Free Business Budget Analysis

I. Executive Summary

Overview:

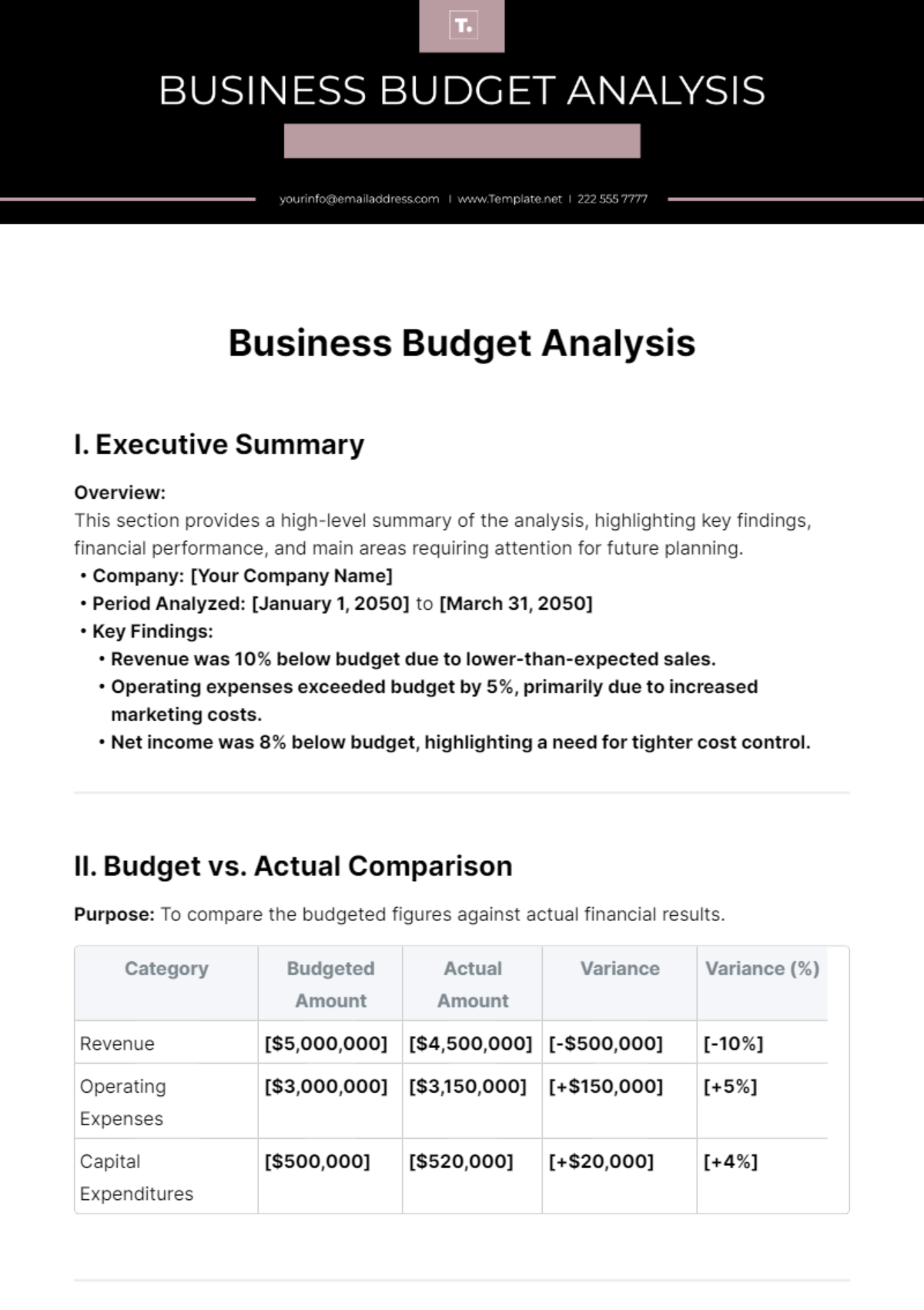

This section provides a high-level summary of the analysis, highlighting key findings, financial performance, and main areas requiring attention for future planning.

Company: [Your Company Name]

Period Analyzed: [January 1, 2050] to [March 31, 2050]

Key Findings:

Revenue was 10% below budget due to lower-than-expected sales.

Operating expenses exceeded budget by 5%, primarily due to increased marketing costs.

Net income was 8% below budget, highlighting a need for tighter cost control.

II. Budget vs. Actual Comparison

Purpose: To compare the budgeted figures against actual financial results.

Category | Budgeted Amount | Actual Amount | Variance | Variance (%) |

|---|---|---|---|---|

Revenue | [$5,000,000] | [$4,500,000] | [-$500,000] | [-10%] |

Operating Expenses | [$3,000,000] | [$3,150,000] | [+$150,000] | [+5%] |

Capital Expenditures | [$500,000] | [$520,000] | [+$20,000] | [+4%] |

III. Variance Analysis

Purpose: To explain significant variances between budgeted and actual figures.

Positive Variances:

Cost of Goods Sold (COGS) was $100,000 below budget due to negotiated supplier discounts.

Negative Variances:

Marketing expenses were $200,000 above budget due to an unplanned campaign to boost sales.

Utility costs exceeded budget by $50,000 due to rate increases.

Causes of Variances: The marketing overspend was aimed at countering lower sales, while increased utility rates were unforeseen.

IV. Income Statement

Purpose: To provide a detailed breakdown of revenues and expenses over the analysis period.

Category | Amount |

|---|---|

Total Revenue | [$4,500,000] |

Cost of Goods Sold (COGS) | [$1,800,000] |

Gross Profit | [$2,700,000] |

Operating Expenses | [$3,150,000] |

Net Income | [-$450,000] |

V. Balance Sheet Summary

Purpose: To offer a snapshot of the company's financial position at a specific point in time.

Category | Amount |

|---|---|

Assets | [$10,000,000] |

Liabilities | [$6,000,000] |

Equity | [$4,000,000] |

VI. Cash Flow Statement

Purpose: To analyze cash inflows and outflows, ensuring the company maintains sufficient liquidity.

Category | Amount |

|---|---|

Operating Activities | [$1,200,000] |

Investing Activities | [-$600,000] |

Financing Activities | [$400,000] |

VII. Recommendations

Purpose: To provide actionable suggestions for future budget adjustments and strategic planning.

Adjusting Revenue Forecasts:

Increase digital marketing efforts to boost online sales.

Explore new market segments to diversify revenue streams.

Reallocating Budget Resources:

Shift budget from traditional marketing to more cost-effective digital campaigns.

Implement stricter controls on utility usage to manage costs.

Strategic Initiatives:

Develop a contingency plan for unexpected expenses.

Enhance supplier negotiations to secure better terms and reduce COGS.

Summary: To address the financial shortfalls, we recommend reallocating marketing budgets, exploring new revenue opportunities, and implementing cost-control measures.

Contact Information:

Company Name: [Your Company Name]

Company Number: [Your Company Number]

Company Address: [Your Company Address]

Company Website: [Your Company Website]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the Business Budget Analysis Template from Template.net! Fully editable and customizable, this template streamlines financial planning. Easily editable in our AI Editor Tool, it allows precise adjustments to fit your business needs. Perfect for creating detailed, professional budget analyses effortlessly.