Accounting Fixed Assets Statement

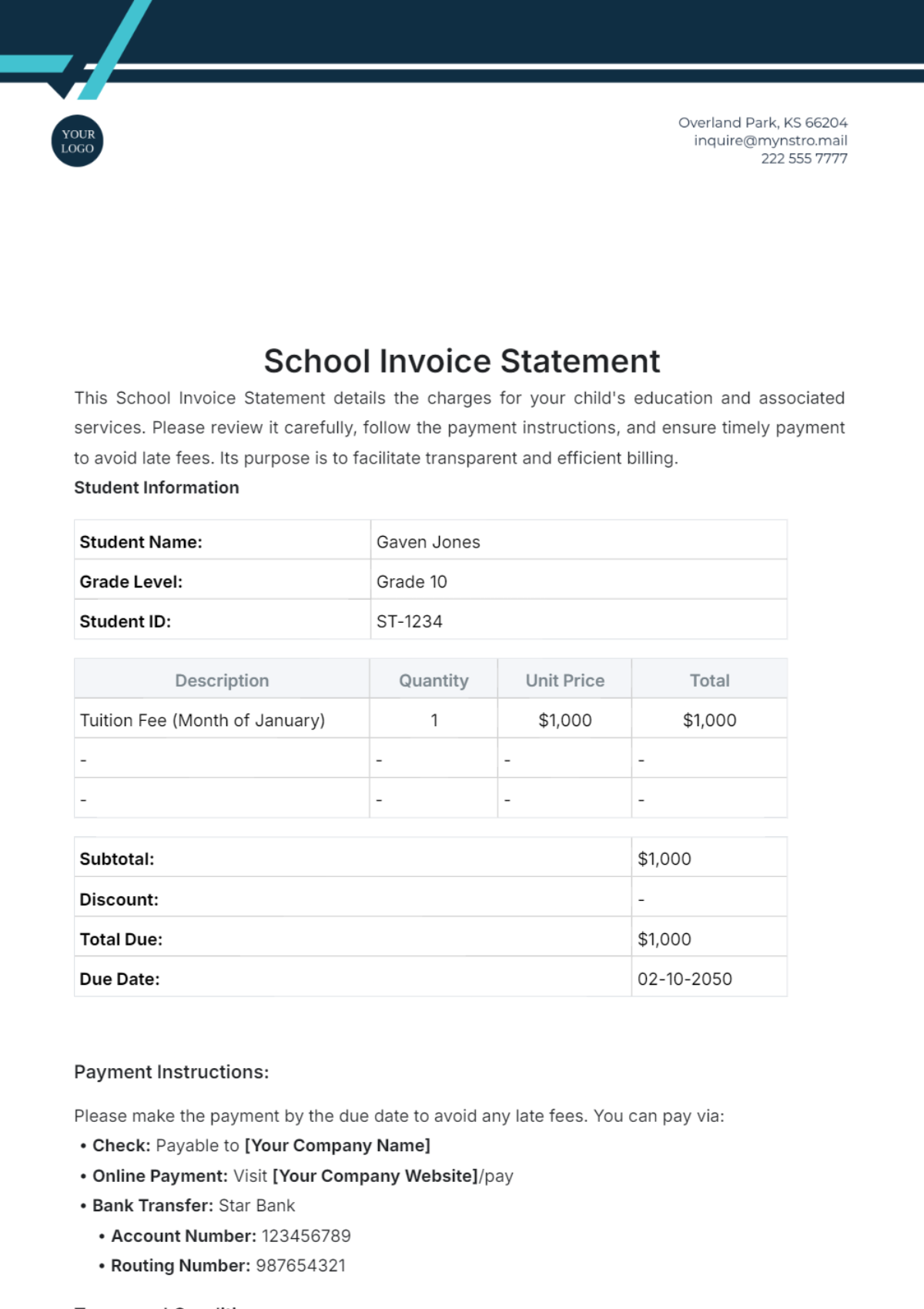

Prepared by: [Your Name]

Date Prepared: [Month Day, Year]

