Administration Cash Flow Statement

I. Introduction

This document provides a detailed breakdown of the cash inflows and outflows of our organization during the period [Period]. This cash flow statement is a critical financial tool that helps the stakeholders of [Your Company Name] understand how cash moves in and out of the company, providing insights into our liquidity, operational efficiency, and financial health.

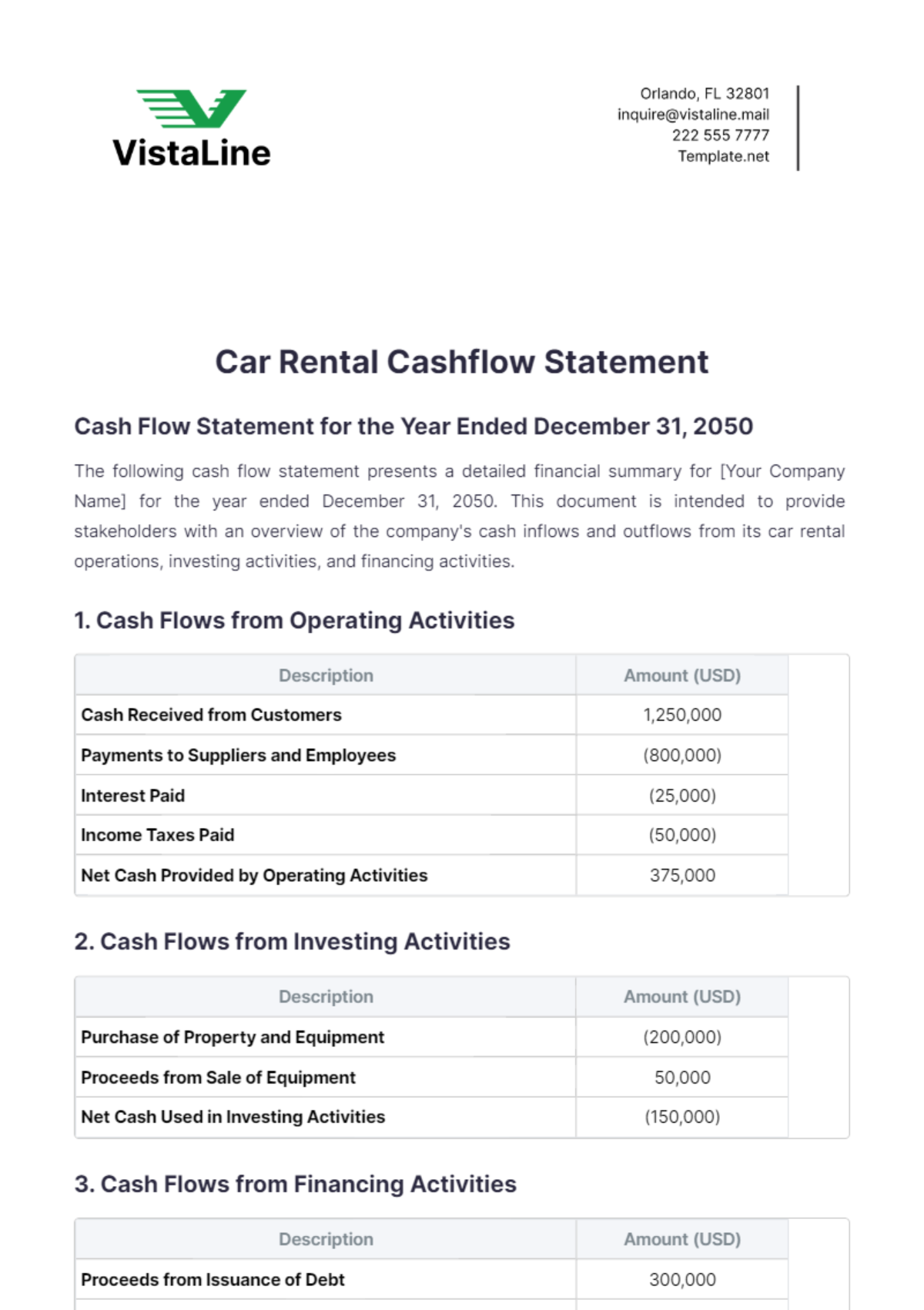

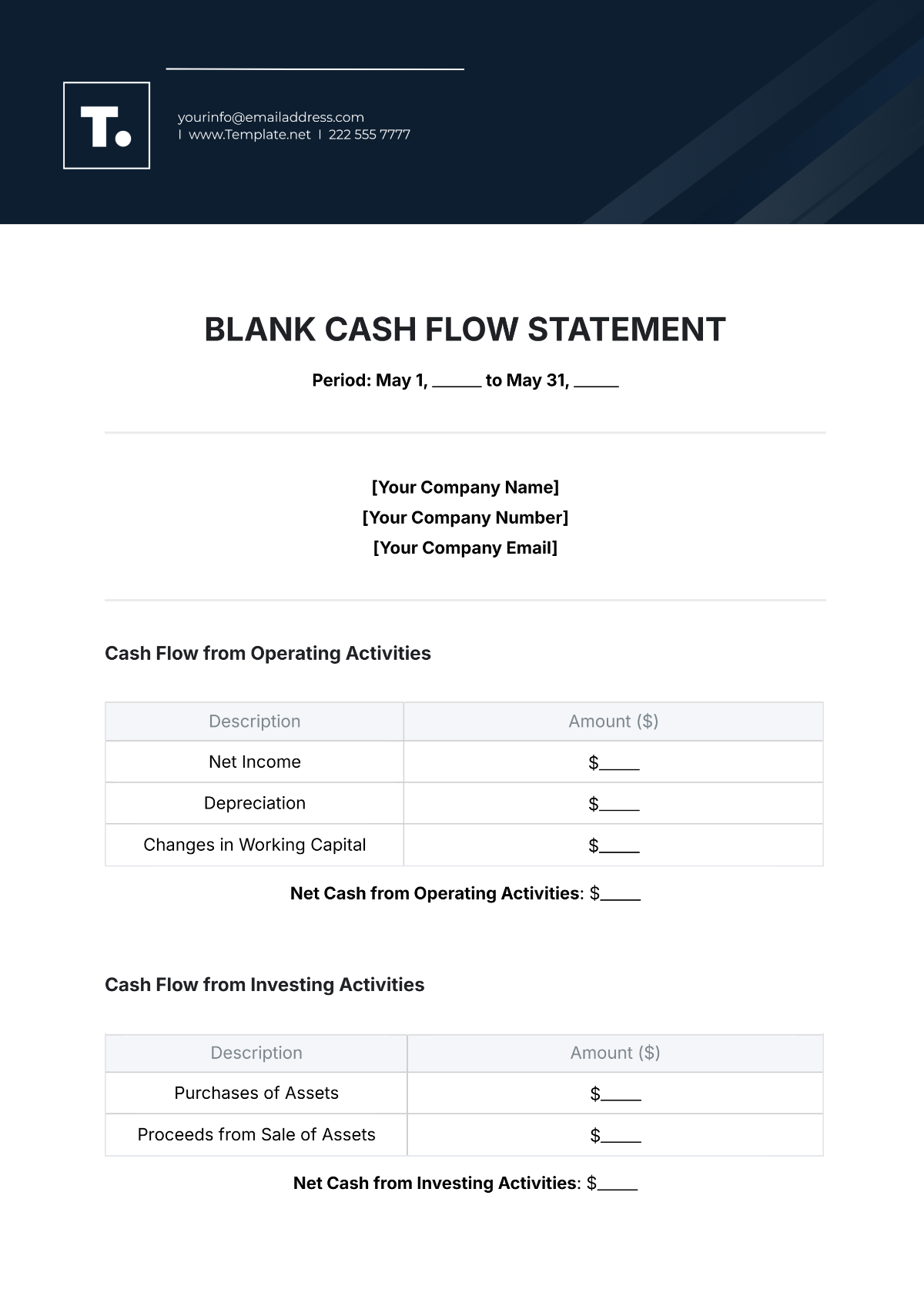

