Free Long-Term Payroll Accounting Management Plan

Management Plan

Executive Summary

The Long-Term Payroll Accounting Management Plan is a strategic blueprint designed to elevate the efficiency and compliance of payroll operations within a corporate framework. In today's fast-paced business environment, the agility and accuracy of payroll systems are not just operational necessities but also strategic assets that can significantly influence overall organizational performance. This plan proposes a holistic approach to redefining payroll management through the meticulous optimization of workflows, the adoption of cutting-edge technological solutions, comprehensive training programs for payroll staff, consistent auditing practices, and the cultivation of robust communication channels.

The essence of this plan lies in its commitment to not only streamline payroll operations but also ensure stringent adherence to evolving payroll legislation, thereby safeguarding the organization against potential compliance risks. By integrating advanced payroll software, we aim to automate the majority of the repetitive and time-consuming tasks, significantly reducing the margin for error and freeing up valuable human resources to focus on more strategic aspects of the business. Regular training sessions will empower our payroll team with up-to-date knowledge of legislative changes, software functionalities, and best practices in payroll management, ensuring that our workforce remains at the forefront of the industry.

Routine audits will serve as a critical control mechanism to identify and rectify discrepancies, ensuring the integrity of the payroll process. Furthermore, by fostering an environment of open communication, we will demystify payroll processes for all employees, enhancing transparency and trust within the organization. Performance metrics will be established to measure the efficacy of the implemented strategies, providing tangible benchmarks for success and areas for improvement.

This plan is not static but a dynamic framework that will evolve in response to internal feedback, technological advancements, and changes in the regulatory landscape, ensuring that the organization's payroll operations remain efficient, compliant, and aligned with the broader business objectives.

Operational Objectives

The operational objectives of this plan are multifaceted, aimed at achieving excellence in payroll management through precision, efficiency, compliance, and innovation. These objectives serve as the foundation upon which the strategies and actions outlined in this plan are built.

Accuracy and Efficiency: At the core of our operational objectives is the relentless pursuit of accuracy in every payroll process. This encompasses precise wage calculations, correct application of tax rates, and timely disbursement of salaries. Efficiency is equally paramount, with a focus on streamlining operations to reduce payroll processing times and eliminate bottlenecks, thereby enhancing productivity and employee satisfaction.

Compliance with Tax Regulations: Adherence to local, state, and federal tax regulations is non-negotiable. Our processes will be designed to ensure that all payroll activities are fully compliant with the latest tax laws, safeguarding the organization against legal repercussions and financial penalties.

Reduction of Manual Intervention: By leveraging technology, we aim to minimize manual interventions in the payroll process, reducing the likelihood of human error and increasing the speed and reliability of payroll operations.

Knowledge-Driven Workforce: Empowering our payroll team with ongoing education and training is crucial. A well-informed team is better equipped to handle complex payroll scenarios, stay abreast of legislative changes, and leverage the full capabilities of payroll systems.

Effective Reporting Systems: Developing comprehensive and actionable reporting mechanisms is essential for informed decision-making. These systems will provide insights into payroll expenditures, tax obligations, and trends, facilitating strategic planning and financial management.

Comprehensive Policy and Guidelines

The establishment of comprehensive policies and guidelines is a cornerstone of this plan, aimed at ensuring a standardized, transparent, and fair payroll process across the organization. These policies will serve as the bedrock for all payroll-related activities, providing clear directions and protocols for handling various payroll scenarios.

Payroll Scheduling: We will define standardized payroll schedules that align with the operational needs of the organization and the expectations of its workforce. This includes setting fixed pay periods, deadlines for timesheet submissions, and pay dates, ensuring predictability and consistency in salary disbursements.

Wage Computation: Clear guidelines will be established for calculating wages, including the treatment of regular hours, overtime, bonuses, commissions, and deductions. These guidelines will ensure that all employees are compensated fairly and in accordance with their employment agreements and applicable labor laws.

Overtime Compensation: Policies regarding overtime work and compensation will be clearly articulated, in compliance with legal requirements. This includes defining what constitutes overtime, the rate of overtime pay, and the process for approving and recording overtime hours.

Records Management: Robust record-keeping practices will be instituted to maintain accurate and comprehensive payroll records for each employee. This will include details of wages paid, hours worked, deductions made, and leave balances, ensuring that the organization can readily produce these records for auditing or compliance purposes.

Grievance Redressal: A formal mechanism for addressing payroll-related grievances will be established, providing employees with a clear pathway to raise concerns regarding their pay, deductions, or any other payroll-related issues. This mechanism will ensure that grievances are addressed promptly and fairly, maintaining trust and transparency in the payroll process.

