Account Audit Protocol

TABLE OF CONTENTS

Introduction..............................................................................................................3

Audit Planning..........................................................................................................5

Data Collection and Analysis..................................................................................6

Audit Findings and Reporting.................................................................................8

Follow-up and Continuous Improvement..............................................................9

Conclusion................................................................................................................10

Introduction

The Account Audit Protocol serves as a guide designed to outline the processes and procedures during an account audit for [Your Company Name]. The protocol aims to ensure the execution of accurate, efficient, and secure audits. This integrated approach manages to weave the company's unique identity into the auditing process, enhancing the brand's credibility and reliability. The protocol emphasizes thoroughness, accuracy, and accountability, ensuring all responsible parties adhere to the protocol while providing clear and concise procedures to follow.

Purpose of Audit:

The primary objective of the audit is to establish an independent and objective evaluation of the financial statements of [Your Company Name], a task of paramount importance. This meticulous process plays a critical role in ensuring the precision and reliability of the company's financial reporting. Such rigor is indispensable for maintaining the confidence of investors and adhering to regulatory standards.

The audit also plays a vital role in enhancing the efficacy of internal decision-making processes by identifying potential discrepancies and areas of risk in the financial records. Consequently, it contributes to the formulation of essential improvements or corrective actions.

Compliance to Ethical Standards:

The audit protocol is meticulously crafted to guarantee absolute compliance with the most recent accounting standards and regulatory directives pertinent to the industry. It underscores a commitment to ethical conduct, underscored by principles of integrity, objectivity, professional competence, confidentiality, and professional behavior.

This protocol mandates that all audit-related activities be executed with utmost adherence to these ethical standards, thereby promoting a culture of transparency and accountability within [Your Company Name]. This approach not only aligns with best practices but also reinforces the company's standing in the business community.

Audit Planning

The Audit Planning section of this protocol is important to the effectiveness of the audit process at [Your Company Name]. This section delineates a methodical approach and outlines preparatory actions essential for conducting a comprehensive and efficient audit. This initial phase is pivotal in establishing a definitive framework and guidelines, which will direct the entire audit lifecycle, encompassing initial risk evaluation through to the final reporting phase. The objective of this planning stage is to ensure the audit achieves unparalleled levels of precision, adherence to regulatory standards, and operational efficiency in scrutinizing and reporting financial activities.

Scope and Objectives:

The audit's scope comprehensively includes the examination of all financial statements of [Your Company Name], such as the balance sheet, income statement, cash flow statement, and statements of shareholders' equity for the designated audit period, typically aligning with the fiscal year. The primary objectives are to authenticate the accuracy of these financial statements, confirm compliance with generally accepted accounting principles (GAAP) and relevant legal requirements, and evaluate the robustness of internal financial controls.

Team Composition:

The audit team will be an amalgamation of internal auditors and external specialists, each with expertise in accounting, finance, and the specific industry sector of [Your Company Name]. Leadership of this team will be under a Certified Public Accountant (CPA) with substantial experience in corporate audits. It is mandatory for team members to engage in ongoing professional development, ensuring they are current with evolving accounting standards and regulations.

Risk Assessment and Materiality:

A preliminary risk assessment is integral to the audit process, aimed at identifying high-risk areas within [Your Company Name]'s financial operations. This assessment entails evaluating the probability and impact of possible inaccuracies or misstatements, thus directing audit efforts towards the most critical areas. Materiality thresholds will be established, identifying the level of financial inaccuracies or omissions that could significantly influence the decision-making of financial statement users.

Timeline and Milestones:

A comprehensive audit timeline will be crafted, specifying key phases of the audit process such as planning, fieldwork, reporting, and follow-up activities. This timeline will elaborate on specific milestones and their corresponding deadlines. The purpose of this detailed timeline is to serve as a strategic framework, ensuring each audit phase progresses in an orderly and systematic manner, while maintaining flexibility to adapt to any unforeseen challenges.

Stakeholder Communication:

Throughout the audit process, efficient and continuous communication channels will be maintained with all essential stakeholders, including [Your Company Name]'s management team, the audit committee, and pertinent external regulators. The aim of this ongoing communication is to ensure a high standard of transparency and accountability. This also facilitates the early detection and resolution of any issues that may arise during the audit, promoting a collaborative and proactive audit environment.

