Finance Mergers & Acquisitions Summary Statement

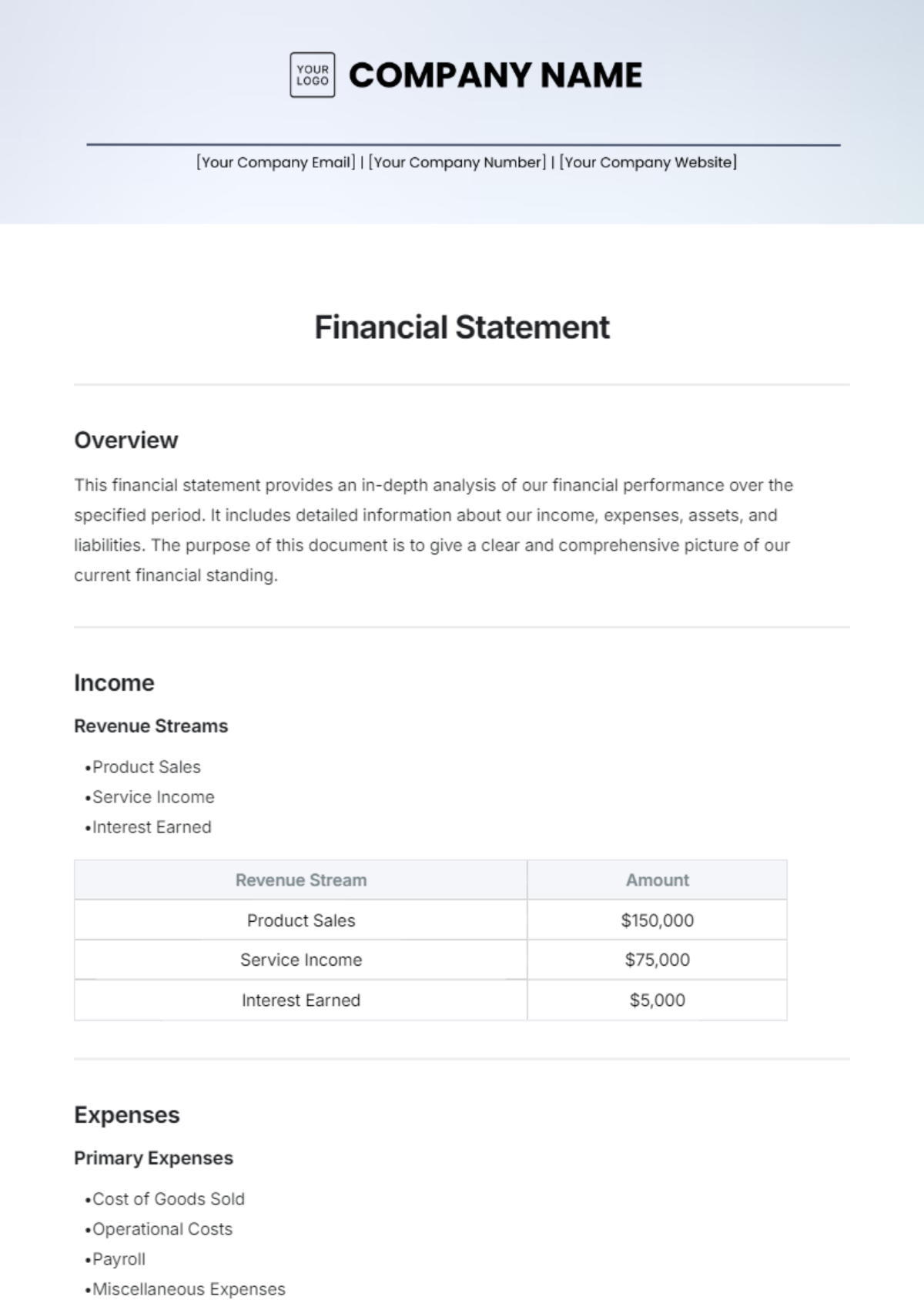

Executive Summary

We have successfully executed a strategic merger and acquisition plan, significantly enhancing our market position and financial stability. This document provides a summary analysis of the financial aspects and implications of these activities.

