FLSA (Fair Labor Standards Act) Comprehensive Guide

TABLE OF CONTENTS

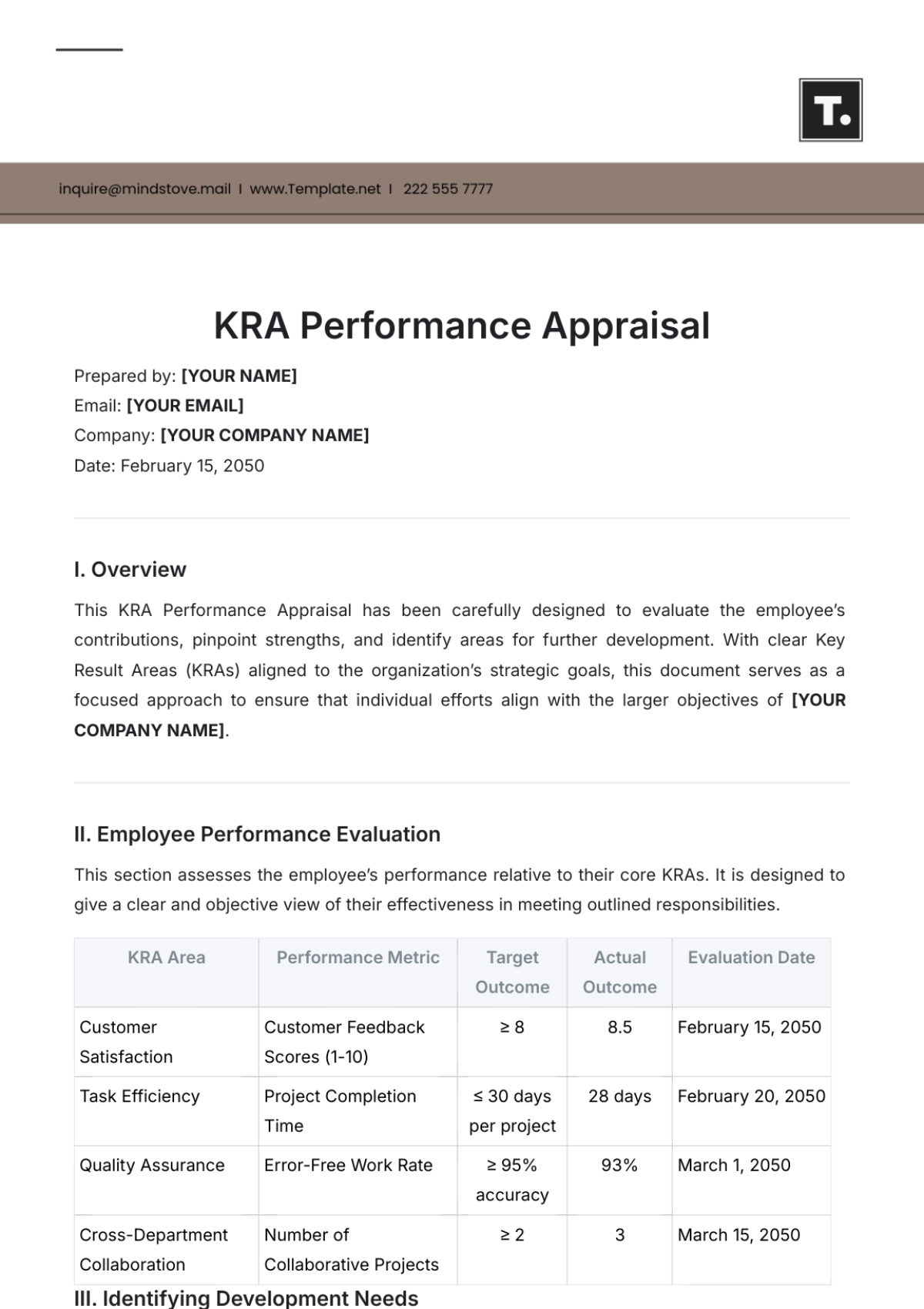

1. Introduction…………………………………………………………………………..............................5

2. Objectives…………………………………………………………………………................................6

3. Scope………………………………………………………………………….......................................6

4. Definitions…………………………………………………………………………................................6

5. General Guidelines…………………………………………………………………………..................8

5.1. Minimum Wage…………………………………………………………………………......................8

5.2. Overtime…………………………………………………………………………...............................8

5.3. Child Labor......................................……………………………………………………………….9

5.4. Record-keeping.......................................................................................................9

6. Compliance Measures…………………………………………………………………………............9

6.2. Timekeeping............................................................................................................11

6.3. Wage Calculation....................................................................................................11

7. Forms……………………………………………………………………………………………...................11

7.1. Employee Classification Form...............................................................................12

7.2. Timekeeping Log....................................................................................................13

8. FAQ..............................................................................................................................10

9. Contacts.....................................................................................................................10

10. Glossary....................................................................................................................10

1. Introduction

The Fair Labor Standards Act (FLSA) is a landmark federal legislation that sets the groundwork for essential labor standards across the United States. This law prescribes guidelines concerning minimum wage rates, eligibility for overtime pay, and restrictions on employing minors, among other issues. The FLSA's broad impact encompasses both full-time and part-time employees in the private sector as well as those working in federal, state, and local governmental organizations.

Understanding and adhering to the FLSA is a crucial obligation for employers, including [Company Name], to ensure fair treatment of employees and to mitigate the risk of legal repercussions. This comprehensive guide serves multiple purposes. Firstly, it aims to elucidate the specific rights and responsibilities that both the employer and employees have under the FLSA. Secondly, it outlines the policies and procedures that [Company Name] has put in place to ensure full compliance with these federal mandates. By doing so, this guide acts as a resourceful reference for all team members, regardless of their role within the organization, and aims to foster a workplace that is not only productive but also compliant with the law.

