FINANCIAL STATEMENT ANALYSIS BRIEF

Prepared by : [YOUR NAME]

Executive Summary

In this executive summary, we provide a comprehensive overview of our company's financial health and performance, focusing on the critical financial indicators and trends identified through an in-depth analysis of our financial statements for the recent fiscal period. We aim to offer stakeholders a clear, concise understanding of our financial status, underpinning our strategic decisions and future outlook.

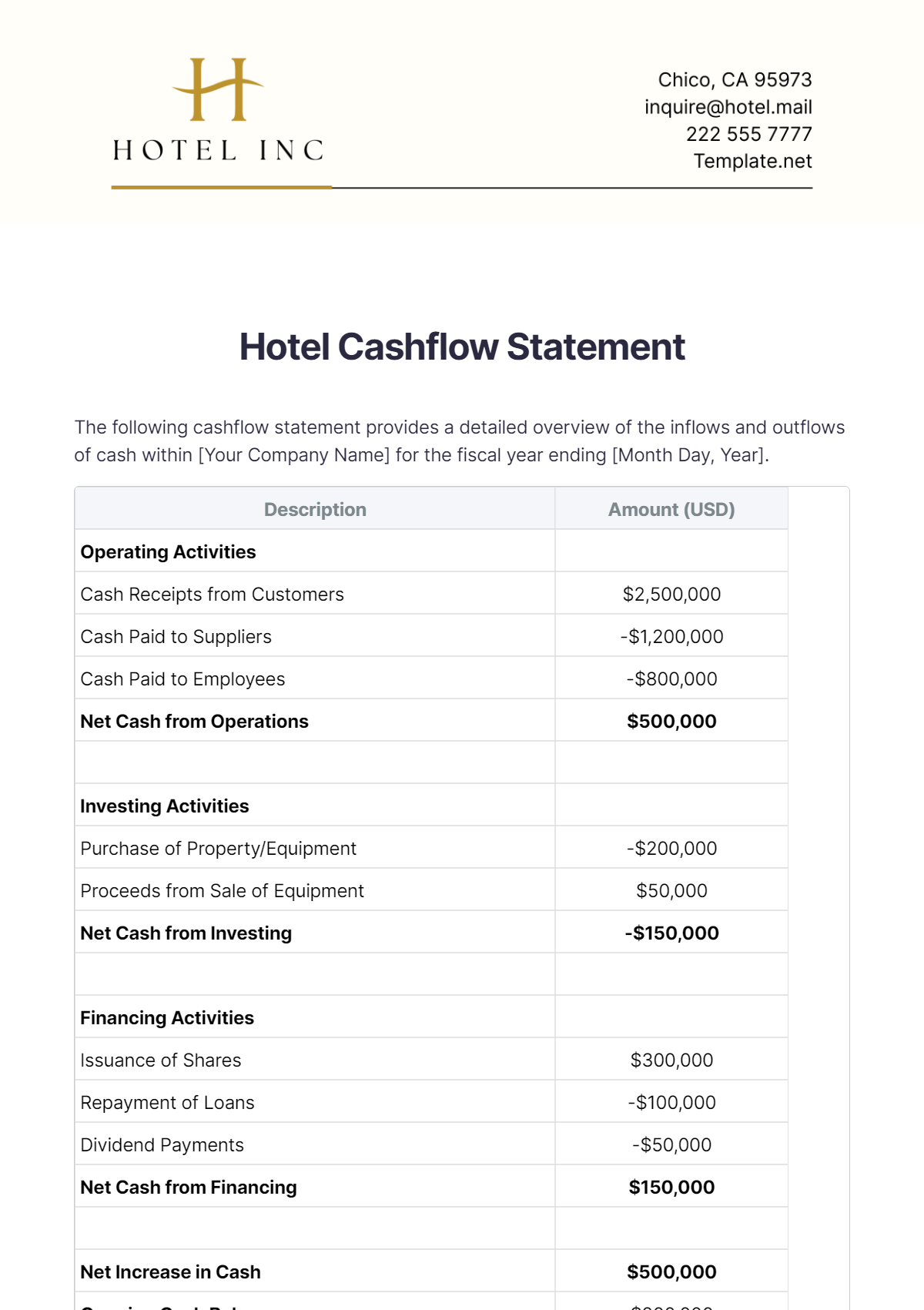

Income Statement Analysis

Our detailed review of the income statement for the fiscal years 2050 and 2051 sheds light on the financial evolution of our company, emphasizing revenues, cost of sales, gross margin, operating expenses, EBIT, net income, and EPS. This analysis not only highlights significant trends but also offers a comparative perspective to better understand our financial dynamics.

