Free Salary Audit Statement HR Template

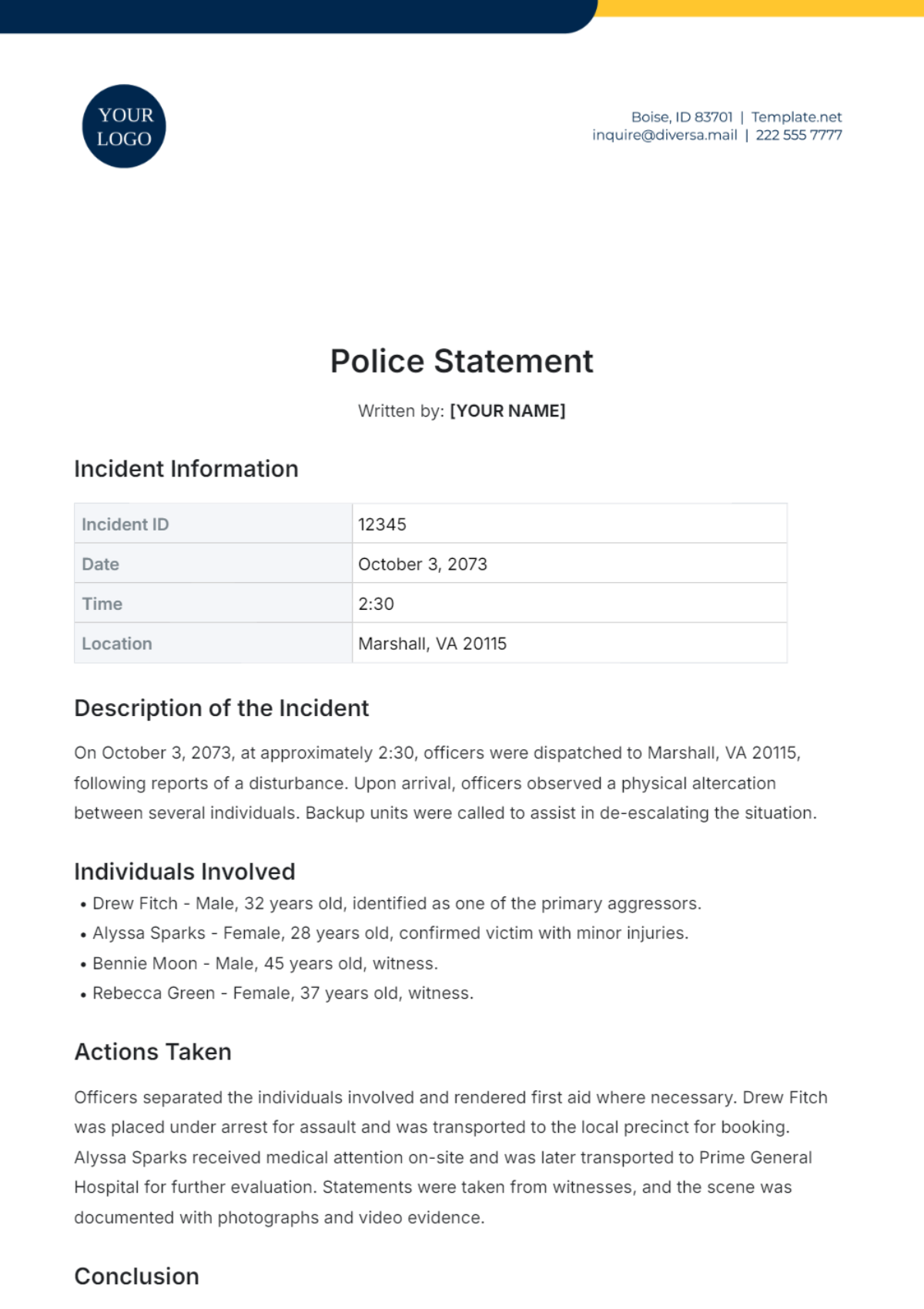

