44+ Simple Rental Agreement Templates – PDF, Word

Legally mandatory documents that are required to be signed by both the parties are the simple rental agreement templates. These…

Aug 02, 2024

For people who are living on their small businesses, a company is the biggest asset, because the modest profit it brings is the one providing food on their tables and that of their staff’s. For some, a coffee shop, an small restaurant, a secondhand bookshop, or a clothing boutique might be their only source of income and their day to day lives depend on its existence and the loyal customers who patronize their product. Suffice to say, their company is their wealth. Especially if they’ve had it in a great part of their lives. You may also see trust agreement templates.

Businessmen can be quite sentimental when it comes to their company. They would stick with it through thick and thin and at times, will refuse point blank to give it up, with their unwavering confidence that it will see the bad times through and walking away is never an option.

trustee.ietf.org

rhpl.org

Keeping it running and protecting it from too much debt would be their biggest priority so instead of having a sizable amount of money kept in the bank and some other financial investments, they often prefer putting their money on projects that took long hard years of blood, sweat, and tears to build.

While these type of endeavors may be paved with nothing but good intentions, it can still cause problems when those they leave behind have smart goals or get a higher value on an open market for a business that declares its owner deceased.

mnumf.org

Whichever it is, there is still a likely chance of them inheriting mostly non-liquid assets but they would need money for payment of estate and inheritance taxes for the liquid funds. Cases like this could see heirs conducting what is known as “fire-sale” of the company to account for the estate tax bill. Either that or a tax juggernaut may pressure them to sell and give up the business instead of sticking up for it and continuing the legacy of the late owner. For a wider selection of professional agreement templates, check out more options here.

You can avoid such complex situations for your beneficiaries if you make sure that your money and the rest of your assets, no matter how small of a value you think it holds, by protecting it through trusts. You don’t want a lifetime’s worth of hard work to go to waste even if you will not be around to see it fade to nothing. Or you probably would only want your investments distributed your way if you think it’s time to close the door for managing it yourself. Maybe concerned about children with special needs that would be left behind for not having enough funds to take care of their basic and medical needs after your death. You may also see free rental agreement templates.

A financial trust is your best chance at ensuring that your loved ones or your hard earned money is secured and properly looked after, long after you have gone. It’s only fair to protect your assets after spending years of days and days of toiling through your simple business, making sure both customers and your staff get their due. It’s only fair.

ok.gov

epa.ohio.gov

americanbar.org

dnr.mo.gov

Planning your trust to protect your assets is down to the cards being taken off the table in good times so that you don’t end up empty-handed even when you lose, because bad times can happen just as much as good times can, in any company. People who take heed and pay attention to protecting their assets often see themselves as the receiving end of lawsuits; brokers, investors, obstetricians, etc.

Then again, even regular people also get caught in complicated situations. No one is really safe. And doing nothing to protect anything you think is worth protecting financially, doesn’t help your case, at all. Thus, setting trusts should at least be an option. You may also like participation agreement templates.

