Accounting Asset Management Portfolio

I. Introduction

A. Background Information

The company, a distinguished technology firm headquartered in Silicon Valley, has established itself as a trailblazer in the field of software development. Over the past two decades, the company has consistently delivered cutting-edge solutions, solidifying its reputation for innovation and excellence. From its humble beginnings, the company has evolved into a global player, shaping the tech landscape through its commitment to quality and forward-thinking strategies. The journey has been marked by milestones, showcasing the company's adaptability and resilience in the ever-changing tech environment.

B. Statement of Purpose

The portfolio is designed to optimize capital allocation, ensuring a balanced approach that aligns with the company's broader financial objectives. Tailored for both internal decision-makers and external investors, it aims to communicate the company's financial strategy transparently.

C. Current Financial Landscape

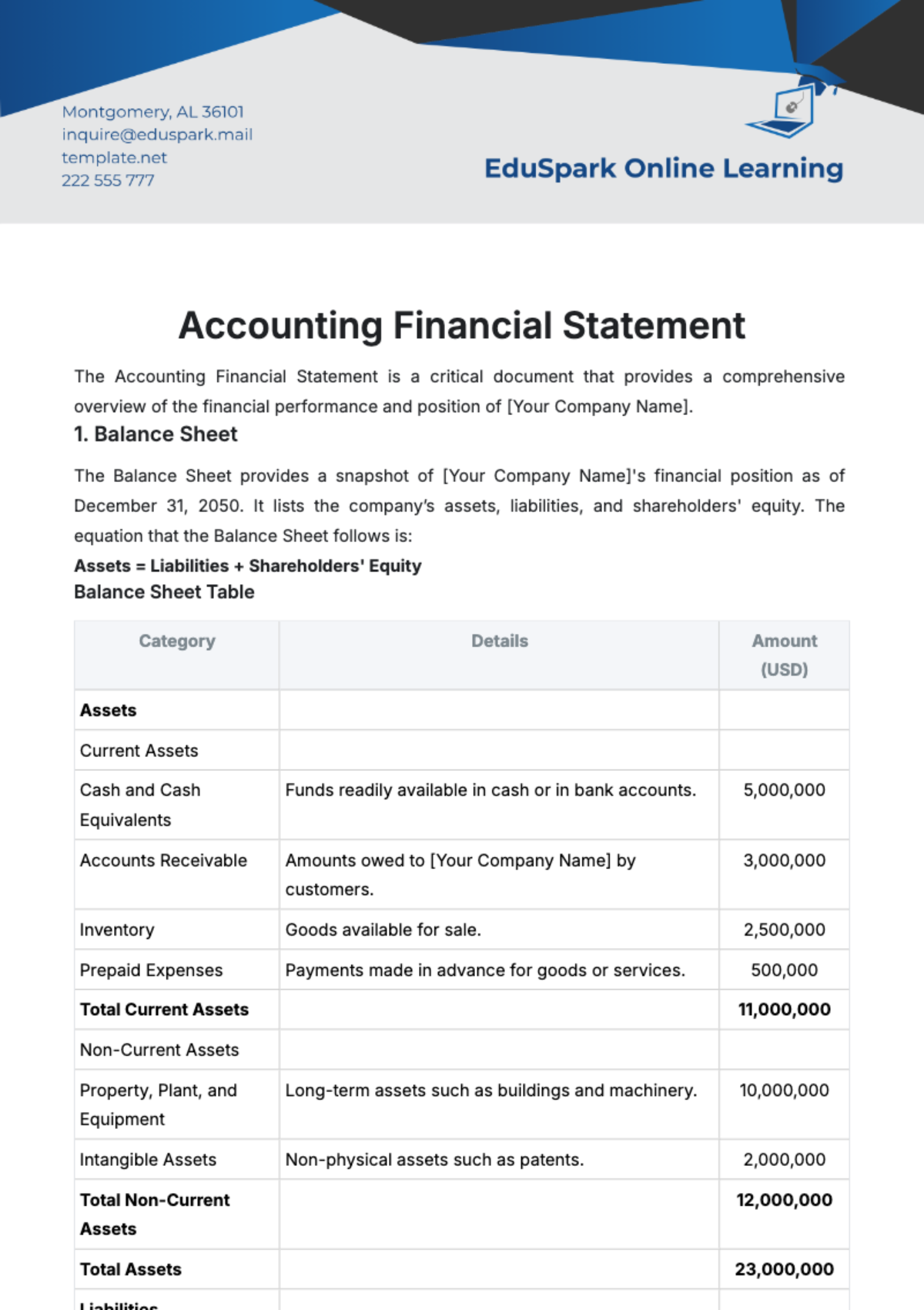

In the context of the rapidly evolving tech industry, the company operates within a dynamic market influenced by continual innovation and global economic trends. To provide a tangible representation, the following table illustrates key industry indicators for the years 2052 and the current year, 2053:

