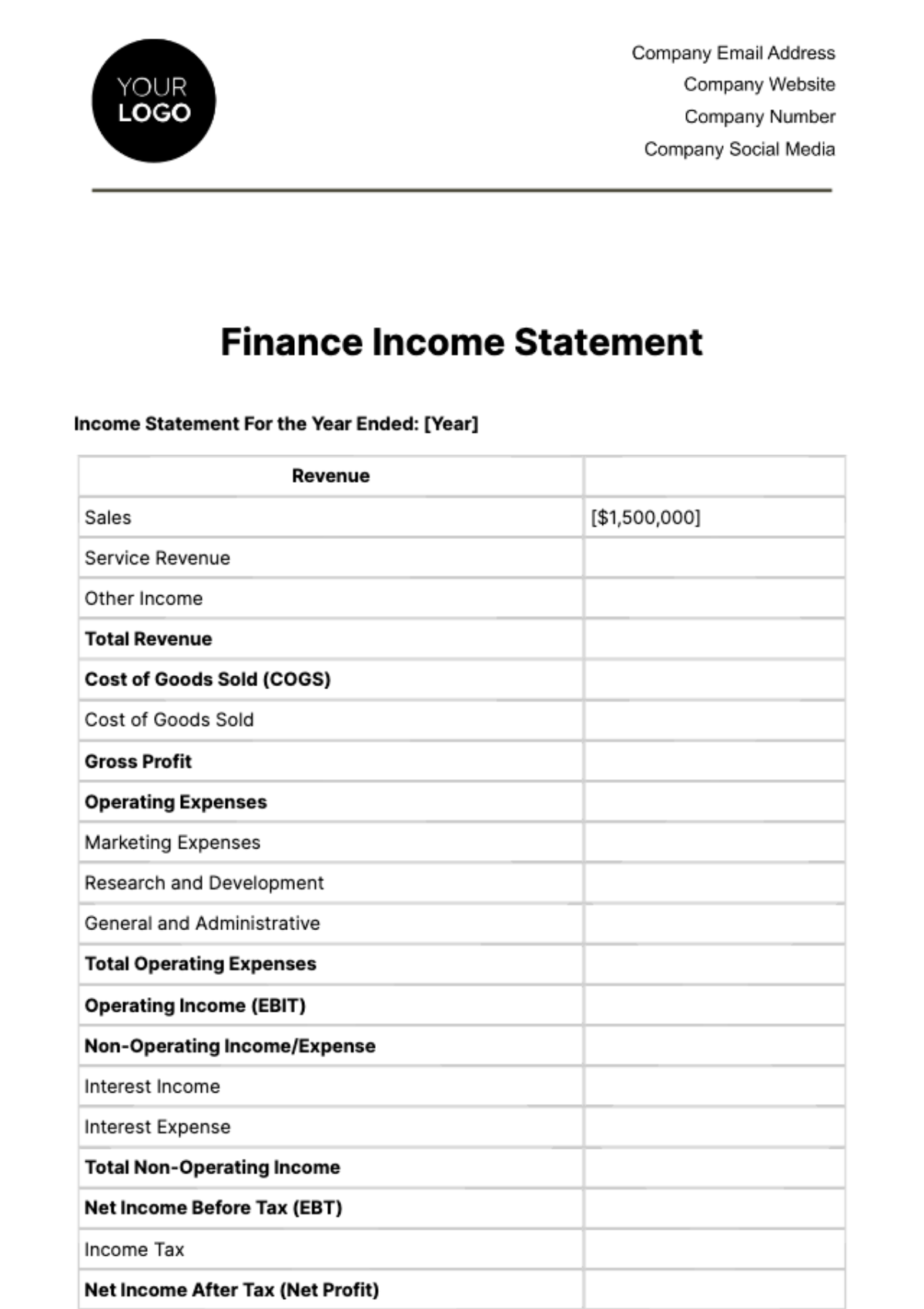

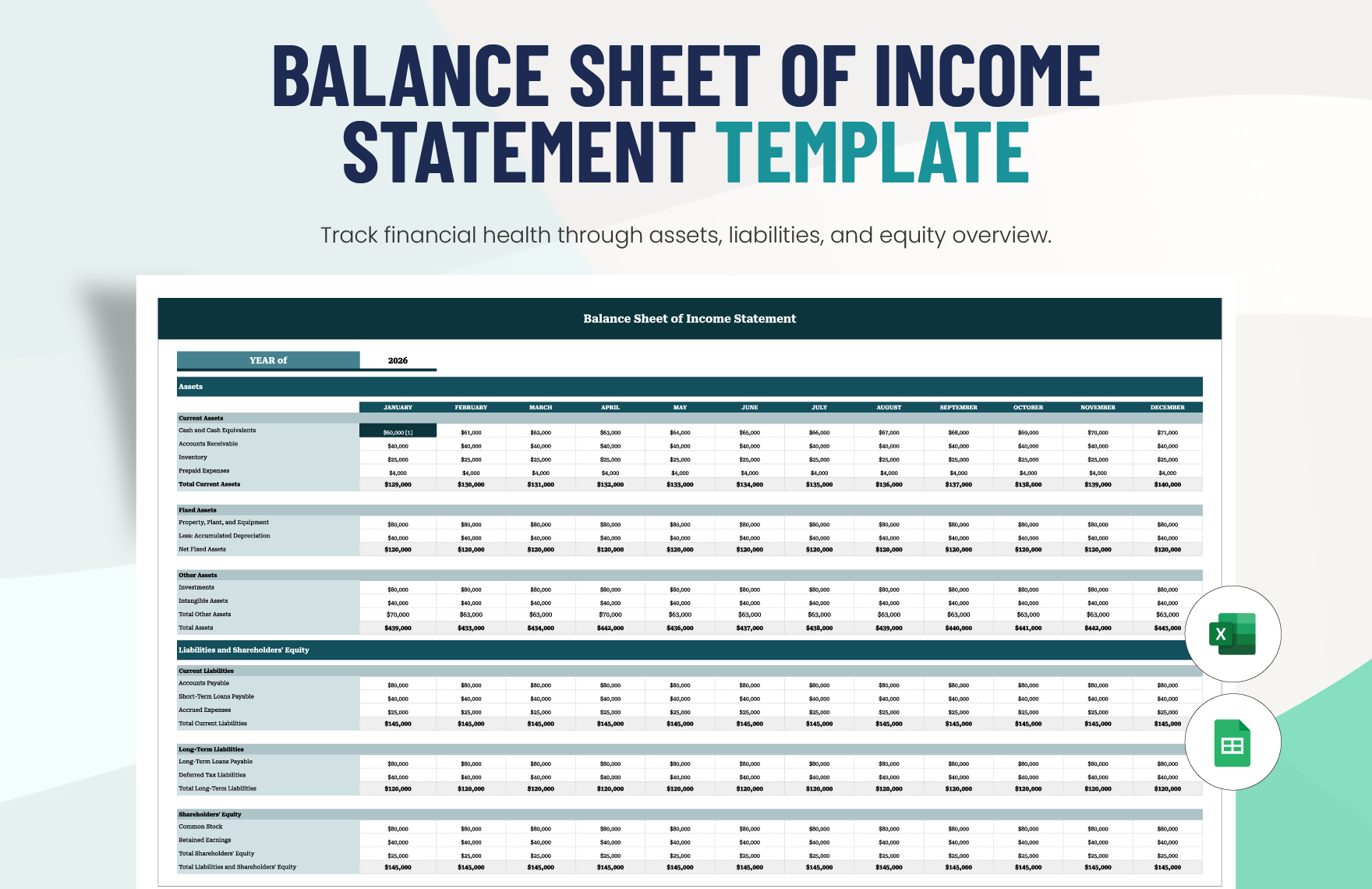

Bring Your Financial Insights to Life with Income Statement Templates from Template.net