2. Objectives

The primary objectives of this FLSA Comprehensive Guide are twofold. First and foremost, we aim to educate all employees—whether they are full-time, part-time, temporary, or permanent—about their rights and obligations under the Fair Labor Standards Act. Knowledge is empowerment, and a well-informed workforce is crucial for promoting fair labor practices and establishing a culture of mutual respect within the organization. Employees who are educated about FLSA are better equipped to uphold its principles, thereby minimizing the risk of inadvertent violations.

The second objective focuses on institutionalizing a framework for compliance within [Company Name]. Establishing clear policies and procedures not only serves as a roadmap for adhering to FLSA requirements but also provides a standardized approach for decision-making related to employee compensation, work hours, and other labor matters. This ensures that the company's operations align seamlessly with federal laws and regulations, thus safeguarding the organization from potential legal liabilities. Collectively, these objectives strive to create a harmonious work environment where both employees and the employer can thrive while upholding the highest standards of labor law compliance.

3. Scope

The provisions and guidelines set forth in this FLSA Comprehensive Guide are intended to be all-encompassing within [Company Name], covering a broad range of individuals associated with our operations. Specifically, this guide applies to all full-time and part-time employees, whether they are salaried or hourly workers. In addition to traditional employees, the scope also extends to contractors who are engaged by the company for various services, as well as interns who are gaining practical experience as part of their educational or professional development.

It's crucial to note that the term "employees" in this context should be understood in its broadest sense to include all persons who are directly or indirectly engaged in activities beneficial to [Company Name]. This universal applicability ensures that everyone associated with the company is well-informed about the Fair Labor Standards Act and is contributing to a culture of compliance. However, there might be specific instances where FLSA regulations apply differently to contractors or interns, and these will be clearly delineated within the guide. The overarching goal is to create a unified standard for compliance that permeates through all levels and roles within the organization, thereby minimizing risks and fostering a respectful and equitable work environment.

4. Definitions

● Non-exempt Employee: A non-exempt employee is one who falls under the jurisdiction of the Fair Labor Standards Act's (FLSA) minimum wage and overtime provisions. These employees are entitled to at least the federal minimum wage for each hour worked and are also eligible for overtime pay. Overtime is calculated as one and a half times the regular hourly rate for any time worked beyond 40 hours in a single workweek. Non-exempt status often applies to hourly employees, although some salaried employees may also be non-exempt depending on their job duties, responsibilities, and earnings.

Exempt Employee: An exempt employee is someone who is exempt from the minimum wage and overtime regulations as defined by the FLSA. Such employees typically work in executive, administrative, or professional roles and often have job responsibilities that are more managerial in nature. They usually receive a salary instead of an hourly wage, and the salary must meet a minimum threshold as defined by federal or state laws. The key distinction is that exempt employees are paid for the job they perform rather than the number of hours they work, and thus are not eligible for overtime pay, regardless of the number of hours they may put in during a workweek.

General Guidelines

5.1. Minimum Wage

In accordance with the Fair Labor Standards Act (FLSA), all non-exempt employees at [Company Name] are entitled to be paid no less than the current federal minimum wage for each hour of work performed. This policy serves as the baseline standard for employee compensation, and it is strictly enforced to ensure fair and equitable treatment of all staff members. It's important to note that if a state or local minimum wage rate is higher than the federal minimum wage, [Company Name] will comply with the higher standard to meet or exceed local regulations. The company's commitment to adhering to minimum wage laws reflects its broader dedication to ethical business practices and legal compliance. Employees are encouraged to consult with the Human Resources department for any questions or clarifications related to their wage structure.

5.2. OvertimeFor non-exempt employees at [Company Name], overtime pay is an essential aspect of compensation that is governed by the Fair Labor Standards Act (FLSA). According to this federal mandate, all non-exempt employees are entitled to receive overtime pay for any hours worked beyond the standard 40-hour workweek. The overtime rate is calculated as not less than one and one-half times the employee's regular rate of pay. This means that for each hour worked over the standard 40 hours, employees will receive 1.5 times their standard hourly rate. This policy aims to fairly compensate employees for additional time and effort expended beyond regular working hours. It also reinforces [Company Name]'s commitment to adhering to federal labor laws and maintaining a balanced work environment. Employees must ensure that all overtime hours are accurately recorded and reported to ensure proper compensation. Any questions regarding overtime policies should be directed to the Human Resources department for clarification.

5.3. Child Labor

[Company Name] is fully committed to adhering to all federal laws and regulations concerning the employment of minors, as dictated by the Fair Labor Standards Act (FLSA). The company takes this responsibility seriously to ensure the welfare and safety of young workers. Minors employed by [Company Name] will be assigned roles and responsibilities that are compliant with their age-specific restrictions on hours worked, types of work performed, and conditions under which the work is carried out. The company has stringent verification processes in place to confirm the age of all applicants, thereby preventing unlawful employment of underage individuals. It is crucial to note that state or local laws may have more restrictive child labor provisions, and where applicable, [Company Name] will comply with the more stringent guidelines. Any questions or concerns regarding child labor policies and practices within the company should be promptly brought to the attention of the Human Resources department for resolution.

5.4. Record-keeping

Accurate record-keeping is an essential component of [Company Name]'s compliance with the Fair Labor Standards Act (FLSA). All employees, whether exempt or non-exempt, are required to meticulously report their working hours through the company's approved timekeeping system. This ensures that non-exempt employees are compensated fairly for hours worked, including any applicable overtime. For exempt employees, accurate record-keeping helps the company in maintaining clear and auditable employment records. Failure to report hours accurately can lead to payroll errors and may result in disciplinary action, including but not limited to termination. The Human Resources department oversees the timekeeping system, ensuring its integrity and confidentiality, and is available to answer any questions employees may have about logging their hours. It is each employee's responsibility to make certain that their work hours are recorded correctly, and any discrepancies should be reported immediately to Human Resources for prompt resolution.

