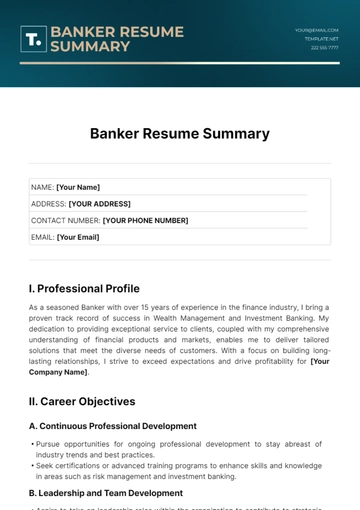

Free Banker Resume Summary

NAME: [Your Name] |

ADDRESS: [YOUR ADDRESS] |

CONTACT NUMBER: [YOUR PHONE NUMBER] |

EMAIL: [Your Email] |

I. Professional Profile

As a seasoned Banker with over 15 years of experience in the finance industry, I bring a proven track record of success in Wealth Management and Investment Banking. My dedication to providing exceptional service to clients, coupled with my comprehensive understanding of financial products and markets, enables me to deliver tailored solutions that meet the diverse needs of customers. With a focus on building long-lasting relationships, I strive to exceed expectations and drive profitability for [Your Company Name].

II. Career Objectives

A. Continuous Professional Development

Pursue opportunities for ongoing professional development to stay abreast of industry trends and best practices.

Seek certifications or advanced training programs to enhance skills and knowledge in areas such as risk management and investment banking.

B. Leadership and Team Development

Aspire to take on leadership roles within the organization to contribute to strategic decision-making and foster a culture of excellence.

Mentor and develop junior team members to empower them to achieve their full potential and contribute to the success of the team.

III. Key Skills and Expertise

A. Financial Analysis and Risk Management

Proficient in conducting in-depth financial analysis to assess risk and identify opportunities for optimization.

Skilled in evaluating creditworthiness and developing strategies to mitigate risk exposure.

Experienced in implementing risk management policies and procedures to ensure compliance with regulatory standards.

B. Client Relationship Management

Exceptional interpersonal skills with a proven ability to cultivate and maintain strong relationships with clients.

Effective at understanding client needs and delivering personalized financial solutions to meet their goals.

Demonstrated success in cross-selling products and services to increase revenue and enhance customer satisfaction.

C. Investment Banking

Extensive knowledge of investment products and strategies, including equities, fixed income, and derivatives.

Proficient in executing complex transactions and providing strategic advice to clients on mergers, acquisitions, and capital raising.

Skilled in conducting due diligence and financial modeling to support investment decisions.

IV. Professional Experience

Wealth Manager: [Previous Company Name], [Location] (2053-2063)

Managed a portfolio of high-net-worth clients, exceeding sales targets by 20% through proactive relationship management and strategic cross-selling initiatives.

Led a team of 10 bankers, providing mentorship and guidance to drive performance and achieve business objectives.

Collaborated with internal stakeholders to develop innovative product offerings and enhance the client experience.

Investment Banker: [Previous Company Name], [Location] (2063-2073)

Developed and executed tailored financial plans for clients, resulting in a 30% increase in assets under management.

Conducted comprehensive financial reviews to identify opportunities for portfolio optimization and risk mitigation.

Cultivated new business relationships and expanded market presence through networking and referrals.

V. Achievements

Recognized as "Top Performer of the Year" for outstanding performance in 2058.

Achieved a milestone of $1 billion in assets under management, resulting in increased revenue and market share.

Received positive feedback from clients and colleagues for successfully navigating volatile market conditions and delivering exceptional results.

VI. Education

MBA in Finance: Harvard Business School, Boston (2053)

Bachelor of Science in Economics: Stanford University, California (2050)