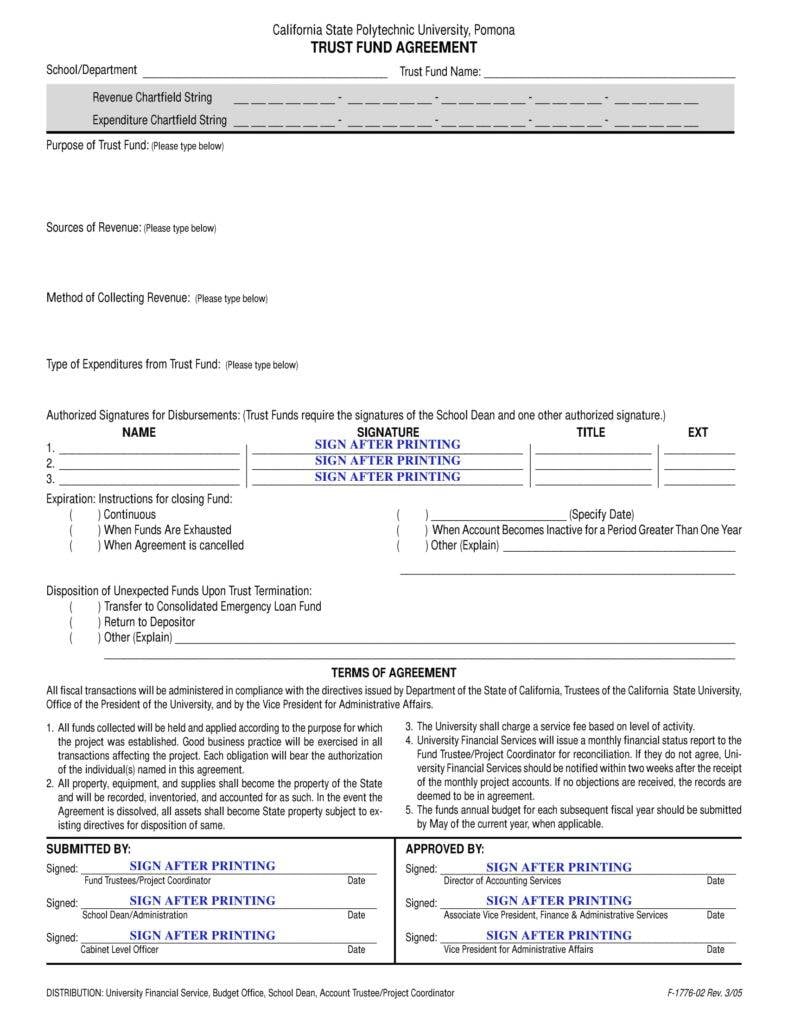

A trust is a legal agreement by three parties that allows you as the “trustor” to transfer your property and assets to your beneficiaries. Beneficiaries can be individuals, businesses, or a non-profit organization whose causes you support. It gives you the right to place your assets under a trustee’s control, an individual or organization managing and distributing the assets as indicated in the trust document with your specific instructions on how your assets should be distributed. There are four main types of trusts and it is important that you know the difference so you would be able to choose the one that works best for you.

This is a trust made by the trustor during his or her lifetime and managed by a trustee who has the legal duty to take care of the trust and makes sure it falls on the best interests of the beneficiary designated by the one who settled the trust which is sometimes also called a “grantor.” Upon the death of the trustor, the assets will go to the beneficiaries as outlined in the agreement. This, however, shouldn’t be a replacement for a will because unlike someone’s last will and testament, a living trust takes effect while the trustor still lives and the trust doesn’t have to undergo certain court processes for it to be distributed to the beneficiaries when the trustor dies. You may also see personal confidentiality agreements.

This one is established by a person’s last will and testament naming the trust as the beneficiary. A testamentary is not the whole will but a provision in the will, instructing the estate’s executor to make the trust. In this case, even though the trust is created while the person is still alive, the trust doesn’t take effect until after his death. And even then, the will must still be examined for its authenticity before the testamentary trust can be created. After which the trustee will oversee the transfer of property into the trust. You may also like word confidentiality agreement templates.

