Free Law Firm Partnership Contract

This Partnership Contract ("Contract") is entered into as of [Insert Date], by the undersigned individuals (hereinafter referred to as the "Partners") who agree to form [Your Company Name], a general partnership ("Partnership"), under the laws of [Insert State or Jurisdiction]. This document outlines the terms and conditions governing the formation, operation, and dissolution of the Partnership.

Article I: Formation of the Partnership

1.1 Formation: By this Contract, the Partners establish a legal entity for the practice of law. This Partnership is formed to provide high-quality legal services, adhere to the highest ethical standards, and leverage collective expertise for the benefit of clients and the professional growth of the Partners.

1.2 Principal Office: The Partnership's principal office is initially located at [Insert Address]. This location will serve as the primary base for operations and client engagement. The Partners may, by mutual agreement, relocate the principal office to another location better suited to the Partnership’s evolving business needs.

1.3 Duration: This Contract takes effect on the date noted above and shall remain in effect indefinitely until terminated by mutual consent of the Partners or as otherwise provided in this Contract.

Article II: Purpose and Activities of the Partnership

2.1 Purpose: The primary purpose of the Partnership is to engage in the practice of law. This includes representing and advising clients in civil, criminal, administrative, and other legal matters. The Partnership will strive to achieve excellence in all areas of service, ensuring that client interests are represented effectively and ethically.

2.2 Activities: In pursuit of its purpose, the Partnership is authorized to perform acts necessary or incidental to the practice of law, including but not limited to:

Hiring of personnel, including associates, paralegals, and administrative support staff.

Renting or purchasing office space and necessary equipment.

Marketing and promotional activities aimed at attracting and retaining clients.

Engaging in professional development and continuing legal education for Partners and staff.

Networking with other legal professionals and participating in professional associations.

Article III: Capital Contributions

3.1 Initial Contributions: Each Partner shall contribute an amount specified in Schedule A attached hereto, which details the initial capital contributions necessary for starting the Partnership. These contributions are essential for covering initial expenses such as office leases, equipment purchases, and operating capital for the first six months.

3.2 Obligation for Additional Contributions: Should additional capital be necessary for the operation of the Partnership, such capital calls shall be made upon a unanimous vote of the Partners. All additional contributions shall be made proportionally according to the Partners’ existing shares in the Partnership.

3.3 Capital Accounts: Each Partner's contribution to the Partnership will be tracked in a separate capital account. No interest will accrue on contributions, regardless of the nature or timing of the contribution.

Article IV: Distributions and Financial Provisions

4.1 Profit and Loss Allocation: Profits and losses of the Partnership shall be determined annually at the close of the fiscal year and shall be allocated to the Partners according to their respective percentage interests in the Partnership as stipulated in Schedule B.

Schedule B: Summary of Profit and Loss Allocation

a. Profit and Loss Calculation: Calculations are done annually, based on the fiscal year's revenues and expenses.

b. Percentage Interests:

Partner A: 40%

Partner B: 30%

Partner C: 30%

These shares reflect the Partners’ contributions and agreements on risk and responsibilities.

c. Adjustments: Changes in interests due to new contributions or changes in partnership structure will proportionally affect profit and loss allocations from the date of the change.

d. Distributions and Loss Handling: Profits may be reinvested or distributed as agreed upon, while losses are proportionately borne by the Partners.

e. Tax Responsibilities: The Partners handle their tax obligations based on their share of profits and losses.

4.2 Regular Distributions: The Partnership may make distributions to the Partners on a quarterly basis, subject to the availability of funds and prudent financial management. Decisions regarding distributions, including timing and amount, shall require a majority vote of the Partners. The primary goal of such distributions is to provide a predictable stream of income to the Partners while maintaining sufficient operating capital within the Partnership.

Article V: Management of the Partnership

5.1 Management Authority: Each Partner shall participate equally in the management and decision-making processes of the Partnership. This collective management approach is intended to foster collaboration and ensure that all significant strategic decisions benefit from the insights and expertise of all Partners.

5.2 Partner Meetings: Regular meetings of the Partners will be held monthly to review the Partnership’s business activities, financial status, and ongoing matters. Special meetings may be called as needed upon request by any Partner. Notice for special meetings shall be given at least three days in advance unless all Partners agree to a shorter timeframe.