By adhering to these comprehensive policies and guidelines, the organization will foster a payroll environment that is efficient, compliant, and respectful of employee rights, thereby contributing to a positive and productive workplace culture.

Workflow Optimization

The essence of efficient payroll management lies in the streamlining and optimization of workflows. This involves a methodical approach to organizing and executing payroll-related tasks to maximize productivity and minimize errors. The optimization of workflows will be tailored to the organization's unique operational structure and needs, ensuring a seamless integration into the existing business processes.

Data Gathering: The first step in the payroll process involves the collection of accurate employee data, including hours worked, leave taken, and any other relevant information. We will implement standardized procedures for submitting, verifying, and approving this data to ensure its accuracy and timeliness.

Payroll Computation: The heart of payroll management, this workflow involves calculating the gross pay, deductions, and net pay for each employee. We will utilize algorithms and formulas that reflect the latest tax laws and company policies, ensuring that each employee's pay is calculated accurately.

Document Generation: Payroll documentation, including payslips, tax forms, and reports, will be generated automatically based on the computed payroll data. This ensures consistency in documentation and aids in compliance with regulatory requirements.

Funds Distribution: The disbursement of salaries will be automated to ensure timely and accurate payment to employees. This workflow will include mechanisms for direct deposit, check issuance, or any other payment method adopted by the organization.

Reporting: Payroll reports will be generated to provide insights into payroll expenses, tax liabilities, and other financial metrics. These reports will be instrumental for the finance department and senior management in strategic planning and budgeting.

Reconciliation and Auditing: Regular reconciliation of payroll records with bank statements and financial ledgers will be conducted to ensure the integrity of payroll transactions. Additionally, periodic audits will be carried out to assess compliance with payroll policies and regulations, identify discrepancies, and implement corrective actions.

Through the optimization of these workflows, the payroll management system will achieve a high level of efficiency, accuracy, and compliance, contributing to the overall effectiveness of the organization's financial operations.

Technology Integration

The strategic integration of technology into payroll processes is a game-changer in the management of payroll operations. By adopting advanced payroll accounting software, the organization will revolutionize the way payroll is processed, significantly enhancing efficiency and accuracy.

Automation of Routine Tasks: The payroll software will automate repetitive tasks such as data entry, calculations, and report generation. This automation reduces the potential for human error and frees up the payroll team to focus on more strategic tasks.

Error Reduction: With built-in checks and validations, the software minimizes the likelihood of errors in payroll processing. This ensures that employees are paid accurately and on time, enhancing employee satisfaction and trust in the payroll system.

Tax Law Compliance: The software will be updated regularly to reflect the latest tax laws and regulations, ensuring that the organization remains compliant with all tax obligations. This feature alleviates the burden of manually tracking legislative changes and reduces the risk of non-compliance penalties.

Secure Record-Keeping: Payroll software provides a secure and centralized database for storing all payroll-related information. This facilitates easy access to historical payroll data for audits, compliance checks, and strategic decision-making.

Integration with Other Systems: The payroll software will be integrated with other business systems such as HR management and time tracking software. This integration ensures the seamless flow of data across systems, enhancing the accuracy and efficiency of payroll processing.

The adoption of payroll technology not only streamlines payroll processes but also positions the organization to adapt swiftly to changes in the business environment and regulatory landscape.

Employee Training

A well-trained payroll team is the backbone of an effective payroll management system. Ongoing training initiatives are crucial to equip the payroll personnel with the necessary knowledge and skills to navigate the complexities of payroll processing.

Understanding Payroll Regulations: Training sessions will cover the latest payroll regulations and tax laws, ensuring that the payroll team is well-versed in the legal aspects of payroll processing. This knowledge is vital to maintain compliance and avoid legal pitfalls.

Software Proficiency: Payroll staff will receive comprehensive training on the payroll software, including its features, functionalities, and best practices for its use. This ensures that the team can leverage the full capabilities of the technology to enhance payroll operations.

Internal Compliance Standards: Training will also focus on the organization's internal payroll policies and procedures. This ensures that all team members are aligned with the company's standards and practices, promoting consistency and accuracy in payroll processing.

Professional Development: Beyond technical training, the payroll team will have opportunities for professional development, including workshops on communication, problem-solving, and analytical skills. This holistic approach to training ensures that the payroll team is not only technically proficient but also well-equipped to handle complex payroll scenarios and provide excellent service to employees.

Through these comprehensive training programs, the organization will cultivate a payroll department that is knowledgeable, efficient, and responsive to the needs of the business and its employees, ensuring the long-term success of the payroll management system.

