Free Finance Mergers & Acquisitions Process Rubric

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Unveil the practicality with Template.net’s Finance Mergers & Acquisitions Process Rubric. Our fully editable and customizable template makes business finance clear-cut. Dramatically enhance process-management with our Ai Editor Tool. Experience convenience, harmonize teams, drive successful finance ventures. Embark on your M&A journey professionally, compellingly, engagingly.

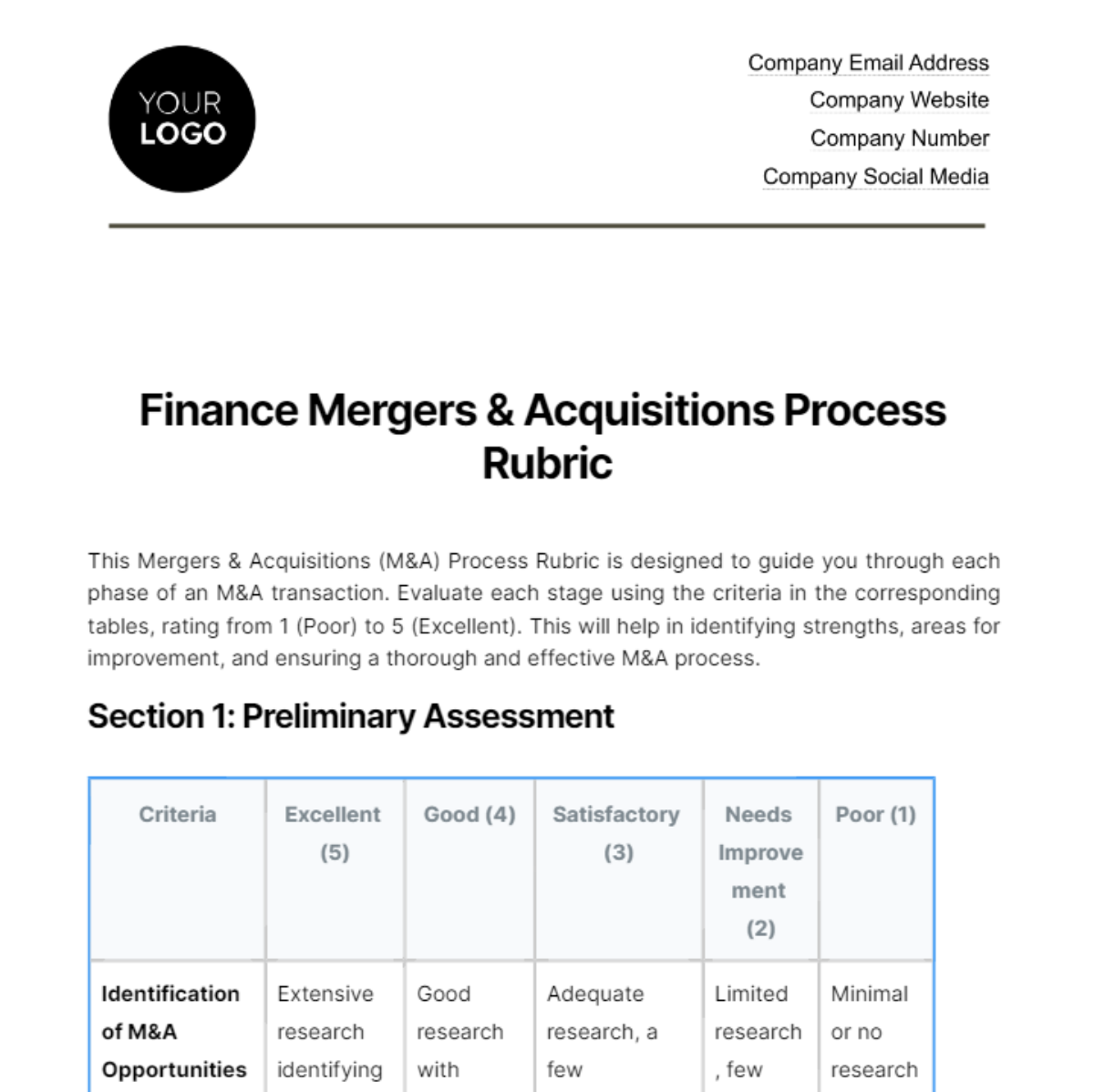

Finance Mergers & Acquisitions Process Rubric

This Mergers & Acquisitions (M&A) Process Rubric is designed to guide you through each phase of an M&A transaction. Evaluate each stage using the criteria in the corresponding tables, rating from 1 (Poor) to 5 (Excellent). This will help in identifying strengths, areas for improvement, and ensuring a thorough and effective M&A process.