The company finds itself at the forefront of technology adoption, leveraging trends such as the integration of AR and VR. The notable 3% increase in GDP growth, stabilizing the global economy, creates a highly conducive environment for sustained growth. This enhanced economic outlook positions the company favorably, allowing for strategic planning and resource allocation. The company's robust financial health and strategic agility serve as valuable assets, enabling it to seize emerging opportunities in the tech landscape and effectively navigate uncertainties.

Furthermore, market dynamics underscore the significance of forging strategic partnerships as a means of navigating the intensified industry competition. The company's proactive approach to forming collaborative alliances ensures a diversified and resilient market presence. This strategic foresight enables the company to not only weather potential challenges but also capitalize on emerging opportunities, further solidifying its position as an industry leader. The commitment to strategic collaborations reflects the company's dedication to fostering innovation and remaining adaptable in a landscape characterized by rapid technological advancements and evolving market conditions.

II. Investment Objectives

A. Optimal Risk-Return Balance

The primary objective revolves around achieving an optimal balance between risk and return. By carefully assessing the risk tolerance of the company and its stakeholders, investments can be diversified across a spectrum that maximizes returns while mitigating potential downsides. This approach ensures a resilient portfolio that can weather market fluctuations and capitalize on growth opportunities.

B. Long-Term Capital Appreciation

The company's investment strategy places a strong emphasis on long-term capital appreciation. By focusing on assets with the potential for sustained growth over time, the portfolio aims to generate wealth gradually and consistently. This aligns with the company's commitment to building lasting value and securing financial stability for future endeavors.

C. Diversification Across Asset Classes

To enhance resilience and minimize exposure to specific market risks, the investment portfolio is strategically diversified across various asset classes. This approach spreads risk and provides the flexibility to adapt to changing market conditions. Diversification encompasses a mix of equities, fixed-income securities, and alternative investments, ensuring a well-rounded and adaptive investment strategy.

D. Income Generation and Dividend Growth

Recognizing the importance of generating regular income, the investment strategy includes a focus on assets that offer consistent dividends. This aims to provide a steady income stream, contributing to financial sustainability. The company seeks investments with a track record of reliable dividends and potential for dividend growth, enhancing overall portfolio stability.

E. Socially Responsible Investing

Embracing a commitment to corporate social responsibility, the company integrates ethical and sustainable considerations into its investment decisions. This reflects a dedication to environmental, social, and governance (ESG) principles. By aligning investments with socially responsible criteria, the company seeks not only financial returns but also positive contributions to societal and environmental well-being.

III. Asset Allocation Strategy

A. Rationale for Risk Profiling and Tolerance

Comprehensive Risk Assessment

The company conducts a thorough analysis of the risks associated with each asset class to inform its allocation decisions. This ensures that the chosen allocation strategy aligns with the company's strategic objectives and risk tolerance, considering potential impacts on the overall portfolio.

Nuanced Risk Tolerance Determination

The assessment of risk tolerance takes into account financial goals, time horizons, and market conditions, resulting in a nuanced understanding of acceptable risk levels. This detailed understanding guides the asset allocation strategy, ensuring it resonates with the company's comfort level and overarching objectives.

B. Strategic Asset Allocation Rationale

Alignment with Long-Term Objectives

The strategic asset allocation emphasizes alignment with the company's long-term financial goals. By defining clear investment objectives and time horizons, the chosen allocation strategy aims to promote sustained growth and wealth accumulation over an extended period.

Diversification for Resilience

Strategic diversification across various asset classes, including equities, fixed-income securities, and alternative investments, is employed. This diversification strategy is chosen to enhance portfolio resilience and mitigate risks associated with specific market fluctuations, aligning with the company's commitment to stability.

