Free Financial Investment Adjustment Proposal

[Month Day Year]

[Recipient Name]

[Recipient Title]

[Recipient Company Name]

[Recipient Company Address]

Dear [Recipient Name],

I am writing to propose a strategic adjustment to our current financial investment plan. This proposal aims to optimize returns, mitigate risks, and align our investment strategy with the evolving market trends and the objectives of [Your Company Name].

Enclosed is a comprehensive proposal outlining the rationale, proposed changes, and the expected impact of these adjustments on our financial portfolio. Our team at [Your Company Name] has conducted a thorough analysis to ensure that these recommendations are in line with both our short-term needs and long-term financial goals.

We look forward to discussing this proposal with you and welcome any questions or feedback you may have.

Sincerely,

[Your Name]

[Your Position]

Executive Summary

This proposal aims to strategically enhance [Your Company Name]'s current investment portfolio through a series of carefully considered adjustments. In response to evolving market dynamics and our commitment to long-term financial sustainability, we propose a recalibration of our investment strategies to better meet our revised objectives, including diversification, risk reduction, and growth.

The core of our proposal involves a multifaceted approach: Firstly, we suggest a rebalancing of asset allocation to optimize our portfolio's performance while mitigating risk. This includes adjusting the distribution of assets across various classes to achieve a more resilient and diversified portfolio. Secondly, we advocate for a focused diversification into new sectors or industries, particularly those showing robust growth potential and resilience against market volatility. This move aims to reduce overexposure to any single sector and spread risk more evenly.

Additionally, we propose a strategic shift from high-risk investments to those with medium risk profiles. This risk management initiative is designed to safeguard our portfolio against sudden market downturns, ensuring more stable returns. Lastly, the proposal identifies and recommends investment in emerging opportunities that align with our future growth trajectories and risk appetite.

Collectively, these adjustments are expected to enhance the overall performance of our portfolio, aligning it with [Your Company Name]'s strategic financial objectives and ensuring its robustness in the face of changing market conditions. This proposal is a roadmap for sustainable growth and risk-managed investment, positioning [Your Company Name] for future financial success.

Current Investment Overview

The following table provides a comprehensive overview of the current investment portfolio of [Your Company Name]. This overview includes key details such as the type of investment, the amount initially invested, its current market value, the annual return rate, and the associated risk level. This data is instrumental in understanding the existing composition of our portfolio and will serve as a baseline for the proposed adjustments.

Investment Type | Amount Invested | Current Value | Annual Return | Risk Level |

|---|---|---|---|---|

Equities | $100,000 | $120,000 | 10% | High |

Bonds | $150,000 | $155,000 | 3.3% | Low |

Real Estate | $200,000 | $220,000 | 5% | Medium |

Commodities | $50,000 | $55,000 | 7% | High |

Emerging Market Funds | $75,000 | $80,000 | 6.7% | Medium-High |

Money Market Funds | $25,000 | $25,500 | 2% | Low |

This table illustrates the diversity and range of our investments, highlighting areas of strength and potential risks. The balance between equities, bonds, real estate, commodities, emerging market funds, and money market funds reflects our current strategy. However, in light of changing market conditions and our evolving financial goals, a reassessment and adjustment of this portfolio are proposed.

Proposed Adjustments

Based on the current investment overview of [Your Company Name], several strategic adjustments are recommended to better align the portfolio with our revised investment goals and market conditions.

Rebalancing Asset Allocation: Our current asset allocation shows a significant leaning towards high-risk equities and emerging market funds, which collectively represent 35% of our portfolio. To balance risk and optimize returns, we propose reducing our equity investments from 20% to 15% and our emerging market funds from 15% to 10%. Concurrently, we suggest increasing our investment in bonds from 30% to 35% and in money market funds from 5% to 10%. This rebalancing aims to create a more stable and diversified portfolio, reducing volatility while maintaining growth potential.

Sector Diversification: A critical analysis of our portfolio reveals an over-exposure to the real estate sector, which currently stands at 40%. To mitigate sector-specific risks and capitalize on diverse growth opportunities, we recommend reducing our real estate investments to 30%. The freed-up capital, amounting to $50,000, should be diversified into technology and healthcare sectors, which are showing promising growth and innovation.

Risk Management: Currently, our portfolio is skewed towards higher risk categories. To achieve a more moderate risk profile, we propose shifting 20% of our investments from high-risk categories (equities and commodities) to medium-risk categories (real estate and emerging market funds). This shift will not only lower the overall risk but also safeguard the portfolio against market volatilities.