Compliance Measures

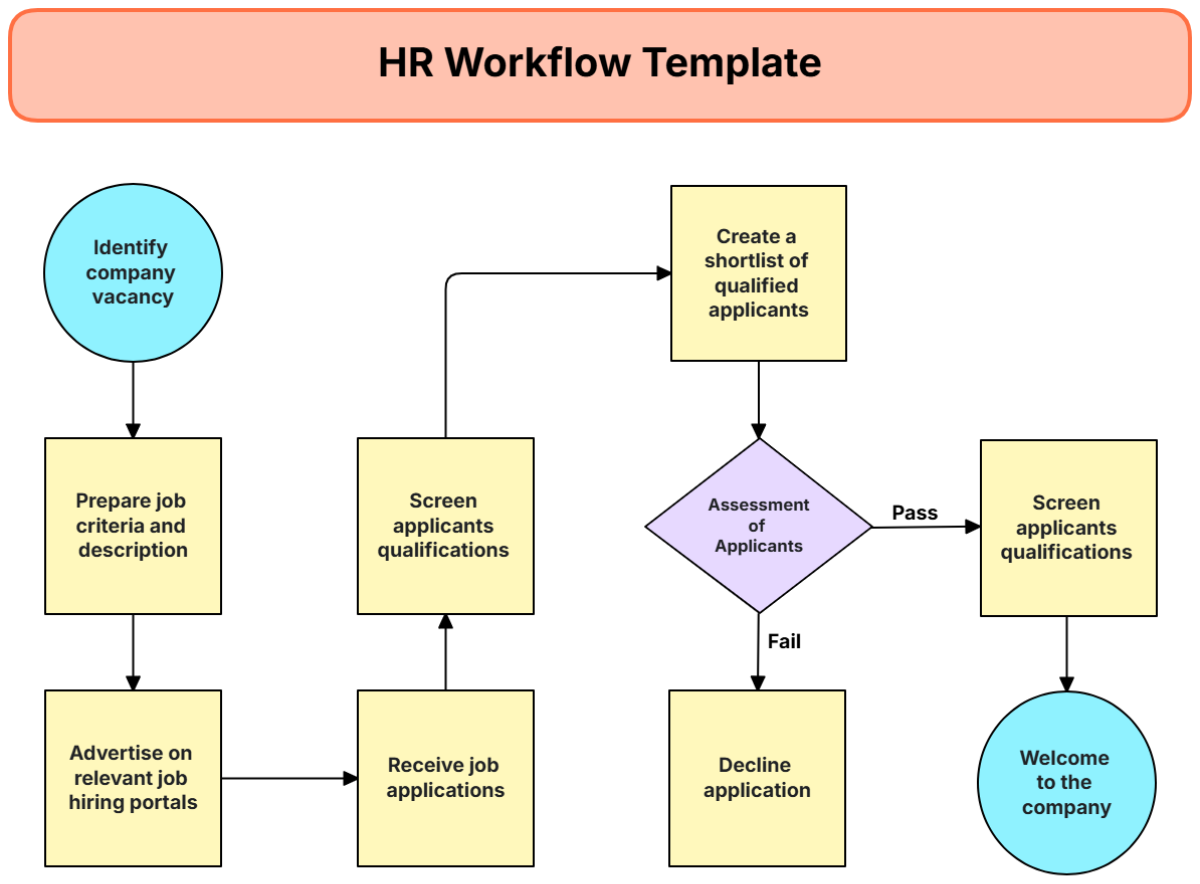

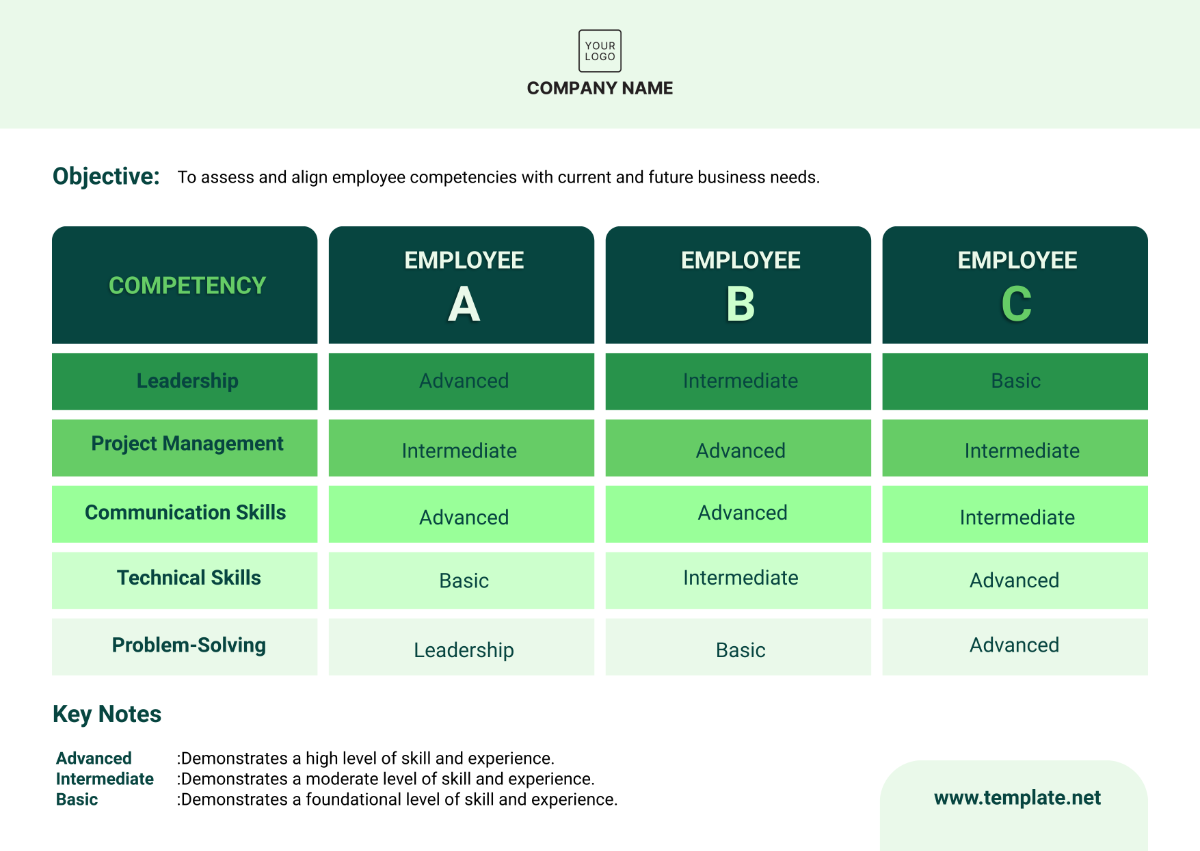

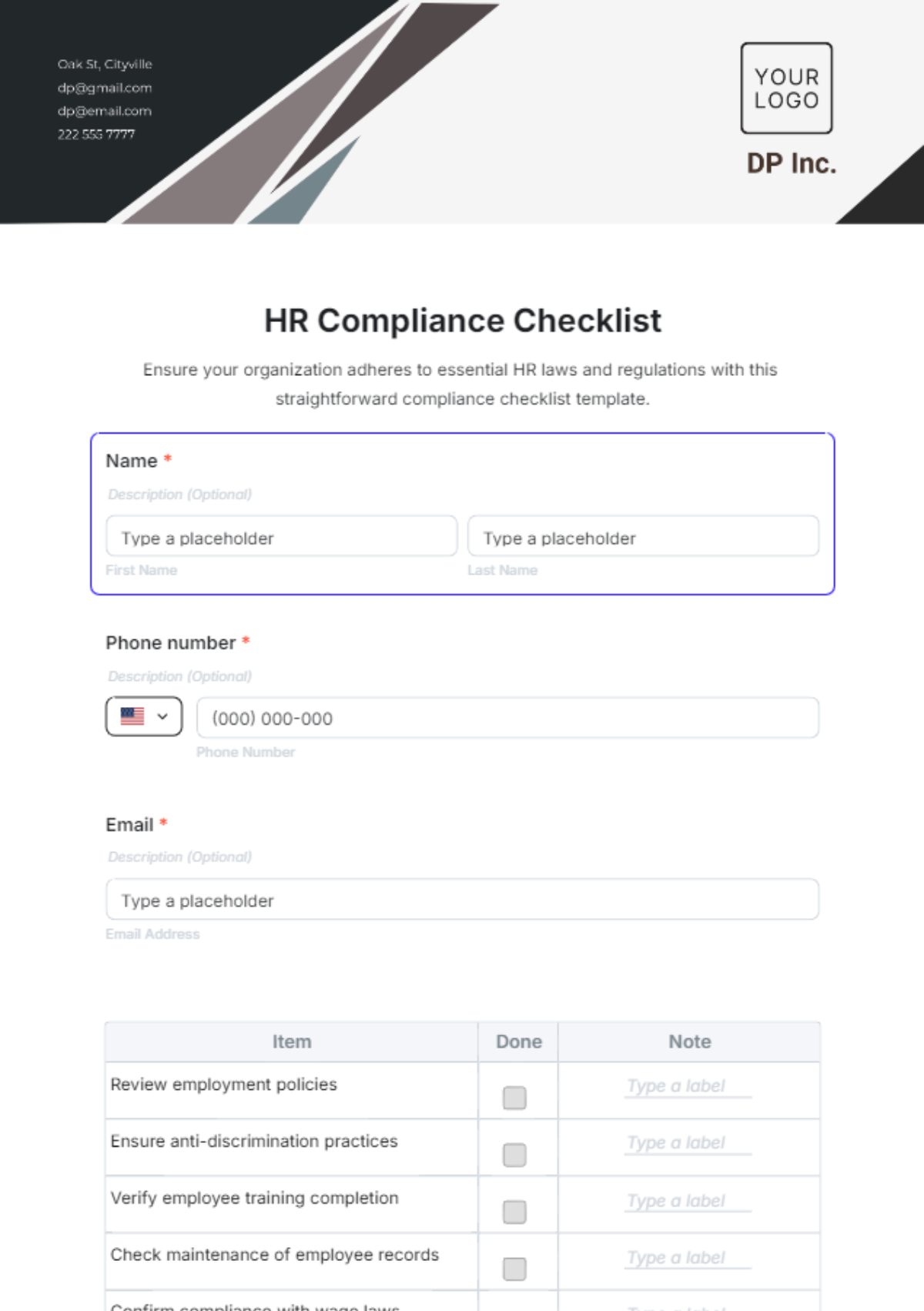

6.1. Employee Classification

Proper classification of employees as either exempt or non-exempt is a critical aspect of compliance with the Fair Labor Standards Act (FLSA) at [Company Name]. Accurate employee classification is not merely a bureaucratic necessity; it has significant implications for an employee's compensation, benefits, and work-life balance. Employees are classified based on specific criteria outlined in FLSA guidelines, which include factors such as job responsibilities, salary levels, and the nature of the work performed. Failure to correctly classify employees can result in legal ramifications for the company, including fines and back payments of wages or overtime. The Human Resources department is responsible for ensuring that each employee's classification is accurate and consistent with federal guidelines. If an employee has questions about their classification or believes they have been incorrectly classified, they are encouraged to consult with Human Resources for clarification and, if necessary, reclassification.