M&A Overview

Type of Transaction: Merger and Acquisition

Objective: Expansion of product lines and market penetration

Total Number of Transactions: 4

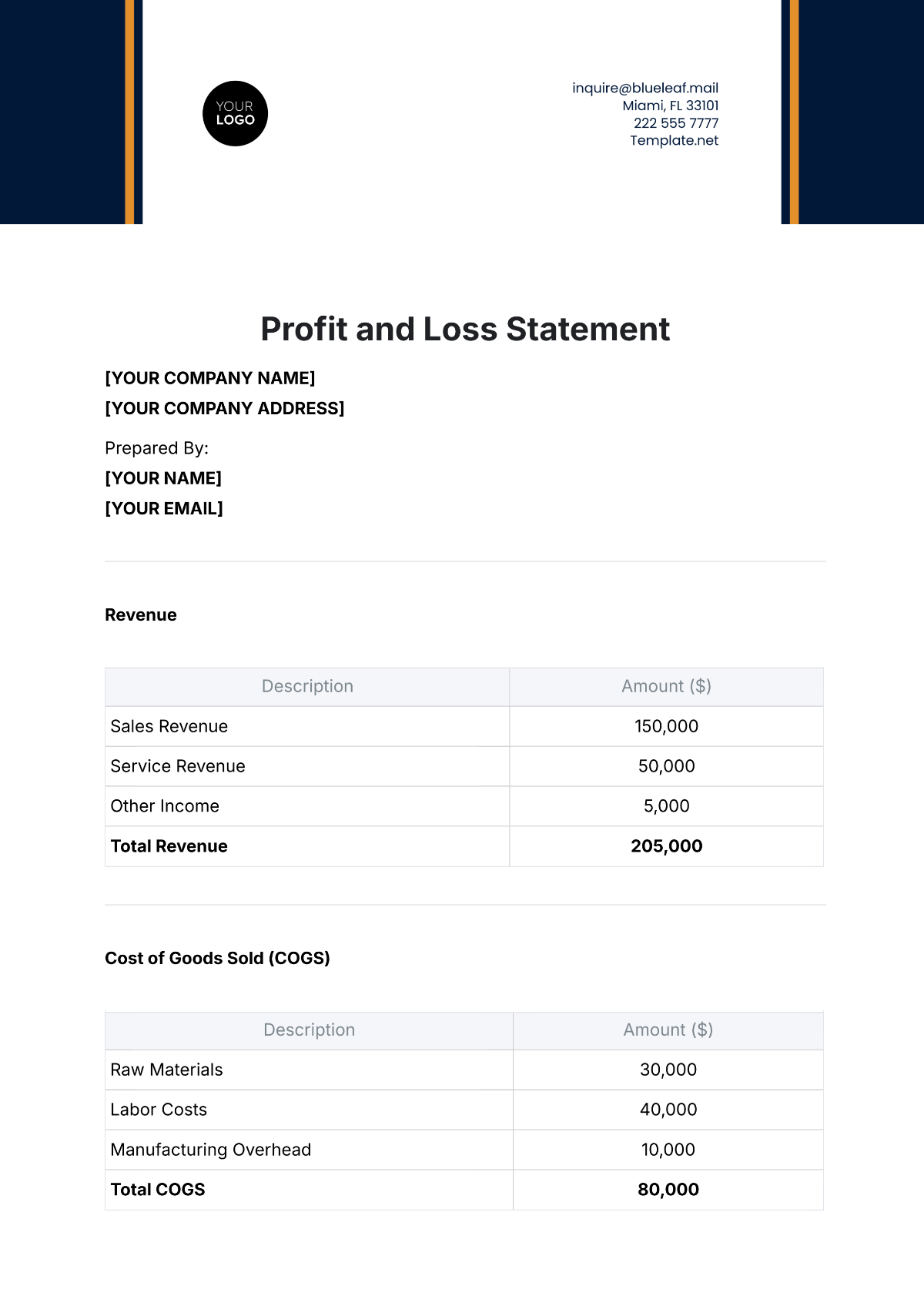

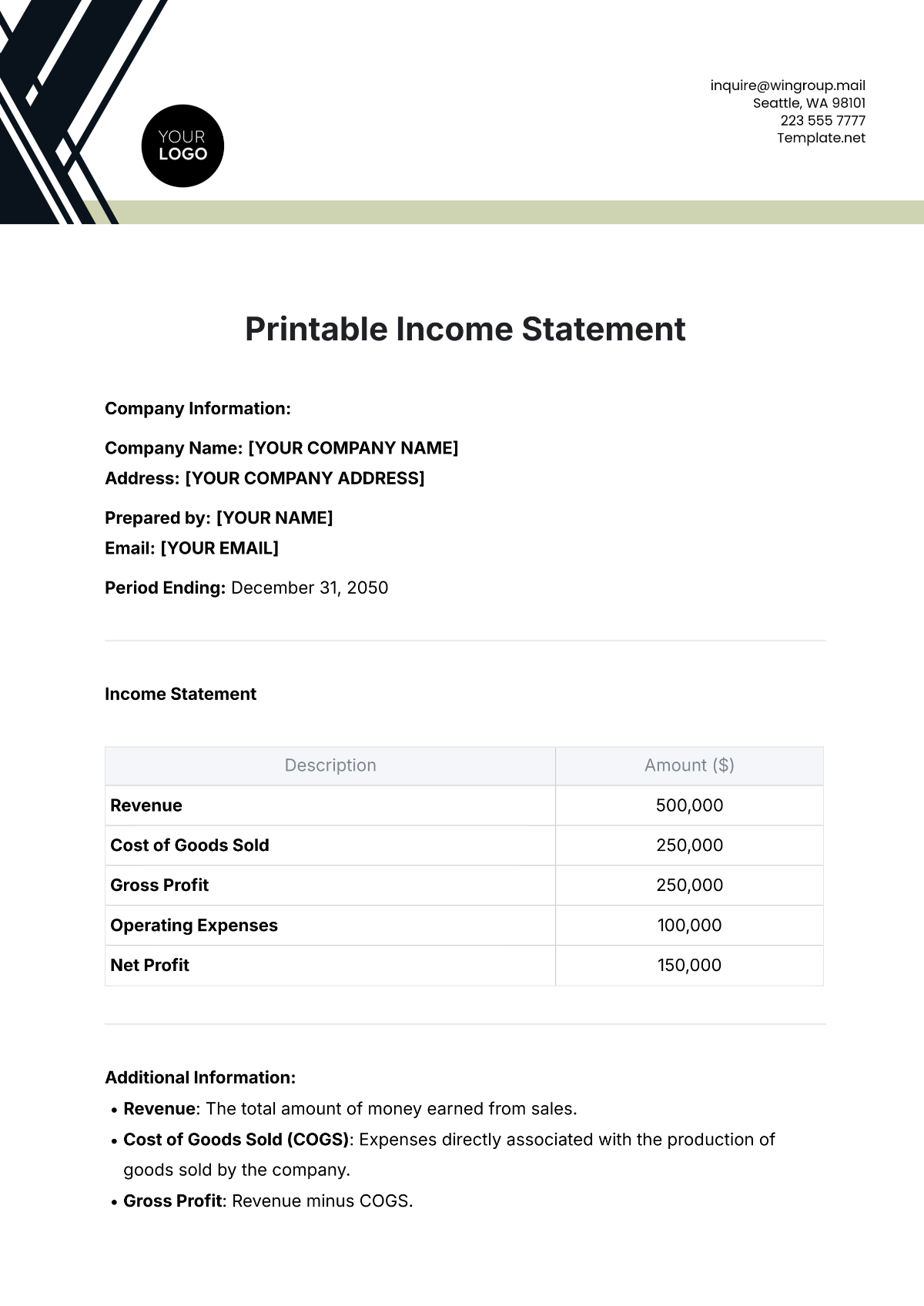

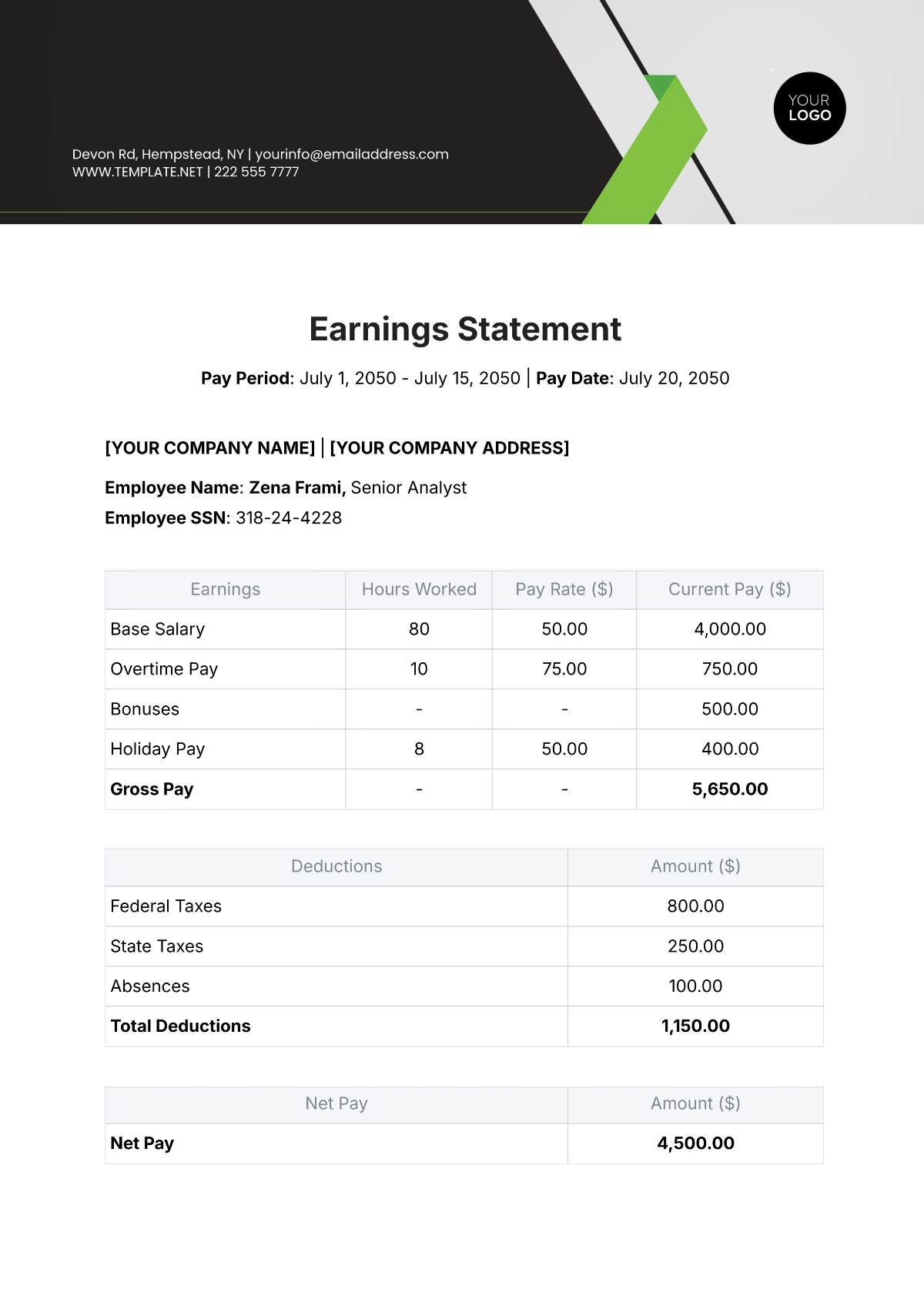