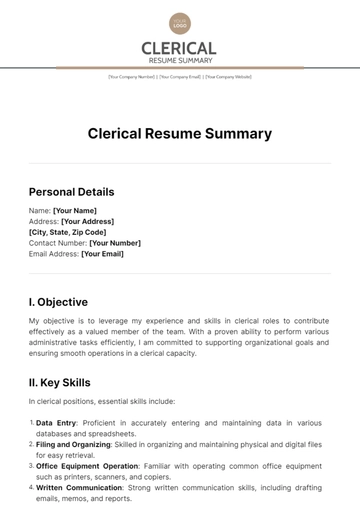

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

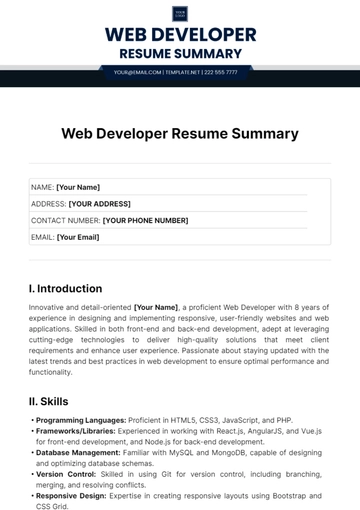

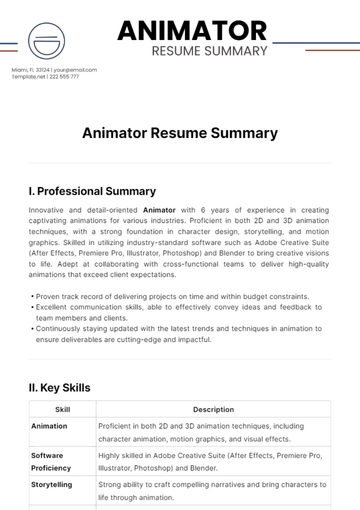

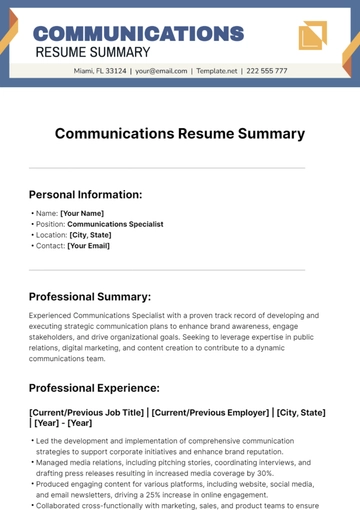

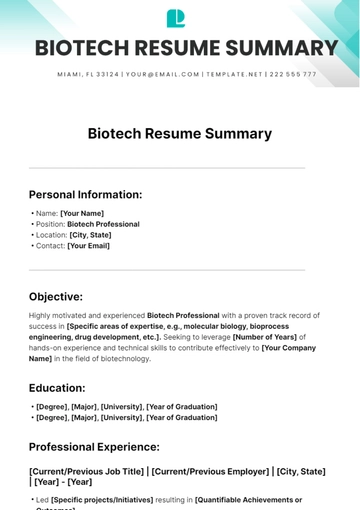

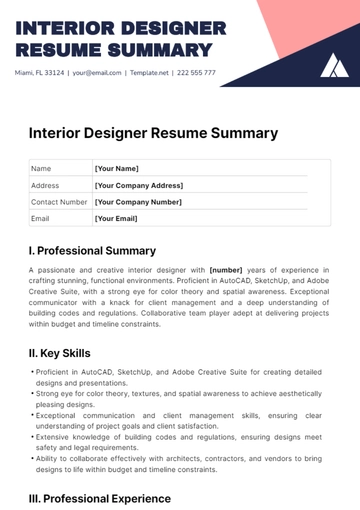

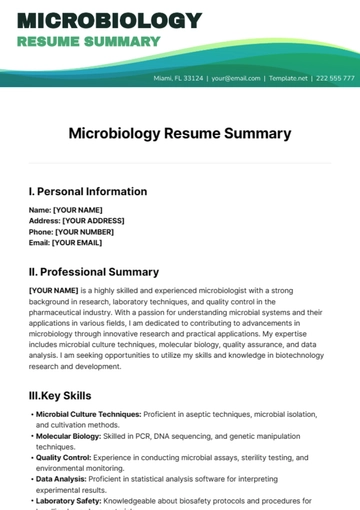

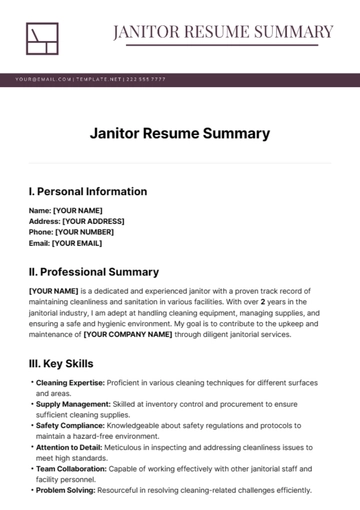

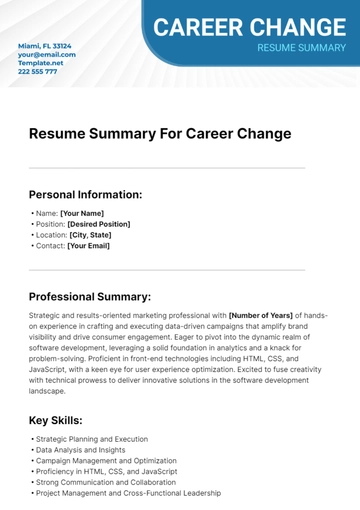

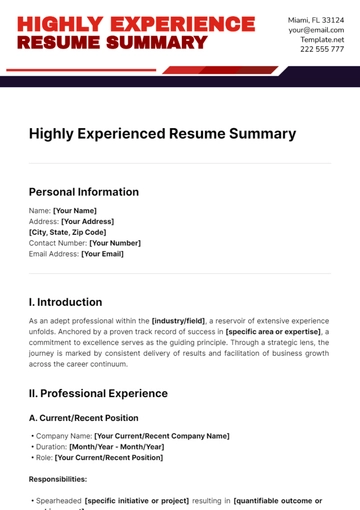

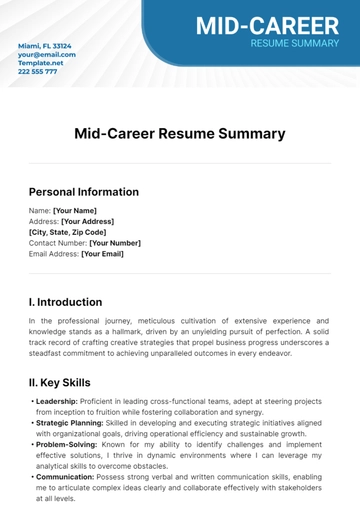

