Entry Summary

Introduction:

This Entry Summary provides crucial information regarding the importation of goods by [IMPORTER NAME]. It includes detailed descriptions of the goods, their declared value, quantity, and country of origin. Additionally, the summary outlines the applicable duties and taxes, ensuring compliance with customs regulations.

Importer Information:

Name: [IMPORTER NAME]

Address: [IMPORTER ADDRESS]

Customs Broker: [BROKER NAME]

Entry Number: [ENTRY NUMBER]

Date of Importation: [IMPORTATION DATE]

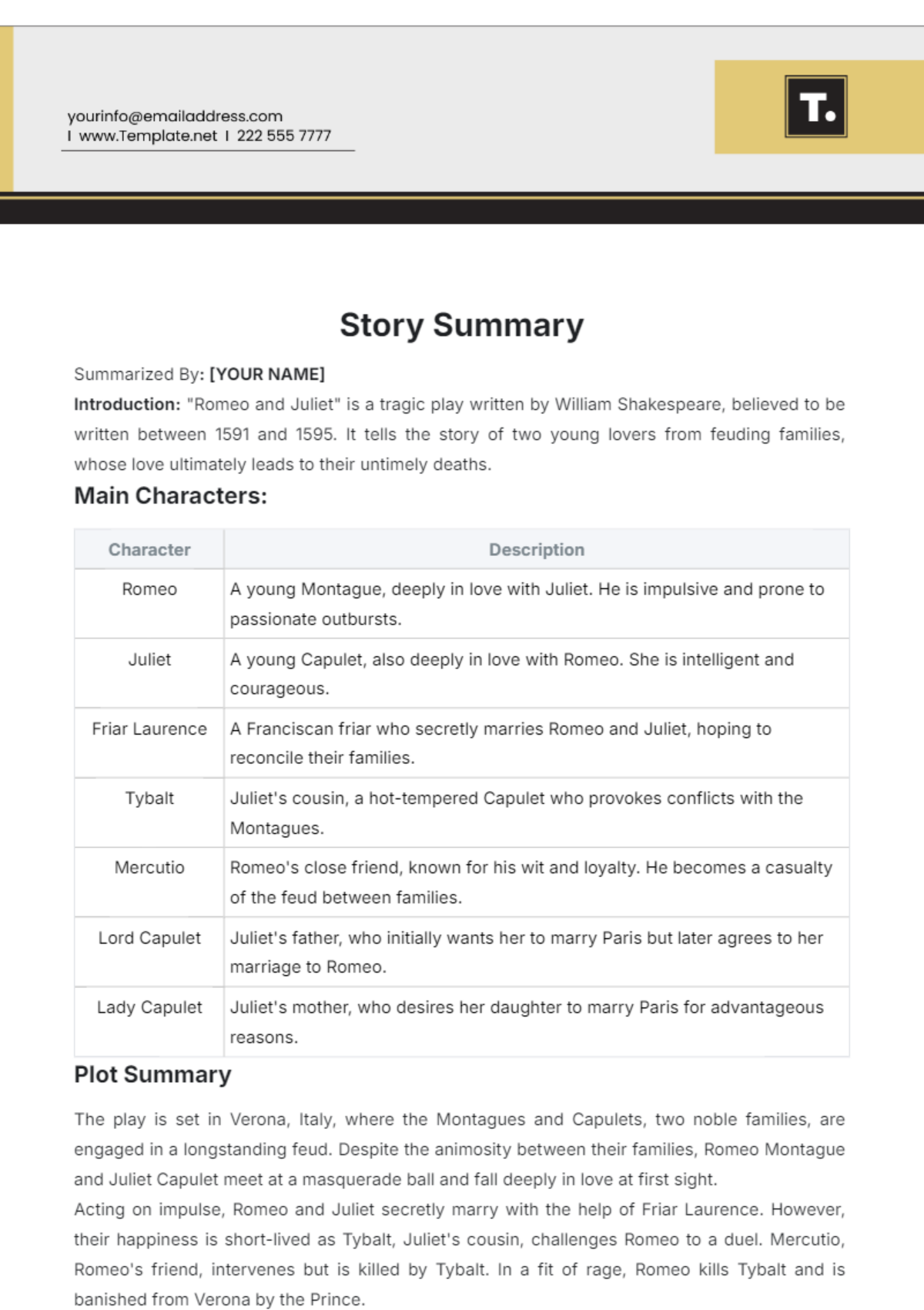

Goods Information:

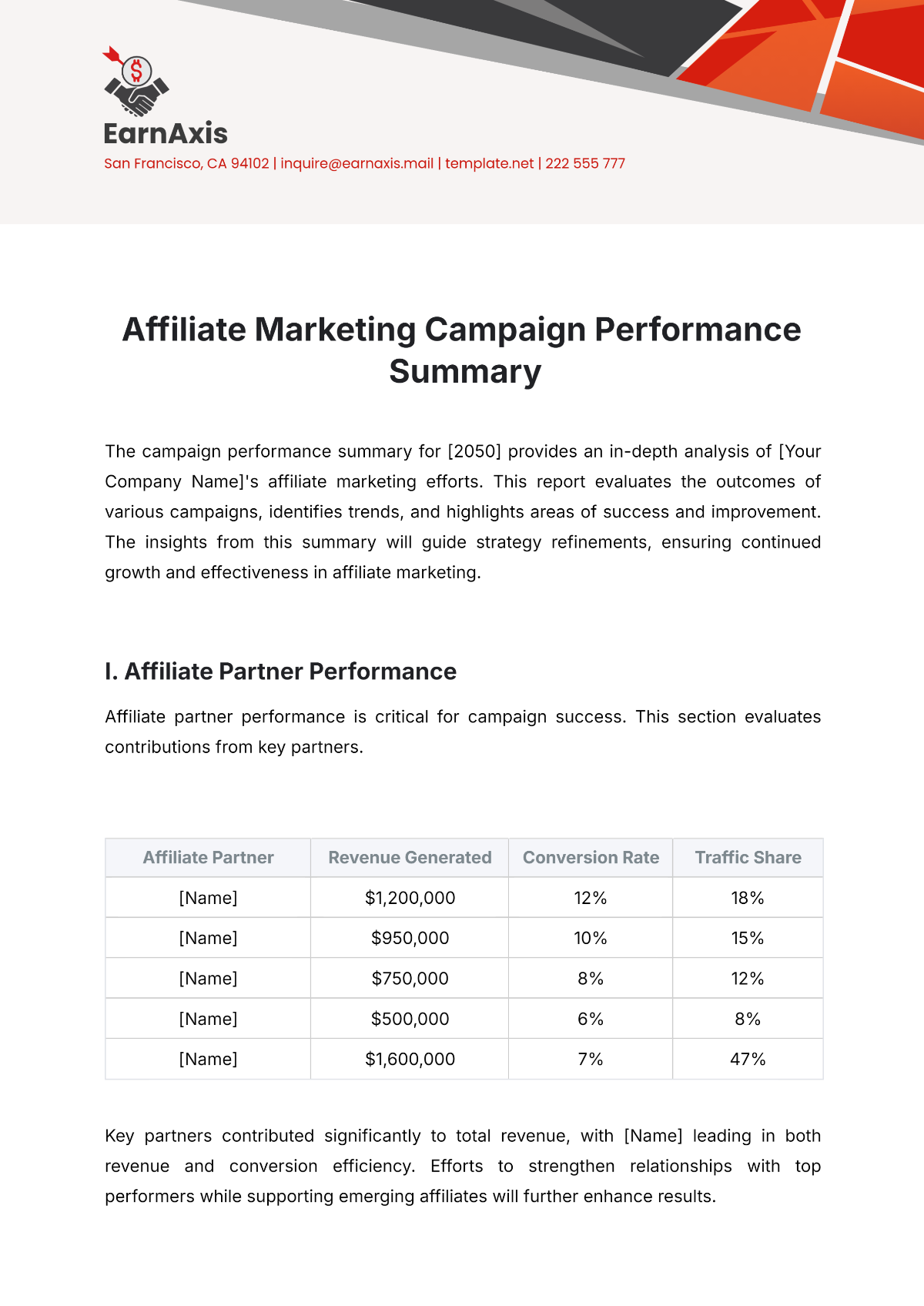

This summary provides detailed information regarding the goods imported into the country, including descriptions, values, quantities, origins, and the applicable duties or taxes.

Goods | HS Code | Quantity | Value (USD) | Country of Origin | Taxes Owed |

|---|---|---|---|---|---|

[Goods Description] | [HS Code] | [Quantity] | [Value (USD)] | [Country of Origin] | [Taxes Owed] |

[Goods Description] | [HS Code] | [Quantity] | [Value (USD)] | [Country of Origin] | [Taxes Owed] |

[Goods Description] | [HS Code] | [Quantity] | [Value (USD)] | [Country of Origin] | [Taxes Owed] |

Total Values and Charges

Total Value of Goods: [TOTAL VALUE OF GOODS]

Total Duties Owed: [TOTAL DUTIES OWED]

Total Taxes Owed: [TOTAL TAXES OWED]

Compliance and Regulations:

The goods listed have been declared in accordance with the country's import regulations and the Harmonized Tariff Schedule. All necessary permits and inspections related to the goods have been obtained and completed, ensuring compliance with safety, health, and environmental standards.

Certification:

I, [BROKER NAME], certify that the information provided in this entry summary is accurate and complete to the best of my knowledge. This document serves as a declaration of goods imported by [IMPORTER NAME] on [IMPORTATION DATE], meeting all requirements for legal entry into the country.

Conclusion:

This entry summary represents a comprehensive overview of the goods imported by [IMPORTER NAME], including detailed descriptions, values, and applicable customs duties and taxes. It ensures transparency and compliance with customs regulations, facilitating a smooth importation process.

Summarized By: [YOUR NAME]