Elements | FY 2050 | FY 2051 | Change (%) |

|---|---|---|---|

Revenue | $100,000 | $120,000 | 20% |

Cost of Sales | $60,000 | $70,000 | 16.67% |

Gross Margin | $40,000 | $50,000 | 25% |

Operating Expenses | $20,000 | $22,000 | 10% |

Earnings Before Interest and Taxes (EBIT) | $20,000 | $28,000 | 40% |

Net Income | $15,000 | $21,000 | 40% |

Earnings Per Share (EPS) | $1.50 | $2.10 | 40% |

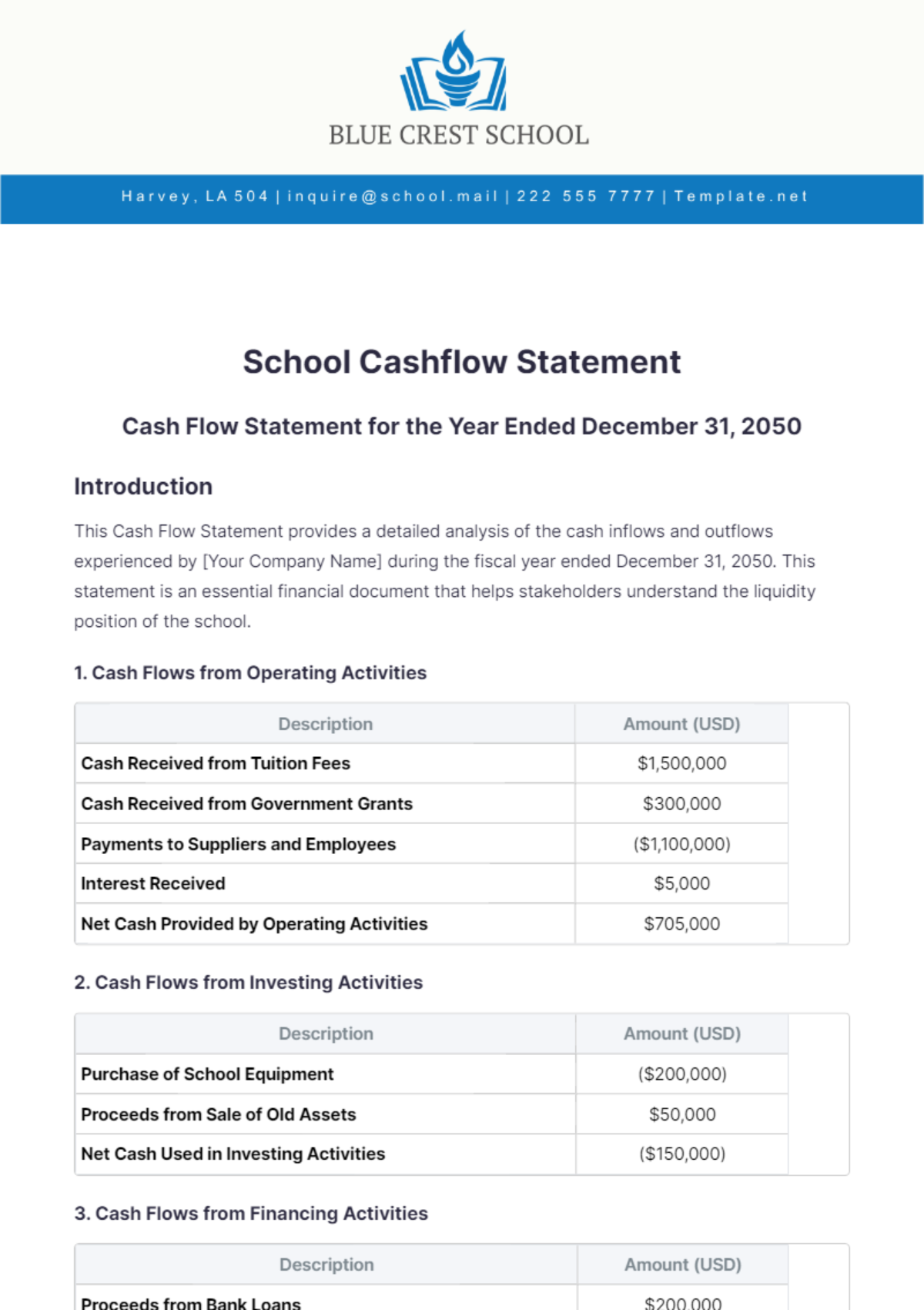

Balance Sheet Analysis

Our analysis of the balance sheet for fiscal years 2050 and 2051 provides an in-depth look at the company's financial position, focusing on total assets, liabilities, and equity. Through this analysis, we assess our liquidity, leverage, efficiency in utilizing assets, and overall capital structure.

