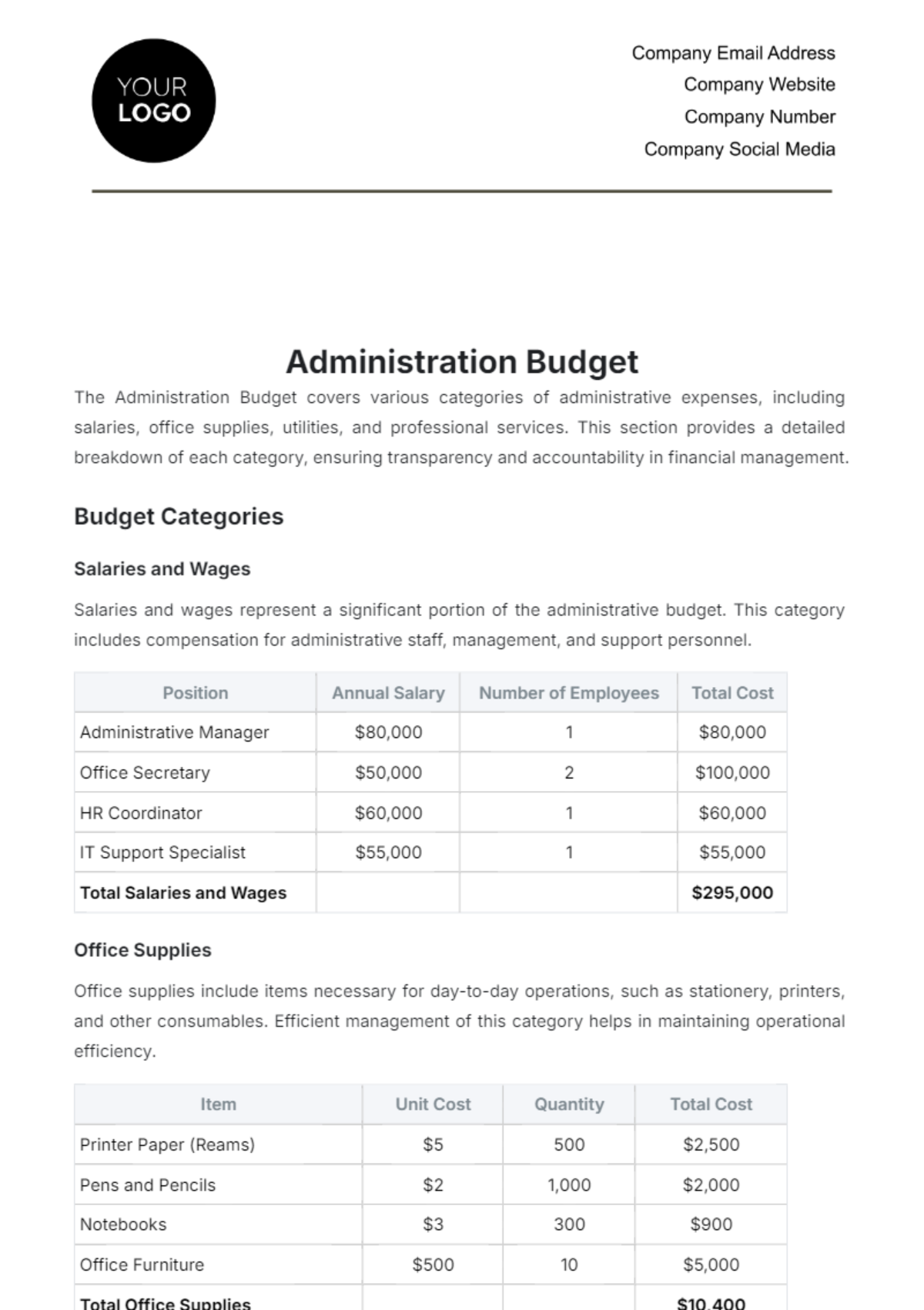

Free Administration Financial Planning Guide

Enhance your financial planning with Template.net's Administration Financial Planning Guide Template. Editable and customizable, this template empowers you to tailor your financial strategies seamlessly. Utilize our AI Editor Tool to effortlessly modify and adapt the guide to your organization's needs. Streamline your administration's financial management with ease.