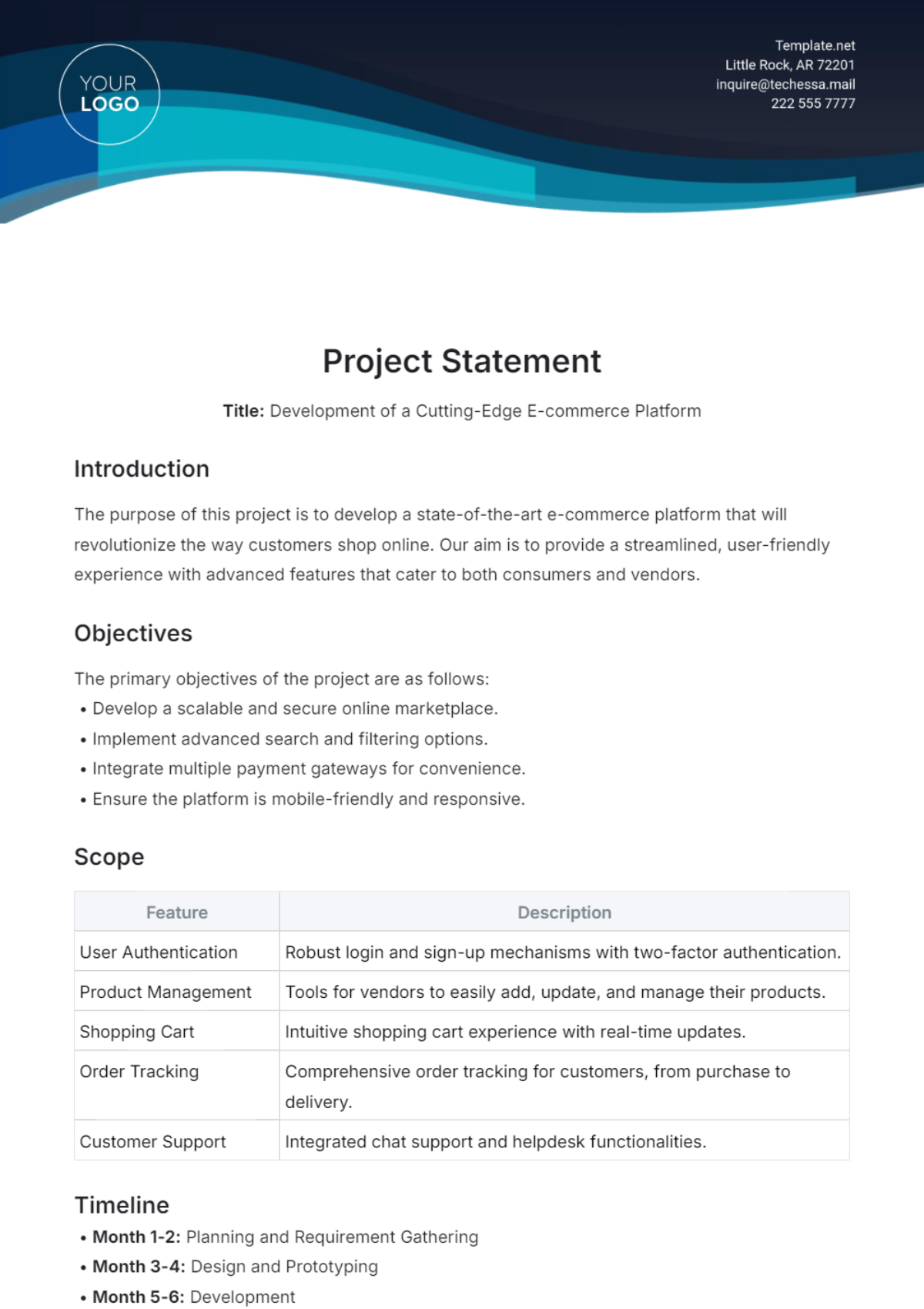

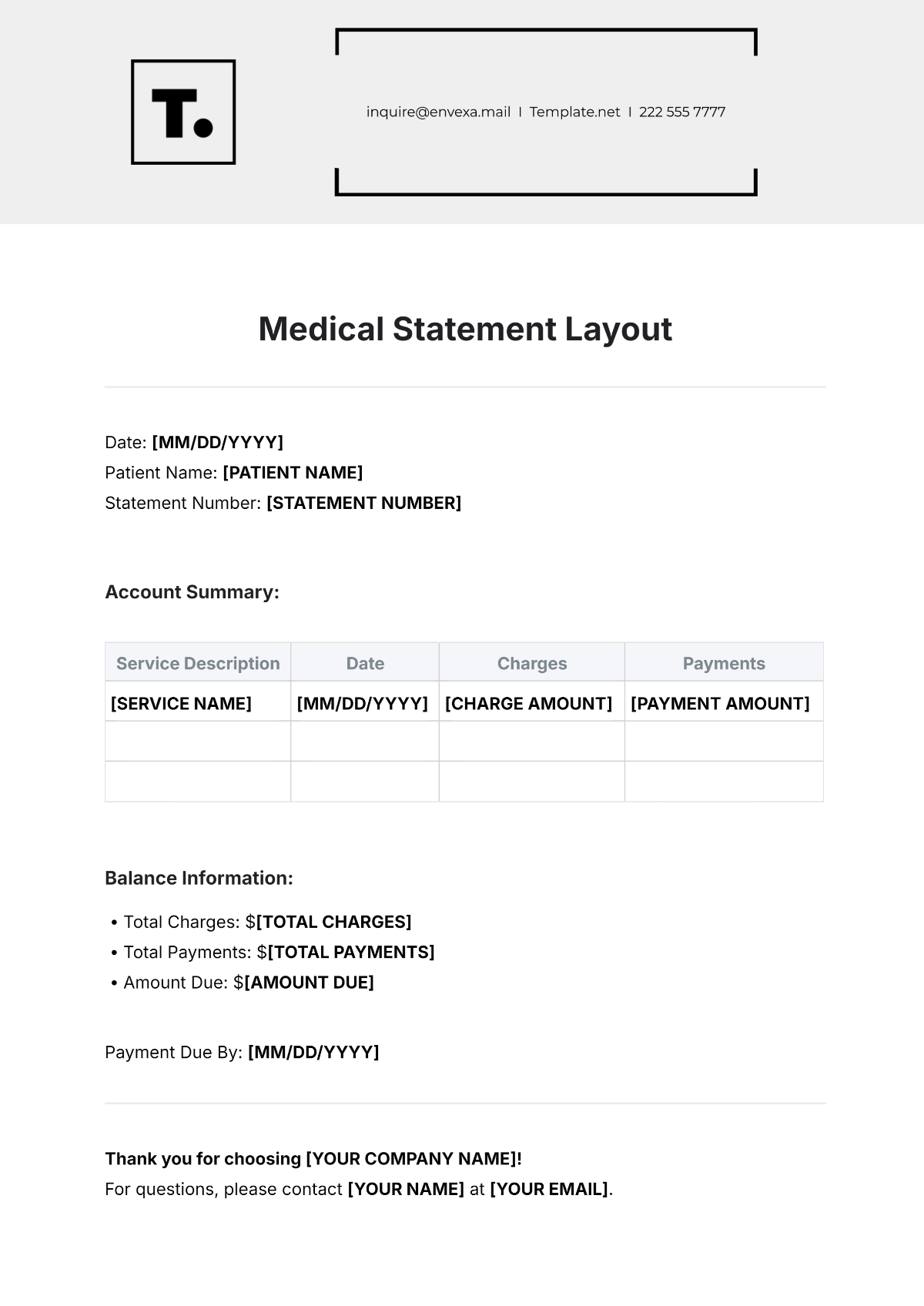

Salary Audit Statement

