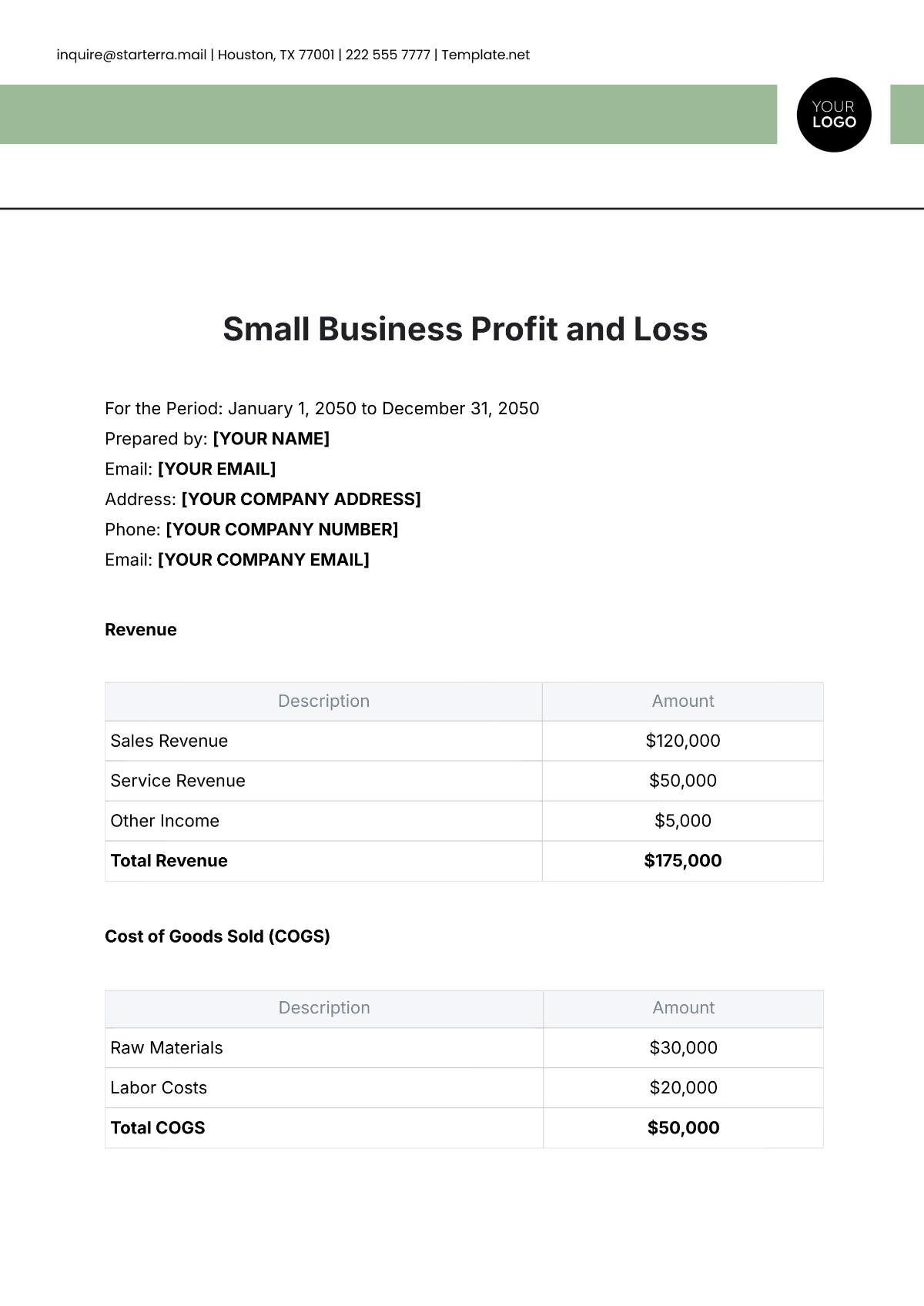

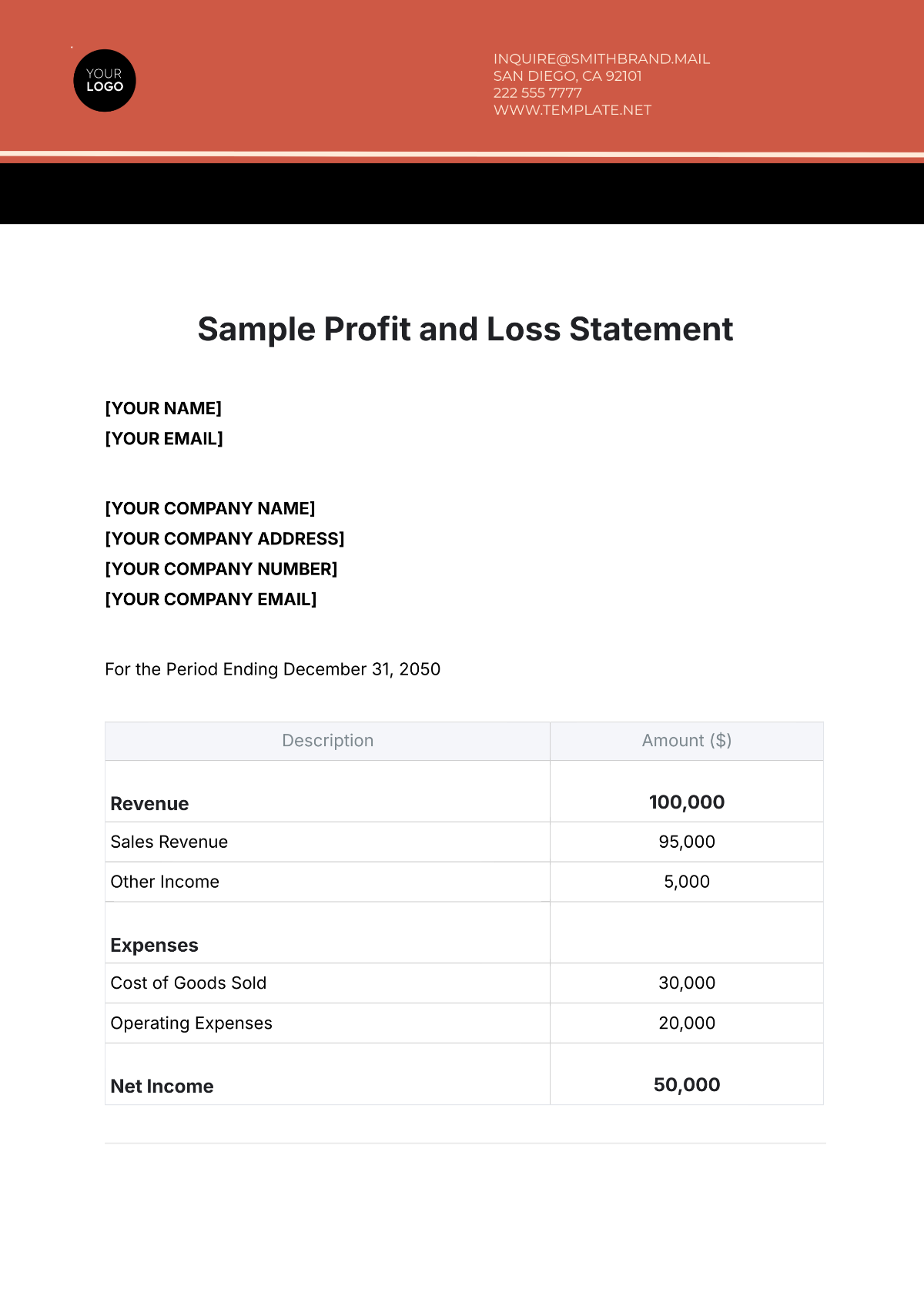

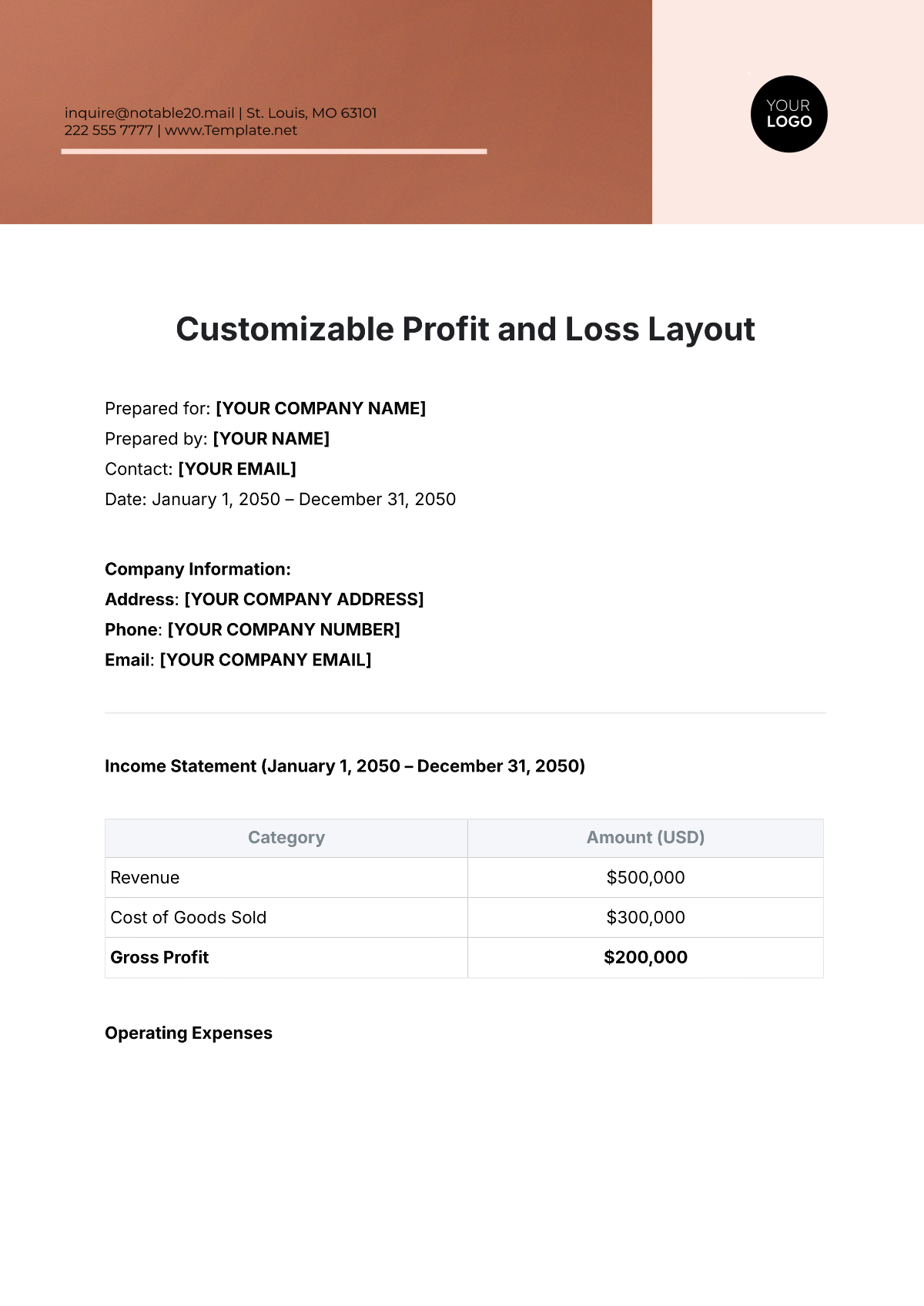

