Free Law Firm Profitability Analysis

I. Introduction

[Your Company Name] is a distinguished law firm committed to delivering exceptional legal services to our clients. As part of our commitment to excellence, we regularly conduct profitability analysis to assess our financial performance and identify areas for improvement. In this report, we will delve into various aspects of our profitability analysis to gain insights into our revenue streams, expenses, client relationships, and practice areas.

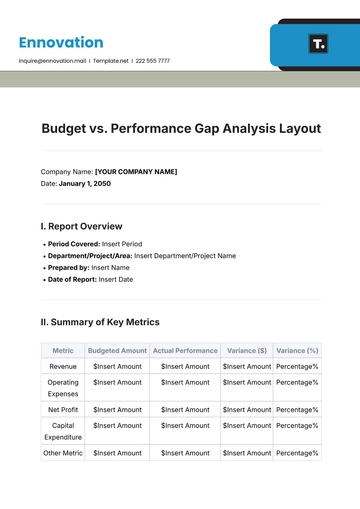

II. Revenue Analysis

Our revenue analysis reveals the diverse sources contributing to our firm's income. We generate revenue through billable hours, flat fees, contingency fees, and retainers. By closely examining these revenue streams, we can better understand our financial stability and potential for growth.

Revenue Source | Amount ($) | % of Total Revenue |

|---|---|---|

Billable Hours | 500,000 | 45% |

Flat Fees | 300,000 | 27% |

Contingency Fees | 200,000 | 18% |

Retainers | 100,000 | 9% |

Total | 1,100,000 | 100% |

Billable Hours: Billable hours represent the fees charged to clients based on the time spent by our attorneys working on their cases. In the table, billable hours account for $500,000 or 45% of our total revenue. This indicates that a significant portion of our revenue is derived from the expertise and services provided by our legal team on an hourly basis. It's important to monitor billable hours closely to ensure that our attorneys' time is utilized efficiently and effectively, maximizing revenue while maintaining client satisfaction.

Flat Fees: Flat fees are predetermined charges for specific legal services, regardless of the time spent on the case. In the table, flat fees contribute $300,000 or 27% of our total revenue. Flat fees provide transparency and predictability for clients and can be advantageous for both parties when the scope of work is well-defined. We should evaluate the profitability of our flat fee arrangements to ensure that they accurately reflect the value of our services and cover associated costs.

Contingency Fees: Contingency fees are typically a percentage of the settlement or award obtained for the client, contingent upon the success of the case. In the table, contingency fees amount to $200,000 or 18% of our total revenue. While contingency fee arrangements involve risk for the firm, they also offer the potential for substantial rewards in successful cases. It's essential to assess the viability and potential outcomes of contingency fee cases carefully to manage risk effectively.

Retainers: Retainers are upfront fees paid by clients to retain our services for ongoing legal representation. In the table, retainers contribute $100,000 or 9% of our total revenue. Retainers provide a steady stream of income and help secure long-term client relationships. We should ensure that retainer agreements are structured appropriately to align with client needs and expectations while safeguarding our firm's interests.

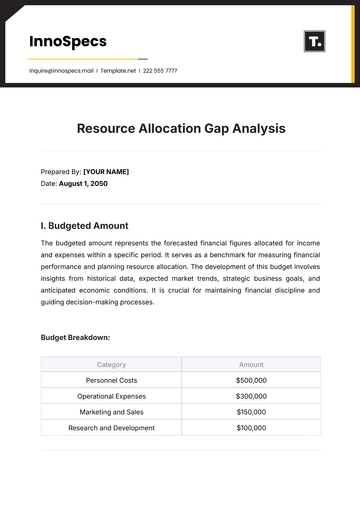

III. Expense Analysis

An in-depth examination of our expenses uncovers the operational costs associated with running our firm. This includes salaries, rent, utilities, marketing expenses, and overhead costs. Identifying areas where expenses can be optimized is crucial for enhancing profitability.

