Guide to Legalities in Employee Recognition and Rewards

TABLE OF CONTENTS

Introduction ................................................................................................................3

Key Legal Principles ................................................................................................4

Tax Implications ........................................................................................................4

Discrimination Concerns ........................................................................................6

Regulatory Reporting and Compliance .............................................................8

Data and Examples ..................................................................................................9

Conclusion ................................................................................................................10

Introduction

In the dynamic landscape of business today, appreciating the contributions of employees has become more than just a simple gesture of goodwill; it has evolved into a strategic imperative. The positive ripple effects of a well-implemented recognition and reward system are undeniable. They not only foster motivation and boost morale but also play a pivotal role in talent retention and promoting a culture of excellence.

At [Your Company Name], our commitment to celebrating the efforts and achievements of our team is unwavering. However, while our intent is to appreciate, it is equally critical to be mindful of the myriad of legal parameters surrounding these practices. This guide seeks to provide a comprehensive overview of the legal intricacies tied to employee rewards and recognitions, ensuring our practices at [Your Company Name] are always on the right side of the law.

The Evolution of Employee Recognition

Historically, employee recognition was a simple pat on the back or perhaps a gold watch after decades of service. Now, with the changing times, businesses have realized that consistent and well-thought-out recognition strategies are crucial for maintaining morale, driving performance, and ensuring retention. In our digital age, where word spreads fast, and corporate cultures are under constant scrutiny, how a company recognizes its employees becomes a part of its brand.

The Legal Landscape

As the methods and types of recognitions have evolved, so have the legalities surrounding them. What was once a straightforward process has now become a complex system, with tax implications, anti-discrimination laws, and data privacy concerns. It's not just about what we recognize, but how we do it.

This guide provides a comprehensive overview of the legal intricacies tied to employee rewards and recognitions, ensuring our practices at [Your Company Name] are not only generous but also compliant.

Key Legal Principles

Employee recognition and rewards are an essential aspect of company culture and morale-boosting; they're also subject to specific legal considerations. A misstep in this area, however well-intentioned, can have significant repercussions. We prioritize the following principles to ensure that our recognition and reward system is beyond reproach:

Transparency: It is vital to create a clear and open process surrounding the allocation of rewards and recognitions. All employees should be informed about the criteria, eligibility, and procedures. This not only ensures fairness but also helps in building trust within the organization.

Consistency: Rewards and recognitions should not be arbitrary. A consistent approach, rooted in defined metrics and standards, prevents the perception (or reality) of favoritism and ensures that all employees are evaluated against the same benchmarks.

Documentation: The importance of keeping meticulous records cannot be overstated. Detailed documentation serves as evidence of fairness and can be crucial in situations where decisions come into question. This includes keeping track of nominations, evaluations, and the basis for every reward or recognition given.

Inclusivity: Ensure that the recognition and reward system is inclusive and does not inadvertently leave out any group or individual. Regular reviews and feedback sessions can help in identifying and rectifying any unintentional oversights.

Flexibility: While consistency is crucial, it's equally important to have a system flexible enough to accommodate exceptional circumstances. This ensures that the organization can recognize unique achievements that might not fit neatly into predefined criteria.

Tax Implications

In the realm of employee recognition and rewards, understanding the tax implications is paramount. Misunderstandings or oversights can lead to costly penalties for both the company and the employee. At [Your Company Name], we prioritize staying updated with the evolving tax codes related to employee rewards. This diligence ensures that we're not only compliant but that our employees understand their own responsibilities.