Documentation and Record Keeping:

Exceptional documentation and rigorous record-keeping are fundamental to the audit process. Every phase, from initial audit procedures to the final outcomes and communications, will be thoroughly documented. This extensive documentation serves several crucial purposes: it provides a definitive record of the audit process, supports the conclusions reached, and offers valuable insights for future audits. Furthermore, this documentation is critical for any potential regulatory examinations, assuring that [Your Company Name] remains compliant and well-prepared for external scrutiny.

Methodology and Techniques:

The audit will employ a blend of contemporary and proven auditing methodologies and techniques, ensuring a thorough examination of [Your Company Name]'s financial statements. This includes employing both quantitative and qualitative analysis methods, such as substantive testing, analytical procedures, and sampling techniques. The use of advanced technological tools for data analysis and financial modeling is also integral to our approach. These methodologies are designed to be adaptable, allowing auditors to efficiently navigate complex financial landscapes and uncover any irregularities or anomalies in financial data. By utilizing a diverse array of techniques, the audit ensures a comprehensive understanding of the company's financial health and the integrity of its financial reporting.

Quality Assurance and Continuous Improvement:

Quality assurance is a critical component of the audit process. This involves regular reviews and assessments of audit work to ensure it meets or exceeds professional standards and regulatory requirements. The aim is to maintain the highest levels of quality in every aspect of the audit, from planning and execution to reporting and follow-up. Furthermore, a commitment to continuous improvement is embedded in our approach. Feedback from each audit cycle is meticulously analyzed to identify areas for enhancement, and lessons learned are integrated into future audits. This ongoing refinement process ensures that the audit methodology remains robust, relevant, and aligned with evolving best practices in the field.

Data Collection and Analysis

Data Collection and Analysis form the foundation of the audit process at [Your Company Name], undertaken by the designated Audit Team. This phase is characterized by the meticulous gathering of comprehensive financial data, followed by an in-depth analysis to gauge the company's financial stability and compliance with accounting norms.