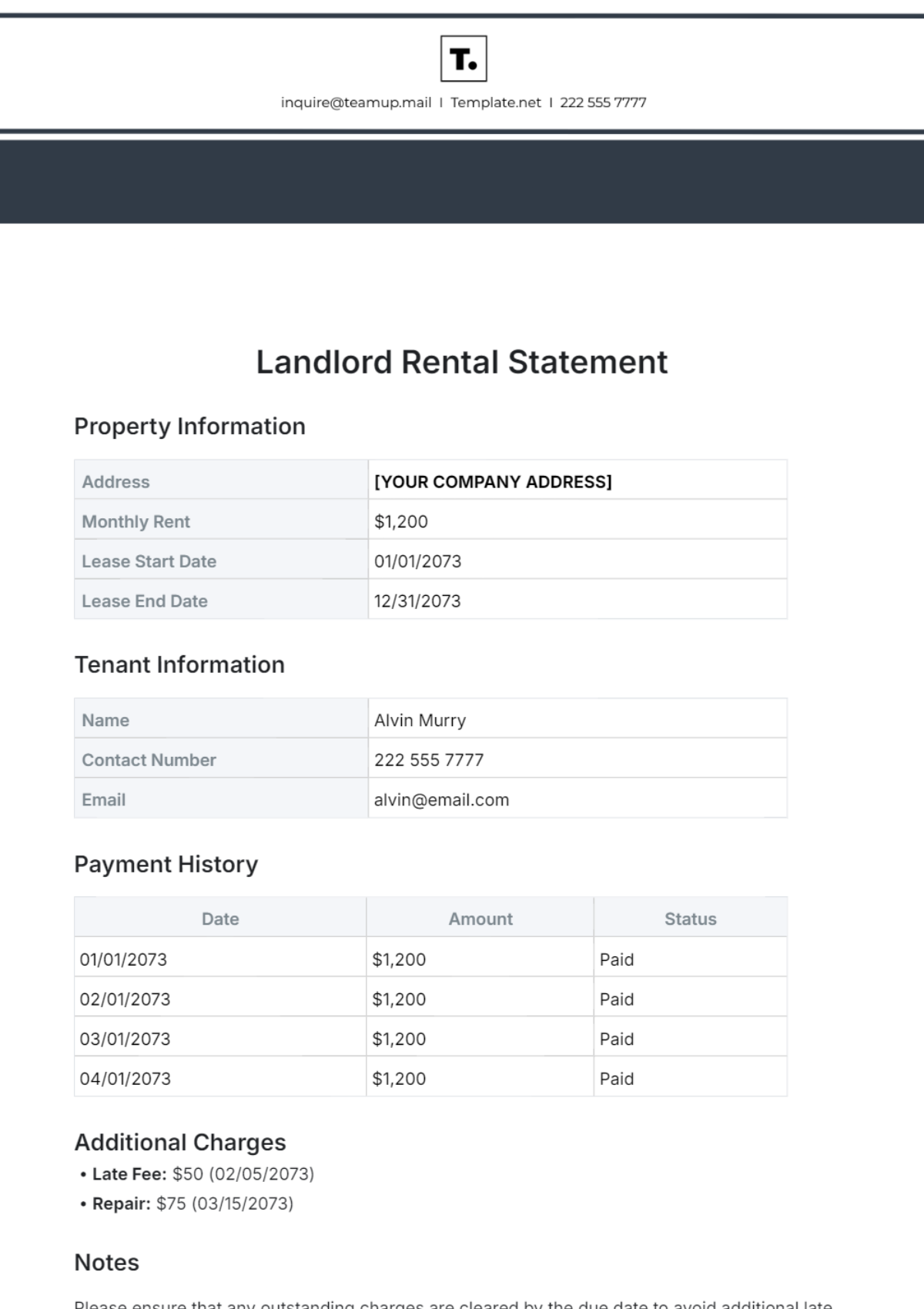

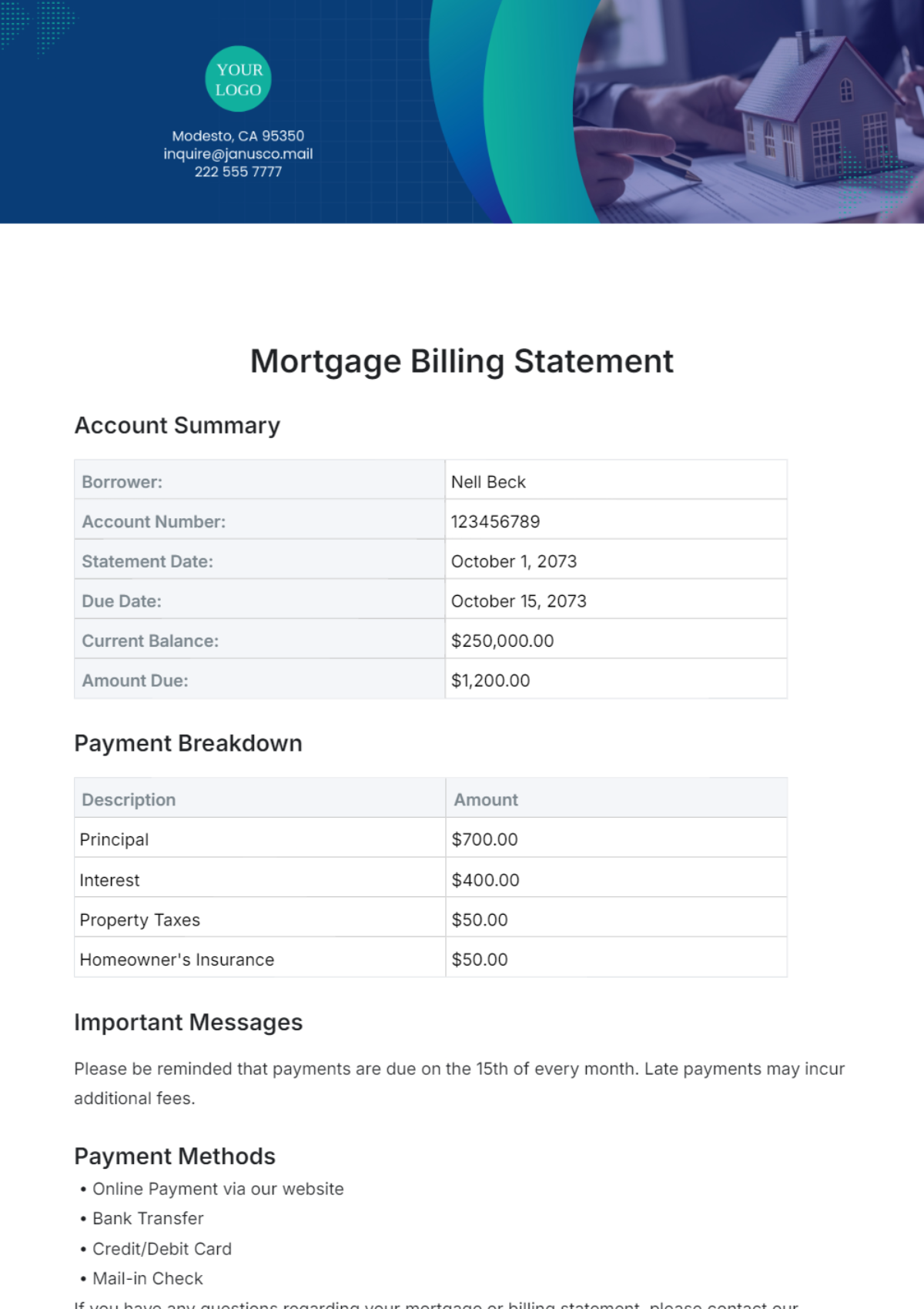

Employee: [Employee’s Name]

