Valuation Summary

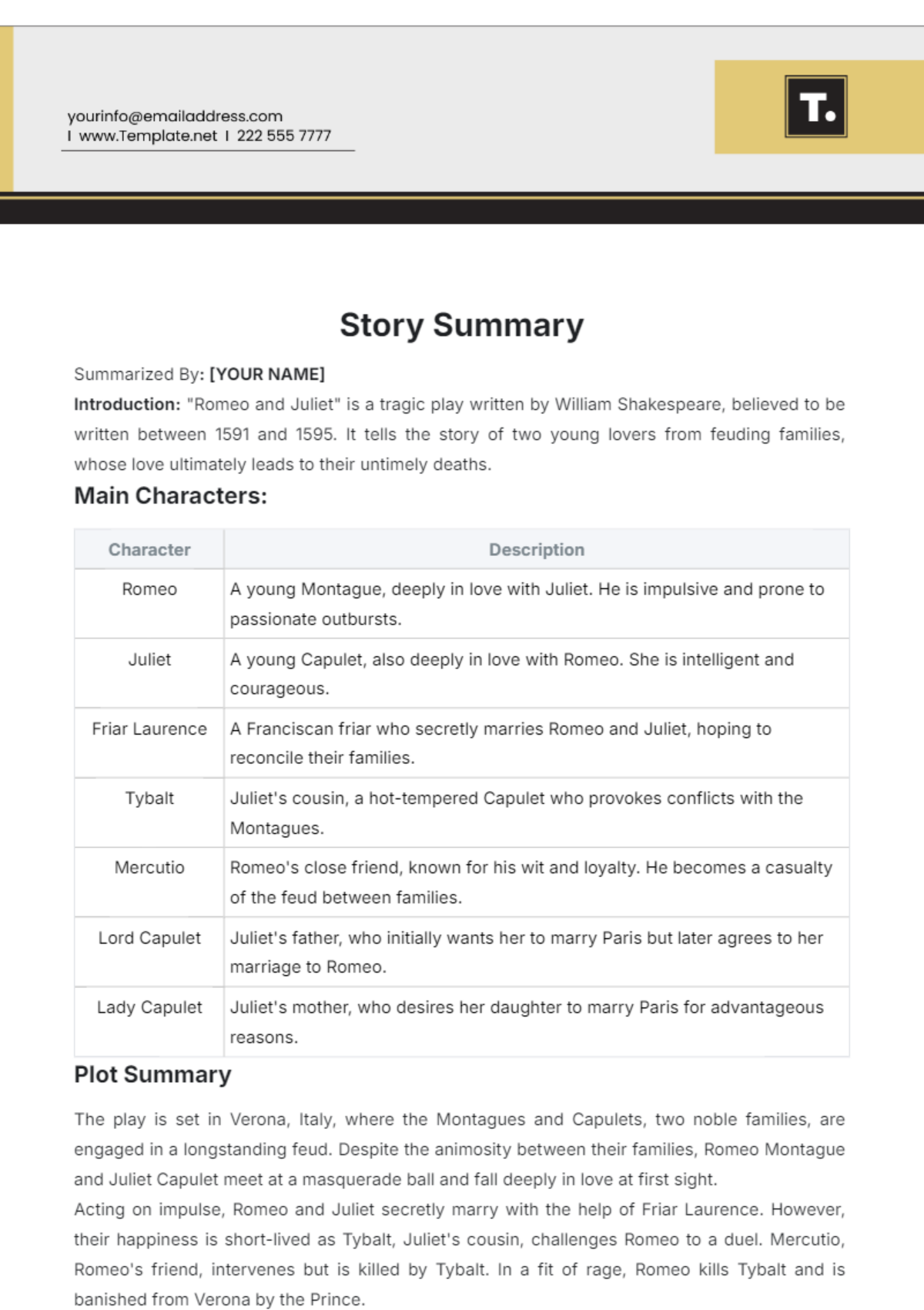

Overview:

Tech Startup [YOUR COMPANY NAME] is a cutting-edge company operating in the technology sector, specializing in [DESCRIPTION OF THE STARTUP'S]. The company has demonstrated significant growth potential due to its innovative approach and scalable business model.