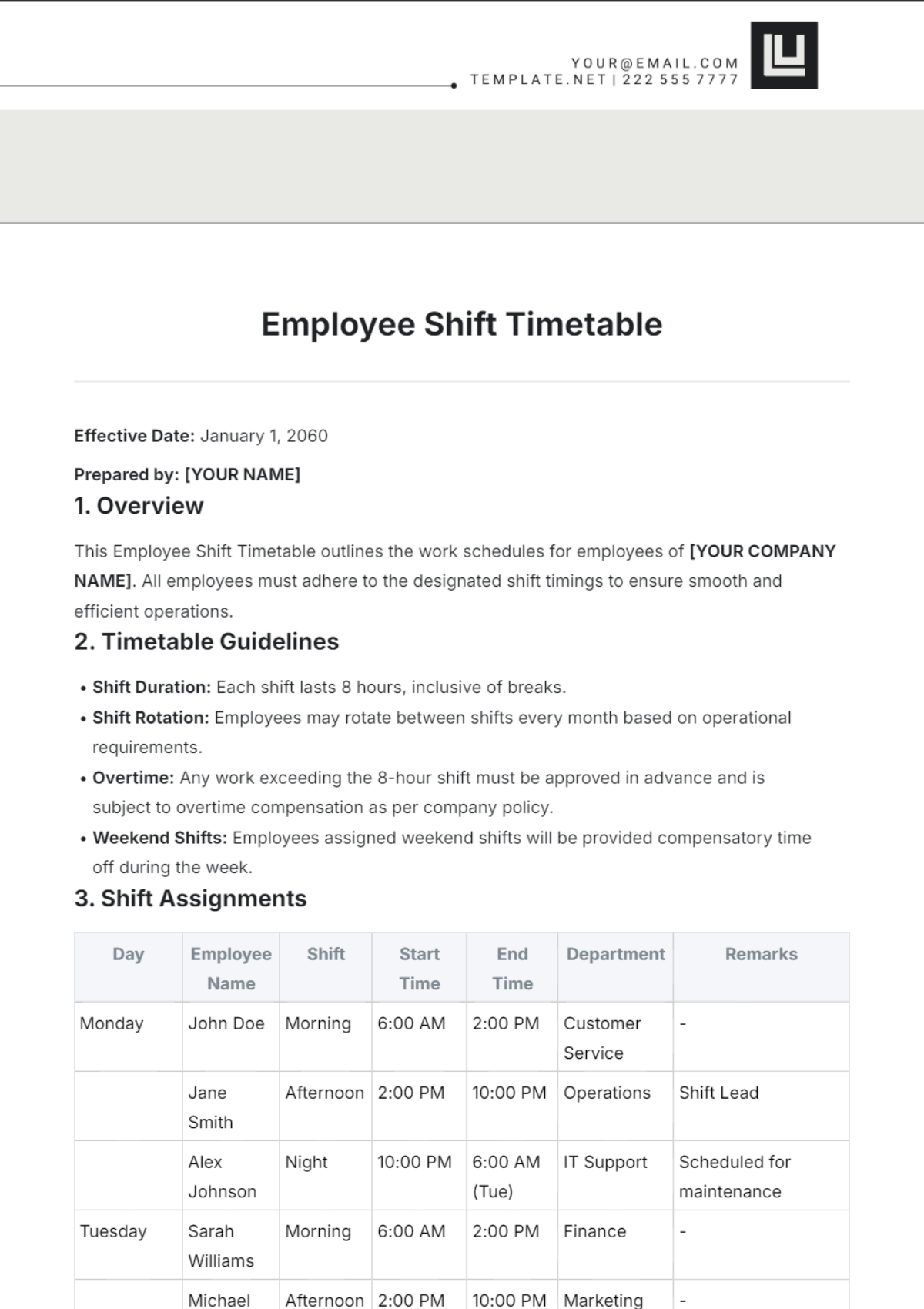

Nature of Rewards

Different rewards come with distinct tax treatments. For example, tangible financial rewards such as cash bonuses and gift cards typically fall under taxable income. In contrast, intangible or non-monetary recognitions, such as trophies or specific developmental training, may often be exempt. Understanding the nuances between these categories is pivotal in adhering to tax codes accurately.

Thresholds and Limits

Jurisdictions often delineate clear value-based thresholds which, when exceeded, trigger tax liabilities for rewards. Familiarity with these thresholds is essential not only for corporate compliance but also to preemptively inform employees. This proactive communication ensures that employees aren't caught off-guard with unforeseen tax implications.

Withholding and Reporting

The nature and quantum of rewards can necessitate the company to either withhold taxes directly at source or report the same to tax bodies. Precise and punctual execution in these matters safeguards the company against inadvertent legal breaches and associated penalties.

Employee Education

Beyond mere compliance, it's the company's duty to enlighten its workforce on the tax ramifications of their rewards. This is not just a regulatory obligation but also a gesture of transparency. Instituting regular workshops, information sessions, or providing detailed documentation can effectively disseminate this knowledge.

Yearly Review

The only constant with tax codes is change. With jurisdictions regularly updating and amending their tax laws, it becomes imperative for companies to conduct an annual scrutiny of these evolving regulations. Collaborating with tax professionals or legal advisors for these reviews guarantees that the company's reward practices remain in sync with the latest legal mandates.

