Table of Contents

- Agreement Template Bundle

- 13+ Equity Investment Agreement Templates in PDF | DOC

- 1. Equity Investment Agreement Template

- 2. Free Private Equity Co-Investment Agreement

- 3. Free Equity Investment Document Agreement Template

- 4. Free Equity Investment Participation Agreement

- 5. Free Alternatives Equity Investment Agreement

- 6. Free International Equity Investment Agreement

- 7. Free Strategic Equity Investment Agreement Template

- 8. Free Cornerstone Equity Investment Agreement

- 9. Free Company Equity Investment Agreement Template

- 10. Free Equity Equivalent Investment Agreement

- 11. Free Project Equity Investment Agreement Template

- 12. Free Advisor Equity Investment Agreement Template

- 13. Free Equity Investment Agreement Template

- How Does Equity Fundraising Work?

- What are the Circumstances that Prevails During an Equity Fund Raising?

- What are the Possible Failures while Making an Equity Investment?

- How to Make an Equity Share Agreement incase of Buying a Property?

13+ Equity Investment Agreement Templates in PDF | DOC

An equity investment takes place when financial specialists consent to contribute to an organization in return for the plausibility of a future profit for their speculation. Stock equity is one of the most alluring sorts of capital for business people, on account of well off speculator accomplices and no reimbursement plan. In any case, it requires the most exertion to discover it. Gathering pledges with value implies that speculators offer cash to your organization in return for a stake in the business, which apparently will turn out to be progressively important as your organization picks up progress. You can also see more on investment agreement templates.

Agreement Template Bundle

13+ Equity Investment Agreement Templates in PDF | DOC

1. Equity Investment Agreement Template

2. Free Private Equity Co-Investment Agreement

lw.com

lw.com3. Free Equity Investment Document Agreement Template

co.uk

co.uk4. Free Equity Investment Participation Agreement

technology.com

technology.com5. Free Alternatives Equity Investment Agreement

trade.com

trade.com6. Free International Equity Investment Agreement

oecd.org

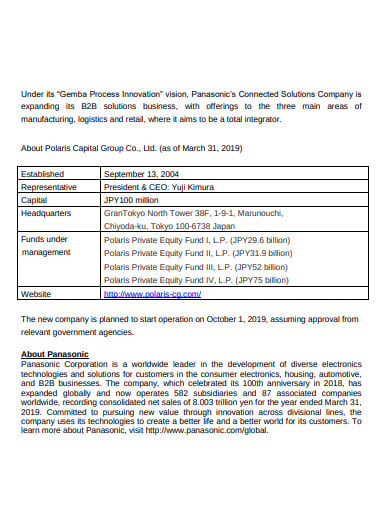

oecd.org7. Free Strategic Equity Investment Agreement Template

panasonic.com

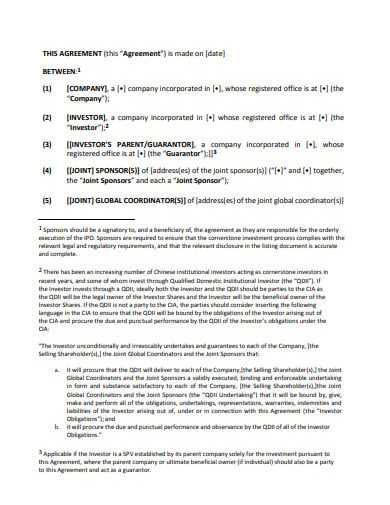

panasonic.com8. Free Cornerstone Equity Investment Agreement

asifma.org

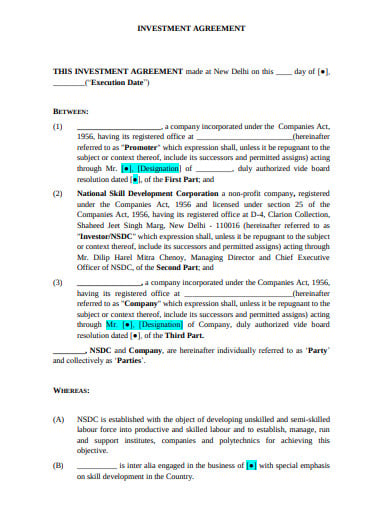

asifma.org9. Free Company Equity Investment Agreement Template

nsdcindia.org

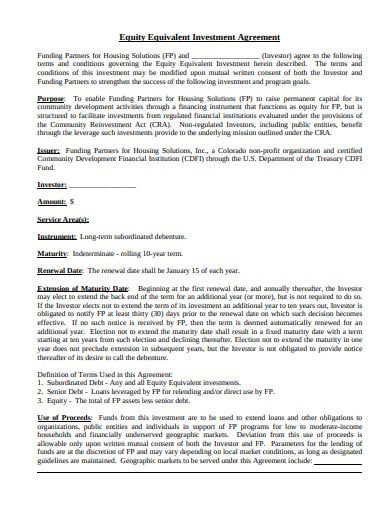

nsdcindia.org10. Free Equity Equivalent Investment Agreement

cdfifund.gov

cdfifund.gov11. Free Project Equity Investment Agreement Template

minerals.com

minerals.com12. Free Advisor Equity Investment Agreement Template

fi.co

fi.co13. Free Equity Investment Agreement Template

cornell.edu

cornell.eduHow Does Equity Fundraising Work?