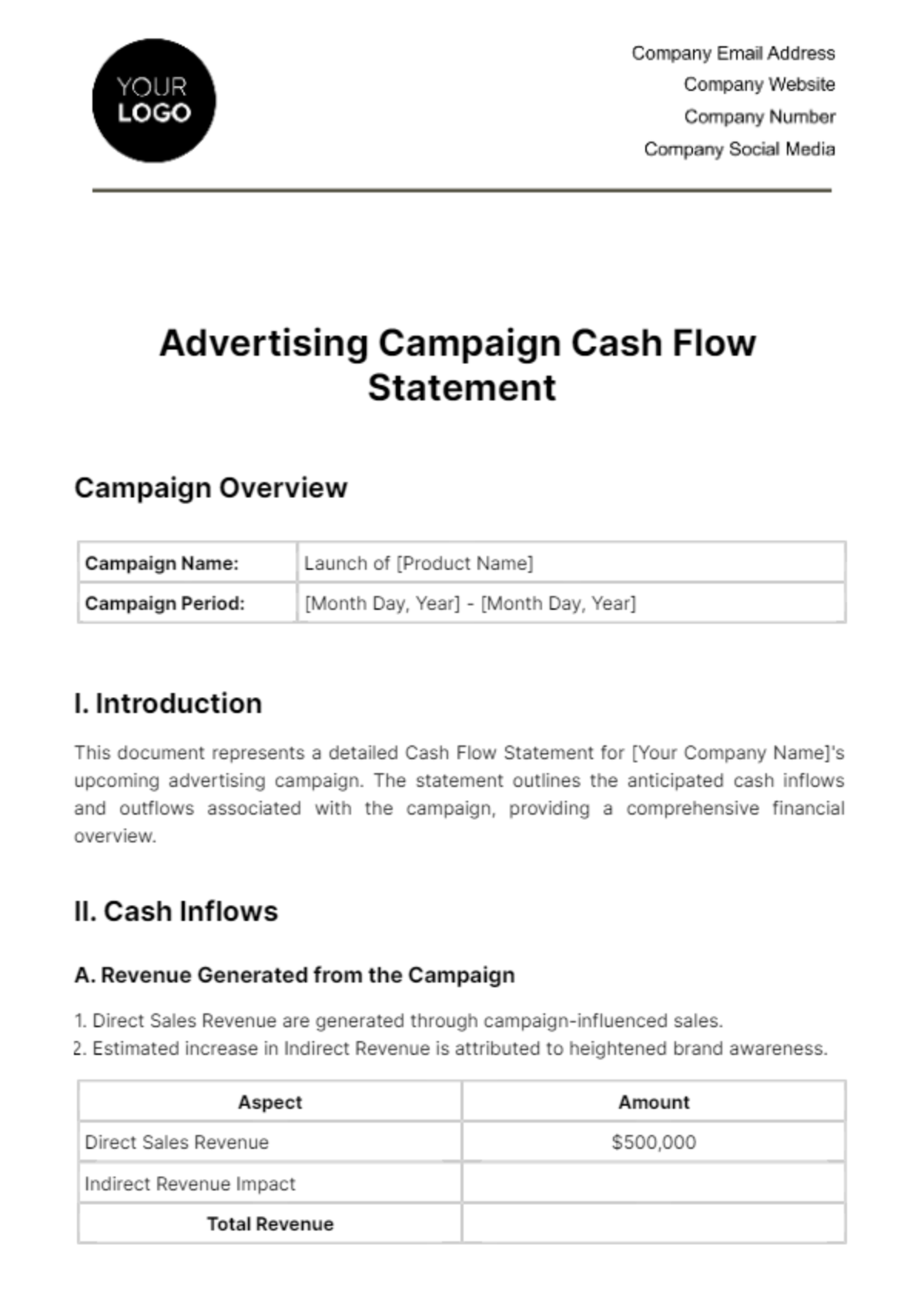

II. Operating Activities

This table shows the cash inflows and outflows originating from our day-to-day operations, showcasing the revenue generated and expenses incurred during the reporting period.