Expense Category | Amount ($) | % of Total Expenses |

|---|---|---|

Salaries and Benefits | 400,000 | 40% |

Rent | 150,000 | 15% |

Utilities | 30,000 | 3% |

Marketing Expenses | 80,000 | 8% |

Office Supplies | 20,000 | 2% |

Professional Fees | 50,000 | 5% |

Technology Expenses | 60,000 | 6% |

Insurance | 40,000 | 4% |

Miscellaneous | 50,000 | 5% |

Other Overhead Costs | 100,000 | 10% |

Total | 980,000 | 100% |

Salaries and Benefits: Salaries and benefits represent the largest portion of our expenses, accounting for $400,000 or 40% of our total expenses. This includes compensation for attorneys, paralegals, administrative staff, and employee benefits such as health insurance, retirement plans, and bonuses. Investing in our talented team is essential for delivering high-quality legal services and maintaining employee satisfaction.

Rent: Rent expenses amount to $150,000 or 15% of our total expenses. This includes the cost of leasing office space to accommodate our firm's operations. Evaluating our lease agreements and exploring cost-saving measures can help optimize our rental expenses while ensuring that our office environment meets the needs of our staff and clients.

Utilities: Utilities expenses total $30,000 or 3% of our total expenses. This encompasses electricity, water, heating, and other utility services necessary for running our office. Implementing energy-efficient practices and technologies can help reduce utility costs while minimizing our environmental footprint.

Marketing Expenses: Marketing expenses account for $80,000 or 8% of our total expenses. This includes advertising, website development, branding initiatives, and networking events aimed at promoting our firm and attracting new clients. Strategic marketing investments are crucial for raising awareness of our services and expanding our client base.

Office Supplies: Office supplies expenses amount to $20,000 or 2% of our total expenses. This includes stationery, printing materials, and other supplies essential for daily operations. Implementing cost-control measures and streamlining procurement processes can help manage office supplies expenses effectively.

Professional Fees: Professional fees total $50,000 or 5% of our total expenses. This includes fees paid to external consultants, auditors, and other professional service providers. Negotiating competitive rates and leveraging these partnerships strategically can help optimize professional fees while accessing specialized expertise.

Technology Expenses: Technology expenses amount to $60,000 or 6% of our total expenses. This includes software licenses, IT infrastructure, cybersecurity measures, and technology upgrades necessary for supporting our firm's operations. Investing in cutting-edge technology solutions can enhance efficiency, collaboration, and data security within our organization.

Insurance: Insurance expenses total $40,000 or 4% of our total expenses. This includes premiums for professional liability insurance, property insurance, and other coverage necessary for protecting our firm against potential risks and liabilities. Reviewing insurance policies regularly and adjusting coverage as needed can help manage insurance expenses effectively.

Miscellaneous: Miscellaneous expenses account for $50,000 or 5% of our total expenses. This category encompasses various miscellaneous costs not covered by other expense categories. Analyzing and categorizing miscellaneous expenses can help identify areas for cost savings and efficiency improvements.

Other Overhead Costs: Other overhead costs amount to $100,000 or 10% of our total expenses. This includes miscellaneous overhead expenses such as administrative costs, maintenance expenses, and other operational overhead not captured in other categories. Implementing cost-control measures and optimizing overhead expenses can contribute to overall cost efficiency and profitability.

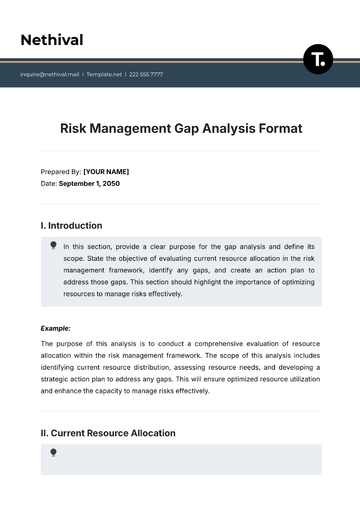

IV. Profitability Ratios

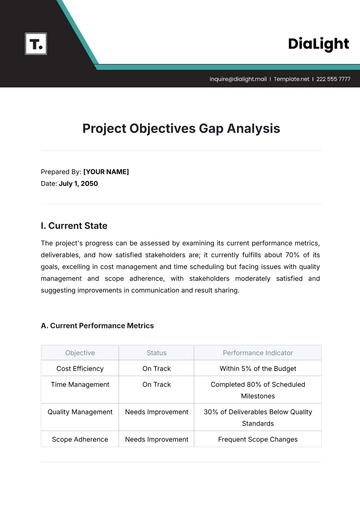

Calculating profitability ratios such as gross profit margin, net profit margin, and return on equity provides valuable insights into our firm's ability to generate profit relative to revenue, assets, and equity. These ratios serve as key performance indicators for evaluating our financial health.

