Integration Challenges

To: Board of Directors

From: [Your Name]

Date: [Date]

Subject: Strategic Rationale, Potential Synergies, and Risks Associated with Merger Proposal

The purpose of this memorandum is to present a comprehensive overview of the strategic rationale, potential synergies, and risks associated with the proposed merger between our company and [Competitor's Name]. This merger aims to expand our market share, enhance operational efficiencies, and drive long-term value for our stakeholders.

Strategic Rationale:

Market Expansion: The merger will expand our market reach and presence, leveraging our complementary strengths to reach a wider customer base and gain more market share.

Operational Efficiency: Consolidating operations can streamline processes, reduce redundancies, and achieve cost savings through economies of scale by optimizing supply chains, consolidating administrative functions, and rationalizing overlapping departments.

Product Diversification: The merger offers opportunities to diversify our product offerings, enhance our competitiveness, and better meet customer needs by integrating complementary products and services.

Potential Synergies:

Cost Synergies: The proposed strategy aims to reduce duplicate costs and streamline operations, thereby enhancing cost synergies across various functions such as procurement, marketing, and distribution.

Revenue Synergies: Through cross-selling opportunities and enhanced market reach, we expect to generate additional revenue streams and unlock untapped growth potential.

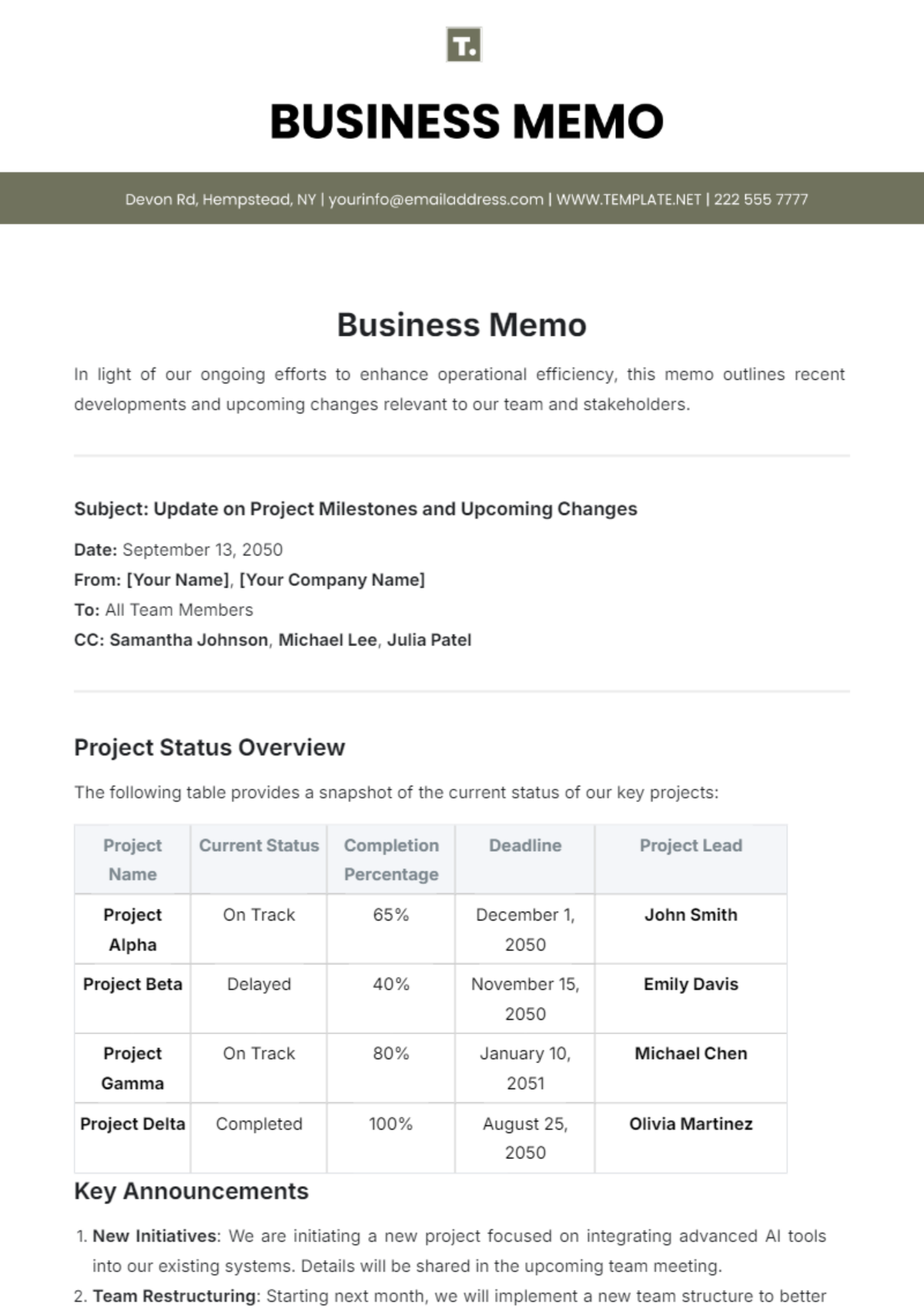

Operational Synergies: Consolidating facilities, integrating systems, and aligning processes will enhance operational efficiency, improve scalability, and facilitate faster decision-making.

Risks Associated with the Merger:

Integration Challenges: Merging two organizations with diverse cultures, processes, and systems can lead to operational disruptions, employee resistance, and potential talent loss.

Regulatory Hurdles: The merger may face regulatory scrutiny, antitrust concerns, and compliance requirements that could delay or impede the completion of the transaction.

Financial Risks: Fluctuations in market conditions, unforeseen expenses, and financing arrangements may impact the financial viability and profitability of the combined entity.

We suggest further analysis and due diligence to evaluate the merger's feasibility and potential impact, focusing on maximizing synergies and mitigating risks. Thank you for your attention to this matter.

Sincerely,

[Your Name]

[Your Designation]

[Your Company Name]