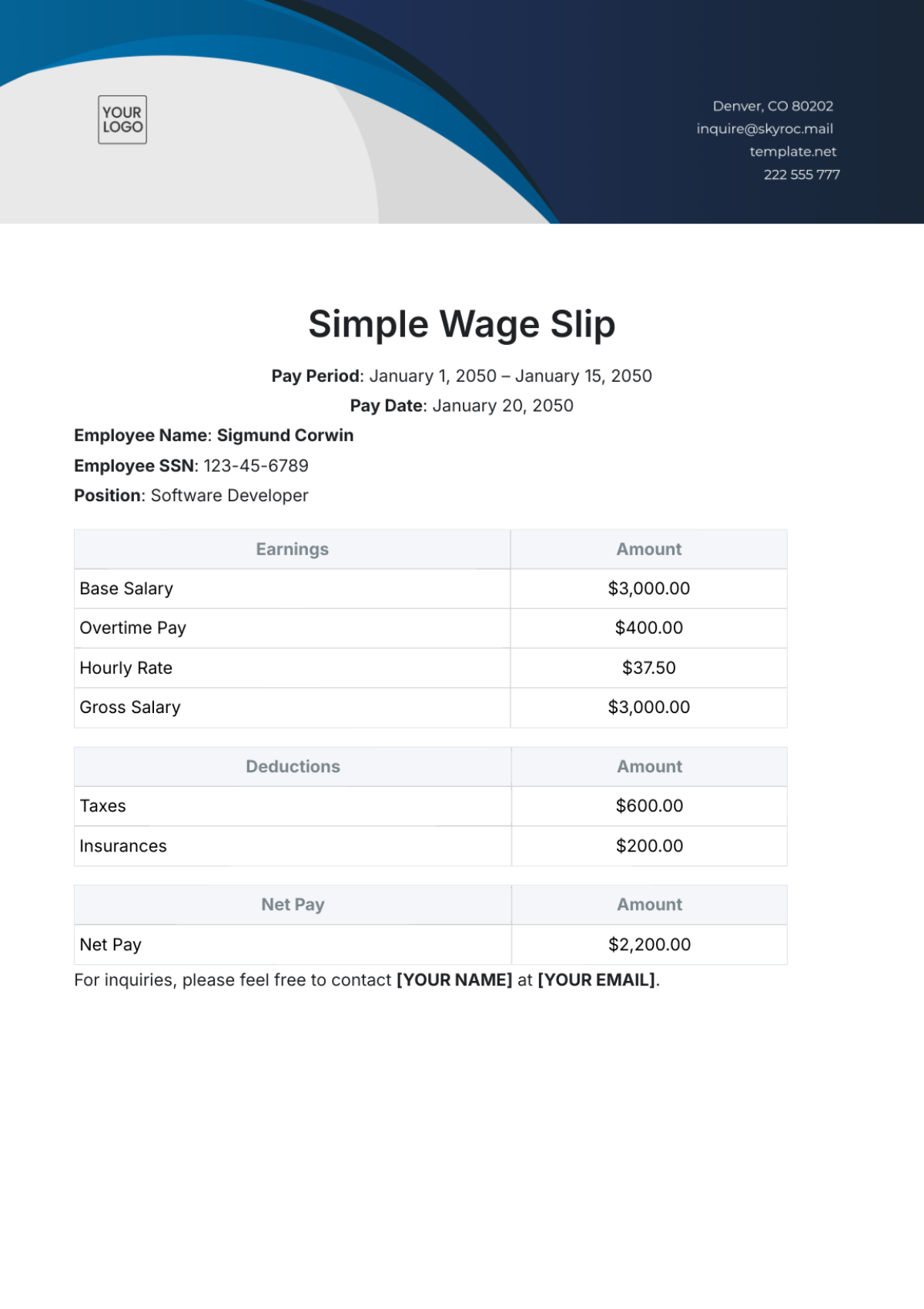

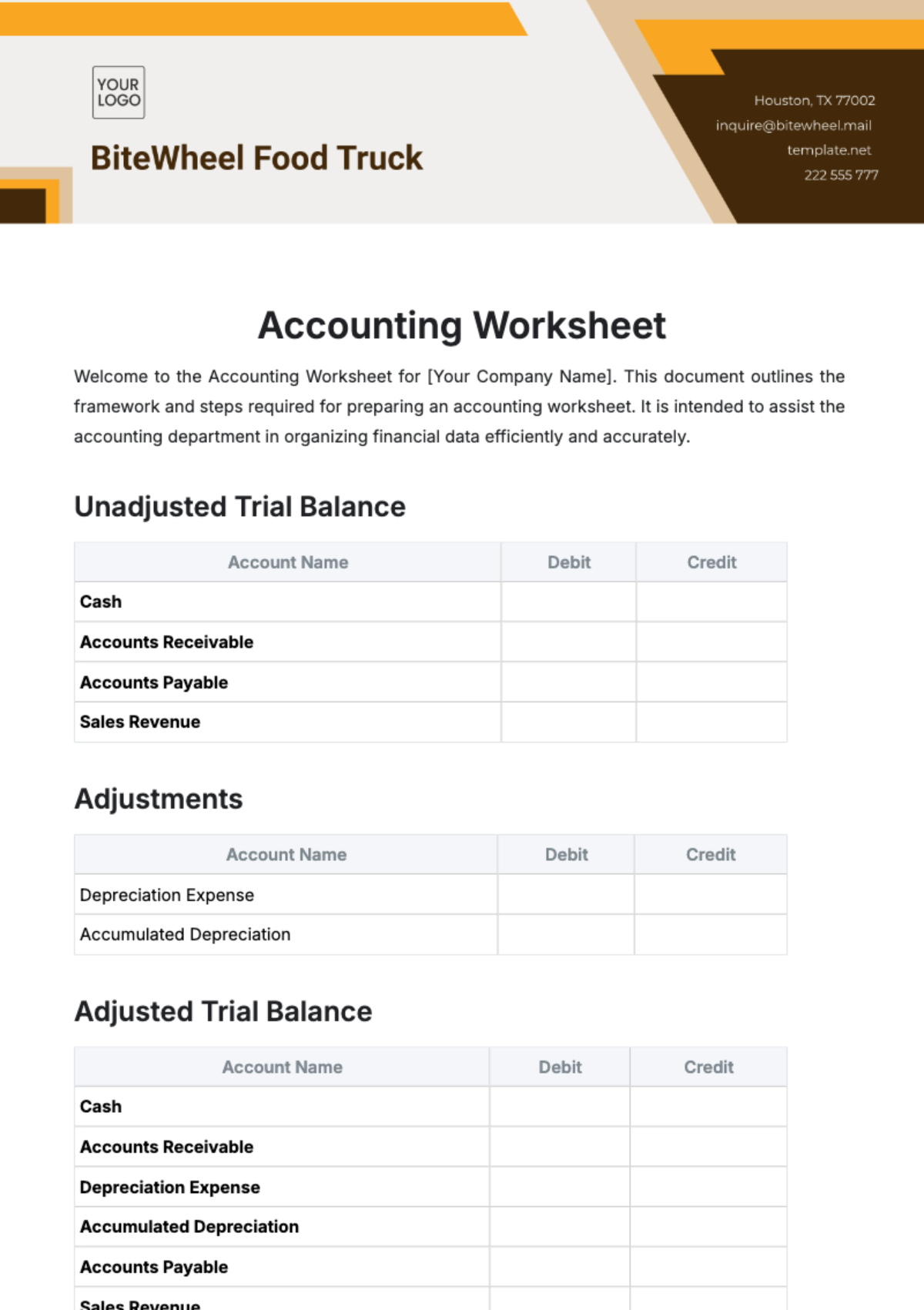

Financial Data Gathering:

A thorough acquisition of financial data is crucial, encompassing balance sheets, income statements, cash flow statements, and explanatory notes to the financial statements for the audit period. This process also includes the collection of corroborative documents such as invoices, bank statements, and transaction records.

Total Assets | Total Liabilities | Total Equity |

|---|---|---|

$500,000,000 | $300,000,000 | $200,000,000 |

Analytical Procedures

In this stage, we conduct analytical procedures on the amassed data, focusing on discerning trends, ratios, and discrepancies indicative of potential financial concerns or areas necessitating deeper investigation.

Current Ratio | Debt-to-Equity Ratio | Gross Profit Margin |

|---|---|---|

1.5 | 1.5 | 25% |

Internal Control Review

An in-depth evaluation of [Your Company Name]'s internal control mechanisms over financial reporting is imperative. This encompasses an assessment of the control environment, risk assessment processes, control activities, information and communication systems, and monitoring controls.

Control Area | [2050] Evaluation | [2051] Evaluation |

|---|---|---|

Risk Assessment | Adequate | Improved |

The data collection and analysis phase is pivotal in providing a detailed, objective perspective of [Your Company Name]'s financial undertakings, thereby equipping the audit team with the means to pinpoint concerns and validate the integrity of financial reports.

Audit Findings and Reporting

The Audit Findings and Reporting phase is the culmination of the auditing process at [Your Company Name]. This stage is of paramount importance as it serves to consolidate all the data, analyses, and testing outcomes into a coherent and comprehensive audit report. This report is instrumental in providing essential insights and recommendations for potential improvements. During this phase, unwavering dedication to transparency, precision, and clarity is imperative to ensure that all stakeholders possess a clear understanding of the audit results and the overall financial health of the company.