Emerging Opportunities: We have identified green energy and sustainable technologies as sectors with significant growth potential. An allocation of $50,000 towards these emerging opportunities will not only diversify our portfolio but also align it with global trends towards sustainability and innovation. This strategic investment in future-forward industries is expected to yield higher returns in the long-term, reflecting our commitment to growth and responsible investing.

These proposed adjustments are designed to create a more balanced, diversified, and resilient portfolio, reducing overall risk while targeting sectors with growth potential. They are a reflection of our proactive approach to investment management and our commitment to achieving the financial objectives of [Your Company Name].

Expected Impact

The proposed adjustments to the investment portfolio of [Your Company Name] are expected to significantly influence its performance, risk profile, and alignment with our strategic objectives. The table below provides a detailed breakdown of the anticipated impact each adjustment will have on the portfolio, including the expected return, revised risk level, and the specific impact on the overall portfolio.

Adjustment Type | Expected Return | Risk Level | Impact On Portfolio |

|---|---|---|---|

Rebalancing | 6% | Medium | Reduces volatility and enhances stability by decreasing the weight of high-risk assets like equities and increasing the allocation in bonds and money market funds. |

Sector Diversification | 7% | Medium | Diversifies risks associated with over-exposure to real estate by investing in technology and healthcare sectors, which are anticipated to have robust growth. |

Risk Management | 5.5% | Medium | Lowers the overall risk of the portfolio by shifting a portion of assets from high-risk to medium-risk categories, leading to more consistent and stable returns. |

Emerging Opportunities | 8% | Medium-High | Introduces growth potential by investing in green energy and sustainable technologies, aligning with future market trends and contributing to long-term profitability. |

Each of these adjustments is aimed at not only optimizing returns but also ensuring a balanced risk-reward ratio. The rebalancing will contribute to a more stable and less volatile portfolio, while sector diversification will protect against sector-specific downturns and tap into new growth areas. Risk management will safeguard against market fluctuations, and investing in emerging opportunities will position [Your Company Name] for future growth. Collectively, these changes are designed to fortify the portfolio's resilience and ensure its alignment with our evolving investment strategy and objectives.

Implementation Timeline

To successfully execute the proposed adjustments to the investment portfolio of [Your Company Name], a detailed implementation timeline has been established. This timeline outlines key action items, their respective start and end dates, and the responsible parties assigned to each task. This structured approach ensures that each adjustment is implemented efficiently and effectively, with clear accountability and oversight.

Review & Approve Adjustments: The first step involves a thorough review and approval of the proposed adjustments. This process will be overseen by [Responsible Person], who will ensure that all recommendations align with our strategic objectives and risk appetite. The review will commence on [Month Day Year] and is expected to be completed by [Month Day Year].

Execute Rebalancing: Following approval, the rebalancing of asset allocation will begin. [Responsible Person] will oversee this process, ensuring that the transition from high-risk assets to more stable investments is done smoothly and in accordance with our revised investment strategy. The execution of this rebalancing is scheduled to start on [Month Day Year] and conclude by [Month Day Year].

Sector Diversification Process: The diversification into new sectors, specifically technology and healthcare, will be managed by [Responsible Person]. This step is crucial in reducing over-exposure to the real estate sector and capitalizing on growth opportunities in other areas. This process is set to start on [Month Day Year] and end on [Month Day Year].

Risk Management Adjustments: Adjusting the risk profile of our portfolio is a critical component of this proposal. [Responsible Person] will be responsible for overseeing the shift of investments from high-risk to medium-risk categories. The timeline for this adjustment is from [Month Day Year] to [Month Day Year].

Invest in Emerging Opportunities: Finally, the allocation of funds to emerging opportunities in green energy and sustainable technologies will be handled by [Responsible Person]. This forward-looking investment is expected to start on [Month Day Year] and be completed by [Month Day Year], marking a significant step towards aligning our portfolio with future market trends.

Each of these steps is integral to the successful implementation of our proposed adjustments, ensuring that [Your Company Name]'s investment portfolio is not only optimized for current market conditions but also poised for future growth and stability.

Conclusion:

This comprehensive proposal has detailed a series of strategic adjustments tailored to enhance the investment portfolio of [Your Company Name]. These recommendations, derived from a thorough analysis of current market trends and our internal financial objectives, are poised to significantly improve our financial standing.