Items | Inflow (USD) | Outflow (USD) |

|---|---|---|

Cash received from customers | $500,000 | |

Payments to suppliers | $300,000 | |

Salaries and wages | $120,000 | |

Administrative expenses | $50,000 | |

Total | $500,000 | $470,000 |

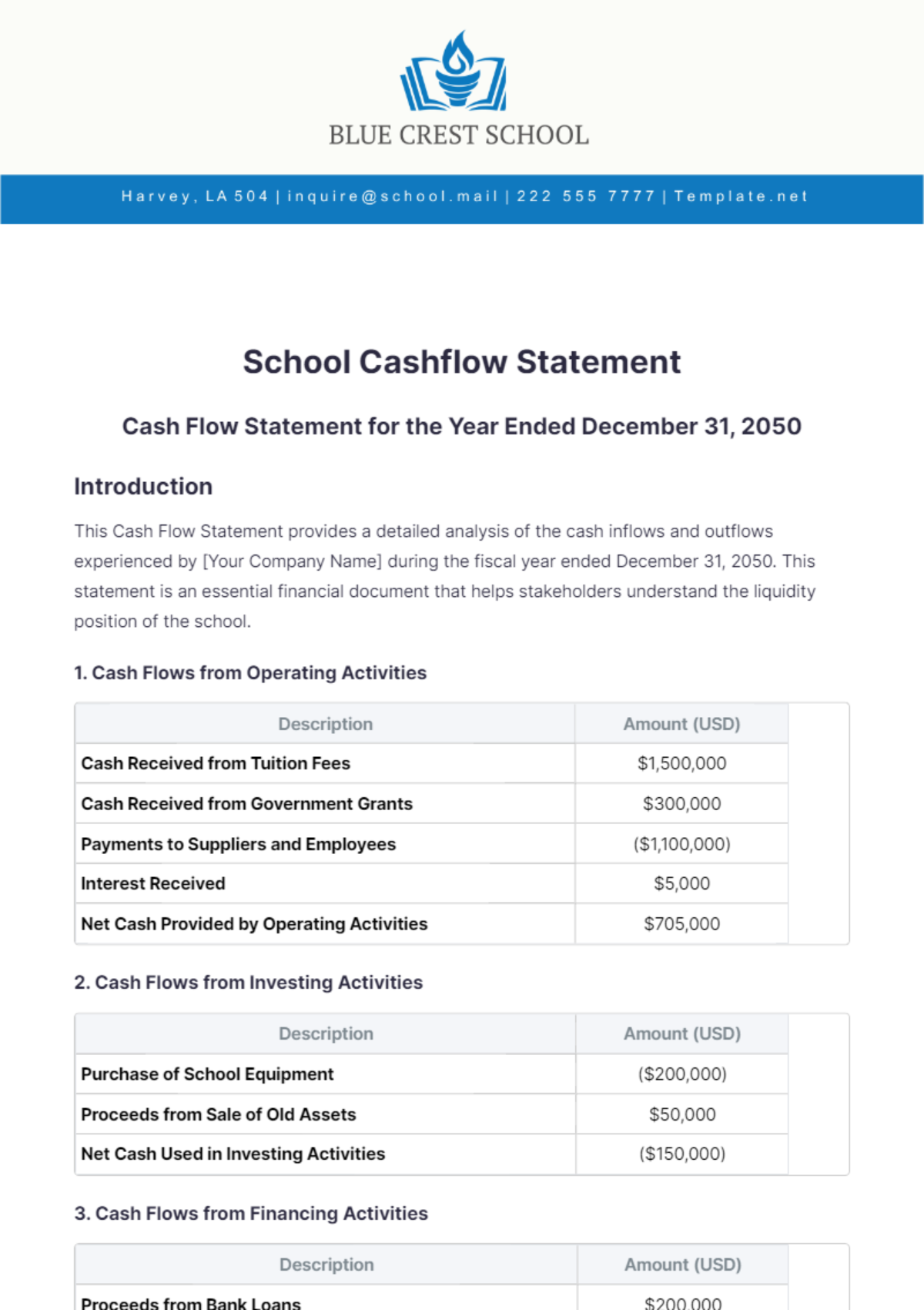