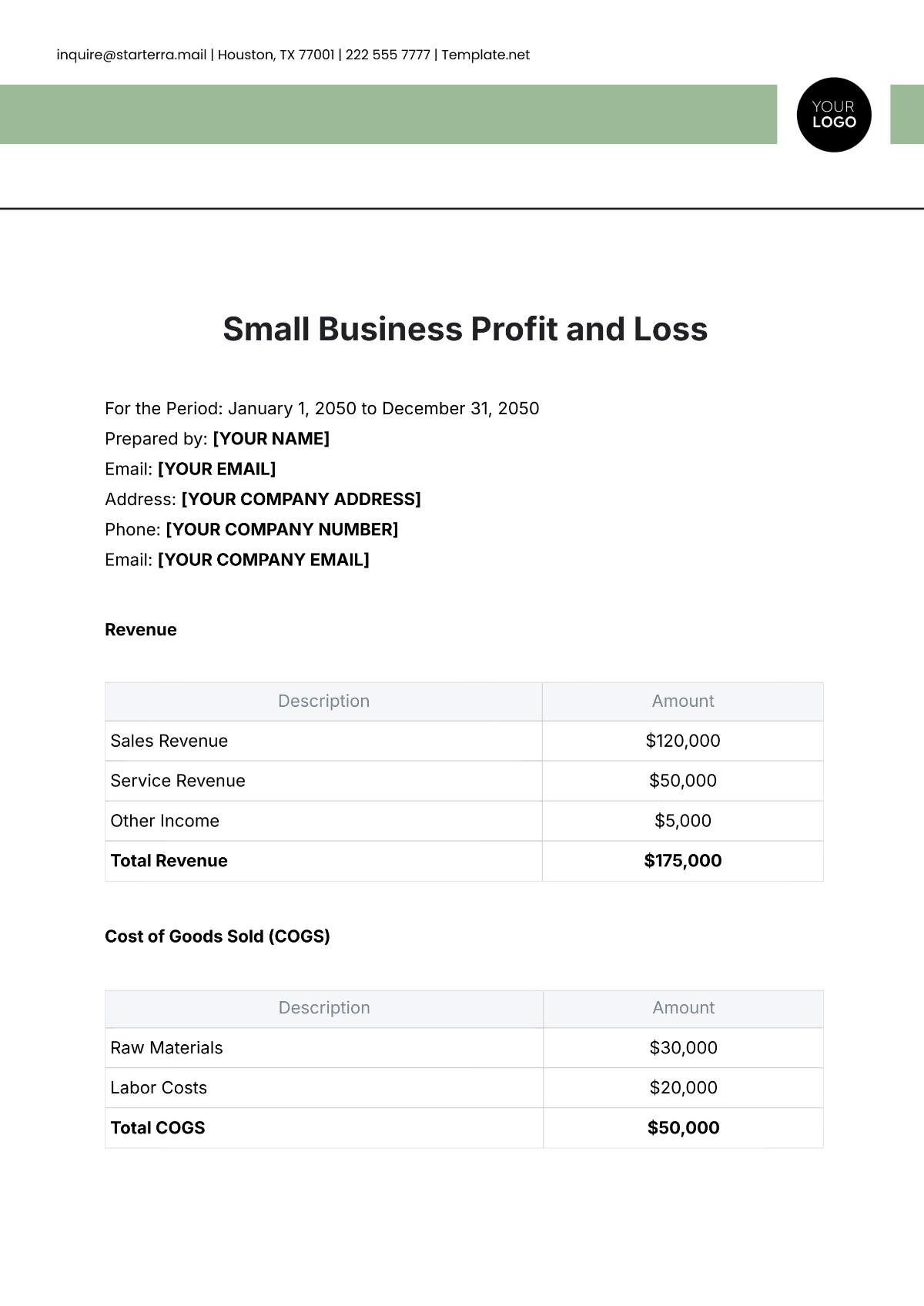

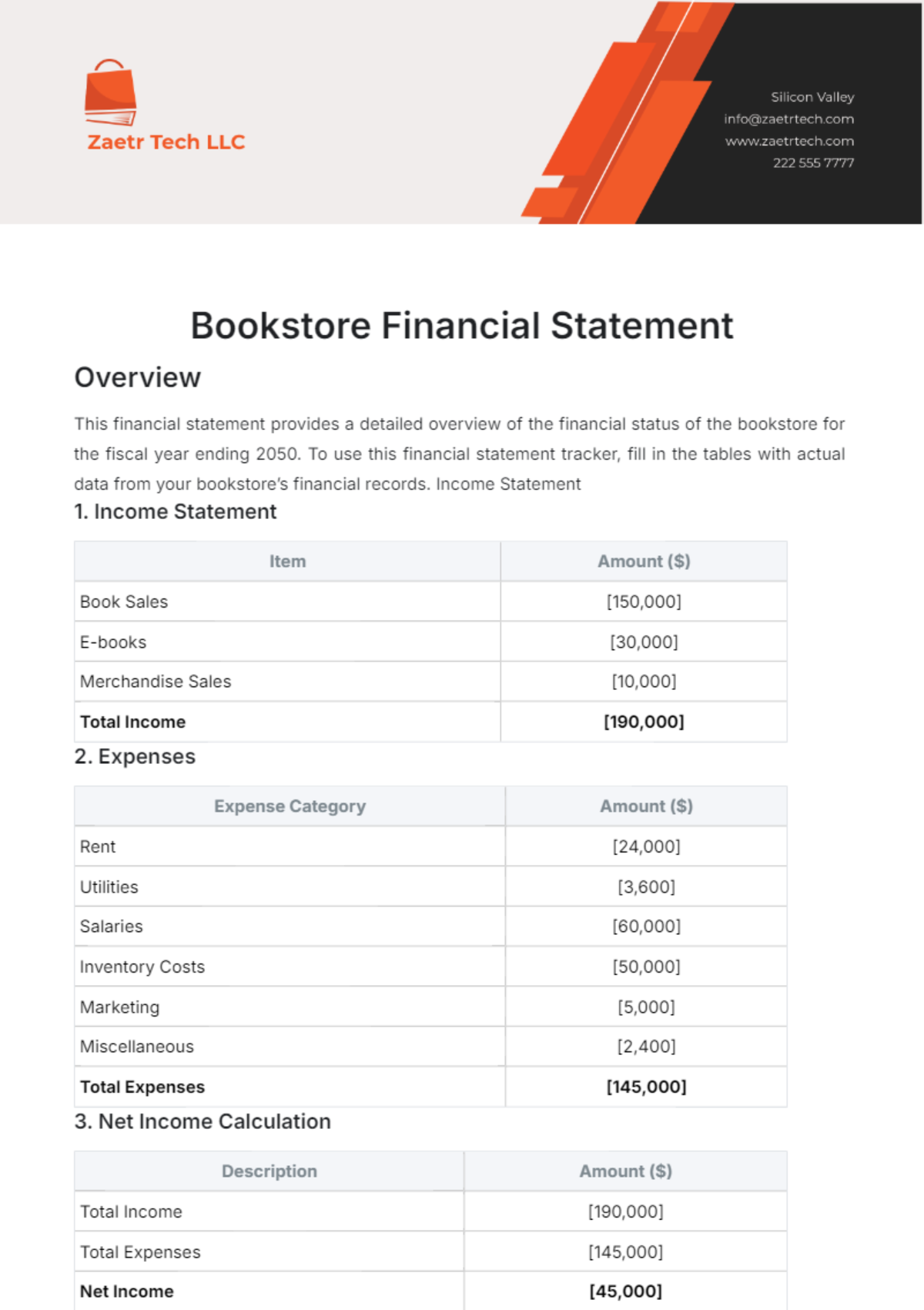

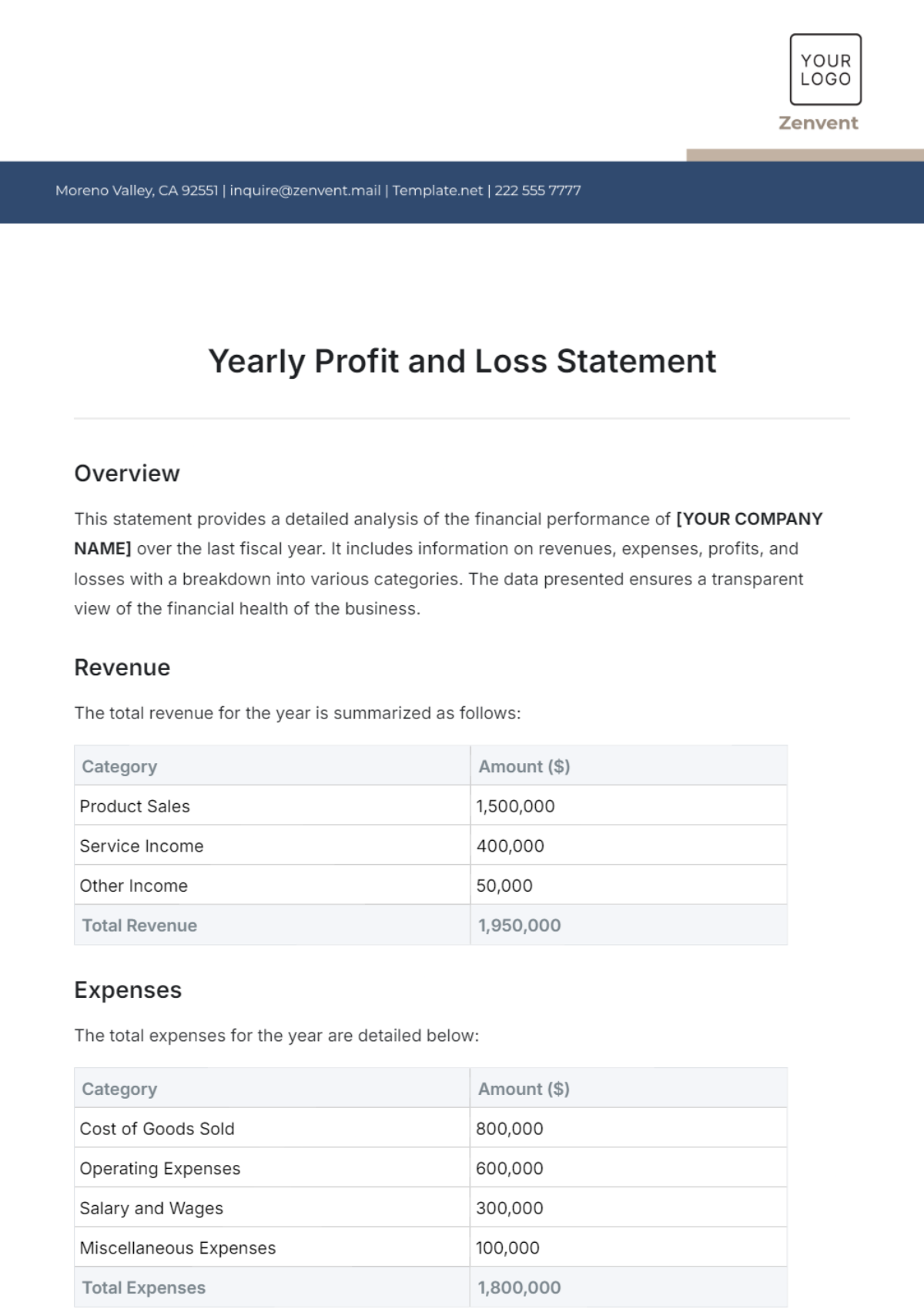

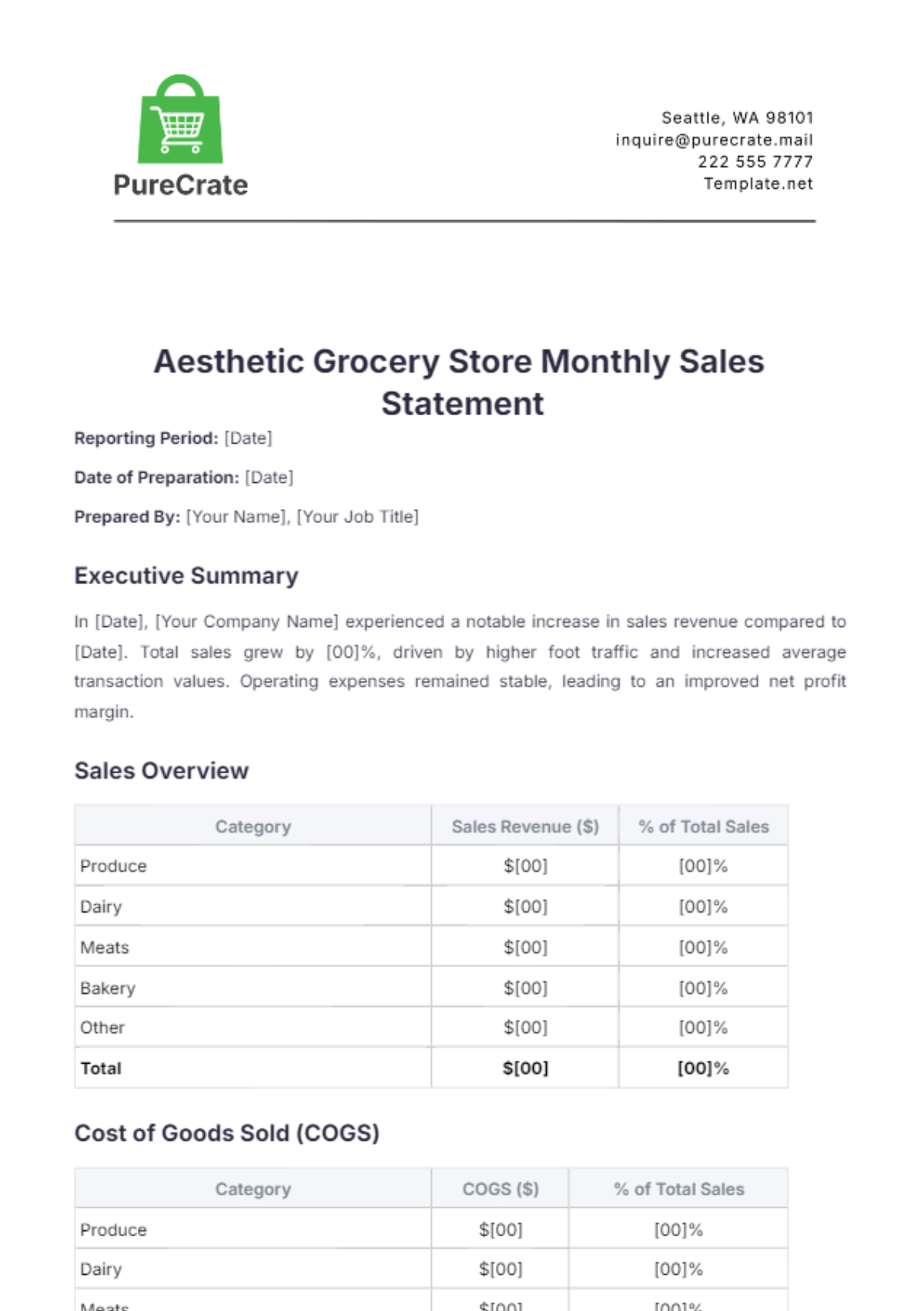

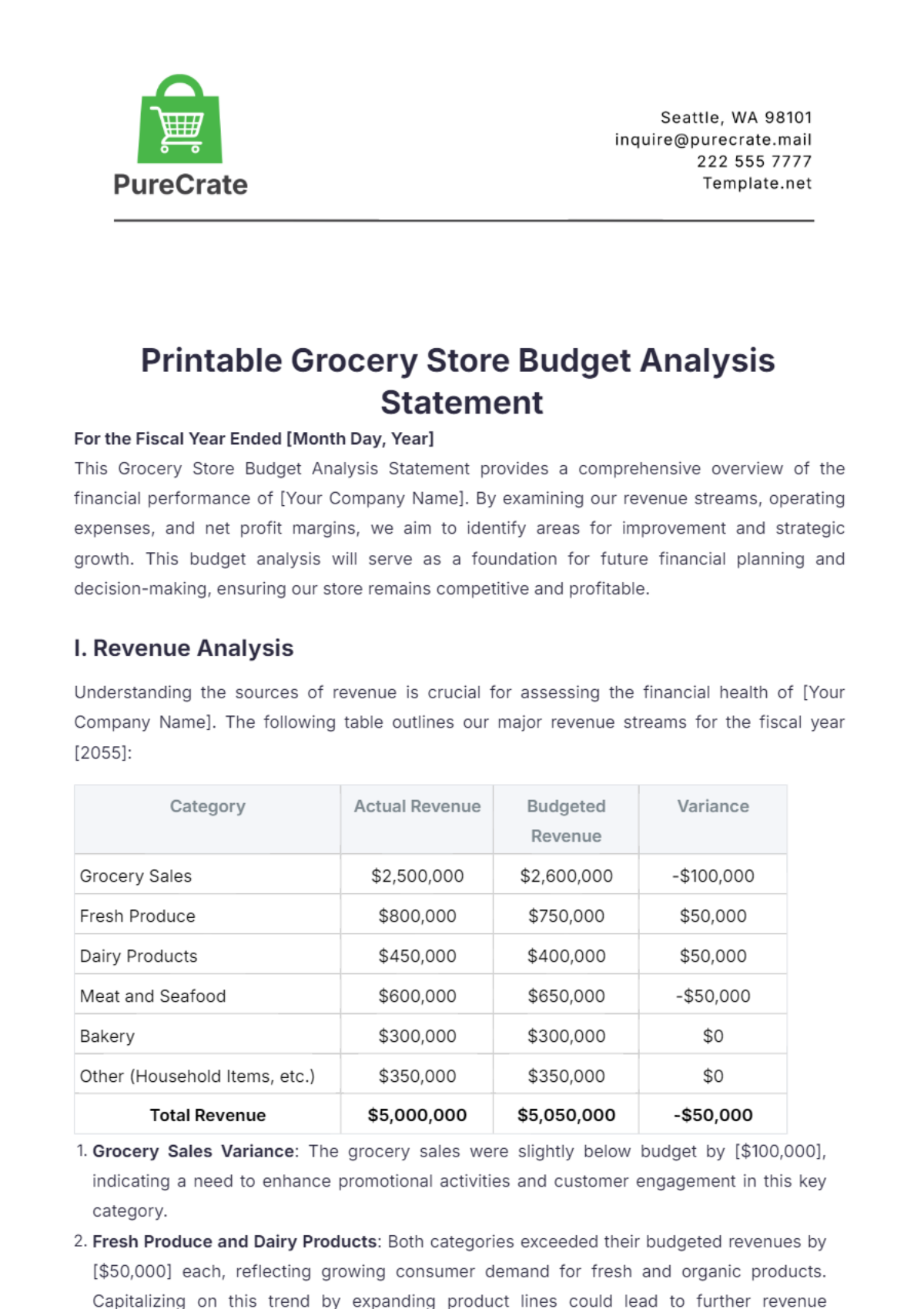

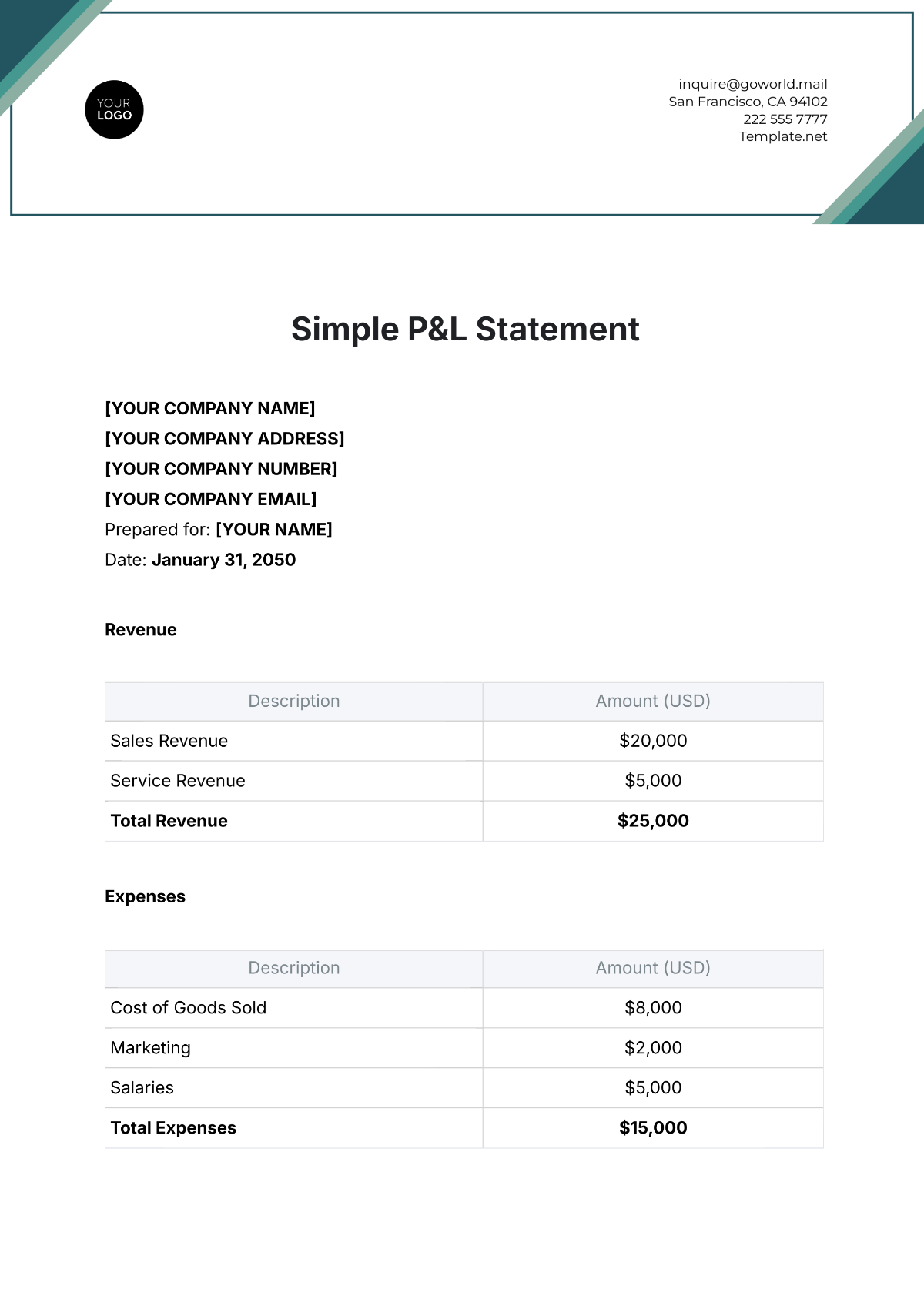

