Free Annual Financial Credit Statement Report

Created by [Your Name]

Date: [Month Day, Year]

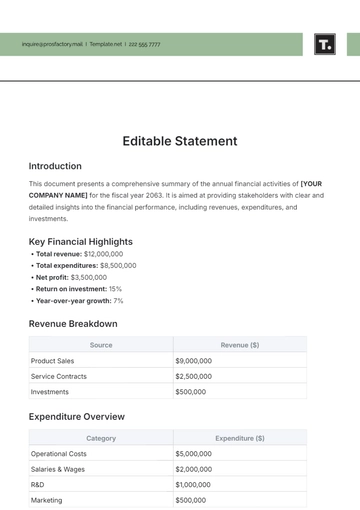

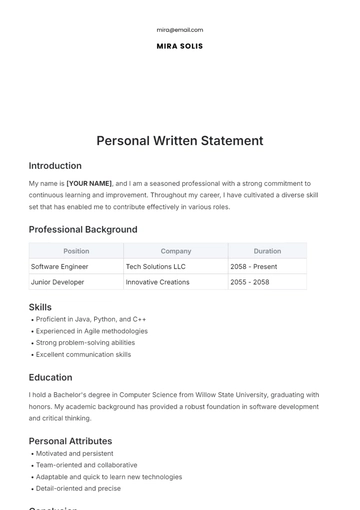

The report before you is meticulously prepared to furnish an in-depth account of the financial standing and performance of [YOUR COMPANY NAME] up to the close of the fiscal year [Year]. Our primary purpose and utmost diligence have been dedicated to preparing this comprehensive documentation, focusing on our stakeholders, who embody our investors, creditors, regulatory bodies, and others who have a vested interest in our company's performance. The objective we strive to achieve with this insightful financial report is to convey most clearly and straightforwardly, the financial position our company holds. The information herein will give you an understanding of our solvency, our ability to meet short-term and long-term obligations and provide an overall picture of our fiscal health.

