Marketing Employee Reimbursement Guide for Activities

1. Introduction

Welcome to the [Your Company Name] Marketing Employee Reimbursement Guide for Activities. This guide is designed to assist our valued marketing professionals in navigating the process of expense reimbursement.

At [Your Company Name], we recognize that our marketing team plays a vital role in our success, and we want to ensure that you have the resources and support you need to carry out your responsibilities seamlessly. This guide will provide you with clear instructions on eligible expenses, the submission process, documentation requirements, and more.

2. Eligible Expenses

At [Your Company Name], we understand that marketing professionals often incur various expenses while executing their roles. To streamline the reimbursement process and ensure transparency, we have outlined the categories of expenses that are eligible for reimbursement

Eligible expenses include, but are not limited to:

|

|

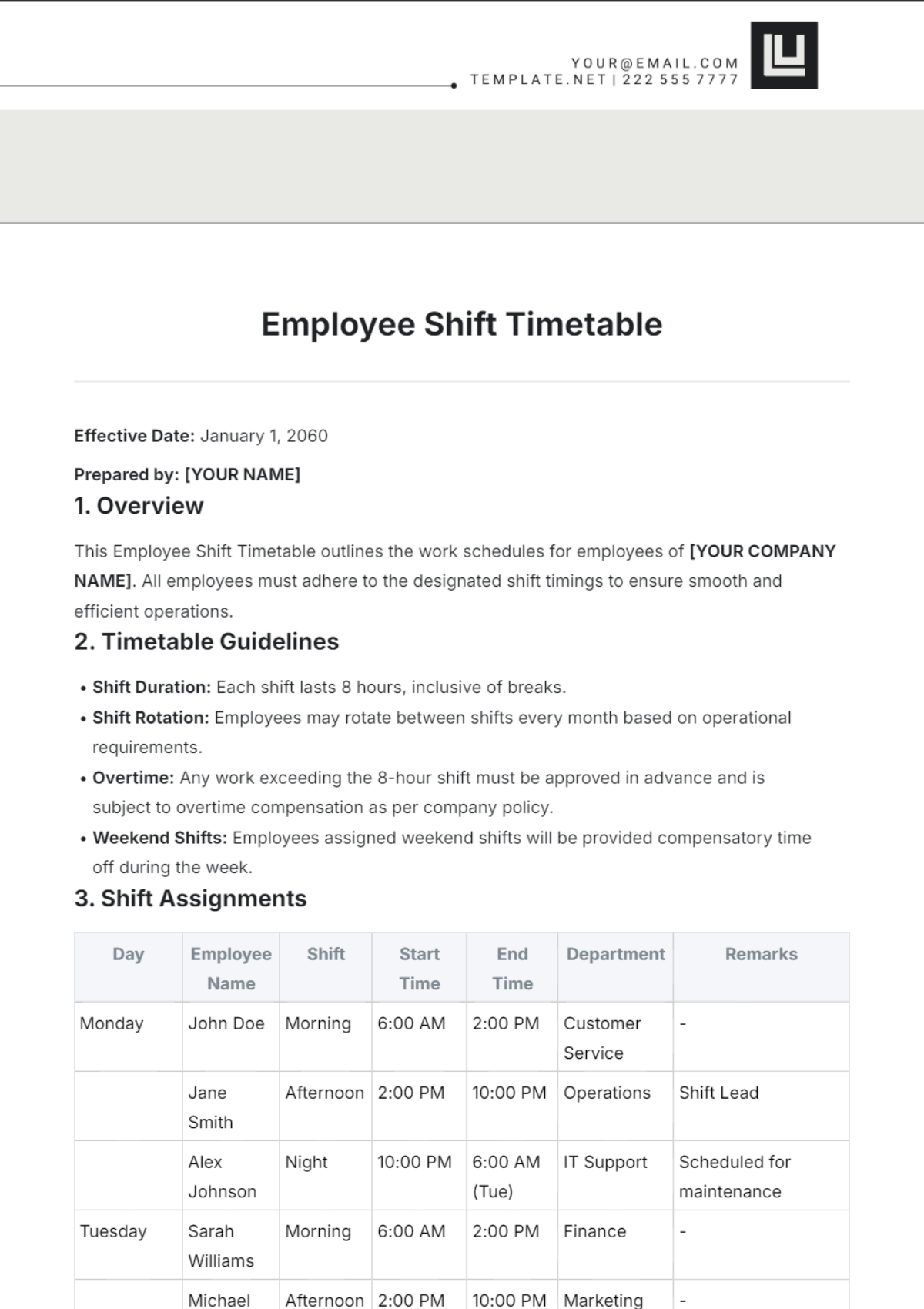

3. Expense Submission Process

Efficiently submitting your expenses is crucial to ensure timely reimbursement. Our 6-step Expense Submission Process simplifies this procedure, guaranteeing a hassle-free experience. Below, we provide an overview of these steps.