C. Tactical Asset Allocation Rationale

Responsive to Market Conditions

Ongoing analysis of market conditions informs tactical asset allocation decisions. This ensures the chosen strategy allows for timely adjustments in response to short-term market trends, economic indicators, and geopolitical events, ensuring the portfolio remains adaptable.

Opportunistic Approach

Tactical asset allocation enables the identification and exploitation of short-term investment opportunities. This opportunistic approach, woven into the chosen allocation strategy, contributes to overall portfolio performance during periods of market volatility or unique opportunities.

D. Rationale for Regular Portfolio Rebalancing

Ensuring Alignment with Objectives

Robust monitoring and evaluation processes are in place to ensure alignment with established objectives and market conditions. Regular assessments of individual asset class performance and overall portfolio health guide the chosen rebalancing strategy, maintaining the desired risk-return profile.

Disciplined Rebalancing Mechanism

A disciplined rebalancing mechanism is employed to maintain the desired asset mix. This involves selling overperforming assets and acquiring underperforming ones, ensuring the portfolio remains in line with strategic targets and the chosen allocation strategy.

IV. Portfolio Holdings

Effective portfolio management involves a meticulous examination of the company's holdings across various asset classes. The following list provides an in-depth exploration of the company's portfolio, shedding light on the allocation of assets and the rationale behind each holding:

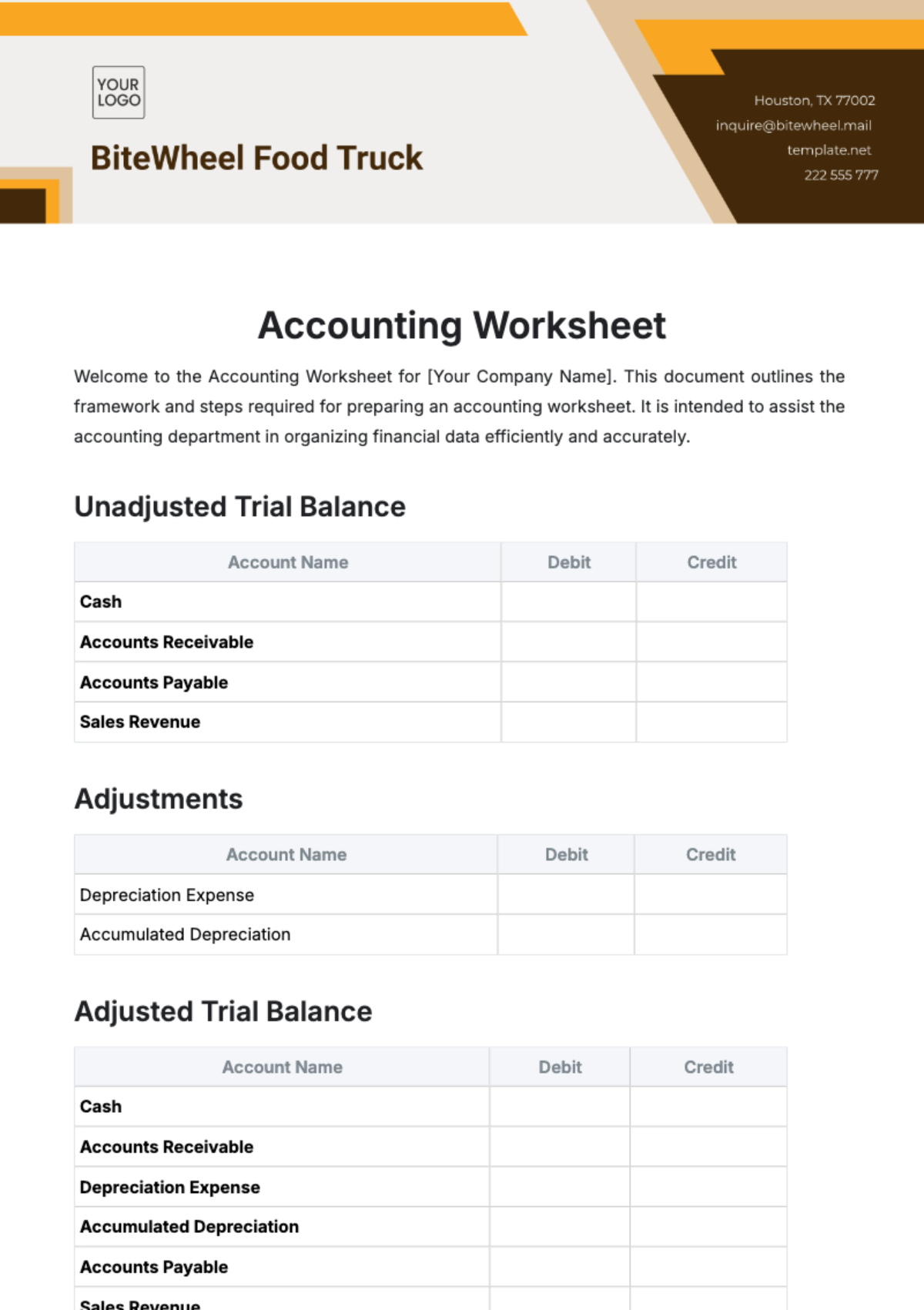

A. Equities

The table below showcases the company's equity holdings:

Company Name | Ticker Symbol | Quantity Held | Market Value | Percentage of Portfolio |

|---|---|---|---|---|

Tech Innovate | TIN | 1,000 | $50,000 | 10% |

Equity holdings are pivotal components of the portfolio, reflecting the company's strategic positioning in publicly traded companies. The careful selection of equities is essential for achieving a balanced risk-return profile and aligning with the company's overall financial goals. This serves as a valuable tool for stakeholders, enabling them to grasp the intricacies of the company's equity investments and fostering a deeper understanding of the strategic rationale behind each holding. It provides a foundation for informed discussions and decisions, ensuring that the equity component of the portfolio is aligned with the company's vision and contributes effectively to long-term financial success.

Tech Innovate, with its 1,000 shares held and a market value of $50,000, represents a significant equity holding constituting 10% of the portfolio. This strategic investment underscores the company's confidence in Tech Innovate's growth potential and aligns with its long-term objectives. The detailed visibility into equity holdings is paramount as it not only provides transparency into specific companies held but also empowers stakeholders to understand the strategic decisions driving the portfolio composition. This knowledge enhances informed decision-making, aligns with the company's risk appetite, and facilitates ongoing adjustments to optimize portfolio performance.

B. Fixed-Income Securities

The table below displays details of the company's fixed-income securities holdings:

Bond Type | Issuer | Face Value | Coupon Rate | Maturity Date | Percentage of Portfolio |

|---|---|---|---|---|---|

Corporate Bonds | Growth Bonds | $100,000 | 3.5% | 5/01/2054 | 15% |

Growth Bonds' corporate bonds, with a face value of $100,000, a coupon rate of 3.5%, and a maturity date of May 1, 2054, represent a crucial component of the fixed-income securities holdings, constituting 15% of the portfolio. This detailed insight into fixed-income securities provides a comprehensive understanding of bond types, issuers, and their contributions to the overall portfolio. The role of fixed-income securities in diversification and income generation aligns with the company's risk-return objectives. The meticulous management of fixed-income holdings ensures a balanced and resilient portfolio, optimizing risk management and income streams.

Fixed-income securities play a vital role in providing stability and income within the portfolio. This offers stakeholders a comprehensive view of the types of bonds held, the issuers, and the specific details of each holding. The inclusion of fixed-income securities in the portfolio is strategically significant, contributing to the overall risk management strategy and providing a source of steady income. Understanding the intricacies of these holdings allows stakeholders to appreciate the careful balance between risk and return, fostering confidence in the company's financial strategy.

C. Alternative Investments

The table below highlights the company's alternative investments:

Investment Type | Fund Name | Investment Amount | Percentage of Portfolio |

|---|---|---|---|

Private Equity | Venture Capital Fund | $200,000 | 20% |

Venture Capital Fund, with an investment amount of $200,000, represents a significant portion of the alternative investments, contributing to 20% of the portfolio. This alternative investment underscores the company's strategic commitment to diversification and potential high returns. The detailed visibility into alternative investments provides insights into the types of funds chosen, investment amounts, and their impact on the overall portfolio. Understanding the rationale behind alternative investments enhances transparency, allowing stakeholders to grasp the company's strategy for achieving a well-rounded and dynamic portfolio. This serves as a valuable guide for stakeholders, enabling them to make informed decisions and navigate the complexities of the company's investment approach.

