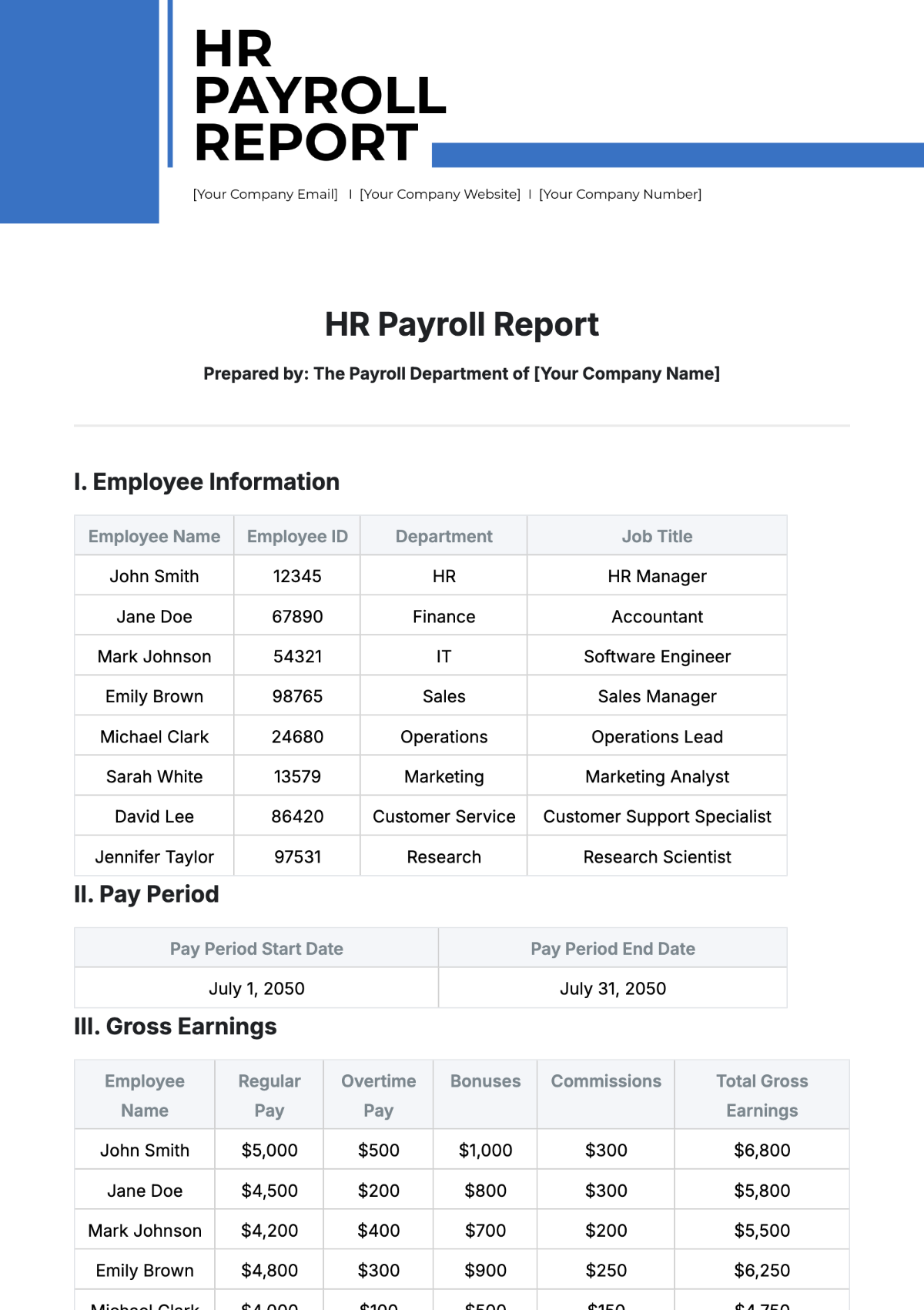

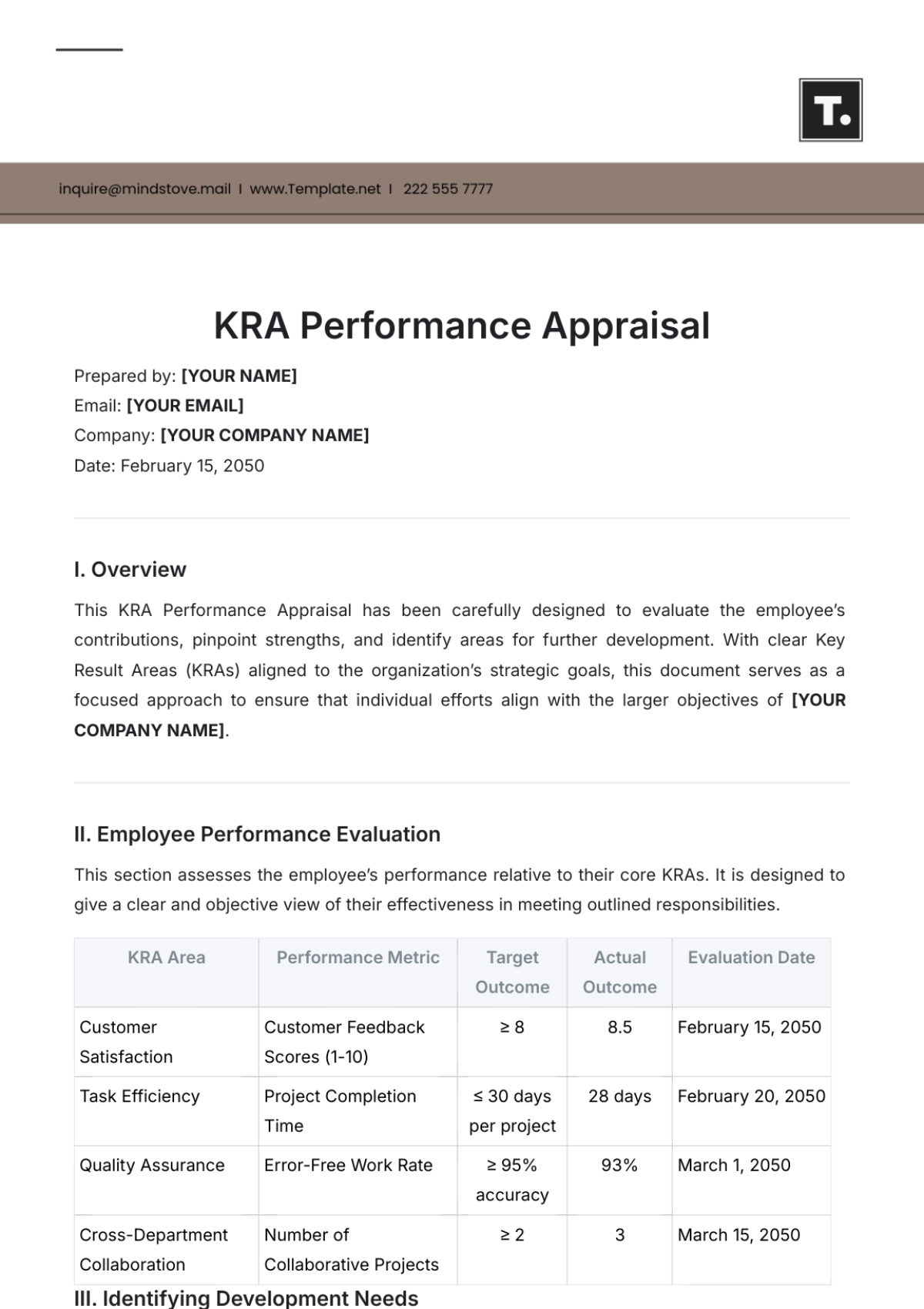

Salary Breakdown Slip

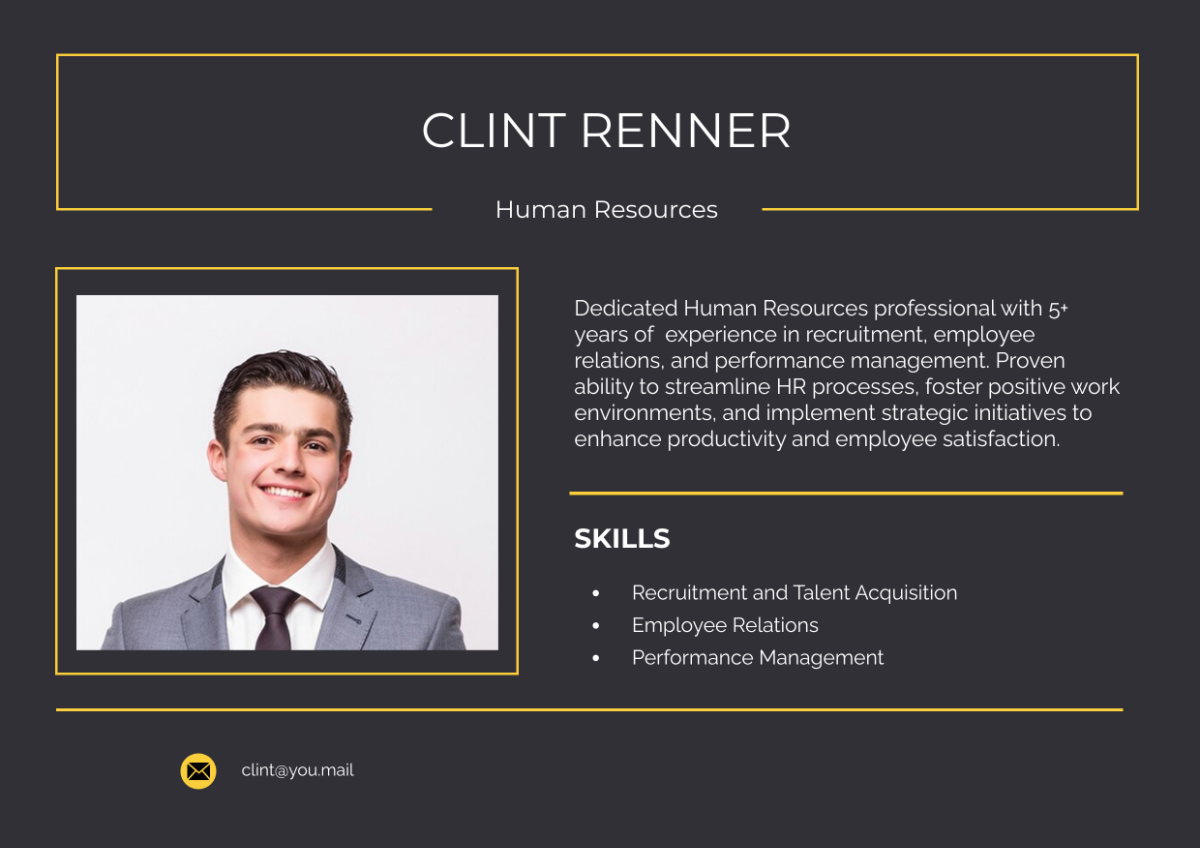

Employee’s Information

Name: Janet Lebeau | Department: Sales Department |

Employee ID: 240-19-607 | Manager: Angela Steed |

Employer Information

Company Name | [Your Company Name] |

Company Address | [Your Company Address] |

Company Contact | 222-555-7777 [Your Email] |

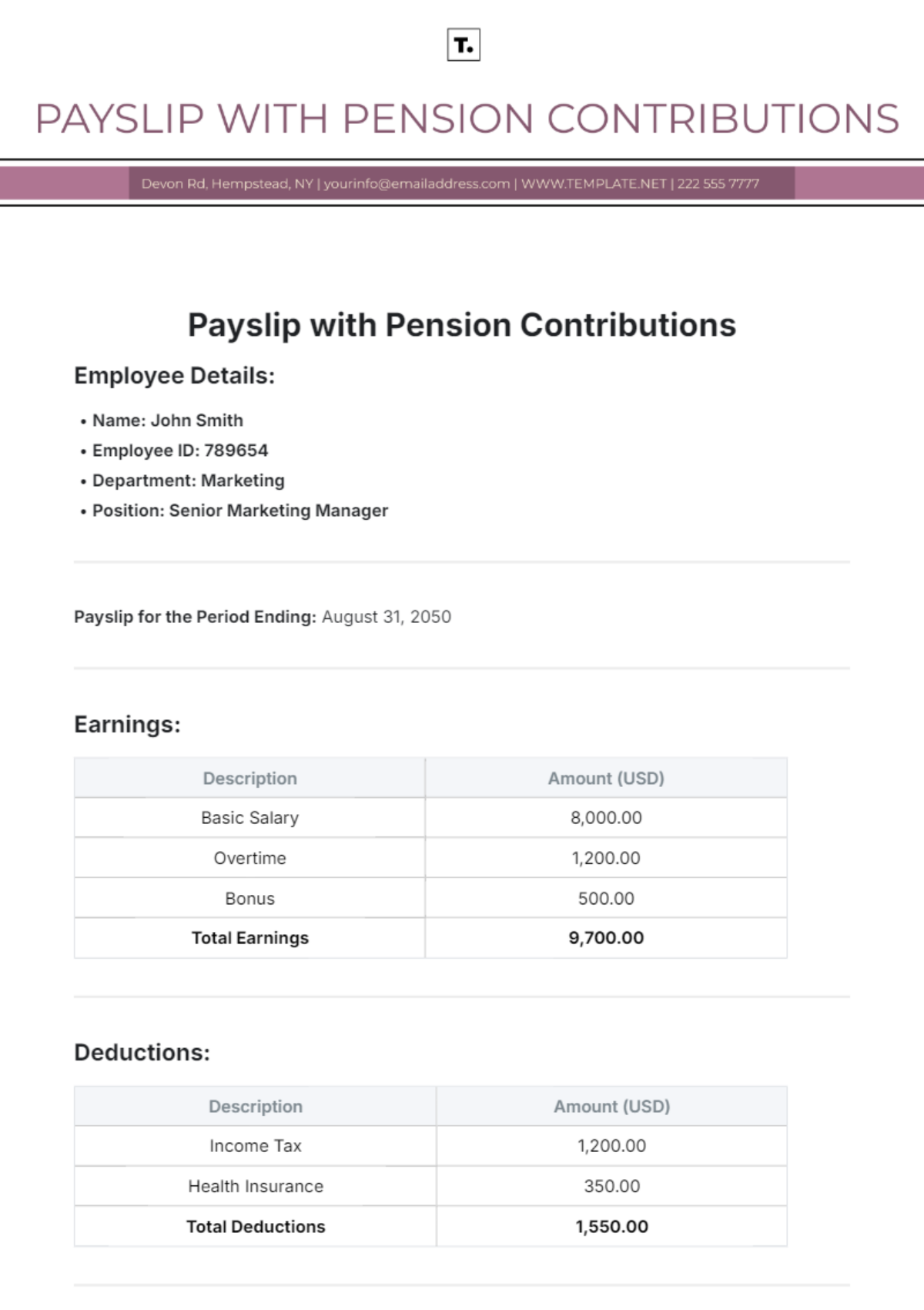

Salary Components

Component | Description | Amount ($) |

Basic Salary | Your base salary before deductions. | $8,000.00 |

