Account System Feasibility Study

TABLE OF CONTENTS

Introduction..............................................................................................................3

Project Overview......................................................................................................4

Market Analysis........................................................................................................5

Financial Feasibility..................................................................................................6

Legal Considerations...............................................................................................7

Operational Feasibility..............................................................................................8

Potential Risks...........................................................................................................9

Recommendations....................................................................................................10

Conclusion.................................................................................................................11

Introduction

This study delivers a detailed examination of the practicality and advisability of introducing an account system within the organization. It incorporates a thorough exploration of the project's goals, market attractiveness, financial feasibility, legal implications, operational challenges, potential risks, and culminates in a set of well-founded recommendations. This analysis aims to equip [Your Company Name] with the necessary insights to make an informed decision regarding this significant organizational change.

Project Overview

This project represents a strategic leap forward for the organization, aiming to modernize and elevate its financial operations through the implementation of a cutting-edge account system. The primary objectives of this visionary initiative are as follows:

Facilitating Seamless Financial Transactions:

The core aim of this project is to seamlessly streamline financial processes within the organization. By doing so, we envision achieving unparalleled levels of efficiency, ensuring that financial transactions occur with maximum fluidity and minimal processing time. This transformation will pave the way for a more agile and responsive financial ecosystem.

Enhancing Efficiency and Accuracy in Record Keeping:

Our proposed system will harness advanced algorithms and state-of-the-art data management techniques to revolutionize record-keeping practices. This revolutionary approach will not only ensure pinpoint accuracy but will also elevate the overall efficiency of our record-keeping processes. The result will be a financial infrastructure that is robust, reliable, and geared for the future.

Providing Real-Time Financial Reporting to Stakeholders:

A hallmark feature of this system is its ability to generate real-time financial reports. This capability empowers stakeholders with immediate access to current financial data, enabling them to make well-informed decisions promptly. It represents a significant leap in transparency and accountability, fostering trust and confidence.

Securing Confidential Accounting Information:

Recognizing the paramount importance of safeguarding financial data, the system will be fortified with robust security protocols. These measures will ensure the utmost confidentiality and integrity of our accounting information, guarding against unauthorized access and potential security breaches. Rest assured, our financial data will remain impenetrable and immune to external threats.

These transformative enhancements will redefine our approach to financial management, catapulting [Your Company Name] to the vanguard of financial technology and efficiency. This project embodies our unwavering commitment to excellence and innovation in the ever-evolving landscape of financial operations.

Market Analysis

The market analysis segment comprehensively evaluates the market, emphasizing the relevance and potential impact of the proposed account system. This evaluation is crucial in understanding the system's fit within the market and its prospective influence on current market dynamics.

Target Market:

The system is meticulously designed for small to midsize corporations, a sector characterized by unique challenges in accounting and financial management. These corporations often confront the necessity for a robust, scalable, and secure accounting framework, especially critical as they grow. The demand for an efficient system that can adapt and align with their evolving growth trajectory is a key focus. Our system addresses these specific needs, offering a solution that not only meets their current requirements but also anticipates future expansion challenges.

Market Trends:

A significant trend in the market is the escalating preference for cloud-based accounting systems. This preference is driven by the myriad advantages these platforms offer, such as enhanced remote access capabilities, scalability to suit growing business needs, and improved collaborative efficiency. This shift towards cloud-based solutions reflects a broader trend in the business world, where there is an increasing emphasis on flexible work models and the integration of advanced technology into everyday business operations.

This market analysis aims to provide a comprehensive understanding of our target market, current trends, and the financial implications of introducing the new account system, thereby guiding strategic decision-making and ensuring alignment with market needs and organizational goals.

