Accounting Asset Control Document

Document Version: 1.0

Effective Date: [Month Day, Year]

Prepared by: Finance Department

This Accounting Asset Control Document outlines the procedures and controls for managing our organization's assets. It aims to ensure accuracy in financial reporting, safeguard assets against loss, and ensure compliance with applicable laws and standards.

Asset Management Overview

Our asset management process encompasses the acquisition, recording, valuation, depreciation, and disposal of assets. It ensures that assets are used effectively and efficiently, enhancing our financial stability and operational capabilities.

A. Asset Acquisition

All asset acquisitions must be approved by the relevant department head and verified by the Finance Department.

Request submission: Departments submit an asset acquisition request form.

Approval: Requests are reviewed and approved based on budget and necessity.

Purchase: Approved assets are purchased and recorded in our accounting system.

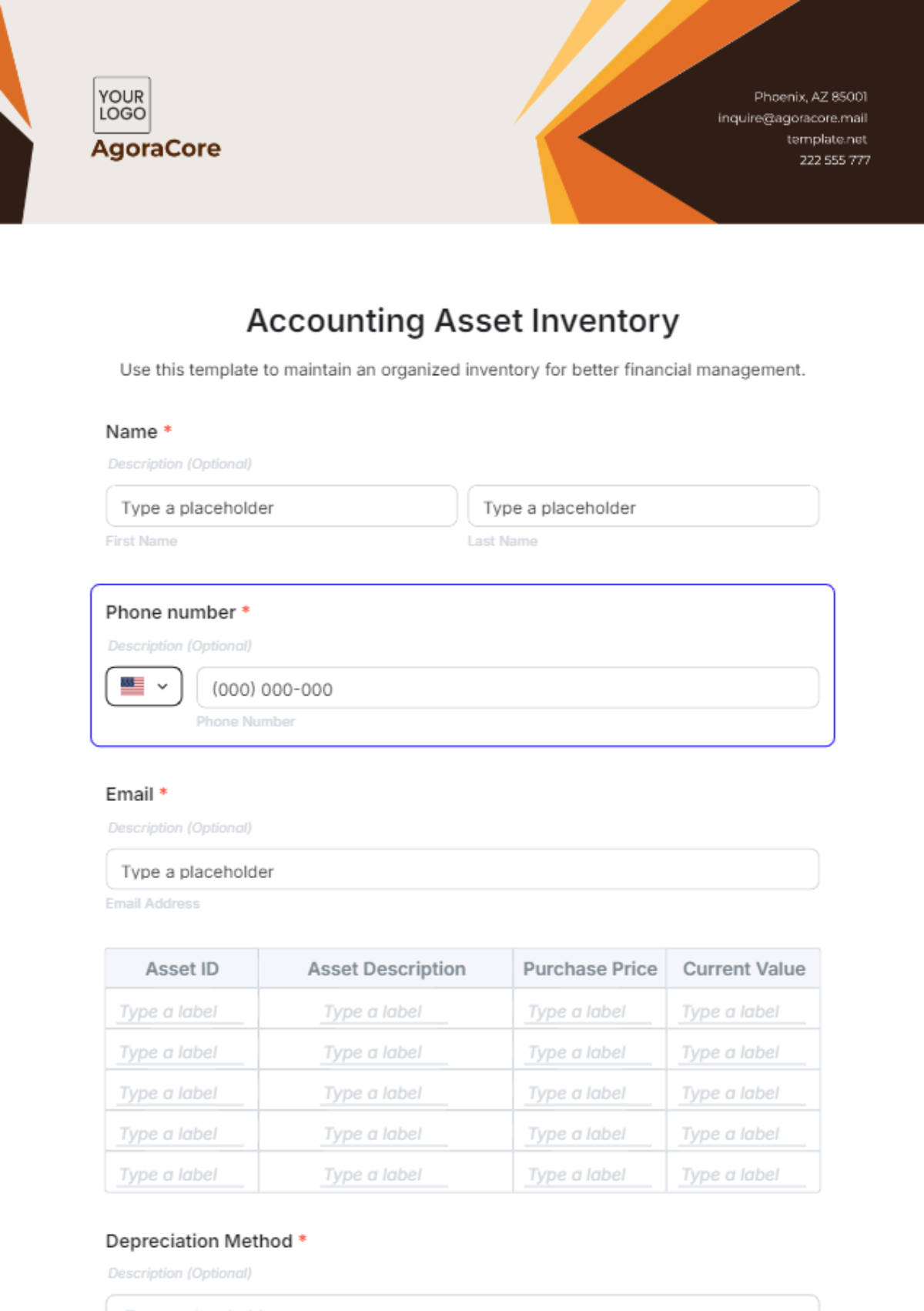

B. Asset Recording

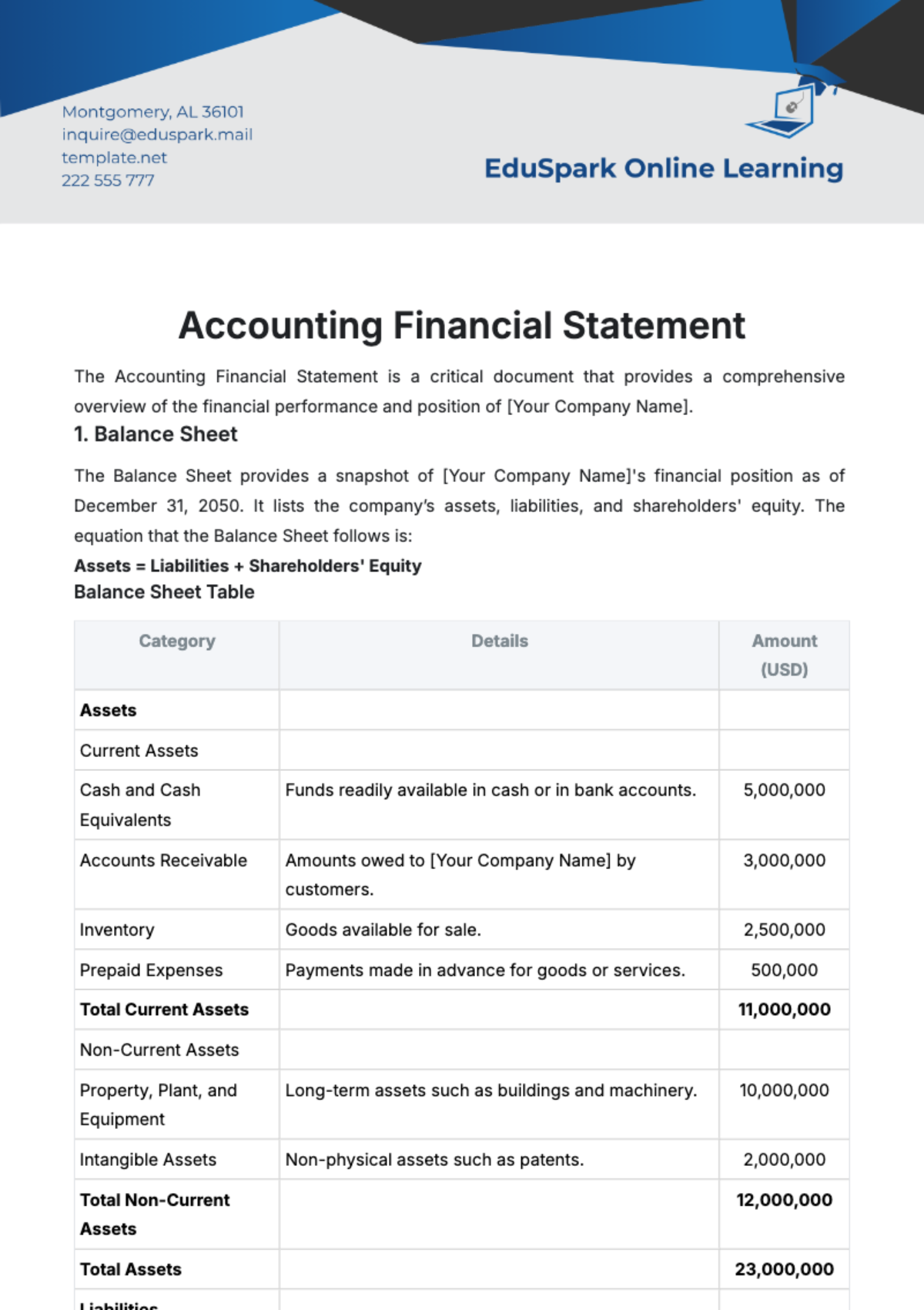

Upon acquisition, assets are recorded in our Asset Register with the following details:

Asset ID: Unique identifier for tracking

Description: Brief description of the asset

Acquisition Date: Date when the asset was acquired

Cost: Purchase price of the asset

Location: Where the asset is located

Depreciation Method: Method used for depreciation

Useful Life: Estimated useful life of the asset

C. Asset Valuation and Depreciation

Assets are valued at cost minus any accumulated depreciation. We primarily use the Straight-Line Depreciation method, except for certain assets where the Declining Balance Method is more appropriate.