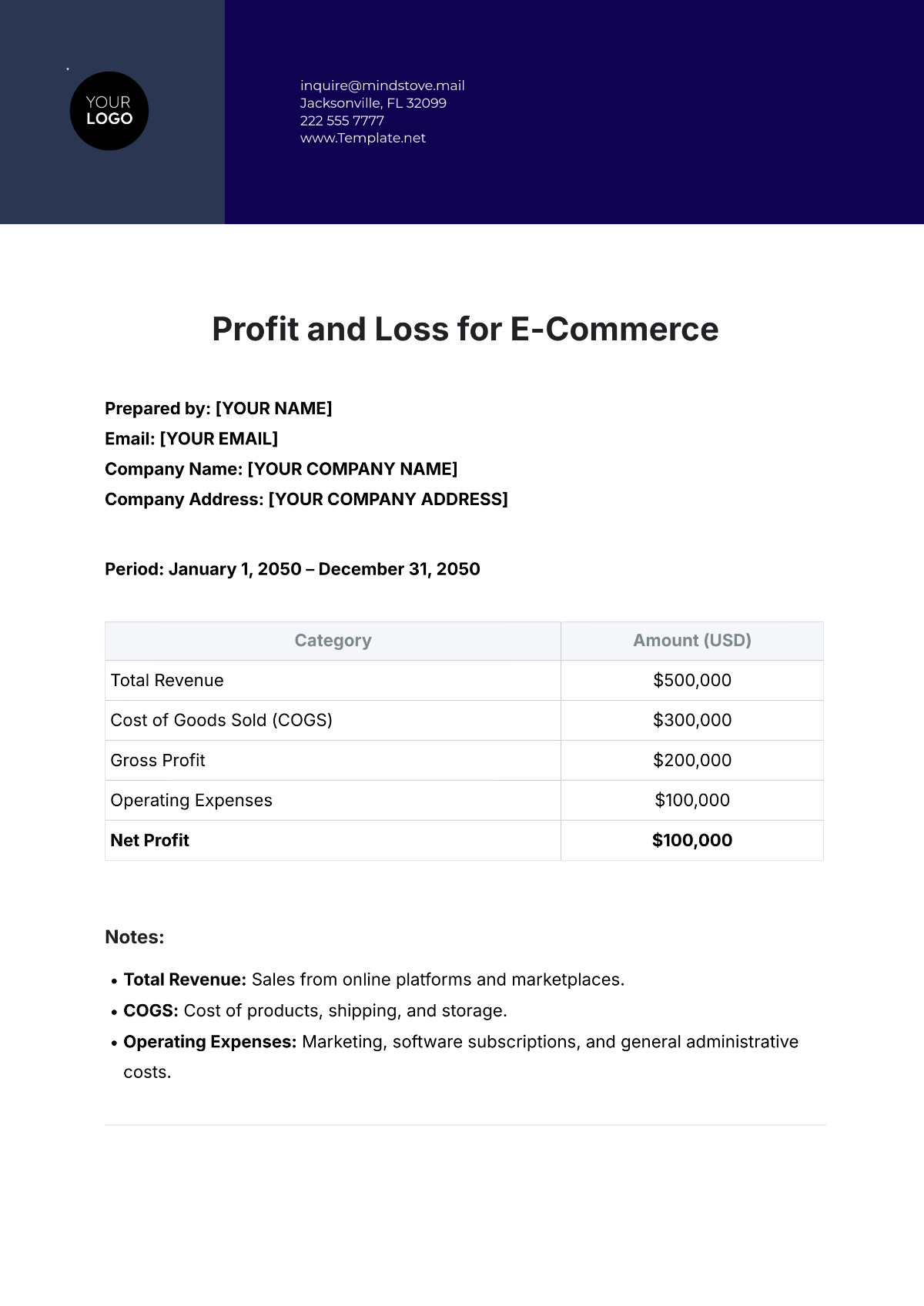

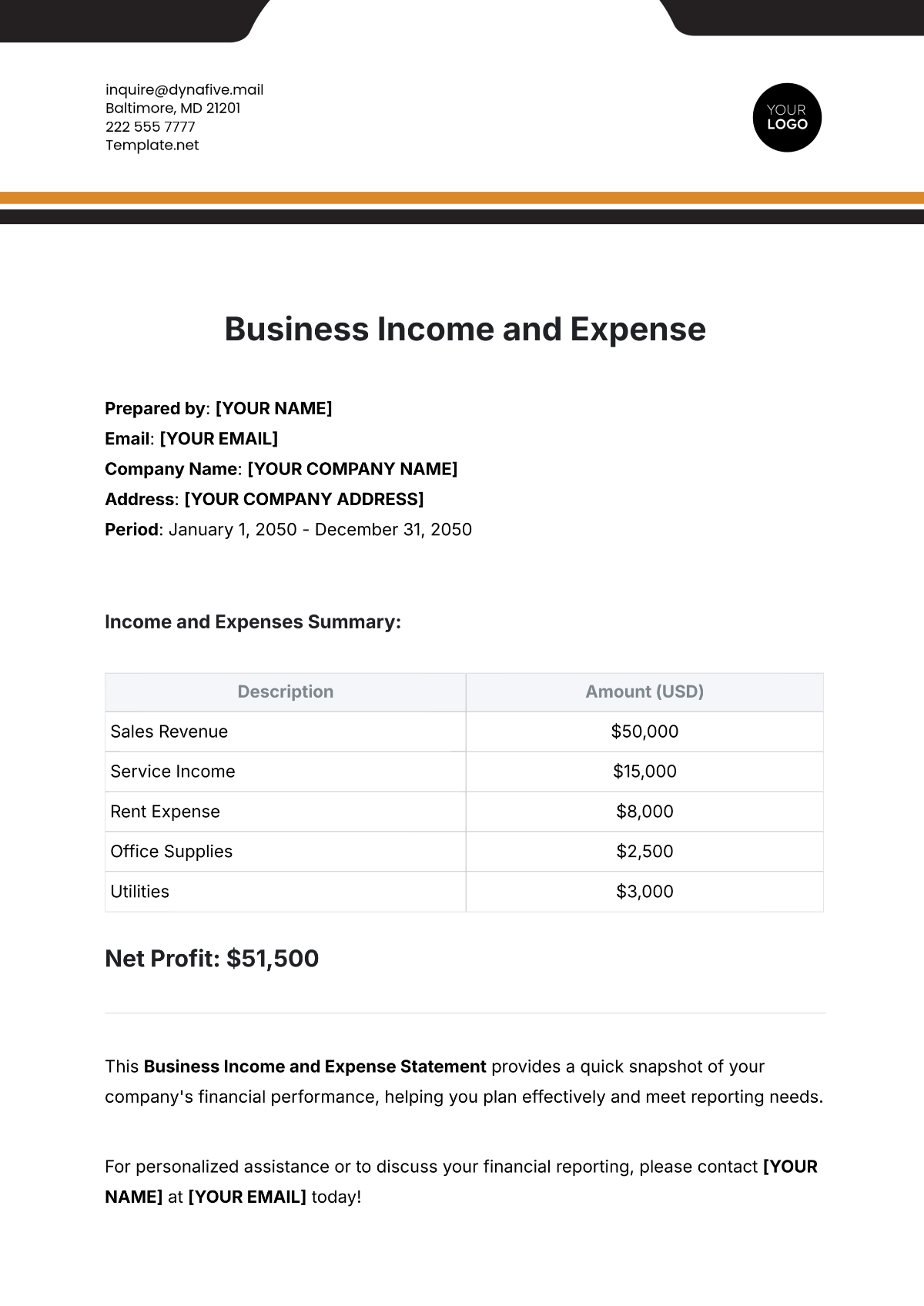

Restaurant Expense Statement

Statement Period: [Date] - [Date]