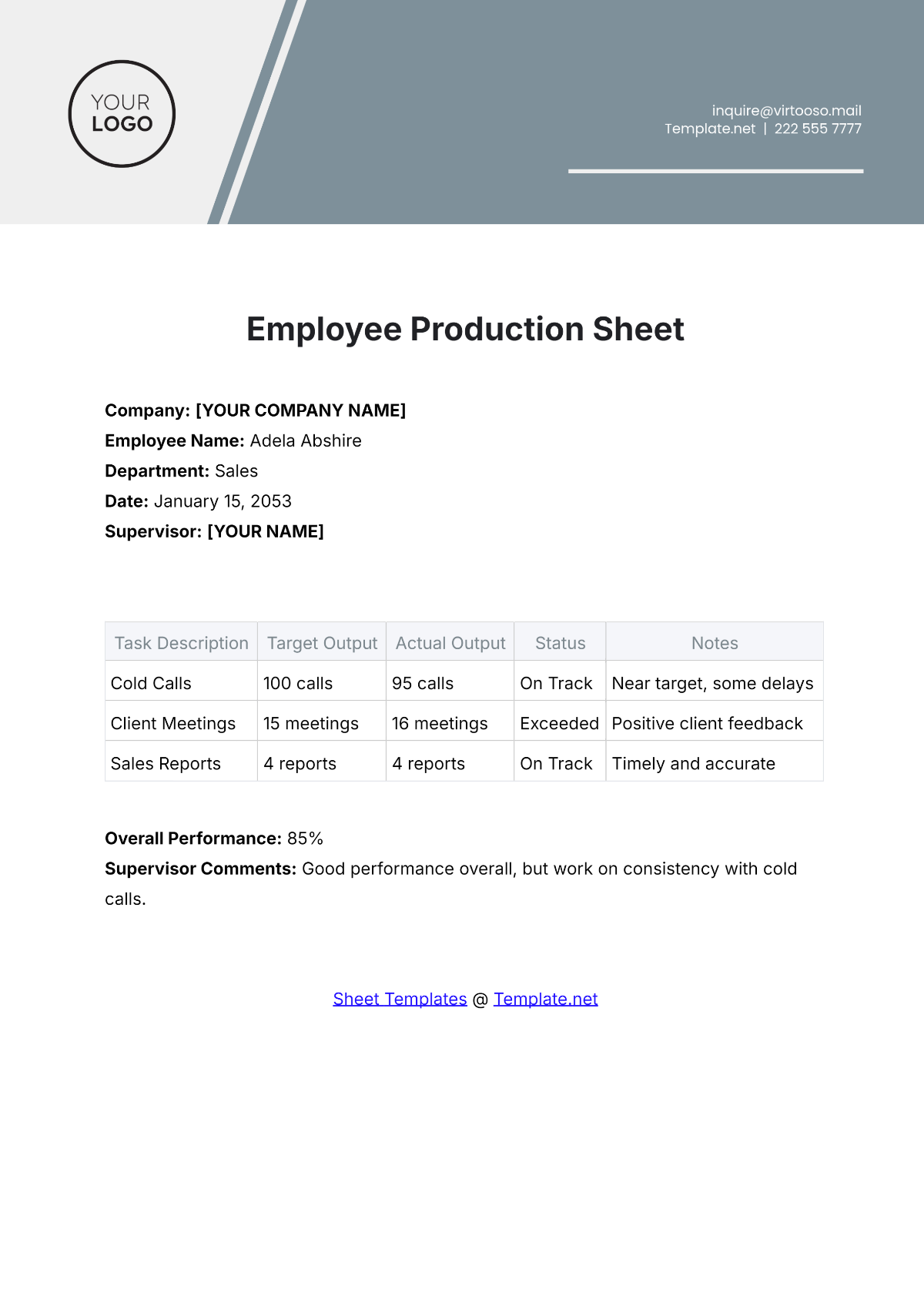

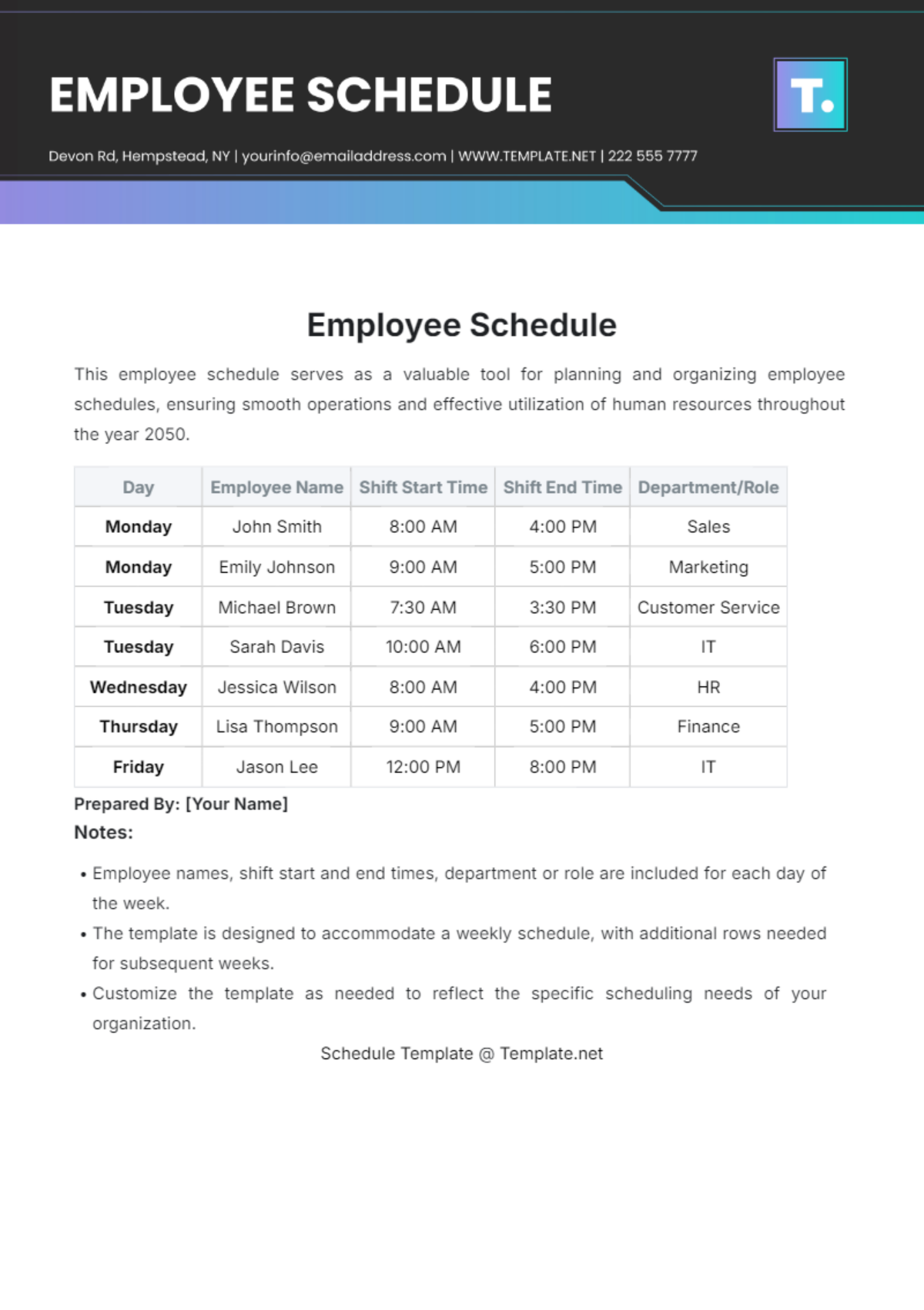

REWARD TYPE | TAXABLE (Y/N) | REPORTING REQUIREMENT |

Cash Bonus | Y | Must report if > $500 |

Gift Cards | Y | Must report if > $100 |

Trophies | N | N/A |

Training | N | Case-by-case basis |

Experiences | Y | Must report if > $250 |

By adhering to these guidelines and regularly consulting with tax experts, [Your Company Name] ensures that our rewards and recognitions are not only generous but also in line with the law. This approach provides peace of mind for both the organization and its valued employees.

Discrimination Concerns

Recognition and rewards should serve as a reflection of an employee's dedication, hard work, and achievements. In the spirit of fairness and equity, [Your Company Name] is staunchly committed to avoiding discriminatory practices. It's imperative to ensure that recognitions are free from biases related to:

Age: Recognizing talent and contributions without preconceptions about an individual's age, whether they are young or seasoned.

Gender: Ensuring that men, women, and non-binary individuals are equally recognized for their achievements without any gender-based stereotypes influencing decisions.

Race: Celebrating achievements beyond racial and ethnic lines, valuing diversity and the unique perspectives it brings.

Religion: Respecting and valuing contributions from individuals of all faiths, without letting religious beliefs influence recognition decisions.

Disability: Recognizing the strengths and achievements of all employees, regardless of physical or cognitive disabilities, and ensuring an inclusive recognition environment.

Marital Status: Understanding that an employee's marital or family situation should have no bearing on their recognition or the value of their contributions.