Drafting Report:

The audit report represents a comprehensive document that encapsulates the essence of the audit findings. It commences with an executive summary, furnishing a concise yet comprehensive overview of the audit outcomes. Subsequently, the report delves into a thorough analysis of the findings, systematically categorized into critical issues, significant deficiencies, and actionable recommendations. Notably, the report includes an auditor's opinion on the financial statements, reflecting the depth and breadth of the audit conducted.

Management Review:

Following the drafting phase, the preliminary report undergoes a rigorous review by the management team of [Your Company Name]. This step is pivotal in fostering a collaborative approach to the audit process. Management is strongly encouraged to provide responses, clarifications, and their perspectives on the findings, particularly concerning identified issues or deficiencies. Their valuable input is meticulously integrated into the final report, ensuring a balanced and comprehensive representation of the audit findings.

Finalizing the Report:

The finalization of the audit report marks a critical juncture. It entails the assimilation of management’s responses and any additional insights garnered during the conclusive stages of the review. The auditor's opinion, a pivotal component of the report, is diligently formulated based on the completeness and accuracy of the financial statements. This opinion can range from an unqualified opinion, reflecting a high degree of confidence in the financial statements, to a disclaimer, which underscores the audit’s thoroughness and integrity.

Communication and Distribution:

Effective communication and the widespread dissemination of the finalized audit report are paramount. This report is distributed to key stakeholders, including the audit committee, the board of directors, investors, and pertinent regulatory bodies. The communication strategy is thoughtfully crafted to ensure absolute clarity and comprehension, emphasizing the significance of the audit findings and the auditor’s opinion.