Introduction

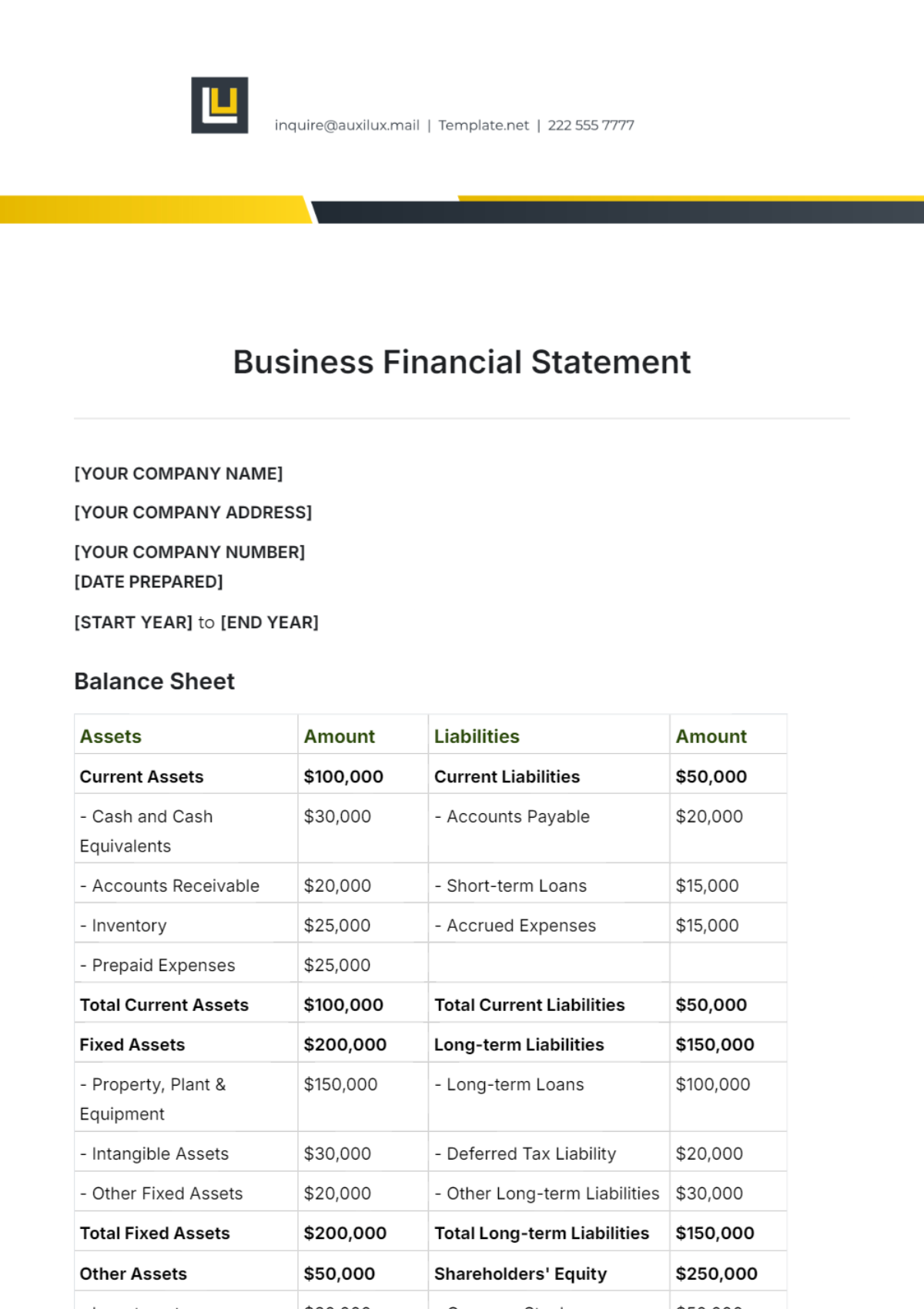

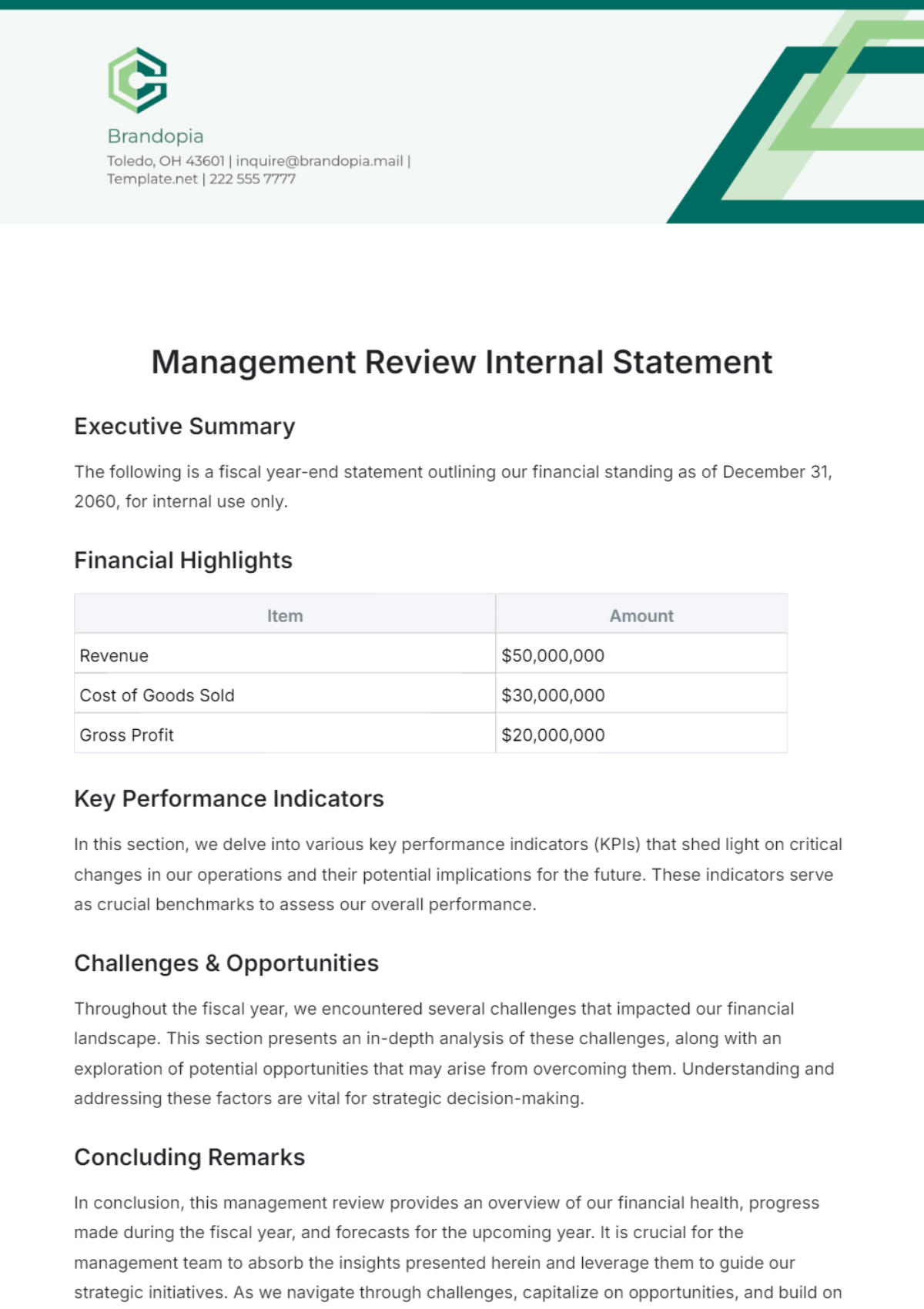

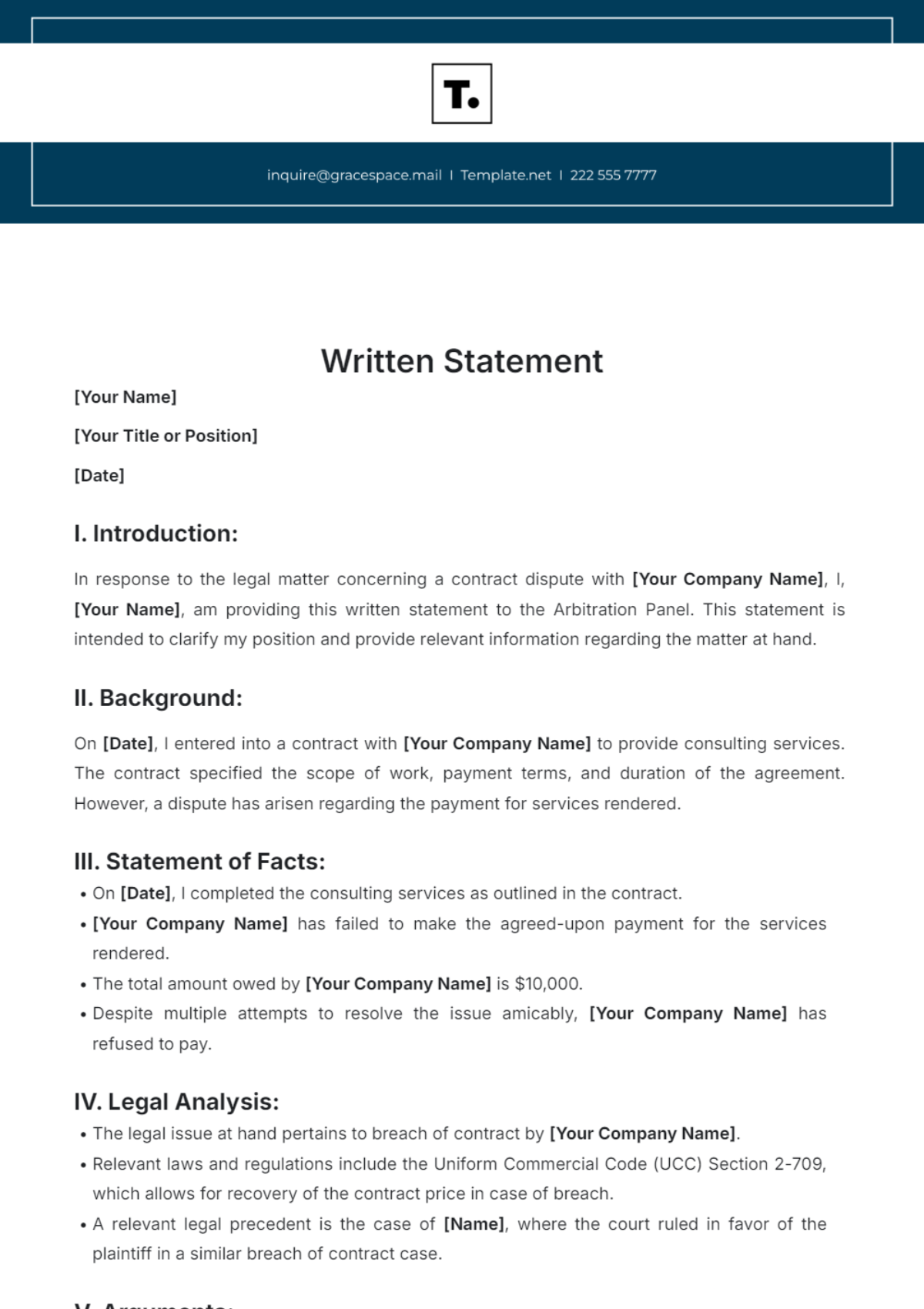

This statement meticulously outlines the diverse investments, tangible properties, and valuable items owned by the organization that possess the potential for conversion into liquid assets. This statement serves as a dynamic snapshot, encapsulating the company's extensive range of both tangible and intangible resources. By delving into the intricate fabric of the organization's asset portfolio, this report aims to provide stakeholders with a nuanced understanding of the diverse elements contributing to the company's financial status. The meticulous documentation of fixed assets sheds light on the breadth and depth of the organization's capital investments, setting the stage for a comprehensive analysis of its financial prowess.