Financial Feasibility

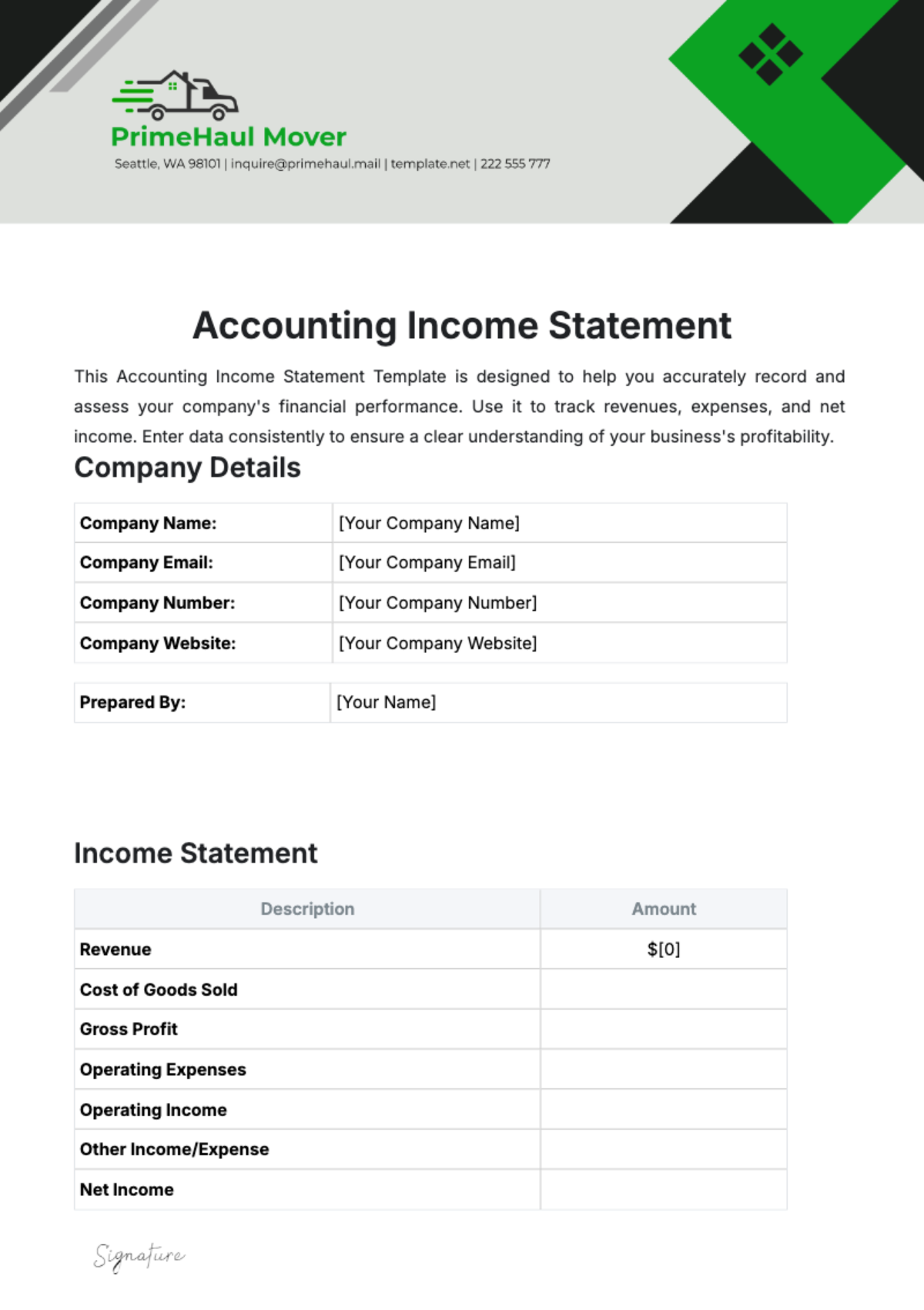

This section evaluates the economic aspects of implementing the proposed account system, considering both short-term and long-term financial implications.

Financial Aspect:

Initial Investment:

The initial investment is a critical financial consideration, encompassing the comprehensive costs incurred during the project's inception phase. This includes the development of the software, integration into existing infrastructures, and the initial deployment process. These foundational expenditures are vital in establishing a resilient and functional account system that aligns with organizational needs.

Operational Costs:

Operational costs refer to the ongoing expenses incurred post-deployment of the system. These costs are diverse and encompass regular maintenance, periodic updates to retain relevance and functionality, and support services to address any technical challenges. A meticulous analysis of these costs is essential to ensure ongoing fiscal management and efficiency.

Return on Investment (ROI):

ROI is a pivotal metric in evaluating the financial benefits of the account system over a set period. This calculation encompasses the anticipated enhancements in operational efficiency and the resultant cost savings. A robust ROI analysis will aid in justifying the initial investment and operational expenses by projecting future financial gains.

Pricing Strategy:

The development of a competitive yet profitable pricing strategy is essential. This strategy will be informed by a strategic market analysis, examining prevailing market rates and conditions. The goal is to set a price that is both appealing to the market and sustainable for long-term business objectives.

