Table of Contents

- Agreement Template Bundle

- Business Agreement Template Bundle

- 10+ Guaranteed Investment Agreement Templates in PDF

- 1. Investment Agreement Template

- 2. Business Investment Agreement Template

- 3. Restaurant Investment Agreement Template

- 4. Investment Contract Agreement Template

- 5. Investment Banking Agreement Template

- 6. Guarantee for Equity Investments Agreement Template

- 7. Guaranteed Investment Agreement Template

- 8. Sample Guaranteed Investment Agreement Template

- 9. Guaranteed Investment Contract Agreement Template

- 10. Flex Pay Guaranteed Investment Agreement Template

- 11. Guaranteed Investment Client Agreement Template

- What is the Difference Between a U.S Guaranteed Investment Contract and a Canadian One?

- What are the Key Features of Guaranteed Investment Contract Agreements?

- Who Takes Care of Guaranteed Investment Contract Agreements?

- The Risks of Owning Guaranteed Investment Contracts

10+ Guaranteed Investment Agreement Templates in PDF

A guaranteed investment agreement or a contract (GIC) is an insurance agency arrangement that ensures a pace of return in return for keeping a store for a specific period. A GIC claims to financial specialists as a trade for a bank account or U.S. Treasury protections. GICs are otherwise called financing understandings.

Agreement Template Bundle

Business Agreement Template Bundle

10+ Guaranteed Investment Agreement Templates in PDF

1. Investment Agreement Template

2. Business Investment Agreement Template

3. Restaurant Investment Agreement Template

4. Investment Contract Agreement Template

5. Investment Banking Agreement Template

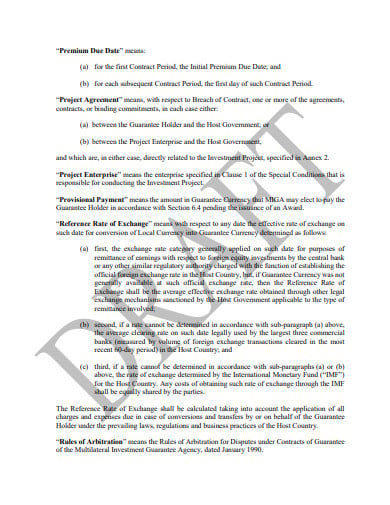

6. Guarantee for Equity Investments Agreement Template

miga.org

miga.org7. Guaranteed Investment Agreement Template

amicusinvest.com

amicusinvest.com8. Sample Guaranteed Investment Agreement Template

eban.org

eban.org9. Guaranteed Investment Contract Agreement Template

desjardins.com

desjardins.com10. Flex Pay Guaranteed Investment Agreement Template

desjardins.com

desjardins.com11. Guaranteed Investment Client Agreement Template

rbcroyalbank.com

rbcroyalbank.comWhat is the Difference Between a U.S Guaranteed Investment Contract and a Canadian One?

A guaranteed investment agreement contract, sold in the U.S. also, similar to a bond in structure, varies from a Canadian ensured speculation testament which has a similar abbreviation. The Canadian endorsement, sold by banks, credit associations and trust, has various characteristics. Americans gave GICs pay a higher loan cost than most bank accounts. Be that as it may, they stay among the most minimal rates accessible. The lower premium is because of the solidness of the speculation. Less loss likens to bring down profits for intrigue installments.

What are the Key Features of Guaranteed Investment Contract Agreements?

- An ensured guaranteed investment agreement contract (GIC) is an understanding between a financial specialist and an insurance agency.

- The backup plan ensures the speculator a pace of return in return for holding the store for a period.

- Financial specialists attracted to GICs regularly search for a substitution for an investment account or U.S. Treasury protections.

- A GIC is moderate and stable speculation, and development periods are typically present moment.

- GIC qualities might be influenced by expansion and flattening. A fund development plan makes a lead of what the organization needs to do to guarantee its money related wellbeing.

Who Takes Care of Guaranteed Investment Contract Agreements?

- Protection suppliers, offer GICs which ensure the proprietor a reimbursement of head alongside a fixed or skimming financing cost for a foreordained period. The speculation is traditionalist and development periods are regularly present moment. Financial specialists who buy GICs regularly search for steady and reliable comes back with low unpredictability.

- A backup plan, for the most part, advertises GICs to establishments that fit the bill to get great duty statuses, for example, places of worship and different strict associations. These associations are charge absolved under area 501(c)(3) of the expense code, because of their charitable and strict nature. Much of the time the backup plan will be the organization that deals with a retirement or annuity plan and offers these items as a moderate speculation alternative.

- Regularly, the supporters of benefits plans will sell ensured speculation contracts as annuity ventures with development dates running from one to upwards of 20 years. At the point when the GIC is a piece of a certified arrangement as characterized by the IRS Tax Code, they may withstand withdrawals or be qualified conveyances and not acquire charges or punishments. Qualified plans, which enable a business to take charge conclusions for commitments it makes to the arrangement, incorporate conceded installment plans, 401(k) and some Individual Retirement Accounts (IRAs).

The Risks of Owning Guaranteed Investment Contracts

- The word ensured in the term ensured to investment or venture contracts—GIC can be deluding. Likewise, with all speculations, financial specialists in GICs are presented to venture losses. Speculation chance is the opportunity that a venture may lose esteem or even become useless.

- Financial specialists face similar dangers related to any corporate commitment, for example, with testaments of the store (CDs) and corporate securities. These dangers incorporate organization bankruptcy and default. Should the safety net provider fumble resources or opt for non-payment, the acquiring foundation may not get the arrival of the head or intrigue installments.

- The GIC may have resource backing from two potential sources. The backup plan may utilize general record resources, or a different record separated from the organization’s general assets. The different record exists only to give subsidizing to the GIC. Notwithstanding the source giving the advantage backing, the insurance agency proceeds to possess the contributed resources and remains at last answerable for sponsorship the venture.