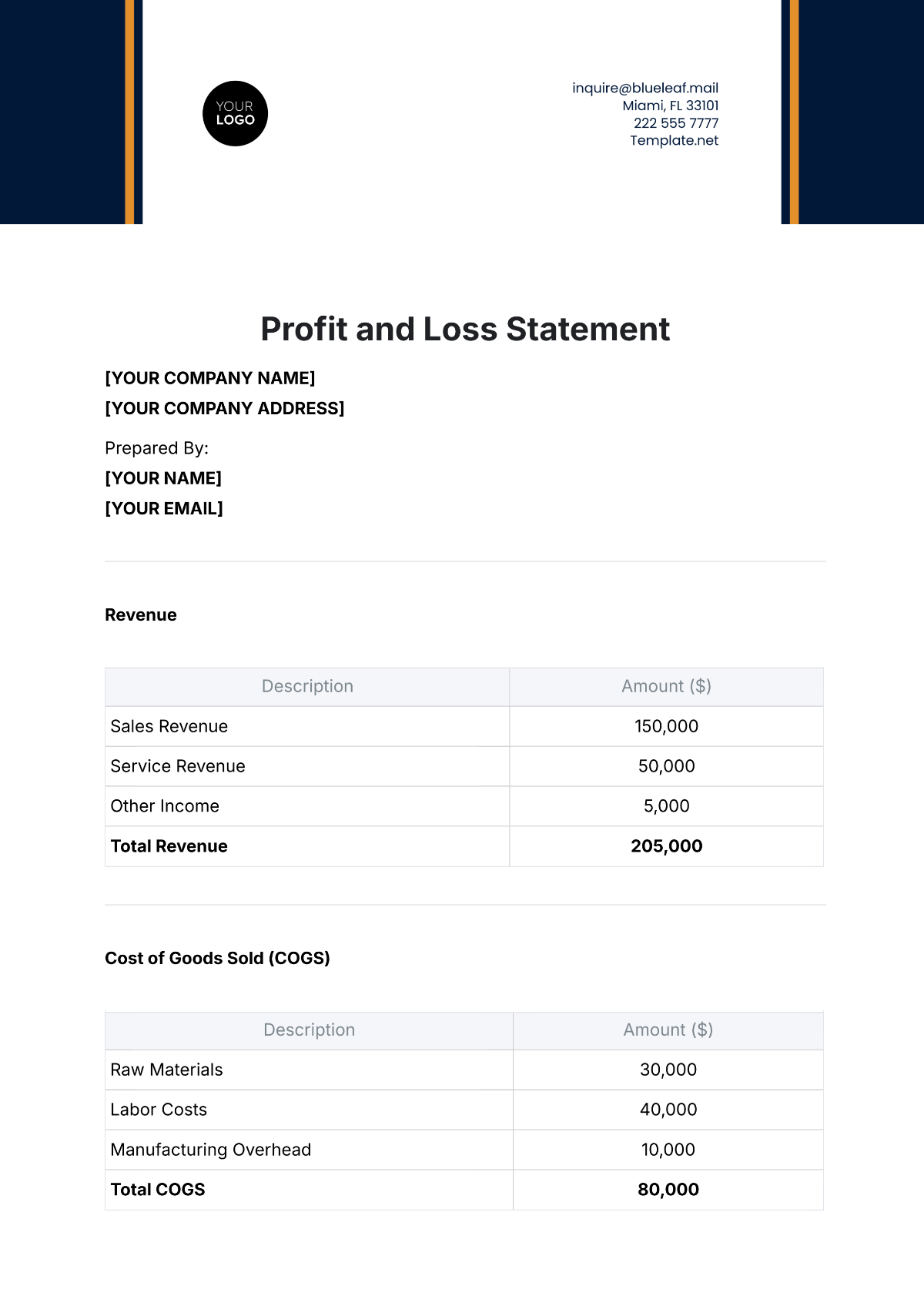

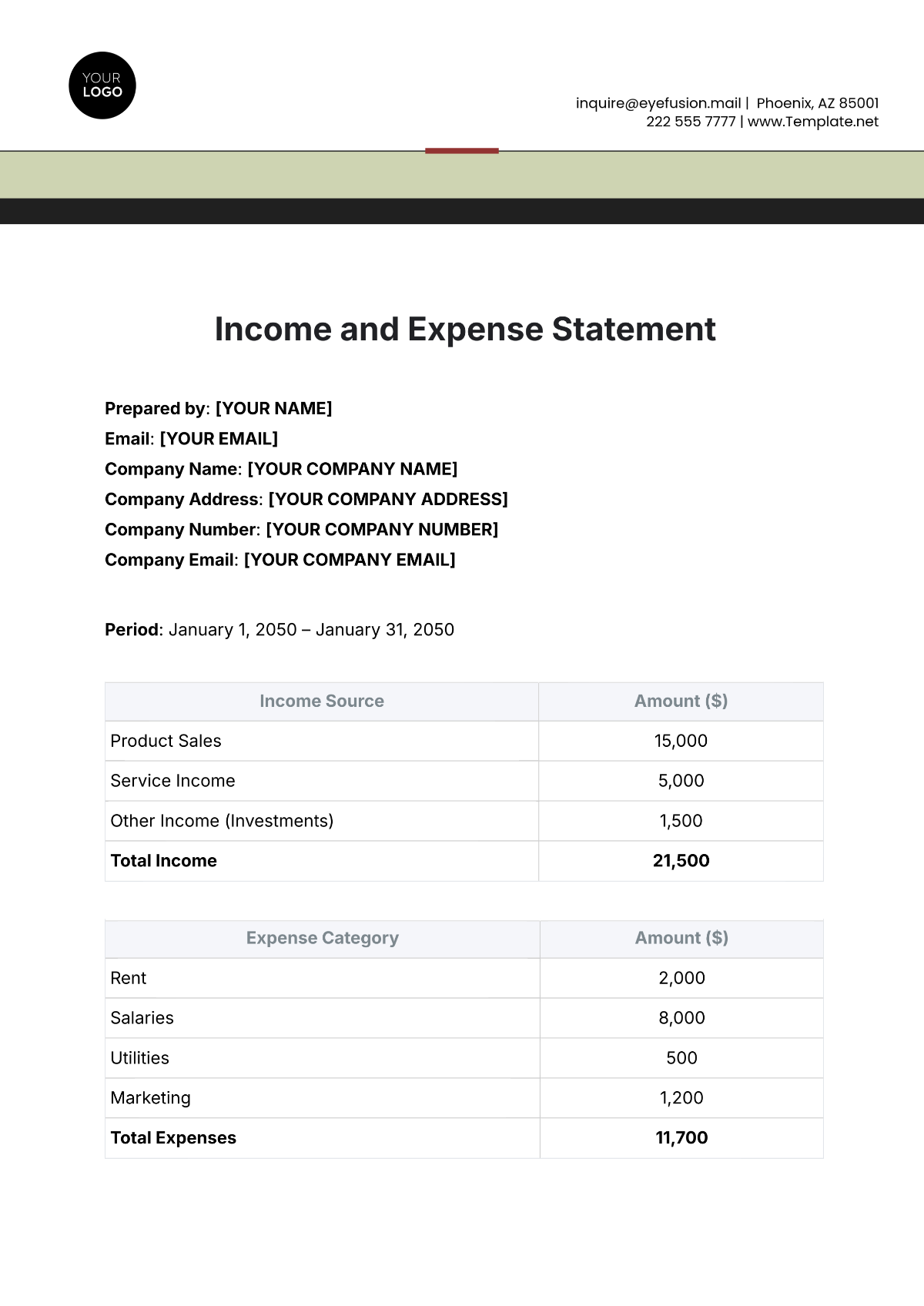

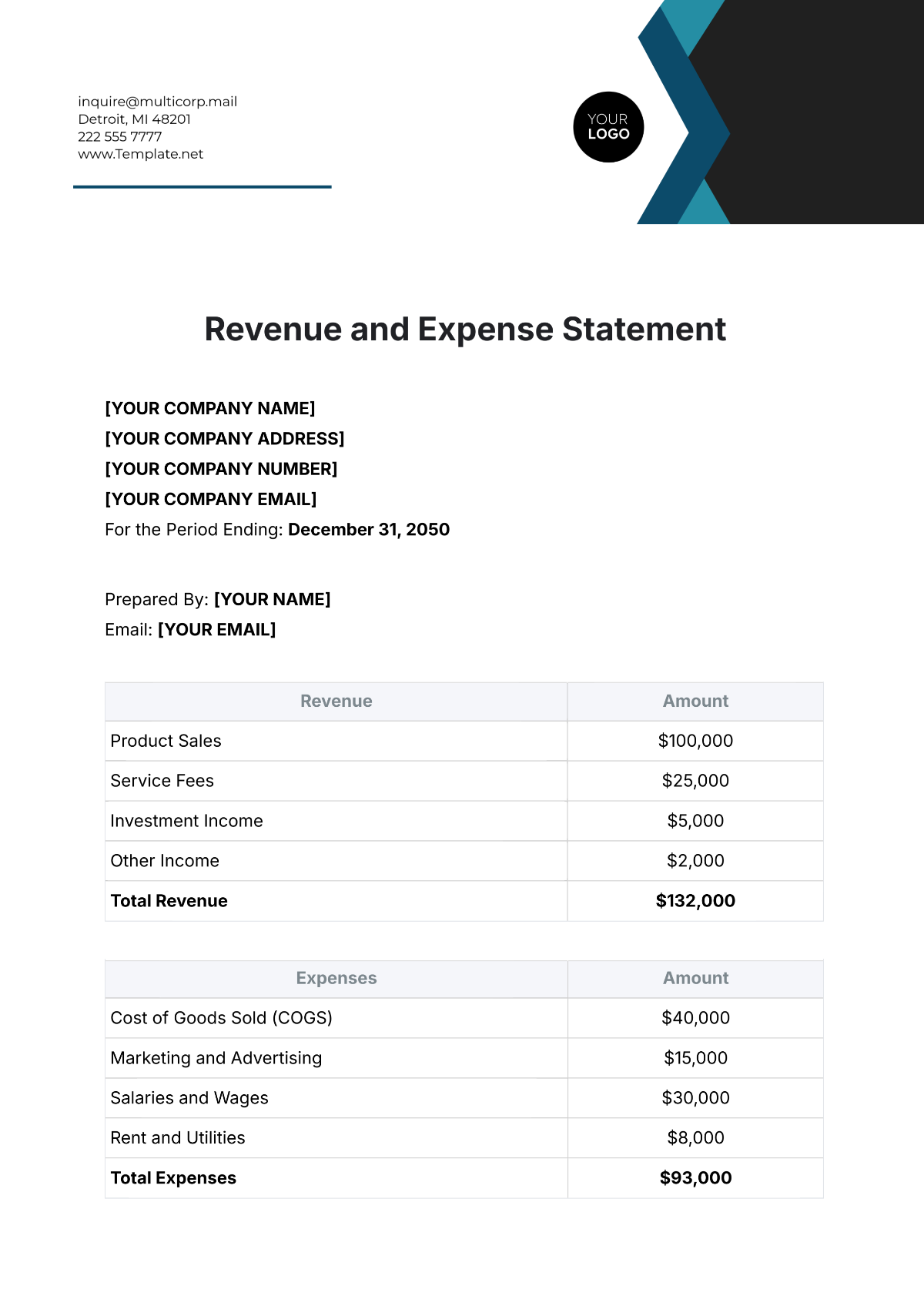

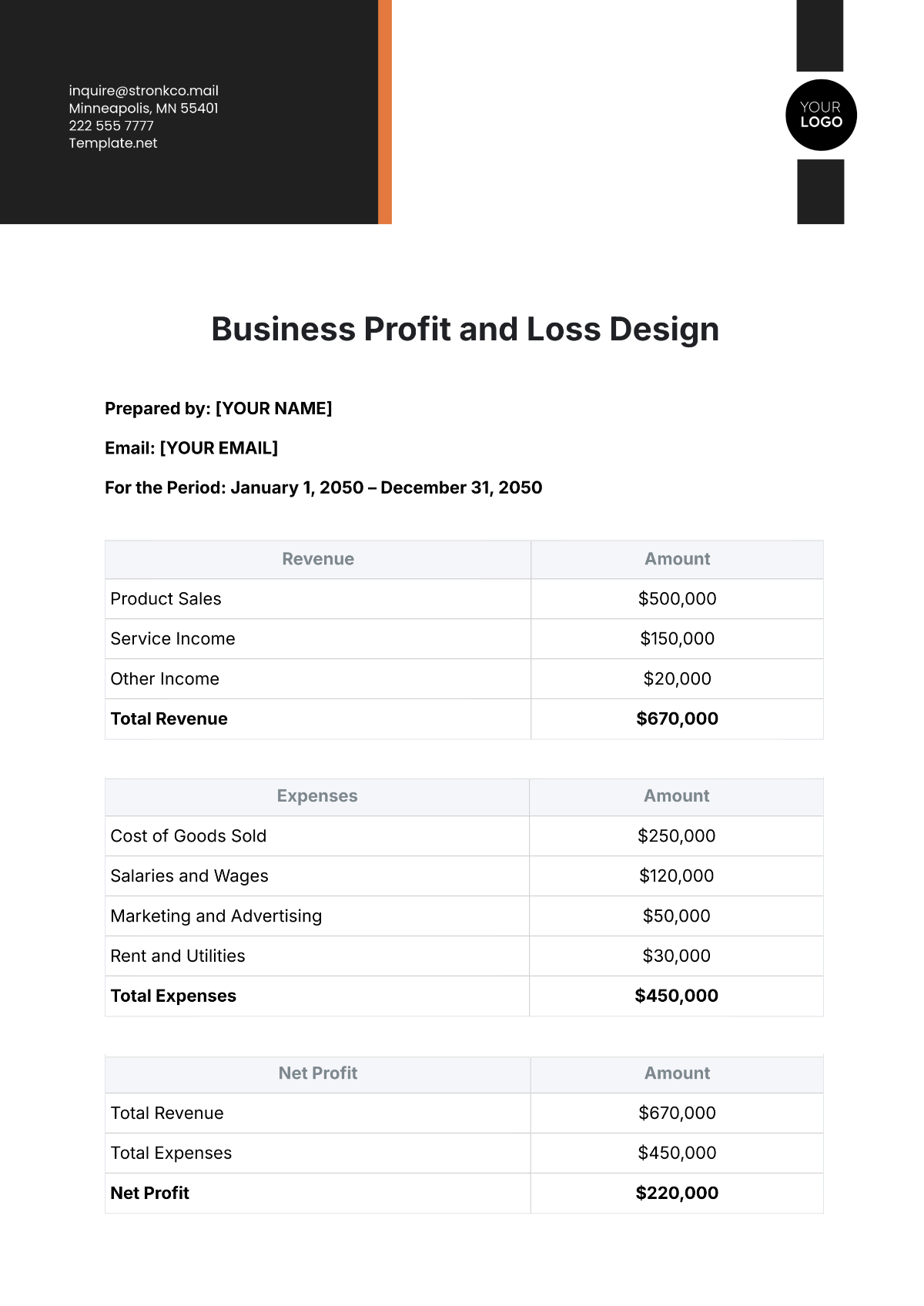

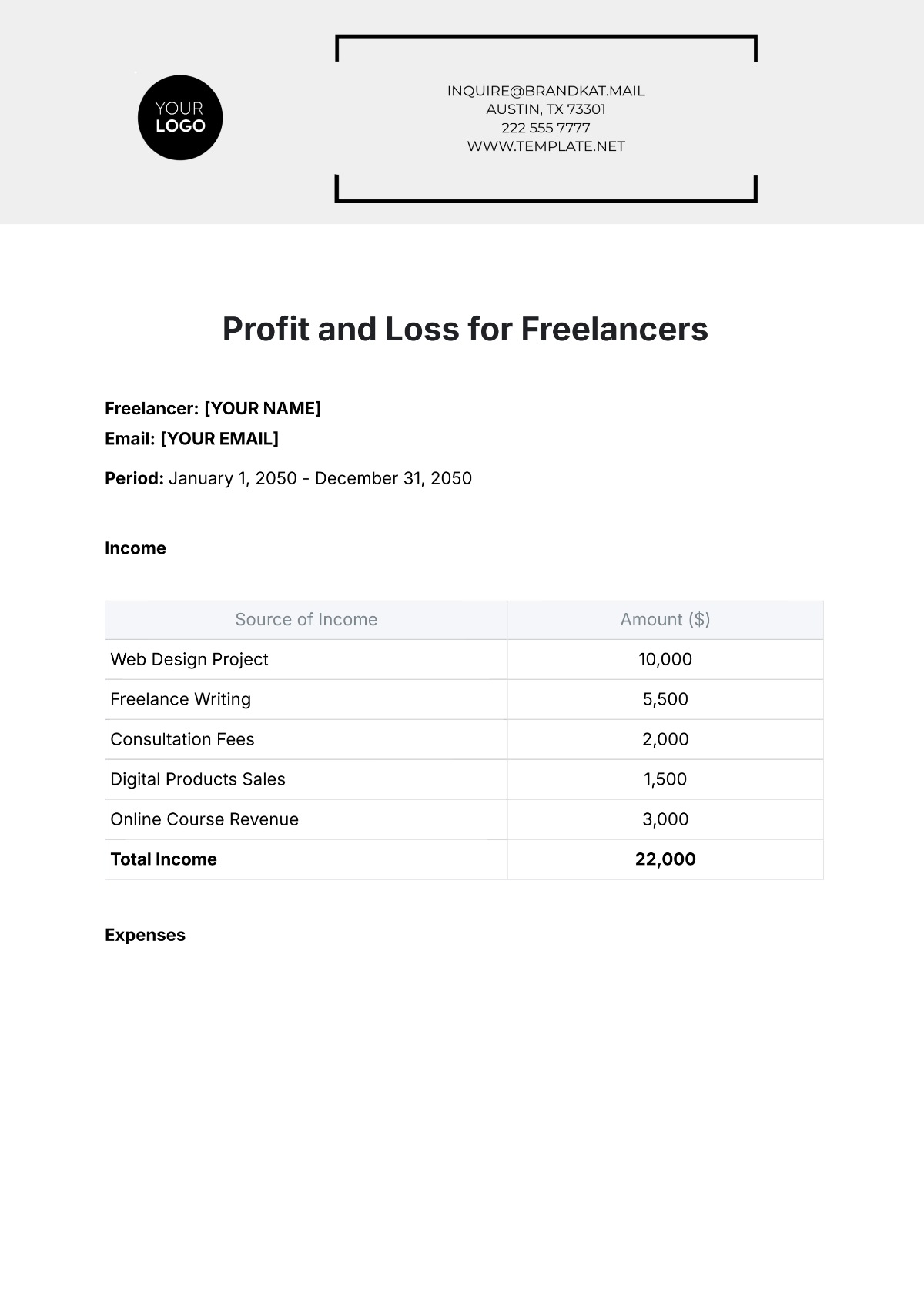

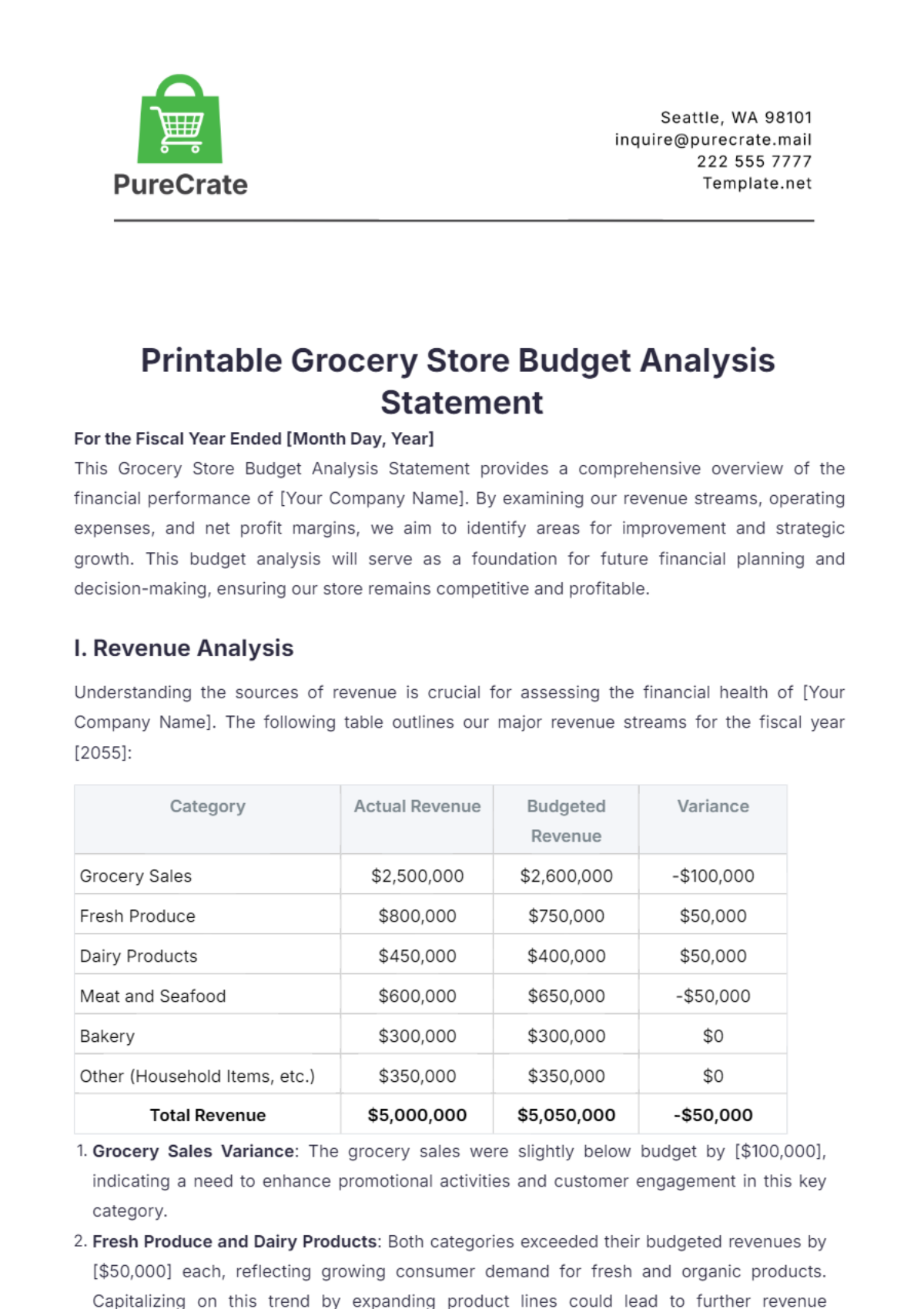