Elements | FY 2050 | FY 2051 | Change (%) |

|---|---|---|---|

Total Assets | $150,000 | $180,000 | 20% |

Total Liabilities | $60,000 | $70,000 | 16.67% |

Total Equity | $90,000 | $110,000 | 22.22% |

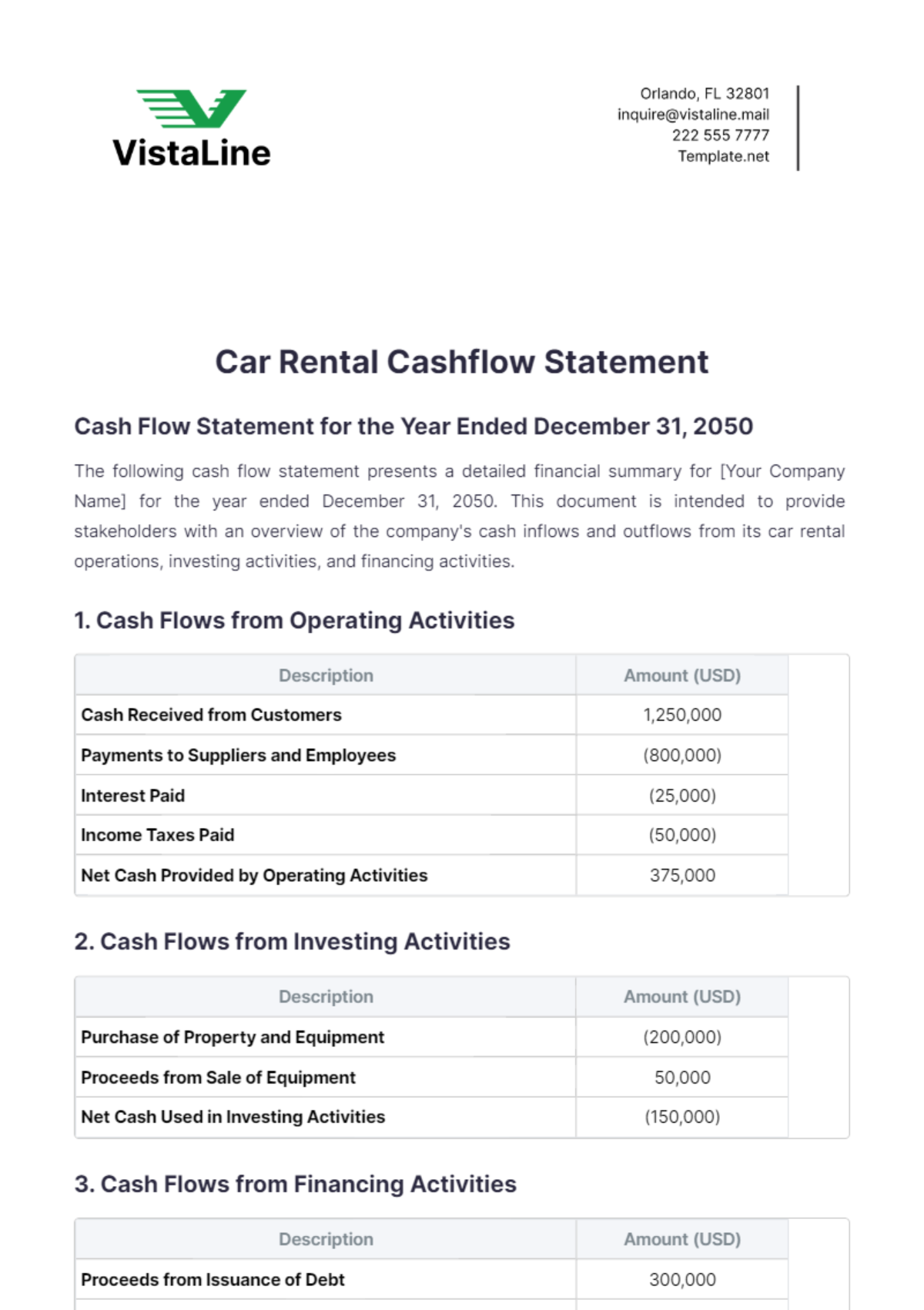