Periodic Audits

Periodic audits are an integral part of maintaining the integrity and compliance of payroll operations. These audits serve a dual purpose: they not only ensure the accuracy and legality of the payroll processes but also instill a culture of accountability and transparency within the organization. The audit process will be methodical, covering all facets of payroll management including wage calculations, tax withholdings, benefit disbursements, and the adequacy of payroll records.

Audit Frequency and Scope: Audits will be conducted on a regular basis, with at least one comprehensive audit scheduled annually. Additional audits may be triggered by significant changes in payroll legislation, the introduction of new payroll systems, or any discrepancies noted during routine checks.

Discrepancy Identification: Each audit will meticulously examine payroll records to identify any discrepancies in payments, deductions, and record-keeping. This includes verifying the accuracy of wage calculations, ensuring that all tax deductions are in line with current laws, and confirming that benefit payouts are correctly administered.

Corrective Actions: Upon identifying any issues, immediate corrective measures will be implemented to rectify the discrepancies. This may involve adjusting payroll records, issuing supplemental payments or deductions, and updating payroll processes to prevent future occurrences.

Audit Reporting: The findings of each audit, along with the corrective actions taken, will be documented in detailed audit reports. These reports will be reviewed by senior management and the payroll team to understand the root causes of any issues and to develop strategies for continuous improvement.

Regulatory Compliance: Special attention will be given to ensuring compliance with all applicable payroll-related laws and regulations. This includes staying abreast of changes in tax laws, labor standards, and other regulations that impact payroll processing.

Through periodic audits, the organization commits to maintaining the highest standards of accuracy and compliance in its payroll operations, safeguarding against financial and legal risks.

Communication and Collaboration

Effective communication and collaboration are the bedrock of successful payroll management. Transparent communication ensures that all employees have a clear understanding of their compensation, benefits, and any payroll-related policies. This openness fosters trust and contributes to a positive organizational culture.

Pay Structure Education: Employees will receive comprehensive information about their pay structure, including details on how their wages are calculated, the schedule of payments, and the breakdown of deductions. This information will be provided at the time of hire and updated as necessary.

Payroll Inquiries and Issues: A formal channel will be established for employees to raise any questions or concerns regarding their payroll. This could be a dedicated payroll support email, a hotline, or an online portal. Ensuring that employees have easy access to payroll support is crucial for resolving issues promptly and maintaining employee satisfaction.

Feedback Mechanism: Employees will be encouraged to provide feedback on the payroll process. This feedback will be invaluable for identifying areas of improvement and enhancing the overall payroll experience.

Inter-departmental Collaboration: The payroll department will work closely with other departments such as Human Resources and Finance to ensure a cohesive approach to payroll management. This collaboration is essential for addressing complex payroll issues that may involve multiple organizational facets, such as benefits administration and tax compliance.

Regular Updates: Regular updates regarding changes in payroll policies, tax laws, or any other relevant information will be communicated to all employees through appropriate channels, such as company newsletters, emails, or meetings. Keeping employees informed helps to manage expectations and reduce uncertainties.

By prioritizing communication and collaboration, the organization ensures that payroll management is not just a function of the finance department but a shared responsibility that involves every employee.

