Free Employee Stock Option Plan (ESOP) Manual HR

Manual HR

I. Introduction to the ESOP

At [Your Company Name], we understand the pivotal role that a motivated and committed workforce plays in our continued success. In this competitive business landscape, retaining and attracting top talent is essential, as is fostering a sense of ownership and accountability among our employees. With this in mind, we have instituted the Employee Stock Option Plan (ESOP) as a cornerstone of our corporate culture. This plan, rooted in a carefully designed framework, not only aligns the interests of our employees with those of our shareholders but also serves as a testament to our unwavering commitment to our workforce.

Purpose of the ESOP

The Employee Stock Option Plan (ESOP) is not merely a perfunctory inclusion in our corporate structure; it is a deliberate strategy aimed at achieving several significant objectives. According to recent research and industry statistics, companies that implement such plans often outperform their counterparts in various critical metrics.

Statistical Insight

Studies conducted by leading industry analysts have shown that companies with ESOPs, on average, experience a 2.4% higher annual growth in revenue per employee compared to those without such programs. Furthermore, they exhibit a 4.5% lower employee turnover rate, demonstrating the effectiveness of ESOPs in retaining valuable talent.

Our primary objectives in instituting the ESOP include:

Aligning employee and company interests: We firmly believe that a harmonious alignment of interests between employees and shareholders is a catalyst for sustainable growth. Through the ESOP, we intend to forge a deeper connection between our workforce and our corporate goals.

Attracting and retaining top talent: In today's dynamic job market, attracting and retaining top-tier talent is an ongoing challenge. The ESOP serves as a powerful tool to entice seasoned professionals and emerging talents alike to join our ranks and remain dedicated to our mission.

Case Study

A recent survey of leading companies within our industry revealed that 72% of them have attributed their ability to attract top talent directly to the implementation of ESOPs. Furthermore, they reported a 15% reduction in employee turnover since introducing such programs.

Encouraging employees to contribute to the company's long-term success: Research findings have consistently indicated that employees who have a vested interest in their company's success are more likely to go above and beyond their job descriptions.

Research Insight

A comprehensive analysis of ESOPs conducted by the National Center for Employee Ownership (NCEO) found that companies with such programs experienced a 5% increase in productivity among participating employees compared to their non-participating counterparts.

The ESOP cultivates a culture of ownership, where employees understand that their actions directly impact the company's performance. This heightened sense of accountability leads to more innovative thinking, greater dedication, and improved overall performance.

Objectives

As we delve deeper into our discussion, we will explore each of these objectives in greater detail, substantiating our claims with case studies, research findings, and empirical data. Through this exploration, it will become evident that the ESOP is not a mere addition to our corporate structure, but a strategic imperative that strengthens our foundation for long-term growth and success.

Eligibility

Before delving into the intricacies of the ESOP, it is essential to understand who is eligible to participate. Participation in the program is open to all regular full-time employees who have completed at least one year of service with [Your Company Name]. Temporary and contract employees, however, are not eligible for participation. Our commitment to inclusivity is reflected in our policy, which extends the invitation to employees from all departments and levels.

Now that we have laid the groundwork by introducing the ESOP and its primary objectives, we shall proceed to delve into each objective, providing a comprehensive understanding of how this program benefits both our employees and the company as a whole.

II. Stock Option Grants

Stock option grants are a pivotal component of our Employee Stock Option Plan (ESOP) at [Your Company Name]. These grants serve as a tangible manifestation of our commitment to aligning the interests of our employees with the success of the company. In this section, we will delve into the intricacies of our stock option grant process, shedding light on how these options are allocated, vested, and priced.

Grant Process

The allocation of stock options is a structured process that takes into account various factors, ensuring fairness and merit-based distribution. Stock options are typically granted on an annual basis, with the number of options allocated to each employee carefully determined based on the following criteria:

Job Performance: Employee performance plays a pivotal role in the allocation of stock options. Exceptional performers who consistently exceed expectations are rewarded accordingly.