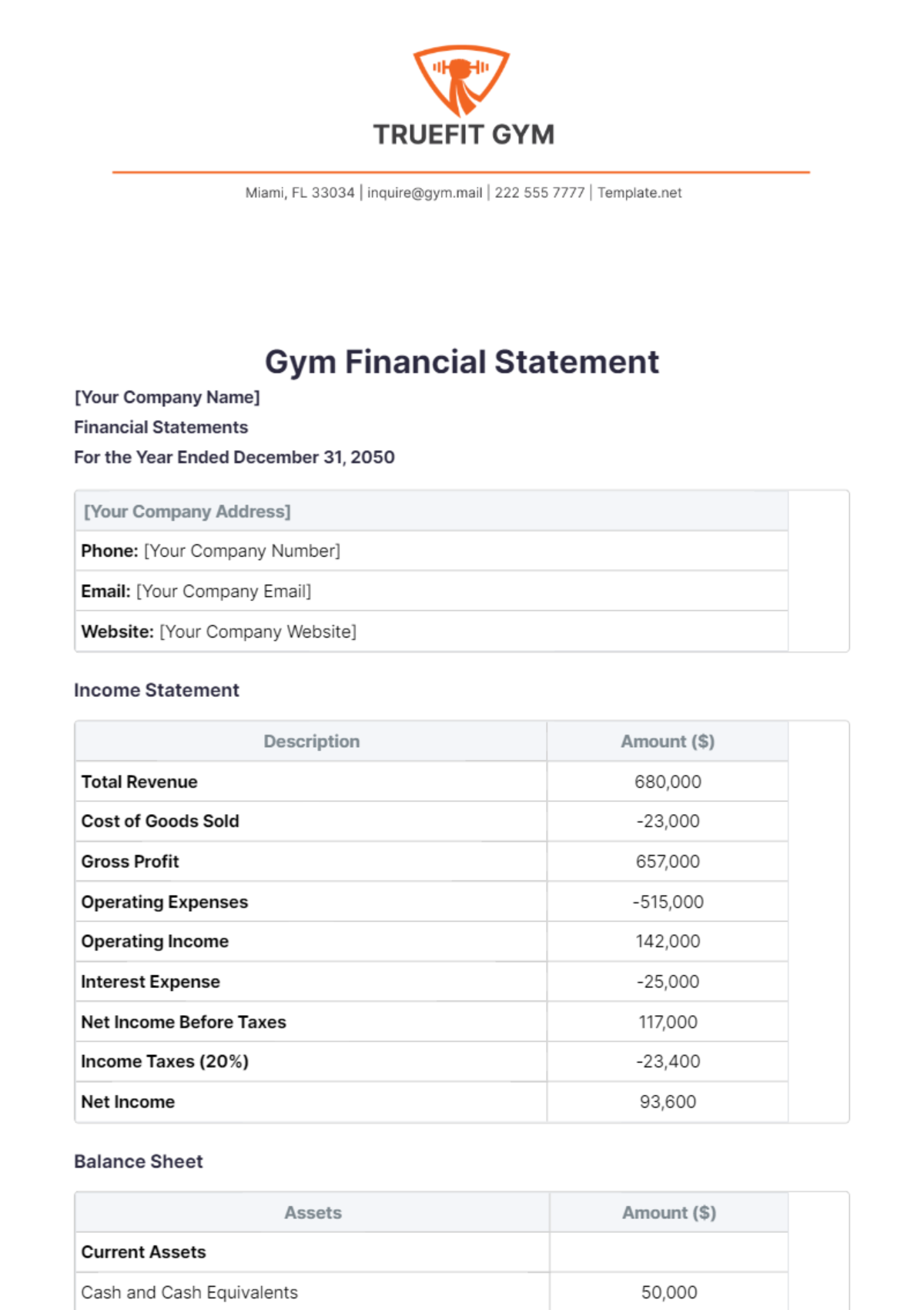

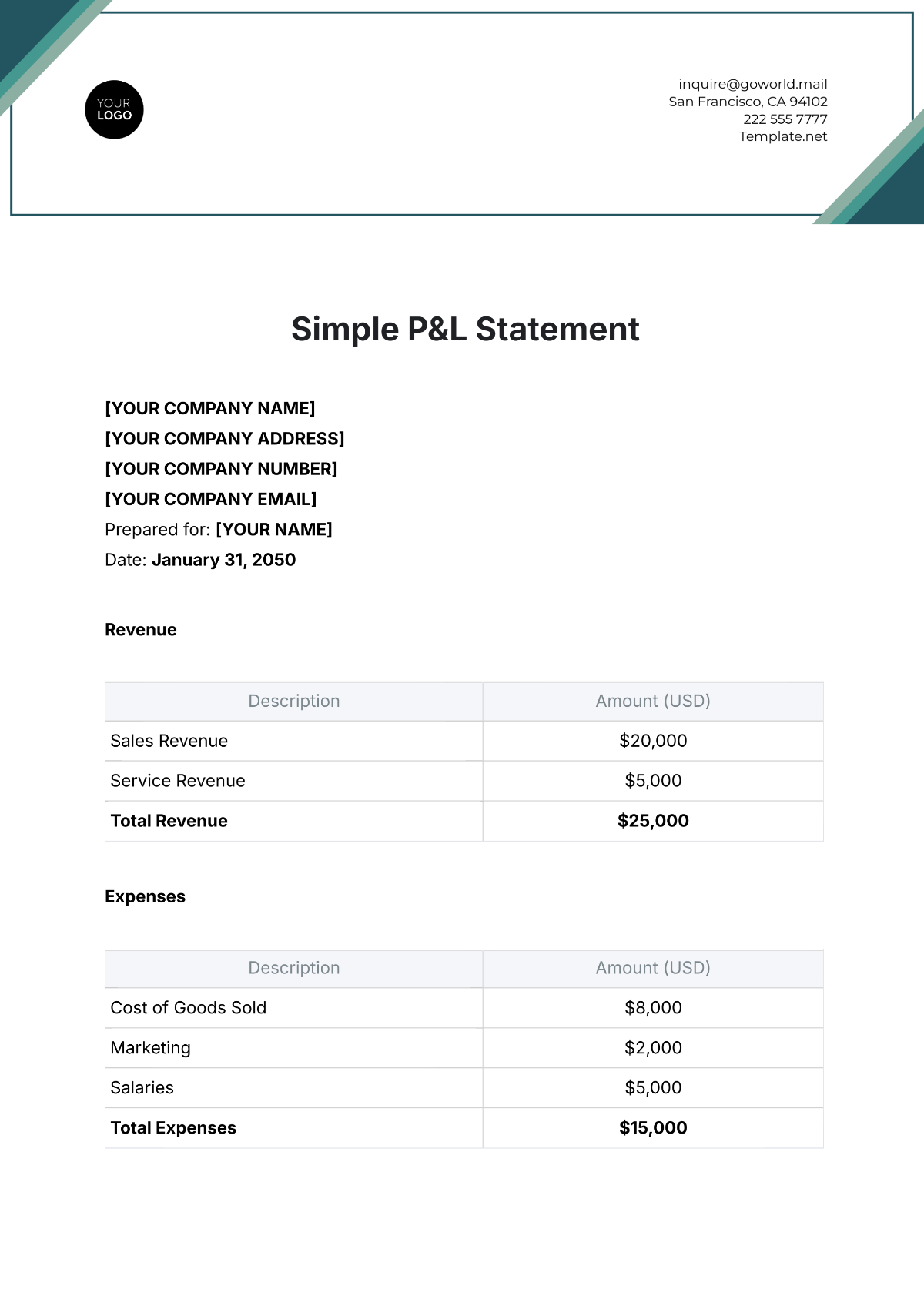

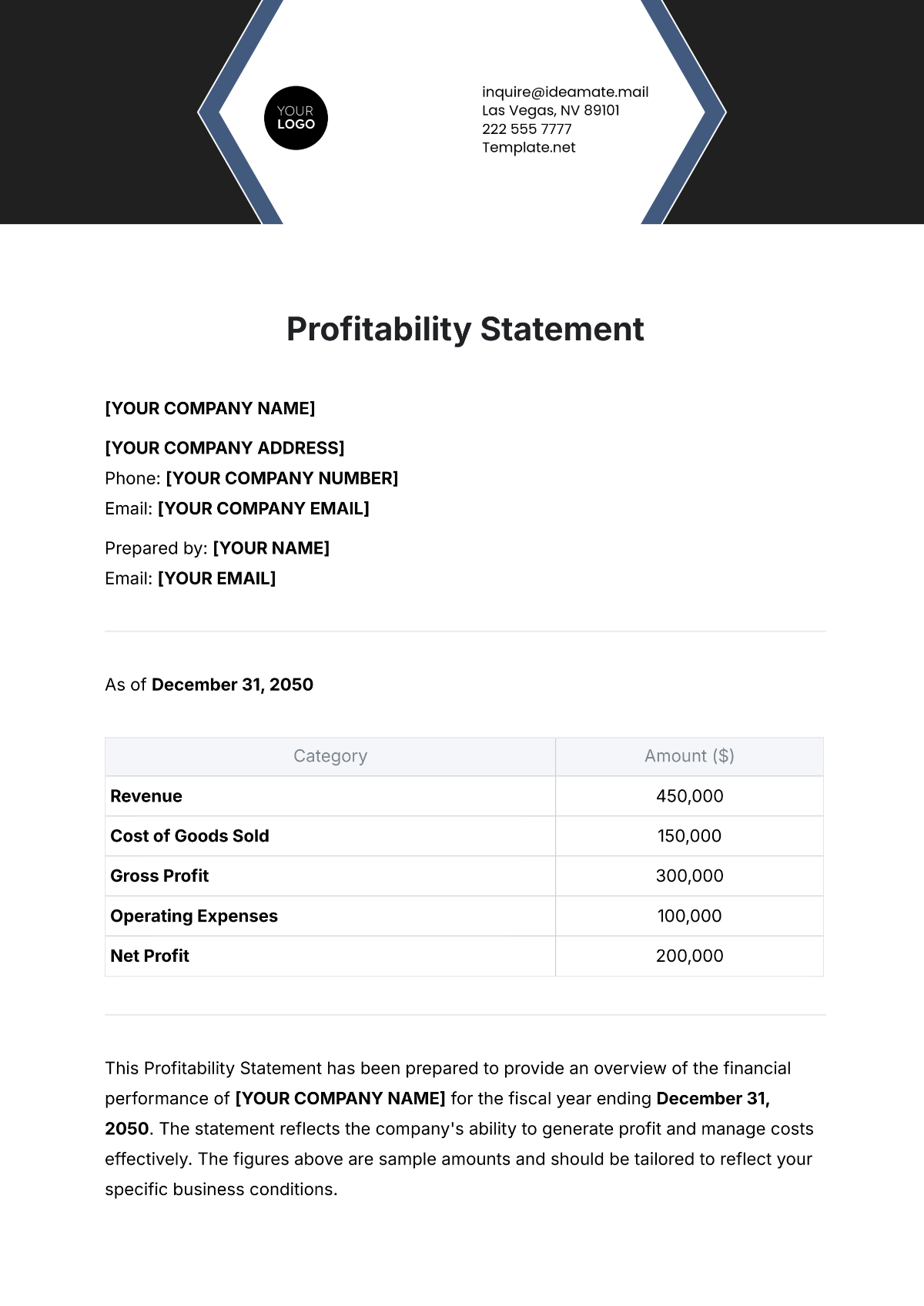

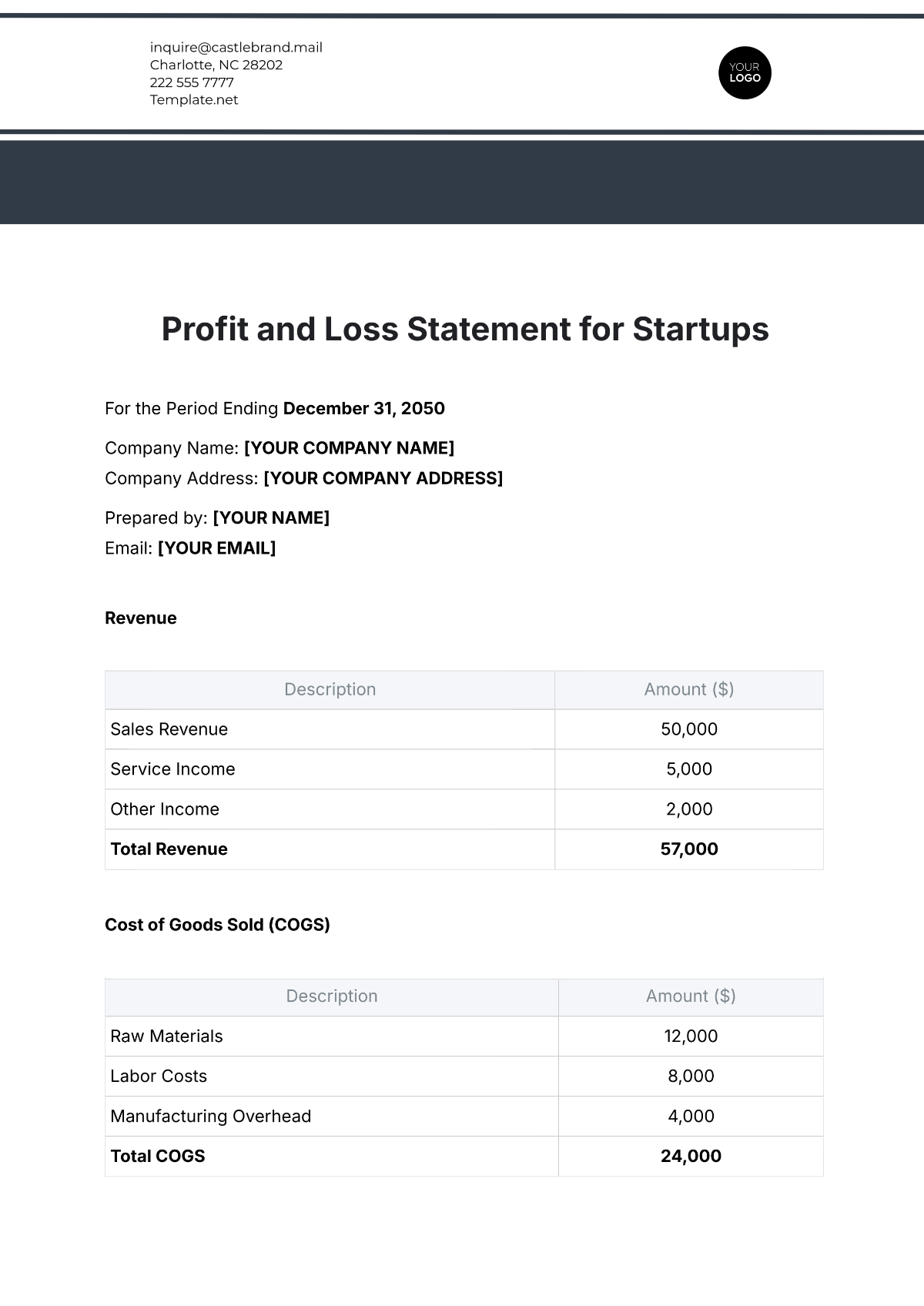

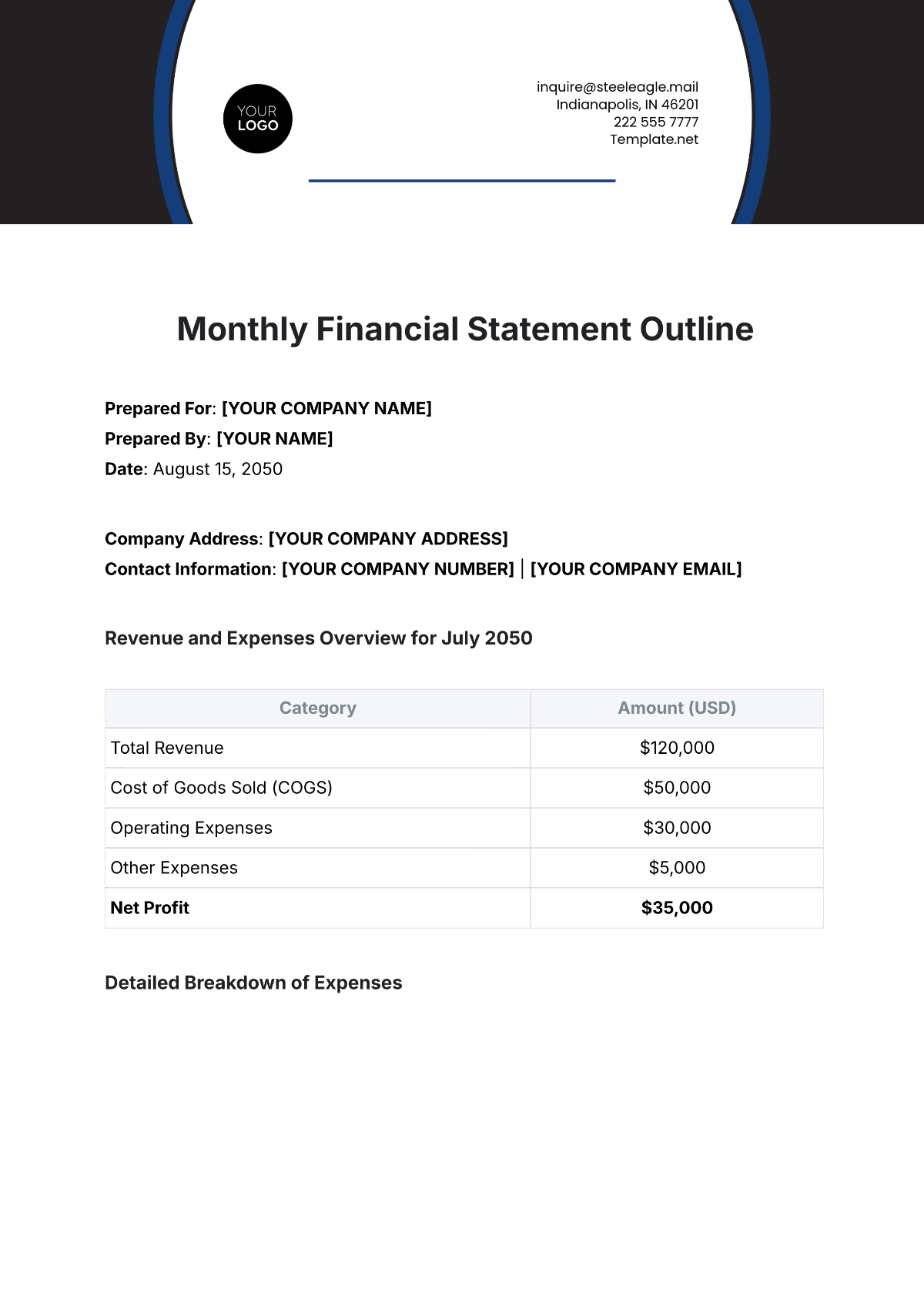

I. Summary Section