Key Metrics:

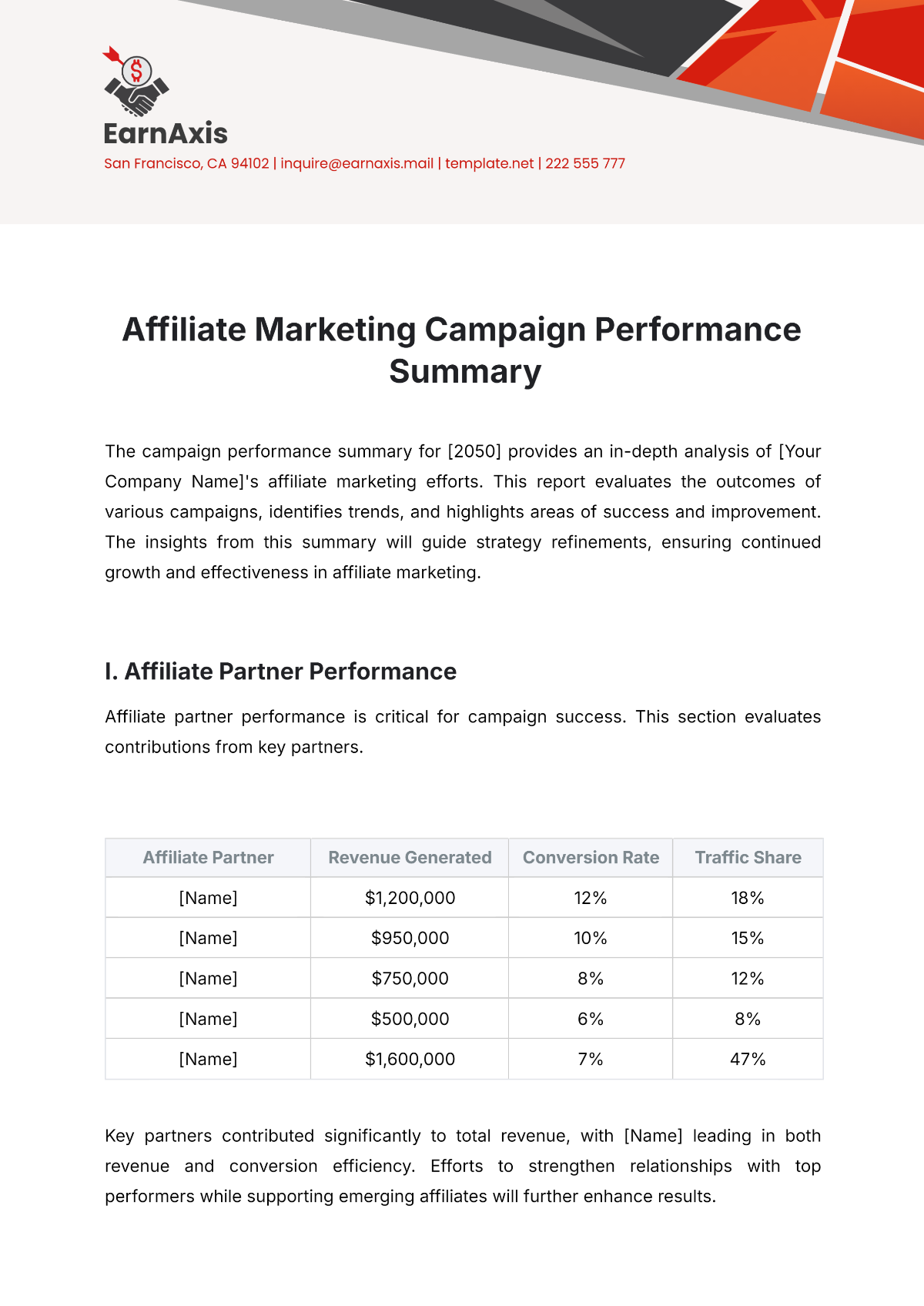

Metric | Value |

|---|---|

Annual Revenue | $[REVENUE] MILLION |

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) | $[EBITDA] MILLION |

Customer Acquisition Cost (CAC) | $[CAC] |

Monthly Active Users (MAU) | [MAU] |

Churn Rate | [CHURN RATE] % |

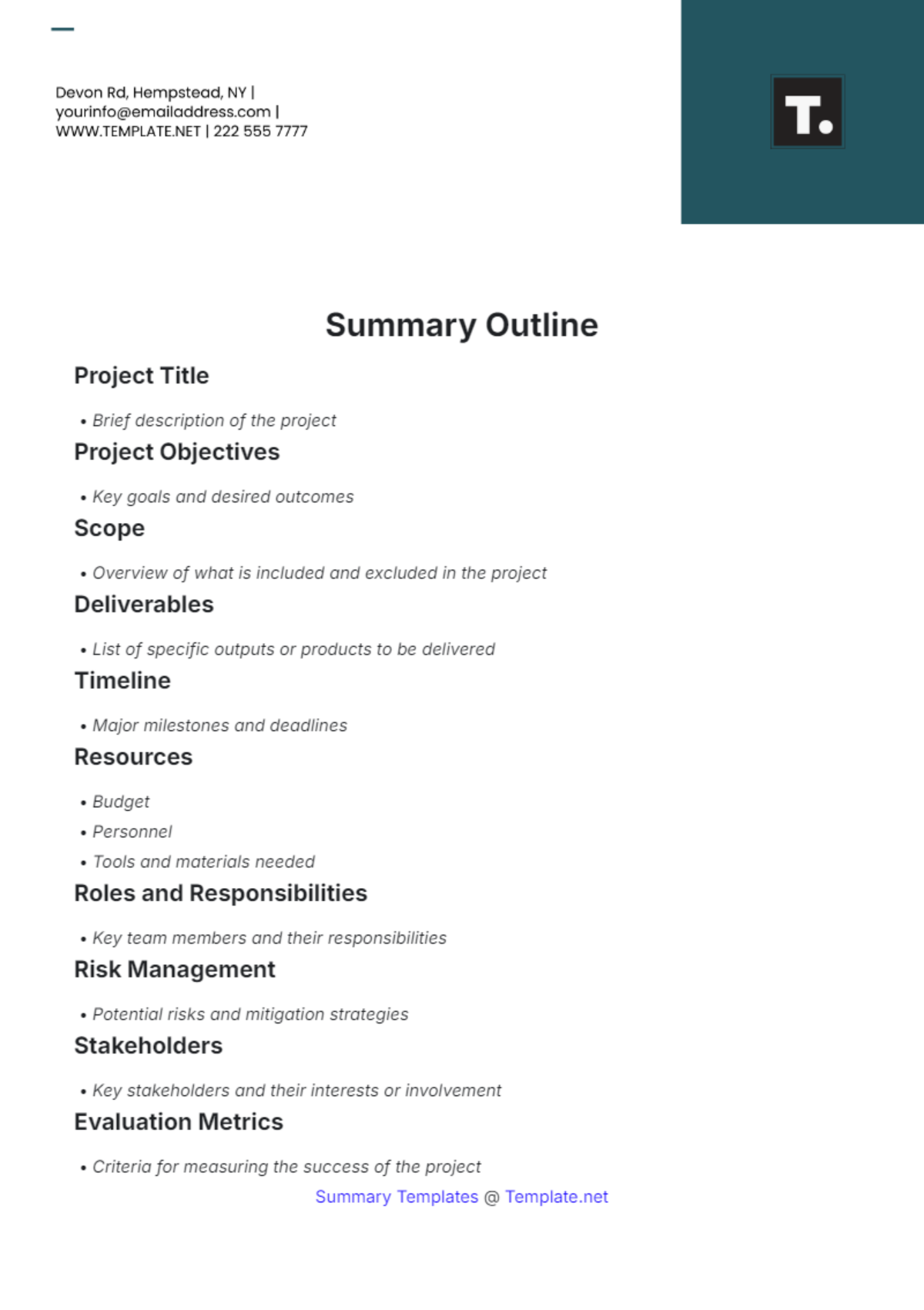

Valuation Methodology:

The valuation of Tech Startup [YOUR COMPANY NAME] was conducted using a combination of methods, including the Discounted Cash Flow (DCF) analysis, Comparable Company Analysis (CCA), and Venture Capital Method (VC Method).

Discounted Cash Flow (DCF) Analysis:

Projected future cash flows were discounted back to present value using a discount rate of [DISCOUNT RATE].

Terminal value was calculated using an appropriate multiple.

Sensitivity analysis was performed to account for various scenarios.

Comparable Company Analysis (CCA):

Comparable publicly traded companies in the technology sector were analyzed based on their financial metrics such as revenue, EBITDA, and growth rates.

Valuation multiples (e.g., EV/Revenue, EV/EBITDA) were applied to Tech Startup XYZ's financials to determine its implied valuation.