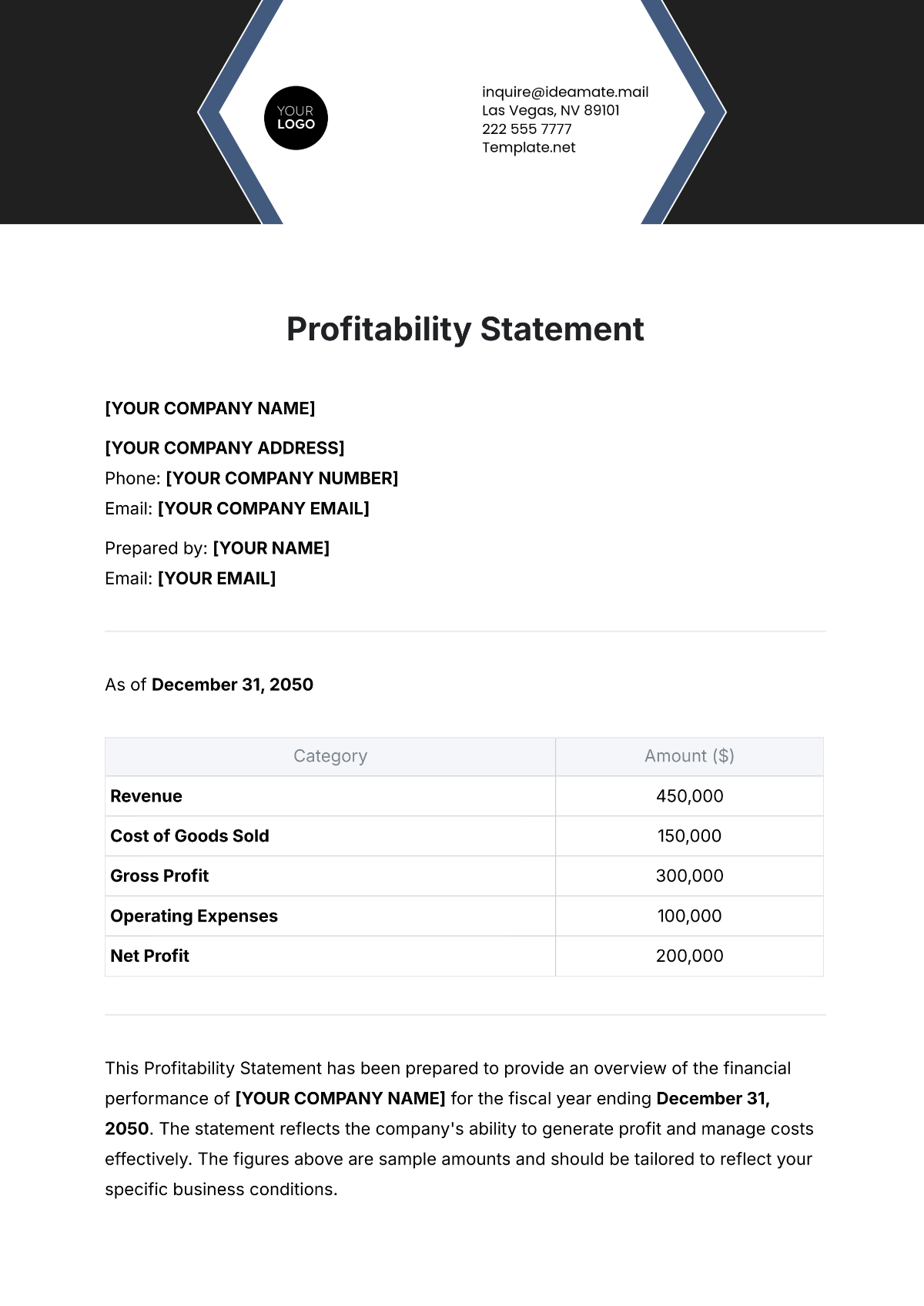

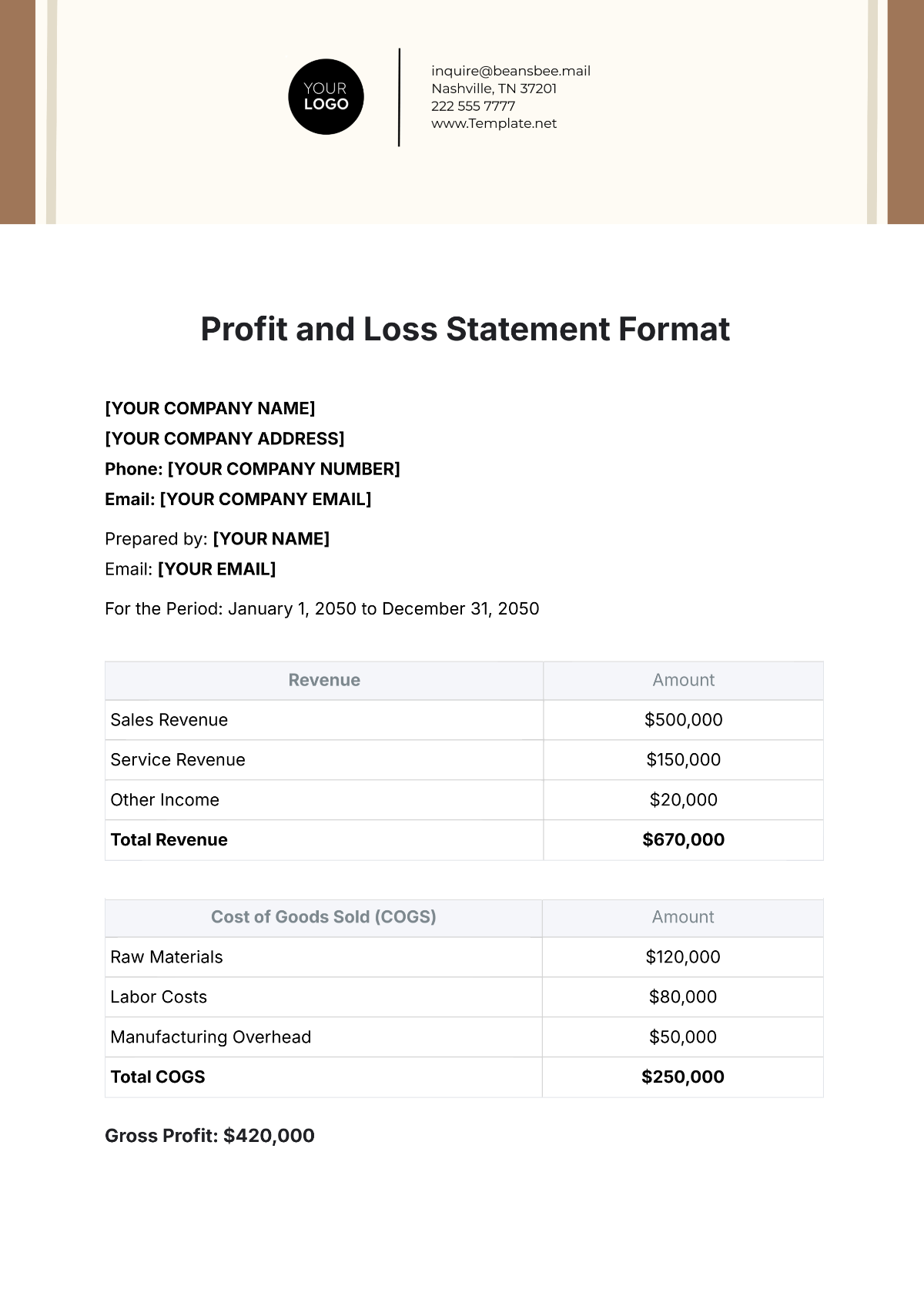

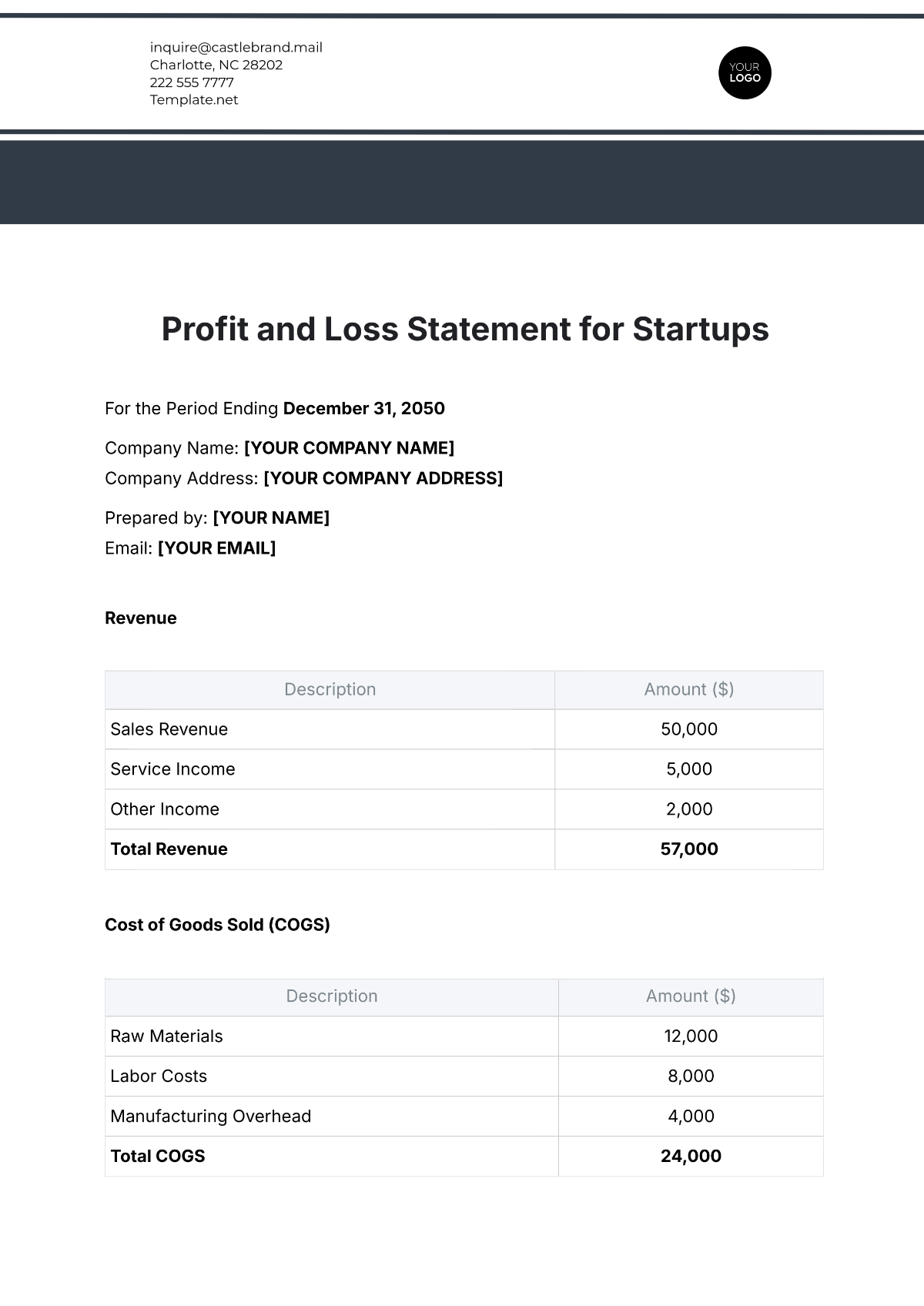

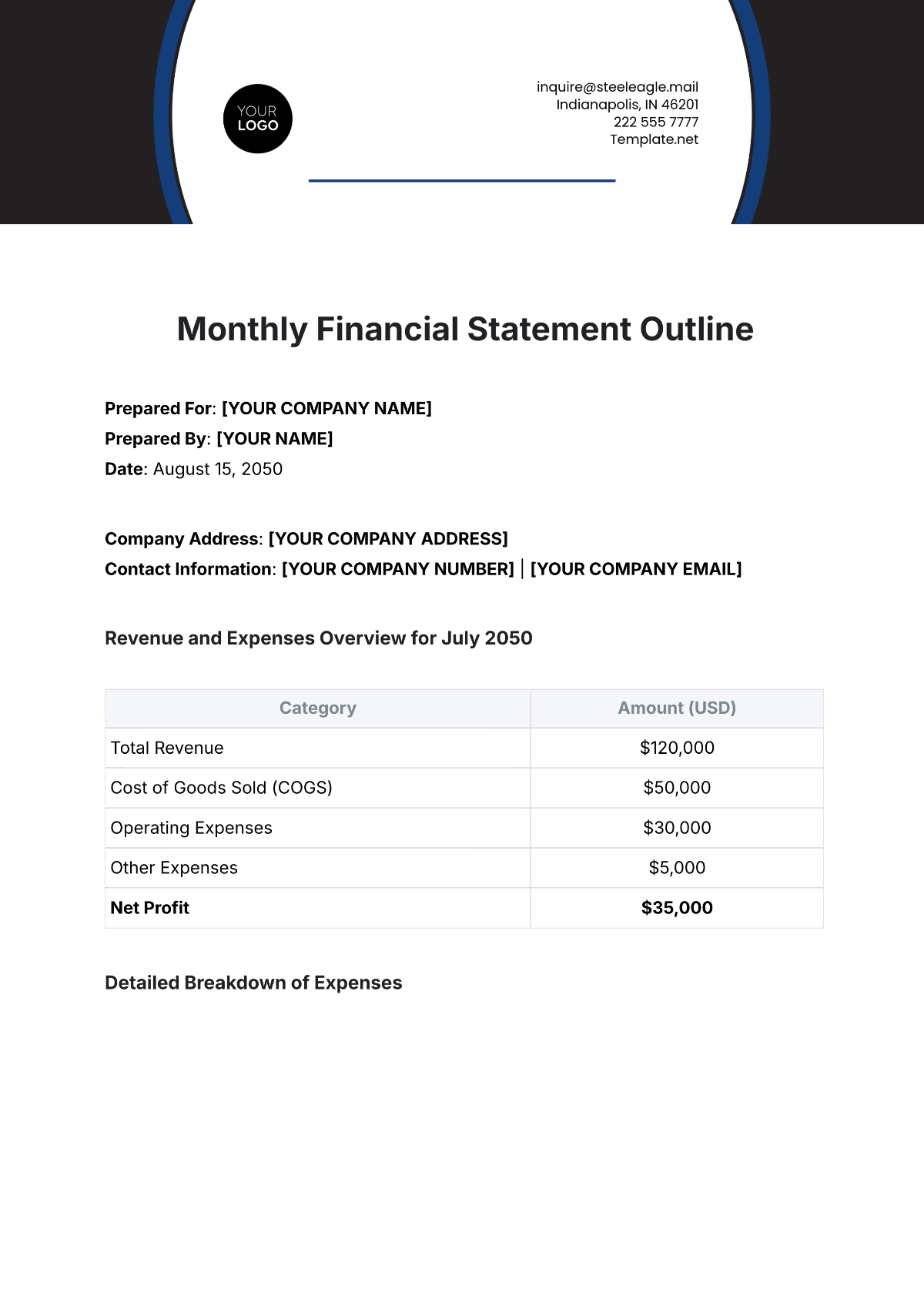

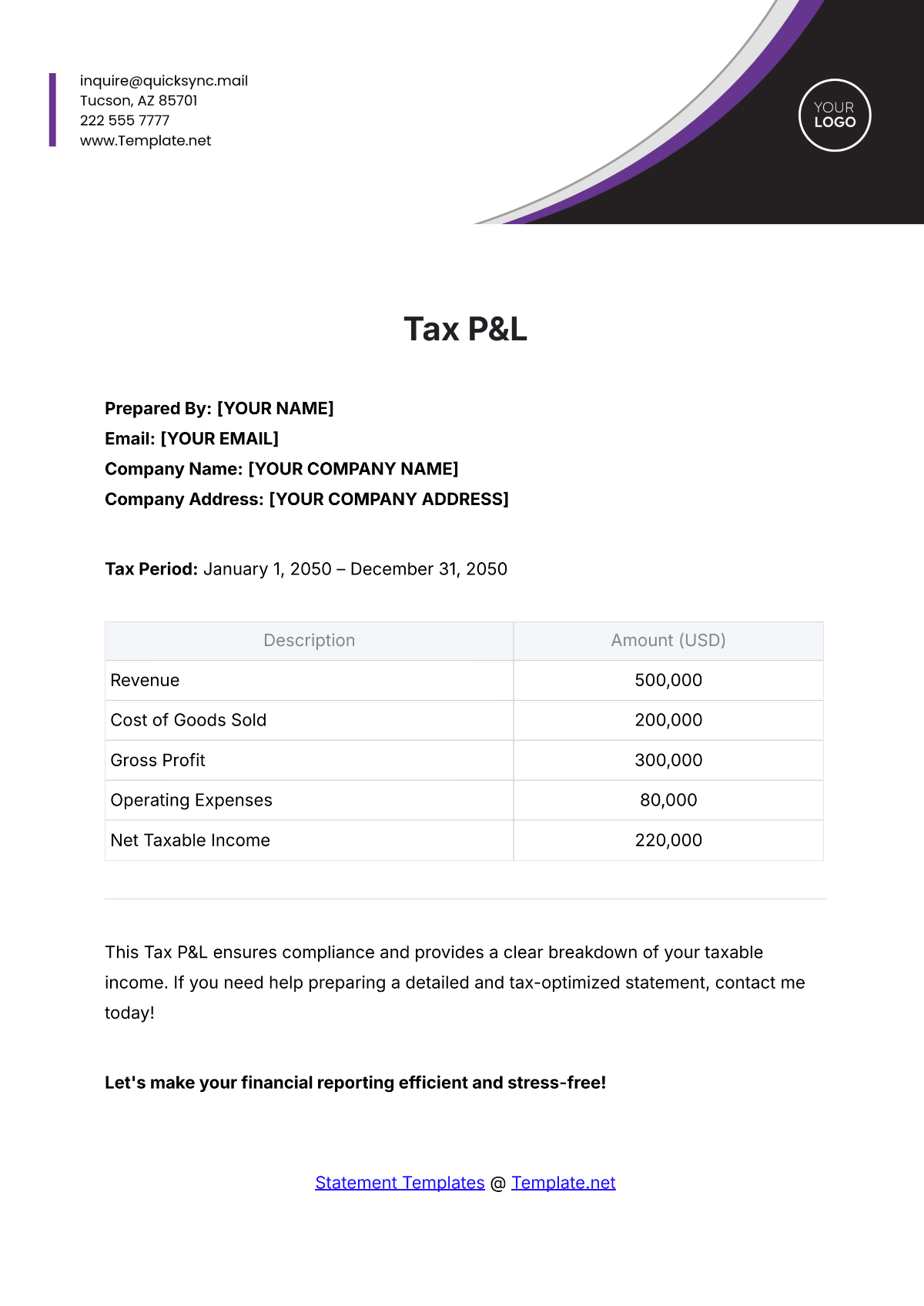

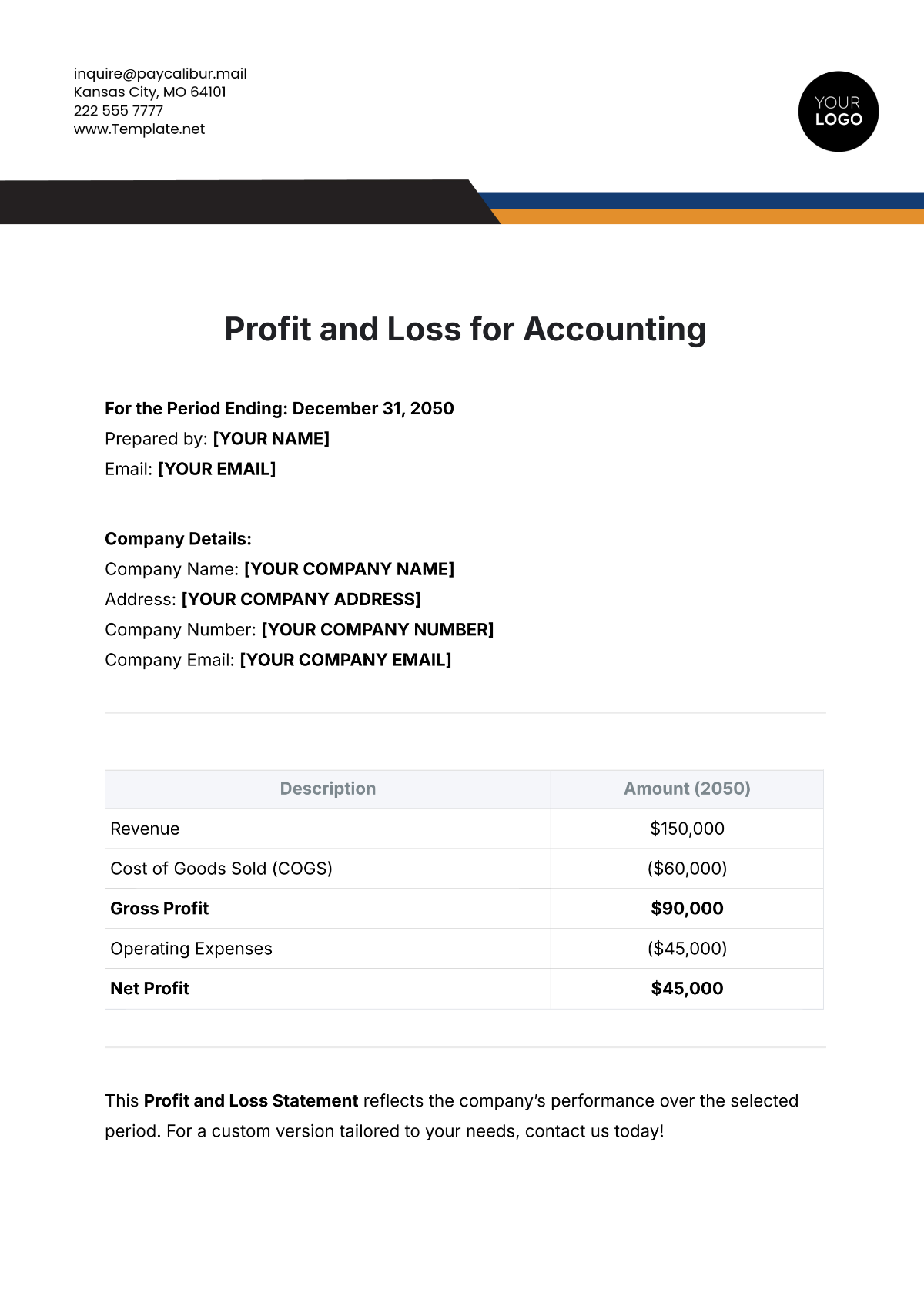