Alternative investments are integral to diversifying the company's portfolio beyond traditional asset classes. This offers a comprehensive overview of the specific alternative investments chosen, providing stakeholders with insights into the types of funds and their respective contributions to the portfolio. The strategic commitment to alternative investments reflects a forward-thinking approach, aiming to capitalize on unique opportunities and enhance overall portfolio performance. Stakeholders gain a deeper understanding of the company's risk appetite and its pursuit of innovative avenues for potential high returns. The inclusion of alternative investments is a testament to the company's adaptability and commitment to exploring diverse pathways to long-term financial success.

V. Performance Analysis

Evaluating the historical performance of the portfolio is integral for strategic decision-making and understanding the trajectory of financial success. The following meticulously analyzes key metrics and performance indicators, offering a comprehensive view of the company's financial health and operational efficiency over the preceding years.

A. Financial Ratios

The table below provides a historical perspective on essential financial ratios for the years 2052 and 2051:

Ratio Name | Calculation | 2052 Value | 2051 Value |

|---|---|---|---|

Liquidity Ratio | Current Assets / Current Liabilities | 1.6 | 1.4 |

In assessing the Liquidity Ratio over the years, from 1.4 in 2051 to 1.6 in 2052, stakeholders gain valuable insights into the company's evolving financial resilience. This ratio reflects the company's ability to meet short-term obligations, showcasing a positive trend toward enhanced liquidity. The upward trajectory suggests improved financial stability and a strengthened capacity to address immediate financial commitments, underlining the company's commitment to adaptability and effective financial management. The Liquidity Ratio, as a key indicator, empowers decision-makers to make informed choices about the company's financial strategy, reinforcing confidence in its capacity to weather unforeseen financial challenges.

Understanding the historical performance of financial ratios is paramount for stakeholders as it provides a comprehensive view of the company's financial health and operational efficiency over time. The analysis of these ratios, including their evolution from 2051 to 2052, offers insights into the company's adaptability and effective financial management. Stakeholders can leverage this historical data to assess the company's resilience in navigating changing financial landscapes, fostering confidence in its capacity to weather unforeseen challenges.

B. Profitability Analysis

The table below outlines historical profitability metrics for the years 2052 and 2051:

Metric | Calculation | 2052 Value | 2051 Value |

|---|---|---|---|

Net Profit Margin | (Net Profit / Total Revenue) * 100 | 9.0% | 8.3% |

Assessing historical profitability metrics, such as the Net Profit Margin, offers stakeholders insights into the company's ability to sustain and enhance profitability over time. The increase in the Net Profit Margin from 8.3% in 2051 to 9.0% in 2052 indicates a positive trend in operational efficiency and cost management. This improvement reflects the company's commitment to contributing to its overall financial success.

Analyzing historical profitability metrics is instrumental for stakeholders seeking a comprehensive view of the company's operational efficiency. The rising Net Profit Margin signifies the company's continuous efforts to enhance profitability, showcasing effective cost management and operational efficiency. Stakeholders can utilize this to assess the company's commitment to maintaining a healthy level of profitability, contributing to sustained financial success. The Net Profit Margin, as a key performance indicator, fostering confidence in its ability to generate consistent returns.