Section 1: Preliminary Assessment

Criteria | Excellent (5) | Good (4) | Satisfactory (3) | Needs Improvement (2) | Poor (1) |

|---|---|---|---|---|---|

Identification of M&A Opportunities | Extensive research identifying multiple high-potential opportunities | Good research with several viable opportunities identified | Adequate research, a few opportunities identified | Limited research, few opportunities | Minimal or no research |

Strategic Fit Analysis | Comprehensive analysis showing strong strategic alignment | Thorough analysis with good strategic fit | Basic analysis, some strategic alignment | Superficial analysis, unclear alignment | No analysis or misalignment |

Initial Valuation | Detailed valuation with robust data and methodology | Solid valuation with good data | Basic valuation with some data gaps | Inadequate valuation, weak methodology | No valuation or highly inaccurate |

Stakeholder Interest Assessment | Thorough evaluation of stakeholder interests and concerns | Good evaluation with some stakeholder insights | Basic evaluation, some stakeholder perspectives considered | Limited evaluation of stakeholder interests | No consideration of stakeholder interests |

Section 2: Due Diligence

Criteria | Excellent (5) | Good (4) | Satisfactory (3) | Needs Improvement (2) | Poor (1) |

|---|---|---|---|---|---|

Financial Analysis | In-depth financial analysis with comprehensive risk assessment | Detailed financial analysis with clear risk identification | Adequate financial analysis, some risks identified | Basic financial analysis, major risks missed | No or flawed financial analysis |

Legal Compliance Check | Exhaustive legal compliance audit with no issues found | Thorough legal check with minor issues addressed | Adequate legal compliance review, some issues noted | Limited legal review, significant issues unresolved | No legal compliance check or major issues unaddressed |

Operational Compatibility Assessment | Comprehensive assessment of operational synergies and challenges | Good evaluation of operational aspects | Basic assessment, some operational aspects covered | Superficial assessment, key areas missed | No operational assessment |

Cultural Fit Evaluation | Detailed analysis of cultural alignment and integration plan | Good cultural fit evaluation with a basic integration approach | Adequate cultural evaluation, some integration strategies | Limited cultural analysis, vague integration plan | No cultural evaluation or plan |

Section 3: Negotiation and Agreement

Criteria | Excellent (5) | Good (4) | Satisfactory (3) | Needs Improvement (2) | Poor (1) |

|---|---|---|---|---|---|

Terms and Conditions Clarity | Exceptionally clear and favorable terms, mutually beneficial | Clear terms, mostly favorable and fair | Adequate terms, some areas of ambiguity | Vague terms, some unfavorable conditions | Unclear and one-sided terms |

Price Negotiation | Excellent negotiation leading to optimal price | Good negotiation, fair price achieved | Adequate negotiation, reasonable price | Limited negotiation, slightly unfavorable price | Poor negotiation, unfavorable price |

Risk Mitigation Strategies | Comprehensive risk mitigation measures in place | Good risk mitigation strategies | Adequate risk mitigation | Basic risk mitigation, some risks unaddressed | No risk mitigation strategies |

Agreement Timeliness | Agreement reached efficiently in a timely manner | Agreement reached with minor delays | Agreement within acceptable time frame | Prolonged negotiations, delayed agreement | Excessive delays, stalled agreement |

Section 4: Integration Planning

Criteria | Excellent (5) | Good (4) | Satisfactory (3) | Needs Improvement (2) | Poor (1) |

|---|---|---|---|---|---|

Integration Strategy Development | Highly effective and detailed integration strategy | Solid integration plan with key elements | Adequate integration plan, some gaps | Basic integration strategy, significant gaps | No integration strategy or plan |

Communication Plan | Excellent communication plan for all stakeholders | Good communication plan, most stakeholders informed | Adequate communication, some stakeholders left out | Poor communication plan, many stakeholders uninformed | No communication plan |

System and Process Integration | Seamless integration of systems and processes | Good integration with minor issues | Adequate integration, noticeable challenges | Problematic integration, major issues | No integration or complete failure |

Cultural and Personnel Integration | Exceptional handling of cultural and personnel aspects | Good handling of cultural and personnel integration | Adequate effort in cultural and personnel aspects | Poor management of cultural and personnel issues | Neglect of cultural and personnel integration |

Section 5: Post-Merger Evaluation

Criteria | Excellent (5) | Good (4) | Satisfactory (3) | Needs Improvement (2) | Poor (1) |

|---|---|---|---|---|---|

Achievement of Strategic Objectives | All strategic objectives met with significant added value | Most strategic objectives met with good value | Some strategic objectives met | Few strategic objectives met, minimal value | Strategic objectives not met |

Financial Performance Post-Merger | Outstanding financial performance exceeding expectations | Good financial performance, meeting expectations | Adequate financial performance, some expectations met | Below par financial performance, many expectations unmet | Poor financial performance |

Operational Efficiency Post-Merger | Exceptional improvement in operational efficiency | Good improvement in operational efficiency | Moderate improvement in operations | Limited improvement, operational inefficiencies | Deterioration in operational efficiency |

Stakeholder Satisfaction Post-Merger | Very high stakeholder satisfaction across all groups | Good stakeholder satisfaction | Moderate stakeholder satisfaction | Low stakeholder satisfaction, some discontent | High dissatisfaction among stakeholders |