Financial Highlights

Total Investment: $500 million

Estimated Annual Revenue Increase: 20%

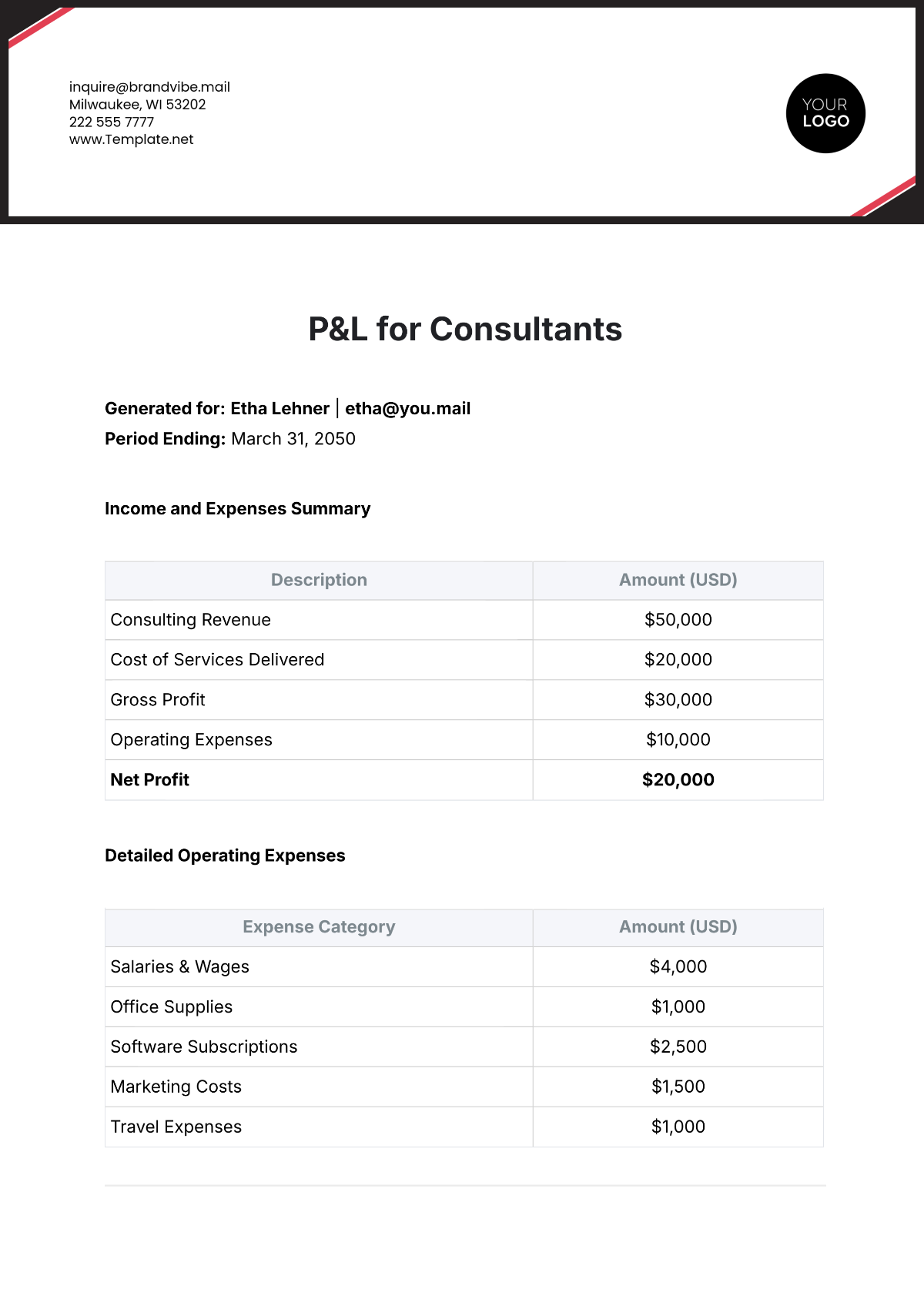

Cost Synergies Realized: $75 million annually

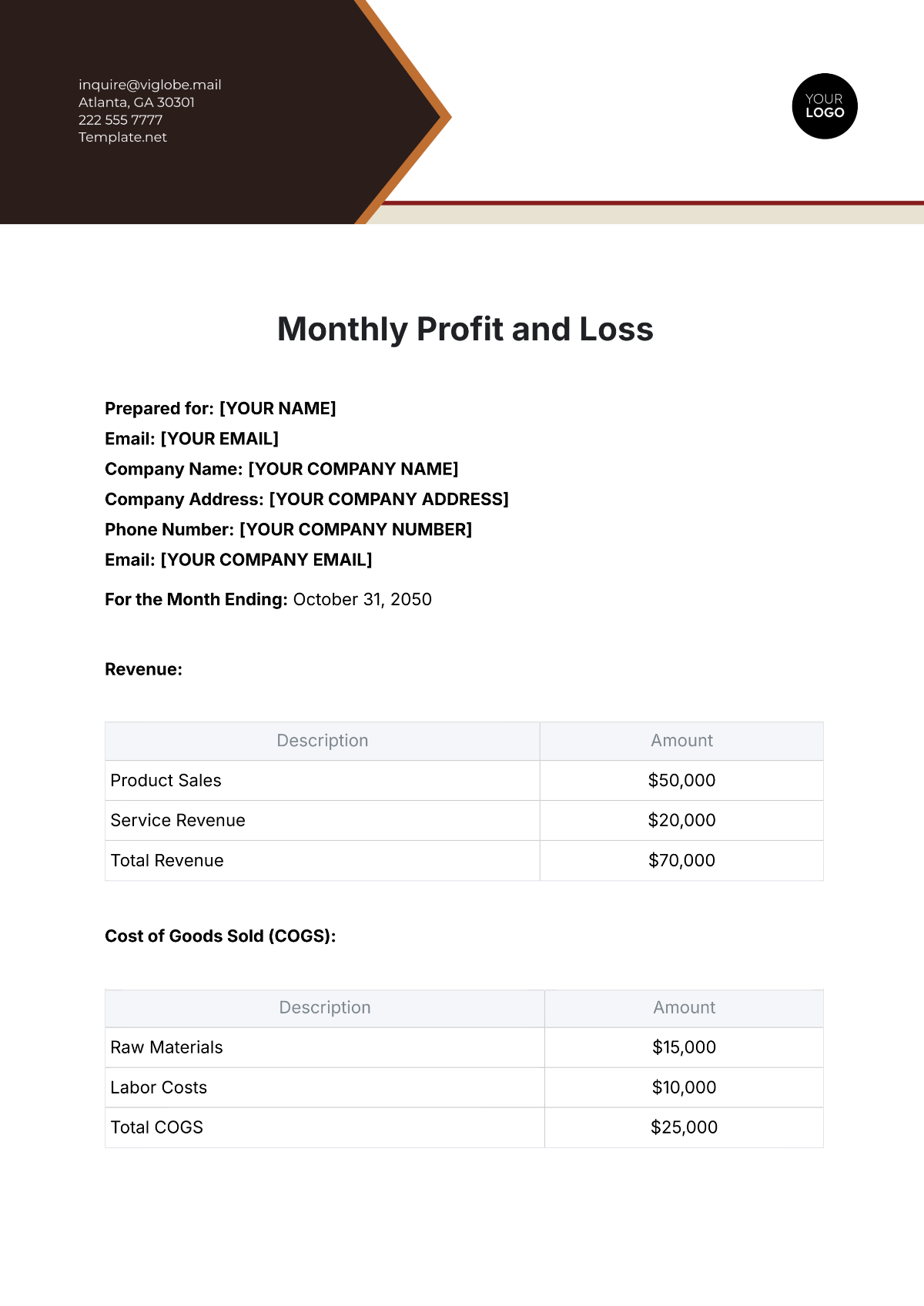

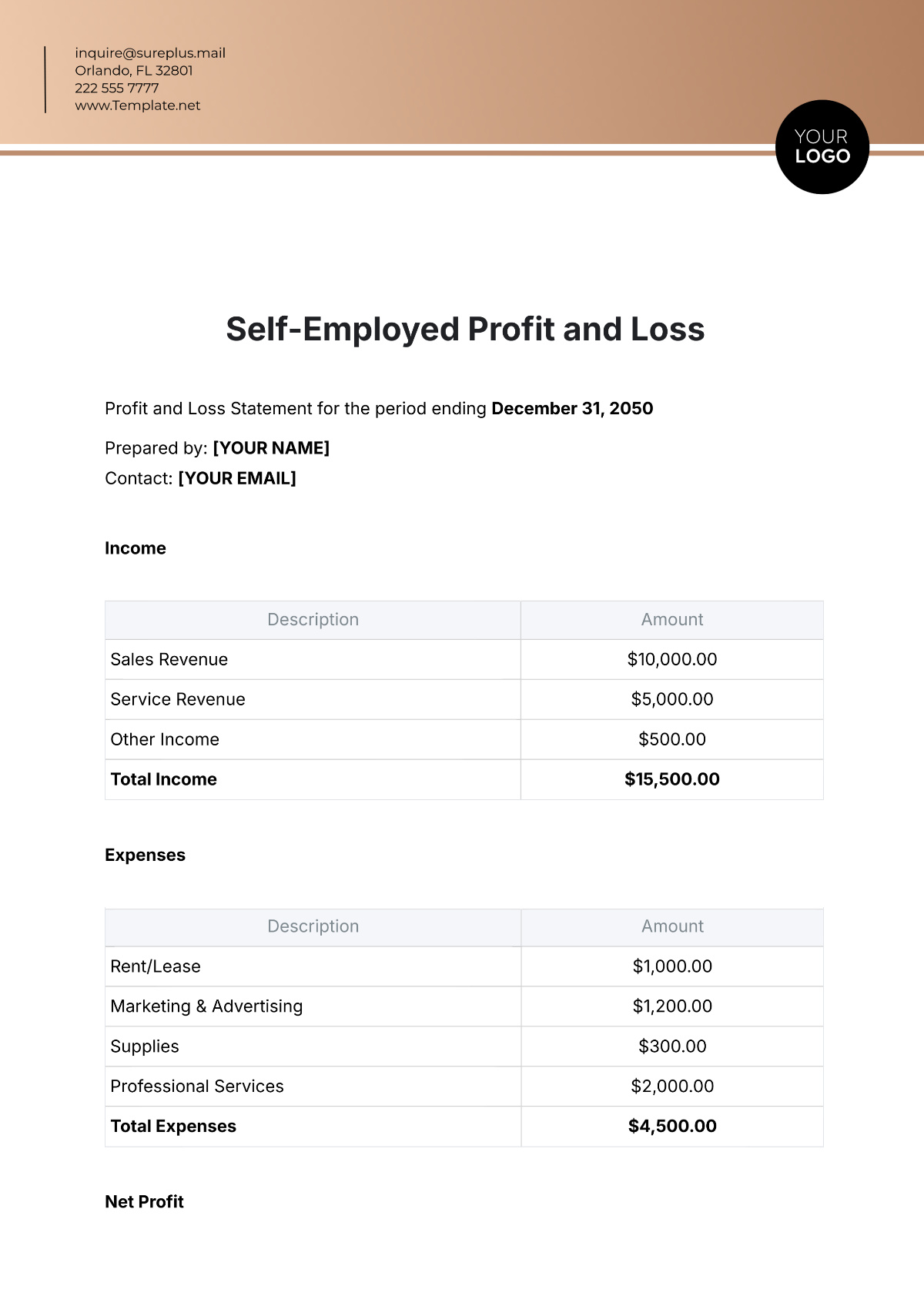