Market Accessibility:

This aspect evaluates how affordable the system is for our target market of small to midsize corporations. It's essential to ensure that the pricing structure does not become a barrier to entry for these businesses, thereby maximizing market penetration and adoption.

Profit Margin Sustainability:

This involves a thorough assessment of the long-term profitability of the system. The aim is to balance competitive pricing with operational costs and investment recovery, ensuring that the system remains financially viable and continues to align with market standards over time.

Financial Feasibility Analysis:

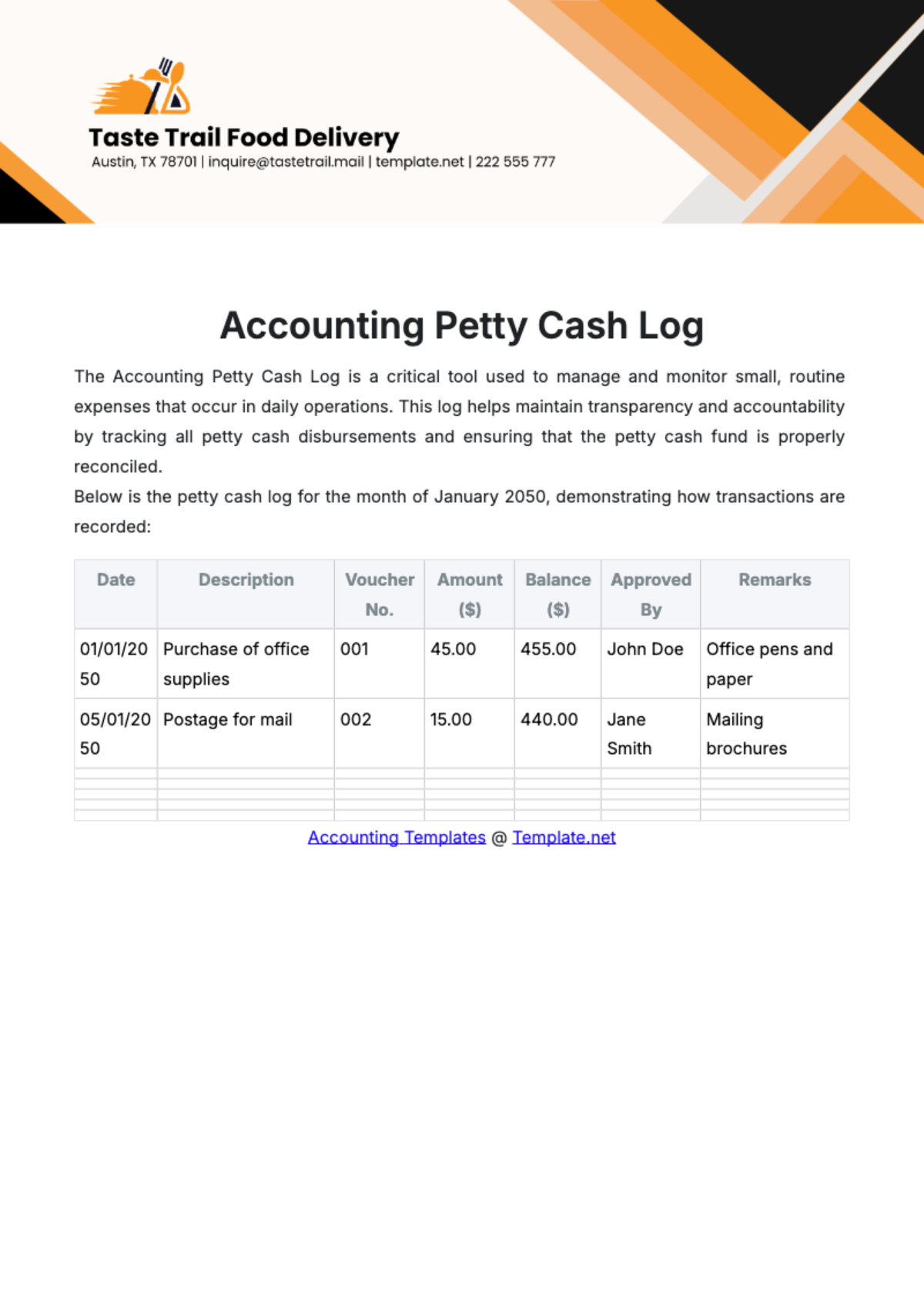

Item | Cost |

|---|---|

Initial Investment | $500,000 |

This financial feasibility analysis aims to provide a clear picture of the economic viability of the account system, ensuring that it is not only beneficial for our clientele but also sustains profitability for [Your Company Name]. The focus is on balancing competitive pricing with quality service delivery, thereby establishing a strong market presence.