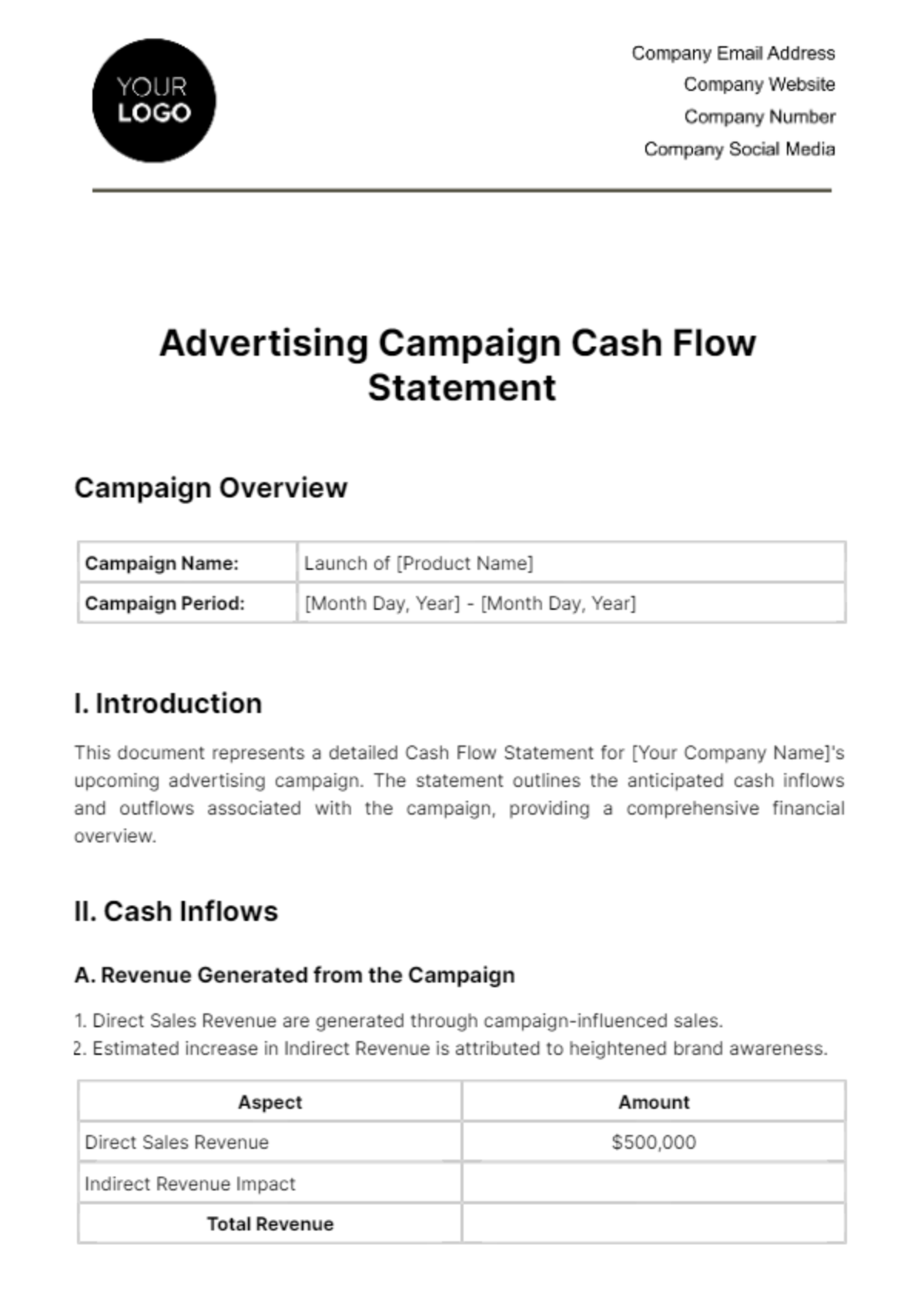

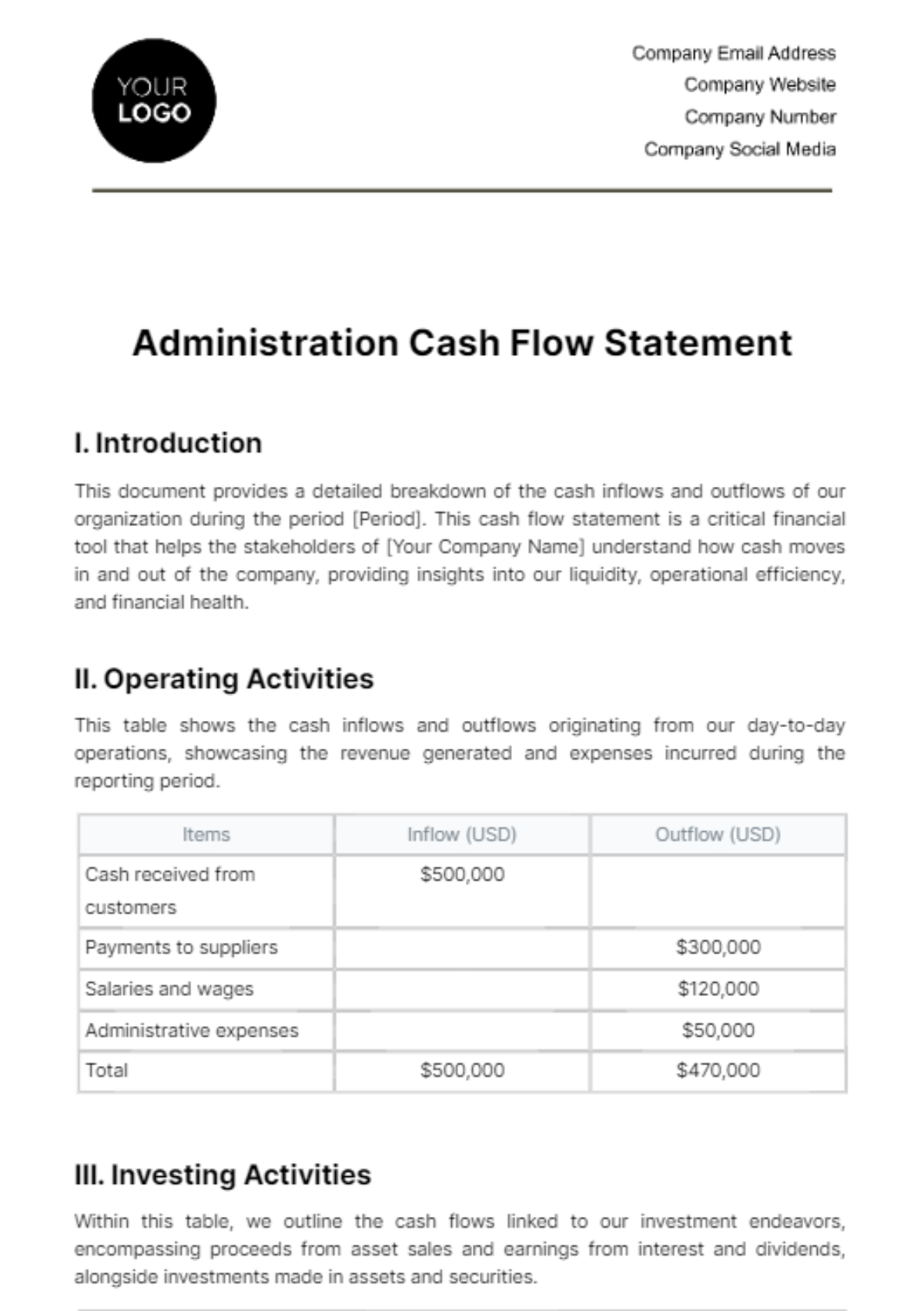

Cash Flow Statement Analysis

Our analysis of the cash flows for the fiscal years 2050 and 2051 dives into the dynamics of cash associated with operating, investing, and financing activities. Understanding these cash flow patterns is essential for assessing the company's capability to generate funds, allocate capital for growth, manage obligations, and uphold overall financial stability.