Overtime | Additional pay for overtime hours worked. | $1,000.00 |

Bonuses and Incentives | Performance-based bonuses and incentives. | $1,000.00 |

Allowances | Special allowances for transportation. | $500.00 |

Total Gross Salary | $10,500.00 | |

Deductions Breakdown

Deduction Type | Description | Amount ($) |

Income Tax | Federal and state income tax deductions. | $600.00 |

Social Security | Social Security contributions. | $300.00 |

Health Insurance | Health insurance premiums (if applicable). | $100.00 |

Retirement Contributions | Contributions to your 401(k) plan. | $400.00 |

Other Deductions | Any other deductions specified. | $100.00 |

Total Deductions | $1,500.00 | |

Net Salary

Total Gross Salary | $10,500.00 |

Total Deductions | $1,500.00 |

Net Salary (After Deductions) | $9,000.00 |

Additional Information

Your net salary is the amount you will receive after HR has finished calculating and making all the necessary deductions, reflecting your take-home pay.

Deductions include income tax, Social Security contributions, health insurance premiums, and contributions to your 401(k) retirement plan.

This statement is for the specified payroll period, and your salary may vary which the HR will base on the hours you have worked, bonuses the company has provided to you, or other factors.

If you have any questions or concerns about your salary breakdown or deductions, please don't hesitate to contact our HR department. We are here to assist you with any inquiries regarding your compensation.

Disclaimer

The HR has provided this Salary Breakdown Slip for informational purposes only and will base the data on the information available at the time of issuance. It does not constitute a legally binding document, and if you have any discrepancies or issues you should address your concerns with the HR department.