The proposed rebalancing of asset allocation, sector diversification, risk management adjustments, and investments in emerging opportunities are all carefully crafted to achieve a more resilient, diversified, and growth-oriented portfolio. By reducing over-exposure to specific sectors and high-risk assets, while simultaneously tapping into new and promising markets, we are not just adapting to the current financial landscape but also proactively preparing for future developments.

The implementation of these adjustments, as outlined in the proposal, demonstrates our commitment to prudent and forward-thinking investment strategies. We are confident that these changes will not only bring about immediate stability and risk mitigation but also set the stage for sustained growth and profitability.

We appreciate your attention to this proposal and are eager to engage in further discussions to refine and implement these strategies. Your insights and feedback will be invaluable as we work together to enhance the financial robustness of [Your Company Name].

Looking forward to a collaborative and prosperous future.

Sincerely,

[Your Name]

[Your Position]

[Your Company Name]

This proposal is confidential and intended solely for the use of the individual or entity to whom it is addressed. If you are not the intended recipient, you are hereby notified that any dissemination, distribution, or copying of this communication is strictly prohibited.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

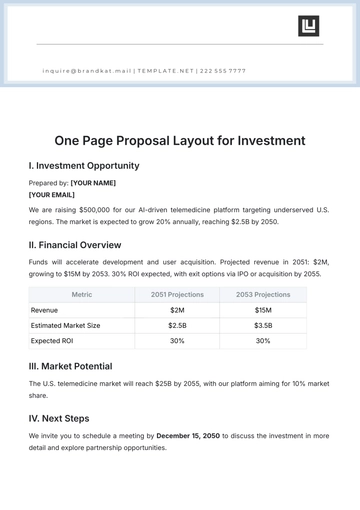

Template.net offers an impeccable Financial Investment Adjustment Proposal Template. Designed to streamline your financial proposals, this AI Editor Tool-editable template ensures precision and professionalism. Crafted by experts, it simplifies the intricate process of investment adjustments. Maximize your financial prowess with this indispensable tool, exclusively from Template.net. Boost your proposals, impress stakeholders, and make informed investment decisions effortlessly!

You may also like

- Business Proposal

- Research Proposal

- Proposal Request

- Project Proposal

- Grant Proposal

- Photography Proposal

- Job Proposal

- Budget Proposal

- Marketing Proposal

- Branding Proposal

- Advertising Proposal

- Sales Proposal

- Startup Proposal

- Event Proposal

- Creative Proposal

- Restaurant Proposal

- Blank Proposal

- One Page Proposal

- Proposal Report

- IT Proposal

- Non Profit Proposal

- Training Proposal

- Construction Proposal

- School Proposal

- Cleaning Proposal

- Contract Proposal

- HR Proposal

- Travel Agency Proposal

- Small Business Proposal

- Investment Proposal

- Bid Proposal

- Retail Business Proposal

- Sponsorship Proposal

- Academic Proposal

- Partnership Proposal

- Work Proposal

- Agency Proposal

- University Proposal

- Accounting Proposal

- Real Estate Proposal

- Hotel Proposal

- Product Proposal

- Advertising Agency Proposal

- Development Proposal

- Loan Proposal

- Website Proposal

- Nursing Home Proposal

- Financial Proposal

- Salon Proposal

- Freelancer Proposal

- Funding Proposal

- Work from Home Proposal

- Company Proposal

- Consulting Proposal

- Educational Proposal

- Construction Bid Proposal

- Interior Design Proposal

- New Product Proposal

- Sports Proposal

- Corporate Proposal

- Food Proposal

- Property Proposal

- Maintenance Proposal

- Purchase Proposal

- Rental Proposal

- Recruitment Proposal

- Social Media Proposal

- Travel Proposal

- Trip Proposal

- Software Proposal

- Conference Proposal

- Graphic Design Proposal

- Law Firm Proposal

- Medical Proposal

- Music Proposal

- Pricing Proposal

- SEO Proposal

- Strategy Proposal

- Technical Proposal

- Coaching Proposal

- Ecommerce Proposal

- Fundraising Proposal

- Landscaping Proposal

- Charity Proposal

- Contractor Proposal

- Exhibition Proposal

- Art Proposal

- Mobile Proposal

- Equipment Proposal

- Student Proposal

- Engineering Proposal

- Business Proposal