Accounts Settlement System

1. Introduction

The Accounts Settlement System (ASS) of [Your Company Name] is designed to establish standardized procedures and guidelines for the efficient, transparent, and accurate settlement of accounts. This document outlines the principles and practices to be followed by all departments and personnel involved in the accounts settlement process. The ASS ensures compliance with regulatory requirements and enhances the financial integrity of [Your Company Name].

The ASS is crafted to support the financial team in navigating complex settlement scenarios, ensuring that all transactions are processed in compliance with legal requirements, and maintaining the company's reputation for fiscal responsibility. It is a living document, evolving as the financial landscape changes, and is a vital tool for the financial health and operational effectiveness of [Your Company Name].

2. Scope

The ASS covers a wide range of financial transactions across [Your Company Name], ensuring that every aspect of account settlement is comprehensively addressed. It is applicable to all departments and units within the company, ensuring a cohesive and uniform approach to financial transactions. This includes:

External transactions, such as payments to suppliers, consultants, and other service providers.

Internal transactions, including inter-departmental transfers and allocations.

Employee-related financial activities, such as payroll processing, reimbursements for business expenses, and other disbursements.

In recognizing the diverse nature of financial transactions, the ASS provides specific guidelines tailored to each type of transaction, ensuring clarity and efficiency in their handling. This policy plays a pivotal role in mitigating financial risks associated with mismanagement, fraud, or error in the settlement process.

3. Objectives

The primary objectives of the ASS are multi-faceted, aiming to establish a robust framework for financial transactions. These objectives include:

Ensuring Accuracy and Integrity: To maintain the highest levels of accuracy in all financial records and reports. This is crucial for providing a true and fair view of the company's financial position.

Promoting Efficiency and Effectiveness: To streamline the settlement process, reducing the time and resources required to complete financial transactions. Efficiency in processing payments and receipts is key to maintaining healthy cash flow and operational effectiveness.

Enhancing Compliance and Control: To ensure that all transactions are in compliance with legal, regulatory, and internal policy requirements. This involves establishing controls to detect and prevent errors, fraud, and misappropriation of funds.

Furthermore, the ASS aims to provide clear guidelines for the resolution of any discrepancies or disputes that arise in the course of settlements. It seeks to foster an environment of transparency and accountability, where all stakeholders are confident in the company's financial practices.

4. Definitions and Key Terms

To ensure clarity and a common understanding, key terms used in the ASS are defined as follows:

Settlement: The completion of a financial transaction where obligations are fulfilled by the transfer of funds.