Employee ID: [Employee ID Number]

Department: [Department Name]

Payroll Period: [Month Day, Year] - [Month Day, Year]

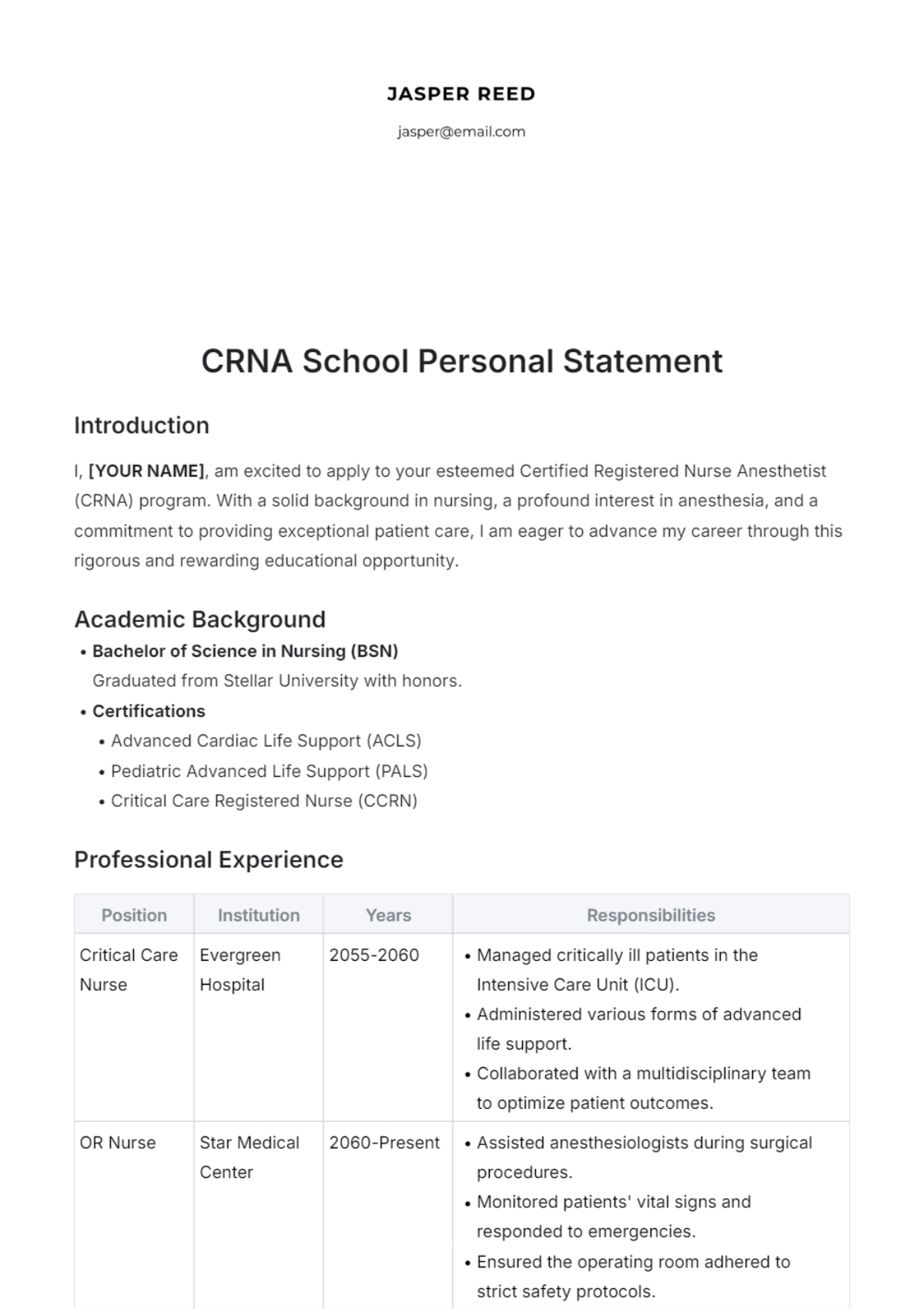

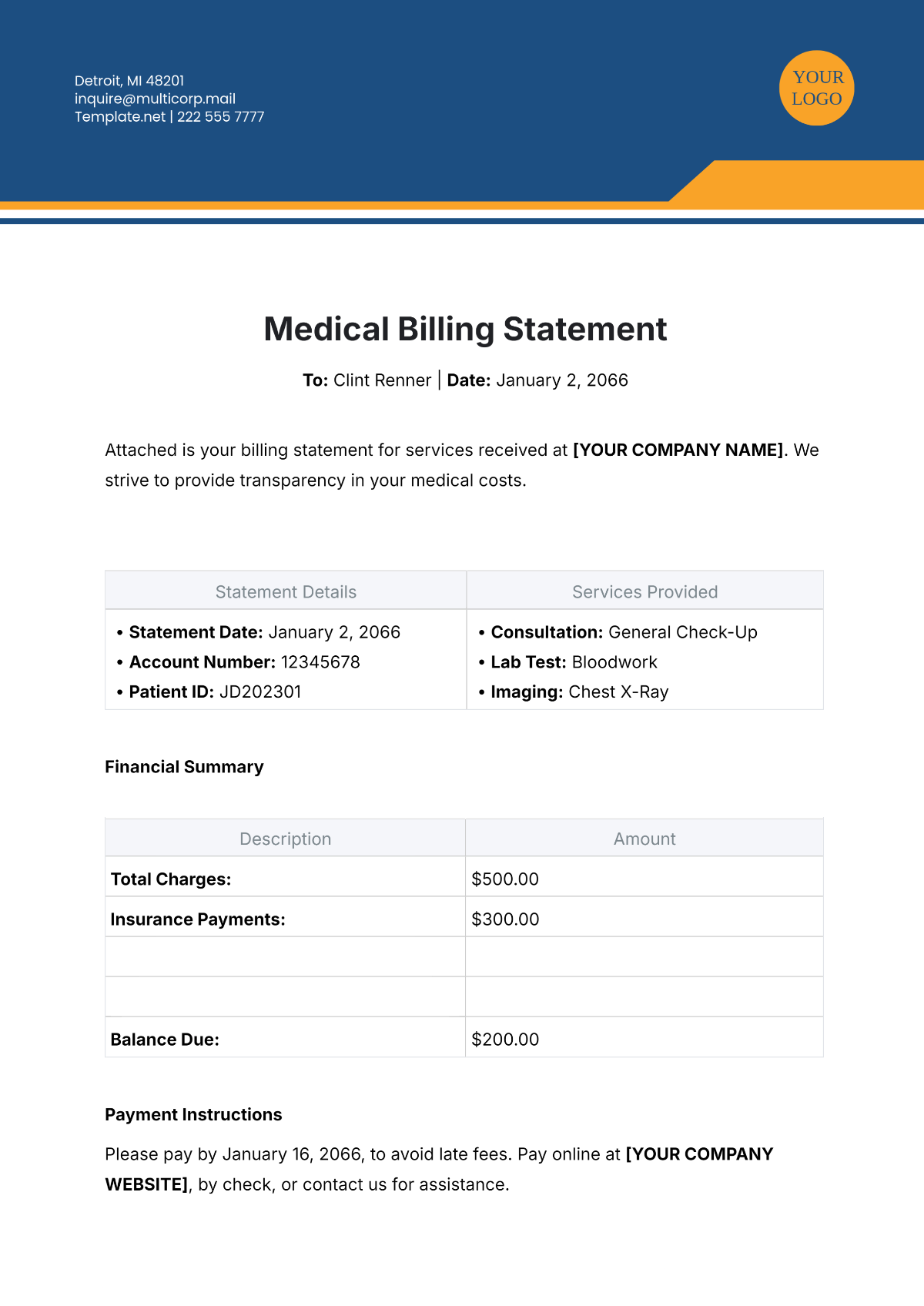

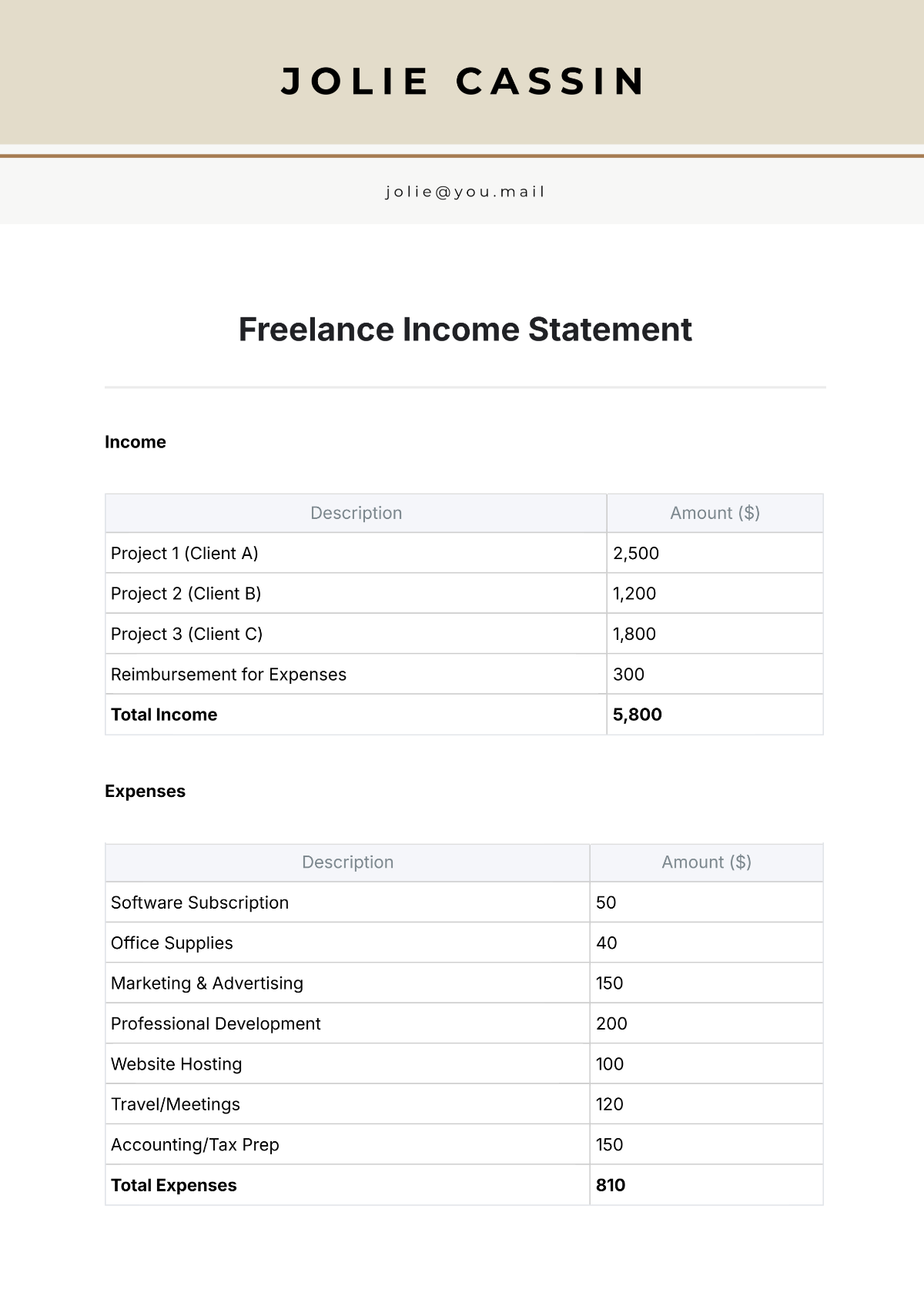

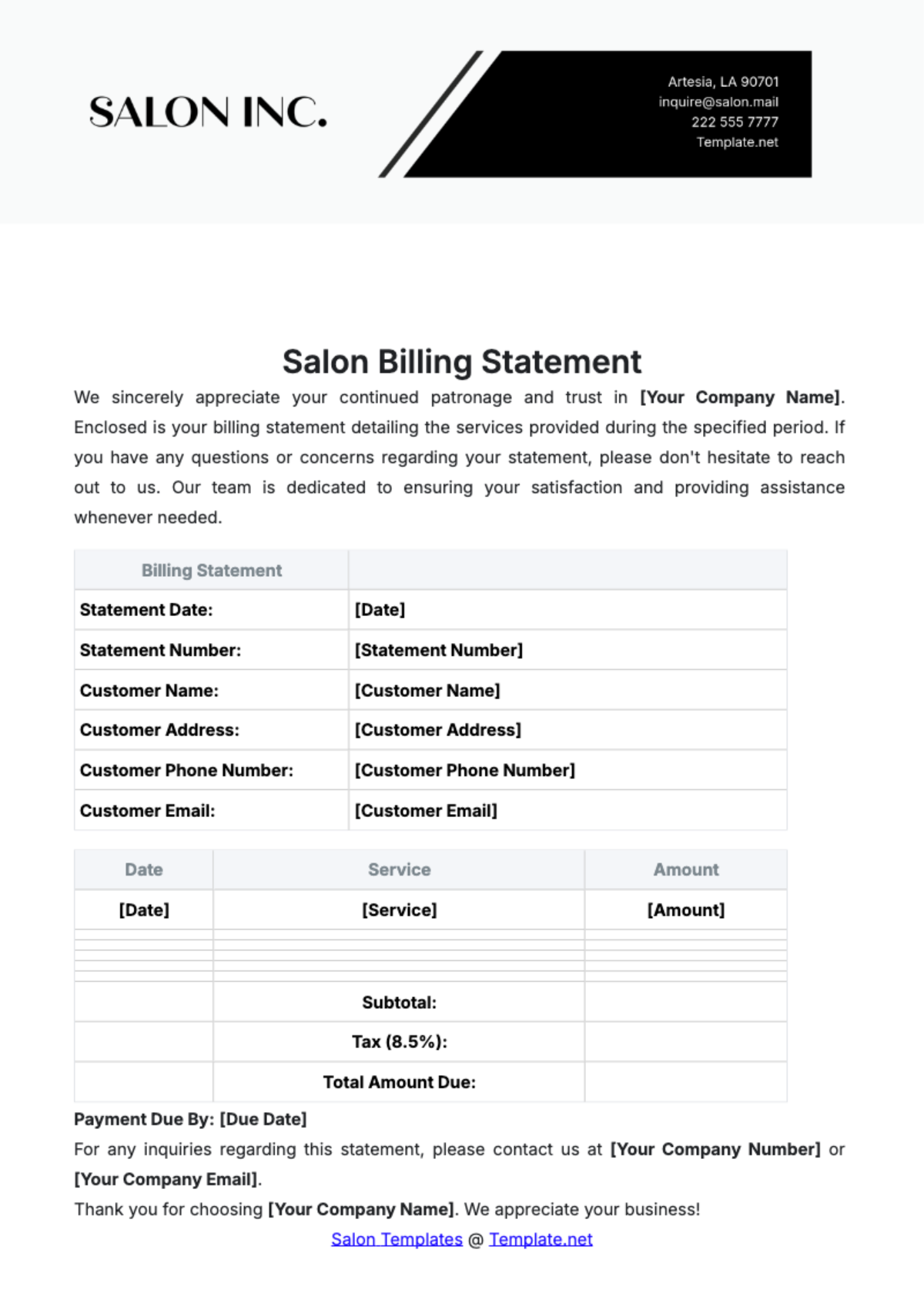

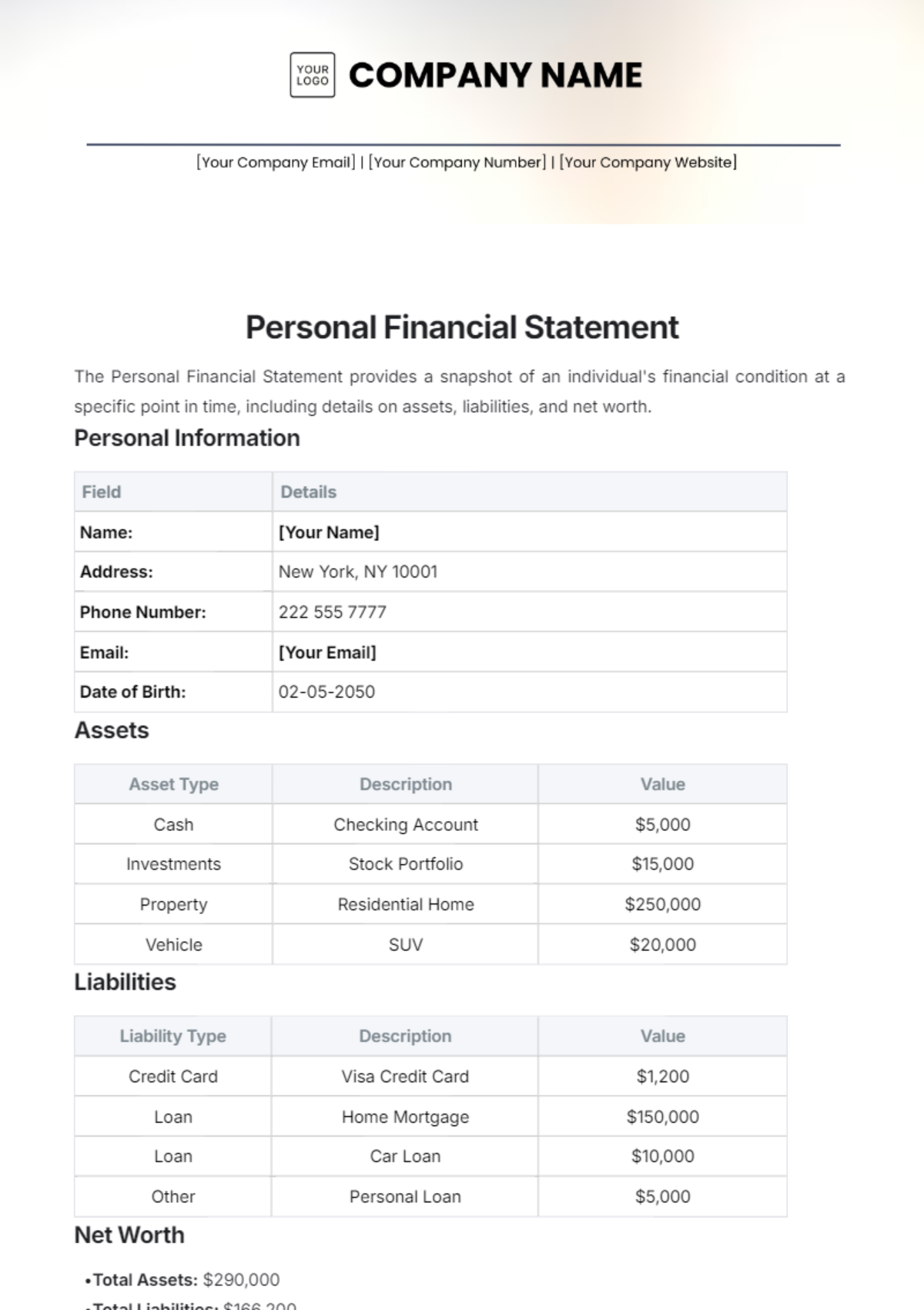

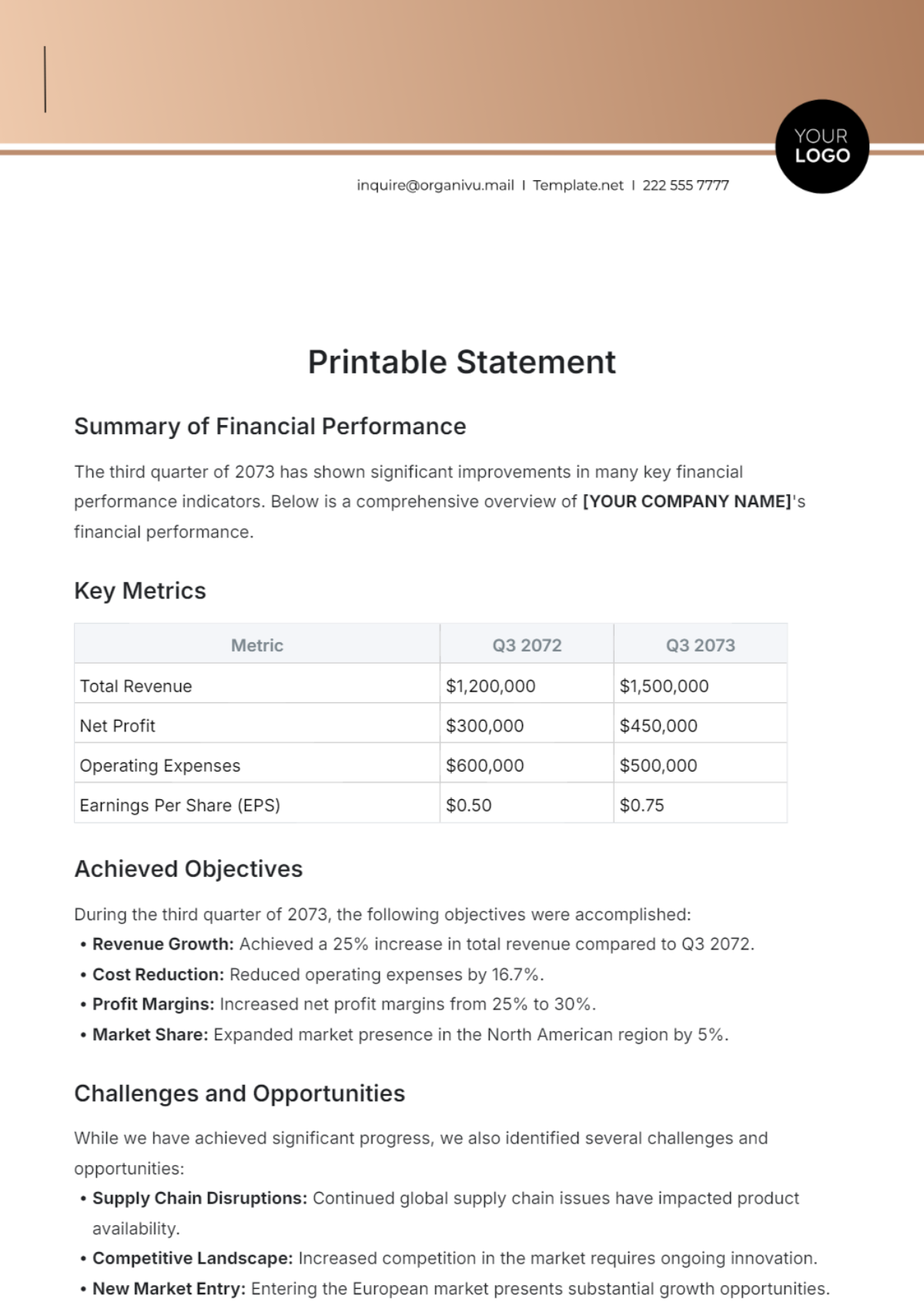

