Financial Statement Analysis

Prepared By: | [YOUR NAME] |

Department: | [YOUR DEPARTMENT] |

Company: | [YOUR COMPANY NAME] |

I. Introduction

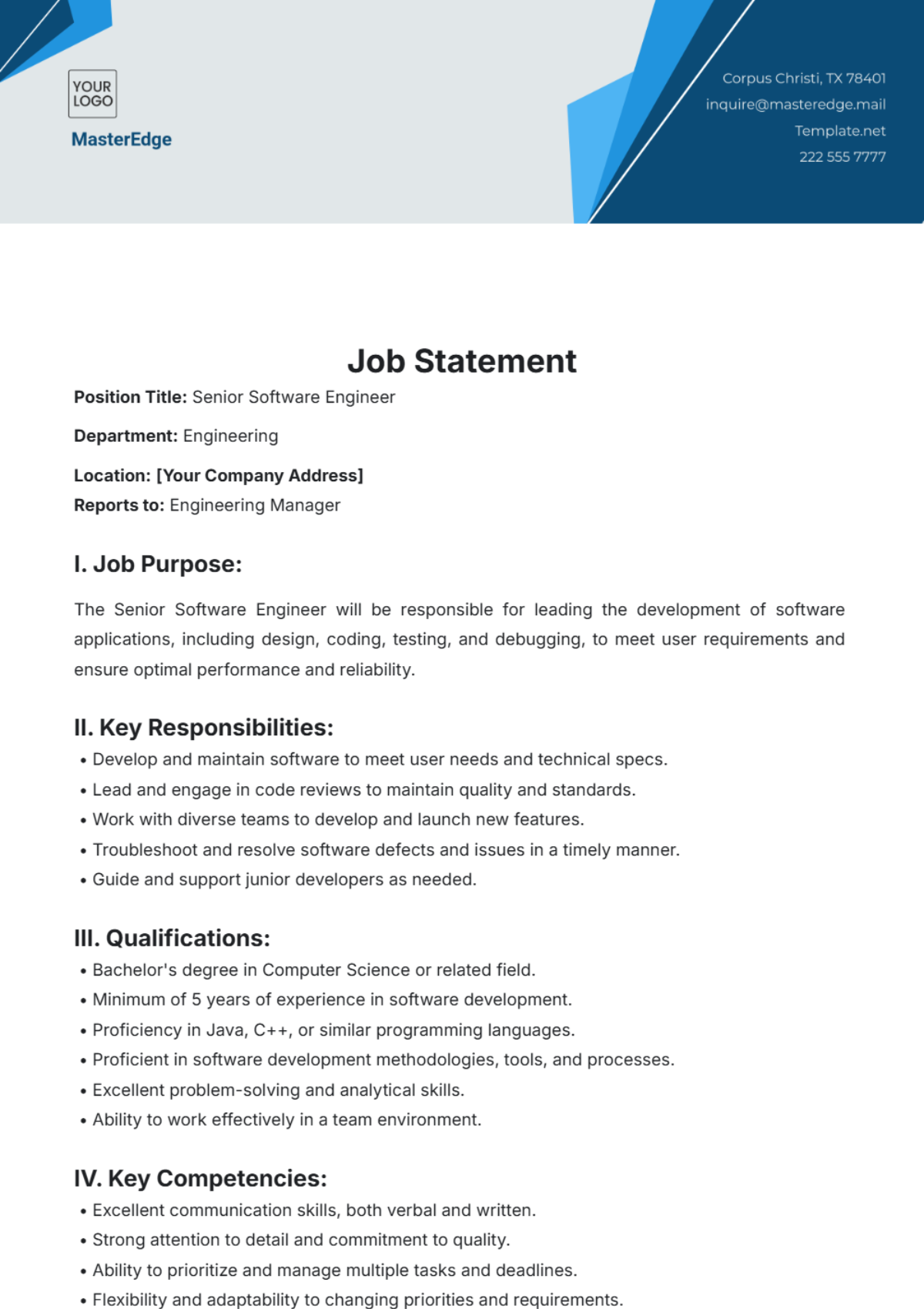

A. Purpose of Analysis

The purpose of this Financial Statement Analysis (FSA) is to evaluate the fiscal performance and well-being of [Your Company Name]. This analysis is prepared to provide investors and stakeholders with a comprehensive understanding of the company's financial health, aiding in informed decision-making.

B. Company Overview

Company Name: [Your Company Name]

Industry: Technology

Headquarters: [Your Company Address]

Founded: 2030

Key Products/Services:

Advanced AI Software Development

Quantum Computing Solutions

Cybersecurity Systems

IT Consulting Services

C. Analysis Period

Fiscal Year: 2050

Reporting Period: January 01, 2050 - December 31, 2050

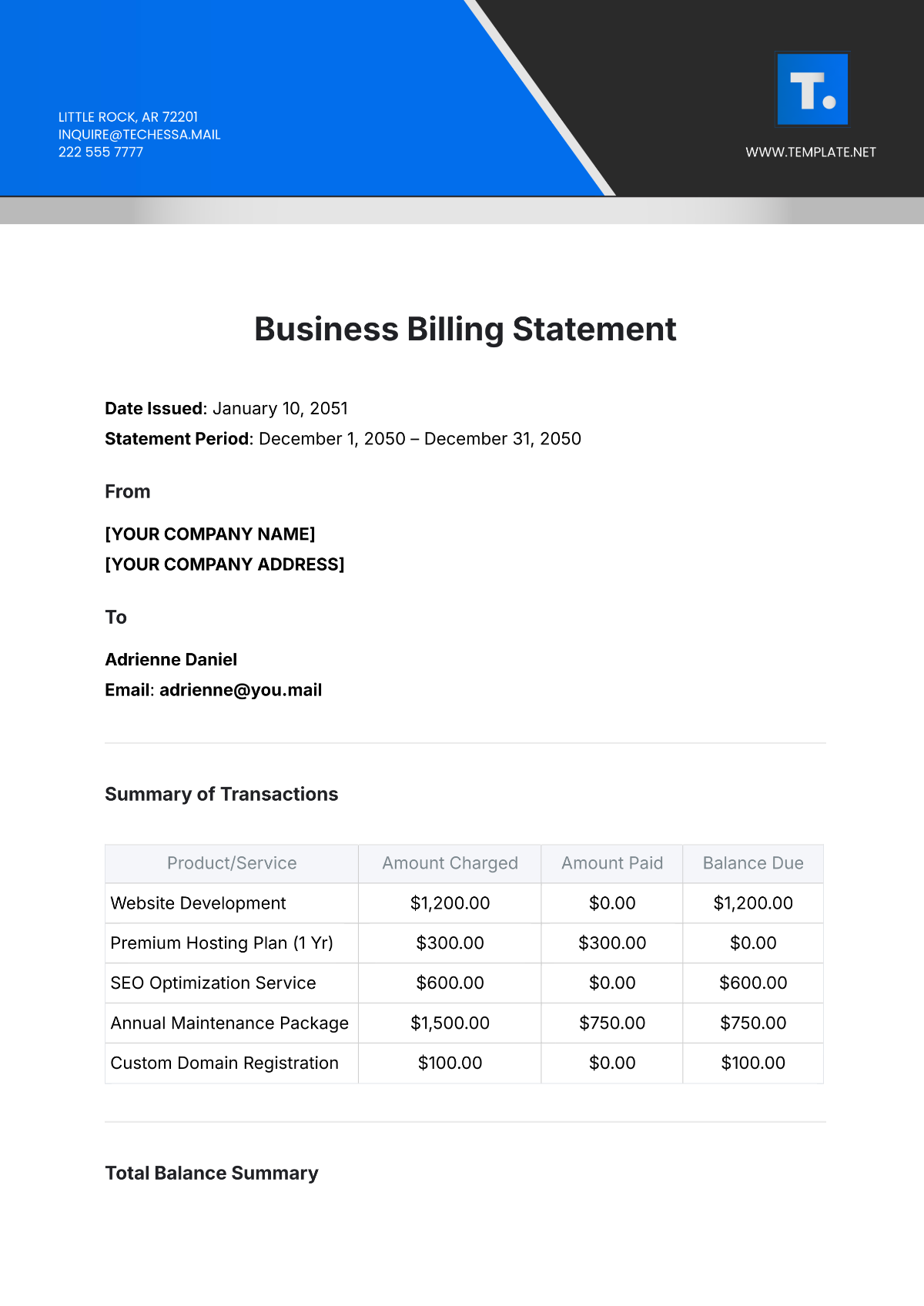

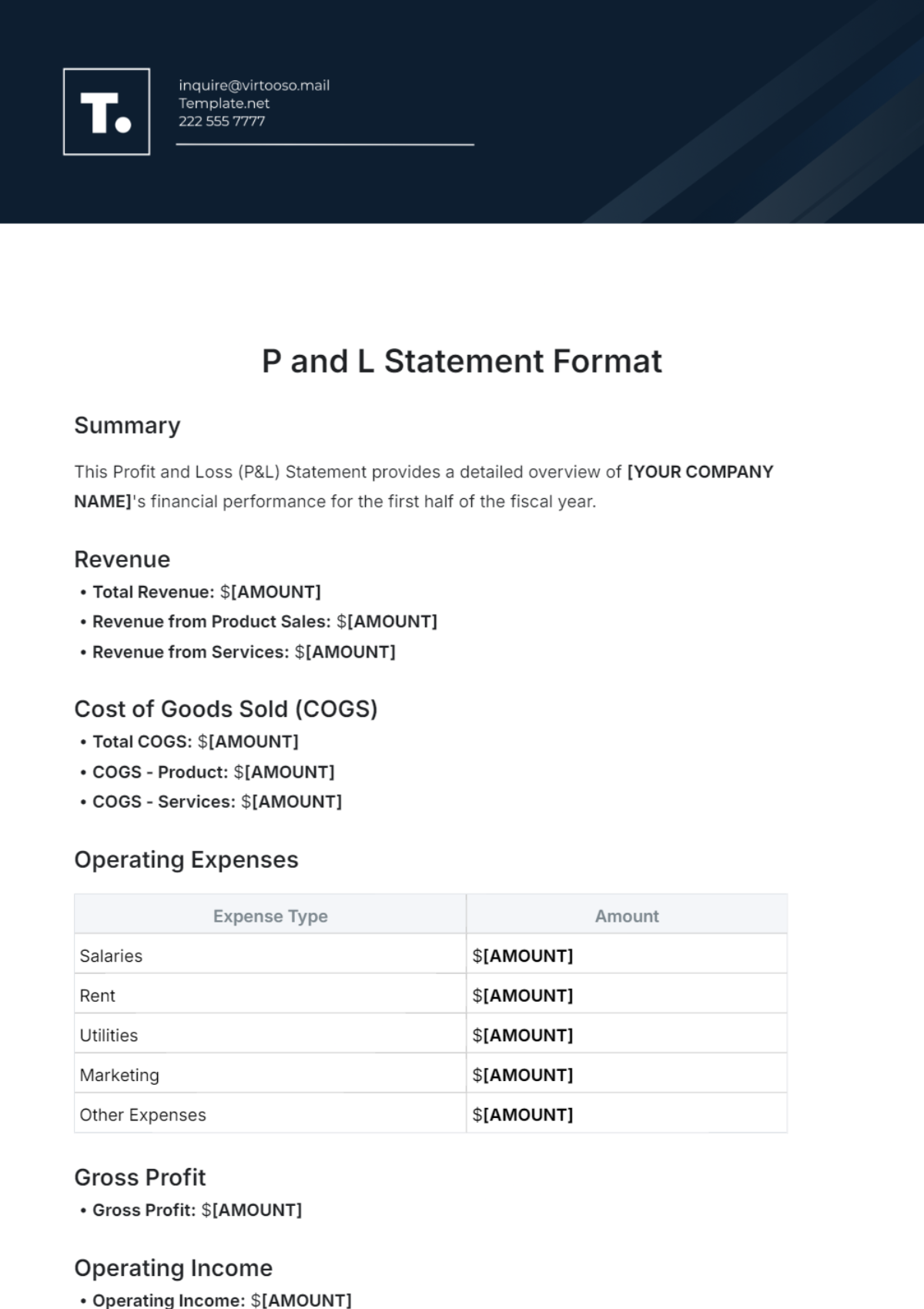

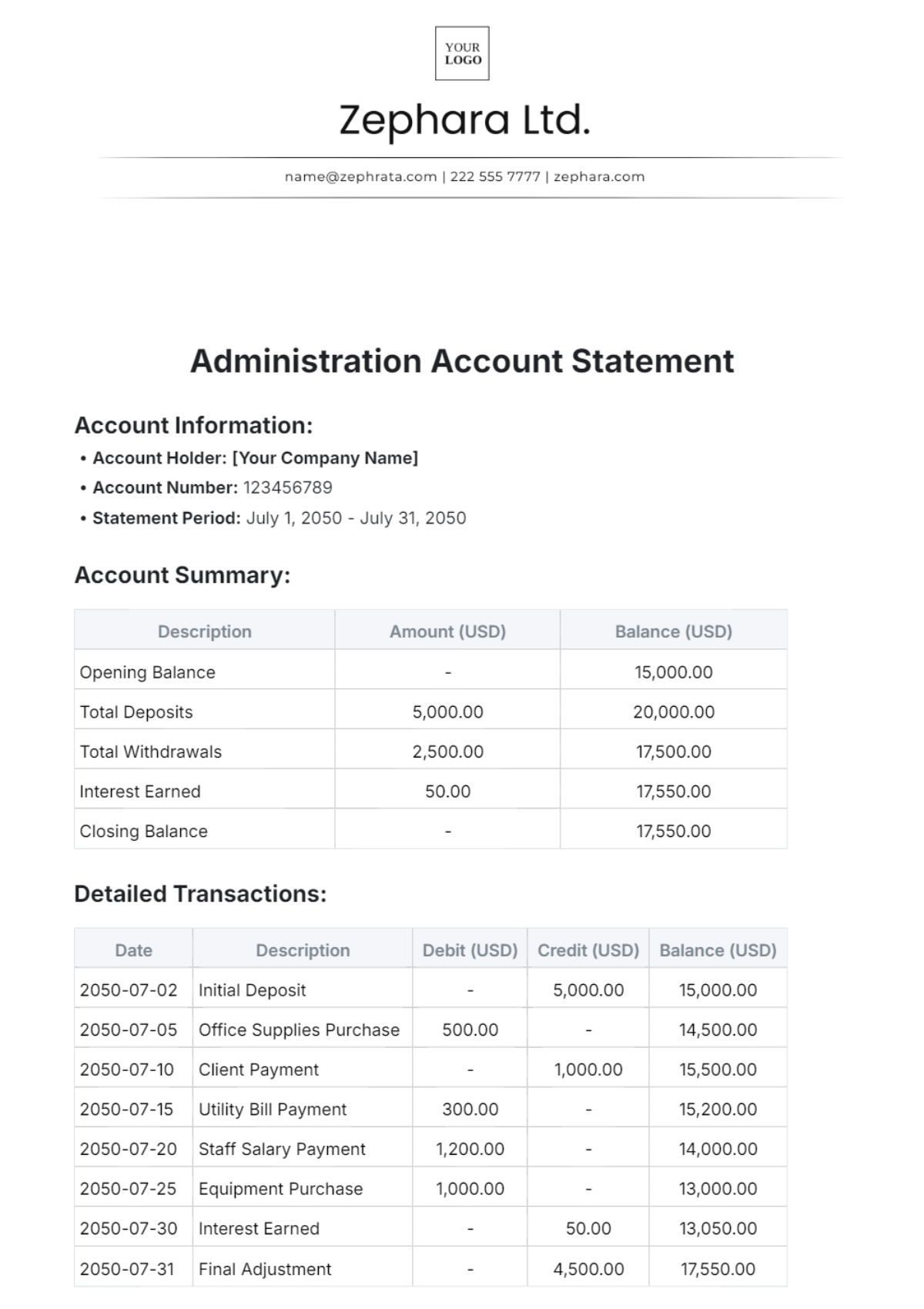

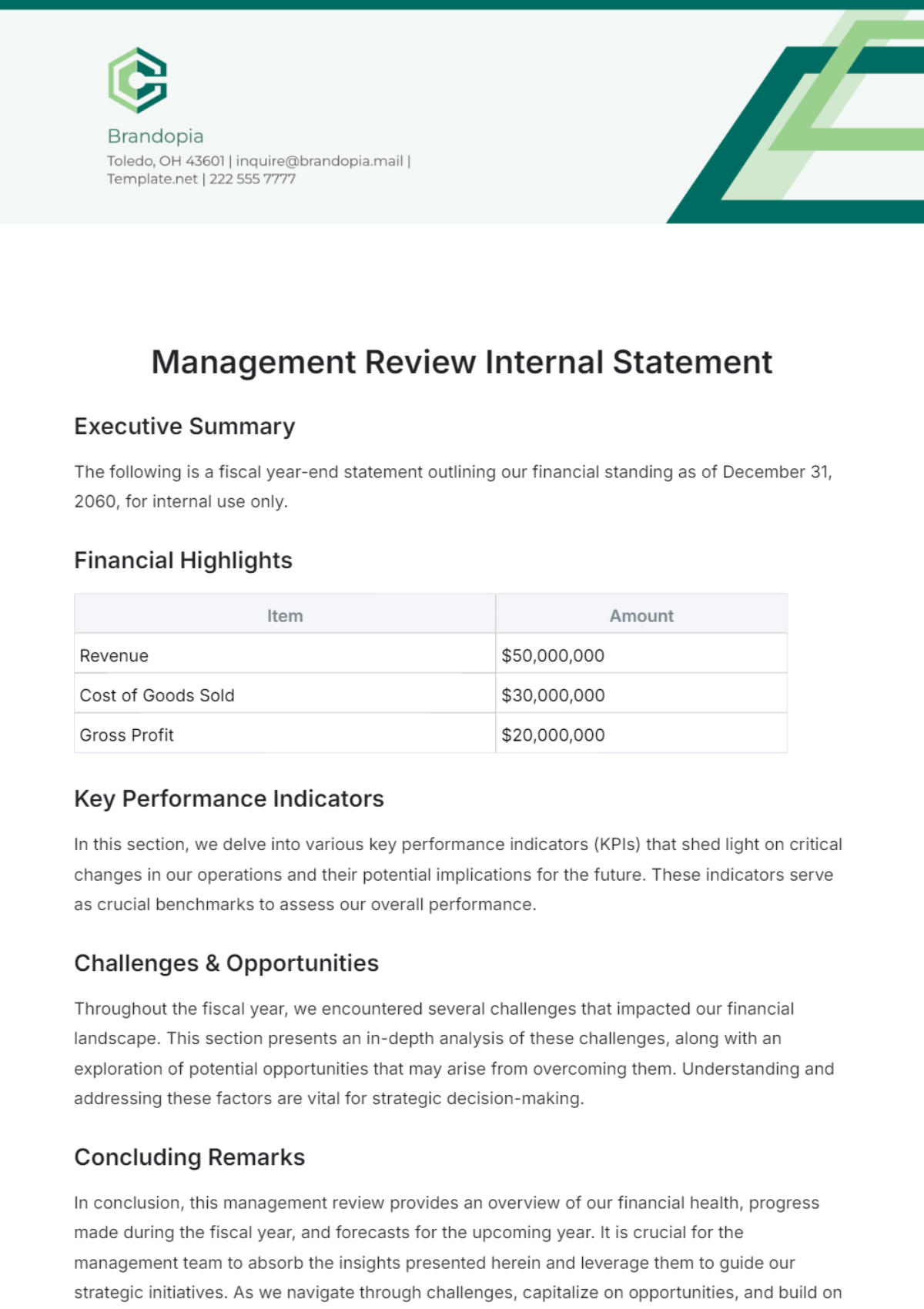

II. Financial Ratios Analysis

A. Profitability Ratios

Profitability ratios measure the ability of a company to generate profit relative to revenue, assets, and equity.

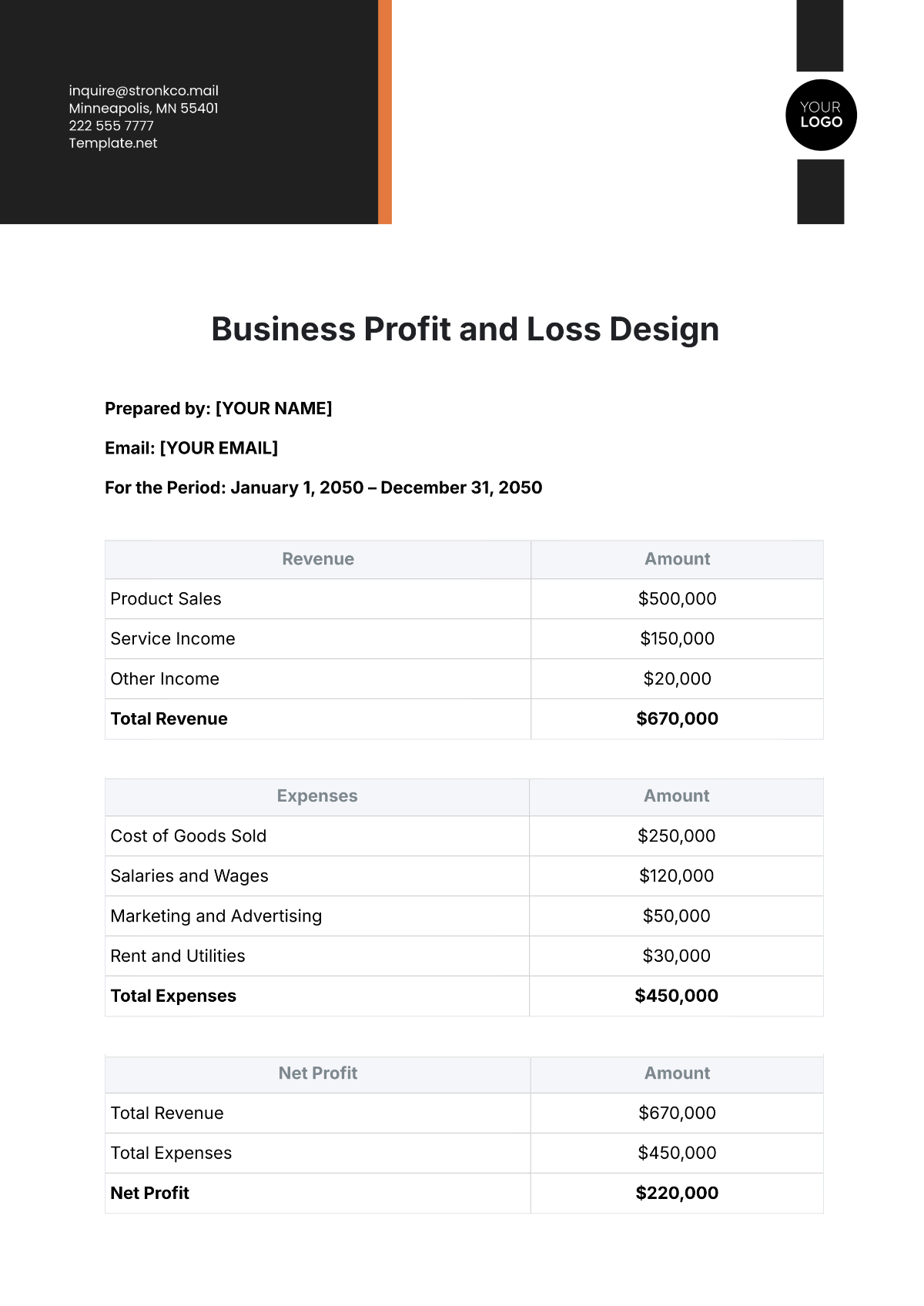

Gross Profit Margin: For [Your Company Name], the gross profit margin for the fiscal year 2050 was 65%, indicating the efficiency in producing goods and services compared to the revenue generated.

Net Profit Margin: The net profit margin for [Your Company Name] stands at 25%, reflecting the overall profitability after all expenses.

Return on Assets (ROA): The ROA is 15%, indicating how efficiently the company uses its assets to generate profit.

Return on Equity (ROE): The ROE for [Your Company Name] is 20%, showing the return generated on shareholders' investments.

B. Liquidity Ratios

Liquidity ratios assess a company's ability to meet its short-term obligations.

Current Ratio: [Your Company Name] has a current ratio of 3.0, indicating its capacity to cover short-term liabilities with short-term assets.

Quick Ratio: The quick ratio, at 2.5, measures the ability to meet short-term obligations without relying on inventory sales.

C. Solvency Ratios

Solvency ratios evaluate a company's ability to meet its long-term obligations.

Debt to Equity Ratio: The debt-to-equity ratio for [Your Company Name] is 0.3, reflecting the proportion of debt used in equity to finance the company's assets.

Interest Coverage Ratio: With an interest coverage ratio of 6.0, [Your Company Name] demonstrates its ability to cover interest expenses with earnings before interest and taxes.

D. Efficiency Ratios

Efficiency ratios measure how well a company utilizes its assets and manages its operations.

Asset Turnover Ratio: The asset turnover ratio of 0.7 indicates how efficiently [Your Company Name] uses its assets to generate sales.

Inventory Turnover Ratio: The inventory turnover ratio of 6.0 reflects how quickly inventory is sold and replaced.

Accounts Receivable Turnover Ratio: The accounts receivable turnover ratio of 8.0 shows how efficiently the company collects receivables from its customers.