C. Return on Investment (ROI)

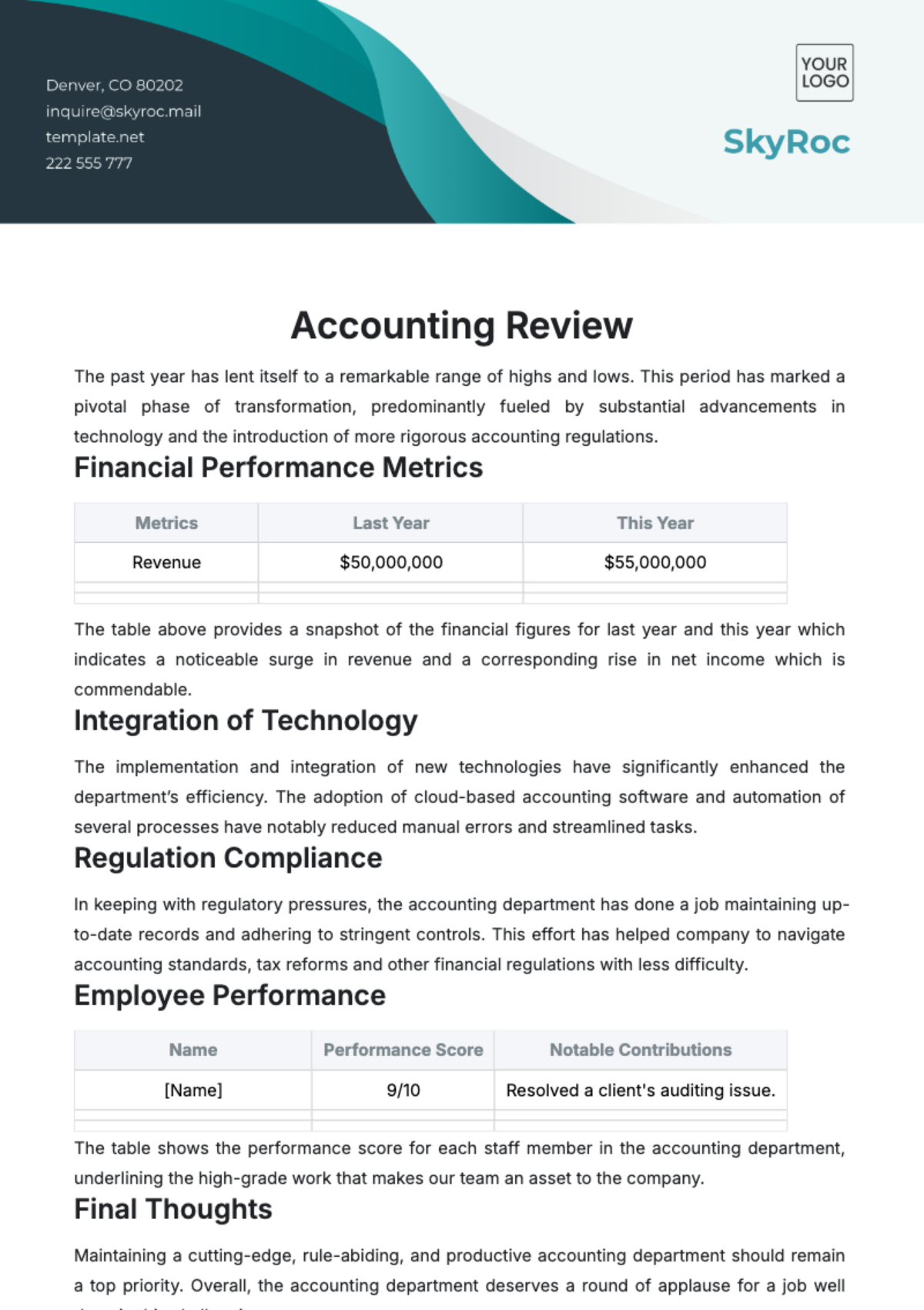

The table and the chart below illustrates historical Return on Investment (ROI) metrics for the years 2052 and 2051:

Investment Type | ROI 2052 | ROI 2051 |

|---|---|---|

Tech Innovate Stock | 30% | 22% |

Evaluating historical Return on Investment (ROI) metrics provides stakeholders with insights into the company's investment performance over the years. The notable increase in ROI for Tech Innovate Stock, from 22% in 2051 to 30% in 2052, indicates the effectiveness of investment decisions. This data empowers stakeholders to make informed decisions about future investment allocations, leveraging insights from successful investment strategies in the past.

Assessing historical Return on Investment (ROI) metrics is crucial for stakeholders seeking to understand the success of the company's investment strategies over time. The notable increase in ROI for Tech Innovate Stock reflects the effectiveness of investment decisions, contributing to enhanced financial growth. This historical data empowers stakeholders to make informed decisions about future investment allocations, leveraging insights from successful investment strategies in the past. The ROI metrics, as key indicators, aid decision-makers in optimizing investment strategies for sustained financial growth.

VI. Risk Management

A. Risk Identification

Market Risks

The company conducts a thorough analysis of market dynamics, identifying potential fluctuations in demand, supply chain disruptions, and changes in consumer behavior. This enables proactive measures to be taken to navigate market uncertainties effectively.

Operational Risks

A detailed examination of internal processes and systems is undertaken to identify operational vulnerabilities. This includes assessing potential disruptions to production, supply chain logistics, and technological dependencies.

B. Risk Assessment

Quantitative Analysis

Utilizing quantitative methods, the company assesses the potential financial impact of identified risks. This involves assigning numerical values to risks to facilitate a data-driven approach to risk prioritization.

Qualitative Analysis

In addition to quantitative measures, a qualitative analysis is conducted, considering the nature and complexity of identified risks. This ensures a holistic understanding of the potential consequences and helps in developing nuanced risk mitigation strategies.