Profitability Ratio | Value |

|---|---|

Gross Profit Margin | 65% |

Net Profit Margin | 25% |

Return on Equity (ROE) | 20% |

Gross Profit Margin: The gross profit margin measures the percentage of revenue that exceeds the cost of goods sold (COGS), representing the profitability of our core legal services. In this table, our gross profit margin is calculated at 65%, indicating that 65 cents of every dollar of revenue is retained after accounting for the direct costs associated with delivering our legal services.

Net Profit Margin: The net profit margin reflects the percentage of revenue that remains as net income after deducting all expenses, including COGS, operating expenses, taxes, and interest. In this table, our net profit margin is calculated at 25%, signifying that 25 cents of every dollar of revenue translates into net income for our firm.

Return on Equity (ROE): Return on equity (ROE) measures the profitability of our firm relative to the equity invested by our shareholders or partners. It indicates the efficiency with which our firm generates profits from the equity capital contributed by stakeholders. In this table, our ROE is calculated at 20%, indicating that for every dollar of equity invested, our firm generates a return of 20 cents in net income.

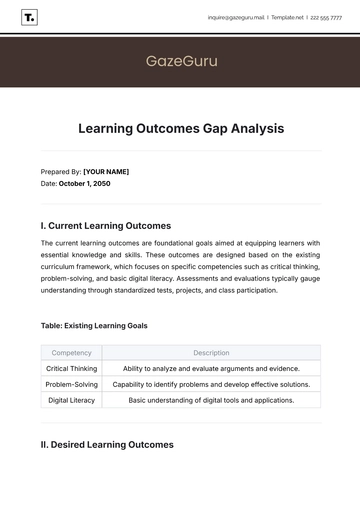

V. Cost per Hour Analysis

Analyzing the average cost per billable hour helps us determine our pricing strategy and assess the efficiency of our operations. By understanding the cost implications of our billable hours, we can make informed decisions to maximize profitability while providing value to our clients.

Attorney Level | Average Hourly Cost ($) |

|---|---|

Partner | 400 |

Senior Associate | 300 |

Associate | 200 |

Paralegal | 100 |

Partner: The average hourly cost for a partner's time is $400. Partners typically have extensive experience and expertise, commanding higher billing rates reflecting their seniority and specialized skills.

Senior Associate: The average hourly cost for a senior associate is $300. Senior associates possess significant legal knowledge and experience, often handling complex legal matters under the guidance of partners.

Associate: The average hourly cost for an associate is $200. Associates are typically early-career attorneys who provide legal research, drafting, and support services under the supervision of senior attorneys.

Paralegal: The average hourly cost for a paralegal is $100. Paralegals assist attorneys with legal research, document preparation, and administrative tasks, offering valuable support at a lower cost compared to attorneys.

VI. Client Analysis

Understanding our clients is essential for delivering tailored legal services, building strong relationships, and maximizing profitability. Our client analysis delves into various aspects of our client base to identify trends, preferences, and opportunities for growth. By segmenting our clients and analyzing their characteristics, behaviors, and needs, we can optimize resource allocation, enhance client satisfaction, and drive sustainable business growth.

A. Client Segmentation

Segmenting our client base allows us to categorize clients based on various criteria such as industry, size, legal needs, and revenue contribution. Common client segments may include:

Corporate Clients: Businesses ranging from small startups to large corporations seeking legal advice and representation in corporate transactions, compliance matters, and litigation.

Individual Clients: Individuals requiring legal services for personal matters such as estate planning, family law, real estate transactions, and personal injury claims.