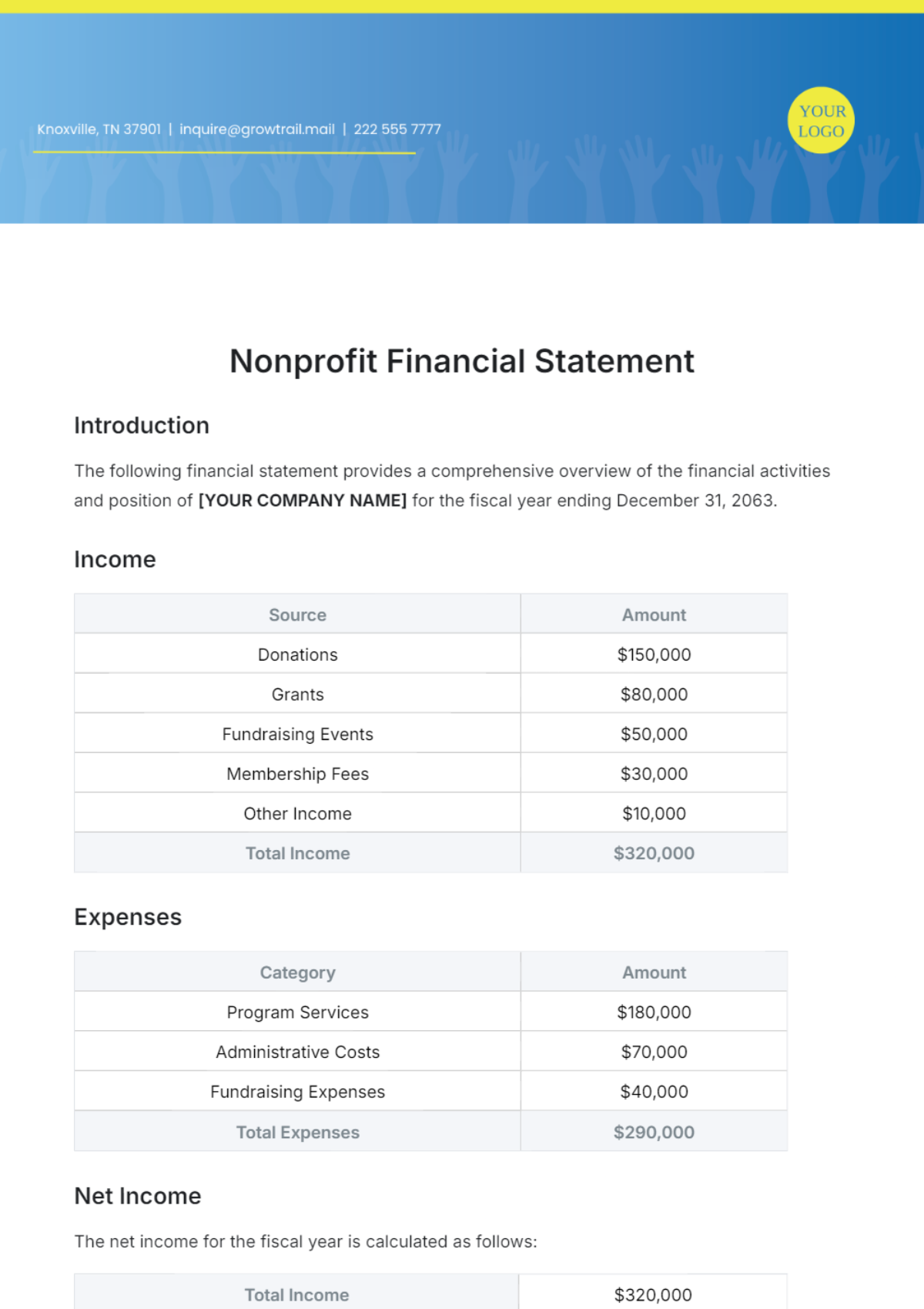

III. Trend Analysis

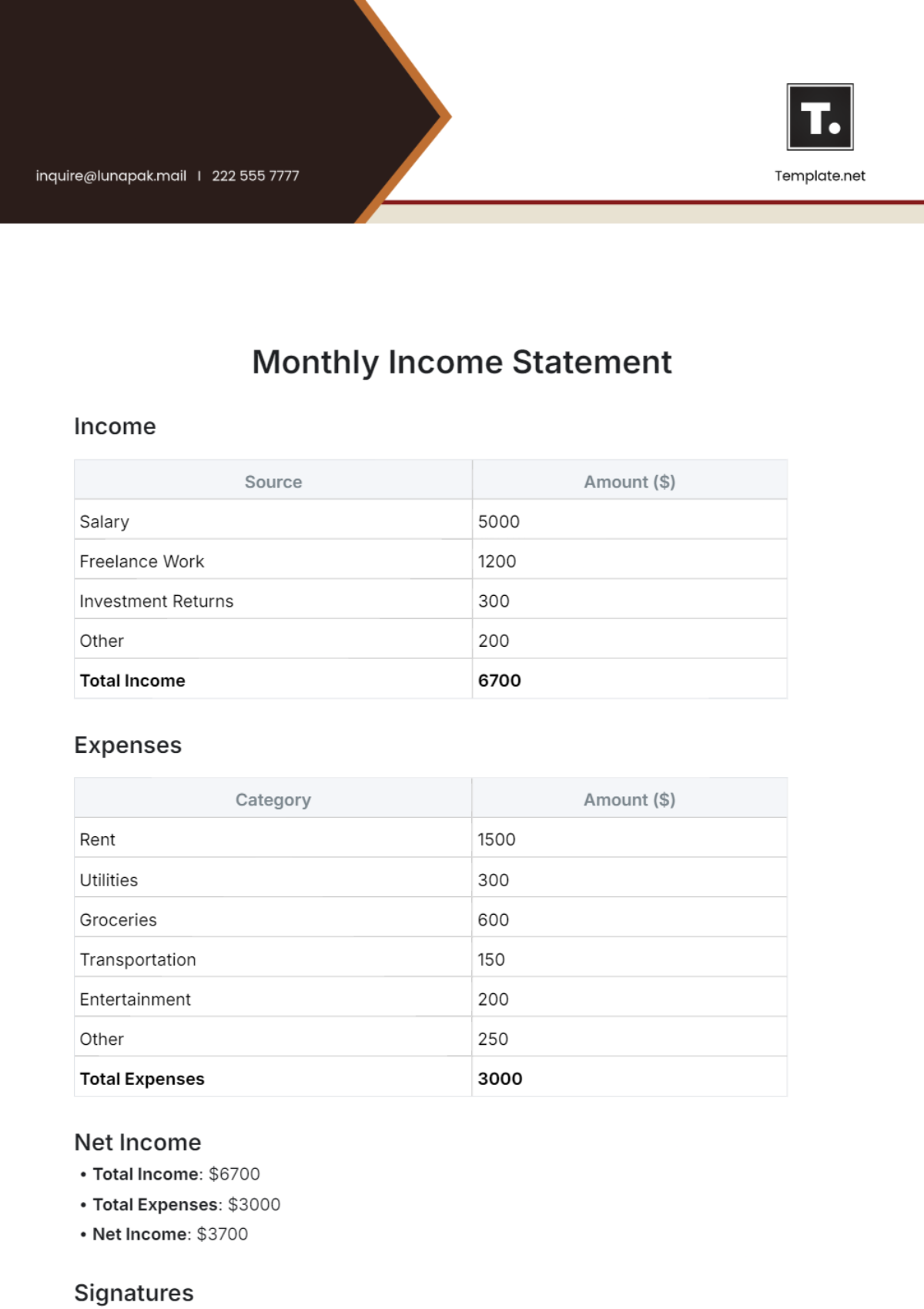

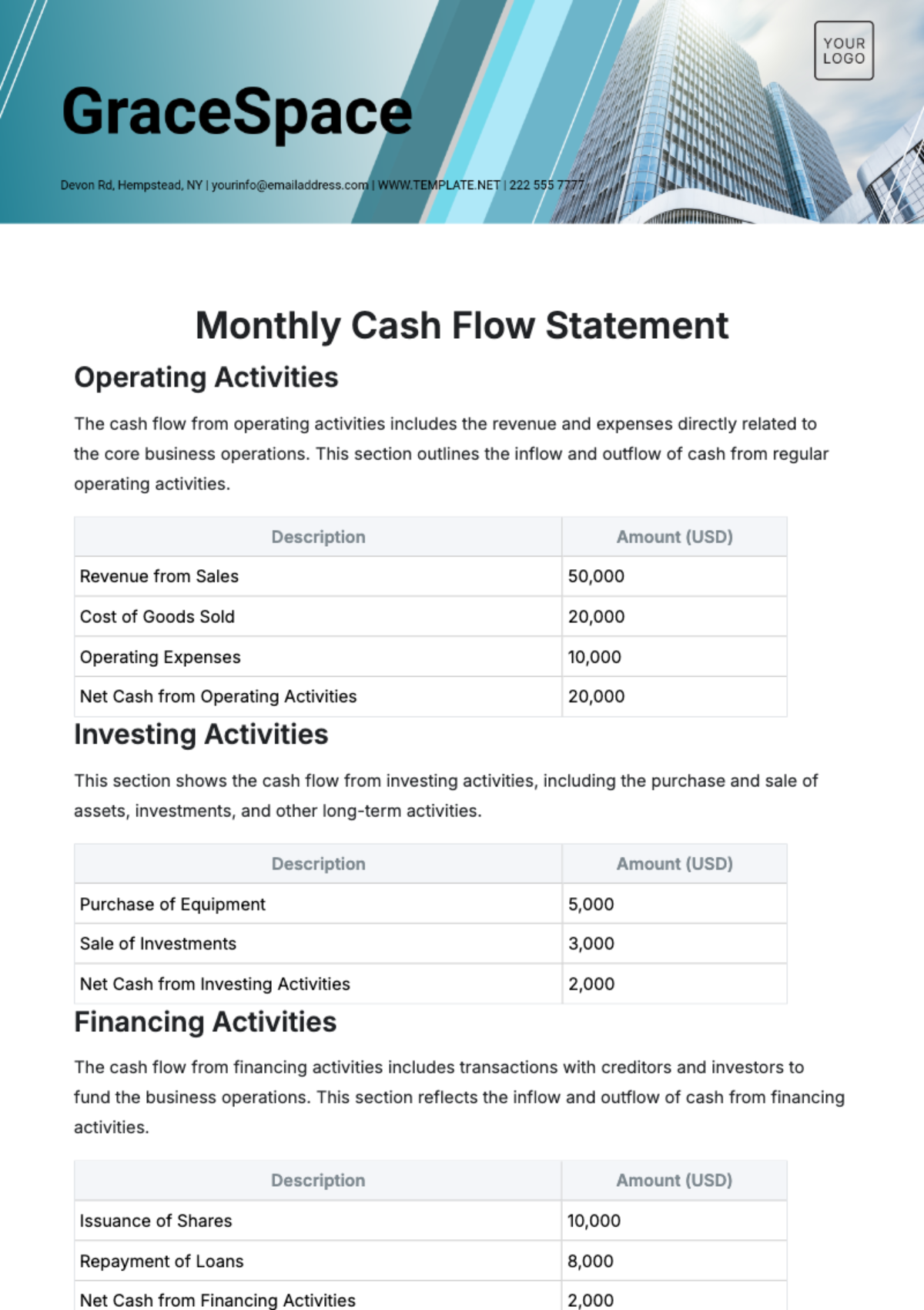

Revenue Trends

Revenue trends provide insights into the company's sales performance over time.

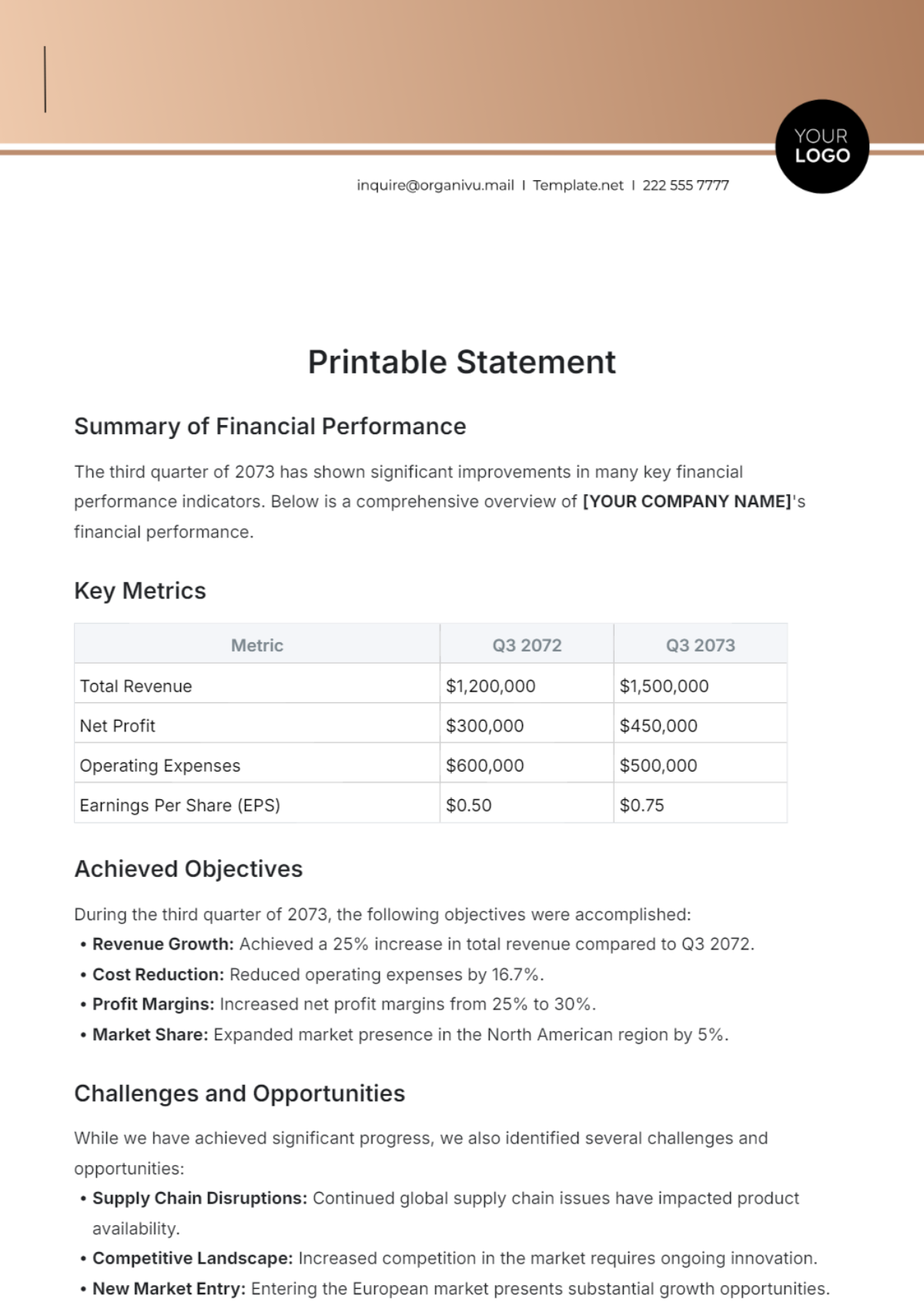

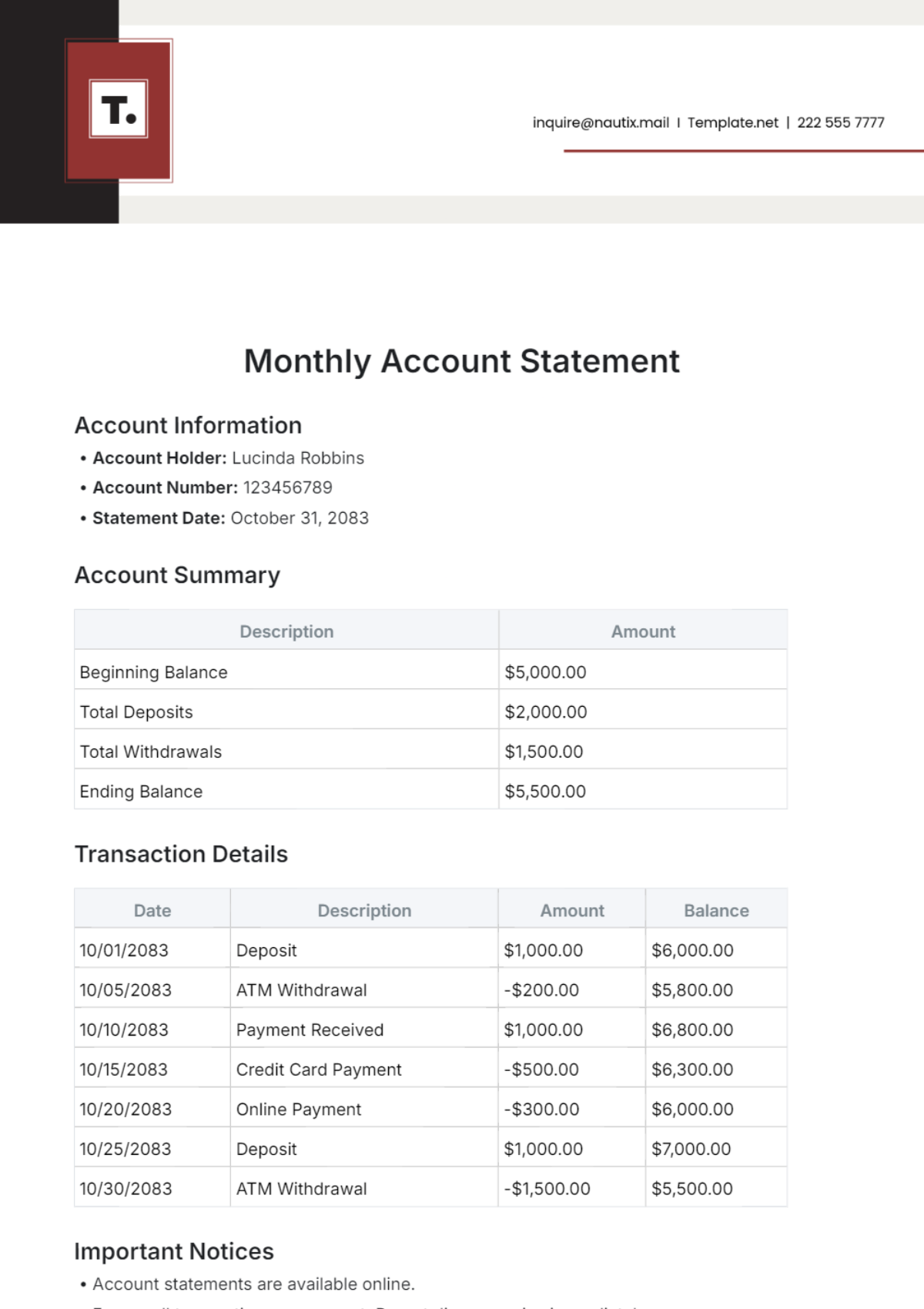

Year | Revenue | % Change Year-over-Year |

|---|---|---|

2021 | $10,000,000 | N/A |

2022 | $12,000,000 | 20% |

2023 | $15,000,000 | 25% |

Analysis: The revenue of [Your Company Name] has shown a consistent increase over the past three years, indicating a positive growth trajectory.

