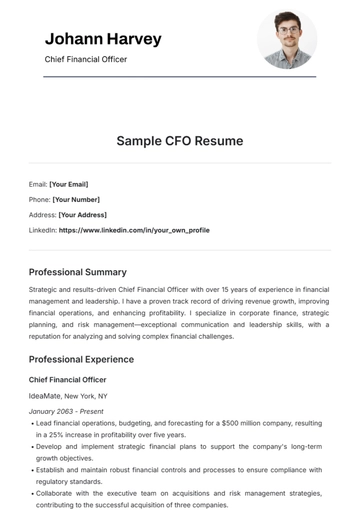

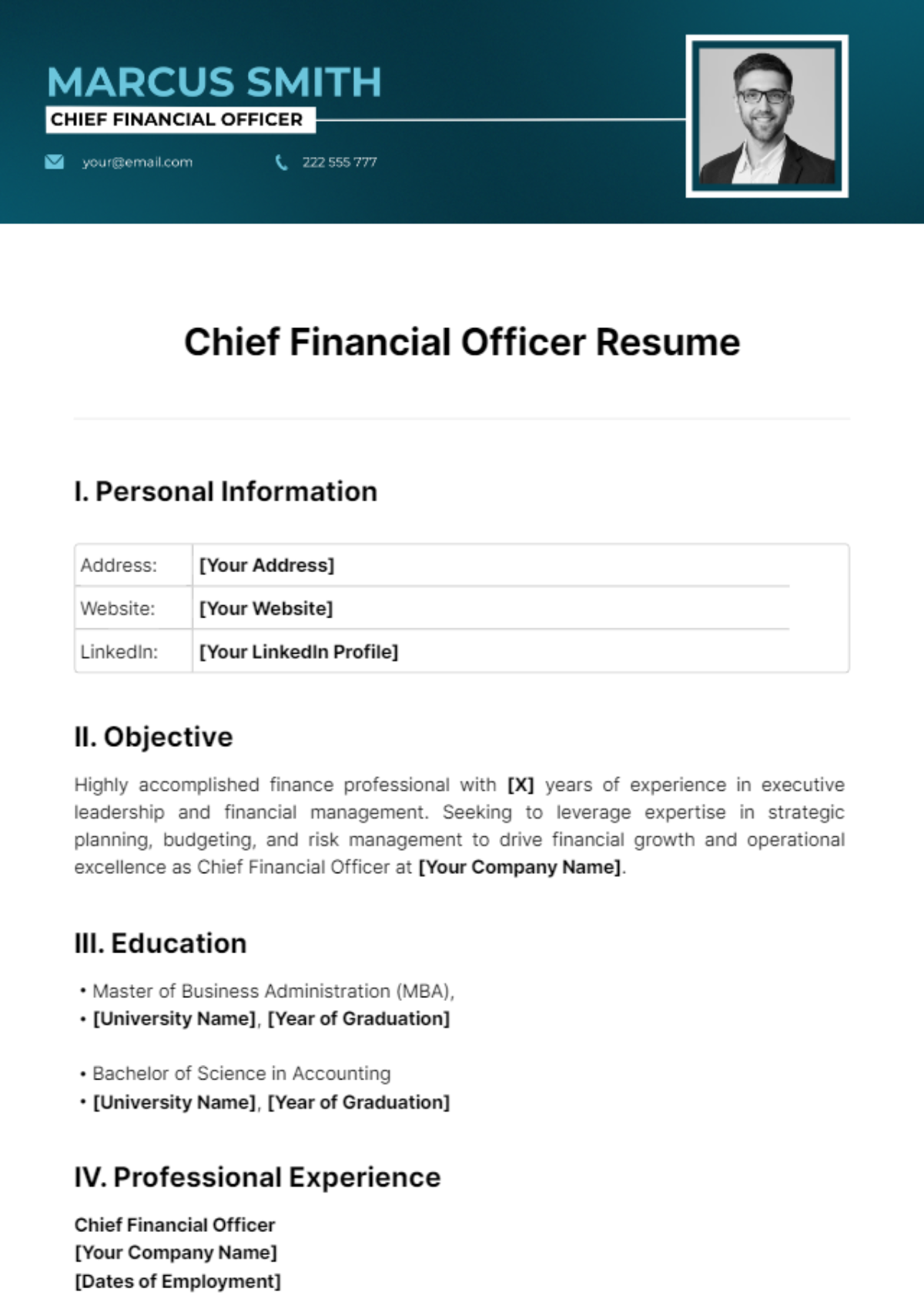

Free Chief Financial Officer Resume

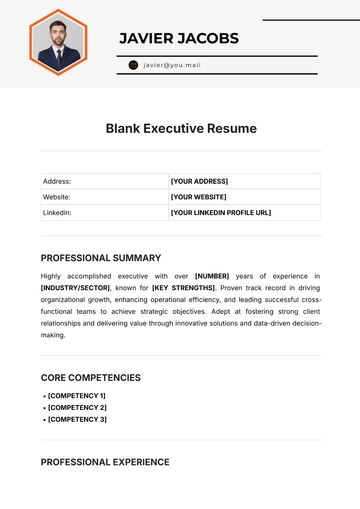

I. Personal Information

Address: | [Your Address] |

Website: | [Your Website] |

LinkedIn: | [Your LinkedIn Profile] |

II. Objective

Highly accomplished finance professional with [X] years of experience in executive leadership and financial management. Seeking to leverage expertise in strategic planning, budgeting, and risk management to drive financial growth and operational excellence as Chief Financial Officer at [Your Company Name].

III. Education

Master of Business Administration (MBA),

[University Name], [Year of Graduation]

Bachelor of Science in Accounting

[University Name], [Year of Graduation]

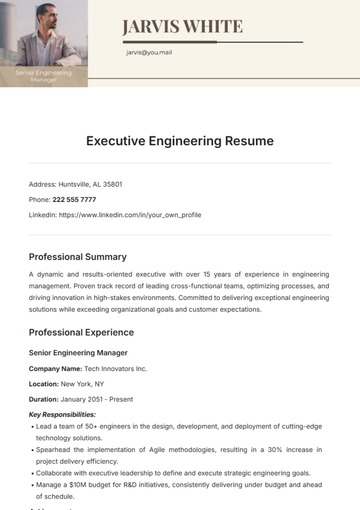

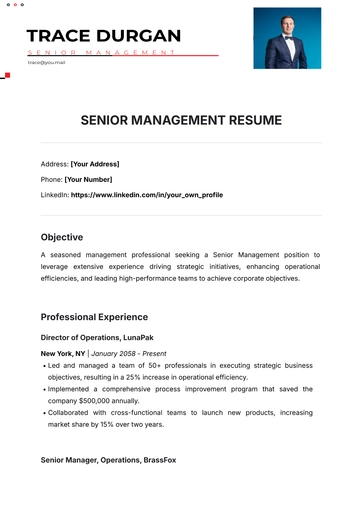

IV. Professional Experience

Chief Financial Officer

[Your Company Name]

[Dates of Employment]

Led financial planning and analysis, budgeting, and forecasting processes, resulting in a [X]% increase in revenue.

Implemented cost-saving initiatives, reducing expenses by [X]% while maintaining operational efficiency.

Spearheaded financial strategy development and execution to support business objectives and drive growth.

Oversaw financial reporting and compliance activities, ensuring accuracy and adherence to regulatory requirements.

Finance Manager

[Previous Company Name]

[Dates of Employment]

Directed financial operations, including accounting, treasury, and financial reporting functions.

Implemented internal controls and processes to mitigate financial risks and improve transparency.

Collaborated with cross-functional teams to optimize resource allocation and drive business performance.