Post-Audit Meeting:

A post-audit meeting is convened, bringing together the management of [Your Company Name] and the audit committee. This interactive session serves as a platform to delve into the audit findings, address any areas of concern, and strategize the implementation of the recommendations. The collaborative nature of this meeting is pivotal in fostering mutual understanding and consensus on future actions and enhancements.

Public Disclosure:

In adherence to legal mandates and company policies, [Your Company Name] may engage in the public disclosure of significant audit findings. This step assumes particular prominence when the findings bear substantial implications for the company’s financial statements or its compliance standing. Such transparency is fundamental in upholding stakeholder confidence and regulatory compliance.

Feedback and Improvement:

Lastly, the protocol underscores the significance of feedback and continual improvement. Feedback is actively solicited from all parties involved in the audit process - the audit team, management, and other stakeholders. This invaluable feedback plays a pivotal role in refining future audits, nurturing a culture of continuous enhancement, and ensuring adaptability to the evolving financial landscape and regulatory requisites.

The Audit Findings and Reporting phase stands as the linchpin in concluding the audit cycle at [Your Company Name], presenting a clear and actionable perspective of the company’s financial standing and paving the way for advancements in financial practices and controls.

Follow-up and Continuous Improvement

The Follow-up and Continuous Improvement phase is an essential component of the audit cycle at [Your Company Name]. This stage ensures that the insights and recommendations derived from the audit are actively implemented and tracked for effectiveness.

Implementation of Recommendations:

This plan should delineate specific, actionable tasks, assign them to designated individuals or departments, and establish clear timelines and expected outcomes for each task. It is imperative for management at [Your Company Name] to actively engage in and take ownership of this implementation process, as this commitment is crucial for the effective resolution of the identified issues and for driving meaningful change within the organization.

Monitoring and Reporting:

A robust monitoring mechanism will be established to diligently track the progress of implementing the audit recommendations. This mechanism will involve periodic updates - either on a quarterly basis or more frequently for critical issues - to the audit committee and senior management. Such consistent reporting is essential to ensure transparency and to maintain the momentum of the implementation process.

Assessment of Implemented Changes:

Post-implementation, a thorough assessment will be conducted to evaluate the effectiveness of the changes made. This evaluation can be integrated into the subsequent audit cycle or executed as an independent review. The primary focus will be to ascertain whether the implemented changes have effectively addressed the identified issues and to gauge their impact on the overall financial control environment of [Your Company Name].

Feedback Loop:

Establishing a dynamic feedback loop is crucial for continuous improvement. This loop will involve the audit team, management, and other stakeholders, enabling an exchange of perspectives on both the audit process and the efficacy of the implementation of its recommendations. Insights gained from this feedback will be instrumental in the continuous refinement of audit practices and the enhancement of financial controls.

Updating Methodologies and Tools:

In response to the audit findings and accumulated feedback, there will be a concerted effort to update and refine the audit methodologies and tools. This update will take into account emerging risks, evolving accounting standards, and technological advancements, ensuring that the audit process remains cutting-edge, efficient, and fully capable of addressing contemporary challenges.

Training and Development:

Ongoing training and professional development will be a cornerstone for the audit team and relevant staff members at [Your Company Name]. This training will encompass the latest developments in accounting standards, advanced audit techniques, and any pertinent changes in regulatory requirements, ensuring that the team remains proficient and well-equipped to handle the complexities of modern financial auditing.

Annual Audit Process Review:

An annual review of the audit process will be conducted to critically assess its efficiency and effectiveness. This review is intended to identify areas for improvement, streamline the audit process, and implement necessary adjustments in preparation for the next audit cycle. This ongoing review and refinement process is essential for maintaining the high standards of auditing at [Your Company Name] and for fostering a culture of excellence and adaptability in our audit practices.

The Follow-up and Continuous Improvement phase at [Your Company Name] is about turning insights into action and fostering an environment of perpetual advancement in financial reporting and control processes. It underscores the company's commitment to upholding the highest standards of financial integrity and responsiveness to change.

Conclusion

The Accounting Audit Protocol for [Your Company Name] embodies a comprehensive and methodical approach to financial auditing. This protocol underscores our unwavering dedication to financial integrity, transparency, and the pursuit of continuous improvement. By steadfastly adhering to these guidelines, [Your Company Name] reaffirms its commitment to upholding the utmost standards of financial accountability, thereby cultivating and nurturing trust among its valued stakeholders.