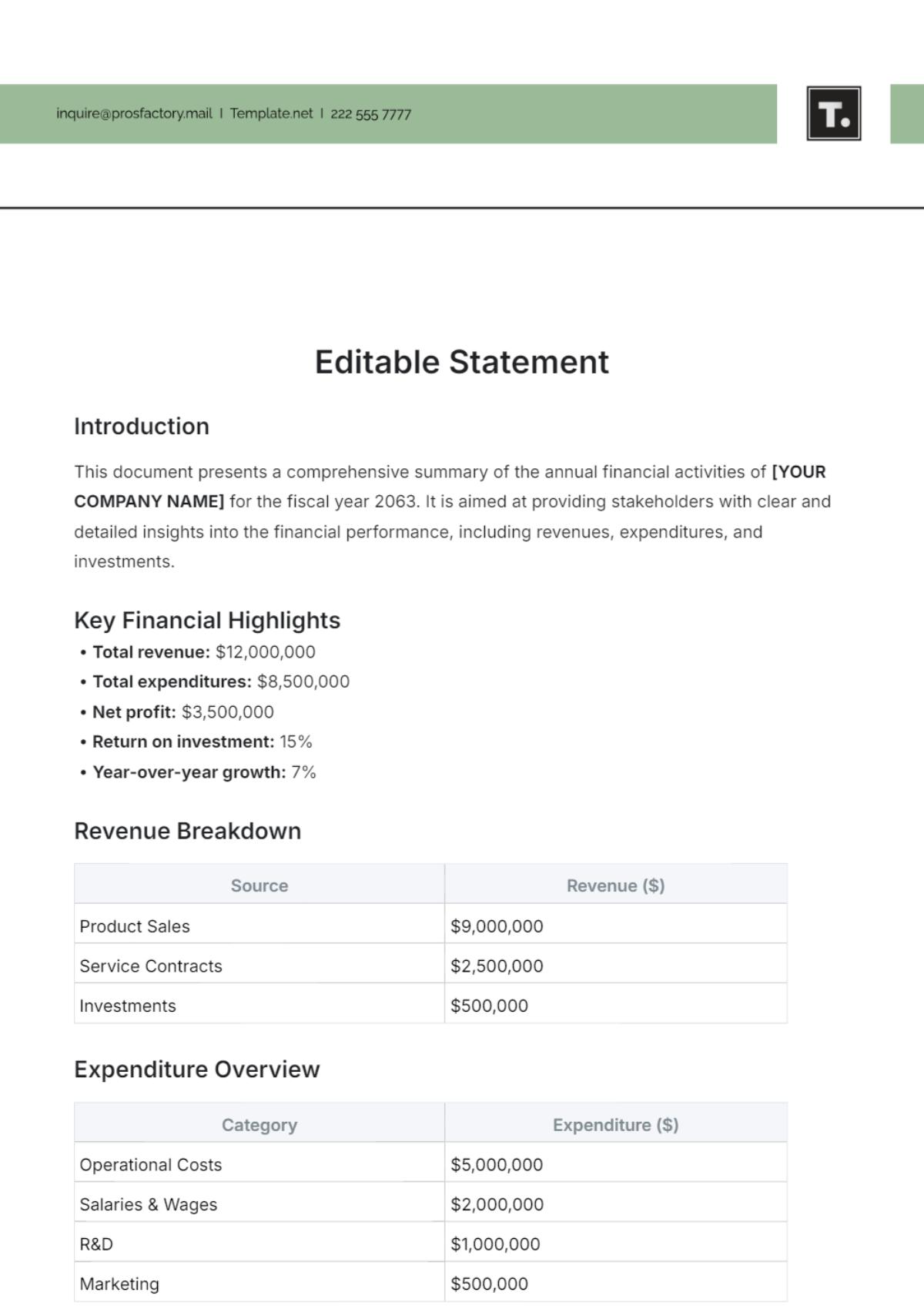

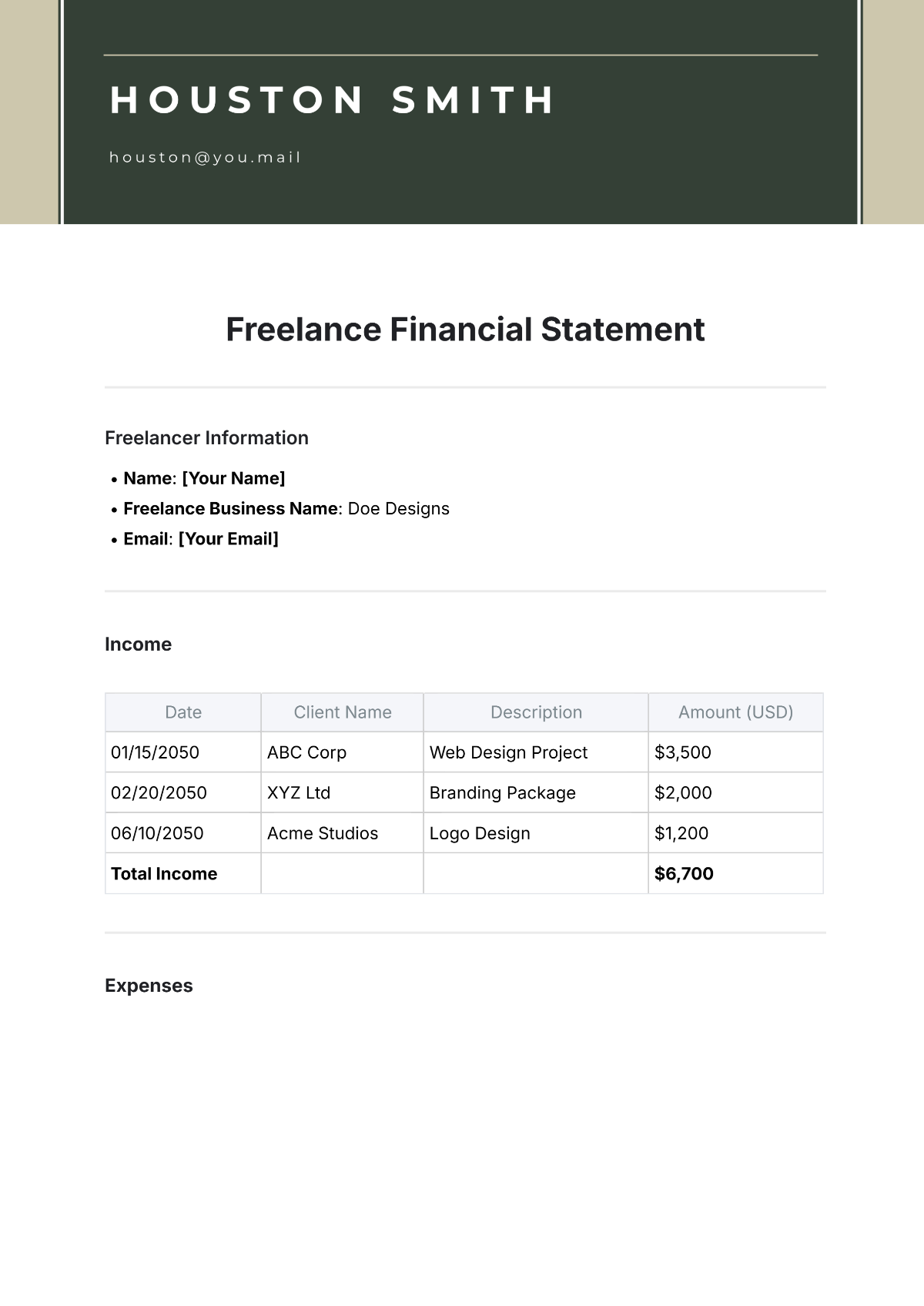

A. Profitability Trends

Profitability trends highlight changes in the company's net income over time.

Year | Net Income | % Change Year-over-Year |

|---|---|---|

2021 | $1,000,000 | N/A |

2022 | $1,500,000 | 50% |

2023 | $2,000,000 | 33.3% |

Analysis: Net income has steadily increased, reflecting improved profitability and cost management.