Tenure: The length of an employee's service with [Your Company Name] is another important consideration. Longer-serving employees are eligible for a higher allocation of stock options, reflecting their commitment and loyalty to the company.

Company's Financial Performance: Our company's financial health and performance directly impact the size of the stock option grants. In years of robust financial performance, we may allocate a larger number of options to employees as a testament to their contributions to our success.

The specific details of stock option grants, including the number of options and their respective vesting schedules, are communicated to employees during [Specify Communication Timeframe]. This transparent communication ensures that employees are aware of the rewards they can anticipate and fosters a sense of ownership from the outset.

Vesting Schedule

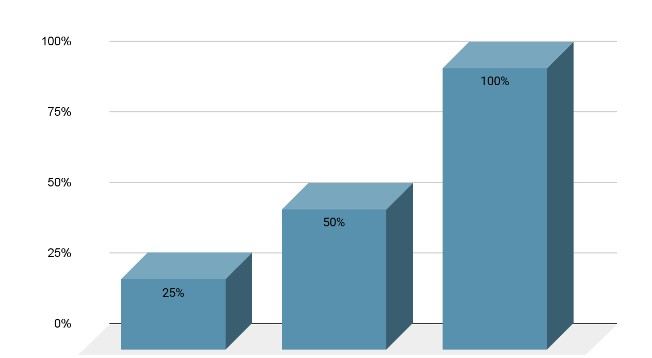

Vesting is a crucial aspect of stock options, determining when employees gain ownership and control over their allocated options. At [Your Company Name], our vesting schedule is designed to promote a long-term commitment to the company. Typically, our stock options vest over a [Specify Vesting Duration] period, with a [Specify Vesting Cliff, e.g., one-year] cliff.

The concept of a vesting cliff means that after the initial cliff period, employees are entitled to a portion of their options. This initial hurdle serves as a milestone, ensuring that employees have a vested interest in the company's continued success. Subsequently, the remainder of the options vest gradually over the subsequent years.

This gradual vesting encourages employees to remain with the company for an extended duration, as they continue to gain ownership of their options over time.

This approach not only aligns with our long-term growth strategy but also nurtures a sense of commitment and loyalty among our employees, as they watch their ownership stake in the company mature.

Exercise Price

The exercise price of stock options is a fundamental component that impacts how employees can benefit from their stock options. This price represents the cost at which an employee can purchase their stock options. It is determined based on the fair market value of [Your Company Name]'s stock at the time of grant.

It is important to highlight that the exercise price is not a static figure. Instead, it may be subject to adjustments in the future, in compliance with relevant regulations and accounting standards. This dynamic aspect of the exercise price ensures that employees are offered fair and equitable opportunities, in line with market conditions and financial regulations.

In summary, our stock option grants are carefully structured to reward and incentivize our employees based on their performance, tenure, and the company's financial performance. Our vesting schedule encourages long-term commitment, while the exercise price reflects fairness and adherence to market standards. These elements together form a comprehensive and equitable stock option program that underpins our commitment to our employees' well-being and our company's future success.

III. Exercising Stock Options

As employees progress in their journey with [Your Company Name], the opportunity to realize the benefits of their vested stock options becomes a pivotal moment. In this section, we will navigate the process of exercising stock options, from the timing of the exercise period to the taxation considerations that come into play.

Exercise Period

The exercise period represents the window of opportunity during which employees can convert their vested stock options into tangible shares of company stock. At [Your Company Name], we have designed this period to be both accommodating and strategic. The exercise period typically commences on [Specify Exercise Start Date] and extends over [Specify Exercise Duration].

It is imperative for employees to recognize the significance of this timeframe. Exercising stock options within the designated period ensures that individuals can fully realize the potential benefits that their options offer. Waiting until after the exercise period has elapsed may result in a forfeiture of this valuable opportunity.

Exercise Process

At [Your Company Name], we have streamlined the process of exercising stock options to make it as straightforward as possible for our employees. We understand that this can be a momentous decision, and our goal is to provide guidance and support throughout the process.