Venture Capital Method (VC Method):

Future projected revenues and EBITDA were estimated based on market trends and the company's growth trajectory.

A suitable discount rate and terminal value multiplier were applied to determine the startup's valuation.

Valuation Results:

Based on the conducted analysis, the estimated valuation of Tech Startup [YOUR COMPANY NAME] is approximately $[VALUATION] MILLION.

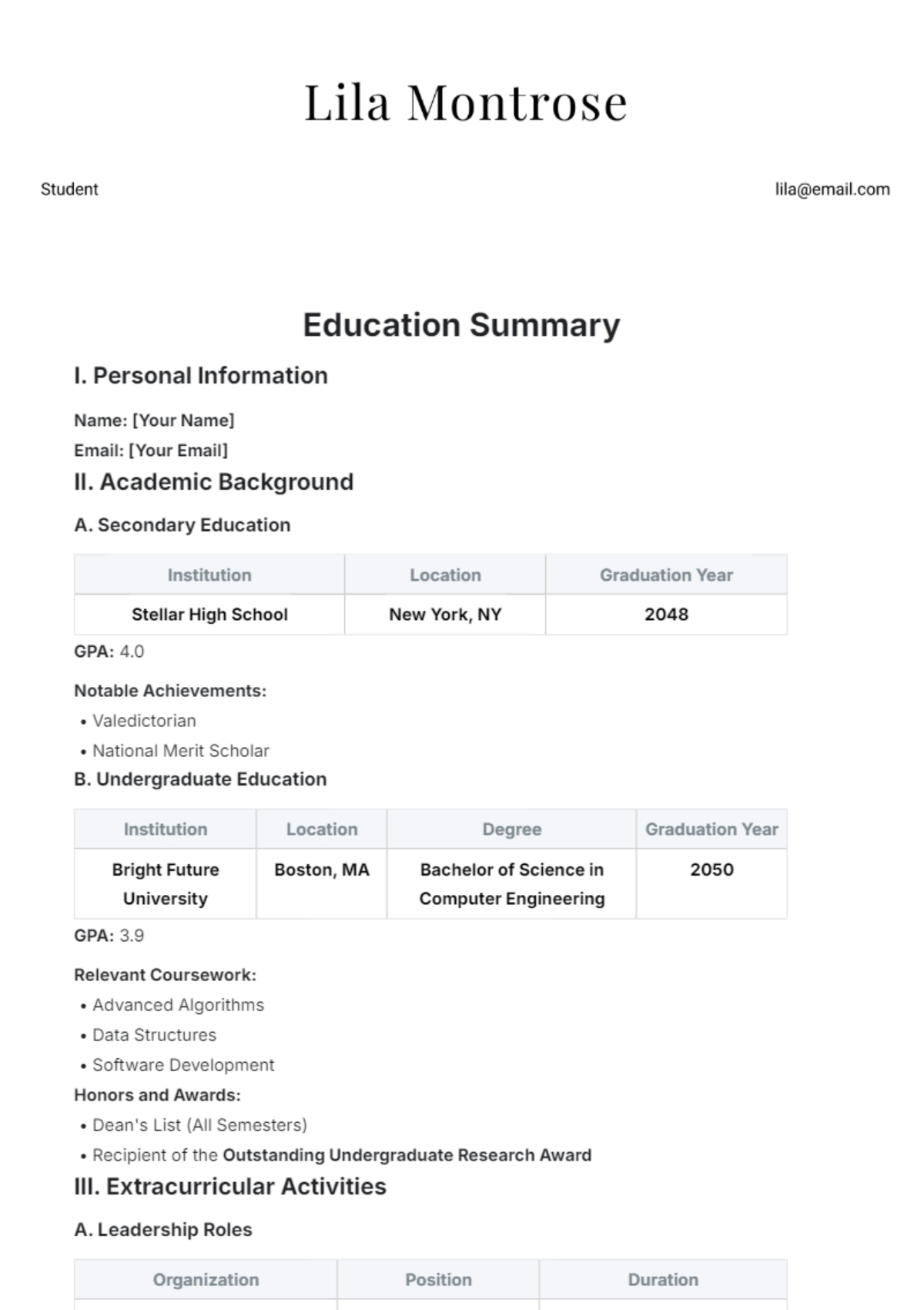

Investment Opportunity:

Investing in Tech Startup [YOUR COMPANY NAME] presents an exciting opportunity to participate in the growth potential of a disruptive technology company. With a strong track record of innovation and a scalable business model, the company is well-positioned to capture a significant market share in the [RELEVANT INDUSTRY OR MARKET SEGMENT].