Prepared financial statements, management reports, and presentations for executive leadership and stakeholders.

V. Skills

Financial planning and analysis

Budgeting and forecasting

Strategic financial management

Risk assessment and mitigation

Regulatory compliance

Team leadership and development

Excellent communication and interpersonal skills

Proficient in financial software and tools

VI. Certifications

Certified Public Accountant (CPA) American Institute of CPAs [Year]

Chartered Financial Analyst (CFA) CFA Institute

VII. Achievements

Given the "Finance Leader of the Year" award performance and leadership.

Implemented financial restructuring, increasing profitability by 20%.

Led ERP system implementation, improving reporting efficiency by 30%.

Secured a significant line of credit, bolstering financial position.

Developed risk management framework, reducing risks by 25%.

Optimized working capital, improving cash flow by 15%.

Facilitated successful acquisition integration ahead of schedule.

Mentored team, fostering improved performance and career growth.

VIII. References

Available upon request.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

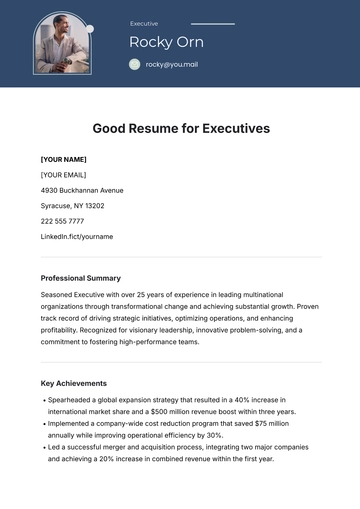

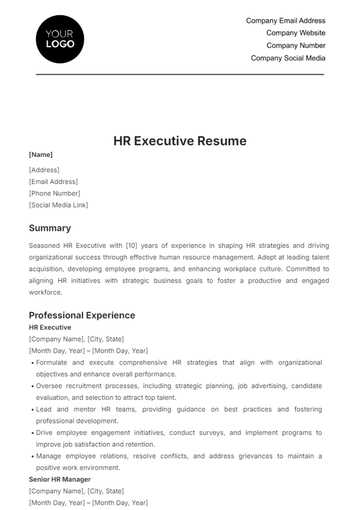

Introducing the Chief Financial Officer Resume Template, a premier offering from Template.net for top-tier finance executives. This editable masterpiece is fully customizable, ensuring your experience and achievements shine through flawlessly. Tailor your resume with precision using our Ai Editor Tool, guaranteeing a polished presentation of your leadership prowess. Secure your next career milestone with confidence using this exceptional template.