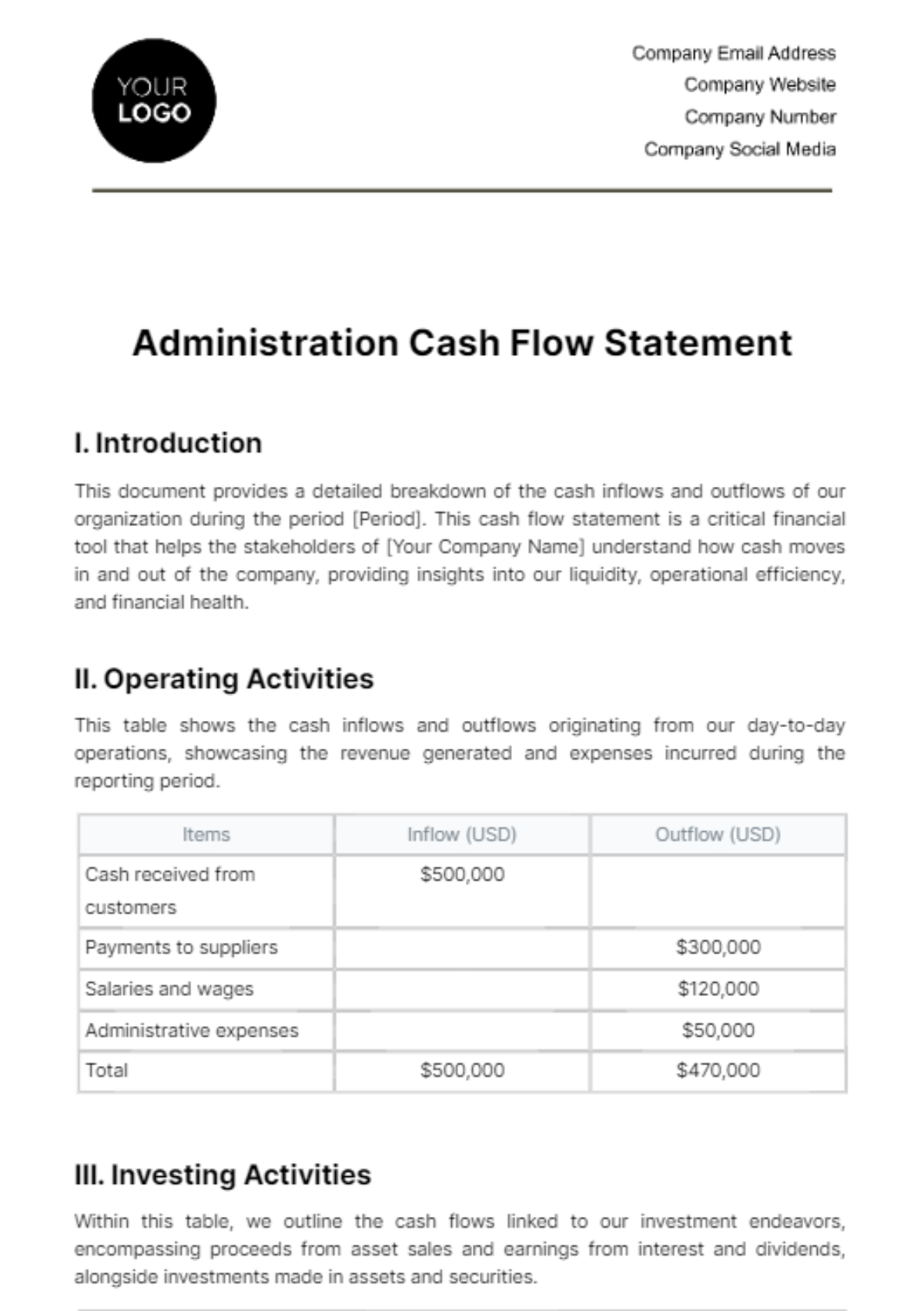

III. Investing Activities

Within this table, we outline the cash flows linked to our investment endeavors, encompassing proceeds from asset sales and earnings from interest and dividends, alongside investments made in assets and securities.