The summary section provides an overview of the restaurant’s financial performance for the month of January [Year].

Description | Amount ($) |

|---|---|

Total Revenue | [00,000] |

Total Expenses | [00,000] |

Net Profit/Loss | [00,000] |

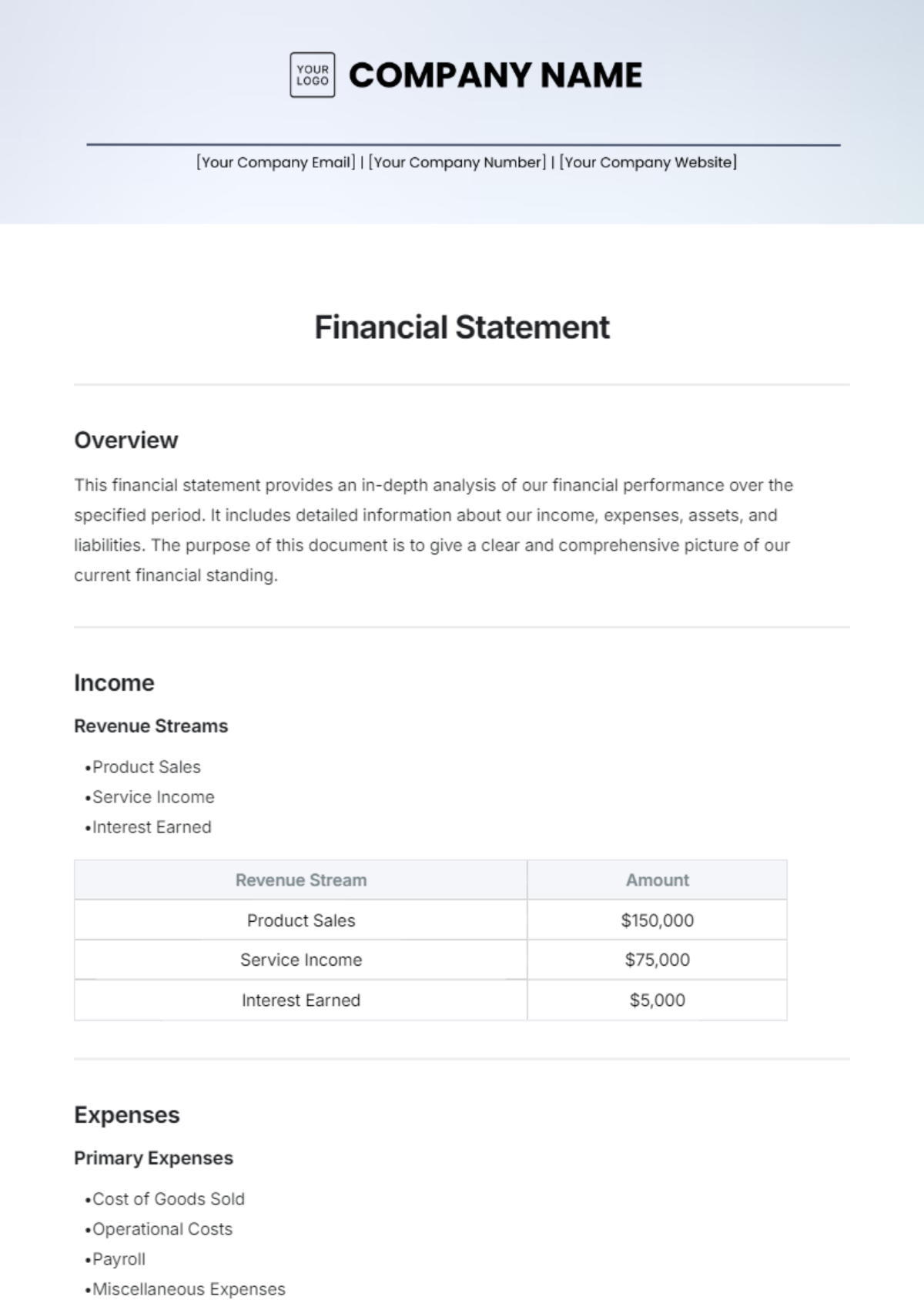

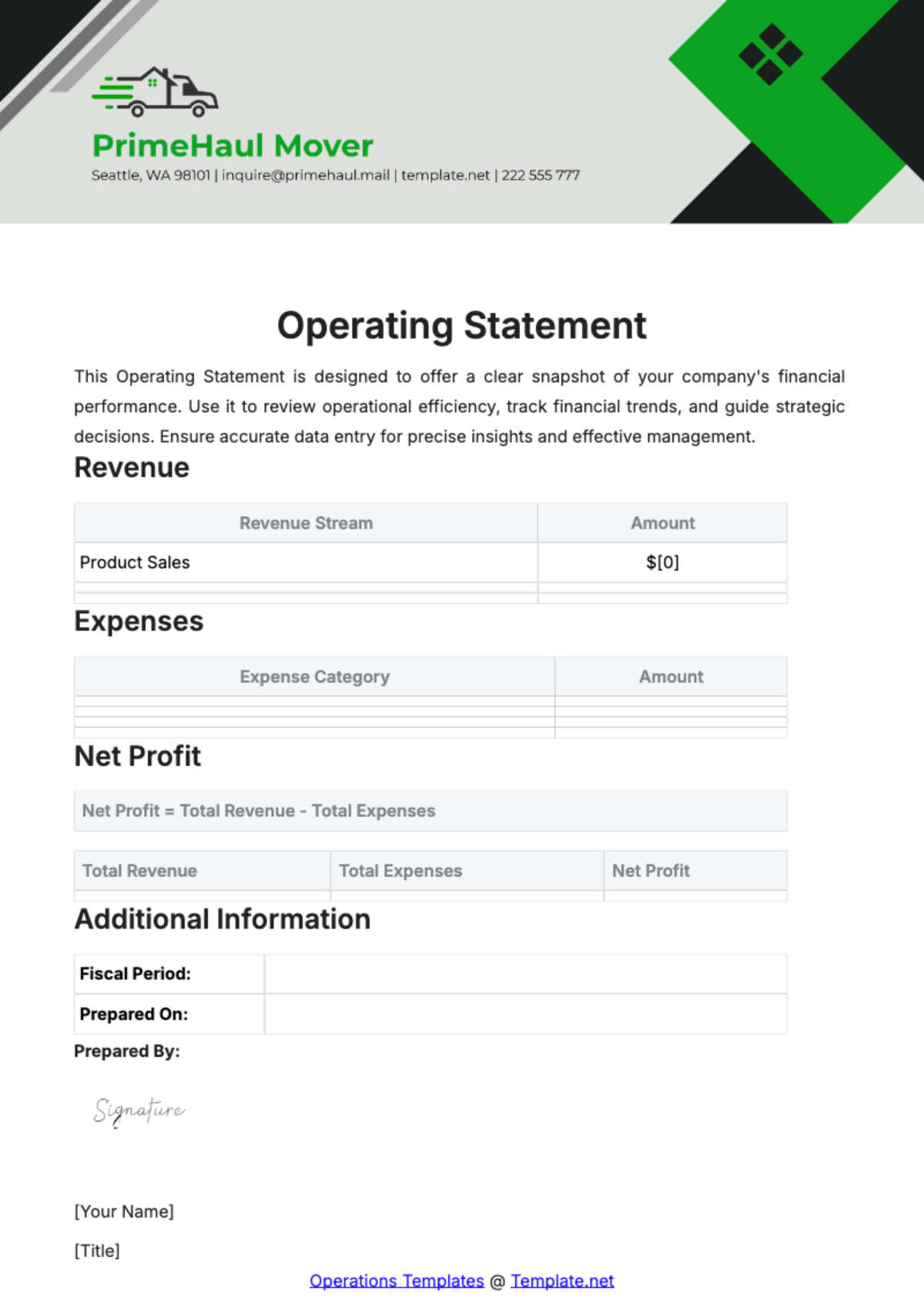

II. Detailed Expense Categories

This section breaks down the various expenses incurred during the month, categorized to provide a clear understanding of where money was spent.