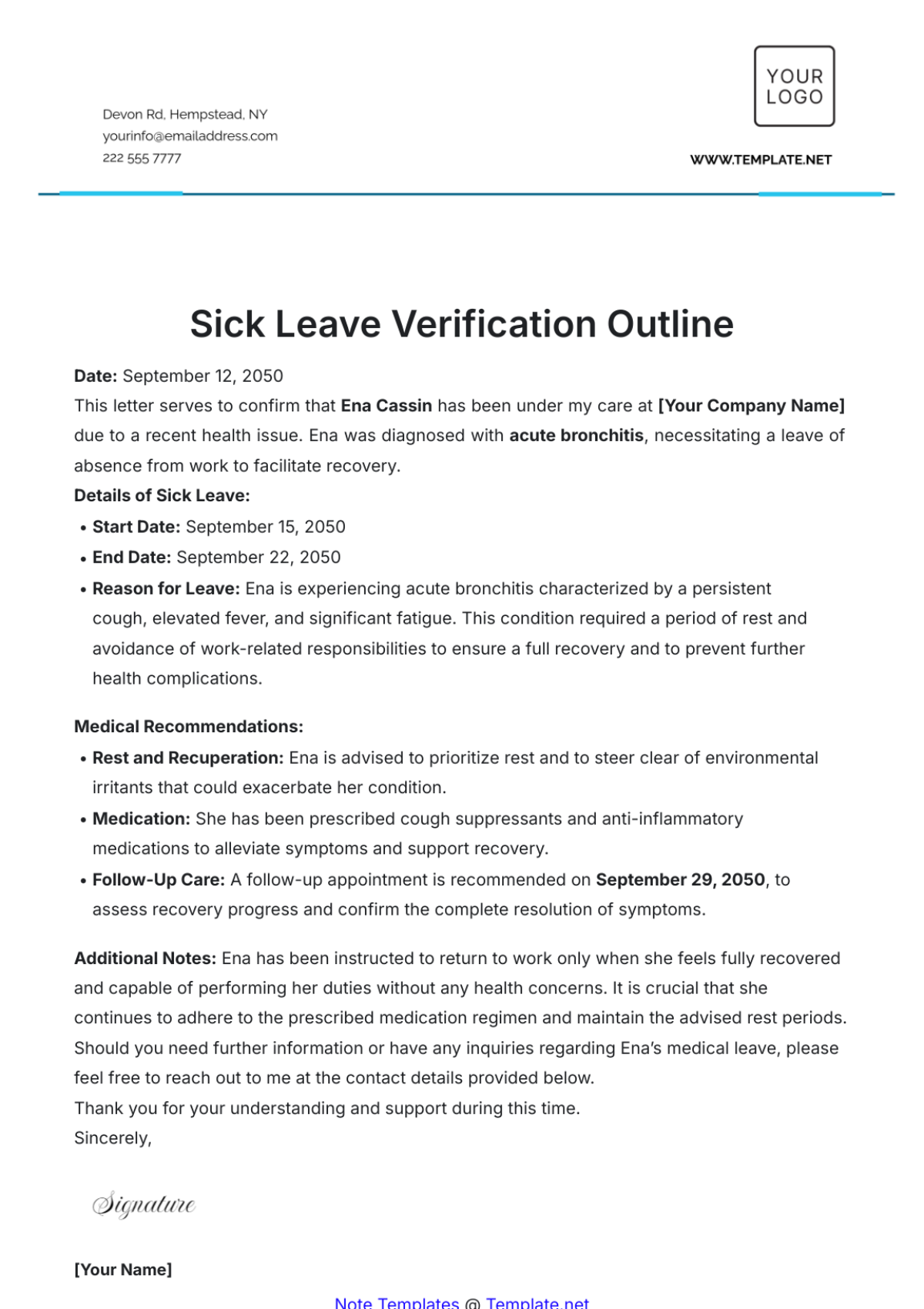

6.2. Timekeeping

Timekeeping is a fundamental aspect of employment at [Company Name], and employees are mandated to use the company's approved timekeeping system to accurately record their hours worked. This requirement is in place to ensure compliance with the Fair Labor Standards Act (FLSA), particularly as it relates to issues of minimum wage and overtime for non-exempt employees. The system is designed to be user-friendly and secure, protecting the privacy and integrity of each employee's data. Accurate timekeeping is not only beneficial for the employee but also crucial for the company's financial planning, labor management, and legal compliance. The Human Resources department oversees the administration and maintenance of the timekeeping system and is available for training and troubleshooting as needed. Any discrepancies, errors, or issues regarding timekeeping should be promptly reported to Human Resources for resolution. It is the responsibility of each employee to ensure that their work hours are correctly logged in the approved system.

6.3. Wage Calculation

Wage calculation at [Company Name] is executed in strict adherence to the guidelines set forth by the Fair Labor Standards Act (FLSA). This means that wages for non-exempt employees will account for both the federal minimum wage standards and any applicable overtime rates for hours worked beyond the standard 40-hour workweek. For exempt employees, the salary will meet or exceed the minimum threshold as defined by federal and, where applicable, state laws. Wage calculation is not a mere arithmetic exercise; it embodies the company's commitment to fairness, legal compliance, and equitable treatment of all employees. Detailed payroll records are maintained by the Human Resources department, which also oversees the regular audit of these records to ensure ongoing compliance. Any discrepancies or questions regarding wage calculations should be brought to the immediate attention of the Human Resources department for timely investigation and resolution. By adhering to FLSA regulations in wage calculation, [Company Name] aims to create a transparent and trustworthy environment for all its employees.