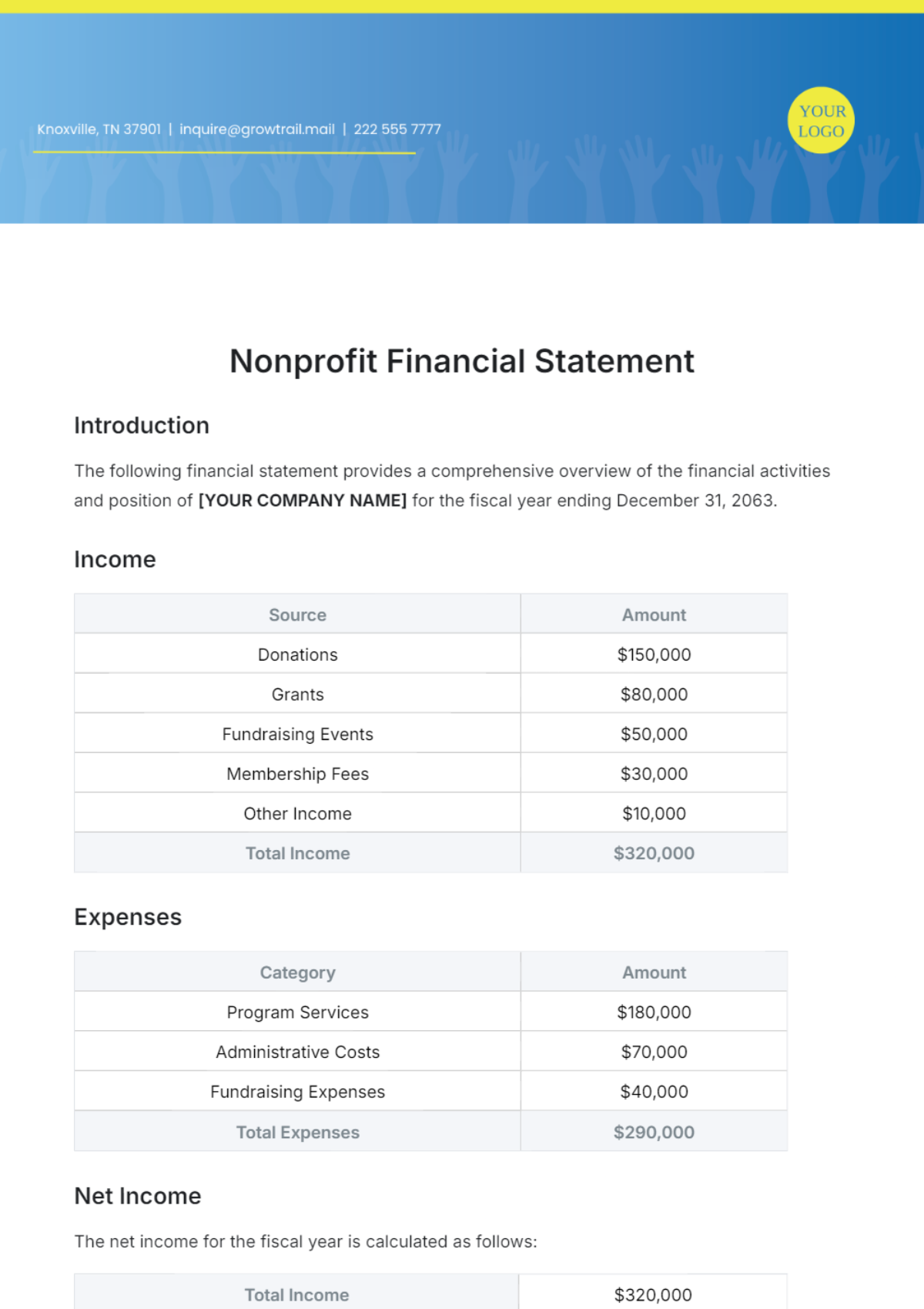

Earnings

Base Salary | $4,500.00 (Monthly) |

Performance Bonus | $1,000.00 |

Sales Commission | $800.00 |

Total Earnings | $6,300.00 |

Deductions

Federal Income Tax | $750.00 |

State Income Tax | $200.00 |

Social Security (FICA) | $318.60 |

Medicare | $74.25 |

Health Insurance Premium | $150.00 |