Legal Considerations

This project encompasses several crucial legal considerations to ensure compliance and safeguard the interests of all stakeholders.

Protection of Financial Data and Customer Privacy:

Paramount in our legal framework is the rigorous protection of sensitive financial data and the privacy of our customers. This includes adherence to laws and regulations governing data protection, such as the General Data Protection Regulation (GDPR) and similar statutes in the United States. We must implement stringent data security measures and privacy policies that not only comply with legal standards but also foster trust among users.

Compliance with Financial Regulatory Standards:

Our system must be in strict compliance with all relevant financial regulations. This includes laws related to financial reporting, auditing standards, and any industry-specific regulations that govern the handling of financial transactions and records. Regular audits and reviews will be conducted to ensure ongoing compliance and to adapt to any changes in financial legislation.

Legal Obligations in the Event of a Security Breach:

In the unfortunate event of a security breach, we are obligated to follow legal protocols which include timely notification to affected parties and regulatory authorities. We must also have contingency plans in place for breach management and data recovery. Furthermore, we are responsible for conducting thorough investigations to understand the breach's scope and prevent future occurrences. It is essential to have robust incident response strategies and breach notification procedures that comply with legal requirements.

In addition to these primary areas, we will also focus on legal aspects related to intellectual property rights, contractual agreements with clients and vendors, and compliance with international financial laws if the system is used in multiple jurisdictions. Legal diligence in these areas is crucial to maintain the integrity of the system and uphold our company's reputation.

Operational Feasibility

Before the implementation of the new account system, it is imperative to conduct a thorough operational feasibility assessment. This evaluation will ascertain whether the proposed system can be effectively integrated and sustained within the existing operational framework of the organization. The assessment covers three fundamental aspects:

Compatibility with Current IT Infrastructure:

A critical factor in the operational feasibility of the new account system is its compatibility with the existing IT infrastructure. This involves a comprehensive assessment to ensure that the new system can be seamlessly integrated without disrupting current operations.

Infrastructure Assessment: An exhaustive analysis of the current IT infrastructure will be conducted to identify its strengths, weaknesses, and compatibility with the new system. This will involve examining hardware, software, networking, and data storage components.

Integration Strategy: A well-defined integration strategy will be developed to outline how the new system will interact with the existing infrastructure. This may entail modifications or upgrades to the current setup to ensure alignment with the functionality and performance requirements of the new system.

Risk Mitigation: Contingency plans and risk mitigation strategies will be established to address any potential issues that may arise during the integration process. This proactive approach ensures that the transition is as smooth as possible.

Manpower Adequacy for System Management and Maintenance:

Ensuring that we have sufficient and skilled manpower is essential for the effective management and maintenance of the new system. This includes having enough staff and ensuring that they possess the requisite technical expertise.

Workforce Assessment: An evaluation of the existing IT team will be conducted to determine whether it possesses the necessary skills and expertise to manage and maintain the new system. Gaps in skills or staffing will be identified.

Staffing Solutions: If there is a shortage of skilled manpower, solutions such as hiring additional personnel or reallocating responsibilities within the IT department will be explored. The goal is to ensure that the team is well-equipped to handle the demands of the new system effectively.

Training Initiatives: Ongoing training programs will be instituted to empower employees with the knowledge and skills required to leverage the new system optimally. These programs will be tailored to accommodate varying levels of technical expertise and will evolve alongside system updates and changes.

Employee Training Programs:

The successful implementation of the new system hinges on the proficiency of employees in utilizing it. Therefore, training programs will be developed and implemented to educate employees about the system's functionalities, best practices, and any new procedures.

Comprehensive Understanding: Our training programs will delve deep into the intricacies of the system, ensuring that employees gain a comprehensive understanding of its functionalities. This encompasses everything from basic operations to advanced features.

Best Practices: Employees will be educated on best practices to optimize their use of the system. These practices will not only enhance efficiency but also mitigate the risk of errors, fostering a culture of excellence.