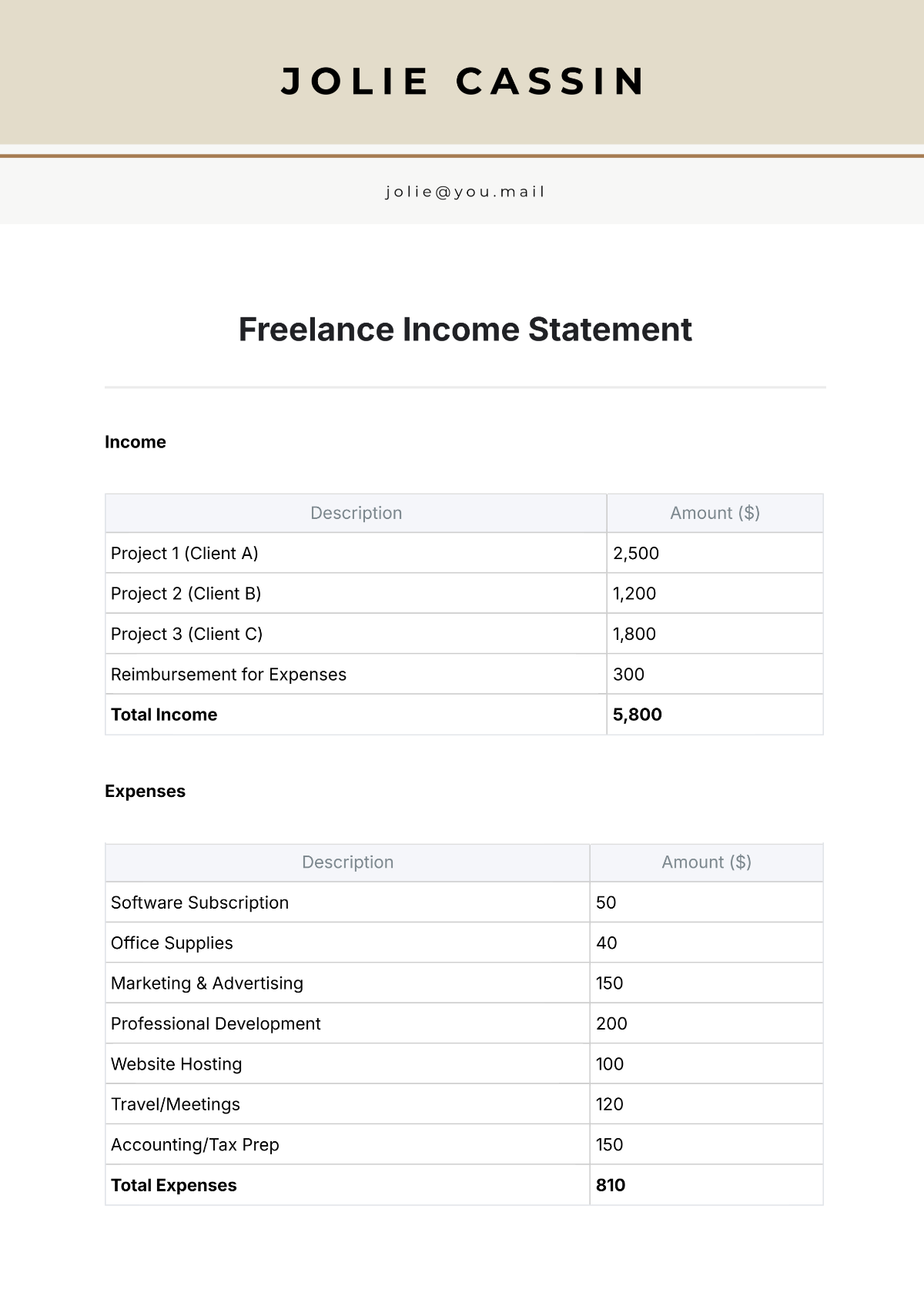

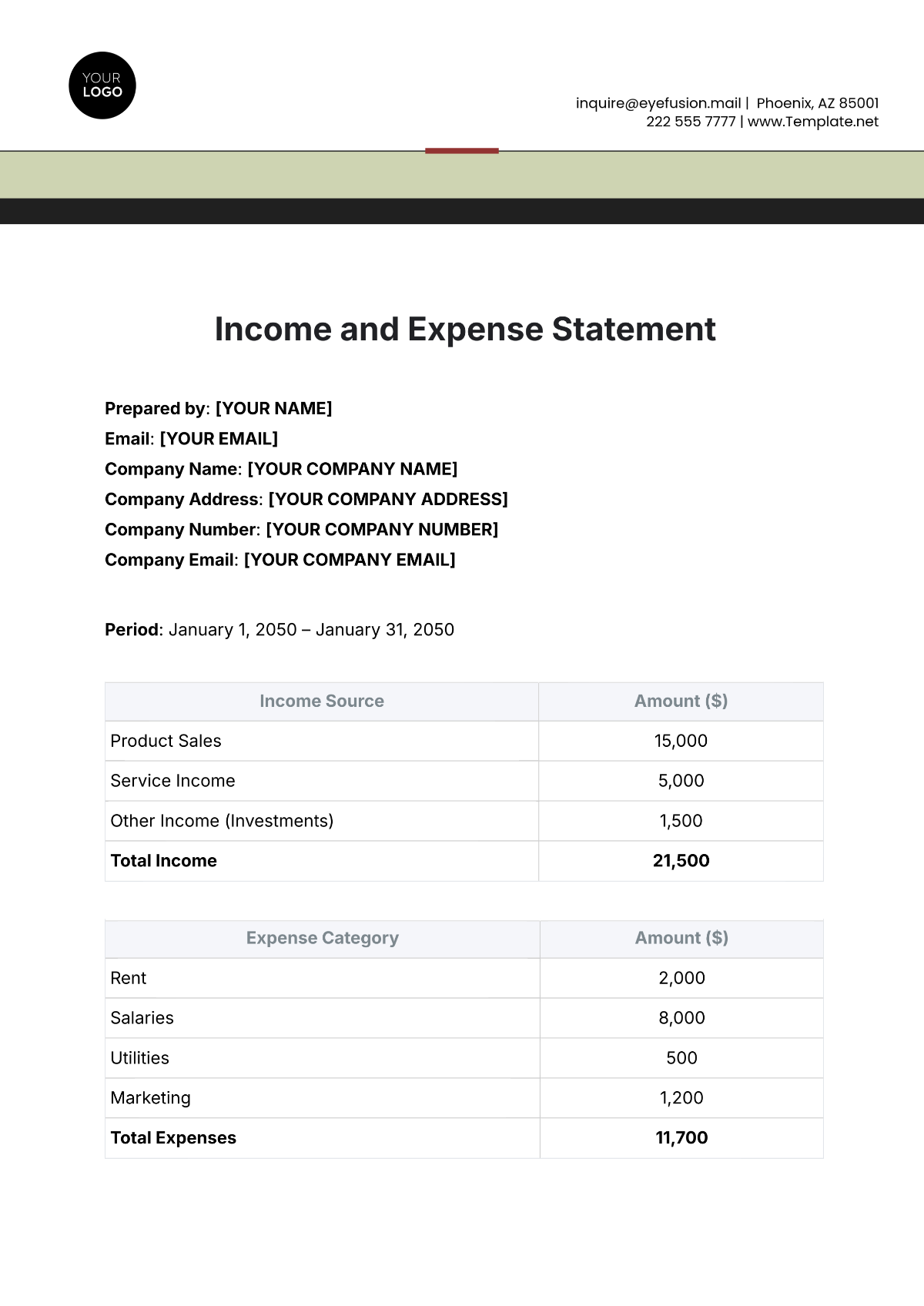

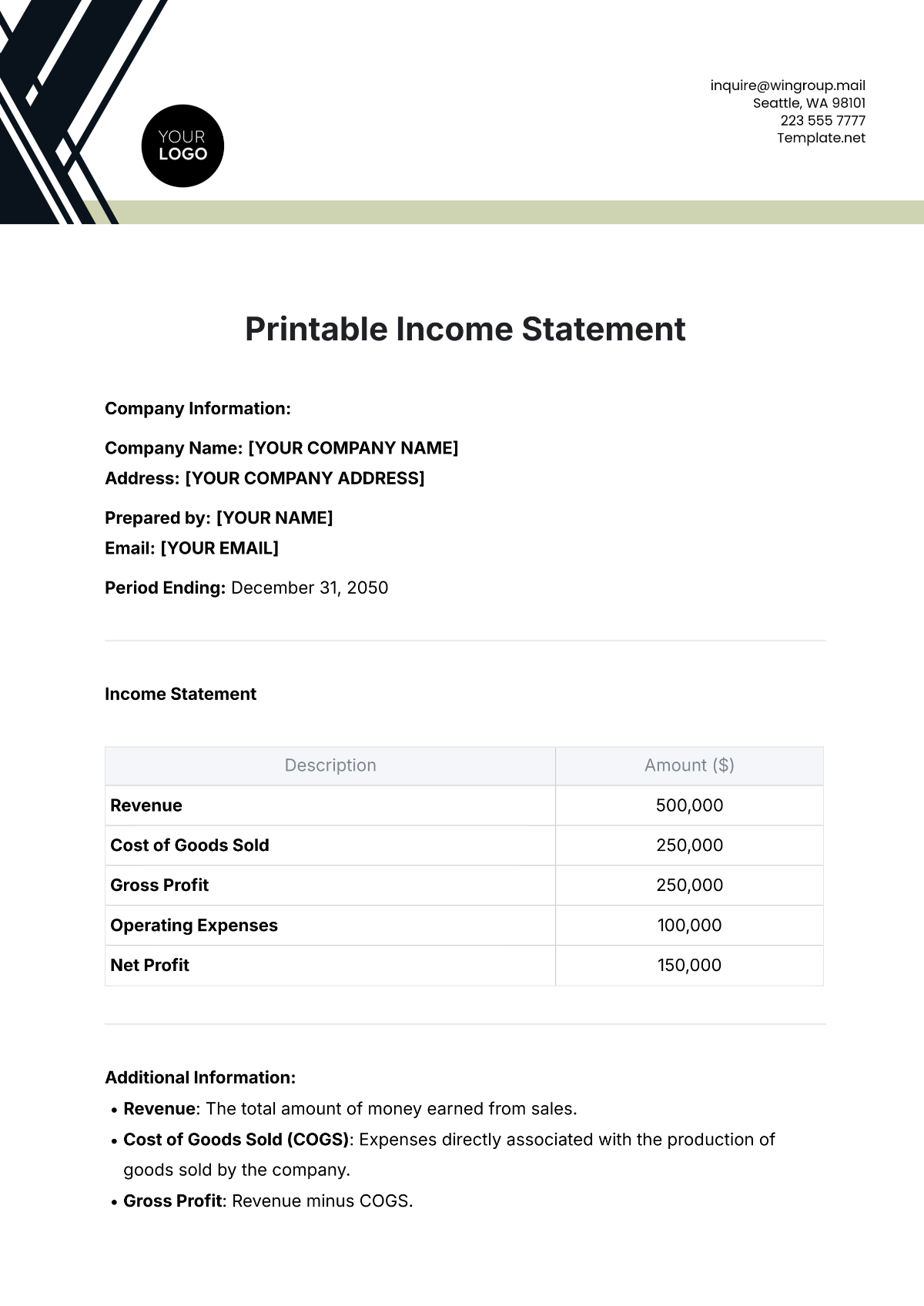

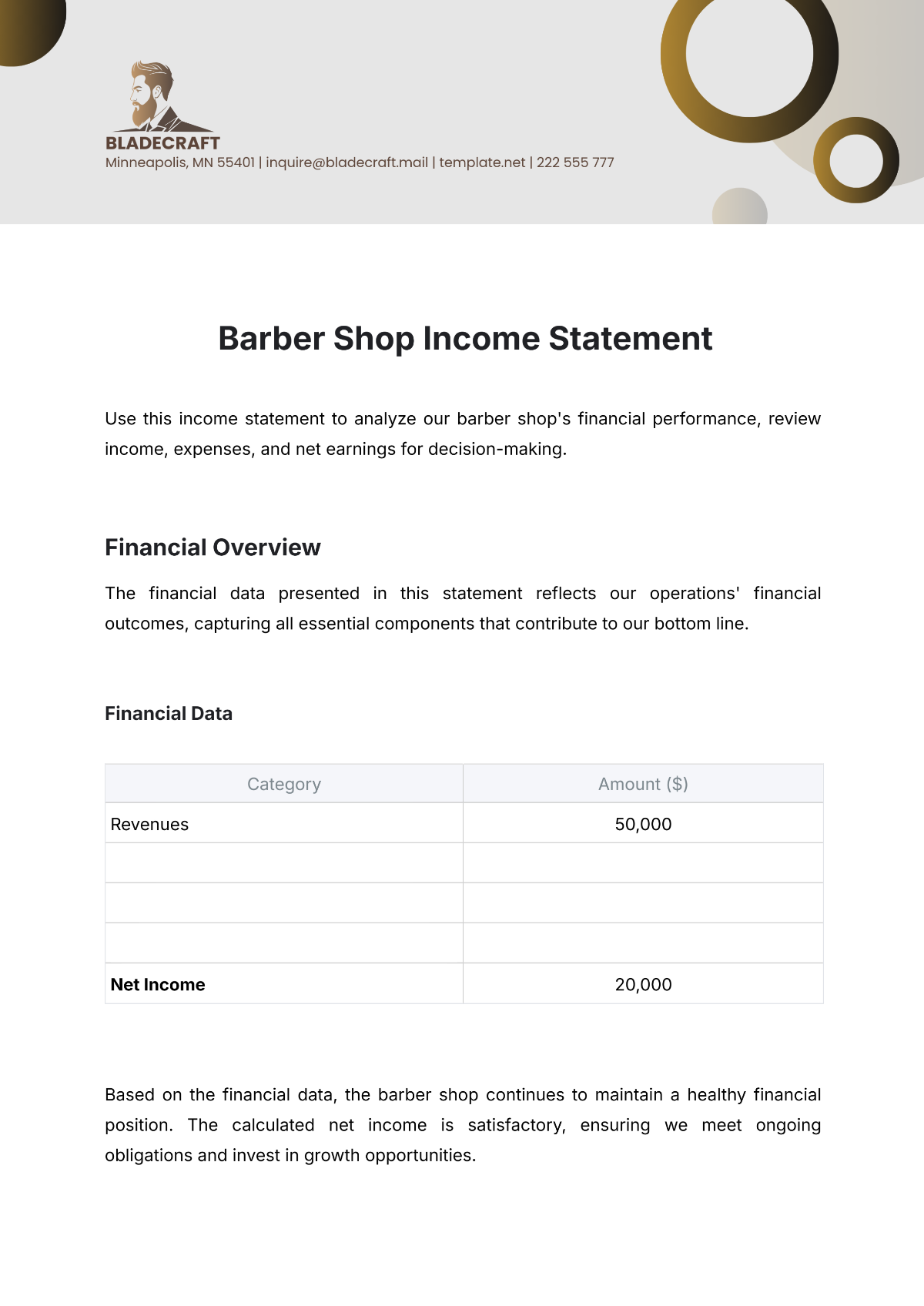

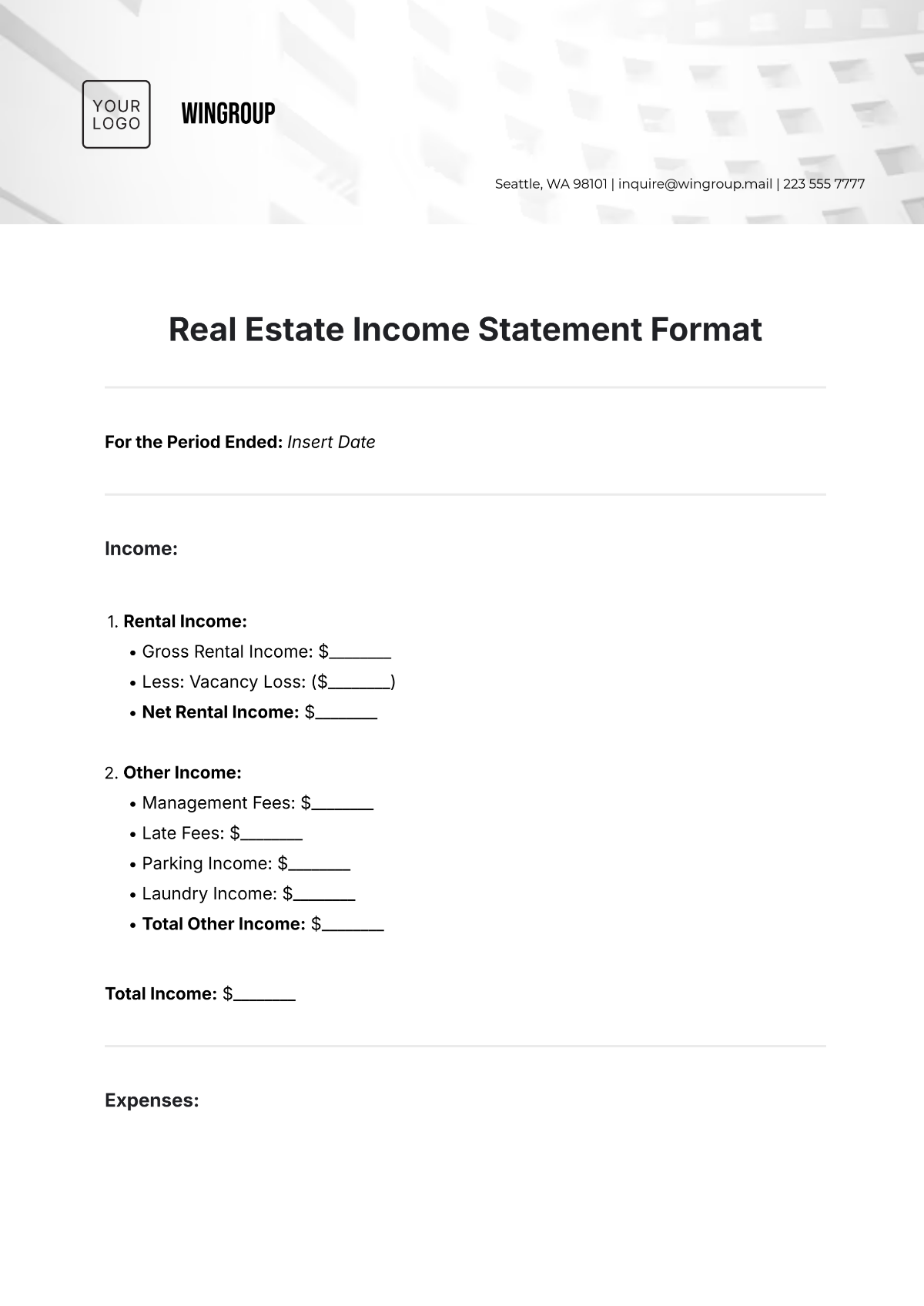

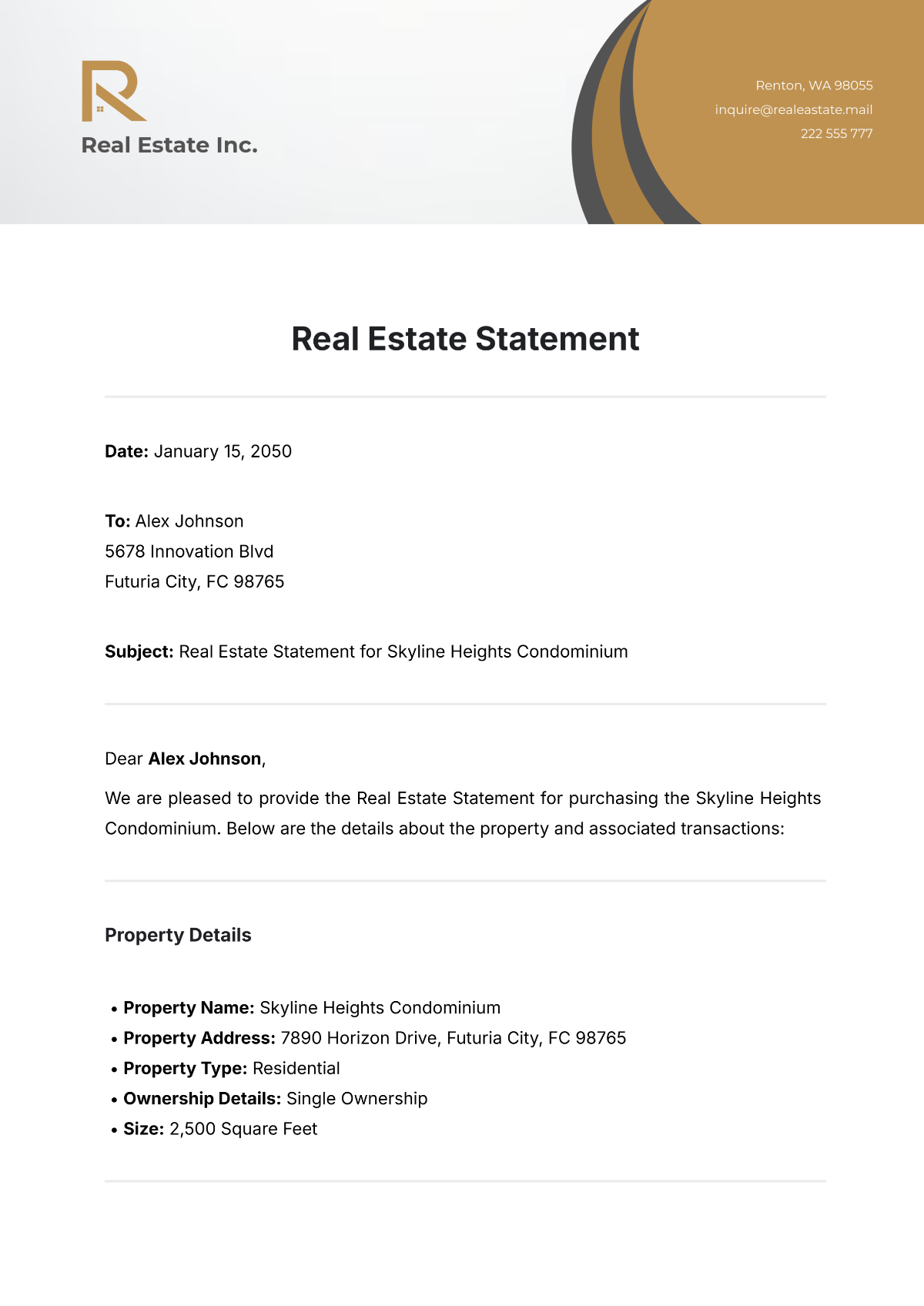

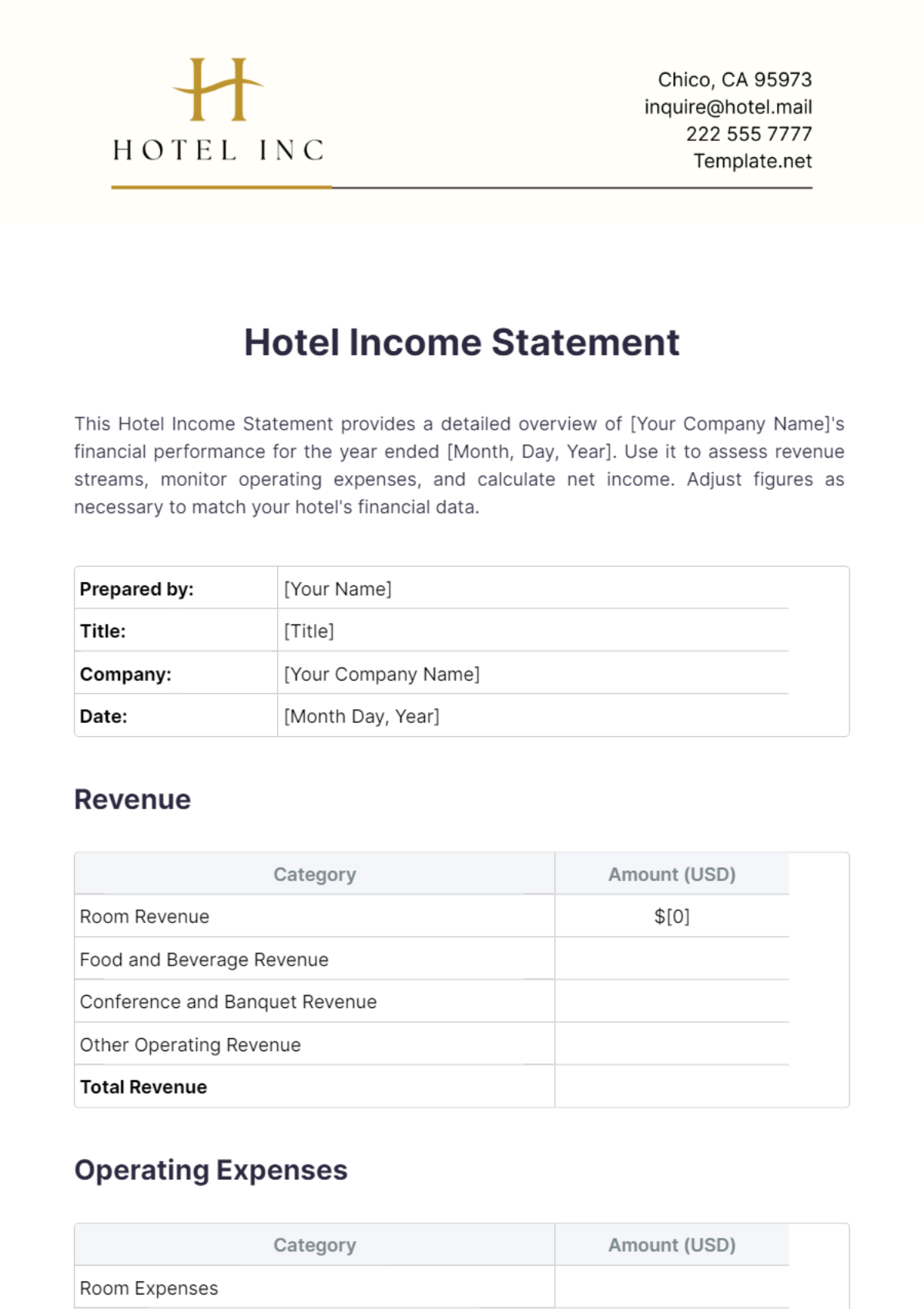

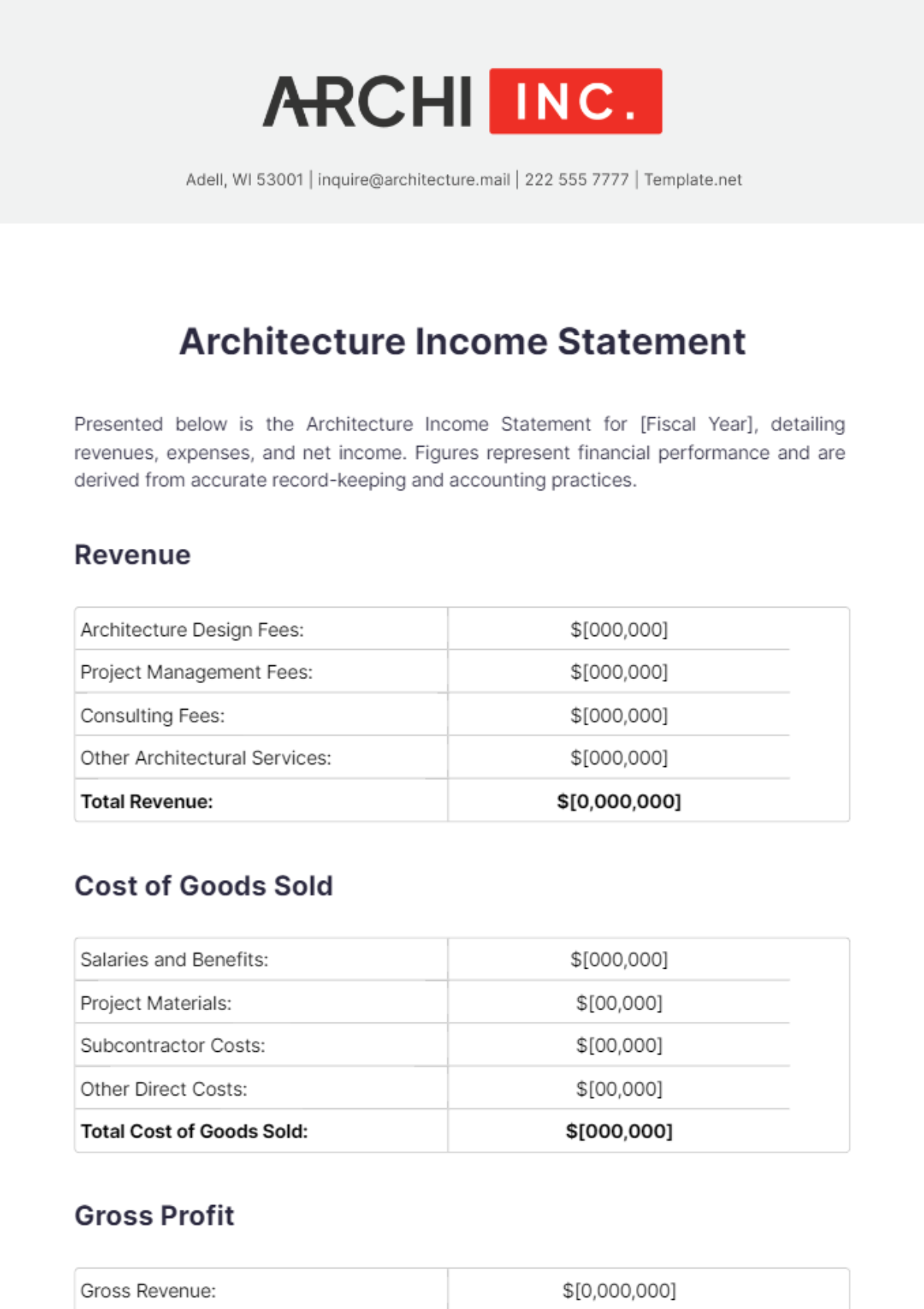