Retirement Contribution (401k) | $300.00 |

Total Deductions | $1,793.85 |

Allowances

Transportation Allowance | $200.00 |

Meal Allowance | $100.00 |

Total Allowances | $300.00 |

Benefits

Health Insurance Coverage

401(k) Retirement Plan

Overtime And Leave

Overtime Hours (if applicable) | 10 hours |

Paid Time Off (Vacation) | 2 days |

Net Pay for September 2050 | $4,806.15 |

Summary

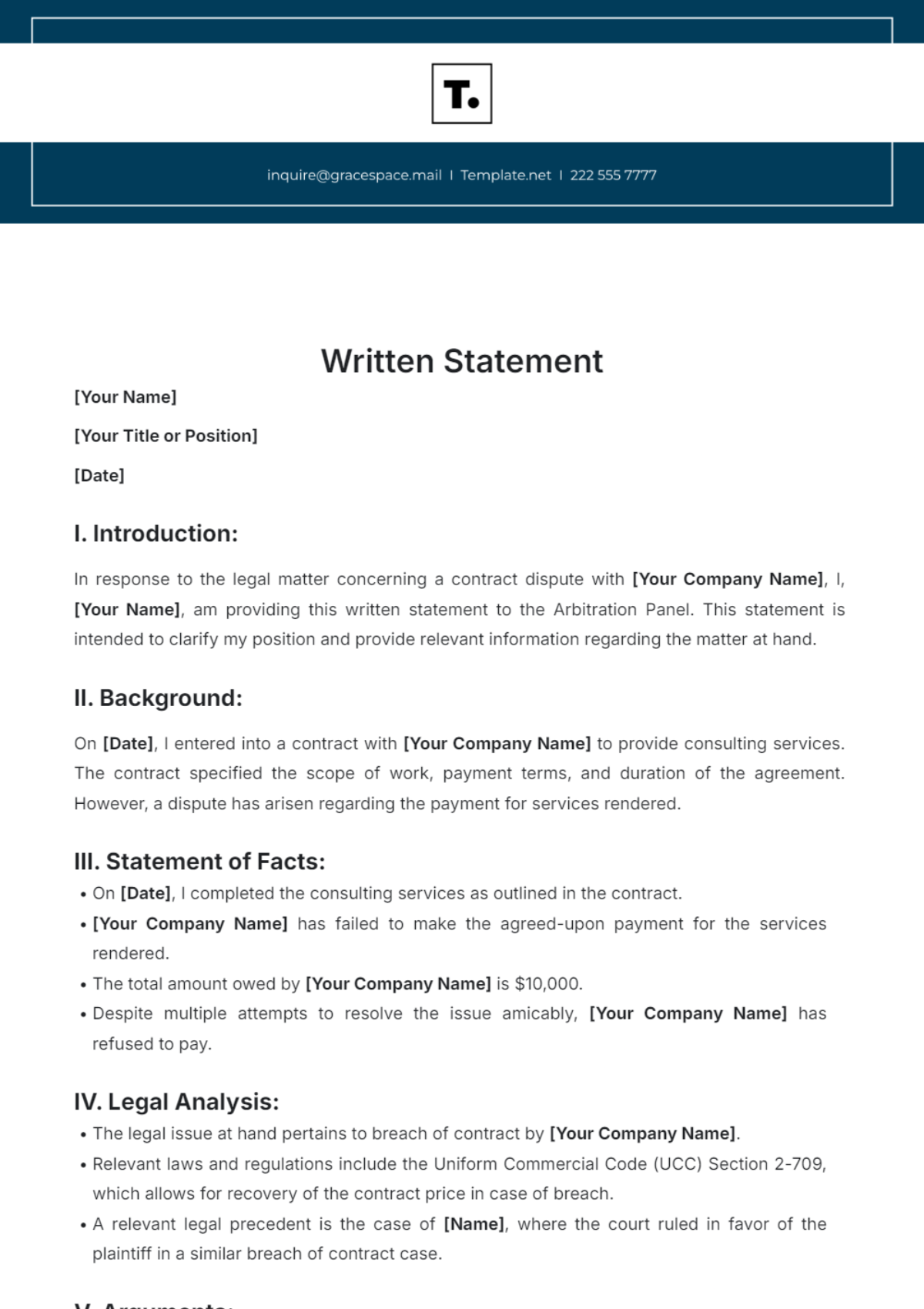

[Employee’s Name]'s total earnings for the month of September 2050 amounted to $6,300.00, including base salary, bonuses, and commissions. After deducting taxes, insurance premiums, and retirement contributions, the net pay for the period was $4,806.15. [Employee’s Name] also received allowances for transportation and meals, totaling $300.00. He worked 10 hours of overtime and took 2 days of paid vacation during this period.

Important Notes

Please review your benefits package for more details on health insurance and retirement plan benefits.

For any discrepancies or questions regarding your salary, please contact the HR department.