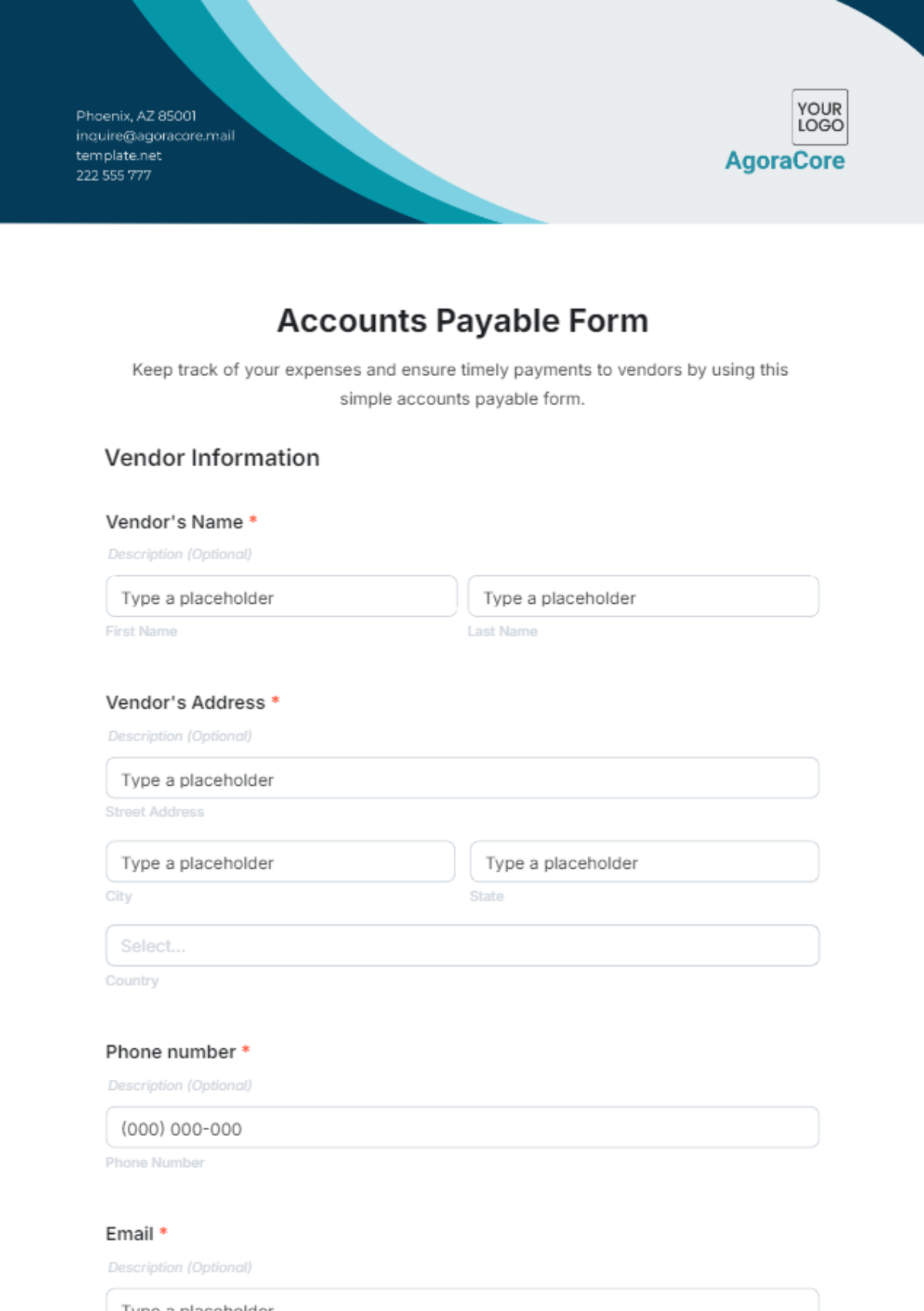

Accounts Payable (AP): Obligations of the company to pay debts owed to creditors or suppliers.

Accounts Receivable (AR): Amounts due to the company for goods or services delivered or used but not yet paid for by customers.

Reconciliation: A critical accounting process used for comparing two sets of records to ensure figures are accurate and in agreement.

Each of these terms forms the foundation of the settlement process and is critical to understanding and implementing the policy effectively.

5. Roles and Responsibilities

The efficient implementation of the ASS requires a clear delineation of roles and responsibilities. These are distributed among various departments and personnel to ensure checks and balances:

Finance Director: Overseeing the entire financial operation, ensuring policy adherence, and providing strategic direction.

Accounts Department: Handling day-to-day transaction processing, record keeping, and ensuring policy compliance.

Procurement Department: Authorizing and verifying purchases, and ensuring the legitimacy and accuracy of invoices.

Human Resources: Managing all employee-related financial transactions, including payroll and reimbursements.

Audit and Compliance Unit: Performing regular audits, ensuring policy adherence, and recommending improvements.

These roles are designed to create a systematic approach to the financial management of the company, ensuring that every transaction is handled with the utmost care and professionalism.

6. Settlement Procedures

The settlement procedures outlined in the ASS ensure a consistent approach to handling financial transactions. These procedures are detailed and specific, catering to various types of transactions:

6.1 Invoice Receipt and Verification

Upon receipt, invoices are logged into the accounting system, with a unique identifier assigned for tracking purposes. The verification process involves checking the details of the invoice against purchase orders, delivery notes, and contractual terms. This step is crucial in ensuring that the goods or services billed have been received and meet the agreed-upon standards and prices.