Performance Metrics

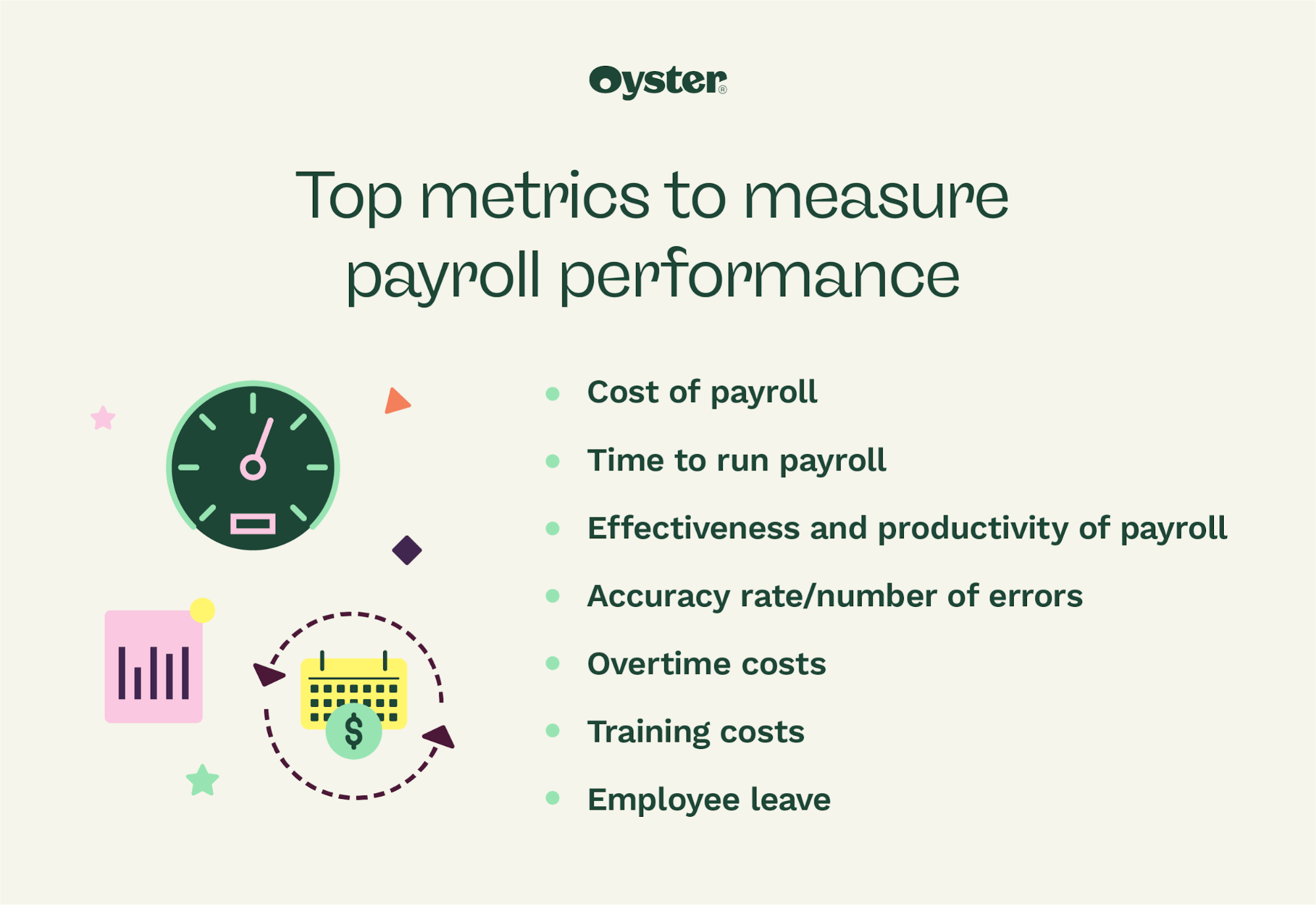

To objectively assess the effectiveness of the payroll management system, specific performance metrics will be established. These metrics will provide quantifiable benchmarks to measure the efficiency, accuracy, and compliance of payroll processes.

Fig. 1: Measuring Payroll Performance (For Illustration Purposes Only)

Fig. 1: Measuring Payroll Performance (For Illustration Purposes Only)

Process Efficiency: This metric will evaluate the speed and smoothness of the payroll process, from data collection to fund disbursement. Improvements in process efficiency can lead to faster payroll processing times and increased productivity.

Processing Time: The average time taken to complete the payroll cycle will be monitored. Reductions in processing time indicate more efficient workflows and system optimizations.

Error Rates: The frequency of errors in payroll processing will be tracked. Lower error rates are indicative of higher accuracy and reliability in the payroll system.

Audit Compliance Scores: These scores will reflect the degree to which payroll processes comply with internal policies and external regulations. High compliance scores demonstrate adherence to best practices and regulatory standards.

Payroll Accuracy: This metric will assess the overall accuracy of payroll calculations, payments, and deductions. High accuracy levels contribute to employee satisfaction and reduce the need for adjustments and corrections.

These performance metrics will be reviewed periodically to identify trends, benchmark against industry standards, and pinpoint areas for improvement. Regular reviews will ensure that the payroll management system remains aligned with organizational goals and continues to meet the needs of employees and the business.

Continuous Improvement

In alignment with the organization's long-term vision, the payroll accounting system will be subject to ongoing evaluation and enhancement. This commitment to continuous improvement ensures that the payroll operations adapt to changing business requirements, technological advancements, and regulatory updates.

Regulatory Updates: The payroll team will stay informed about changes in payroll-related laws and regulations to ensure ongoing compliance and adapt payroll processes accordingly.

Technology Upgrades: As new payroll technologies and software features become available, the organization will assess and integrate these advancements to improve efficiency, accuracy, and security.

