Executive Summary for GST Project

Prepared by: [YOUR NAME]

[YOUR COMPANY NAME]

[DATE]

Project Overview

The Goods and Services Tax (GST) implementation initiative aimed to streamline taxation processes and enhance efficiency across [YOUR COMPANY NAME]. This project was conducted to analyze the impact of GST on our organization and derive actionable insights for future compliance and optimization.

Key Findings

The project identified several key findings:

Impact on Operations:

Significant reduction in compliance time due to centralized tax reporting.

Improved transparency and accountability in financial transactions.

Financial Implications:

Initial cost implications due to system upgrades and training.

Long-term cost savings through optimized input tax credits and reduced tax cascading.

Vendor and Customer Relationships:

Improved relationships with vendors due to standardized tax processes.

Enhanced customer satisfaction with clear tax invoicing.

Compliance and Governance:

Enhanced compliance with GST regulations, minimizing risk exposure.

Strengthened governance framework for tax management.

Recommendations

Based on the findings, the following recommendations are proposed:

Continuous Training:

Conduct regular training programs to keep teams updated on GST regulations and procedures.

System Integration:

Explore integration of ERP systems with GSTN for seamless tax reporting and compliance.

Vendor Collaboration:

Collaborate with key vendors to align on GST-compliant processes and documentation.

Customer Education:

Educate customers on GST implications to improve transparency and understanding.

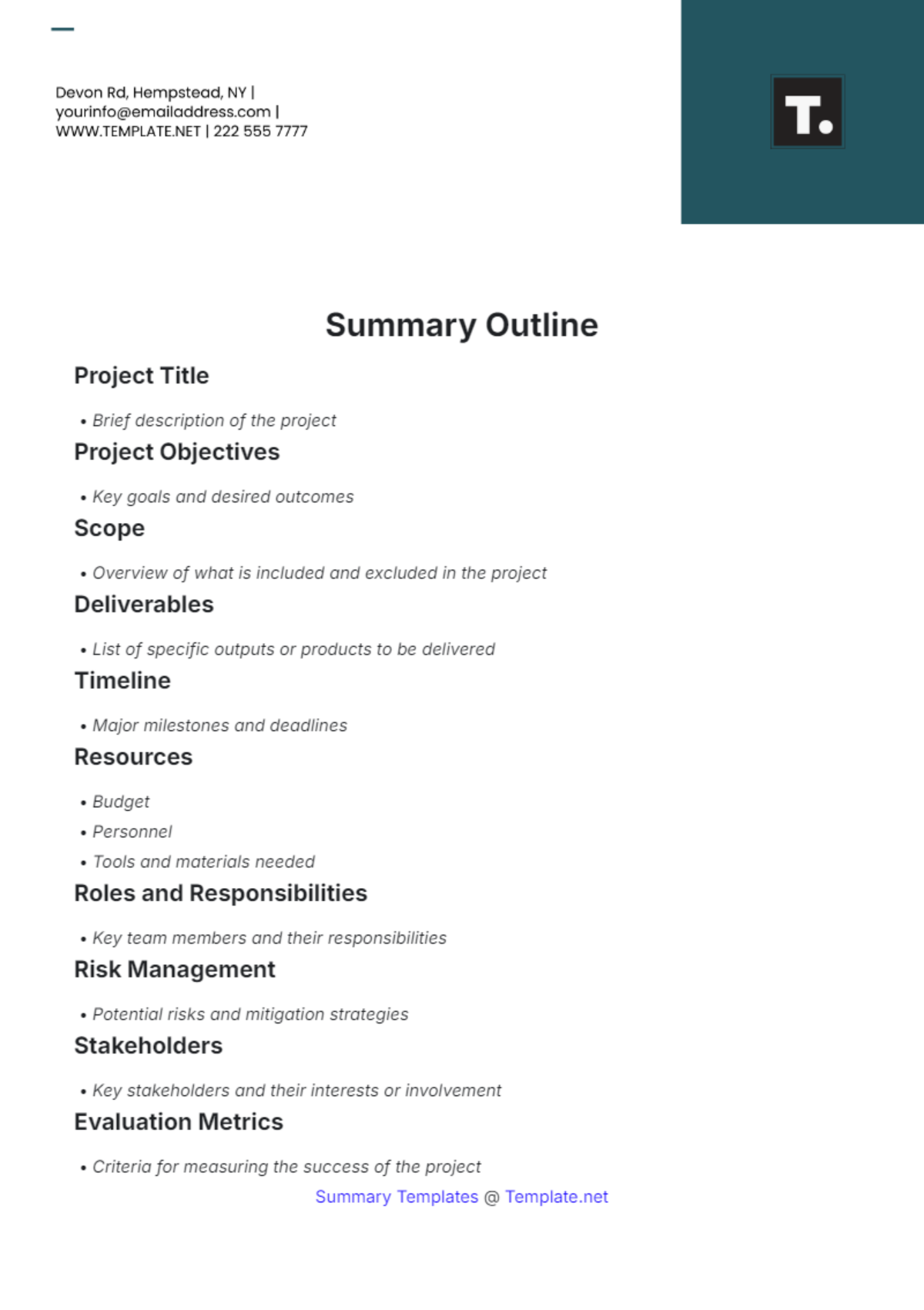

Action Plan

The action plan for implementing these recommendations is as follows:

Task Description | Responsible Party | Timeline |

|---|---|---|

Organize GST training sessions | HR and Finance | Monthly |

Evaluate ERP-GSTN integration feasibility | IT and Finance | Q2 - Q3, 2050 |

Engage with top vendors for collaboration | Procurement | Q2, 2050 |

Develop customer education materials | Marketing | Q3, 2050 |

Conclusion

The GST implementation project has resulted in tangible benefits for [YOUR COMPANY NAME], including operational efficiency gains and enhanced compliance. By implementing the recommended actions, we aim to further optimize our GST processes and foster stronger stakeholder relationships.