Activities | FY 2050 | FY 2051 | Change (%) |

|---|---|---|---|

Net Cash from Operating Activities | $25,000 | $35,000 | 40% |

Net Cash Used in Investing Activities | ($15,000) | ($20,000) | 33.33% |

Net Cash from Financing Activities | $10,000 | $5,000 | (50%) |

Net Increase in Cash | $20,000 | $20,000 | 0% |

Operating Activities: The increase in net cash from operating activities, from $25,000 in FY 2050 to $35,000 in FY 2051 (40%), highlights enhanced profitability and more effective management of working capital, contributing positively to our liquidity.

Investing Activities: The cash outflow for investing activities rose by 33.33%, from ($15,000) in FY 2050 to ($20,000) in FY 2051. This increase is indicative of our commitment to fuelling long-term growth through strategic asset acquisitions and investments, essential for future revenue and profit expansion.

Financing Activities: A noticeable shift in net cash from financing activities, decreasing by 50% from $10,000 in FY 2050 to $5,000 in FY 2051, reflects our strategy towards reducing dependency on borrowing and improving our debt position, signaling a move towards financial sustainability.

Overall Cash Position: The net increase in cash remained stable at $20,000 across both years, demonstrating adeptness in balancing cash inflows with outflows. This balance supports our liquidity while allowing for growth investments and effective debt management.