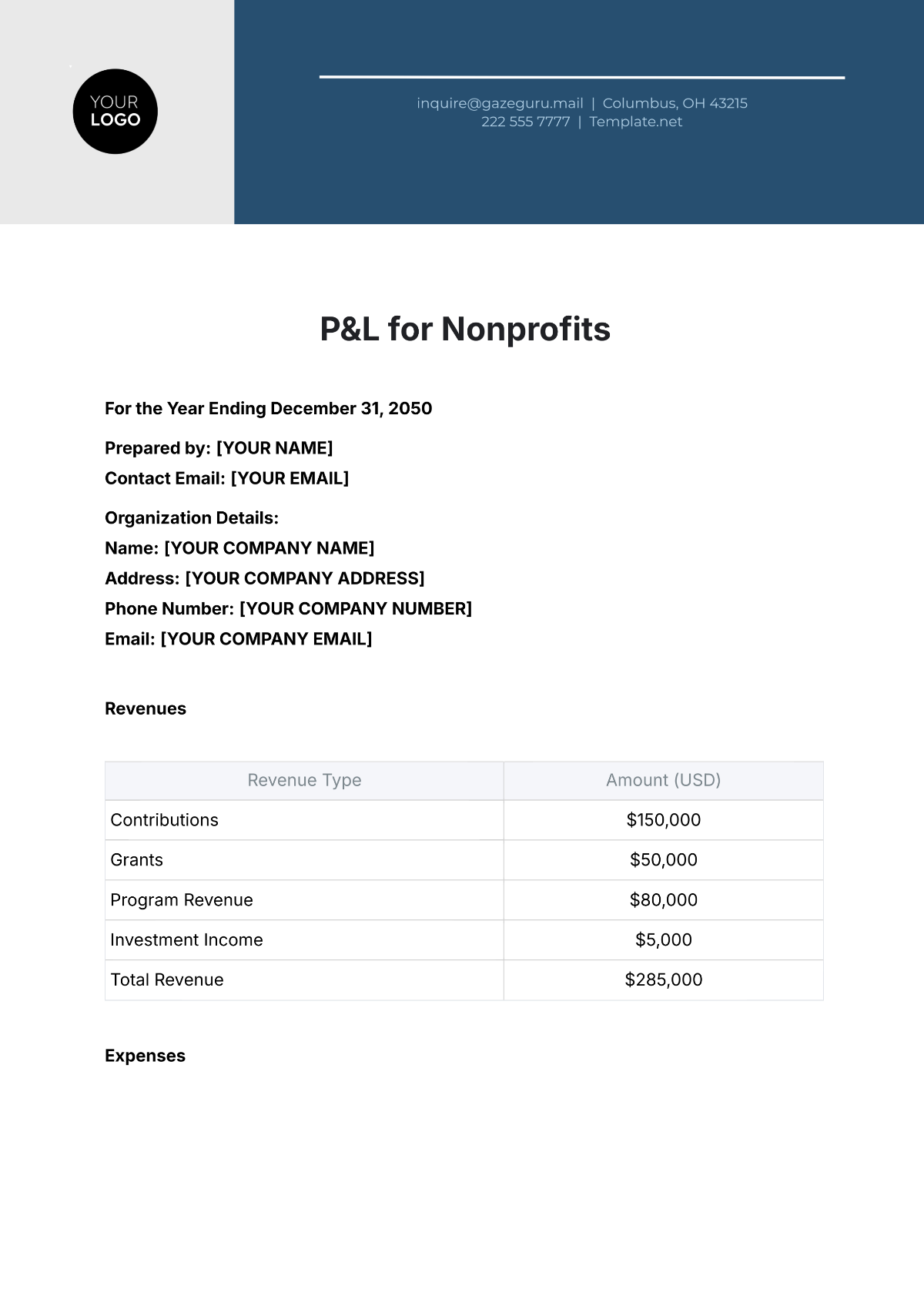

Key Transactions

Company Name | Investment ($ M) | Revenue Increase ($ M) | Cost Savings |

|---|---|---|---|

Company A | 200 | 25 | 30 |

Company B | 150 | 15 | 20 |

Company C | 75 | 10 | 15 |

Company D | 75 | 15 | 10 |