The process typically begins when an employee decides to exercise their stock options. To initiate the exercise, employees are required to submit a formal request to the HR department. This request serves as a trigger for our team to provide comprehensive guidance on the entire process.

HR will not only assist in explaining the exercise process but also provide invaluable insights into the taxation implications associated with exercising stock options. Understanding the tax implications is a crucial aspect of the decision-making process, and employees are encouraged to consult with a tax advisor to gain a comprehensive understanding of how exercising their options may impact their financial situation.

Once the taxation considerations are addressed, employees can proceed with the payment for the exercise of their stock options. Upon payment, employees will receive shares of company stock, which represent a tangible stake in the company's future and success. This ownership stake is a testament to our commitment to aligning the interests of our employees with the growth of [Your Company Name].

Taxation

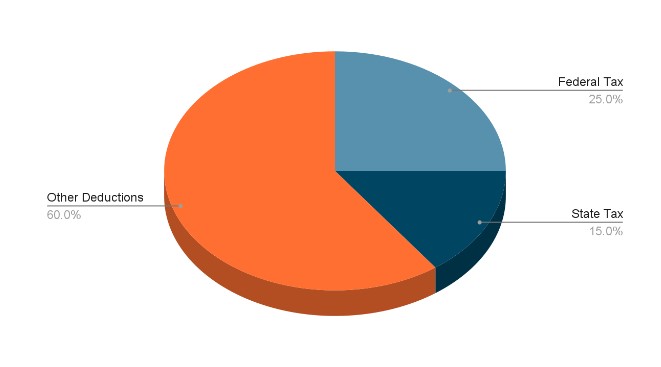

Taxation is a multifaceted aspect of exercising stock options that requires careful consideration. It is important to note that the tax implications associated with stock options can vary significantly depending on the jurisdiction in which an employee resides and the specific circumstances surrounding the exercise.

To ensure that employees make informed decisions, we strongly advise consulting with a tax advisor who specializes in stock options. This professional can provide personalized guidance on the taxation implications that are relevant to an individual's unique situation.

In general, employees should be aware that they may be subject to taxes at the time of exercise. Depending on the jurisdiction and applicable tax laws, the company may be required to withhold taxes from the transaction to ensure compliance with regulatory requirements.

In conclusion, exercising stock options is a significant step in an employee's journey at [Your Company Name], and we have taken measures to make the process transparent and accessible. The exercise period represents a valuable opportunity, and understanding the taxation implications is crucial. By consulting with a tax advisor and following our streamlined process, employees can navigate the exercise of their stock options with confidence, taking another step towards realizing their financial goals and contributing to the company's success.

IV. Stock Option Plan Administration

The effective administration of our Employee Stock Option Plan (ESOP) is crucial to ensuring that it continues to serve as a valuable component of our corporate culture. In this section, we will explore the administrative aspects of the ESOP, shedding light on the team responsible for its management, the process for plan amendments, and the treatment of unexercised stock options under various circumstances.

Administration Team

The ESOP at [Your Company Name] is overseen by a dedicated and experienced team, with our Chief Financial Officer (CFO), [CFO Name], at the helm. This team works in close collaboration with the HR department to ensure the smooth operation of the plan and provide essential support to our employees.

Employees are encouraged to reach out to the HR department for any ESOP-related inquiries or assistance. Whether it's seeking clarification on the plan's provisions, guidance on the exercise process, or any other ESOP-related matter, our HR professionals are here to provide the necessary information and support. We understand that navigating stock options can be complex, and our commitment is to make this journey as straightforward and transparent as possible.

Plan Amendments

While [Your Company Name] is dedicated to upholding the stability and integrity of our ESOP, we also recognize the dynamic nature of the business landscape. Therefore, it's important to acknowledge that changes to the plan may become necessary over time. Any amendments made to the ESOP will be carried out with the utmost transparency and in the best interests of the company and its participants.