5.3 Major Decisions: For major decisions, including those involving investments exceeding a certain amount, changes to the Partnership Agreement, or dissolution of the Partnership, a unanimous vote is required. This ensures that all Partners have a direct say in the most critical decisions affecting the Partnership.

Article VI: Admission and Withdrawal of Partners

6.1 Admission of New Partners: Prospective Partners must be unanimously approved by all existing Partners. Admission criteria include professional qualifications, compatibility with the Partnership’s goals and culture, and the ability to contribute capital as required. The terms of admission, including the new Partner’s capital contribution, profit share, and responsibilities, will be outlined in an amendment to this Contract.

6.2 Withdrawal of Partners: Partners wishing to withdraw from the Partnership must provide written notice to the other Partners six months in advance. The terms governing the buyout of the withdrawing Partner’s interest, including valuation of the interest, payment terms, and any non-compete agreements, will be specified in Schedule C that will be attached to this contract which sets forth the procedures and financial terms related to the withdrawal of a Partner from the Partnership

Article VII: Resolution of Disputes

7.1 Dispute Resolution: The Partners commit to resolving disputes through direct negotiation. If direct resolution is unattainable, disputes will be submitted to mediation before resorting to arbitration.

Article VIII: General Provisions

8.1 Amendments: No amendment or modification of this Contract will be effective unless it is in writing and signed by all Partners.

8.2 Governing Law: This Contract shall be governed by and construed in accordance with the laws of the State of [Insert State], without regard to its conflict of laws principles.

8.3 Severability: If any provision of this Contract is found to be illegal or unenforceable, that provision will be severed from this Contract, and the remaining provisions will remain in full force and effect.

IN WITNESS WHEREOF, the Partners have executed this Partnership Contract as of the date first above written.

This Partnership Contract has been agreed to and accepted by the undersigned Partners. Each Partner acknowledges having read the entire Contract, including all schedules and appendices and agrees to be bound by its terms.

Please sign and date below to indicate your acceptance of this Contract and all associated terms.

[Your Company Name]

[Partner Name]

[Date]

[Partner Name]

[Date]

[Partner Name]

[Date]

Acknowledgment by Witness

[Name of Witness]

[Date]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Forge successful partnerships with Template.net's Law Firm Partnership Contract Template. Meticulously designed for legal partnerships, this template is fully customizable and editable via our Ai Editor Tool. Define terms clearly, ensuring mutual understanding and agreement. An essential tool for establishing and maintaining robust legal collaborations, exclusively available at Template.net.

You may also like

- Rental Contract

- Contractor Contract

- Contract Agreement

- One Page Contract

- School Contract

- Social Media Contract

- Service Contract

- Business Contract

- Restaurant Contract

- Marketing Contract

- Real Estate Contract

- IT Contract

- Cleaning Contract

- Property Contract

- Supplier Contract

- Partnership Contract

- Food Business Contract

- Construction Contract

- Employment Contract

- Investment Contract

- Project Contract

- Payment Contract

- Student Contract

- Travel Agency Contract

- Startup Contract

- Annual Maintenance Contract

- Employee Contract

- Gym Contract

- Event Planning Contract

- Personal Contract

- Nursing Home Contract

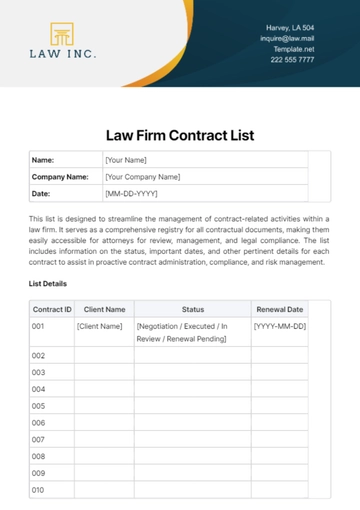

- Law Firm Contract

- Work from Home Contract

- Software Development Contract

- Maintenance Contract

- Music Contract

- Amendment Contract

- Band Contract

- DJ Contract

- University Contract

- Salon Contract

- Renovation Contract

- Photography Contract

- Lawn Care Contract