During the underlying phase of raising money, you’ll decide a particular valuation of your organization. At the end of the day, you’ll choose what your business is worth around then. As per your organization’s valuation and the measure of cash a financial specialist provides for your organization, they will claim a level of stock in it. When your organization opens up to the world or sells, it will get back remuneration to a similar extent that they contributed. You can also see more on equity agreement templates.

What are the Circumstances that Prevails During an Equity Fund Raising?

Under certain conditions, value raising support bodes well. In different conditions, it is the main practical alternative for business. You can also see more on equity templates. A couple of these circumstances include:

- Your organization needs quite a while to build up itself. Only one out of every odd organization will begin delivering salary when it’s propelled. Some may put in two or three years in the negative before creating a salary. That doesn’t mean the organization isn’t feasible. If you need a huge piece of activity money to run your organization before it starts turning a benefit, value ventures are the sort of capital that bodes well. You can also see more on business investment agreements.

- Your organization has zero guarantees. Loan specialists expect borrowers to offer something of significant worth as guarantee on the off chance that they can’t take care of their obligation. On the off chance that you can’t offer a moneylender that security, your best-raising money choice is to find value financial specialists who consent to take a risk with your organization. On the off chance that the business falls flat, they will have lost their speculation. You can also see more on restaurant investment agreements.

- You can’t bootstrap. Most speculators anticipate that you should dispatch your business before you contribute, regardless of whether it’s simply from your carport or extra room. Nonetheless, a few organizations (a personal yacht line, for instance) require monstrous subsidies just to begin.

- Huge development is up and coming. Value capital speculators will in general put resources into organizations and businesses that have the potential for enormous development and exponential returns. You can also see more on investment agreements in Pages.

What are the Possible Failures while Making an Equity Investment?

- Like all types of raising support, Equity Investment has two focal points and weaknesses. One of the most valuable attributes of equity investment is that not normal for standard bank financing, it doesn’t require any customary installments. Speculators anticipate a future chance to money out a lot of the benefits. Another bit of leeway is that value financial specialists (particularly those known as “heavenly attendant speculators”) can offer important counsel and direction that will bolster the development of your business. What’s more, it’s regularly simpler to procure early speculations from your loved ones since they share your fervor in your prosperity. You can also see more on startup investment templates.

- Then again, tolerating speculation assets from loved ones may make strain in the connections, particularly if you can’t offer an arrival on their ventures. Finding the correct speculator may likewise take significantly more time and exertion than applying for credit. Long haul business confusions may likewise exist when you take value venture. If you hand over a huge piece of value in your organization, you surrender your elite power over both present and future business choices. You can also see more on construction investment proposal templates.

- There are circumstances when more than one gathering is keen on the responsibility for a single property. In such circumstances, a value-sharing understanding is drafted. This understanding gives the privilege to responsibility for property at least two gatherings. The included gatherings share the proprietorship among them where the down payment is made by at least one financial specialist. The person who possesses the house should pay the month to month costs. You can also see more on investment proposals.

How to Make an Equity Share Agreement incase of Buying a Property?

Mention the Details of the Parties

Before you can begin settling on the land understanding, you first need to talk and examine it with all the included gatherings. Every one of them ought to consent to agree and ought to know about the subtleties of such an agreement. When this has been finished, you can proceed onward to settle on the understanding. The primary thing you have to remember for the understanding is the title of the record, for example, the ‘Land Equity Share Common Agreement’. This ought to be trailed by subtleties of the gatherings associated with the understanding. Such an understanding, by and large, incorporates multiple gatherings. The names, locations, and full contact subtleties of the gatherings.

Mention the Details of the Property

After you have embedded every one of the subtleties of the included gatherings, you have to give the subtleties of the property in the following area. This property is the one where every one of the gatherings is keen on sharing proprietorship. The compulsory subtleties of the property that will be incorporated are the name or title of the property, the area, the number of units, the kind of property, and the name, address, and contact subtleties of the first proprietor. You can also see more on Property Management Agreement Templates.

Provide the Valuation and Equity Split Clause

The valuation of the property alludes to the present market cost of the property. This sum is essential to be incorporated as commonly the market cost of the property diminishes after the property has been purchased once. The value split statement is the most significant condition of understanding. This sample statement decides what number of offers each gathering will get. As indicated by the inclination of the gatherings, the value sum can be haggled and afterward chose. When these components are prepared, you have to enter them in understanding.

Mention the Earnest Money and the Purchase Price

The price tag of the property is the credit sum that the first proprietor of the domain had paid when the property had been purchased. If the property doesn’t have a past proprietor, the price tag will that value that the included gatherings pay to purchase the property. The sincere cash is comprehensive of the price tag. It is the sum paid by the gatherings to show the vender that they are not kidding about purchasing the property. You can also see more on Purchase And Sale Agreement Templates.

Provide a Non-Compete Clause

The last simple statement that should be remembered for the understanding is the non-contend provision. This statement is set up to help the gatherings purchasing the property. Such a provision expresses, that the property might be possessed by the individuals consenting to the arrangement. The proprietorship can’t be assigned to some other outsider. This proviso likewise expresses the results that will be looked at by the gathering who out of nowhere chooses to move in the opposite direction from the understanding. You can also see more on Sample Agreements.