Tailored to Expertise Levels: Recognizing that our workforce encompasses individuals with varying levels of technical expertise, our training sessions will be meticulously designed to cater to different skill levels. Novices will receive foundational training, while more technically adept individuals will have access to advanced training modules.

Ongoing Learning: Technology is ever-evolving, and so will be our training programs. They will be dynamic and adaptable, evolving in tandem with system updates and changes. This ensures that employees remain up-to-date with the latest system enhancements.

The operational feasibility of the new account system is contingent upon these three key components working harmoniously to ensure a smooth transition and efficient ongoing operation. Regular reviews and updates will be conducted to ensure that the system continues to align with our operational needs.

Potential Risks

In implementing the new account system, it is critical to identify and plan for potential risks to ensure the system's integrity and effectiveness. The major risks identified are as follows:

Security Breach Risk:

This could involve unauthorized access to sensitive financial data, data theft, or other forms of cyberattacks. The consequences of such breaches could range from financial loss to severe damage to the company's reputation. Therefore, robust security measures, including encryption, firewalls, and regular security audits, are essential to mitigate this risk.

System Failure Risk:

The risk of system failure, either due to technical glitches, software bugs, or hardware malfunctions, is a critical concern. Such failures could lead to disruptions in financial operations, loss of data, or erroneous data processing. To counter this risk, we will implement rigorous testing of the system before full-scale deployment, establish a regular maintenance schedule, and develop a disaster recovery plan.

Non-Compliance Risk from Employees:

The risk that employees may not fully comply with or adapt to the newly implemented system is a significant human factor concern. This can result from a lack of understanding, resistance to change, or insufficient training. To mitigate this risk, it is crucial to develop extensive training programs, provide ongoing support, and establish clear guidelines and procedures for using the new system.

In addition to these primary risks, we will also consider other potential issues such as compatibility problems with existing systems, legal and regulatory compliance challenges, and the potential impact on customer relationships. A proactive approach to identifying and managing these risks will be critical to the successful implementation and operation of the new account system.

Recommendations

After a thorough analysis of the potential benefits and the identified risks, the following recommendations are proposed for the successful implementation and management of the new account system:

Proceed with Implementation:

Given the substantial benefits that the new account system promises, including enhanced efficiency, accuracy, and security, it is advised to proceed with its implementation. This decision is anchored in the belief that the system's advantages significantly outweigh the manageable risks identified.

Conduct Regular System Audits:

To ensure the system's ongoing integrity and performance, regular audits should be conducted. These audits will assess not only the security posture but also the efficiency and accuracy of the system. They will help in identifying any vulnerabilities or areas for improvement, thereby ensuring that the system remains robust against threats and aligned with business objectives.

Comprehensive Employee Training Programs:

Adequate training for employees is crucial for the smooth operation of the new system. Tailored training programs should be developed to cater to varying levels of technical expertise among staff. These programs should focus on operational procedures, best practices, and awareness of security protocols. Continuous education and refresher courses should also be implemented to keep pace with system updates and changes.

Adherence to Legal and Compliance Norms:

Strict compliance with legal and regulatory standards is non-negotiable. The system should be regularly reviewed to ensure adherence to data protection laws, financial regulations, and any other relevant legal requirements. This will not only safeguard against legal repercussions but also reinforce the organization's commitment to ethical and responsible business practices.

Establish a Robust Risk Management Framework:

A proactive risk management approach should be established. This framework should include regular risk assessments, development of contingency plans, and a clear response strategy for potential security breaches or system failures. The aim is to minimize the impact of any adverse events and ensure business continuity.

Monitor and Evaluate System Performance:

Post-implementation, continuous monitoring of the system's performance should be conducted. This will involve tracking metrics related to system efficiency, user satisfaction, and the financial impact of the system on the organization. Regular evaluations will provide insights into the system's effectiveness and guide any necessary adjustments or enhancements.

With careful planning, rigorous risk management, and ongoing evaluation, the implementation of the new account system is expected to bring significant improvements to the organization's operational capabilities and financial management.

Conclusion

This study has evaluated the viability of implementing a new account system within [Your Company Name]. The analysis encompassed various critical aspects, including market analysis, financial feasibility, legal considerations, operational feasibility, potential risks, and strategic recommendations. With the recommended measures in place, the new account system is poised to significantly bolster the organization's financial operations and overall performance. It is advised that [Your Company Name] proceeds with the implementation of this system, ensuring continuous monitoring and adaptation to maximize its effectiveness to the growing industry.