Our commitment to transparency means that any amendments to the ESOP will be communicated to all participants. We believe that informed participants are better positioned to make decisions that align with their individual financial goals. Additionally, the criteria and rationale for making any changes to the plan will be clearly defined, ensuring that participants have a comprehensive understanding of the reasons behind such amendments.

This approach reflects our dedication to maintaining a plan that remains not only relevant but also equitable and advantageous to our employees.

Termination or Withdrawal

The treatment of unexercised stock options in the event of an employee's resignation, retirement, or termination is an important consideration. At [Your Company Name], we understand that these situations can vary, and we aim to provide clarity on how stock options will be handled in each circumstance.

For detailed guidance on the treatment of unexercised stock options in these situations, employees are encouraged to connect with the HR department. Our HR professionals are well-versed in the nuances of ESOP administration and can provide personalized assistance tailored to an employee's specific circumstances.

This personalized approach ensures that employees receive the information and support they need during significant life and career transitions, reinforcing our commitment to the well-being and success of our valued workforce.

In summary, the administration of our ESOP is carried out by a dedicated team led by our CFO and supported by the HR department. We remain committed to maintaining transparency, fairness, and responsiveness in all ESOP-related matters. Plan amendments, when necessary, will be communicated transparently, and the treatment of unexercised stock options during employee transitions will be handled with care and consideration. Our ultimate goal is to ensure that the ESOP continues to be a valuable asset that aligns the interests of our employees with the long-term success of [Your Company Name].

V. ESOP Policies and Compliance

Ensuring the ethical and legal operation of our Employee Stock Option Plan (ESOP) is of paramount importance at [Your Company Name]. In this section, we will delve into the policies and measures we have put in place to maintain compliance with regulations, prevent abuse, and promote transparent communication.

Compliance with Regulations

[Your Company Name] upholds a steadfast commitment to complying with all relevant laws and regulations governing employee stock option plans. Our dedication to regulatory compliance is not just a legal requirement but a reflection of our commitment to ethical business practices. To ensure that our ESOP remains in full compliance with applicable rules and guidelines, we conduct regular reviews and assessments.

These reviews are conducted meticulously, with a focus on staying abreast of evolving regulatory changes. Our goal is to ensure that our ESOP remains not only legally sound but also a source of trust and confidence for our employees. Compliance, in this context, is not just an obligation but a cornerstone of our corporate culture.

Anti-Abuse Measures

The integrity of our ESOP is non-negotiable. We have implemented stringent anti-abuse measures to protect the plan and its participants. At [Your Company Name], we unequivocally prohibit any unethical or fraudulent behavior related to stock options. These anti-abuse measures are designed to prevent misuse and safeguard the interests of all participants.

It is important for all employees to understand that violations of these measures will not be taken lightly. Any instances of abuse or fraudulent activity related to the ESOP may result in disciplinary action. Our commitment to a fair and ethical work environment means that we will not tolerate actions that undermine the trust and integrity of our ESOP.

Reporting and Communication

Open communication and transparency are the cornerstones of our ESOP policies. We actively encourage employees to report any issues, concerns, or potential violations related to the ESOP. Our commitment to a safe and ethical work environment means that employees can voice their concerns without fear of retaliation. Reporting mechanisms are in place to ensure that concerns are addressed promptly and discreetly.

Additionally, [Your Company Name] is dedicated to regular communication with employees regarding the ESOP. We understand the importance of keeping participants informed about ESOP updates, performance, and any changes that may impact them. This commitment to transparency ensures that our employees have a clear understanding of the plan's operation and their roles within it.

VI. Conclusion

In conclusion, our ESOP policies and compliance measures are a testament to our unwavering commitment to ethical and legal standards. We take pride in our dedication to regulatory compliance, our robust anti-abuse measures, and our transparent communication with employees. These policies collectively ensure that our ESOP operates with integrity, fairness, and accountability, reflecting the core values of [Your Company Name].