7. Forms

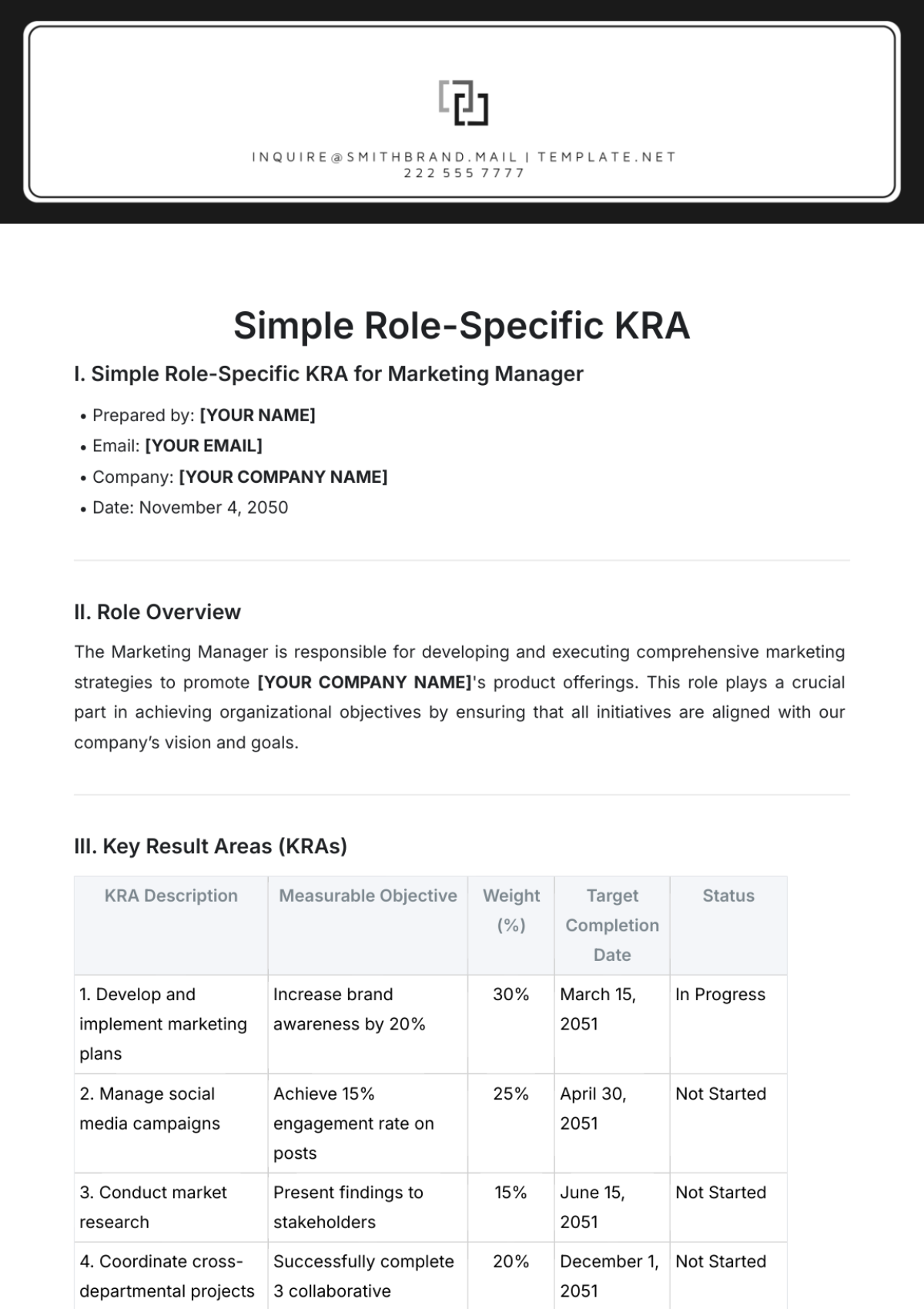

7.1. Employee Classification Form

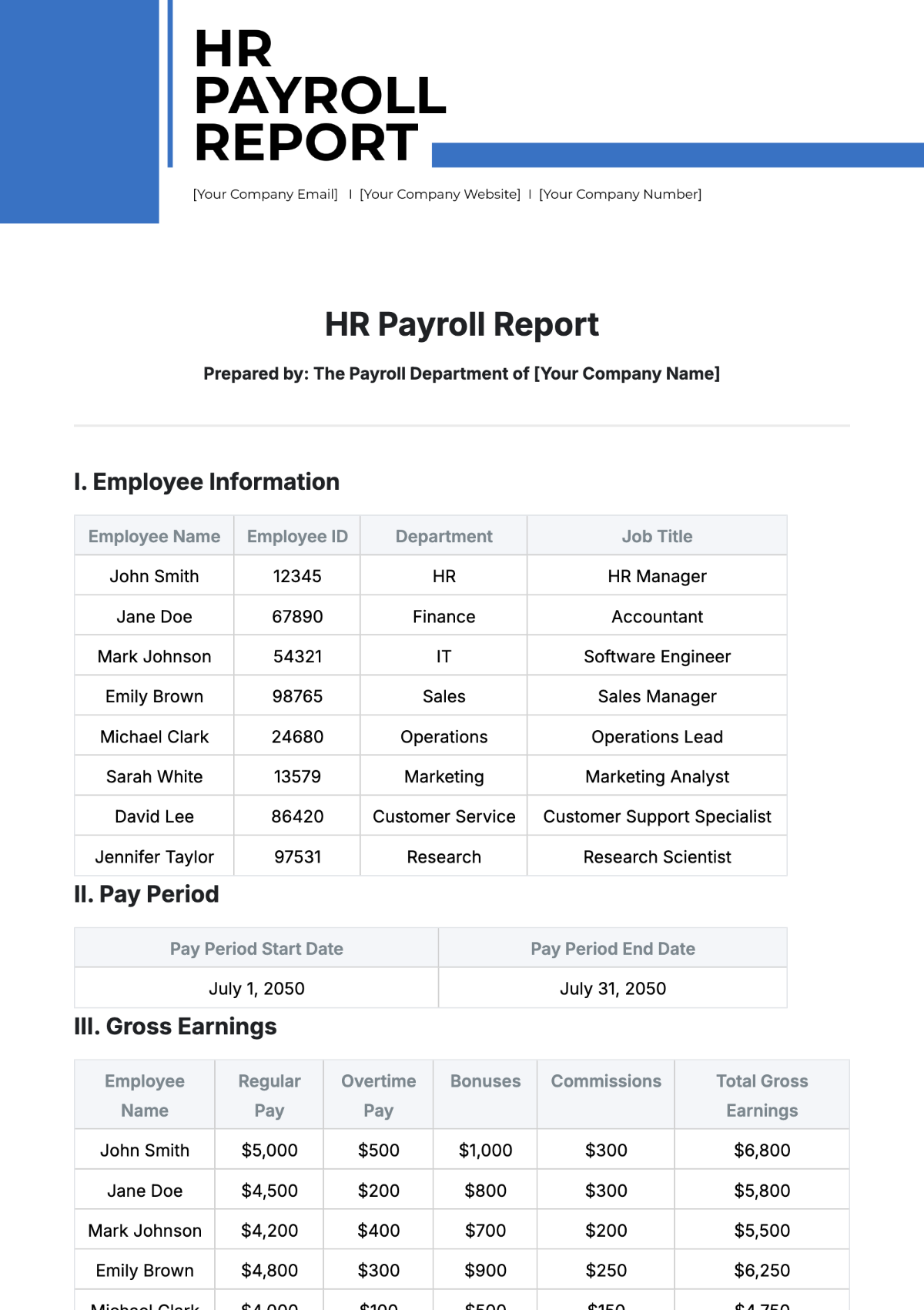

To streamline compliance with the Fair Labor Standards Act (FLSA) and [Company Name]'s policies, an Employee Classification Form has been designed. This form serves as an official document for classifying employees as either exempt or non-exempt, based on FLSA guidelines. It is imperative for each employee to complete this form accurately, sign it, and submit it to the Human Resources department for record-keeping and compliance purposes. Below is a sample table layout of the Employee Classification Form, which can be expanded as needed to accommodate the diverse roles within the organization.

Employee Name | Job Position | Exempt / Non-Exempt | Signature |

[Names] | [Job Position] | Exempt | _______________ |

[Names] | [Job Position] | Non-Exempt | _______________ |

[Names] | [Job Position] | Exempt | _______________ |

[Names] | [Job Position] | Non-Exempt | _______________ |