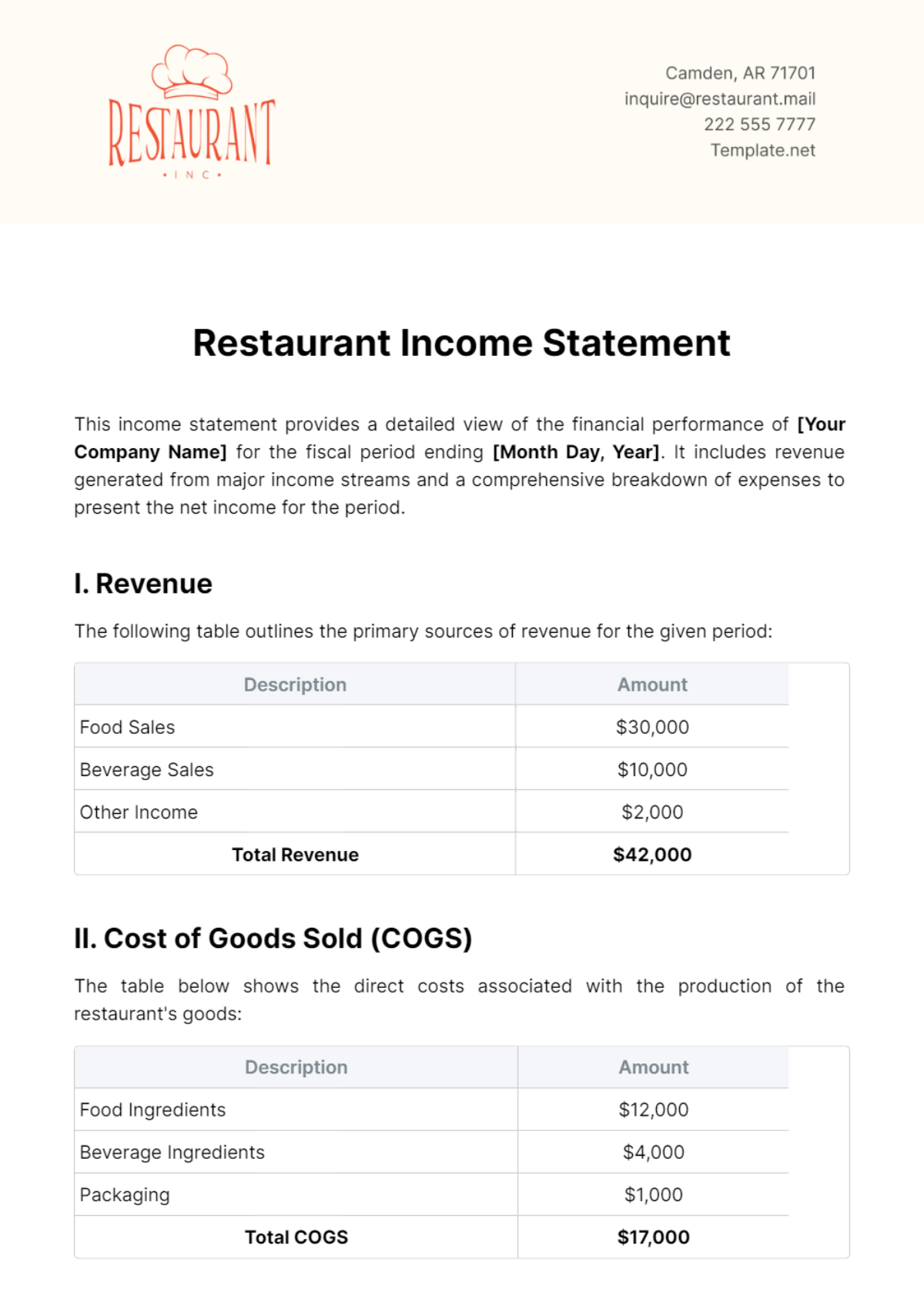

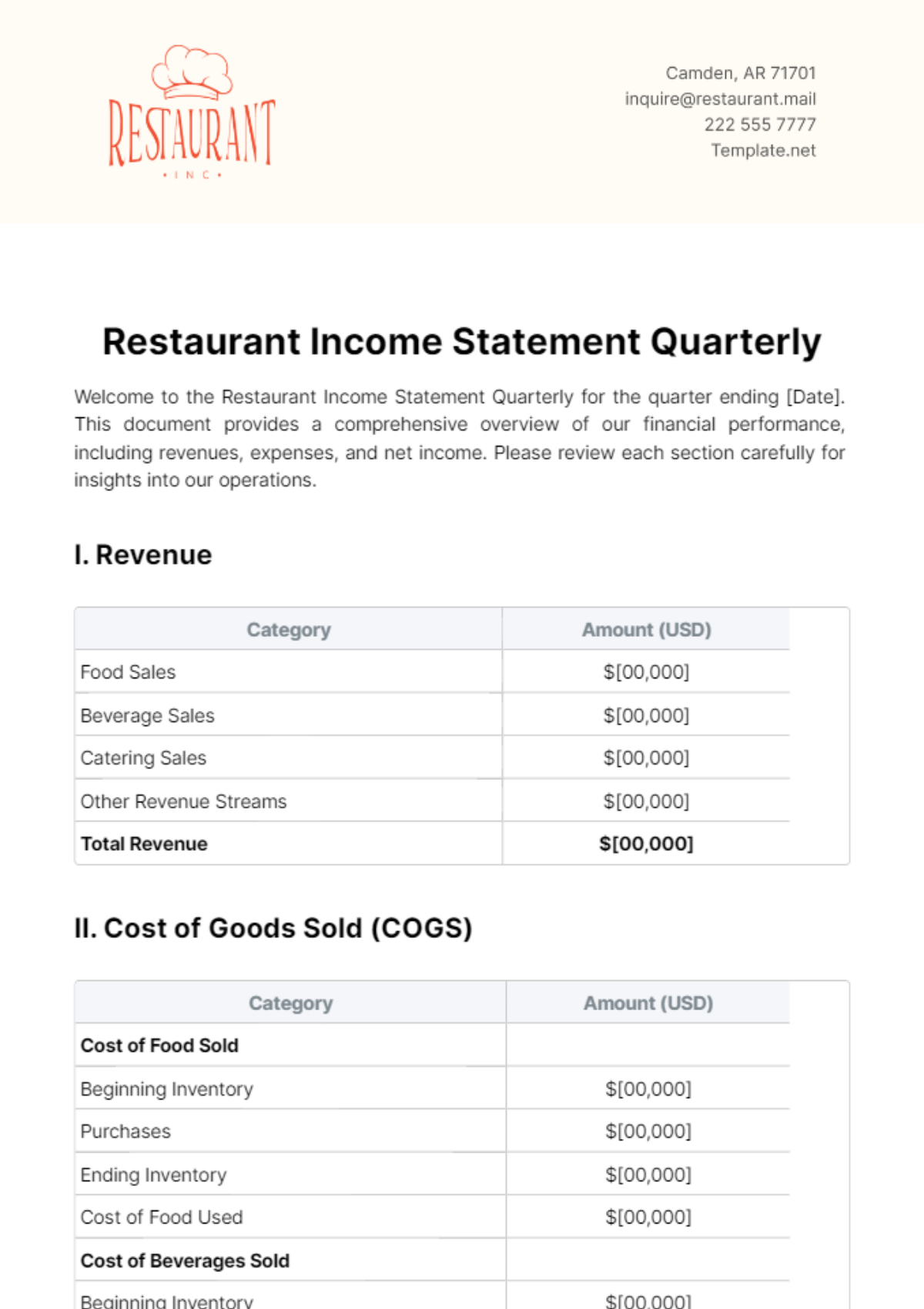

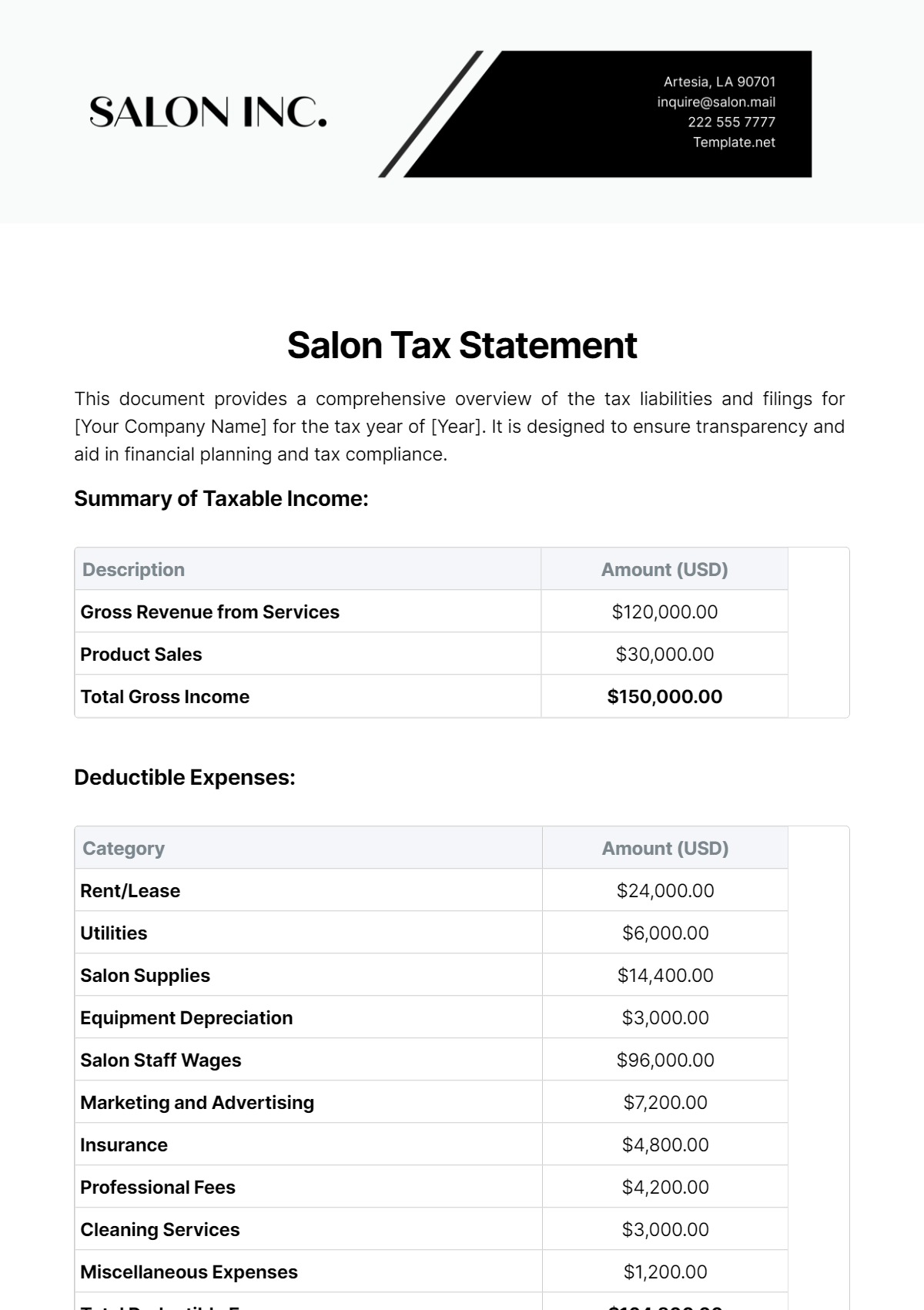

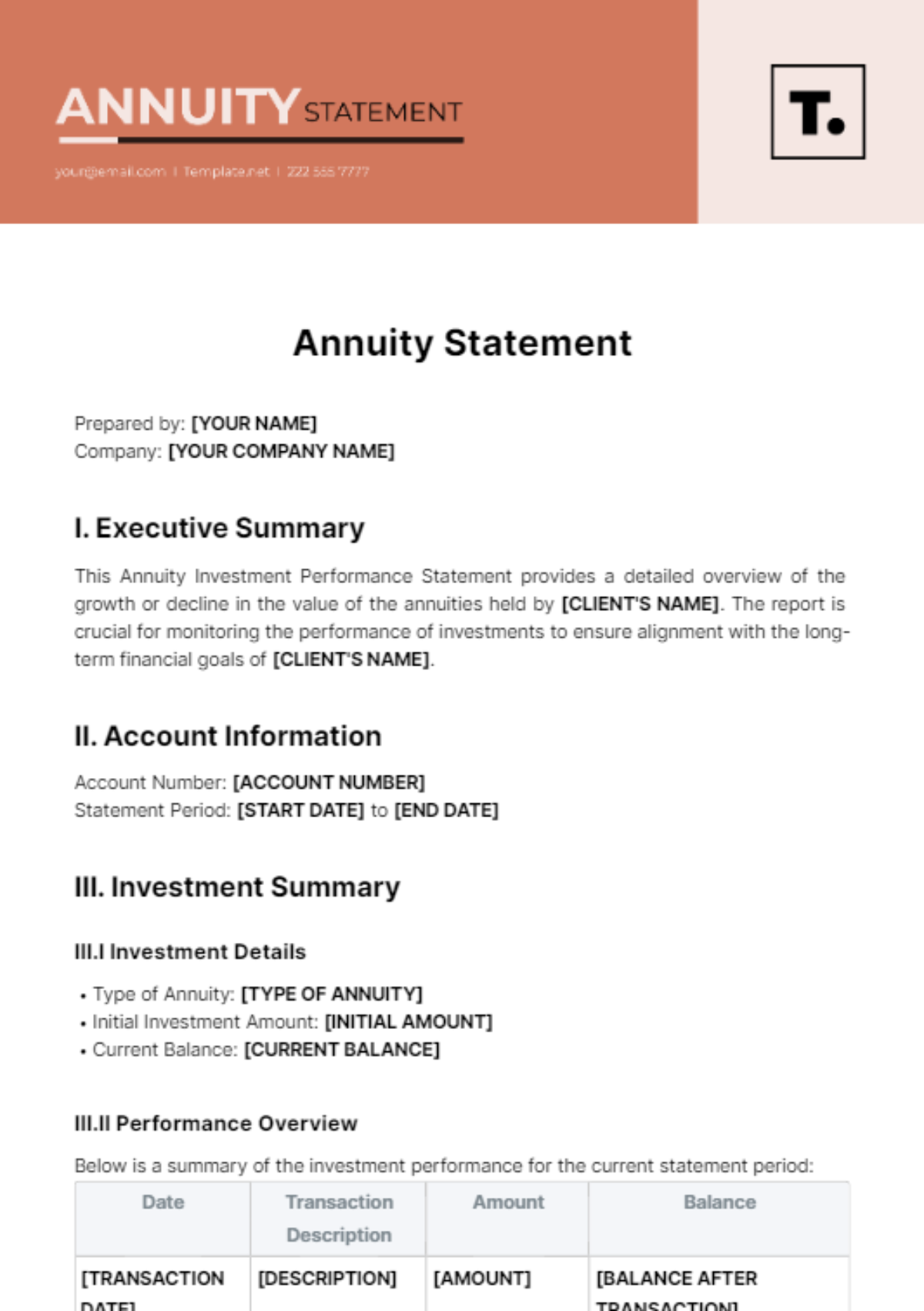

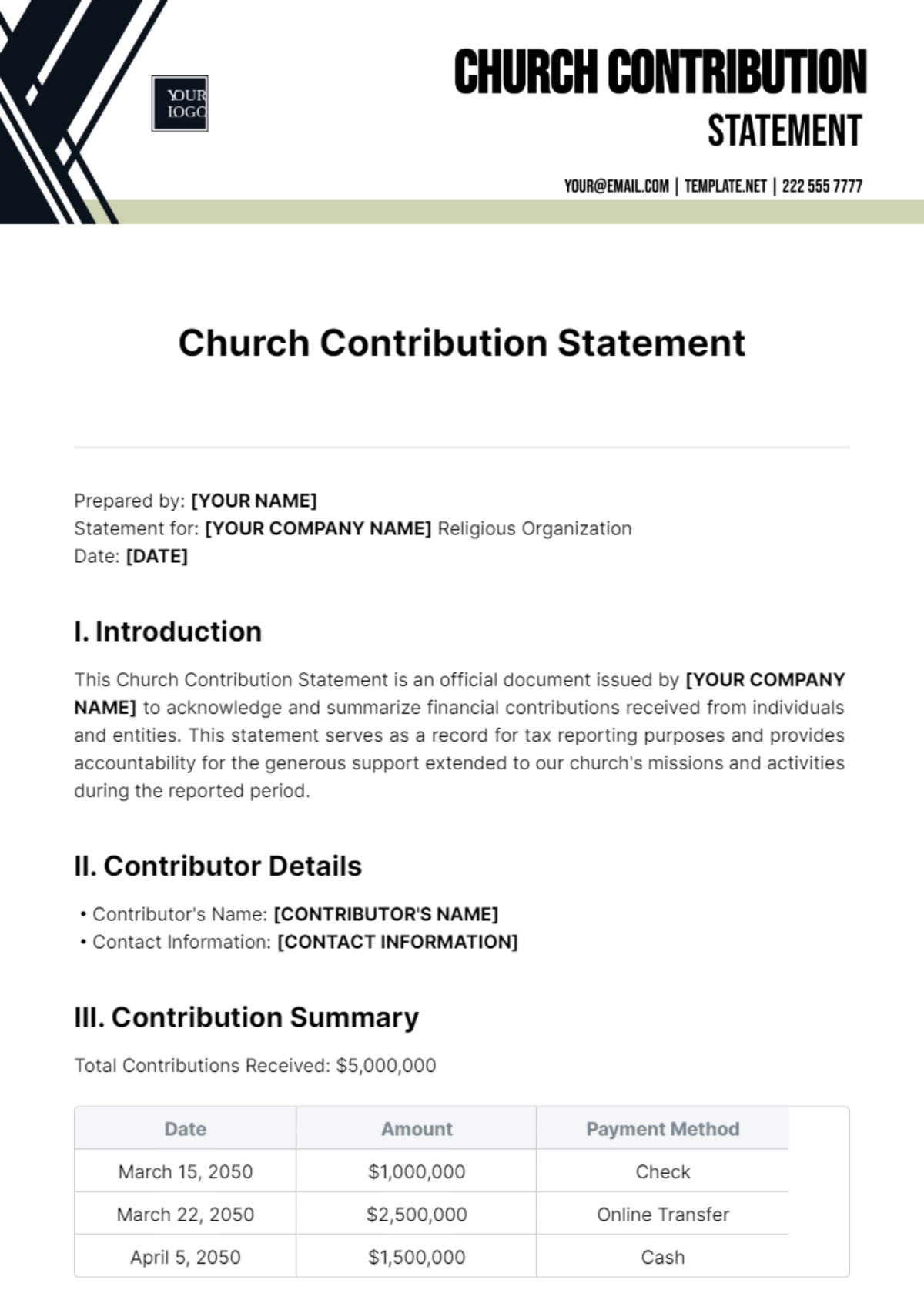

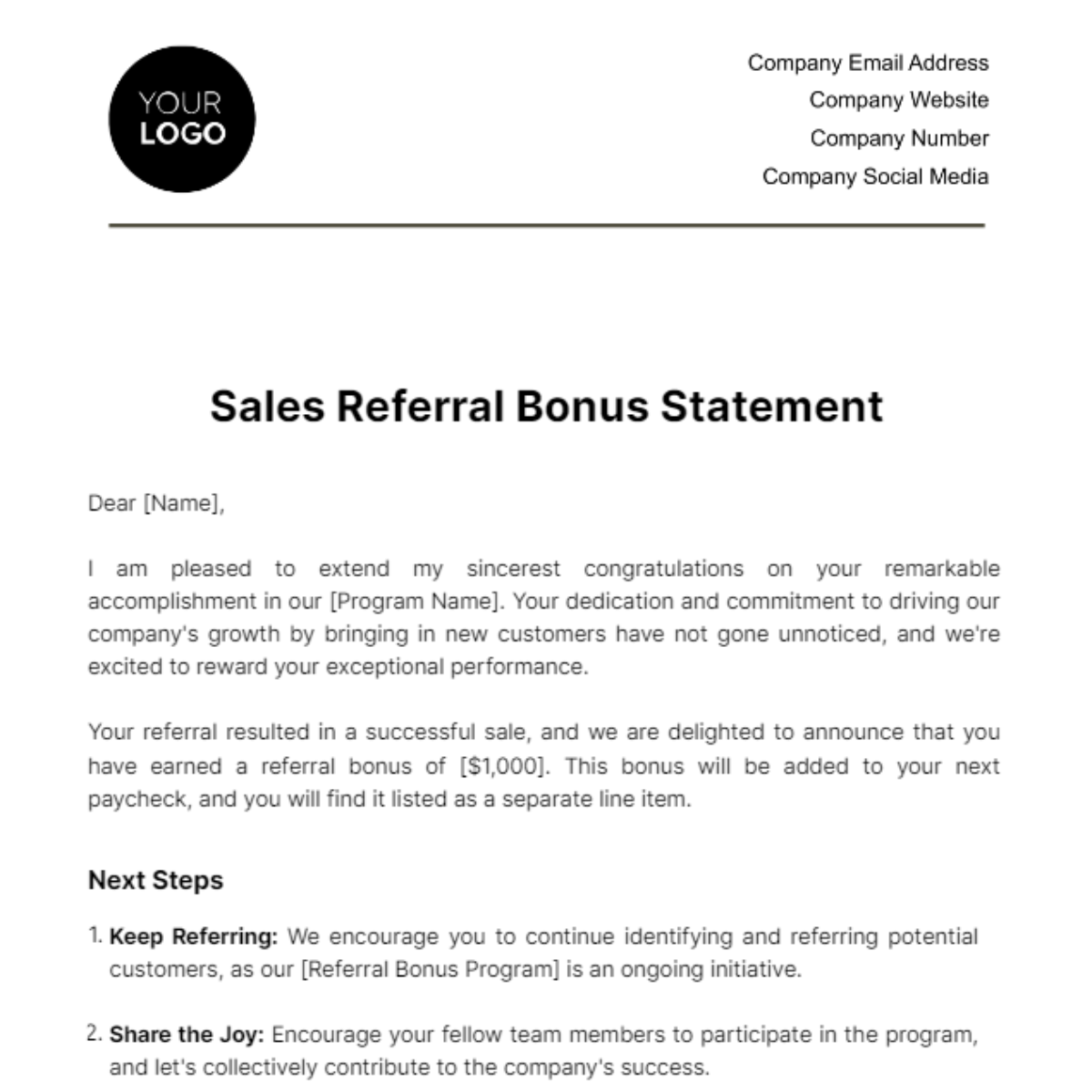

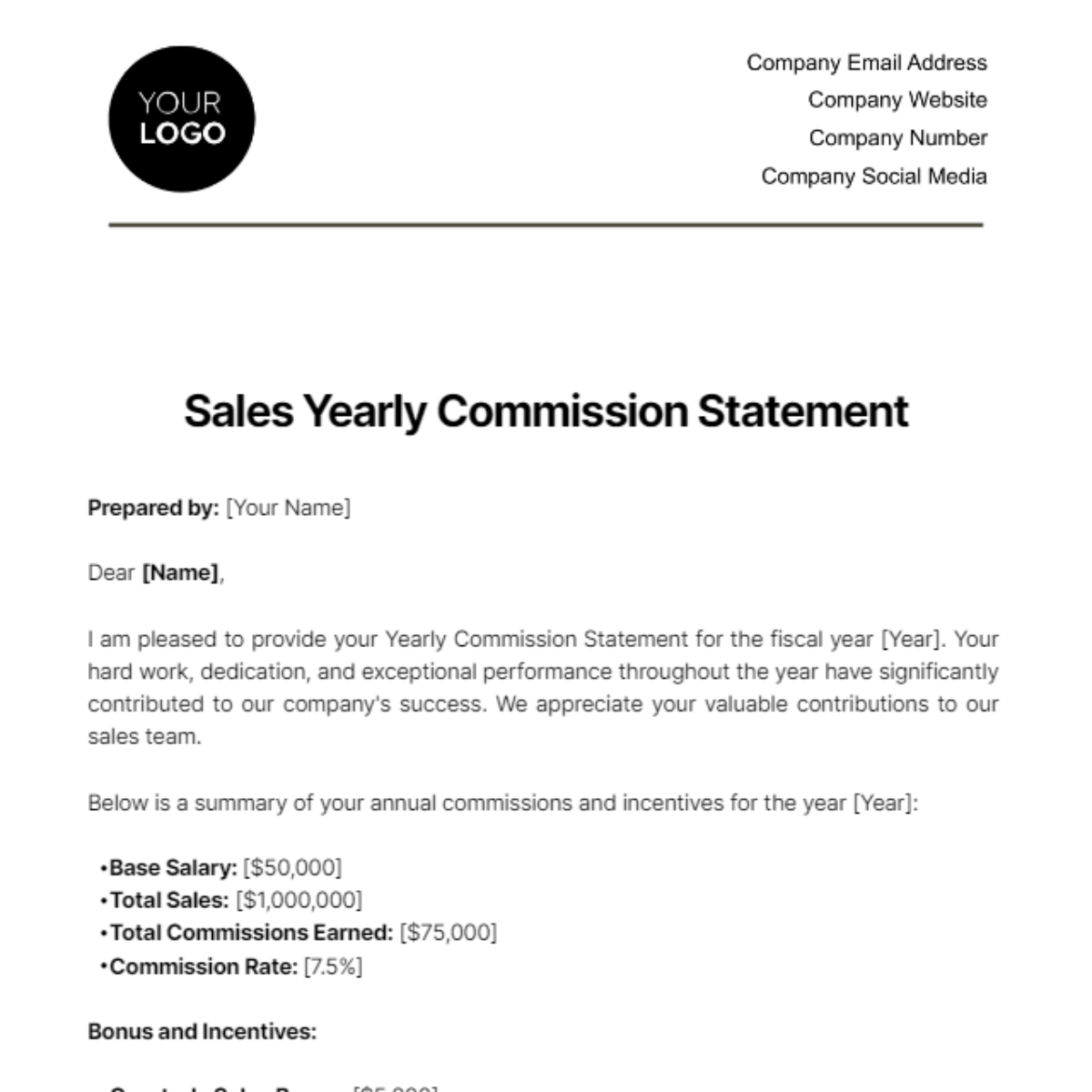

Keep your business organized and strategically focused with Income Statement Templates from Template.net. Designed for small business owners, accountants, and finance professionals, these templates offer a structured way to track financial performance, analyze trends, and make informed decisions. Use them to prepare for a quarterly review meeting or when you need to present the annual financial results to stakeholders. The templates include essential details like time periods, revenue classifications, and expense categories. Enjoy the ease of use with no advanced accounting skills required, and benefit from professional-grade design layouts. These templates save time and effort and are perfect for both digital and print distribution.

Discover the many Income Statement Templates we have on hand, each designed to cater to your specific reporting needs. Begin by selecting a template that best suits your style and modify elements such as text, figures, and charts with ease. Personalize by tweaking colors and fonts to align with your brand guidelines. Enhance your reports by dragging-and-dropping icons and graphics or adding animated effects to highlight critical insights. Experience the endless possibilities without needing any expertise, thanks to our user-friendly interface. Our library is regularly updated with new designs and templates to keep you ahead of your reporting needs. When you're finished, simply download or opt to share your professional-looking reports via email, print, or other export options, making it ideal for multiple channels and offering collaboration in real-time.