Process Refinements: Internal payroll processes will be regularly reviewed and refined based on audit findings, employee feedback, and performance metric evaluations. This iterative approach ensures that payroll workflows remain optimized and responsive to the dynamic needs of the organization.

Training and Development: The payroll team will engage in continuous learning and professional development to enhance their expertise in payroll management, software applications, and compliance requirements.

Benchmarking: The organization will benchmark its payroll practices against industry standards and best practices to identify areas of excellence and opportunities for improvement.

Through a culture of continuous improvement, the organization ensures that its payroll management system is not only efficient and compliant today but also poised to meet the challenges and opportunities of the future.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover the future of payroll management with Template.net's Long-Term Payroll Accounting Management Plan Template. This dynamic solution, customizable through our AI editor, revolutionizes your payroll processes. Achieve precision, efficiency, and flexibility while ensuring seamless payroll management for the long term. Simplify your accounting journey effortlessly with this cutting-edge template.

You may also like

- Finance Plan

- Construction Plan

- Sales Plan

- Development Plan

- Career Plan

- Budget Plan

- HR Plan

- Education Plan

- Transition Plan

- Work Plan

- Training Plan

- Communication Plan

- Operation Plan

- Health And Safety Plan

- Strategy Plan

- Professional Development Plan

- Advertising Plan

- Risk Management Plan

- Restaurant Plan

- School Plan

- Nursing Home Patient Care Plan

- Nursing Care Plan

- Plan Event

- Startup Plan

- Social Media Plan

- Staffing Plan

- Annual Plan

- Content Plan

- Payment Plan

- Implementation Plan

- Hotel Plan

- Workout Plan

- Accounting Plan

- Campaign Plan

- Essay Plan

- 30 60 90 Day Plan

- Research Plan

- Recruitment Plan

- 90 Day Plan

- Quarterly Plan

- Emergency Plan

- 5 Year Plan

- Gym Plan

- Personal Plan

- IT and Software Plan

- Treatment Plan

- Real Estate Plan

- Law Firm Plan

- Healthcare Plan

- Improvement Plan

- Media Plan

- 5 Year Business Plan

- Learning Plan

- Marketing Campaign Plan

- Travel Agency Plan

- Cleaning Services Plan

- Interior Design Plan

- Performance Plan

- PR Plan

- Birth Plan

- Life Plan

- SEO Plan

- Disaster Recovery Plan

- Continuity Plan

- Launch Plan

- Legal Plan

- Behavior Plan

- Performance Improvement Plan

- Salon Plan

- Security Plan

- Security Management Plan

- Employee Development Plan

- Quality Plan

- Service Improvement Plan

- Growth Plan

- Incident Response Plan

- Basketball Plan

- Emergency Action Plan

- Product Launch Plan

- Spa Plan

- Employee Training Plan

- Data Analysis Plan

- Employee Action Plan

- Territory Plan

- Audit Plan

- Classroom Plan

- Activity Plan

- Parenting Plan

- Care Plan

- Project Execution Plan

- Exercise Plan

- Internship Plan

- Software Development Plan

- Continuous Improvement Plan

- Leave Plan

- 90 Day Sales Plan

- Advertising Agency Plan

- Employee Transition Plan

- Smart Action Plan

- Workplace Safety Plan

- Behavior Change Plan

- Contingency Plan

- Continuity of Operations Plan

- Health Plan

- Quality Control Plan

- Self Plan

- Sports Development Plan

- Change Management Plan

- Ecommerce Plan

- Personal Financial Plan

- Process Improvement Plan

- 30-60-90 Day Sales Plan

- Crisis Management Plan

- Engagement Plan

- Execution Plan

- Pandemic Plan

- Quality Assurance Plan

- Service Continuity Plan

- Agile Project Plan

- Fundraising Plan

- Job Transition Plan

- Asset Maintenance Plan

- Maintenance Plan

- Software Test Plan

- Staff Training and Development Plan

- 3 Year Plan

- Brand Activation Plan

- Release Plan

- Resource Plan

- Risk Mitigation Plan

- Teacher Plan

- 30 60 90 Day Plan for New Manager

- Food Safety Plan

- Food Truck Plan

- Hiring Plan

- Quality Management Plan

- Wellness Plan

- Behavior Intervention Plan

- Bonus Plan

- Investment Plan

- Maternity Leave Plan

- Pandemic Response Plan

- Succession Planning

- Coaching Plan

- Configuration Management Plan

- Remote Work Plan

- Self Care Plan

- Teaching Plan

- 100-Day Plan

- HACCP Plan

- Student Plan

- Sustainability Plan

- 30 60 90 Day Plan for Interview

- Access Plan

- Site Specific Safety Plan