6.2 Payment Processing

Payments are processed according to the terms agreed upon with the vendor or service provider. The method of payment is selected based on efficiency, cost-effectiveness, and security considerations. The process includes authorization by the relevant department head and a final check by the Accounts Department to ensure compliance with the ASS.

6.3 Reconciliation

Monthly reconciliation of all accounts ensures that the accounting records accurately reflect the true financial position of the company. This process involves matching transactions recorded in the company’s accounting system with bank statements, invoices, and other relevant financial documents.

7. Settlement Timing and Deadlines

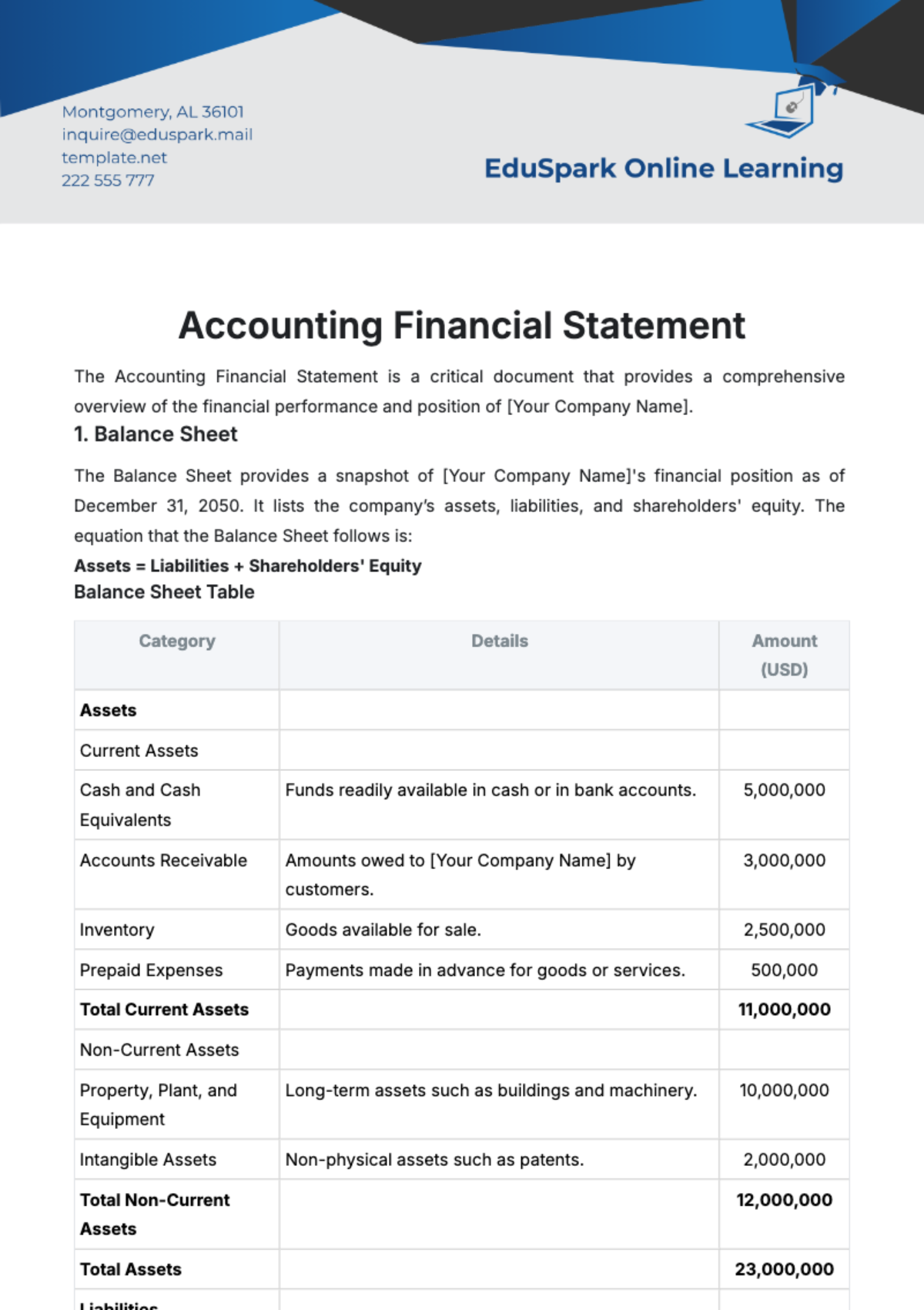

To maintain financial discipline and efficiency, strict adherence to settlement timings and deadlines is mandatory. The following table outlines the standard and urgent processing times for different transaction types:

Transaction Type | Standard Processing Time | Urgent Processing Time |

|---|---|---|

Supplier Payments | 30 days | 5 days |

Employee Reimbursements | 15 days | 3 days |

Customer Refunds | 15 days | 3 days |

Inter-Company Settlements | 20 days | 7 days |

These timeframes are established to balance the company's cash flow requirements with the need for timely settlements. Exceptions to these standard timings must be justified and approved by the Finance Director.

8. Discrepancies and Dispute Resolution

The ASS provides a structured approach for handling discrepancies and disputes in financial transactions. This includes a step-by-step process for reporting, investigating, and resolving such issues. A Dispute Resolution Committee, comprising members from the Finance, Legal, and relevant operational departments, is responsible for handling these matters.

Initial Assessment: Upon reporting of a discrepancy or dispute, an initial assessment is conducted to understand the nature and extent of the issue.

Investigation: A thorough investigation is conducted, involving the examination of relevant documents, interviews with concerned parties, and analysis of transaction records.

Resolution: The committee proposes a resolution based on its findings, which may include adjustments to financial records, additional payments, or other corrective actions.

This process is designed to be fair, transparent, and efficient, ensuring that disputes are resolved in a timely manner, with minimal disruption to the company's operations.