Items | Inflow (USD) | Outflow (USD) |

|---|---|---|

Sale of equipment | $50,000 | |

Purchase of new office furniture | $40,000 | |

Investment in new software | $30,000 | |

Total | $50,000 | $70,000 |

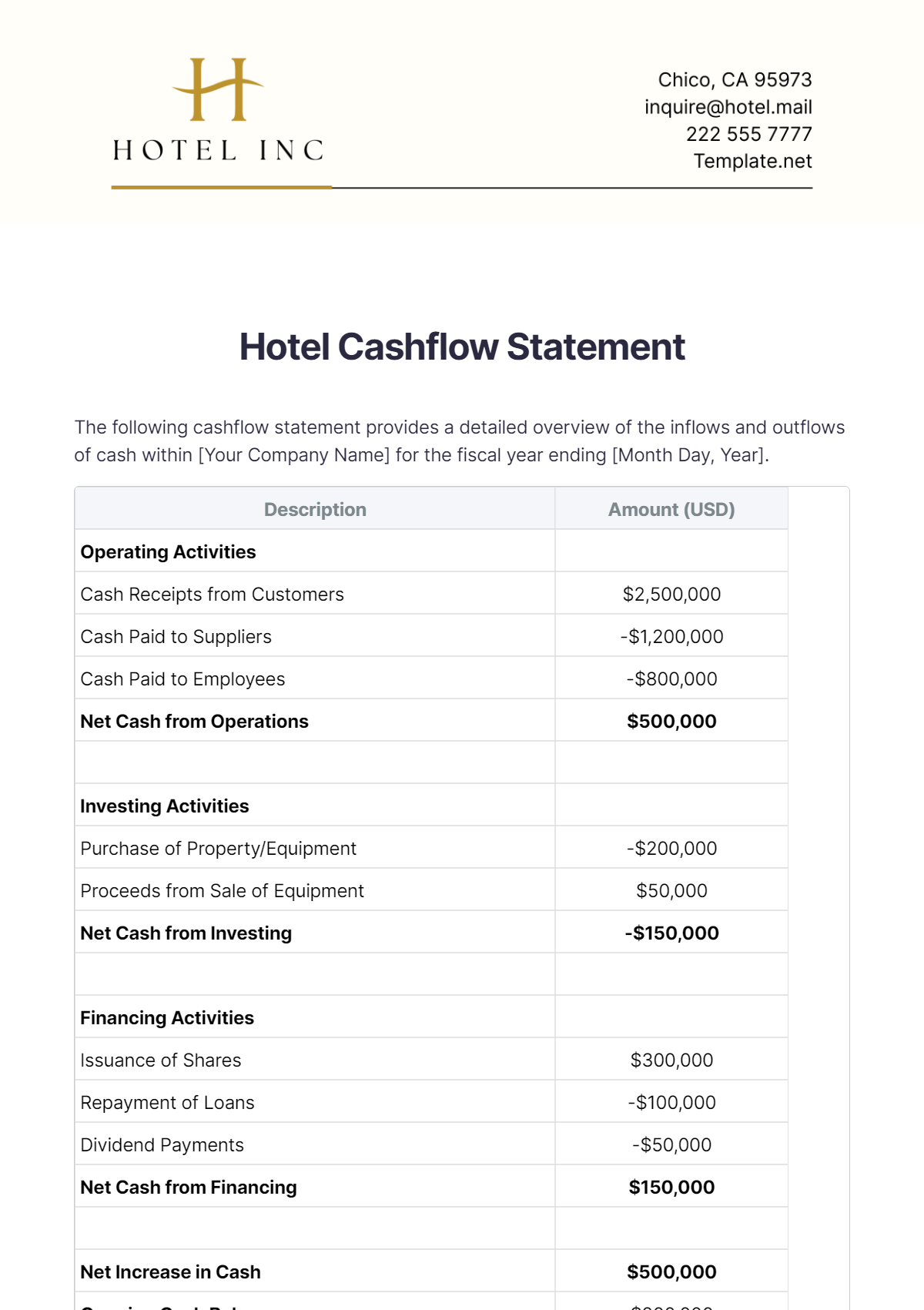

IV. Financing Activities

Presented here are the cash movements associated with our financing endeavors, spotlighting cash infusions from equity issuance and borrowings, as well as cash outflows for debt repayments and shareholder distributions.

Items | Inflow (USD) | Outflow (USD) |

|---|---|---|

Proceeds from new loan | $100,000 | |

Repayment of bank loan | $50,000 | |

Dividends paid to shareholders | $20,000 | |

Total | $100,000 | $70,000 |

V. Summary of Cash Flows

This table provides a consolidated view of the cash inflows and outflows from operating, investing, and financing activities, highlighting the overall cash position of the company during the specified period.

Activities | Inflow (USD) | Outflow (USD) |

|---|---|---|

Operating Activities | $500,000 | $470,000 |

Investing Activities | $50,000 | $70,000 |

Financing Activities | $100,000 | $70,000 |

Totals | $650,000 | $610,000 |

Net Increase/Decrease | $40,000 |

VI. Conclusion

[Your Company Name] maintained a balanced approach to managing cash flows, with significant inflows from customer receipts and financing activities offsetting outflows for operating and investing activities. This statement serves as a valuable tool for assessing our financial performance and guiding strategic decision-making to ensure continued success and sustainability.