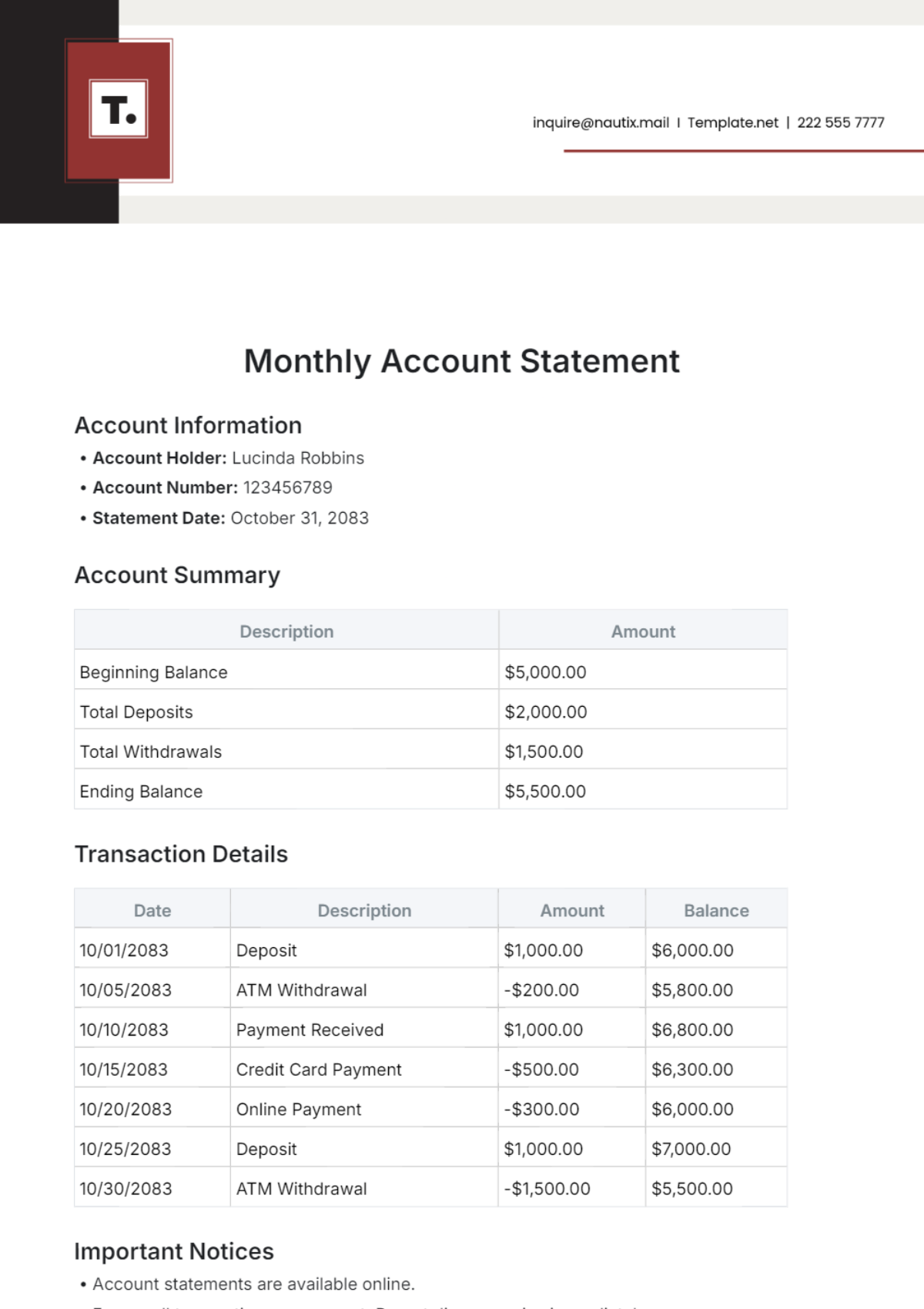

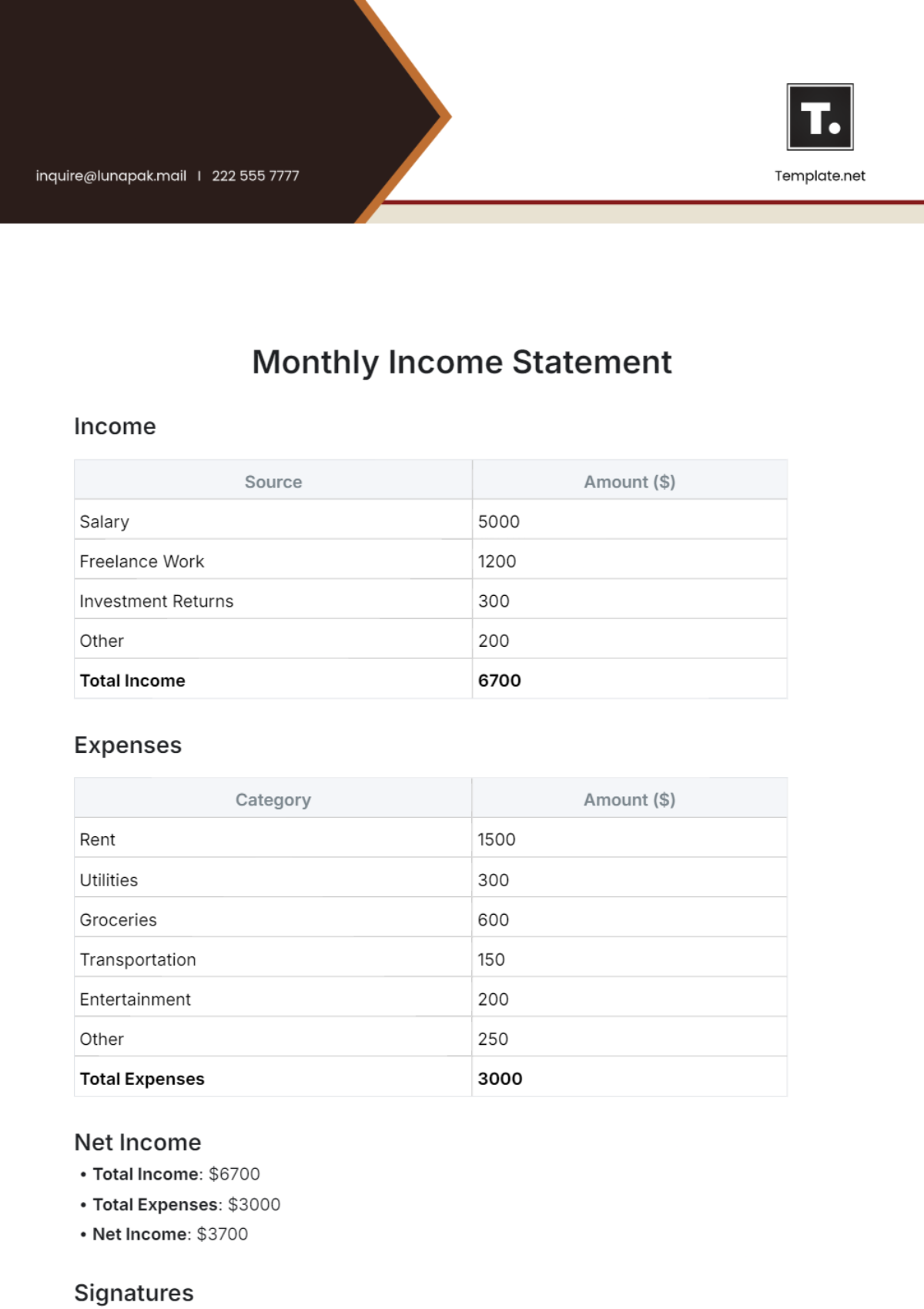

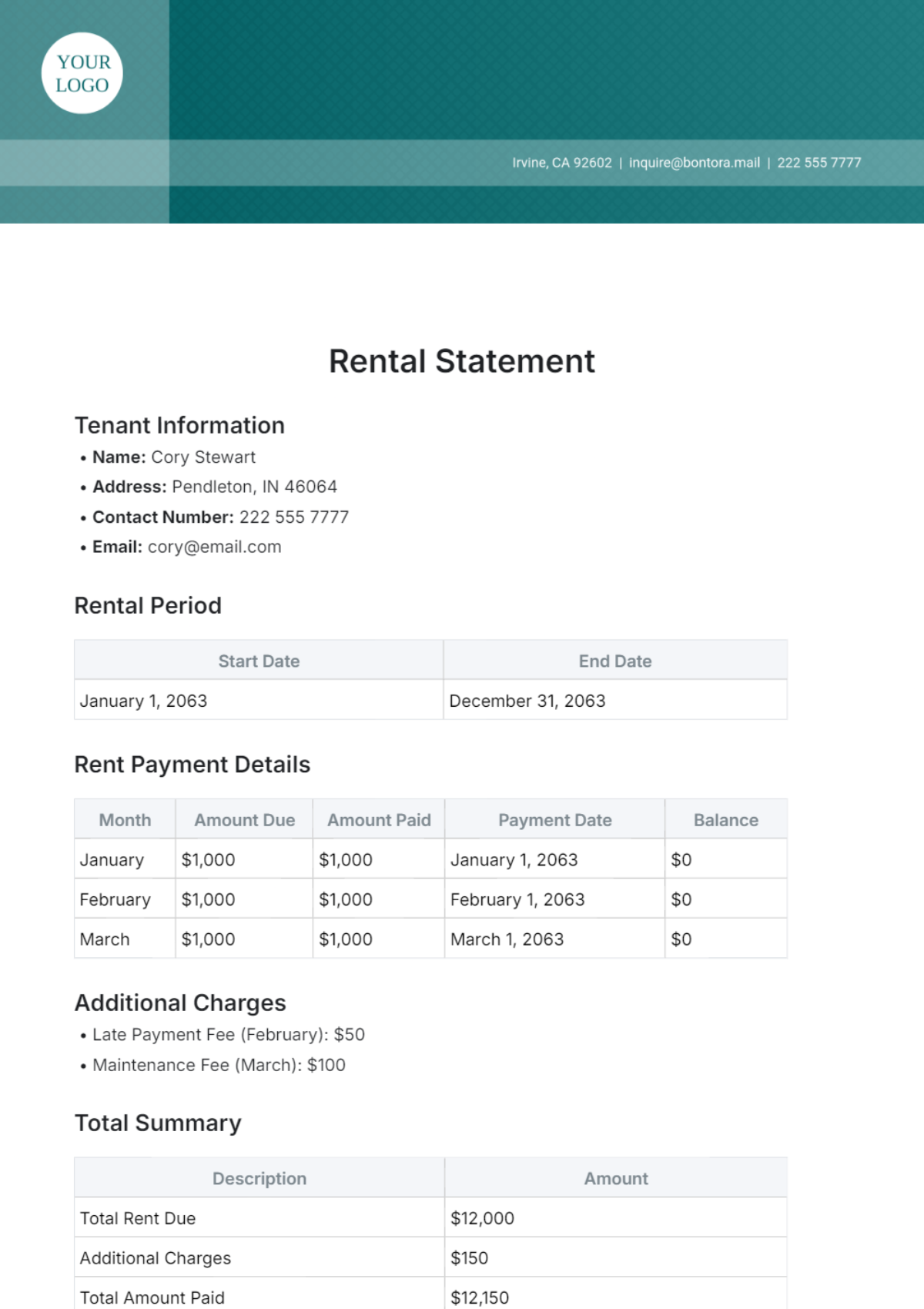

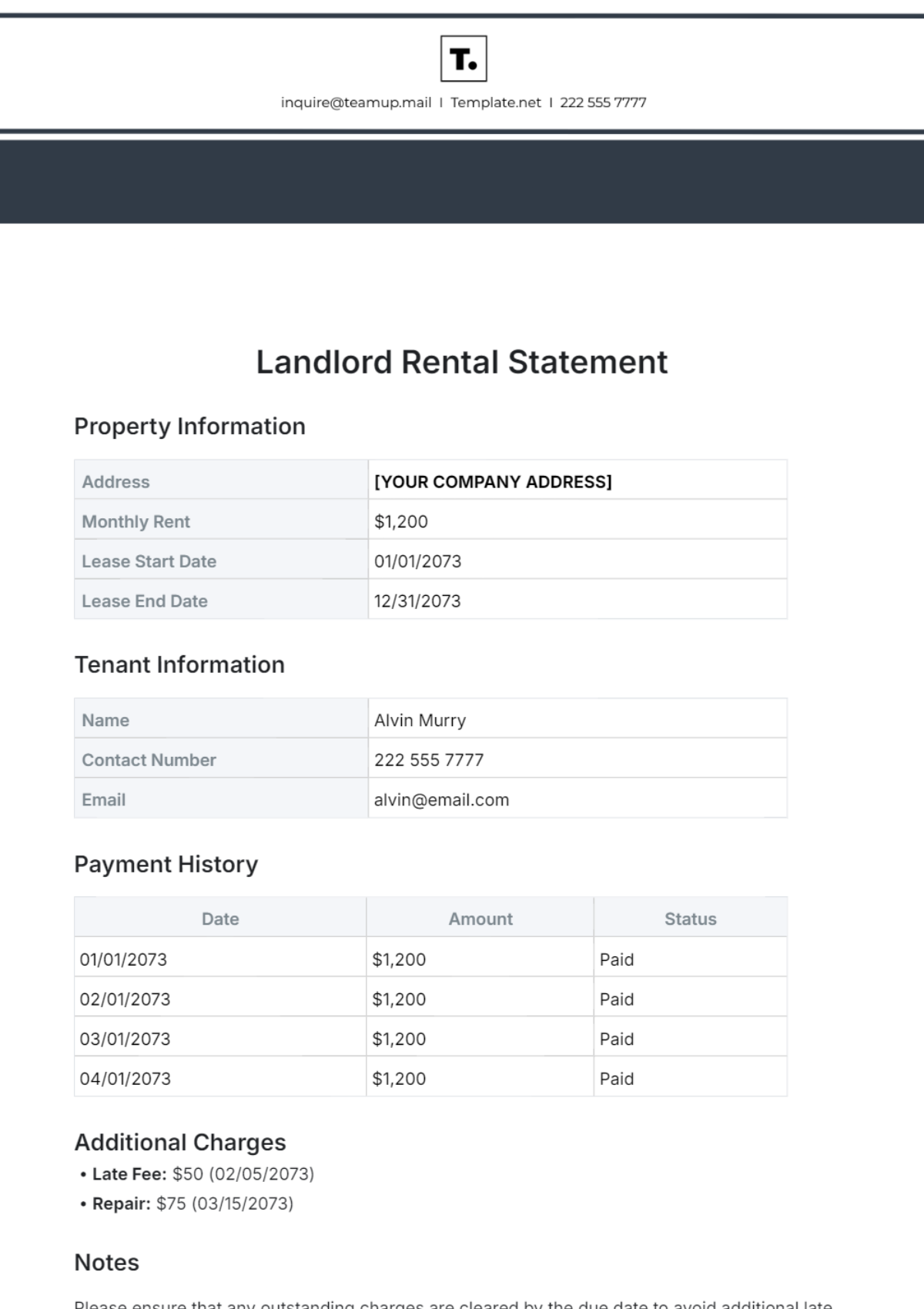

Fixed Assets

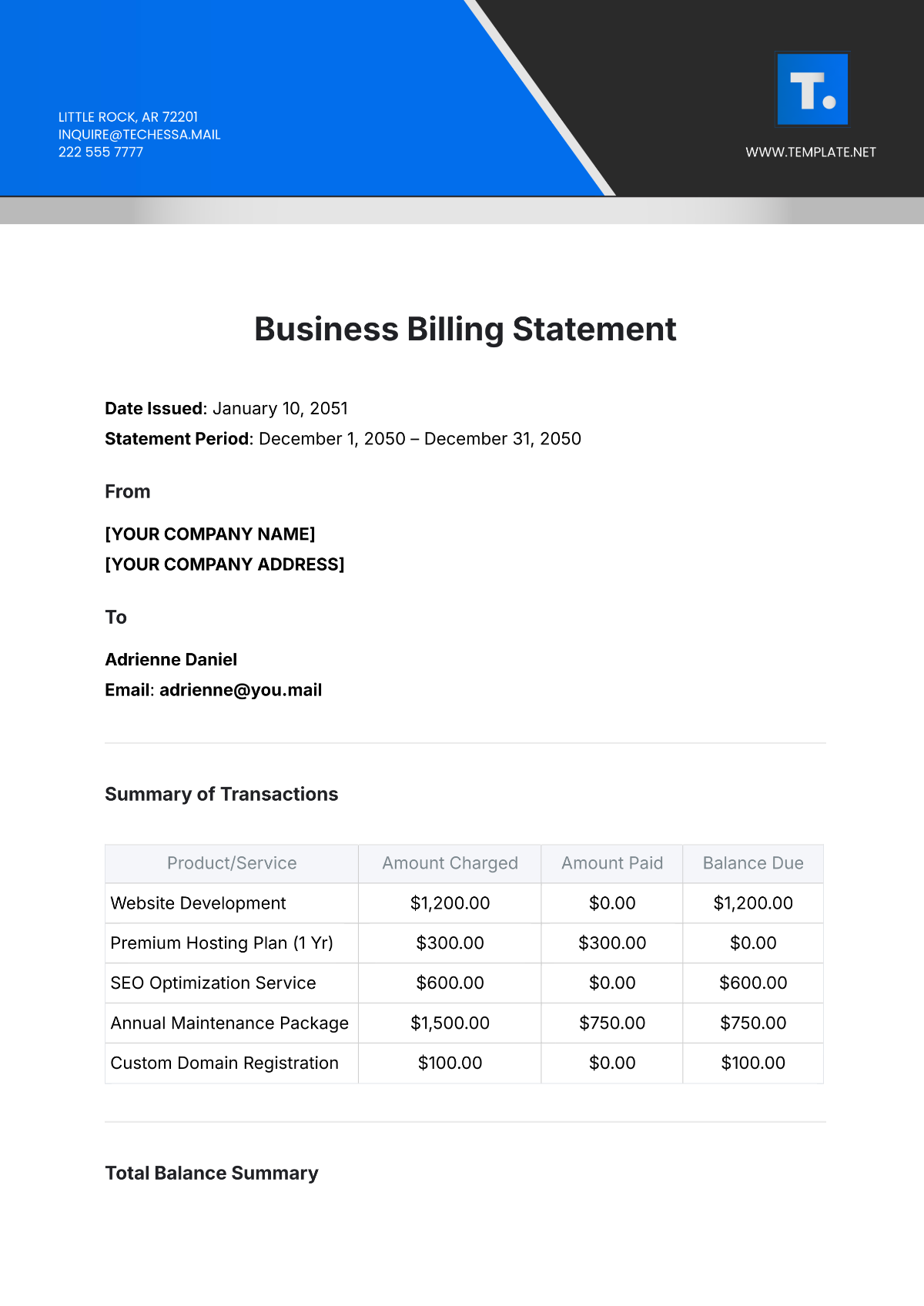

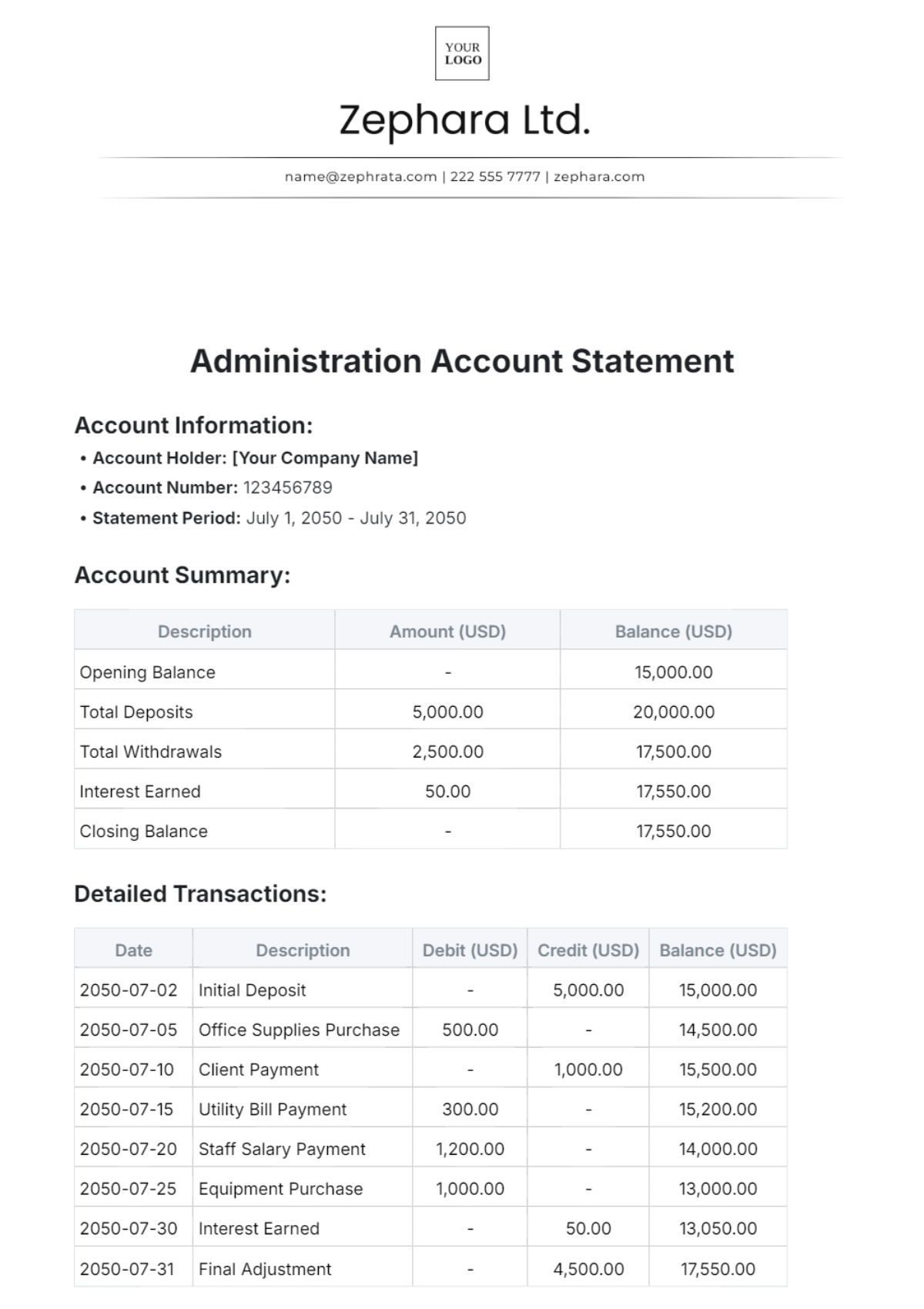

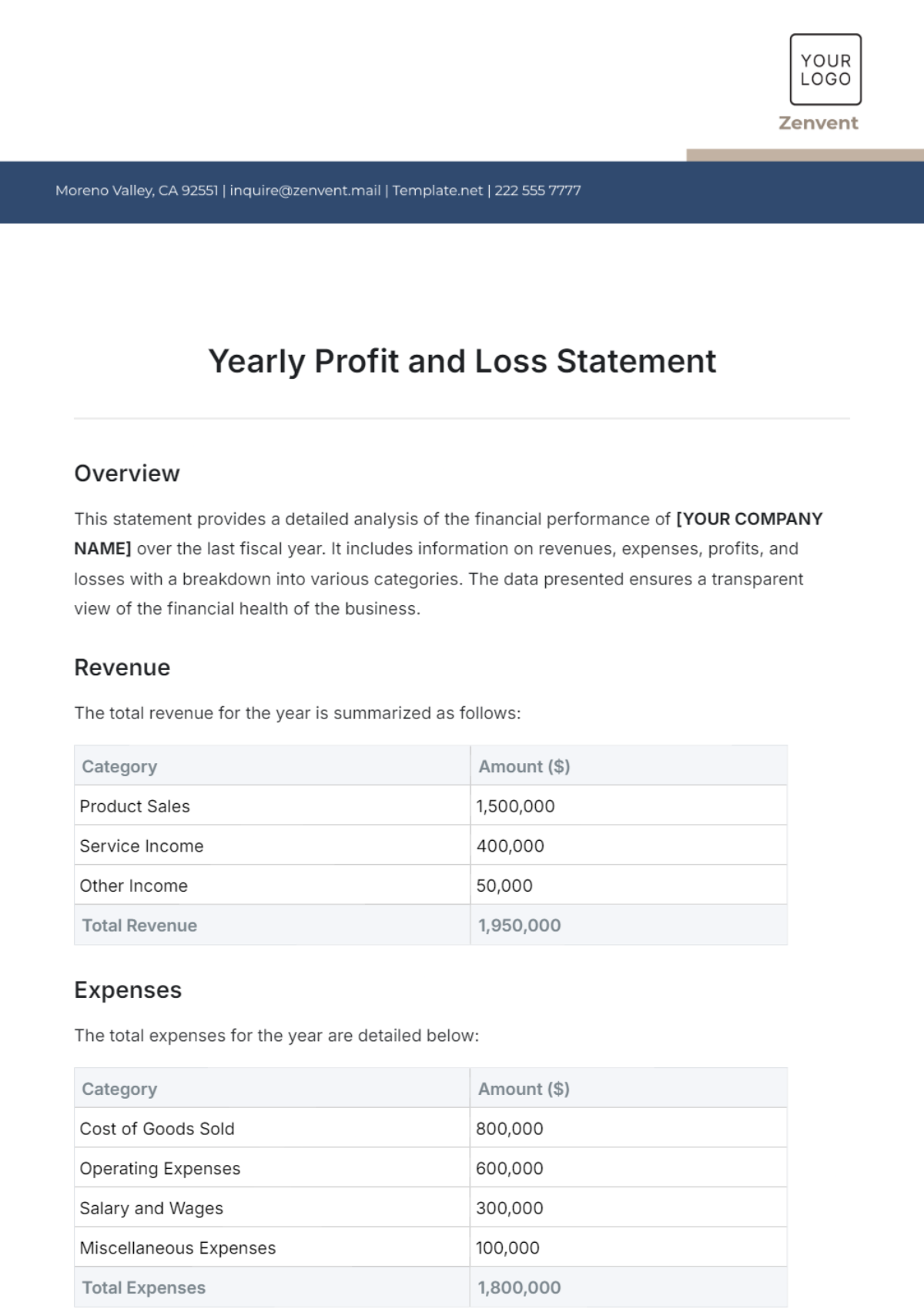

The table below succinctly presents key details about the organization's fixed assets, offering a granular view of each asset's date of purchase, original cost, accumulated depreciation, and net book value:

Asset | Date of Purchase | Original Cost | Accumulated Depreciation | Net Book Value |

|---|---|---|---|---|

Company Vehicles | 01/05/2052 | $1,000,000 | $200,000 | $800,000 |

Total |

Total Values

The total original cost of all fixed assets: $1,160,000

The total accumulated depreciation of all fixed assets: $200,000

The net book value of all fixed assets: $800,000

The asset acquired on January 5, 2052, with an original cost of $1,000,000, has undergone a commendable depreciation of $200,000, resulting in a net book value of $800,000. This judicious depreciation reflects the organization's commitment to responsible financial stewardship and underscores its ability to maintain a strong net asset value. The meticulous record-keeping of these assets further reinforces the company's dedication to transparency and compliance with financial reporting standards.

Conclusion

In conclusion, this statement not only serves as a testament to the organization's meticulous record-keeping but also underscores its financial robustness and stability. The demonstrated net asset value reflects a judicious balance between capital investments and prudent depreciation practices, showcasing the company's commitment to sound financial management. The minimal accumulated depreciation relative to the original cost of assets highlights the effectiveness of the organization's strategic approach in preserving the value of its investments over time. With a strong net book value of $800,000, the company is positioned favorably, signifying a solid financial foundation that instills confidence in stakeholders. Overall, this comprehensive analysis affirms the organization's commitment to transparency, financial responsibility, and its capacity to navigate the complexities of asset management.