Sexual Orientation: Ensuring that employees are rewarded based on merit, without any biases related to their sexual orientation.

Ensure managers and supervisors are trained to recognize employees based solely on performance and achievements, devoid of any biases. We're committed to fostering an equitable environment where all employees feel valued and recognized based on their merit and not influenced by any other factors. Here's how we address and prevent discrimination concerns:

Objective Criteria: It is vital to establish clear, objective, and universally applied criteria for rewards and recognitions. This ensures that decisions are based on measurable achievements and performance, minimizing the risk of subjective biases.

Diverse Committees: By creating diverse committees or panels to evaluate and decide on recognitions, we ensure multiple perspectives are considered, reducing the chances of unintentional biases creeping into the decision-making process.

Regular Training: Regular sensitivity and anti-discrimination training sessions for all employees, especially those in managerial and decision-making roles, can help in recognizing and mitigating unconscious biases.

Feedback Mechanisms: Creating transparent channels for employees to voice their concerns, give feedback, or report perceived discrimination ensures that any potential issues are addressed promptly and effectively.

Audits and Reviews: Periodically conducting internal or third-party audits on recognition and reward programs helps in identifying any patterns that might indicate discrimination, ensuring continuous improvement and rectification.

By placing discrimination concerns at the forefront of our rewards and recognitions strategy, [Your Company Name] not only ensures legal compliance but also cultivates a culture where every individual, regardless of their background, feels valued, appreciated, and treated fairly.