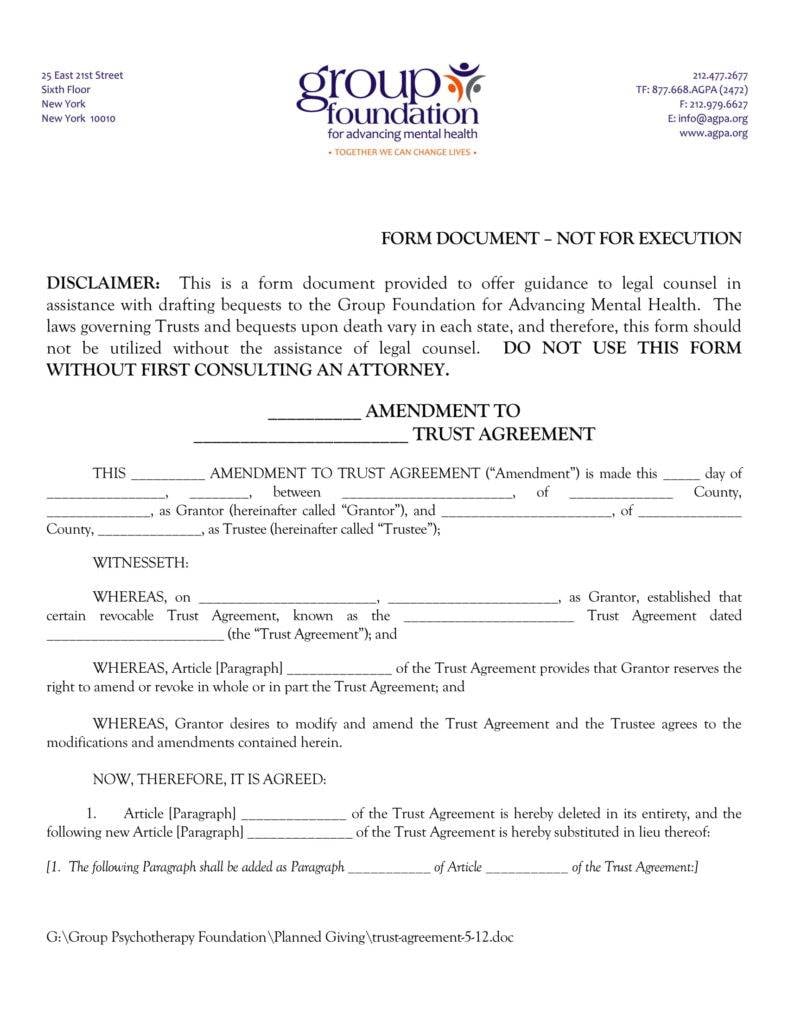

A revocable trust is a trust in which provisions can be changed or even canceled depending on what the grantor decides. Income earned is transferred to the grantor in the life of the trust, and only after his death will the property and assets get distributed to the beneficiaries. An agreement like this allows for more flexibility and income to the trustor who is still alive thereby allowing him to adjust the trust provisions and still earn with the knowledge that his estate will go to someone else upon his death. you may also see license agreement templates.

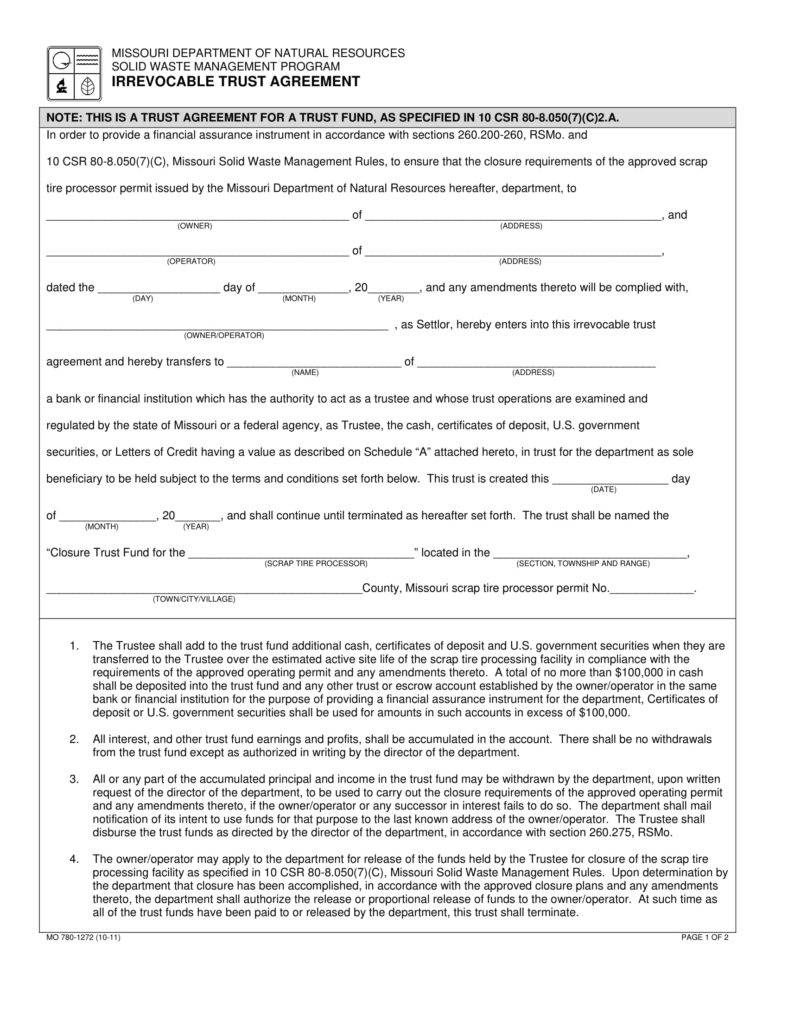

The exact opposite of revocable trust, this agreement cannot be altered or canceled without the knowledge or permission of the intended beneficiary. Upon transferring assets into the trust, it is understood by all parties that the trustor revokes all ownership rights he has over the assets and the trust. In short, he is rendered powerless in any wish to modify the trust, once this takes effect. Find more agreement format templates by visiting this link.

Knowing all of them would allow you to explore your options, should you be planning to create a trust agreement anytime soon. Any of the four benefits a trustor only when he knows what it entails. Unless you have no idea which one suits you best, according to your property and assets, both business and private or personal, you should seek the advice of a lawyer. Lest you want to live the rest of your days unsure of what would happen to all the things you have worked hard for when you finally bid this world goodbye. It also helps if businessmen don’t confuse a trust with a will and an insurance. Explore a variety of agreement layout templates here.

In establishing a trust, the trustor drafts an agreement, usually according to how he or she wishes to have his or her assets get distributed or transferred, and when he or she already has a beneficiary in mind. The contract would indicate what the trust covers, which property that the trust covers and their respective beneficiaries, with the names of all parties and instructions detailing the holding and investment of the property and income if there is any. A trust covers the management of different assets. From real estate, insurance policy, money, stocks, and shares to business, while the trustor is still alive or after he is deceased.

