Memorandum

To: All Department Heads

From: [Your Name], Finance Manager

Date: January 20, 2055

Subject: Insights into Organization's Cash Flow Patterns

Dear Team,

I hope this memo finds you well. As part of our ongoing efforts to enhance financial transparency and understanding within the organization, I am pleased to provide insights into our cash flow patterns, detailing inflows and outflows of funds from operating, investing, and financing activities.

Overview of Cash Flow Patterns:

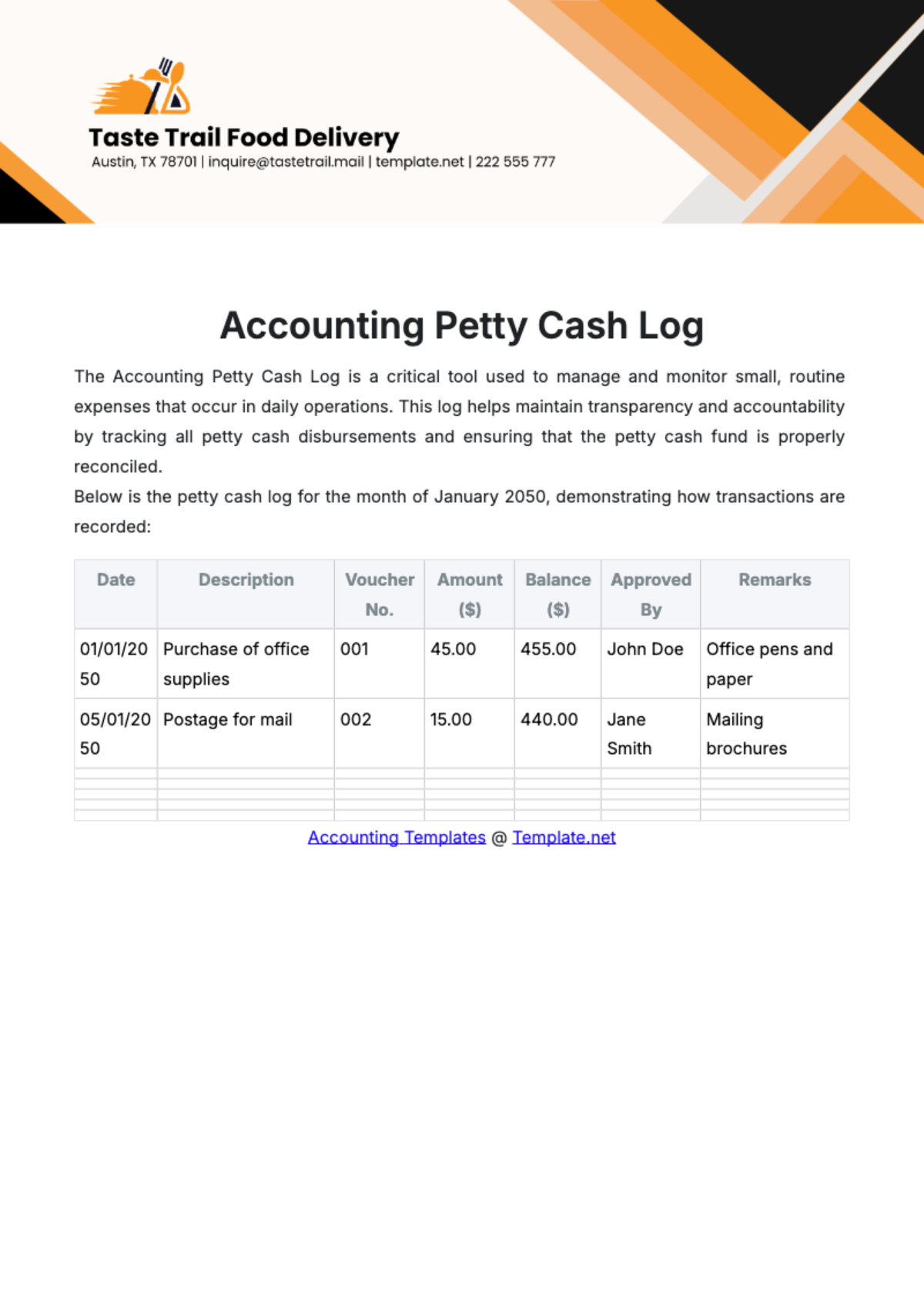

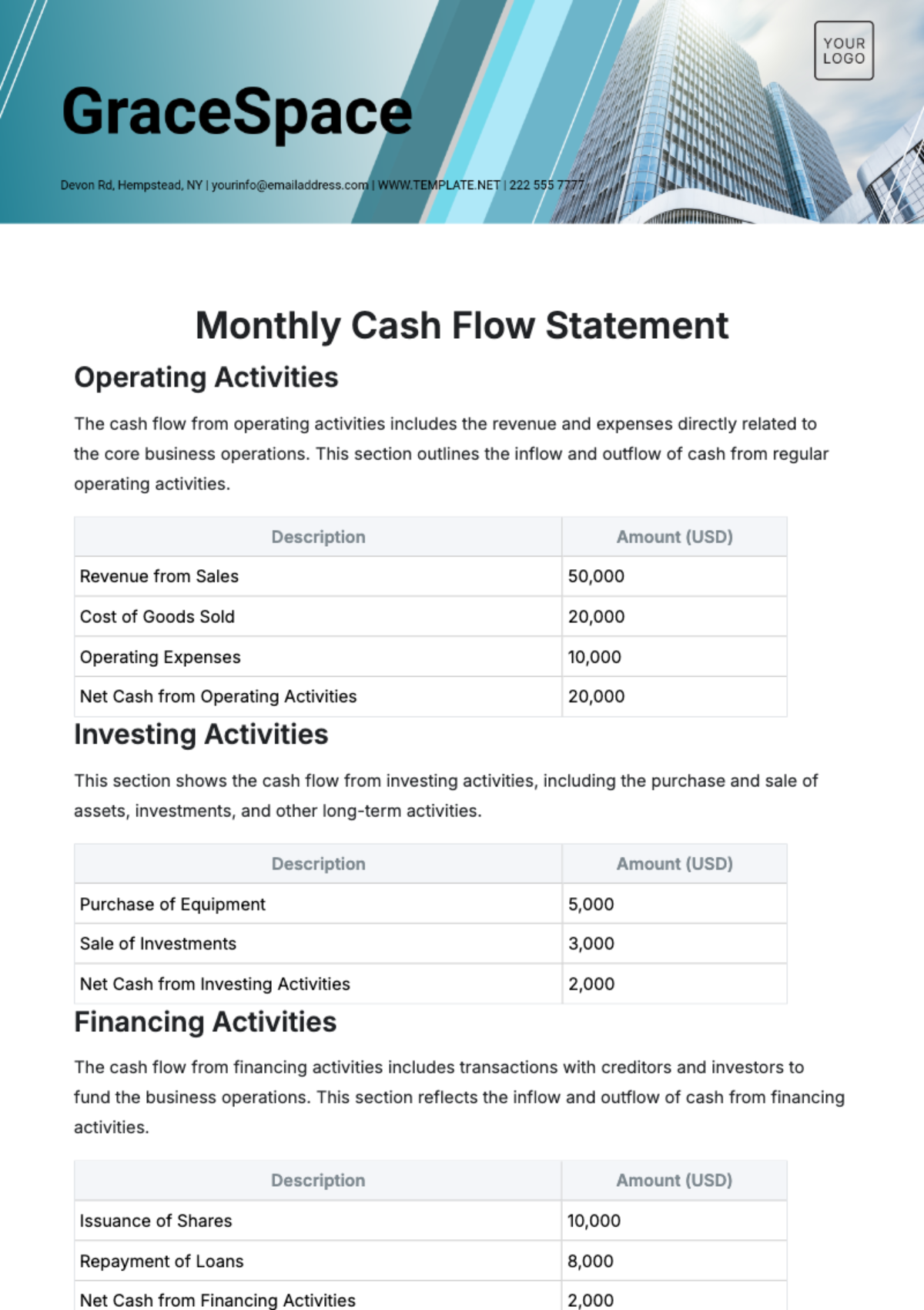

Operating Activities:

Inflows: Primarily consist of revenue generated from the sale of goods or services.

Outflows: Include expenses related to day-to-day operations such as salaries, utilities, and raw materials.

Investing Activities:

Inflows: Typically stem from proceeds of asset sales or returns on investments.

Outflows: Involve investments in long-term assets such as property, equipment, or securities.

Financing Activities:

Inflows: Derived from sources such as loans, equity financing, or issuance of bonds.

Outflows: Include repayment of debt, dividends to shareholders, or share repurchases.

Key Insights:

Our operating cash flows have remained steady, reflecting consistent revenue streams and diligent cost management practices.

Investing activities have primarily focused on strategic acquisitions and capital expenditures to support growth initiatives and enhance operational capabilities.

Financing activities have been directed towards securing favorable financing terms and optimizing our capital structure to support long-term sustainability and growth.

Next Steps:

We encourage department heads to review their respective budgets and expenses in alignment with the organization's cash flow objectives.

Collaborative efforts to optimize cash flow management will be instrumental in ensuring financial stability and resilience amidst evolving market dynamics.

Conclusion:

Understanding our cash flow patterns is critical for informed decision-making and strategic planning. By leveraging insights from our cash flow analysis, we can better allocate resources, mitigate risks, and capitalize on opportunities to drive sustainable growth and success.

Should you have any questions or require further clarification, please feel free to reach out to [Your Company Email].

Thank you for your attention and cooperation.

Best regards,

[Your Name]

Finance Manager

[Your Company Name]