9. Documentation and Record Keeping

Effective documentation and record keeping are vital components of the ASS. All financial transactions must be supported by appropriate documentation, such as invoices, receipts, contracts, and correspondence. These records are critical for audit purposes, resolving disputes, and ensuring compliance with legal and regulatory requirements.

Document Management: The company maintains a centralized document management system for storing and retrieving financial records. This system ensures that documents are organized, secure, and easily accessible.

Record Retention: Financial records are retained for a minimum of seven years, in line with regulatory requirements and best practices. Electronic records are backed up regularly to prevent data loss.

This approach ensures that the company has a comprehensive and accurate record of all financial transactions, which is essential for financial reporting, audit, and compliance purposes.

10. Compliance and Monitoring

The success of the ASS depends on strict compliance and regular monitoring. The company has established various mechanisms to ensure adherence to the policy, including:

Regular Audits: Conducted both internally and by external auditors, these audits assess compliance with the ASS and identify areas for improvement.

Compliance Training: Regular training sessions are held for employees involved in the settlement process, ensuring they are aware of the policy requirements and best practices.

Monitoring and Reporting: The Finance Department monitors compliance with the policy, reporting any deviations or concerns to the Finance Director and Audit and Compliance Unit.

These measures are essential for maintaining the integrity of the financial management system and ensuring the ongoing effectiveness of the ASS.

11. Amendments and Revisions

The ASS is a dynamic document, subject to periodic review and amendment to reflect changes in the business environment, regulatory requirements, and best practices. The process for amending the policy is as follows:

Proposal for Amendment: Any proposed changes to the policy must be submitted to the Finance Director for initial review.

Review and Approval: The proposed amendments are reviewed by a policy review committee, which includes representatives from various departments.

12. Approval and Implementation

This document is approved by the Board of Directors of [Your Company Name].

The effective date of implementation is [Enter Date].