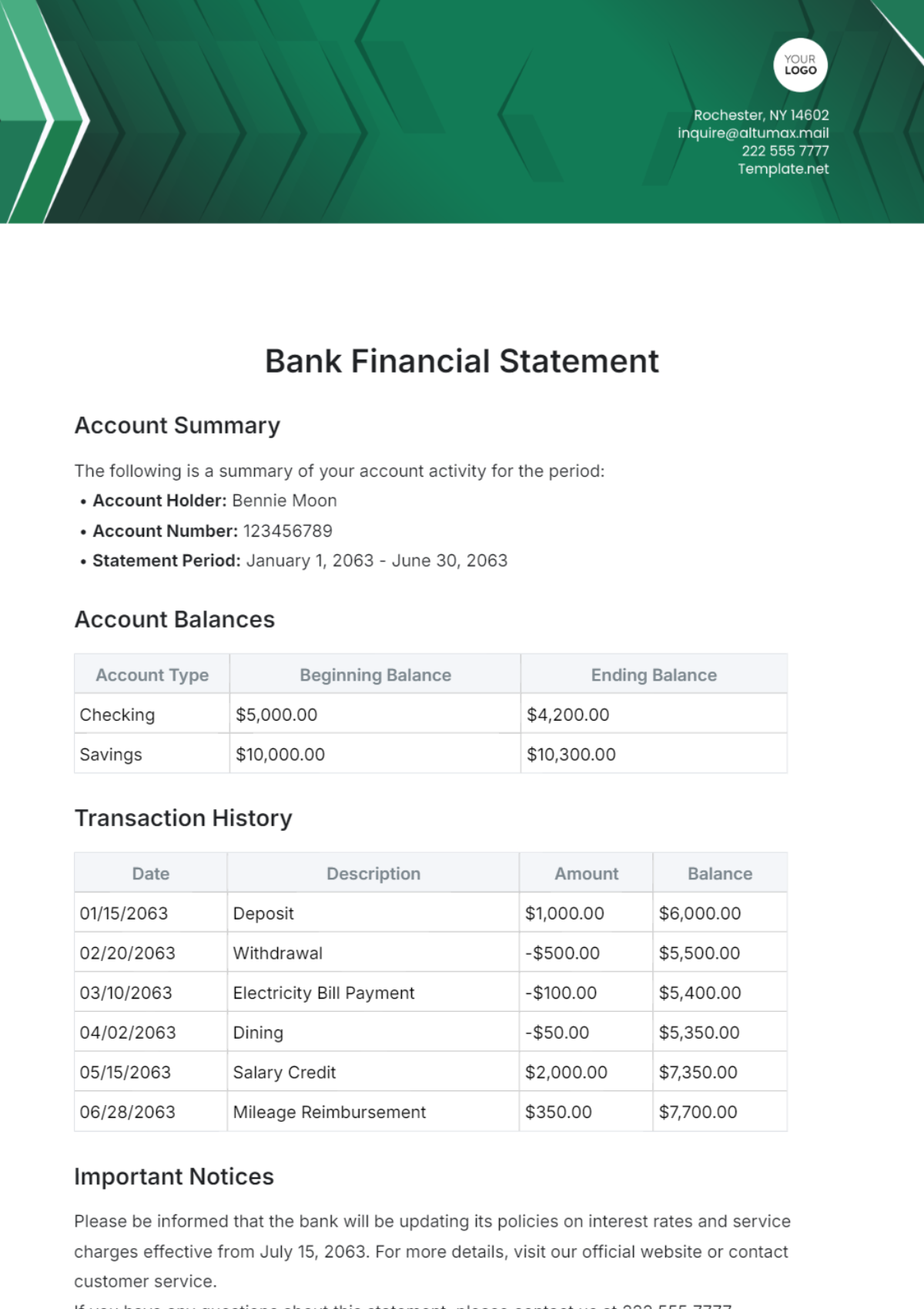

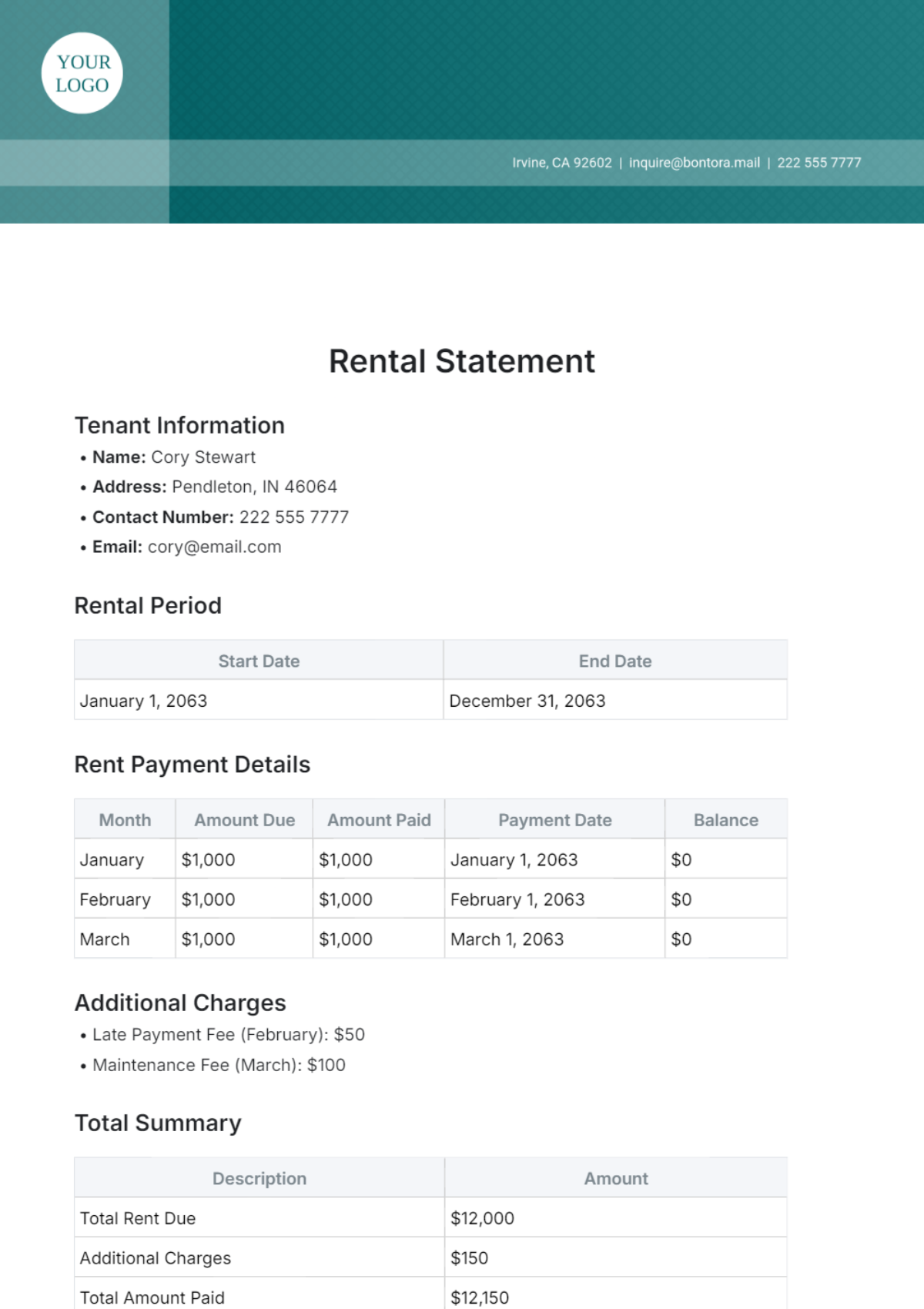

B. Liquidity Trends

Liquidity trends assess the company's ability to meet short-term obligations over time.

Year | Current Ratio | Quick Ratio |

|---|---|---|

2021 | 1.5 | 1.2 |

2022 | 1.7 | 1.4 |

2023 | 1.8 | 1.5 |

Analysis: Improving liquidity ratios indicates a stronger short-term financial position.

C. Solvency Trends

Solvency trends evaluate the company's long-term financial stability.

Year | Debt to Equity Ratio | Interest Coverage Ratio |

|---|---|---|

2021 | 0.5 | 4.0 |

2022 | 0.45 | 4.5 |

2023 | 0.4 | 5.0 |

Analysis: The decreasing debt-to-equity ratio and increasing interest coverage ratio suggest enhanced financial stability and reduced reliance on debt financing.

D. Efficiency Trends

Efficiency trends track how well the company utilizes its resources.