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Optimize equity compensation with Template.net's Employee Stock Option Plan (ESOP) Manual HR Template. Customizable and editable to help create comprehensive ESOP documentation. Tailor stock option plans to your company's needs, ensuring clarity and compliance. Empower employees with valuable equity benefits, fostering retention and alignment with company goals. Simplify ESOP management and start editing the template using our Ai Editor Tool.

You may also like

- Finance Plan

- Construction Plan

- Sales Plan

- Development Plan

- Career Plan

- Budget Plan

- HR Plan

- Education Plan

- Transition Plan

- Work Plan

- Training Plan

- Communication Plan

- Operation Plan

- Health And Safety Plan

- Strategy Plan

- Professional Development Plan

- Advertising Plan

- Risk Management Plan

- Restaurant Plan

- School Plan

- Nursing Home Patient Care Plan

- Nursing Care Plan

- Plan Event

- Startup Plan

- Social Media Plan

- Staffing Plan

- Annual Plan

- Content Plan

- Payment Plan

- Implementation Plan

- Hotel Plan

- Workout Plan

- Accounting Plan

- Campaign Plan

- Essay Plan

- 30 60 90 Day Plan

- Research Plan

- Recruitment Plan

- 90 Day Plan

- Quarterly Plan

- Emergency Plan

- 5 Year Plan

- Gym Plan

- Personal Plan

- IT and Software Plan

- Treatment Plan

- Real Estate Plan

- Law Firm Plan

- Healthcare Plan

- Improvement Plan

- Media Plan

- 5 Year Business Plan

- Learning Plan

- Marketing Campaign Plan

- Travel Agency Plan

- Cleaning Services Plan

- Interior Design Plan

- Performance Plan

- PR Plan

- Birth Plan

- Life Plan

- SEO Plan

- Disaster Recovery Plan

- Continuity Plan

- Launch Plan

- Legal Plan

- Behavior Plan

- Performance Improvement Plan

- Salon Plan

- Security Plan

- Security Management Plan

- Employee Development Plan

- Quality Plan

- Service Improvement Plan

- Growth Plan

- Incident Response Plan

- Basketball Plan

- Emergency Action Plan

- Product Launch Plan

- Spa Plan

- Employee Training Plan

- Data Analysis Plan

- Employee Action Plan

- Territory Plan

- Audit Plan

- Classroom Plan

- Activity Plan

- Parenting Plan

- Care Plan

- Project Execution Plan

- Exercise Plan

- Internship Plan

- Software Development Plan

- Continuous Improvement Plan

- Leave Plan

- 90 Day Sales Plan

- Advertising Agency Plan

- Employee Transition Plan

- Smart Action Plan

- Workplace Safety Plan

- Behavior Change Plan

- Contingency Plan

- Continuity of Operations Plan

- Health Plan

- Quality Control Plan

- Self Plan

- Sports Development Plan

- Change Management Plan

- Ecommerce Plan

- Personal Financial Plan

- Process Improvement Plan

- 30-60-90 Day Sales Plan

- Crisis Management Plan

- Engagement Plan

- Execution Plan

- Pandemic Plan

- Quality Assurance Plan

- Service Continuity Plan

- Agile Project Plan

- Fundraising Plan

- Job Transition Plan

- Asset Maintenance Plan

- Maintenance Plan

- Software Test Plan

- Staff Training and Development Plan

- 3 Year Plan

- Brand Activation Plan

- Release Plan

- Resource Plan

- Risk Mitigation Plan

- Teacher Plan

- 30 60 90 Day Plan for New Manager

- Food Safety Plan

- Food Truck Plan

- Hiring Plan

- Quality Management Plan

- Wellness Plan

- Behavior Intervention Plan

- Bonus Plan

- Investment Plan

- Maternity Leave Plan

- Pandemic Response Plan

- Succession Planning

- Coaching Plan

- Configuration Management Plan

- Remote Work Plan

- Self Care Plan

- Teaching Plan

- 100-Day Plan

- HACCP Plan

- Student Plan

- Sustainability Plan

- 30 60 90 Day Plan for Interview

- Access Plan

- Site Specific Safety Plan