You may also like

- Simple Resume

- High School Resume

- Actor Resume

- Accountant Resume

- Academic Resume

- Corporate Resume

- Infographic Resume

- Sale Resume

- Business Analyst Resume

- Skills Based Resume

- Professional Resume

- ATS Resume

- Summary Resume

- Customer Service Resume

- Software Engineer Resume

- Data Analyst Resume

- Functional Resume

- Project Manager Resume

- Nurse Resume

- Federal Resume

- Server Resume

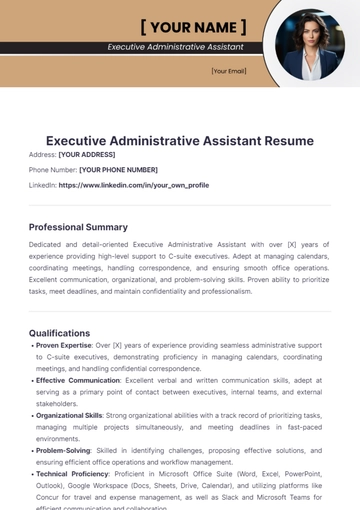

- Administrative Assistant Resume

- Sales Associate Resume

- CNA Resume

- Bartender Resume

- Graduate Resume

- Engineer Resume

- Data Science Resume

- Warehouse Resume

- Volunteer Resume

- No Experience Resume

- Chronological Resume

- Marketing Resume

- Executive Resume

- Truck Driver Resume

- Cashier Resume

- Resume Format

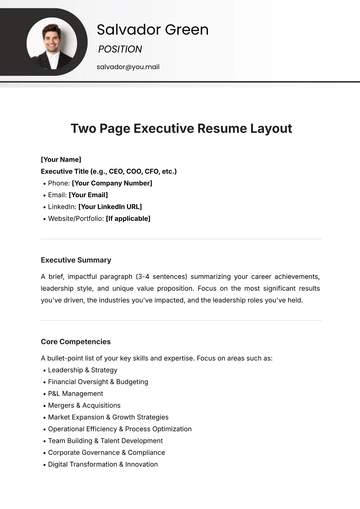

- Two Page Resume

- Basic Resume

- Manager Resume

- Supervisor Resume

- Director Resume

- Blank Resume

- One Page Resume

- Developer Resume

- Caregiver Resume

- Personal Resume

- Consultant Resume

- Administrator Resume

- Officer Resume

- Medical Resume

- Job Resume

- Technician Resume

- Clerk Resume

- Driver Resume

- Data Entry Resume

- Freelancer Resume

- Operator Resume

- Printable Resume

- Worker Resume

- Student Resume

- Doctor Resume

- Merchandiser Resume

- Architecture Resume

- Photographer Resume

- Chef Resume

- Lawyer Resume

- Secretary Resume

- Customer Support Resume

- Computer Operator Resume

- Programmer Resume

- Pharmacist Resume

- Electrician Resume

- Librarian Resume

- Computer Resume

- IT Resume

- Experience Resume

- Instructor Resume

- Fashion Designer Resume

- Mechanic Resume

- Attendant Resume

- Principal Resume

- Professor Resume

- Safety Resume

- Waitress Resume

- MBA Resume

- Security Guard Resume

- Editor Resume

- Tester Resume

- Auditor Resume

- Writer Resume

- Trainer Resume

- Advertising Resume

- Harvard Resume

- Receptionist Resume

- Buyer Resume

- Physician Resume

- Scientist Resume

- 2 Page Resume

- Therapist Resume

- CEO resume

- General Manager Resume

- Attorney Resume

- Project Coordinator Resume

- Bus Driver Resume

- Cook Resume

- Artist Resume

- Pastor Resume

- Recruiter Resume

- Team Leader Resume

- Apprentice Resume

- Police Resume

- Military Resume

- Personal Trainer Resume

- Contractor Resume

- Dietician Resume

- First Job Resume

- HVAC Resume

- Psychologist Resume

- Public Relations Resume

- Support Specialist Resume

- Computer Technician Resume

- Drafter Resume

- Foreman Resume

- Underwriter Resume

- Photo Resume

- Teacher Resume

- Modern Resume

- Fresher Resume

- Creative Resume

- Internship Resume

- Graphic Designer Resume

- College Resume