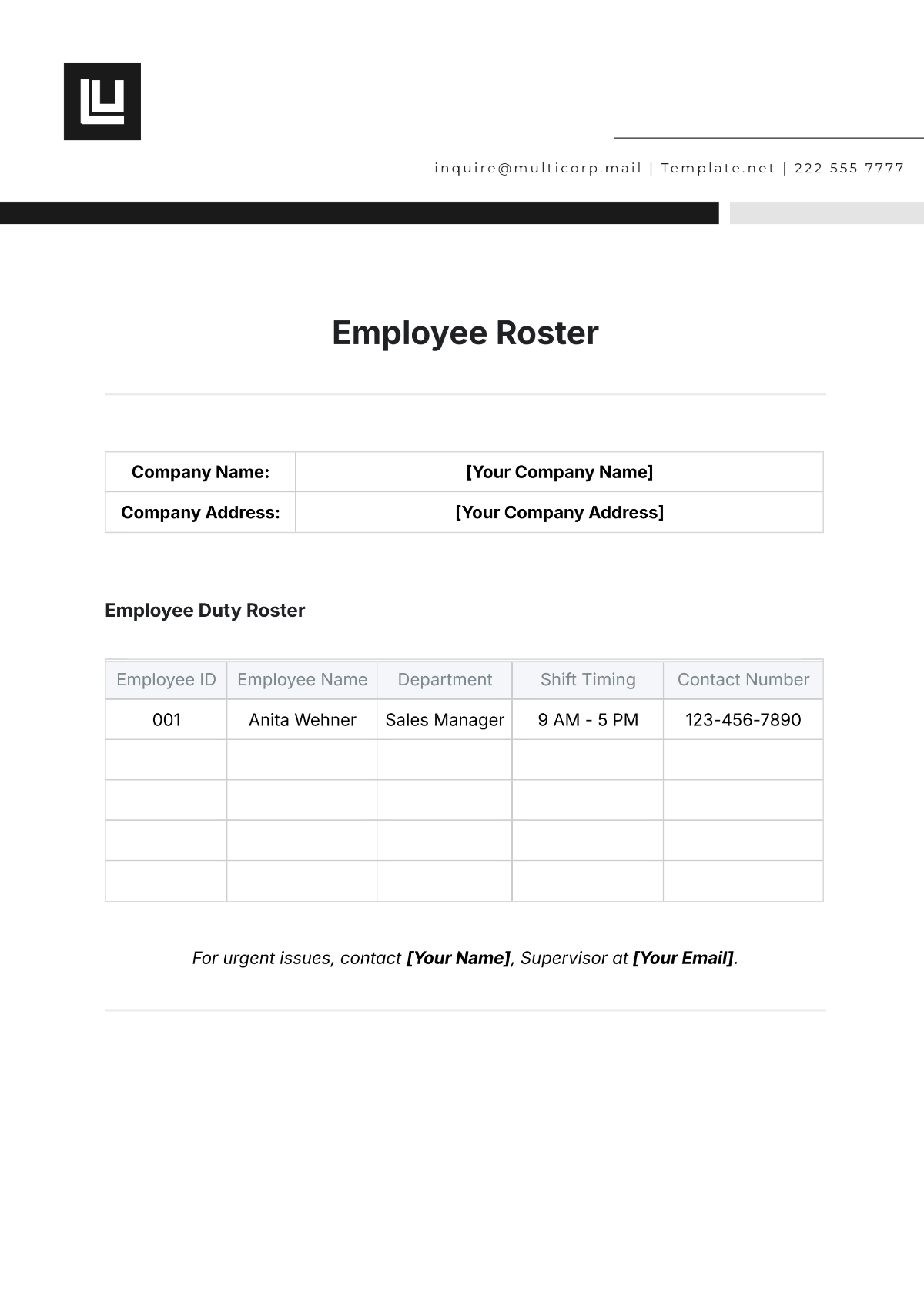

Regulatory Reporting and Compliance

Recognizing and rewarding employees is not just about boosting morale and driving performance; it also involves navigating a web of regulations designed to ensure transparency, fairness, and accountability.

Key Aspects of Regulatory Reporting and Compliance:

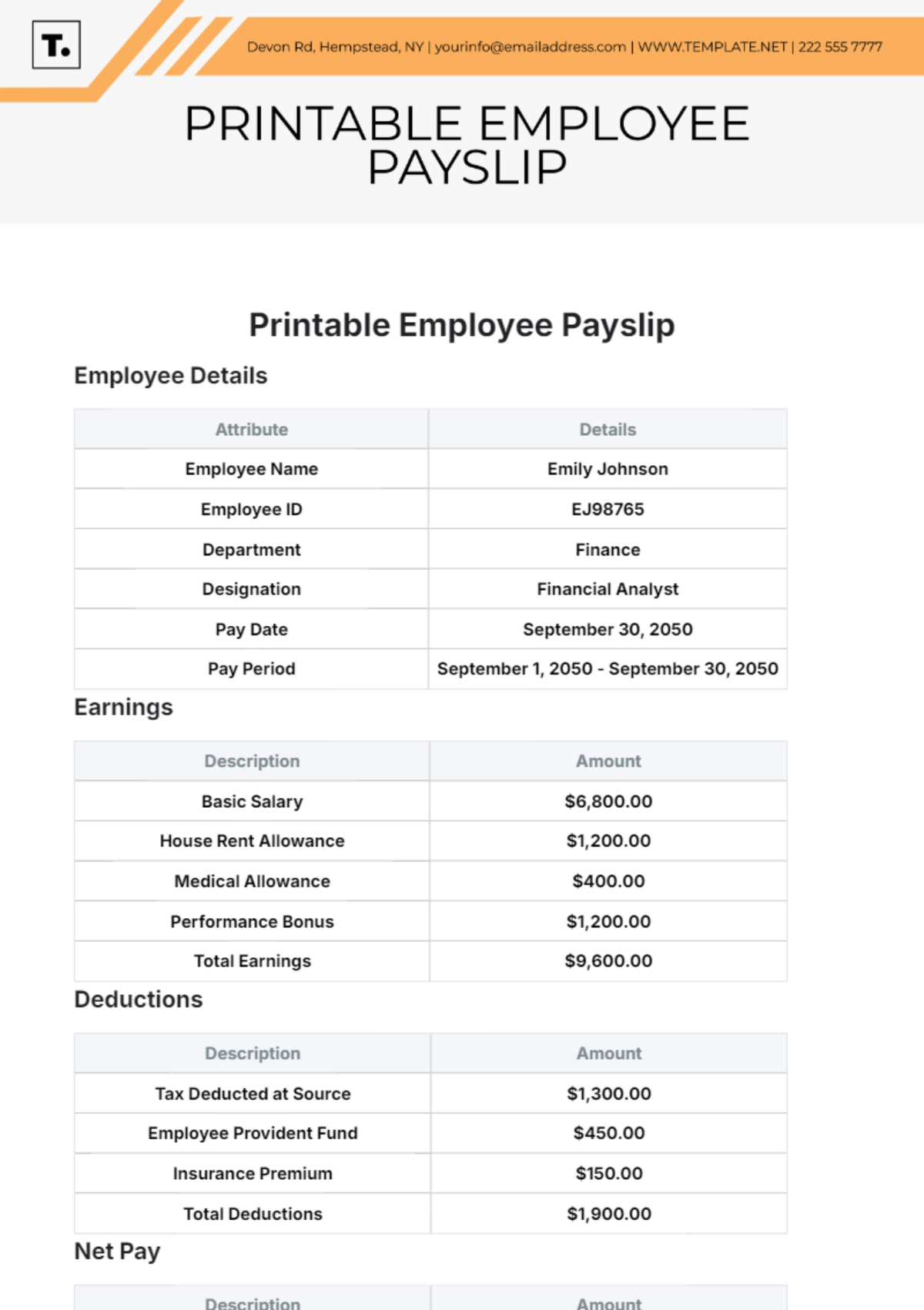

ASPECT | ACTION |

Transparent Record-Keeping | Every recognition and reward given is meticulously documented, capturing the reason, value, and recipient details. This not only ensures transparency but also provides a solid foundation for any audits or checks that may arise. |

Periodic Audits | We regularly conduct internal audits, and when necessary, third-party audits, to verify that our reward systems are compliant with prevailing regulations. These audits also help identify areas for improvement, ensuring that we always remain ahead of the curve. |

Updates and Training | Regulatory landscapes evolve. As such, we commit to periodic training sessions for our HR and management teams, ensuring that they're up-to-date with the latest regulations and best practices related to rewards. |

Clear Communication | Any changes to regulations or our internal reward policies are promptly communicated to all relevant stakeholders. This ensures that everyone involved in the process, from decision-makers to recipients, is informed and aligned. |

Engaging Experts | Recognizing the complexity of the legal landscape, [Your Company Name] engages with legal and HR consultants specializing in employee rewards. Their expertise ensures that our practices not only meet but often exceed regulatory requirements. |

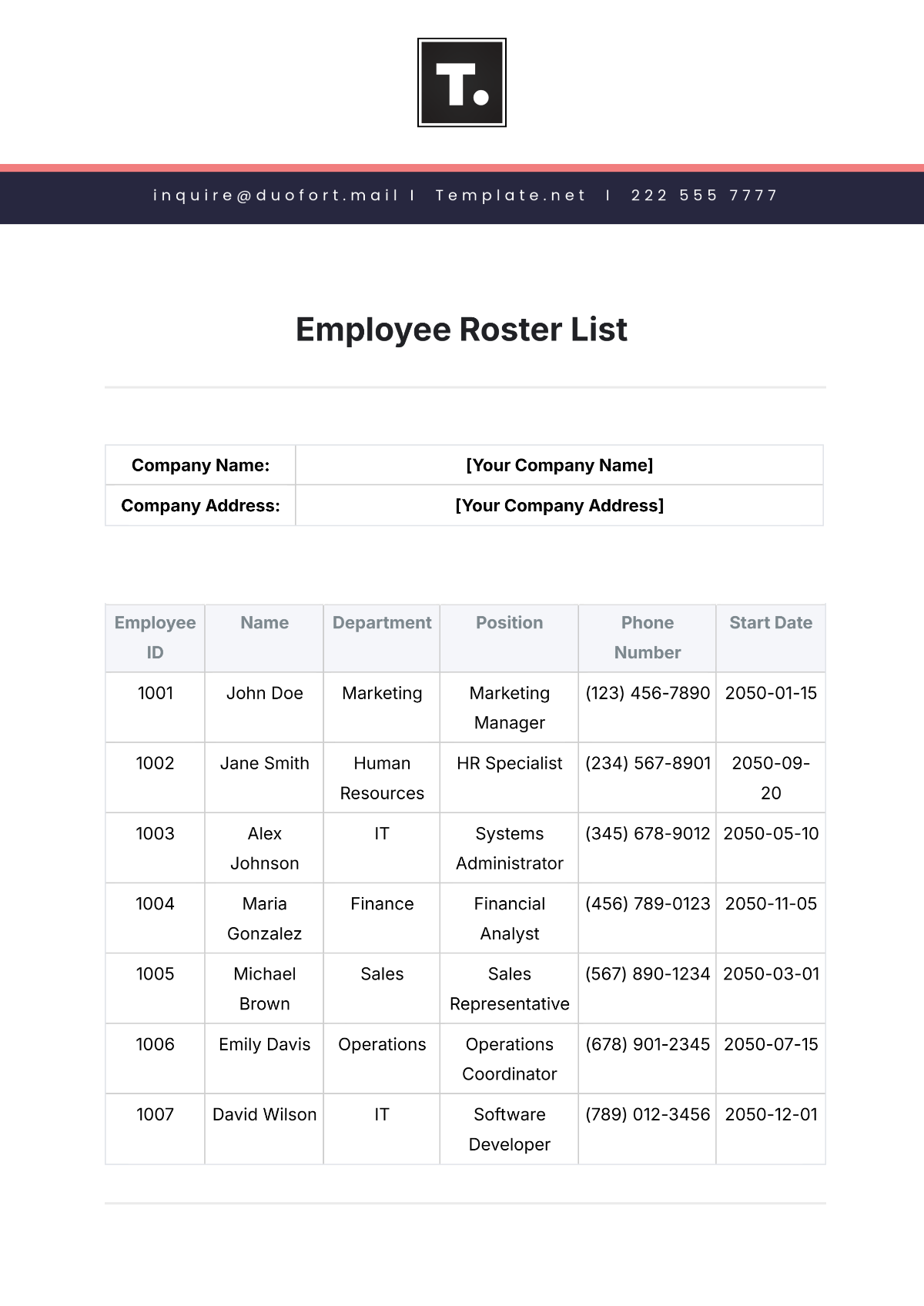

Data and Examples

Understanding complex regulatory and legal frameworks can be challenging. To provide clarity and actionable insights, we've illustrated some scenarios and accompanying data that showcase how [Your Company Name] navigates the intricate world of employee rewards and recognitions. These examples, while not based on real events, aim to elucidate the principles and practices we uphold.