4. Approval Process

The Approval Process at [Your Company Name] ensures that expenses are reviewed and authorized in accordance with our established guidelines. It's essential to understand this process to facilitate timely reimbursement. Below, we outline the approval process, which guarantees accountability and compliance:

5. Expense Categories

To maintain clarity and accuracy in expense reporting, expenses at [Your Company Name] are categorized into distinct groups. Familiarizing yourself with these categories will help you allocate expenses correctly and ensure adherence to our reimbursement policies.

Travel Expenses: This category encompasses costs incurred during business-related travel, including airfare, accommodation, ground transportation, and meals while away from your primary work location.

Entertainment Expenses: Expenses associated with client or prospect entertainment, such as business meals, event tickets, and hospitality expenses, fall under this category.

Advertising and Promotion: Expenses for marketing campaigns, promotional materials, online advertising, and similar activities aimed at boosting our brand and sales.

Professional Development: Fees and expenses related to marketing conferences, workshops, seminars, and training programs designed to enhance your marketing skills and knowledge.

Technology and Tools: Costs linked to marketing software, tools, subscriptions, or devices essential for your job.

Office Supplies: Expenses related to marketing-specific office supplies, including stationery, business cards, and promotional collateral.

Event Participation: Fees and expenses associated with marketing events, trade shows, or exhibitions where your participation contributes to our business objectives.

Mileage and Transportation: Reimbursement for using personal vehicles for business-related travel, calculated based on the IRS-approved mileage rate.

Miscellaneous Expenses: Any other justifiable expenses directly related to your marketing responsibilities.

Assign your expenses to the appropriate category in your expense report to expedite the approval process and maintain accurate records.

6. Documentation Requirements

Accurate and complete documentation is vital to ensure the smooth processing of expense reimbursements at [Your Company Name]. Properly maintained records help substantiate your expenses. Below are the essential documentation requirements:

|

|

7. Reimbursement Policies

At [Your Company Name], we maintain clear and fair reimbursement policies to ensure consistency. Familiarize yourself with these policies to facilitate the reimbursement process:

Maximum Limits: Expenses must not exceed predefined maximum limits within each expense category. Refer to the expense categories section for specific limits.

Receipt Submission: Receipts and supporting documents must be submitted within 30 days of incurring the expense. Late submissions may result in delayed reimbursement or denial.

Currency Conversion: For expenses incurred in foreign currencies, reimbursement will be based on the exchange rate in effect at the time of the expense. Ensure currency conversion records are provided.

Per Diem Rates: When applicable, adhere to company per diem rates for meals and incidentals during travel. Rates are consistent with IRS guidelines.

Pre-Approval: Seek pre-approval for expenses that fall outside standard guidelines or require special consideration.

Compliance: Expenses must comply with all relevant laws, regulations, and company policies.

Taxation: Be aware that reimbursements may be subject to taxation in compliance with IRS regulations. Consult your tax advisor for guidance.

Expense Dispute: If you have concerns about an expense decision, contact [Your Name] at [Your Company Email] to initiate a resolution process.

By adhering to these reimbursement policies, you help us maintain financial transparency and ensure equitable treatment for all marketing professionals.

8. Expense Reporting Tools

To streamline the expense reporting process and enhance efficiency, [Your Company Name] provides access to user-friendly expense reporting tools. These tools are designed to simplify expense tracking, submission, and approval. Here's how to access and use these resources:

Expense Report Template: Download our standardized expense report template from [Your Company Website]. This template will guide you through the necessary fields and categories for reporting expenses accurately.

Expense Management Software: [Your Company Name] employs user-friendly expense management software accessible via [Your Company Website]. This software allows you to create, submit, and track expense reports online, ensuring a seamless experience.

Mobile Apps: We offer mobile apps for expense reporting, allowing you to capture receipts and submit expenses on the go. Download the app from your device's app store and log in using your company credentials.

Training Resources: Comprehensive training resources and tutorials are available on [Your Company Website] to help you navigate our expense reporting tools effectively.

