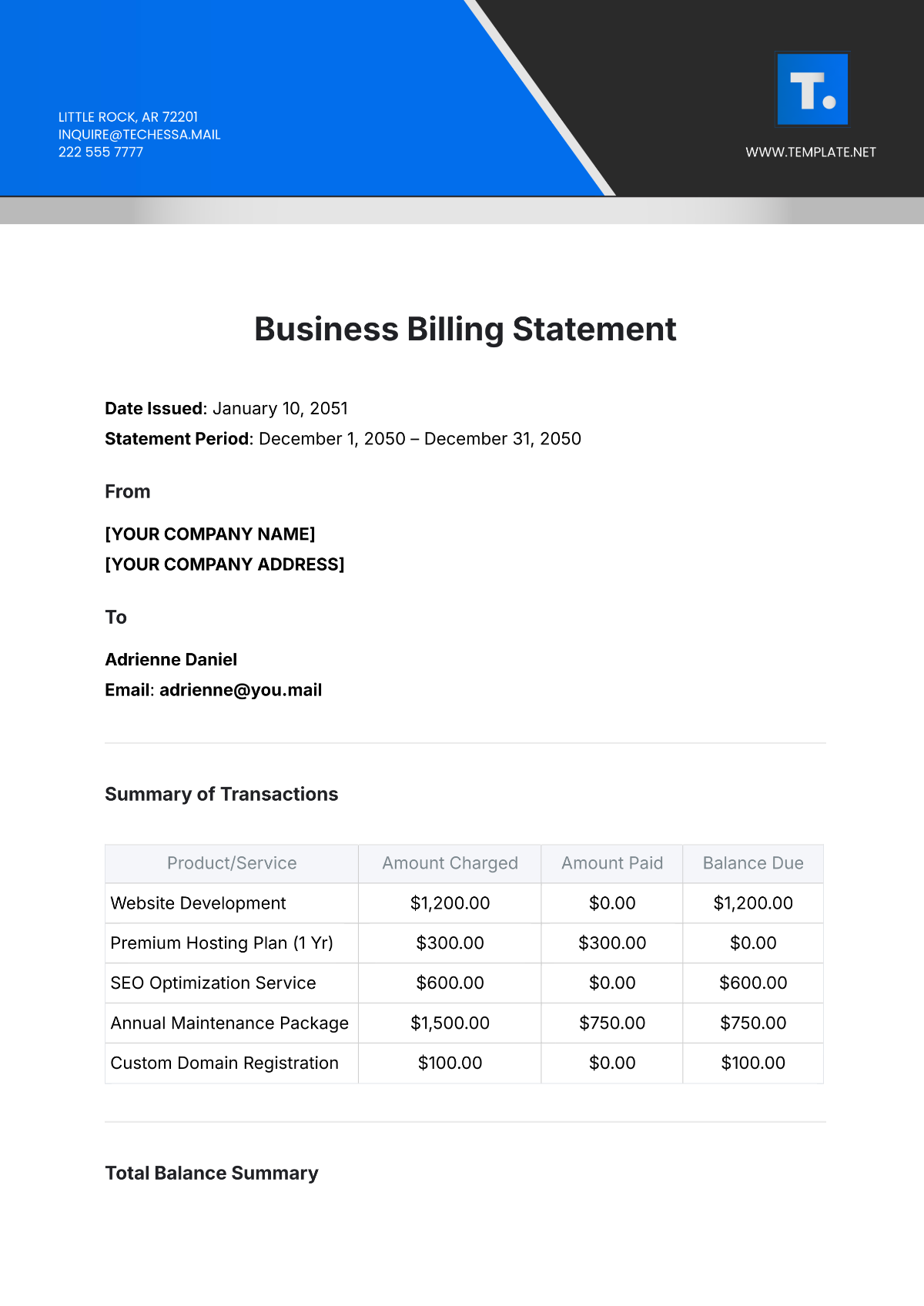

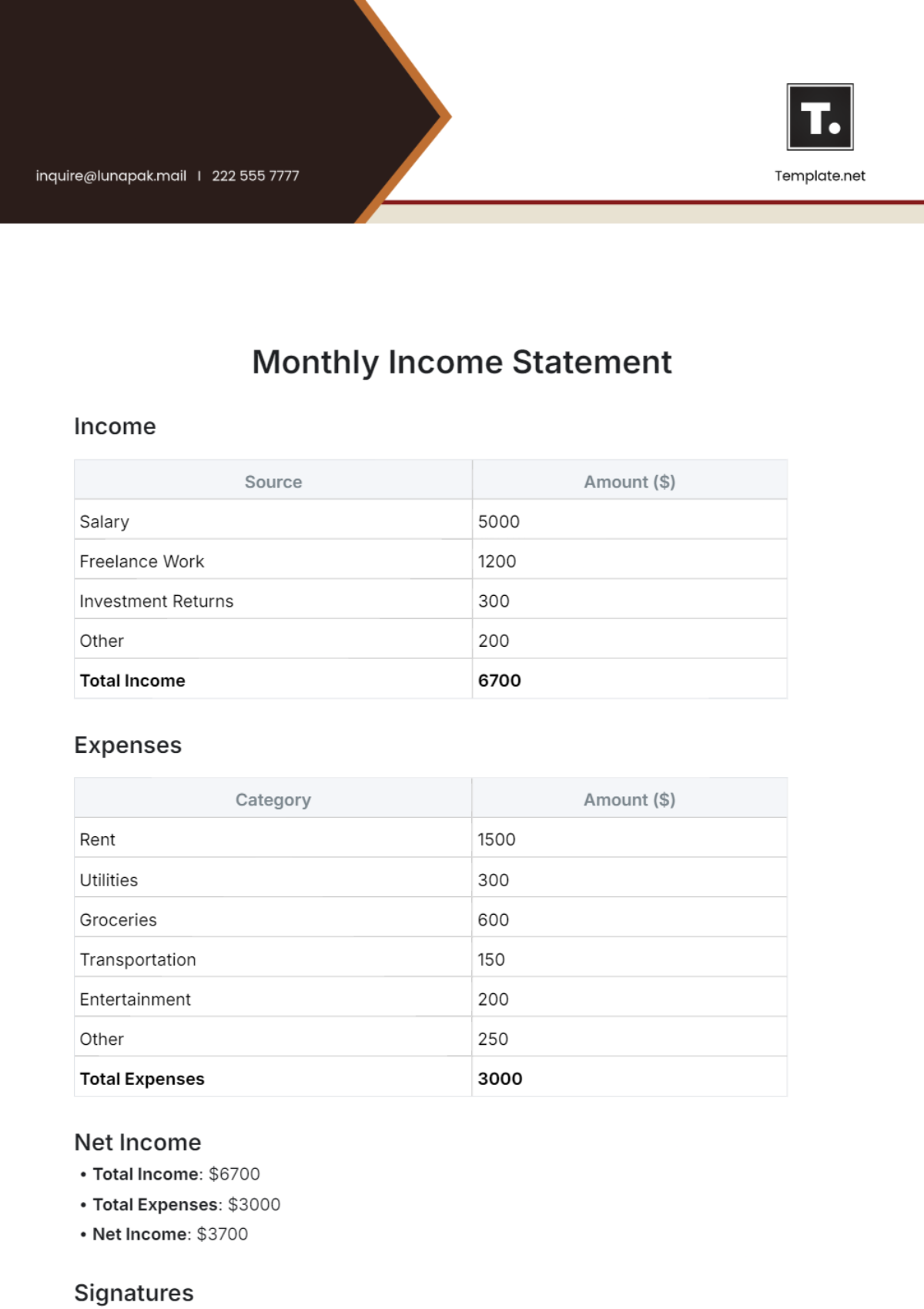

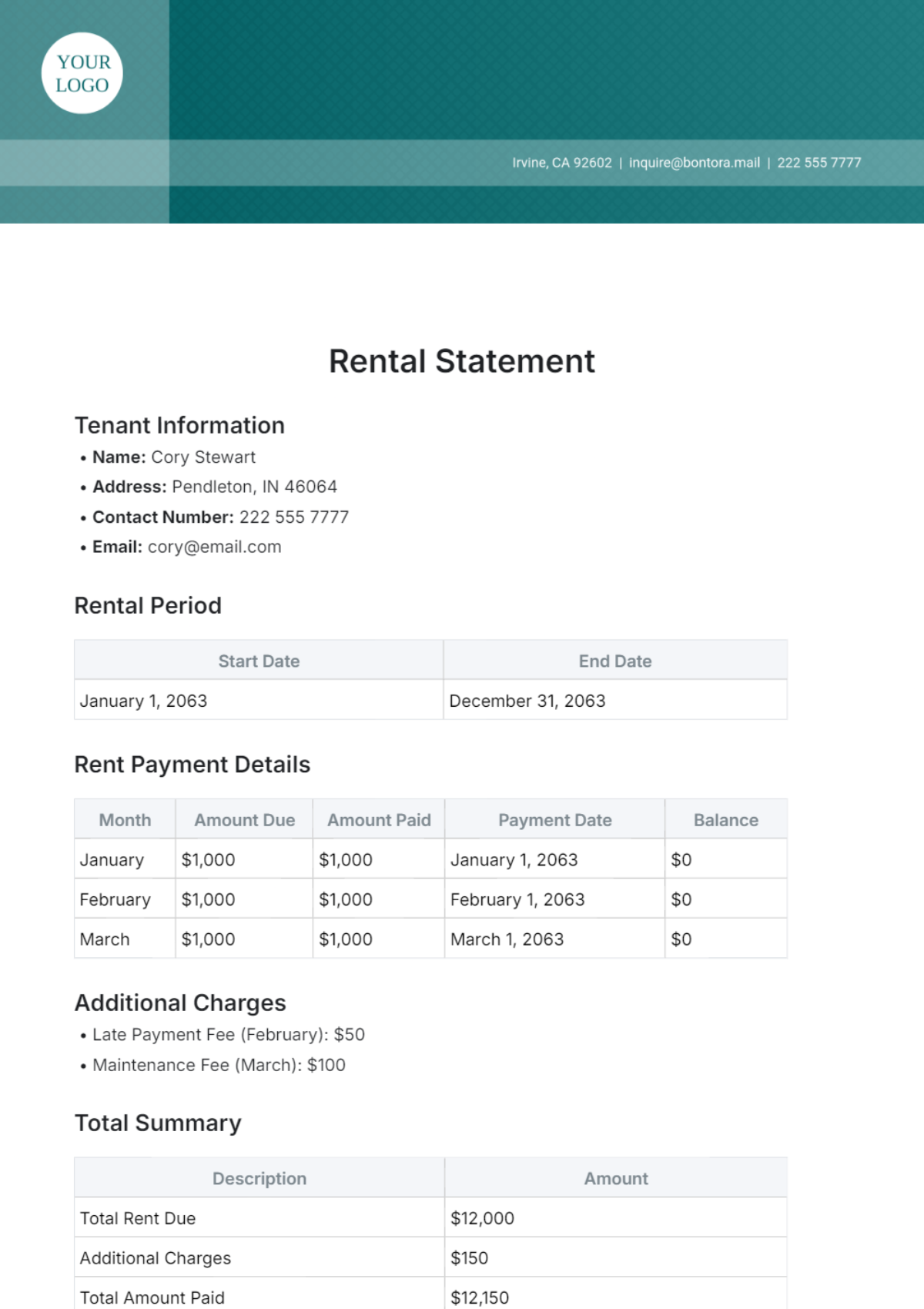

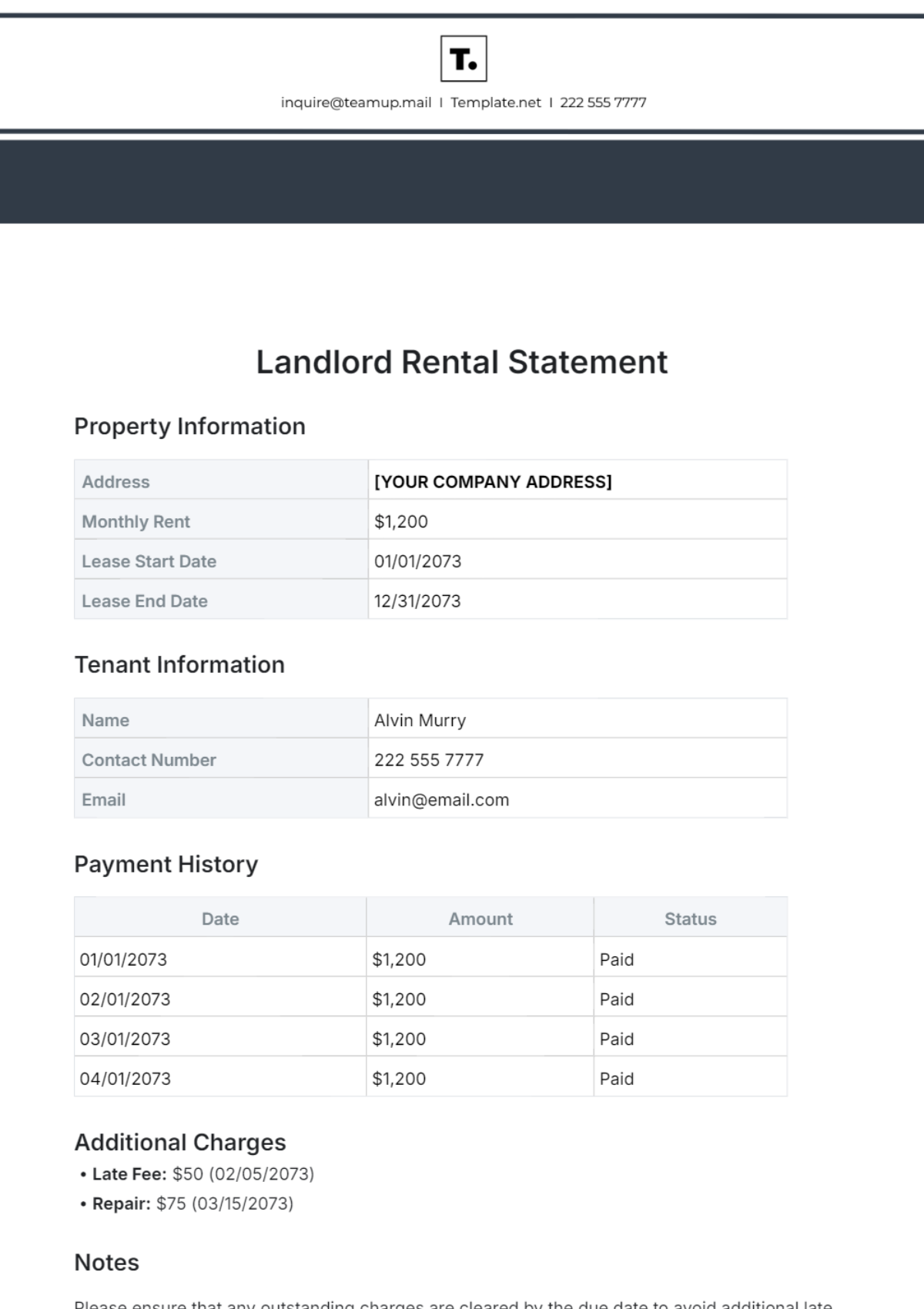

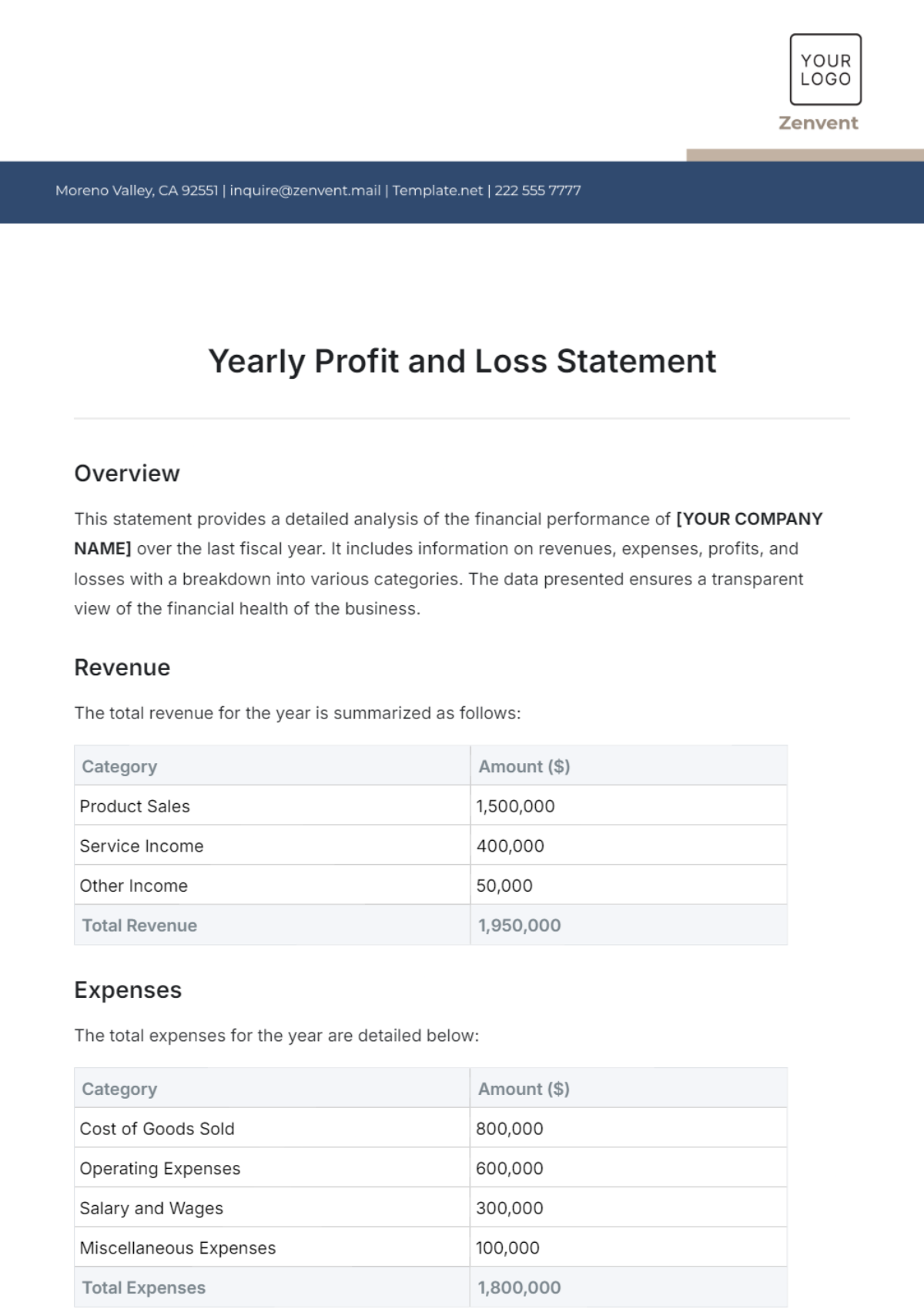

Cleaning Services Labor Cost Statement

This Cleaning Services Labor Cost Statement provides an overview of the labor costs incurred by [Your Company Name] during the reporting period of [Period], totaling $50,350. It serves as a valuable tool for financial analysis, budgeting, and decision-making.

Category | Amount ($) |

|---|---|

Wages and Salaries | 25,000 |

Overtime Pay | 2,500 |

Benefits | |

- Health Insurance | 3,000 |

- Retirement | 1,500 |

- Paid Time Off | 2,000 |

Taxes | |

- Federal Income Tax | 3,500 |

- State Income Tax | 1,200 |

- Social Security | 1,900 |

- Medicare | 450 |

- Unemployment | 600 |

Training Expenses | 1,200 |

Uniforms and Equipment | 800 |

Bonuses or Incentives | 1,000 |

Contract Labor | 4,000 |

Employee Turnover Costs | |

- Recruitment | 1,500 |

- Training | 2,000 |

Miscellaneous Expenses | 700 |

Total Labor Costs | 50,350 |

Notes:

Wages and Salaries include payments to cleaning staff for regular work hours.

Overtime Pay is calculated based on additional hours worked by employees beyond their regular schedule.

Benefits include expenses for health insurance, retirement contributions, and paid time off for employees.

Taxes consist of federal, state, Social Security, Medicare, and unemployment taxes.

Training Expenses cover the costs associated with training new hires and ongoing staff development.

Uniforms and Equipment represent the expenses for providing necessary attire and cleaning supplies to employees.

Bonuses or Incentives are discretionary payments made to recognize exceptional performance.

Contract Labor includes payments to subcontractors or temporary workers hired to support cleaning operations.

Employee Turnover Costs encompass recruitment and training expenses incurred due to staff turnover.

Miscellaneous Expenses cover any other labor-related costs not categorized above.