Finance Payroll Statement

This Financial Payroll Statement provides a detailed overview of the financial aspects related to the payroll processing for [Your Company Name]. It includes essential information about employee compensation, deductions, and overall payroll expenditures.

Employee Compensation Summary

A. Total Compensation Expense

Employee Name | Position | Gross Salary | Benefits | Overtime | Total Compensation |

|---|---|---|---|---|---|

[John Berry] | Manager | [$5,000] | [$1,000] | [$500] | [$6,500] |

B. Benefits Breakdown

Health Insurance

Employee Name | Health Insurance |

|---|---|

[John Berry] | [$300] |

Retirement Contributions

Employee Name | Retirement Contributions |

|---|---|

[John Berry] | [$150] |

Deductions

A. Tax Withholdings

Employee Name | Federal Tax | State Tax | Local Tax | Total Tax Withholding |

|---|---|---|---|---|

[John Berry] | [$800] | [$300] | [$50] | [$1,150] |

B. Other Deductions

Employee Name | Deduction Type | Amount |

|---|---|---|

[John Berry] | Health Insurance Premium | [$50] |

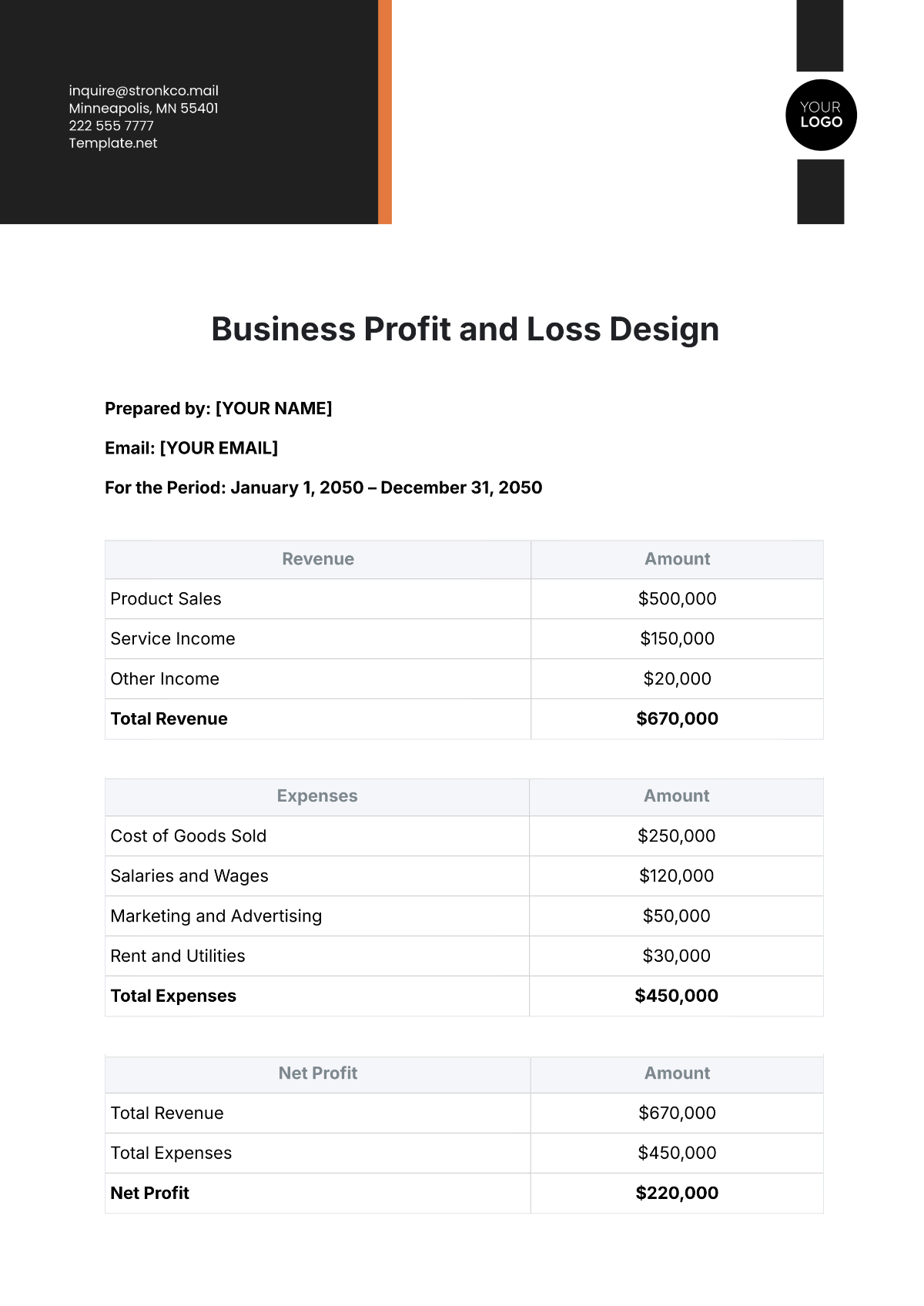

Net Pay Calculation

Total Gross Pay for all employees: | [$11,000] |

Total Deductions for all employees: | [$1,980] |

Net Pay for all employees: | [$9,020] |