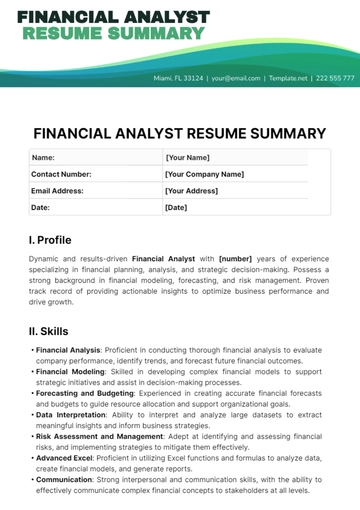

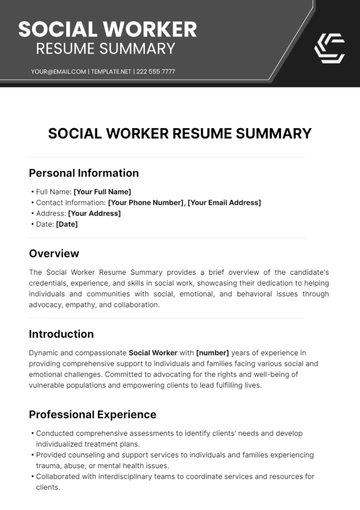

Crafting the perfect resume is now simpler than ever with Template.net's Banker Resume Summary Template. This meticulously designed template offers a blend of professionalism and style, ensuring your credentials shine. Fully editable and customizable, it empowers you to tailor your summary effortlessly. Compatible with our AI Editor Tool, achieving a standout resume has never been easier.