D. Asset Maintenance and Verification

Regular maintenance and verification are conducted to ensure the physical and functional status of assets.

Physical verification: Annually

Maintenance check: As per manufacturer's recommendation or need

E. Asset Disposal

When assets are no longer needed or are beyond repair, they are disposed of following our Asset Disposal Procedure.

Asset disposal request submitted by department

Evaluation of disposal method (sale, recycle, donate)

Final approval by Finance Department

Removal from Asset Register

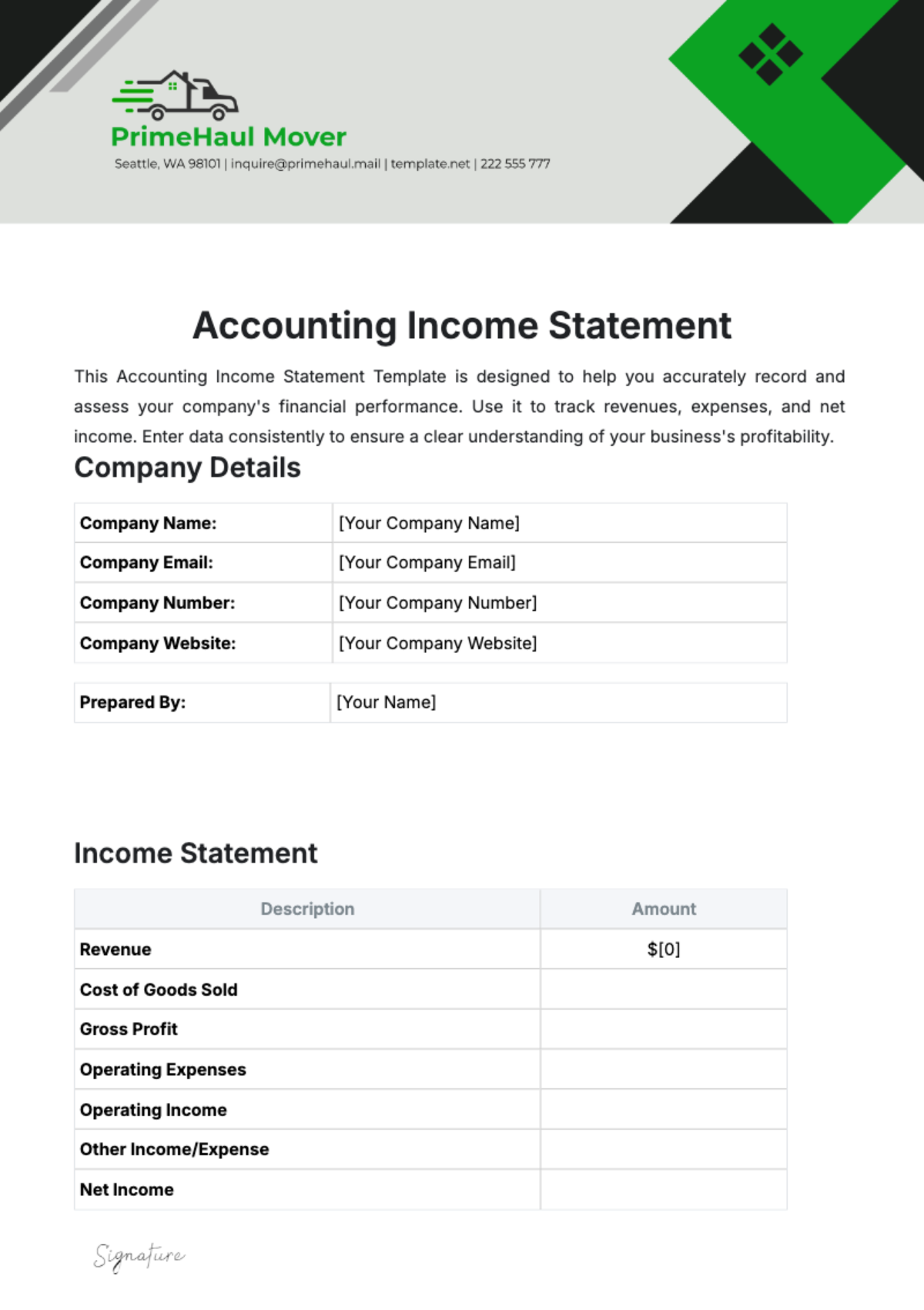

Control Measures

Authorization: All asset-related transactions require authorization from the designated authority.

Documentation: Complete and accurate records must be maintained for all transactions.

Physical Security: Assets must be secured physically to prevent loss or theft.

Reconciliation: Regular reconciliation of the Asset Register with physical assets and financial records.