By filling out this form, employees acknowledge their classification status and consent to the wage and hour policies that apply to them. In case of any questions or concerns, employees are encouraged to reach out to the Human Resources department for clarification.

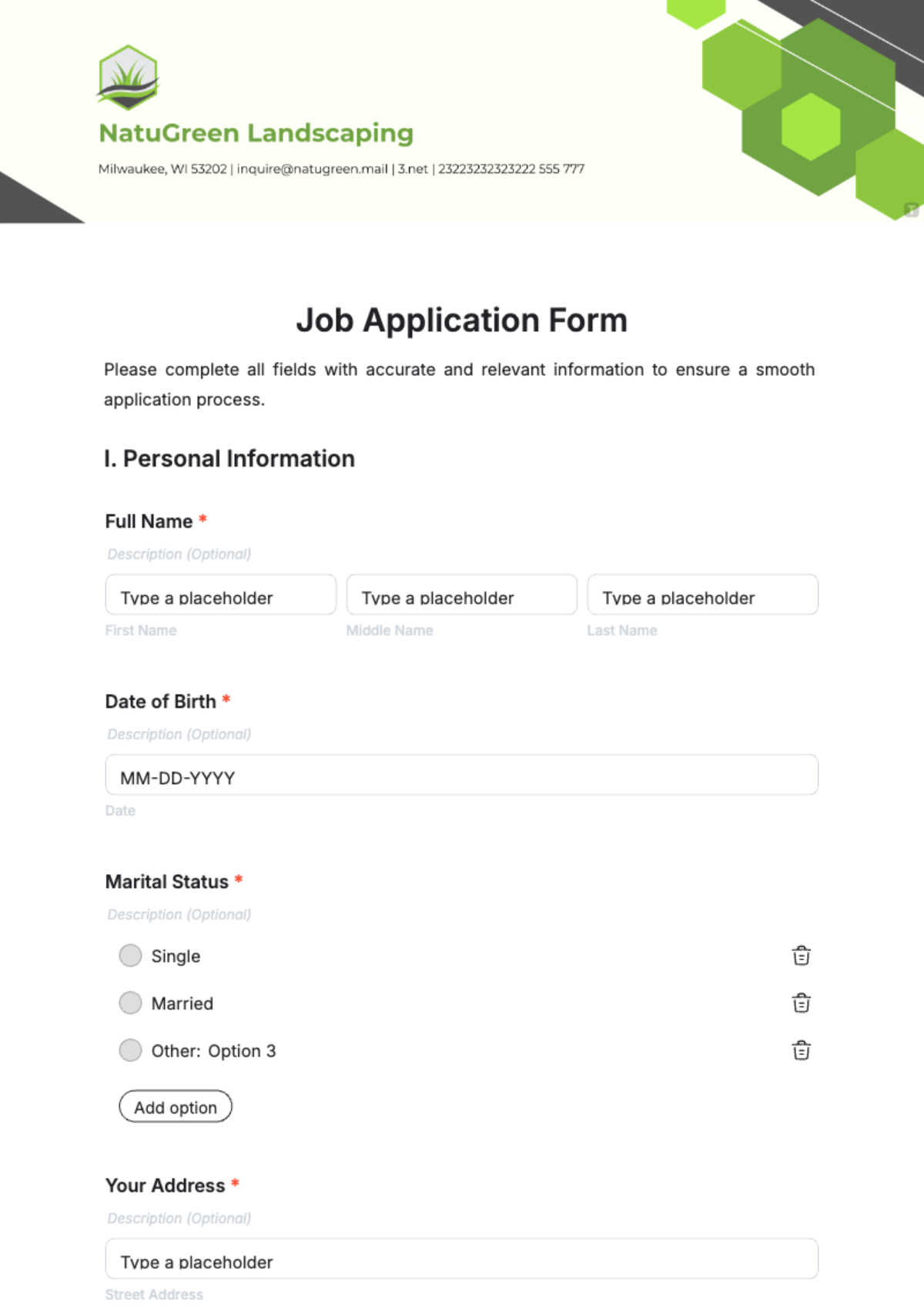

7.2. Timekeeping Log

Accurate timekeeping is crucial for both compliance with the Fair Labor Standards Act (FLSA) and ensuring that all employees are compensated fairly for the time they have worked. To assist in this, [Company Name] has implemented a Timekeeping Log that all non-exempt employees are required to fill out. This log captures essential information including the date of work, start and end times, total hours worked, and the employee's signature for verification. Exempt employees may also use this log for record-keeping purposes, though they are not subject to the same FLSA regulations concerning overtime. Below is an expanded sample table layout of the Timekeeping Log:

Date | Start Time | End Time | Break Duration | Total Hours | Signature |

[Date] | 09:00 AM | 05:00 PM | 1 Hour | 7 Hours | |

[Date] | 08:30 AM | 04:30 PM | 30 Minutes | 7.5 Hours | |

[Date] | 10:00 AM | 06:00 PM | 1 Hour | 7 Hours | |

[Date] | 09:30 AM | 05:30 PM | 30 Minutes | 7.5 Hours |

Employees should fill out this log daily to ensure accurate tracking of work hours. Once filled out, the log should be submitted to the Human Resources department at the end of each pay period for review and payroll processing. Should any discrepancies or questions arise, employees are encouraged to consult the Human Resources department promptly for clarification and resolution.

8. FAQ

Contact Human Resources immediately.

9. Contacts

Human Resources: [Company Email]

Legal Department: [Company Email]

10. Glossary

FLSA: Fair Labor Standards Act

Workweek: A period of seven consecutive days that starts on the same calendar day each week.

This guide is for informational purposes only and does not constitute legal advice. For any specific questions or legal advice, please consult appropriate legal counsel.

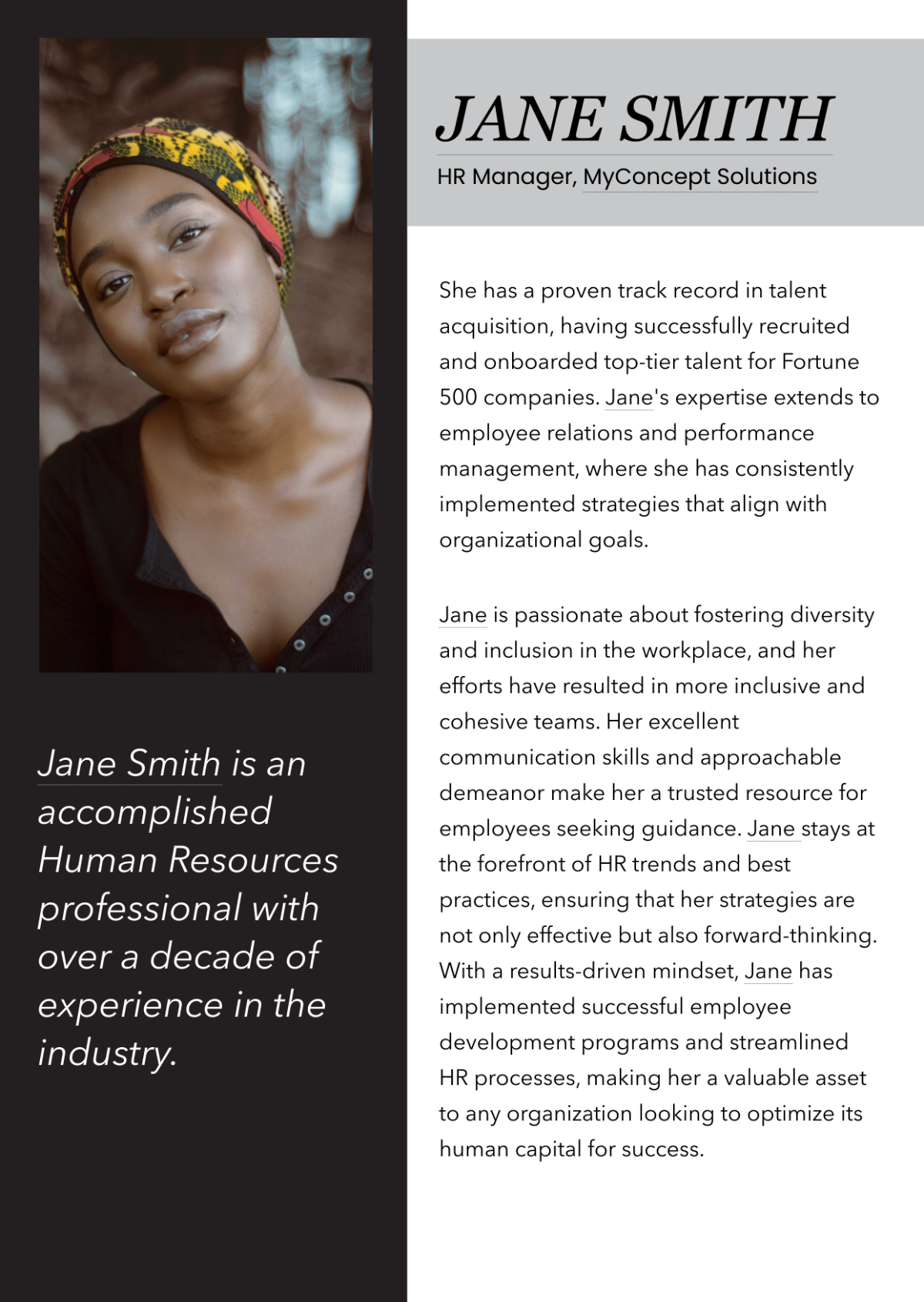

Prepared by:

[Names]

[Job Position]

[Personal Email]

[User Phone]

[Date]

This document is a property of [Company Name] and is intended for internal use only.