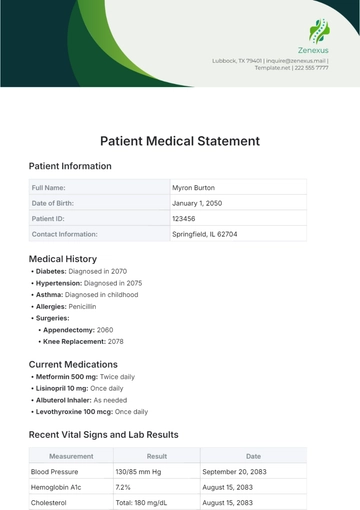

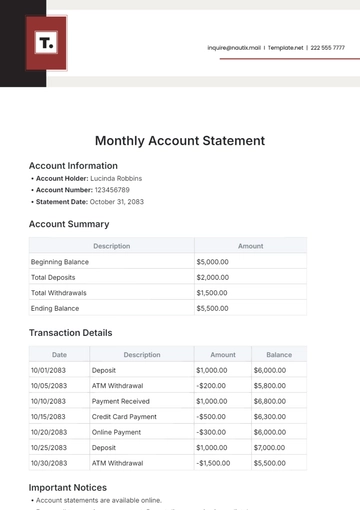

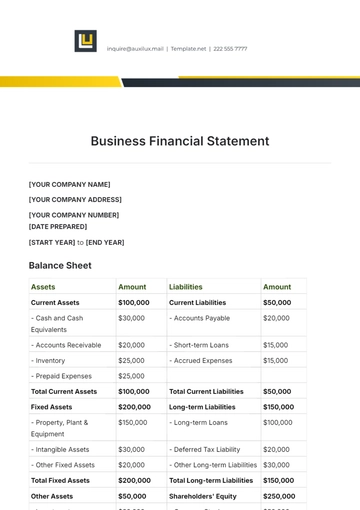

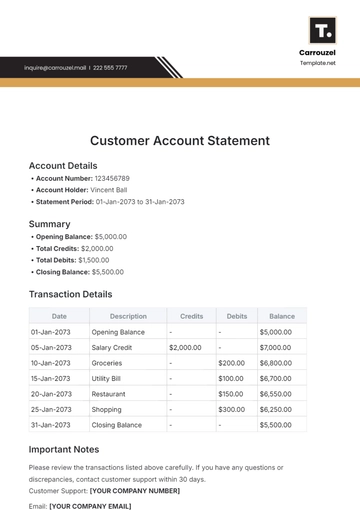

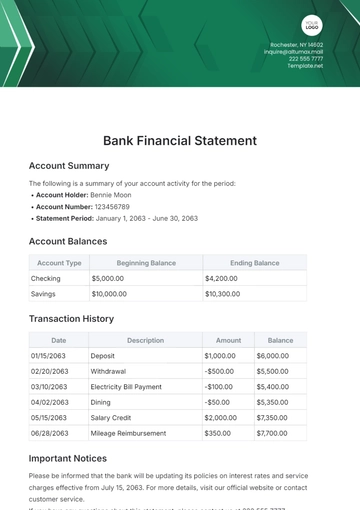

Financial Position

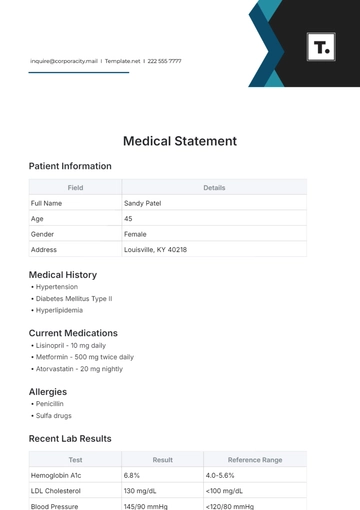

Assets

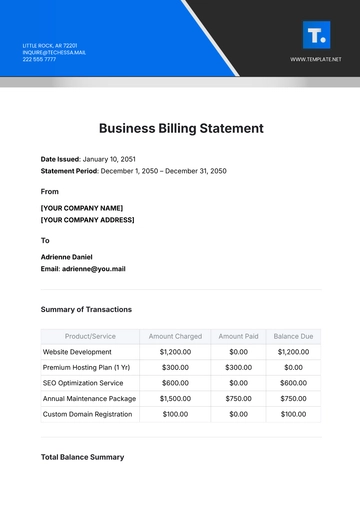

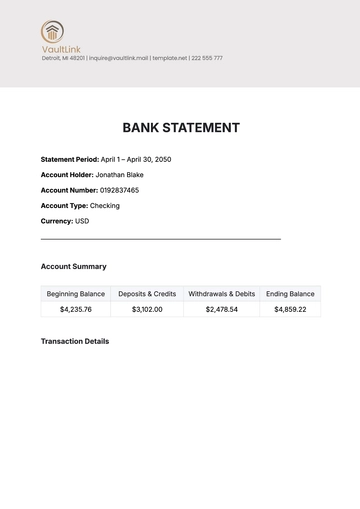

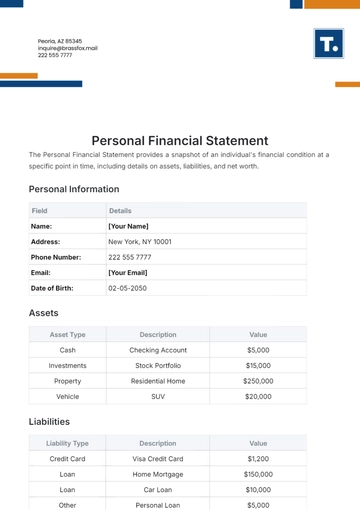

As of [Month Day, Year], [YOUR COMPANY NAME] total assets were approximately $2 billion, up from $1.7 billion in the previous year. The 17.6% increase in the asset base can be attributed primarily to the rise in accounts receivable and the purchase of new machinery during the year.

Liabilities

The company's total liabilities stood roughly at $1.2 billion, compared to $900 million in the previous year. The rise in liabilities resulted from a significant increase in long-term debt, which amounted to $200 million to finance our company's expansion.

Equity

Shareholders' equity increased from $800 million to about $850 million, showing our continued commitment to enhancing shareholder value. The increase was primarily due to the retention of net earnings.