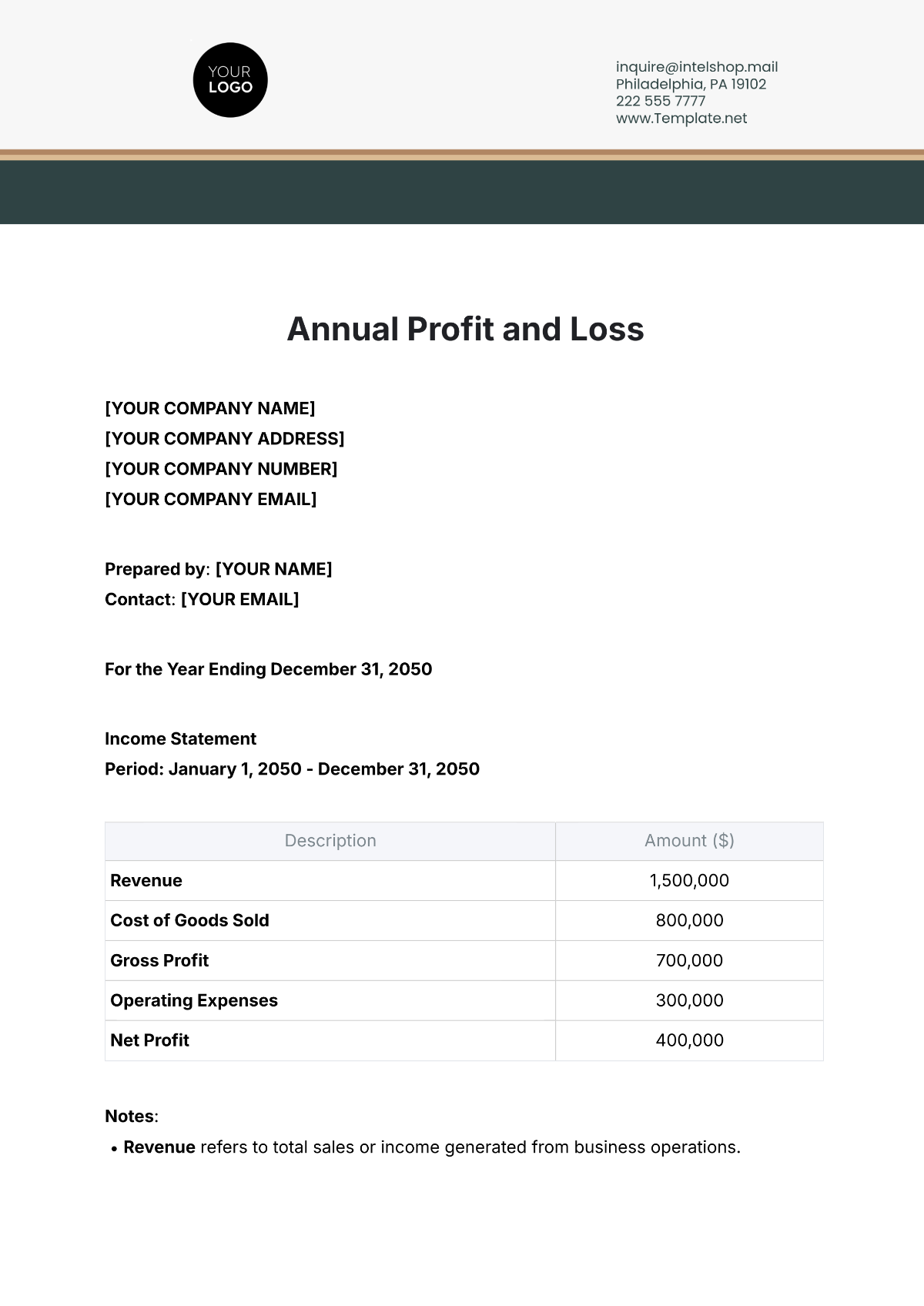

Future Outlook

Our strategic M&A initiatives are projected to strengthen our financial position and drive long-term growth. We anticipate a sustained increase in revenue and a continuous improvement in operational efficiencies.

Conclusion

Through these mergers and acquisitions, we have not only expanded our market reach but also fortified our financial foundations. We remain committed to leveraging these opportunities for continued growth and shareholder value enhancement.