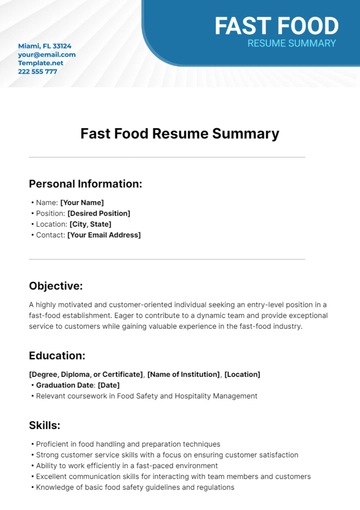

You may also like

- Simple Resume

- High School Resume

- Actor Resume

- Accountant Resume

- Academic Resume

- Corporate Resume

- Infographic Resume

- Sale Resume

- Business Analyst Resume

- Skills Based Resume

- Professional Resume

- ATS Resume

- Summary Resume

- Customer Service Resume

- Software Engineer Resume

- Data Analyst Resume

- Functional Resume

- Project Manager Resume

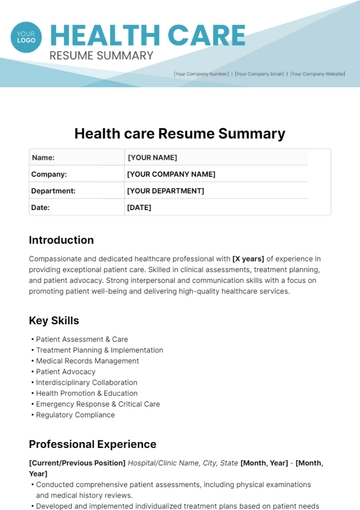

- Nurse Resume

- Federal Resume

- Server Resume

- Administrative Assistant Resume

- Sales Associate Resume

- CNA Resume

- Bartender Resume

- Graduate Resume

- Engineer Resume

- Data Science Resume

- Warehouse Resume

- Volunteer Resume

- No Experience Resume

- Chronological Resume

- Marketing Resume

- Executive Resume

- Truck Driver Resume

- Cashier Resume

- Resume Format

- Two Page Resume

- Basic Resume

- Manager Resume

- Supervisor Resume

- Director Resume

- Blank Resume

- One Page Resume

- Developer Resume

- Caregiver Resume

- Personal Resume

- Consultant Resume

- Administrator Resume

- Officer Resume

- Medical Resume

- Job Resume

- Technician Resume

- Clerk Resume

- Driver Resume

- Data Entry Resume

- Freelancer Resume

- Operator Resume

- Printable Resume

- Worker Resume

- Student Resume

- Doctor Resume

- Merchandiser Resume

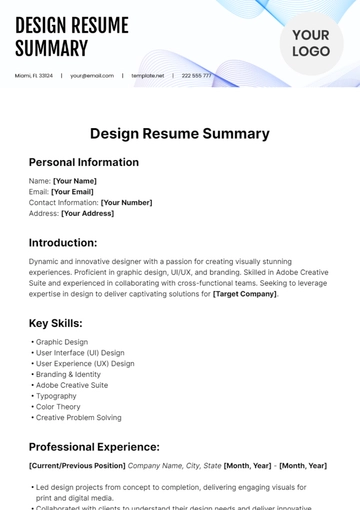

- Architecture Resume

- Photographer Resume

- Chef Resume

- Lawyer Resume

- Secretary Resume

- Customer Support Resume

- Computer Operator Resume

- Programmer Resume

- Pharmacist Resume

- Electrician Resume

- Librarian Resume

- Computer Resume

- IT Resume

- Experience Resume

- Instructor Resume

- Fashion Designer Resume

- Mechanic Resume

- Attendant Resume

- Principal Resume

- Professor Resume

- Safety Resume

- Waitress Resume

- MBA Resume

- Security Guard Resume

- Editor Resume

- Tester Resume

- Auditor Resume

- Writer Resume

- Trainer Resume

- Advertising Resume

- Harvard Resume

- Receptionist Resume

- Buyer Resume

- Physician Resume

- Scientist Resume

- 2 Page Resume

- Therapist Resume

- CEO resume

- General Manager Resume

- Attorney Resume

- Project Coordinator Resume

- Bus Driver Resume

- Cook Resume

- Artist Resume

- Pastor Resume

- Recruiter Resume

- Team Leader Resume

- Apprentice Resume

- Police Resume

- Military Resume

- Personal Trainer Resume

- Contractor Resume

- Dietician Resume

- First Job Resume

- HVAC Resume

- Psychologist Resume

- Public Relations Resume

- Support Specialist Resume

- Computer Technician Resume

- Drafter Resume

- Foreman Resume

- Underwriter Resume

- Photo Resume

- Teacher Resume

- Modern Resume

- Fresher Resume

- Creative Resume

- Internship Resume

- Graphic Designer Resume

- College Resume