Industry-Specific Clients: Clients operating in specific industries such as healthcare, technology, finance, real estate, and entertainment, each with unique legal needs and challenges.

High-Value Clients: Clients with significant revenue potential, long-term relationships, or strategic importance to our firm, warranting special attention and customized service offerings.

Referral Partners: Other law firms, professionals, or organizations referring clients to us for specialized legal expertise, collaboration, or co-counsel arrangements.

B. Client Relationship Management

Effective client relationship management is crucial for fostering loyalty, trust, and repeat business. Our client analysis involves assessing the strength and depth of our relationships with individual clients and client segments. Key factors to consider include:

Client Satisfaction: Soliciting feedback, conducting surveys, and monitoring client interactions to gauge satisfaction levels and identify areas for improvement.

Client Communication: Maintaining open and transparent communication channels to keep clients informed, address concerns promptly, and provide updates on their legal matters.

Client Retention: Implementing retention strategies such as loyalty programs, personalized services, and value-added offerings to encourage repeat business and foster long-term loyalty.

Client Referrals: Leveraging satisfied clients as advocates for our firm, encouraging referrals, and building a network of trusted referral partners to expand our client base.

C. Client Profitability Analysis

Analyzing the profitability of individual clients or client segments is essential for optimizing resource allocation and maximizing profitability. Key metrics to consider in client profitability analysis include:

Revenue Contribution: Assessing the revenue generated by each client or client segment and identifying high-value clients that contribute significantly to our firm's revenue.

Profit Margins: Calculating the profitability of serving individual clients by comparing revenue generated with the cost of delivering services, including attorney time, overhead, and other expenses.

Client Lifetime Value: Estimating the long-term value of client relationships by considering factors such as revenue potential, retention rates, and referral opportunities over the client's lifetime.

Cost-to-Serve: Evaluating the cost-effectiveness of serving different clients based on the resources and effort required to meet their needs relative to the revenue generated.

D. Client Demographics and Preferences

Analyzing client demographics, preferences, and behavior patterns provides insights into their needs, expectations, and decision-making processes. Key aspects to consider include:

Demographic Profile: Understanding the demographic characteristics of our clients, such as age, gender, income level, geographic location, and industry affiliation.

Legal Needs and Preferences: Identifying the specific legal needs, priorities, and pain points of our clients, and tailoring our services and solutions to meet their requirements.

Communication Preferences: Recognizing how clients prefer to communicate (e.g., email, phone, in-person meetings) and adapting our communication strategies accordingly to enhance engagement and satisfaction.

Legal Technology Adoption: Assessing clients' readiness to embrace legal technology solutions, online platforms, and self-service options for accessing legal services and information.

E. Client Acquisition and Retention Strategies

Developing effective client acquisition and retention strategies is critical for sustaining business growth and profitability. Our client analysis informs the development of targeted strategies aimed at:

Client Acquisition: Identifying opportunities to attract new clients through targeted marketing campaigns, networking events, referral programs, and strategic partnerships.

Client Onboarding: Streamlining the onboarding process to make it seamless and efficient for new clients, ensuring a positive first impression and setting the stage for long-term relationships.

Client Retention: Implementing retention initiatives such as client appreciation events, exclusive benefits, ongoing communication, and proactive legal guidance to strengthen loyalty and reduce churn.

Client Win-Back: Re-engaging with former clients or inactive accounts through targeted outreach, special offers, and reactivation campaigns to win back their business and rekindle relationships.

VII. Conclusion

In conclusion, our profitability analysis reveals valuable insights into the financial health and performance of [Your Company Name]. By continuously evaluating our revenue streams, expenses, client relationships, and practice areas, we can identify opportunities for growth and optimization. Through strategic decision-making and a commitment to excellence, we remain dedicated to achieving our financial goals and delivering unparalleled value to our clients.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Evaluate your law firm's profitability with Template.net's Law Firm Profitability Analysis Template. Editable in our AI Editor Tool, this customizable template provides a structured format for analyzing revenue, expenses, and profit margins to assess the financial health of your firm. Enhance financial visibility, identify areas for improvement, and make informed decisions effortlessly with Template.net!