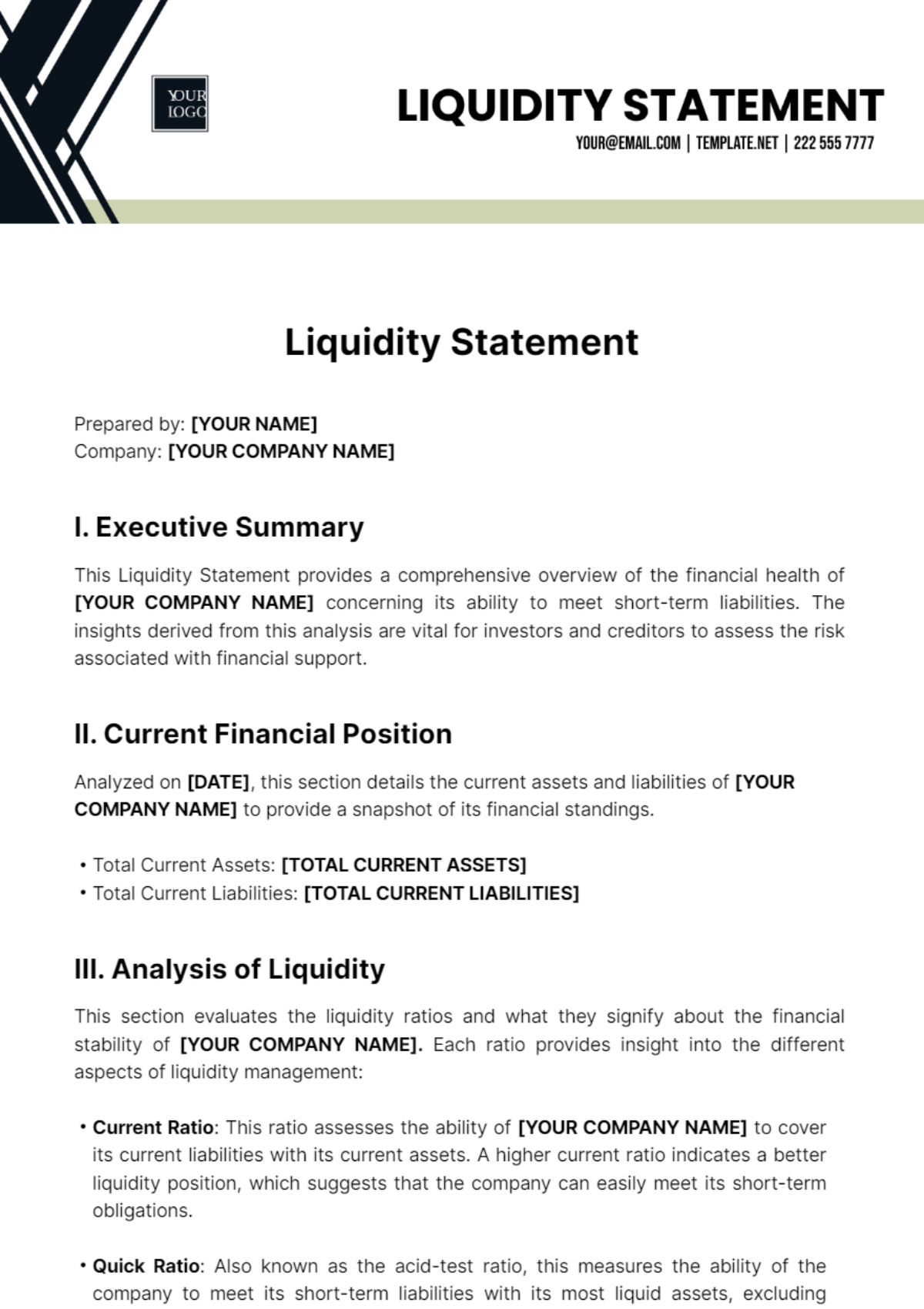

Key Financial Ratios Analysis

We also analyzed various financial ratios to get a better understanding of the financial health and performance of the business. From liquidity ratios, efficiency ratios, profitability ratios, and leverage ratios to market ratios.

Ratios | FY 2050 | FY 2051 | Change (%) |

|---|---|---|---|

Current Ratio | 1.8 | 2.0 | 11.11% |

Quick Ratio | 1.2 | 1.4 | 16.67% |

Debt to Equity Ratio | 0.8 | 0.7 | -12.50% |

Gross Margin Ratio | 40% | 42% | 5% |

Net Profit Margin | 15% | 18% | 20% |

Return on Equity (ROE) | 20% | 23% | 15% |

Inventory Turnover | 5 times | 5.5 times | 10% |

Asset Turnover Ratio | 0.8 times | 0.85 times | 6.25% |

Conclusions and Recommendations

Concluding our comprehensive analysis of the financial statements, including the income statement, balance sheet, cash flow statement, and key financial ratios, we've identified several critical insights that outline the company's financial health and operational performance over fiscal years 2050 and 2051. This analysis reveals a positive trend across various financial metrics, indicating improved liquidity, profitability, efficiency, and a stable leverage position.

Conclusions:

Improved Liquidity: The analysis highlights an enhanced liquidity position, as evidenced by increased current and quick ratios. This improvement suggests that the company is in a better position to meet its short-term liabilities with its most liquid assets.

Strengthened Profitability: Significant improvements in gross margin, net profit margin, and return on equity indicate that the company has successfully increased its profitability. These enhancements are attributable to better cost management, pricing strategies, and operational efficiencies.

Enhanced Operational Efficiency: The rise in inventory and asset turnover ratios reflects a more efficient use of resources, leading to improved operational performance. This suggests that the company has effectively managed its inventory and assets to support sales and revenue generation.

Stable Financial Leverage: The decrease in the debt-to-equity ratio demonstrates a move toward a more balanced and sustainable financing structure. This adjustment indicates a strategic shift in reducing dependency on debt, thereby enhancing financial stability.

Recommendations:

Continue Enhancing Liquidity Management: While liquidity ratios have improved, it's crucial to maintain vigilant cash management practices. Optimizing working capital and maintaining sufficient cash reserves will be key in navigating unforeseen challenges.

Focus on Core Competencies to Sustain Profitability: The company should continue to leverage its core competencies to enhance profitability. This can include investing in high-margin products or services, exploring new markets, and leveraging technology for operational efficiency.

Invest in Growth Opportunities: With a more stable financial structure and improved profitability, the company is well-positioned to explore growth opportunities. These could include strategic acquisitions, expansion into new markets, or investment in research and development to foster innovation.

Monitor and Adjust Financial Leverage as Necessary: Although the company's leverage has improved, it's essential to continuously monitor debt levels and adjust financing strategies accordingly. Balancing debt and equity financing will ensure long-term sustainability and financial flexibility.

Strengthen Efficiency Measures: Continued focus on improving operational efficiency, through measures such as process optimization and technology adoption, can further enhance inventory and asset turnover rates. This will support sustained growth and competitive advantage.