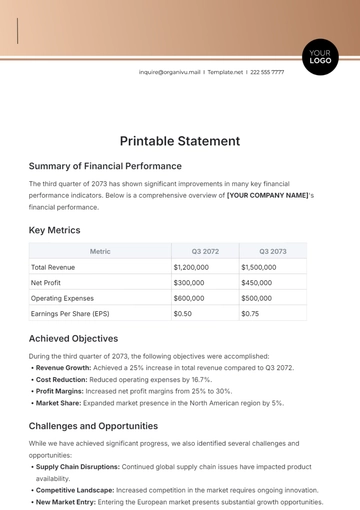

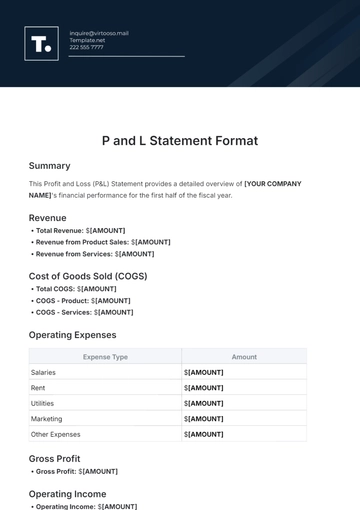

Financial Performance

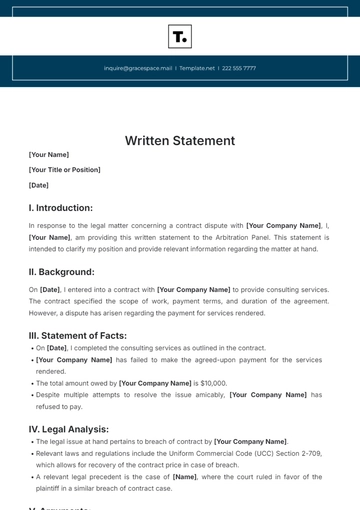

Revenue

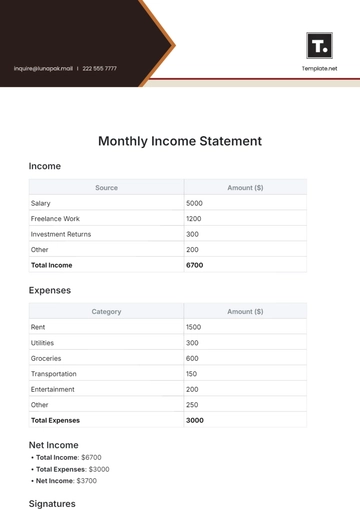

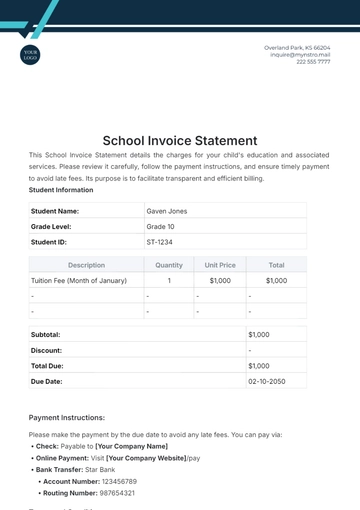

Revenue for the fiscal year ended [Month Day, Year], totaled $3 billion, a 20% increase over the previous year. Both the core and ancillary business segments contributed to this increase.

Expenses

Operating expenses of [YOUR COMPANY NAME] totaled $1.5 billion, up from $1.3 billion, reflecting a $200 million increase in the cost of goods sold and administrative expenses.

Net Income

In [Year], [YOUR COMPANY NAME]'s net income totaled $500 million, up from $400 million in 2049, resulting in a net profit margin of 16.6%, well above the industry average.

The progressive trends seen in [YOUR COMPANY NAME]'s financial position and performance confirm that we have had another financially strong year. We are gratified with the confidence and trust our stakeholders have shown in our financial management and commitment to continually enhance shareholder returns. We trust this report provides a clear picture of our economic health and inspires continued faith in the entity's promising future.

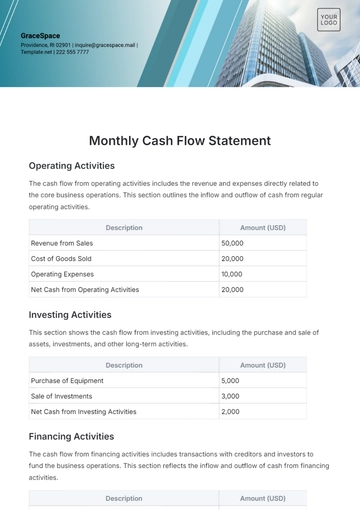

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover financial clarity with Template.net's Annual Financial Credit Statement Report Template. Crafted for ease, it's an editable and customizable solution. Utilize the AI Editor Tool to personalize your report effortlessly. Elevate your financial presentations with precision and professionalism. Unleash the power of simplicity in detailing your annual credit insights with this dynamic template.