Payroll Accounting Settlement Statement

This statement represents the comprehensive accounting of payroll expenses, deductions, and transactions of the organization for the specified period. It provides a clear and precise picture of all payroll activities and serves as vital financial documentation to ensure accuracy and adherence to financial regulations.

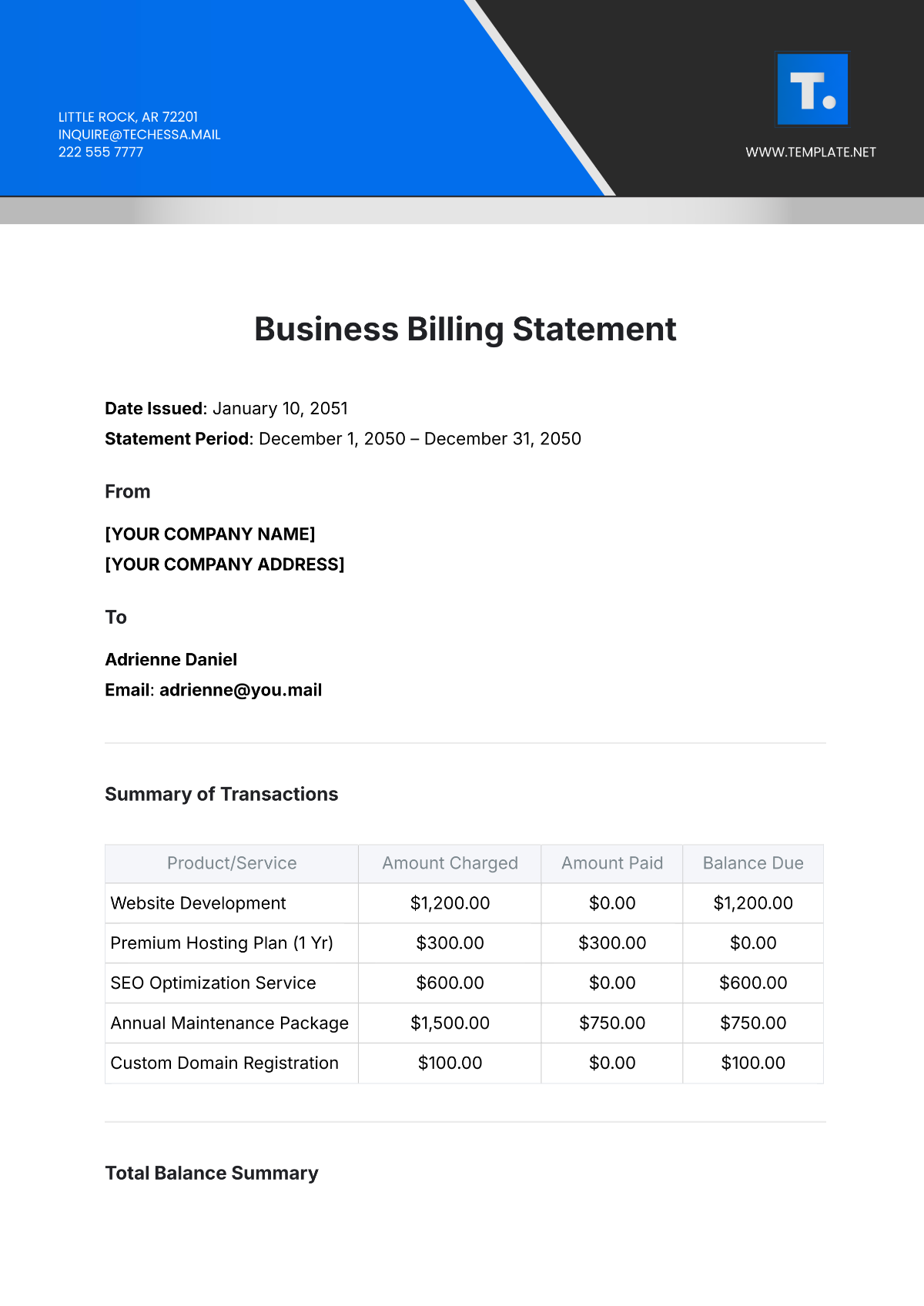

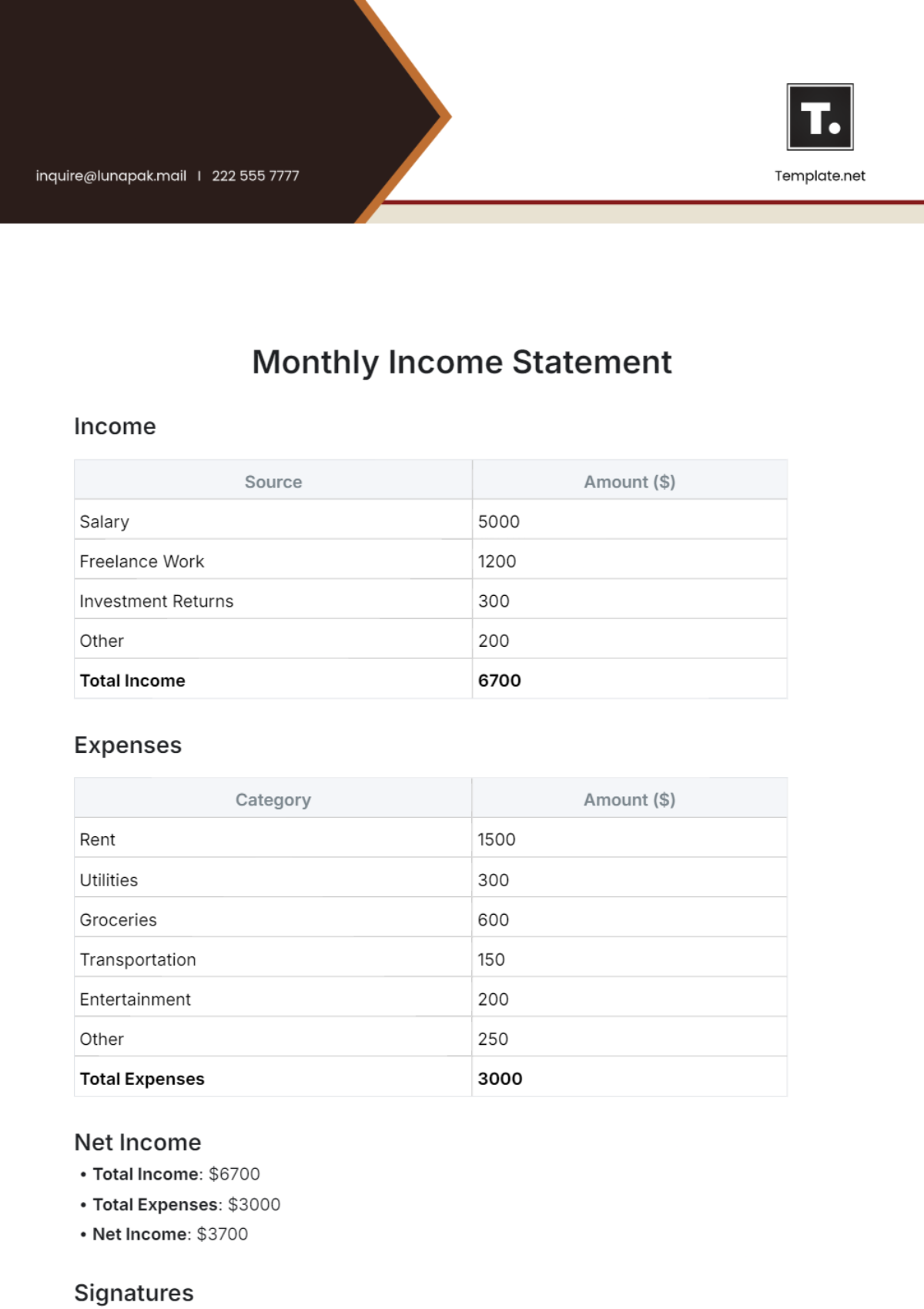