A. Cost of Goods Sold (COGS)

COGS represents the direct costs attributable to the production of the food and beverages sold by the restaurant.

Item | Amount ($) |

|---|---|

Food Costs | |

Raw Ingredients | [00,000] |

Prepared Food Purchases | [00,000] |

Inventory Adjustments | [00,000] |

Beverage Costs | |

Alcoholic Beverages | [00,000] |

Non-Alcoholic Beverages | [00,000] |

Inventory Adjustments | [00,000] |

Total COGS | [00,000] |

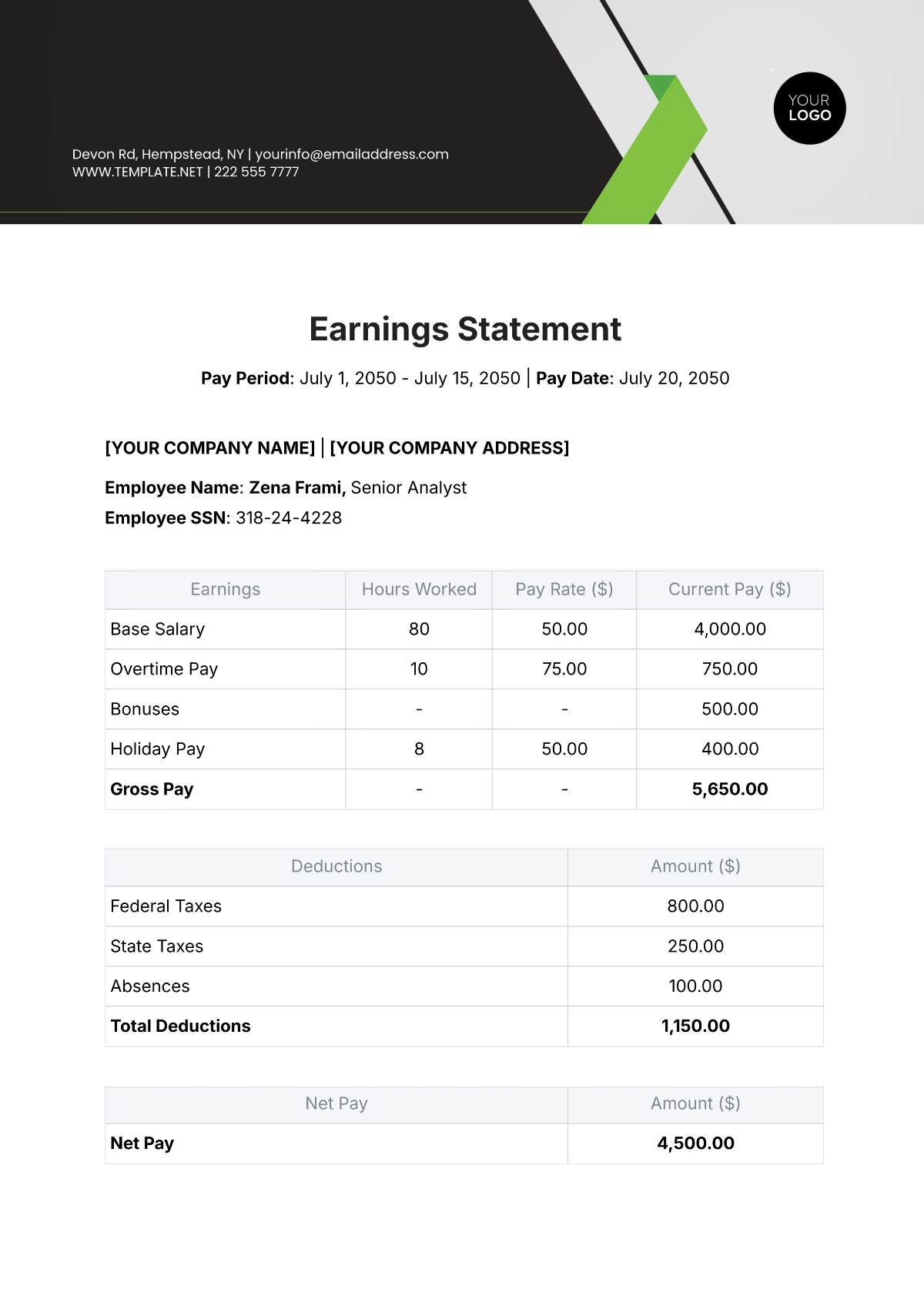

B. Labor Costs

Labor costs cover all employee-related expenses including wages, benefits, and payroll taxes.

Item | Amount ($) |

|---|---|

Salaries and Wages | |

Kitchen Staff | [00,000] |

Servers | [00,000] |

Bartenders | [00,000] |

Management | [00,000] |

Employee Benefits | |

Health Insurance | [00,000] |

Retirement Plans | [00,000] |

Other Benefits | [00,000] |

Payroll Taxes | |

Social Security | [00,000] |

Medicare | [00,000] |

Unemployment Taxes | [00,000] |

Total Labor Costs | [00,000] |

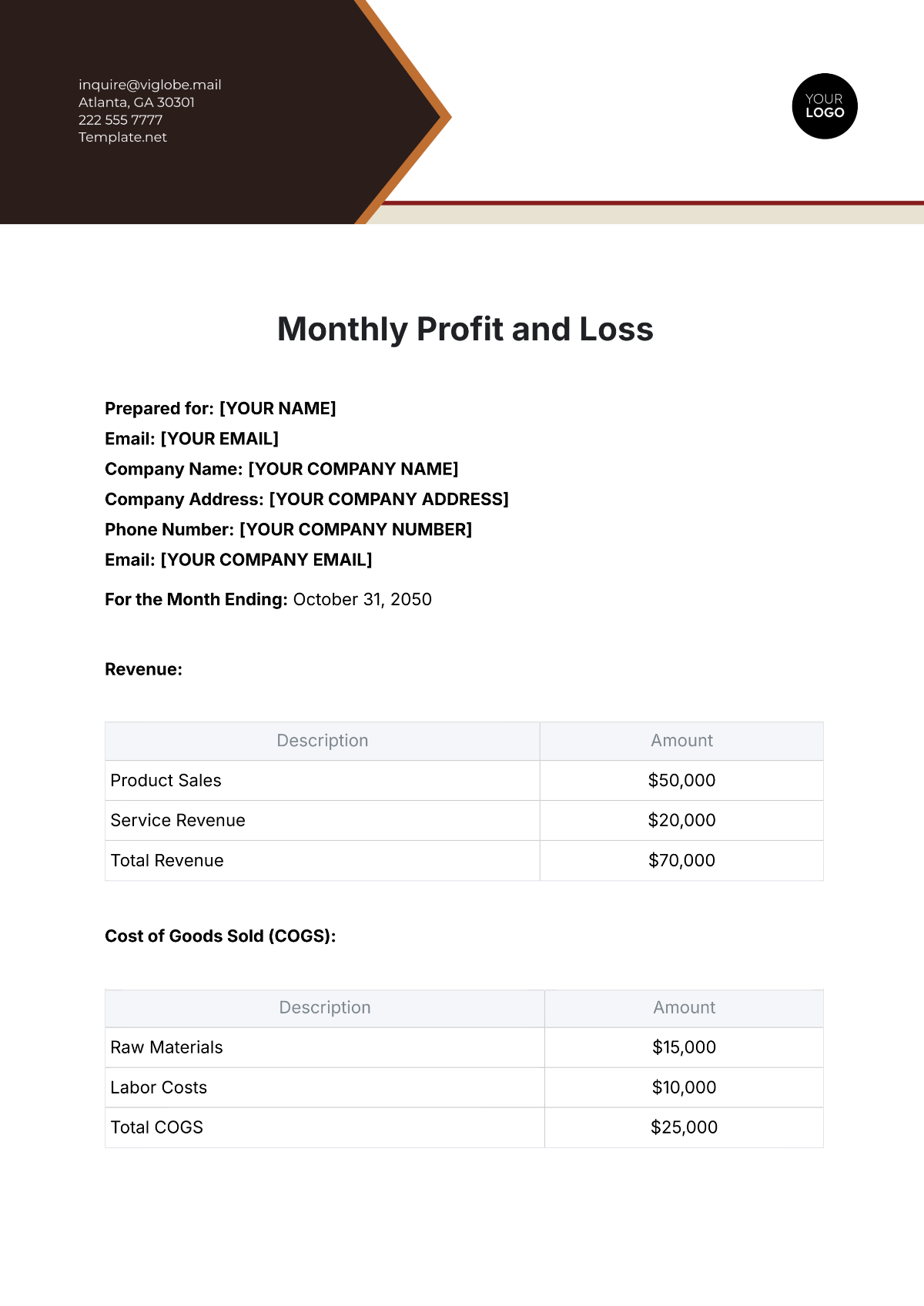

C. Operational Expenses

Operational expenses include costs associated with running the physical location and maintaining its operations.