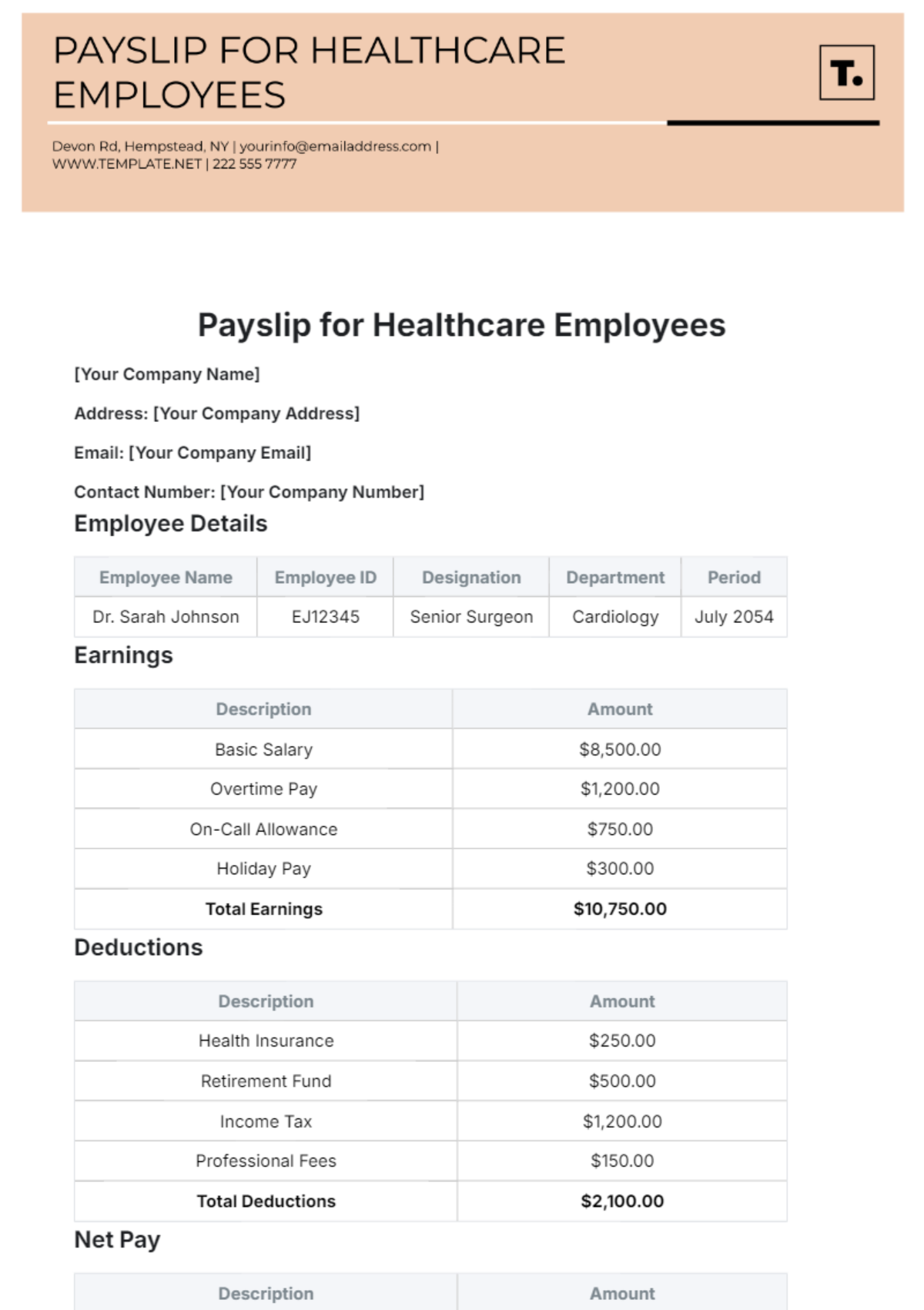

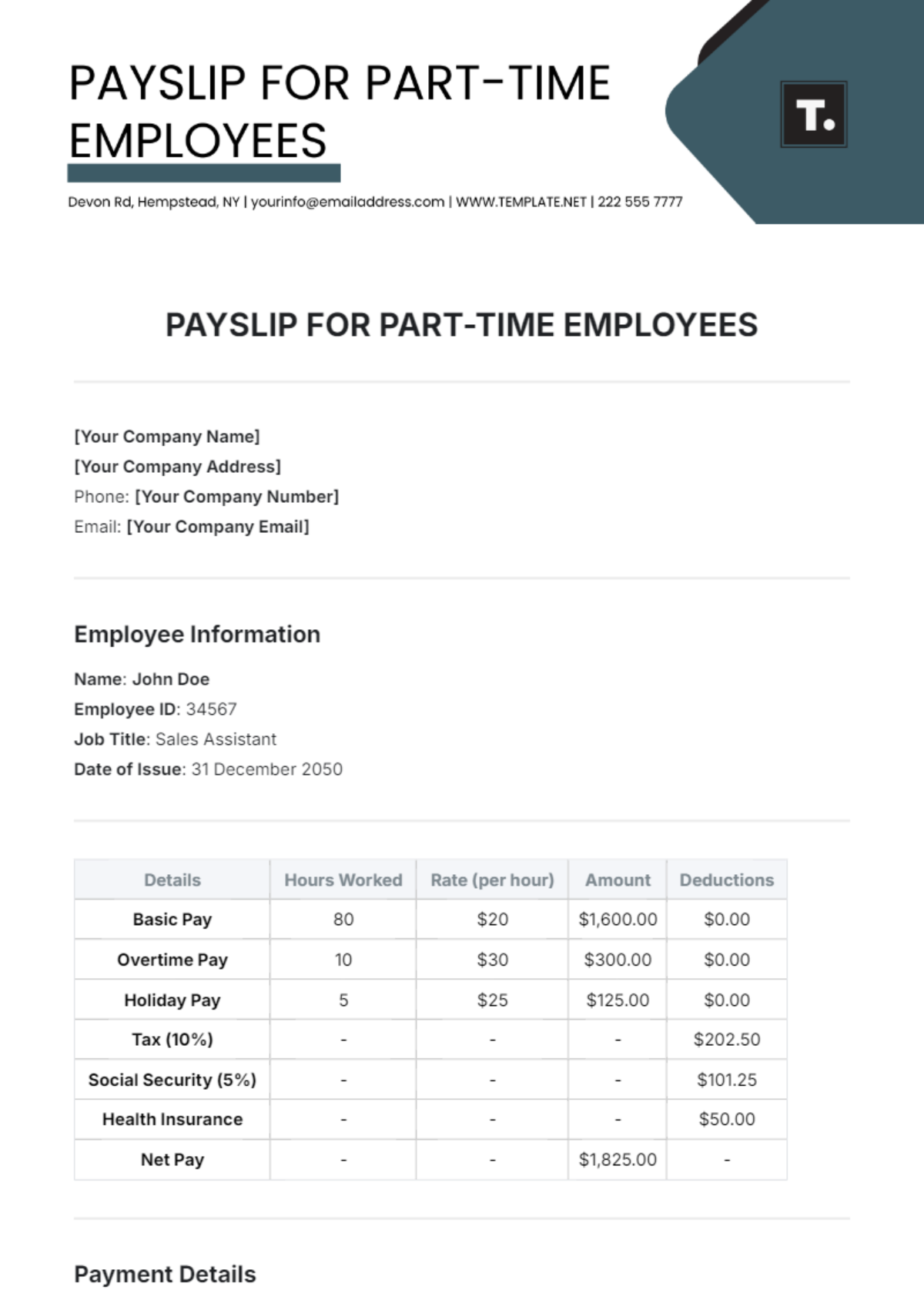

Example 1: The Cash Bonus Dilemma

Jane, an outstanding employee, exceeded her annual targets within just six months. The management decided to award her with a cash bonus. However, how much is too much without incurring excessive tax liabilities? |

BONUS AMOUNT | TAX BRACKET | ACTUAL AMOUNT RECEIVED |

$5,000 | 20% | $4,000 |

$10,000 | 25% | $7,500 |

$15,000 | 30% | $10,500 |

Example 2: Recognition Without Discrimination

In a bid to promote diversity, the company planned a recognition event. The goal was to ensure diverse representation in the awardees without introducing biases. |

RECOGNITION | GENDER BREAKDOWN | AGE GROUP REPRESENTATION |

Innovation | 50% M, 30% F, | 20s: 4, 30s: 3, 40s: 2, 50+: 1 |

Leadership | 60% F, 40% M | 20s: 1, 30s: 1, 40s: 2, 50+: 1 |

Example 3: Non-Monetary Rewards and Tax Implications

Mark was offered a two-week, company-paid vacation as a reward. Would this incur any tax implications for him? |

VACATION VALUE | TAXABLE AMOUNT | AMOUNT TO DECLARE |

$3,000 | 10% | $300 |

$5,000 | 15% | $750 |

$7,000 | 20% | $1,400 |

These examples, backed by fabricated data, serve as a guide to understanding the myriad factors [Your Company Name] considers in its rewards and recognitions program. By illustrating potential situations, we hope to shed light on the intricacies of our process, reaffirming our commitment to fairness, compliance, and utmost transparency.

Conclusion

Employee rewards and recognition programs are more than just mechanisms to celebrate achievements; they're catalysts that can invigorate a positive company culture, fostering motivation, and spurring excellence. Yet, as potent as these tools are in shaping workplace dynamics, they are intricately intertwined with a matrix of legalities demanding unwavering diligence.

At [Your Company Name], our commitment goes beyond mere acknowledgment of successes. We are steadfast in our resolve to marry the spirit of appreciation with the letter of the law. By intertwining fairness with transparency, and celebrating achievements within the boundaries of legal compliance, we ensure that our gestures of gratitude are both heartfelt and grounded in integrity.