The moment it takes effect, the trustor’s rights to what he owns would no longer be valid. He doesn’t own his assets anymore because they become the property of the trust. This is why a trust is considered an altogether separate entity. The trustee then fulfills his fiduciary responsibility, in which case he would have to act with no bias towards all of the beneficiaries and ensures all transactions work to the best interests of those to which the assets will be transferred. Trustees must also keep tabs on all transactions and keep a documentation of all trust activity, including the filing tax returns and make payments to the IRS. Check out more work agreement templates available here.

uwyo.edu

agpa.org

treasurydirect.gov

ndhealth.gov

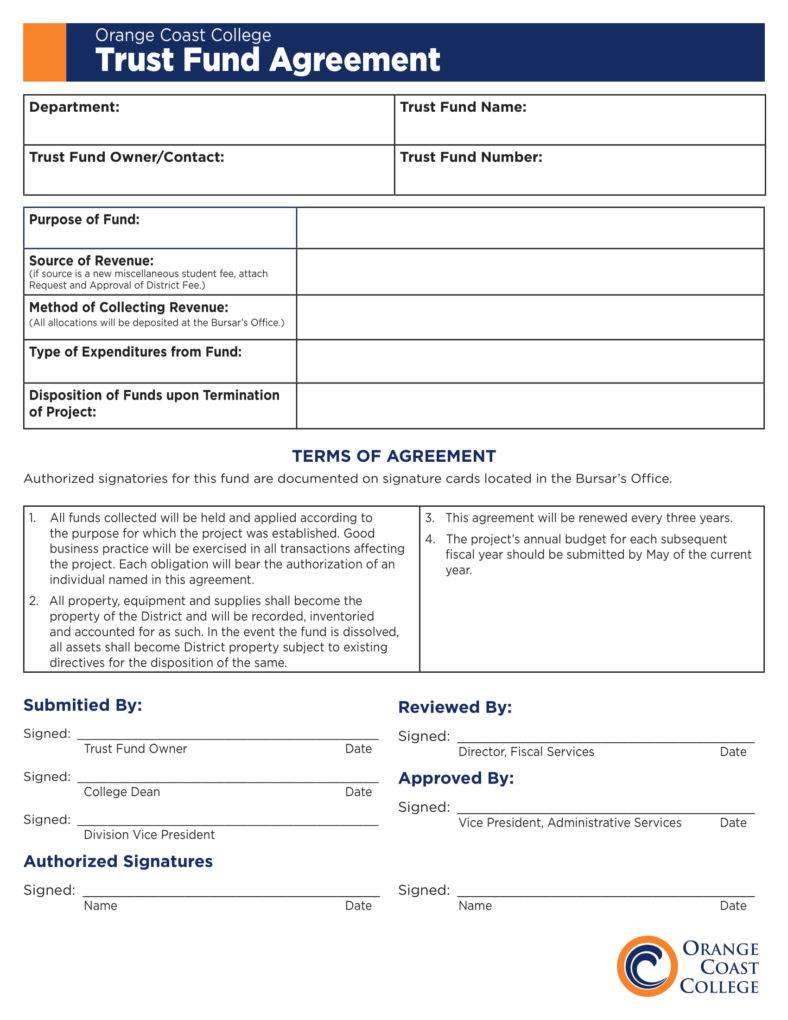

orangecoastcollege.edu

oregon.gov

Download Now

[/ns_row]

cpp.edu

Trusts are ideally for estate planning but creating them also gives small business owners lesser taxes while assets are protected from ridiculous probates. It also works as a shield for your investments so that creditors cannot just exercise unnecessary control over them while you are still alive and even after death.

If you mean for members of your family to succeed the ownership of your assets, or another buyer to get it at the right price, your business is properly screened from competitors waiting for you to walk away with almost nothing. Explore additional trust agreement templates on our website, template.net, to find a variety of options that suit your needs.

Legally mandatory documents that are required to be signed by both the parties are the simple rental agreement templates. These…

A purchase and sale agreement is a compulsory legal document to have when a buyer and seller are entering into…

Living alone or with a family has enormous risks, and the responsibilities can be complicated to manage. Become a good…

Discovering and verifying the top ability is no simple undertaking. It requires a profound comprehension of the organization’s culture and…

An agreement that occurs between two parties where one party (the recruiter or recruiting firm) is appointed by the other…

During the 1848 revolutions in Europe, the term “logistics” played a crucial role in transferring goods, equipment, and military personnel.…

The recruitment services agreement is provided by the recruitment agencies. And, that acts as the middleman or the middle-party between…

Many projects among businesses involve heavy management and great plans sample that logistics will be relevant. Operations involve proper organization…

A simple tenancy agreement is a legally binding document that outlines the terms and conditions between a landlord and a…