Conclusion:

Tech Startup [YOUR COMPANY NAME]'s valuation reflects its potential to generate substantial returns for investors. With a solid foundation, innovative products/services, and a clear growth strategy, the company is poised for success in the dynamic tech industry. Investors are encouraged to consider this opportunity for potential investment.

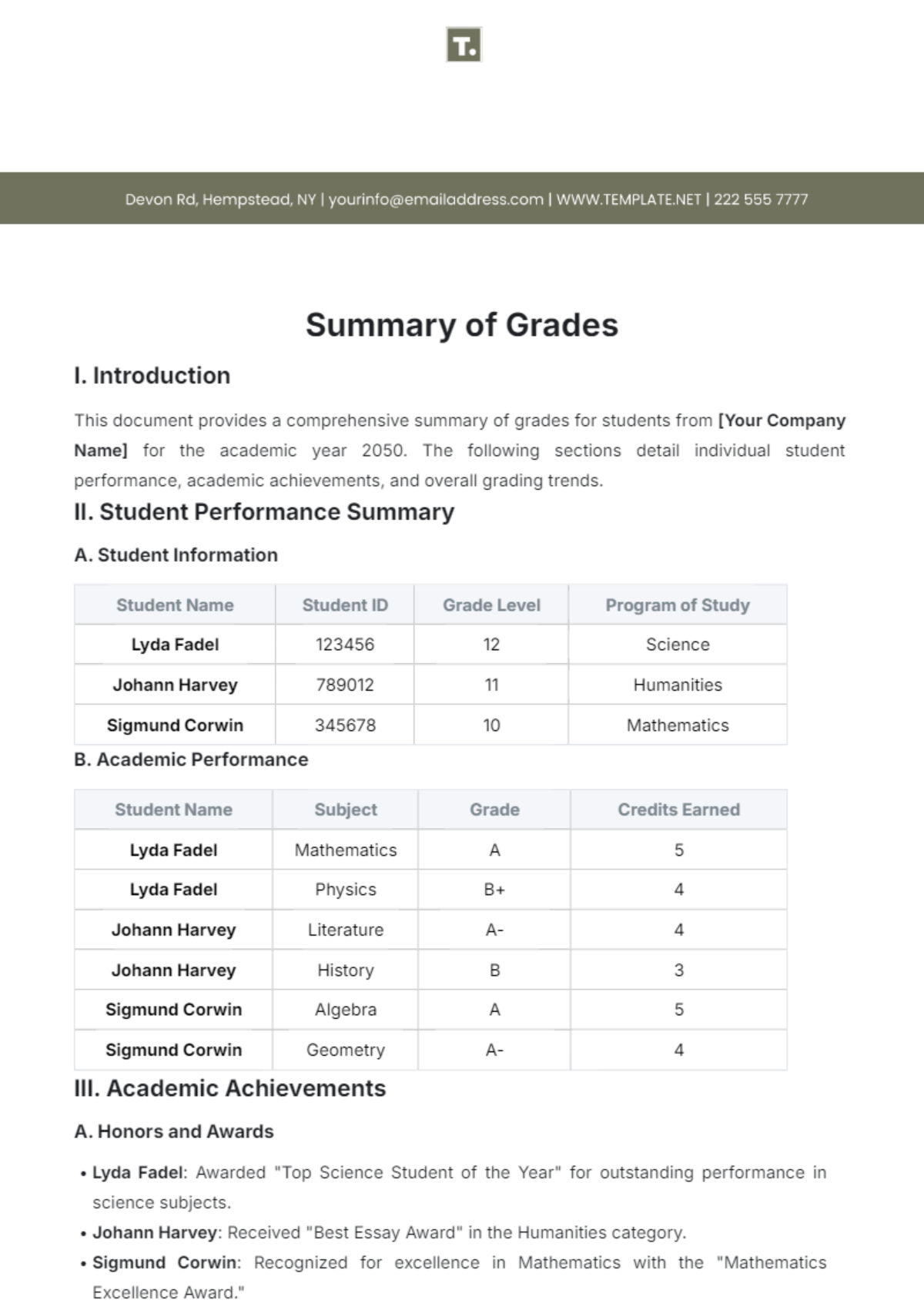

Summarized By:

[YOUR NAME]