Employee Earnings and Deductions

Employee Name | Total Earnings | Total Deductions | Net Pay |

|---|---|---|---|

[Employee Name] | [$5,700] | [-$800] | [$4,900] |

Payroll Information

Component | Description | Amount |

|---|---|---|

Basic Salary | Monthly basic salary | [$5,000] |

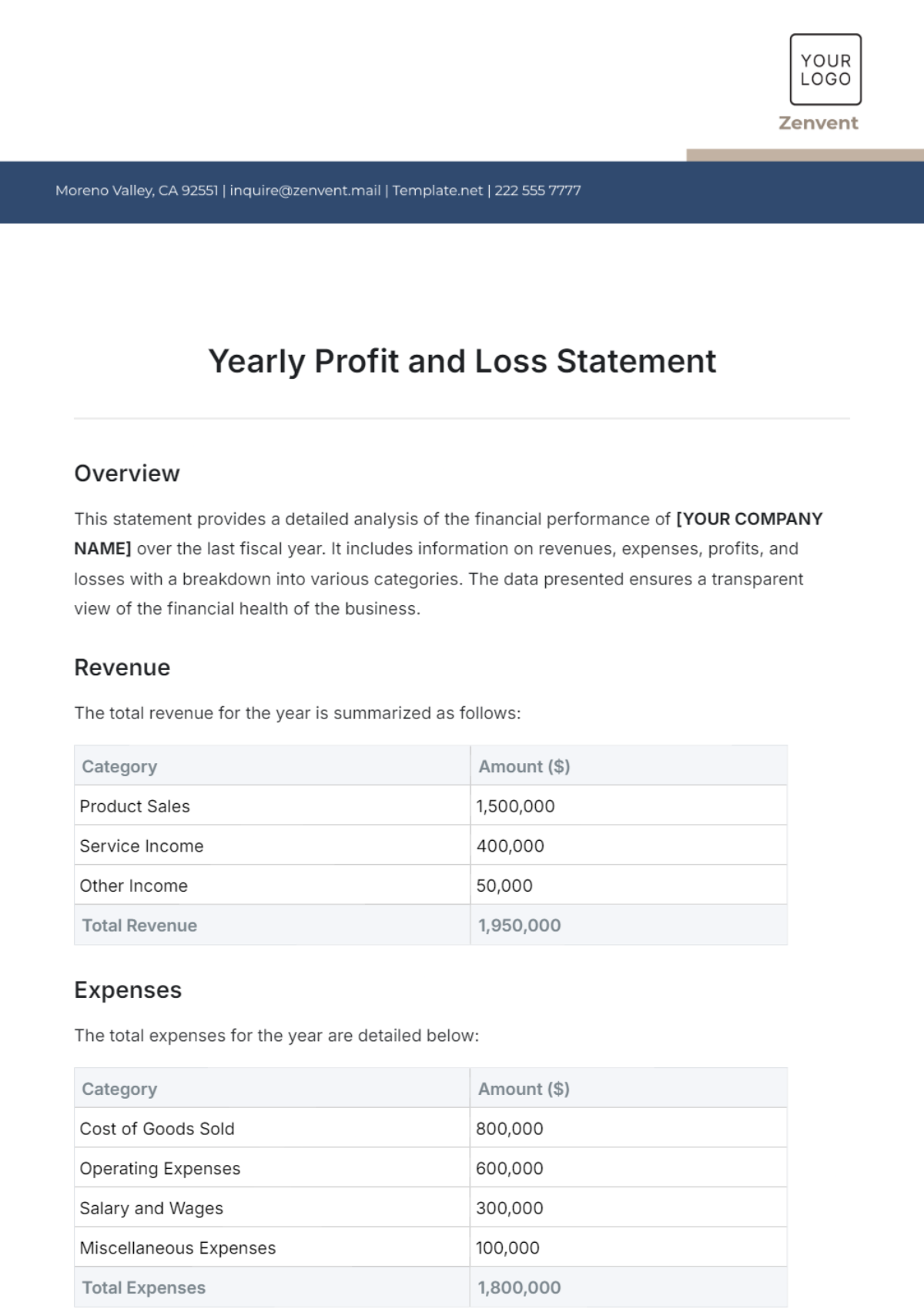

Total Payroll Expenses

The total payroll expenses for the period amount to: [$15,500]. This includes the employees' net pay and all associated payroll costs, such as employer contributions to social security, health insurance, and other benefits.

Payroll Liabilities

The payroll liabilities for the specified period are: [$7,890]. These liabilities represent the total amount of withholding from employees' paychecks that is owed to government agencies, benefit providers, or other entities.

Prepared By: [YOUR NAME]