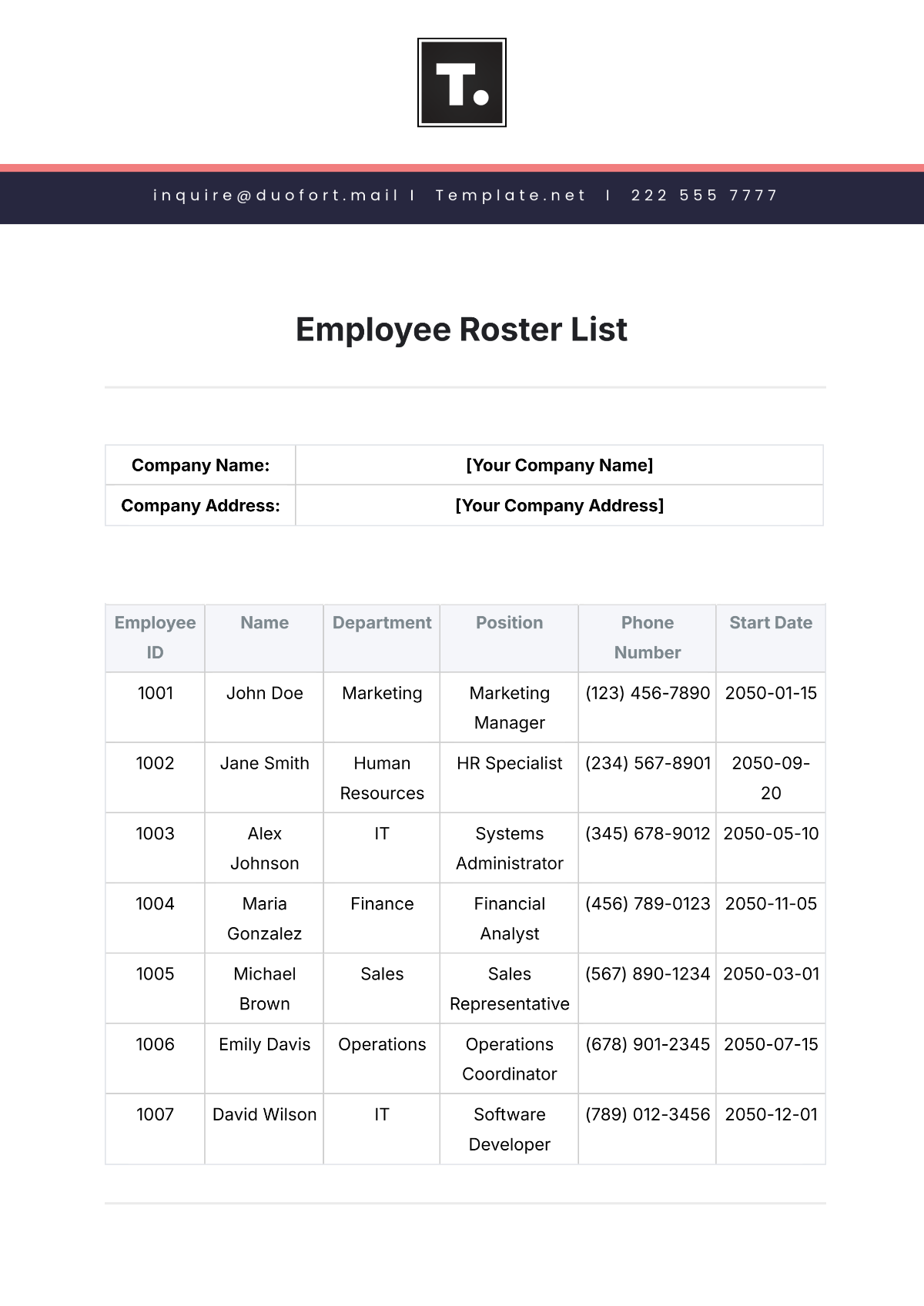

9. Timeline for Reimbursement

We understand the importance of timely reimbursement for our marketing professionals. Our commitment is to process reimbursements promptly and efficiently. Here is an overview of the typical timeline for reimbursement:

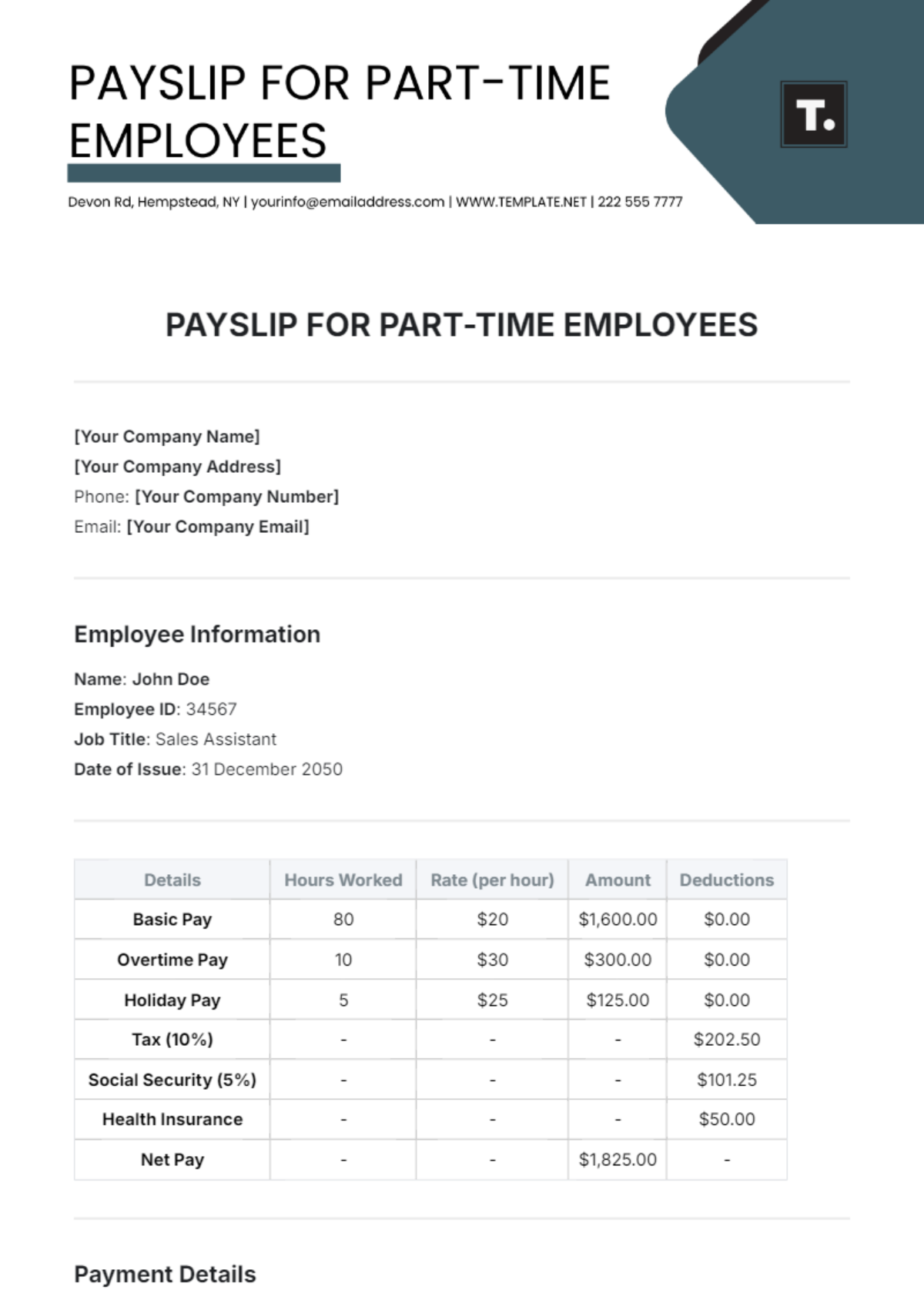

Step | Duration |

Expense Submission | 2-3 business days |

Manager Approval | 5 business days |

Department Head Approval | 5-7 business days |

Finance Review | 5-7 business days |

Payment Processing | 10-14 business days (post-approval) |

10. Contact Information

For any questions, concerns, or assistance related to the reimbursement process or expense reporting, please do not hesitate to reach out to us. We are here to support you in every way possible.

[Your Name]: [Your Company Email] Position: Operations Manager Contact Hours: Monday - Friday, 8:00 AM - 5:00 PM |

|---|

Finance Department Email: finance@email.com Phone: (555) - 123 - 7890 |

Human Resources Department Email: hr@email.com Phone: (555) - 567 - 7890 |

IT Support Email: it@emial.com Phone: (555) - 789 - 7890 |

Company Address: [Your Company Address] Company Number: [Your Company Number] Company Website: [Your Company Website] Social Media: [Your Company Social Media] |

Please feel free to contact us at your convenience, and we will be glad to assist you with any inquiries or issues you may have regarding expense reimbursement or any other aspect of your role at [Your Company Name].

We understand that efficient expense reimbursement is crucial to your seamless operations, and we have designed this guide to provide you with the tools and information you need to navigate this process effectively.

As you embark on your journey with us, remember that our support extends beyond reimbursement. We are here to help you succeed in your marketing role, so never hesitate to reach out with questions or concerns. Your contributions are vital to our success, and we look forward to a productive and mutually rewarding partnership. Thank you for choosing [Your Company Name] as your professional home.