Strategic Risks

Evaluating risks associated with strategic decisions and market positioning is essential. This involves assessing potential shifts in consumer preferences, technological advancements, and competitive landscapes.

C. Risk Mitigation Strategies

Diversification

To mitigate market risks, the company employs diversification strategies, both in product offerings and geographic presence. This approach helps spread risks across different market segments, reducing the impact of adverse market conditions.

Technology Investments

Addressing operational risks, the company invests in robust technologies and contingency plans to ensure the resilience of critical operational processes. This includes embracing digital transformation, implementing redundant systems, and staying abreast of technological advancements.

Partnership and Collaboration

Strategic partnerships and collaborations are leveraged to share and mitigate risks. By establishing alliances with key players in the industry, the company can collectively navigate challenges and capitalize on shared resources and expertise.

D. Crisis Response and Communication

Preparedness Protocols

Establishing clear crisis response protocols is paramount. The company recognizes that being well-prepared for potential crises is fundamental to safeguarding its operations and reputation. The preparedness protocols encompass several key components:

Crisis Response Team Formation

A dedicated crisis response team is formed, comprising individuals with diverse skills and expertise. This team is trained to act swiftly and efficiently in the face of a crisis, ensuring a coordinated and organized response.

Communication Chain of Command

A clear communication chain of command is established to facilitate efficient decision-making and response. Designated individuals are assigned specific roles and responsibilities, streamlining the communication process during critical moments.

Resource Allocation and Contingency Planning

The company allocates necessary resources and develops contingency plans to address potential disruptions caused by a crisis. This includes identifying alternative supply chain routes, ensuring employee safety, and securing critical infrastructure.

Legal and Regulatory Compliance

The company ensures that its crisis response protocols adhere to legal and regulatory requirements. This includes compliance with reporting obligations, privacy considerations, and other relevant regulations applicable to crisis management.

Stakeholder Communication

Open and transparent communication with stakeholders is prioritized during times of crisis. The company ensures that stakeholders are informed promptly and accurately, maintaining trust and confidence even in challenging circumstances.

Media Relations Strategies

Crafting effective media relations strategies is essential for managing the narrative during a crisis. The company develops communication plans to address the media and the public, ensuring a consistent and controlled message. Key components of these strategies include:

Proactive Messaging

The company develops pre-emptive messages that emphasize transparency, accountability, and a firm commitment to resolving the crisis. This proactive approach enables the organization to respond promptly to unforeseen events with a consistent and thoughtful narrative.

Spokesperson Training

Designated spokespersons undergo rigorous training to enhance their communication skills. This includes effective message delivery, conveying empathy, and adeptly handling media inquiries. Consistent and empathetic communication from spokespersons contributes to maintaining trust and credibility.

Media Outreach Plans

The company meticulously identifies key journalists, news outlets, and digital platforms relevant to the industry. Tailored communication approaches for each media channel ensure a comprehensive and targeted dissemination of information, reaching diverse audiences.

Social Media Management

Recognizing the impact of social media on public perception, the company implements a robust strategy for managing its online presence. This includes proactive monitoring, engagement with stakeholders, addressing concerns, correcting misinformation, and providing real-time updates.

Monitoring and Analysis: Continuous monitoring of media coverage and public sentiment is integral to the strategy. Utilizing sophisticated tools, the company tracks news articles, social media mentions, and public reactions. Data analysis guides ongoing adjustments to communication strategies for optimal effectiveness.

VII. Future Outlook and Strategy

The company's future outlook and strategy are grounded in a forward-thinking approach that aligns with the dynamic landscape of the industry. Embracing technological advancements and market trends, the company envisions continued growth and innovation. A key focus is placed on expanding market presence through strategic partnerships, leveraging emerging technologies, and staying attuned to evolving consumer preferences.

In line with the commitment to sustainability, the company is dedicated to implementing eco-friendly practices and fostering a culture of corporate responsibility. The strategy encompasses diversification of product offerings, exploring new markets, and enhancing operational efficiency through digitalization. By prioritizing adaptability and resilience, the company aims to navigate future challenges successfully, positioning itself as a leading force in the industry. The future outlook is characterized by a commitment to innovation, sustainability, and strategic agility, ensuring sustained growth and relevance in a rapidly evolving business environment.