Year | Asset Turnover Ratio | Inventory Turnover Ratio | Accounts Receivable Turnover Ratio |

|---|---|---|---|

2021 | 0.8 | 6.0 | 8.0 |

2022 | 0.85 | 6.5 | 8.5 |

2023 | 0.9 | 7.0 | 9.0 |

Analysis: Improving efficiency ratios reflects better asset utilization, inventory management, and receivables collection.

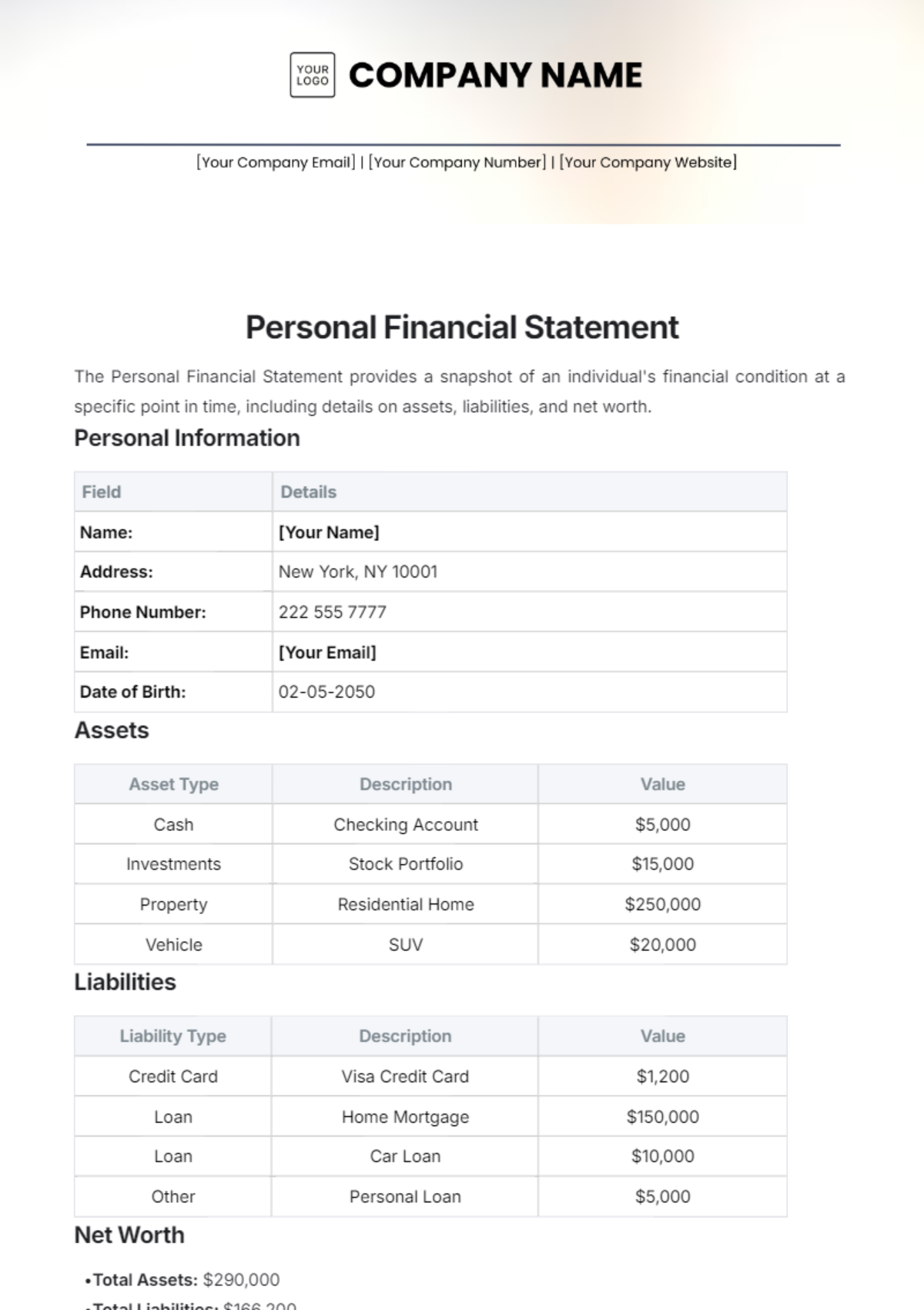

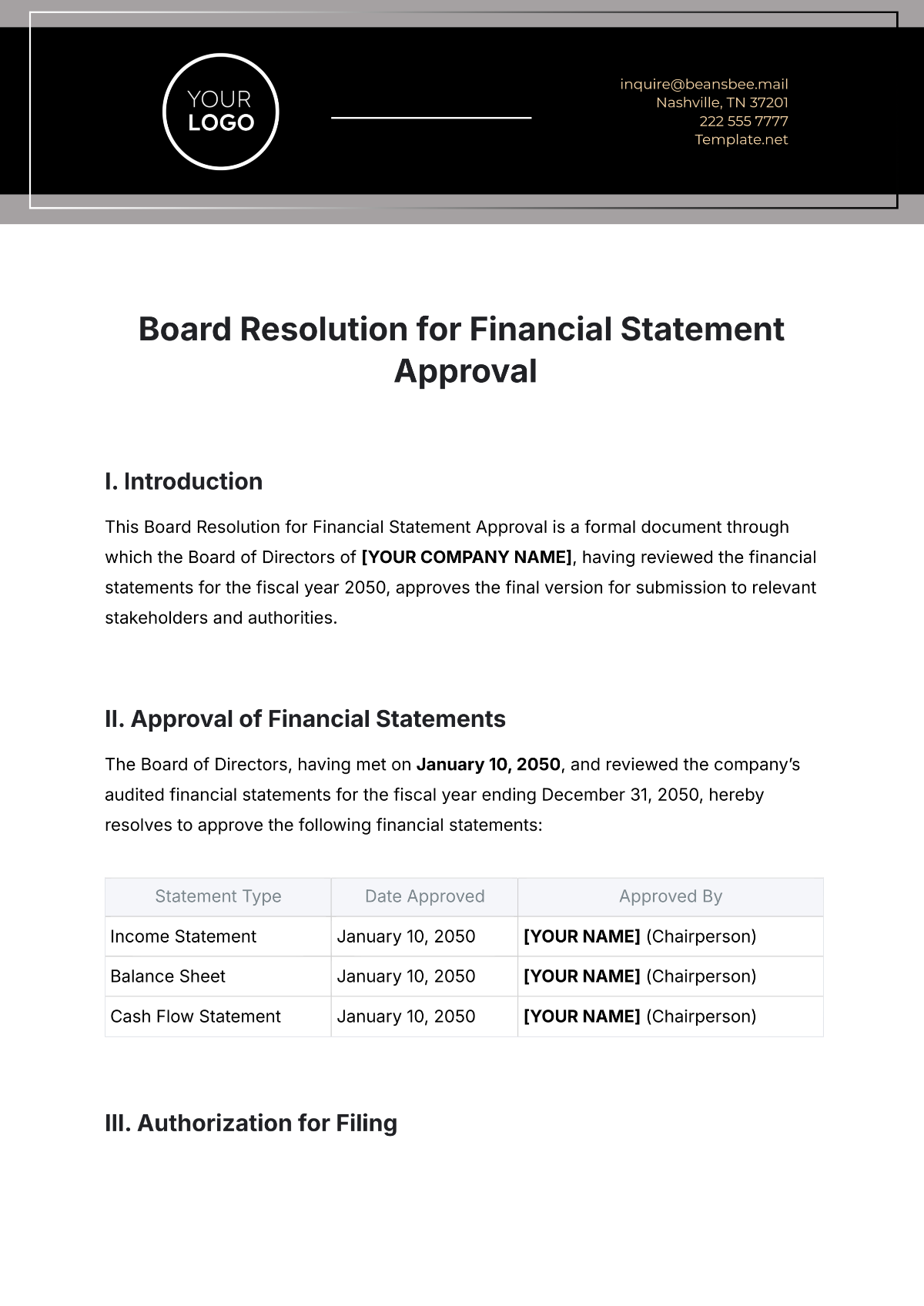

IV. Conclusion

A. Key Findings

Profitability: [Your Company Name] has demonstrated strong profitability growth, with significant increases in net income and profit margins over the past three years.

Liquidity: The company’s liquidity position has strengthened, as evidenced by improving current and quick ratios.

Solvency: Enhanced solvency metrics indicate a reduced dependency on debt and a better ability to meet long-term obligations.

Efficiency: Improved efficiency ratios suggest that [Your Company Name] is effectively utilizing its assets and managing its operations.

B. Recommendations

Investment: Based on the robust financial performance and positive trends, it is recommended to consider investing in [Your Company Name].

Operational Improvements: Continue focusing on cost management and operational efficiency to sustain profitability growth.

Financial Strategy: Maintain a balanced approach to debt financing to ensure long-term financial stability while exploring opportunities for strategic investments.

C. Final Remarks

This Financial Statement Analysis provides crucial insights into [Your Company Name]'s financial health and performance. It is designed to aid investors and stakeholders in making well-informed decisions.