Item | Amount ($) |

|---|---|

Rent or Mortgage | |

Rent | [00,000] |

Mortgage Payments | [00,000] |

Utilities | |

Electricity | [00,000] |

Water | [00,000] |

Gas | [00,000] |

Internet and Phone | [00,000] |

Insurance | |

General Liability | [00,000] |

Property Insurance | [00,000] |

Worker’s Compensation | [00,000] |

Maintenance and Repairs | |

Equipment Maintenance | [00,000] |

Facility Repairs | [00,000] |

Total Operational Expenses | [00,000] |

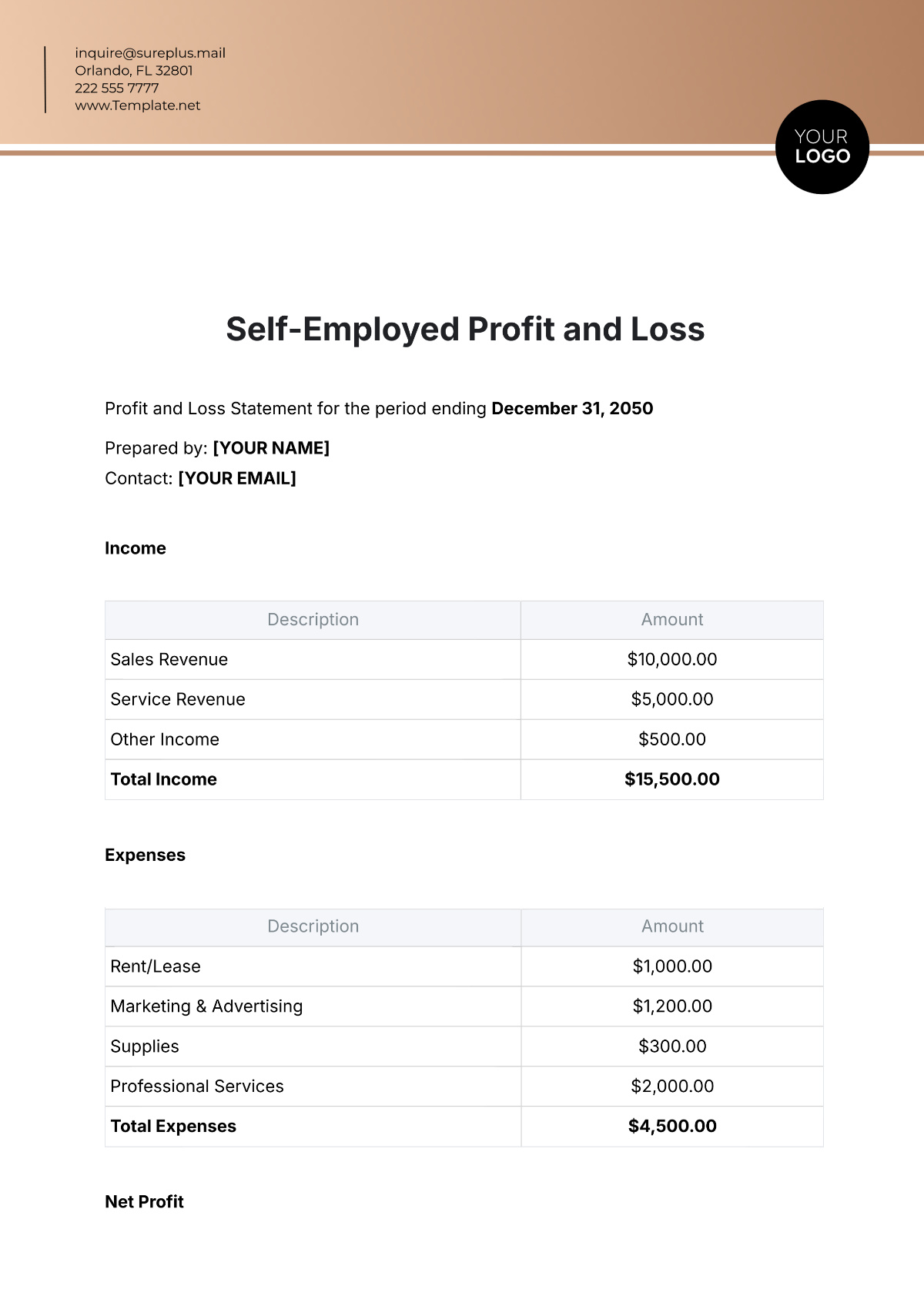

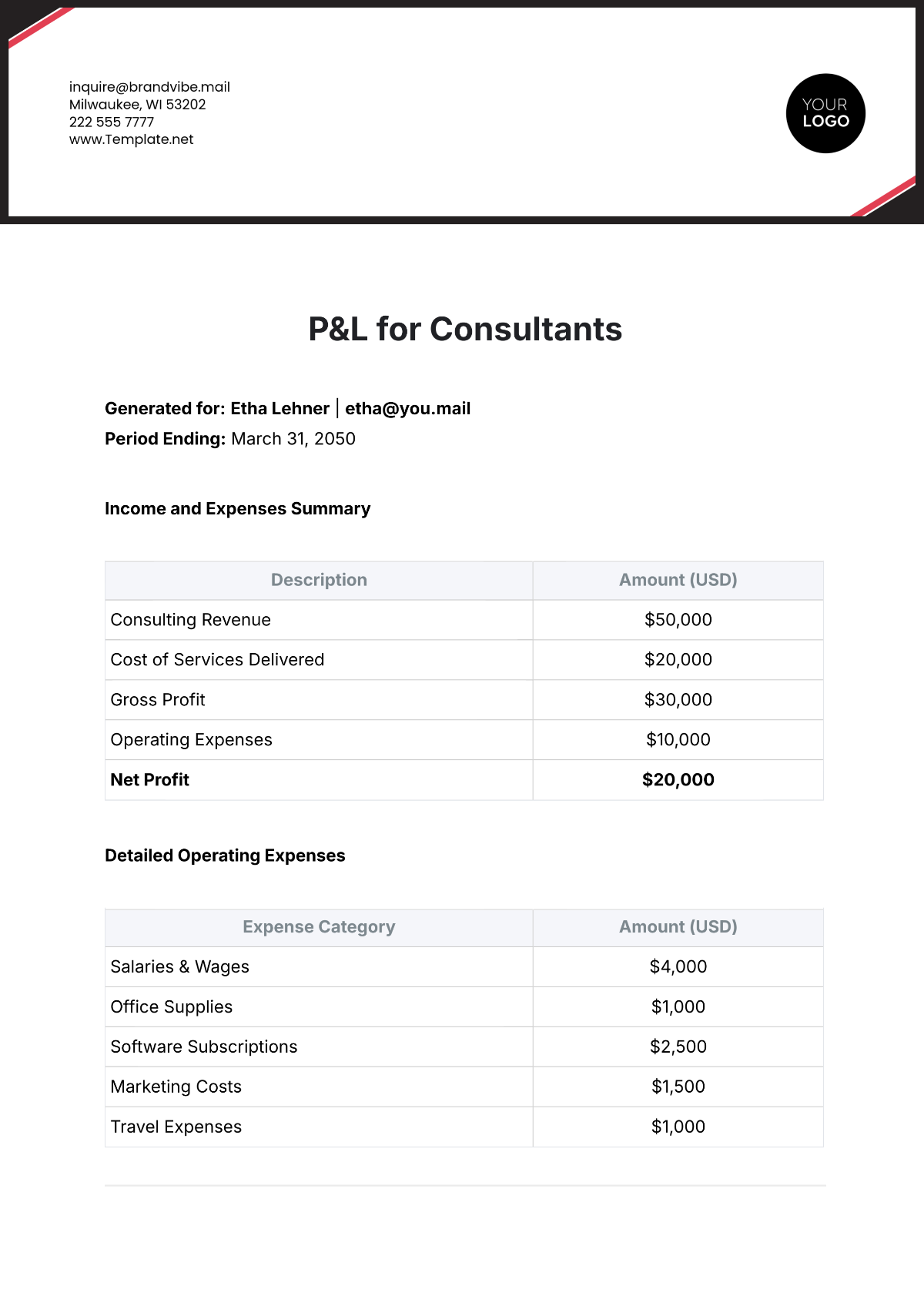

D. Administrative Expenses

Administrative expenses cover the costs associated with office operations and marketing efforts.

Item | Amount ($) |

|---|---|

Office Supplies | |

Stationery | [000] |

Computers | [000] |

Other Supplies | [000] |

Marketing and Advertising | |

Online Advertising | [000] |

Print Advertising | [000] |

Promotions | [000] |

Social Media Marketing | [000] |

Total Administrative Expenses | [0,000] |

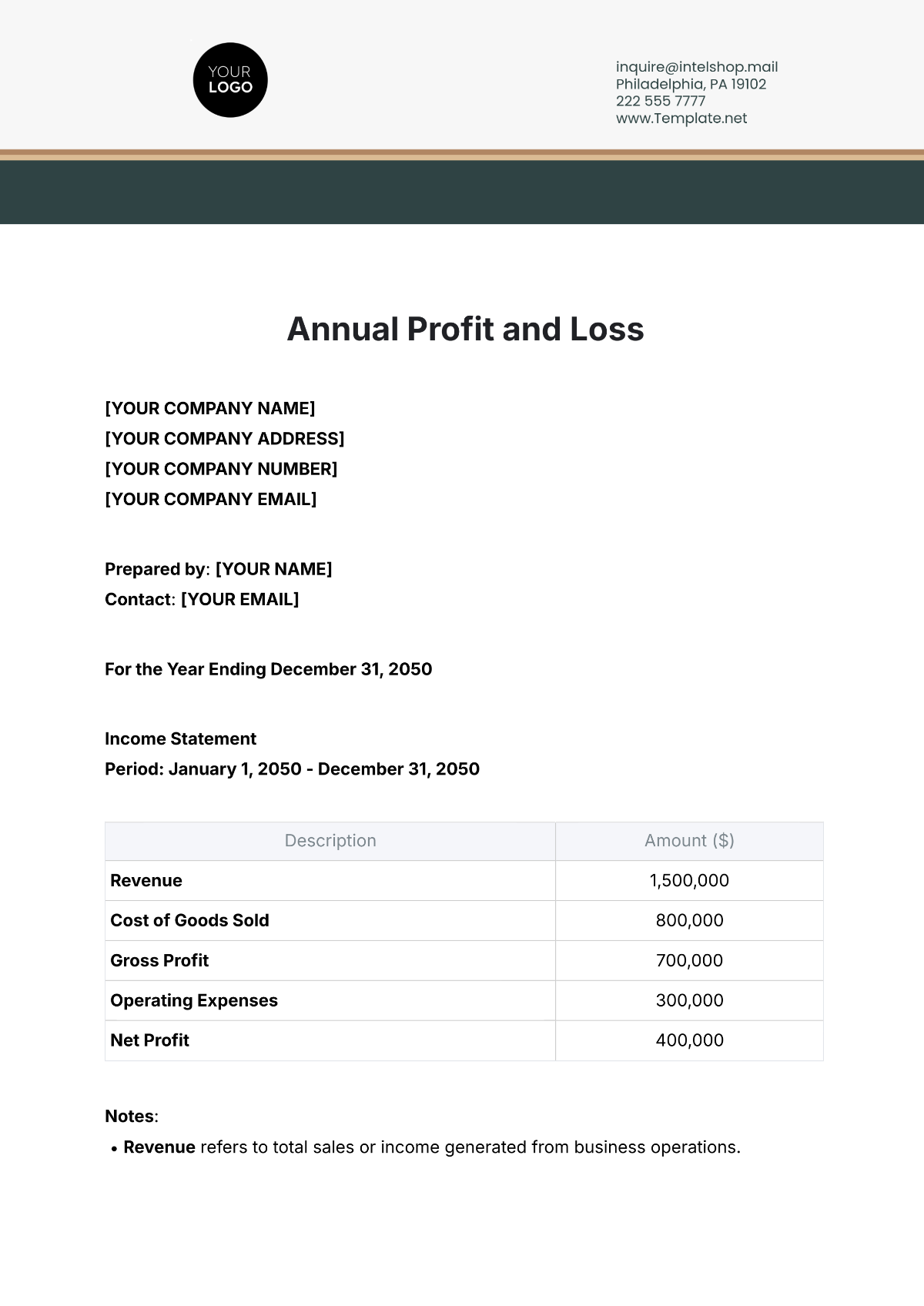

E. Other Expenses

This category includes miscellaneous expenses that don't fit into the other categories.

Item | Amount ($) |

|---|---|

Licenses and Permits | |

Health Permits | [000] |

Alcohol Licenses | [000] |

Business Licenses | [000] |

Professional Services | |

Accounting Services | [000] |

Legal Services | [000] |

Consulting | [000] |

Miscellaneous Expenses | |

Uniforms | [000] |

Staff Training | [000] |

Miscellaneous Supplies | [000] |

Total Other Expenses | [0,000] |

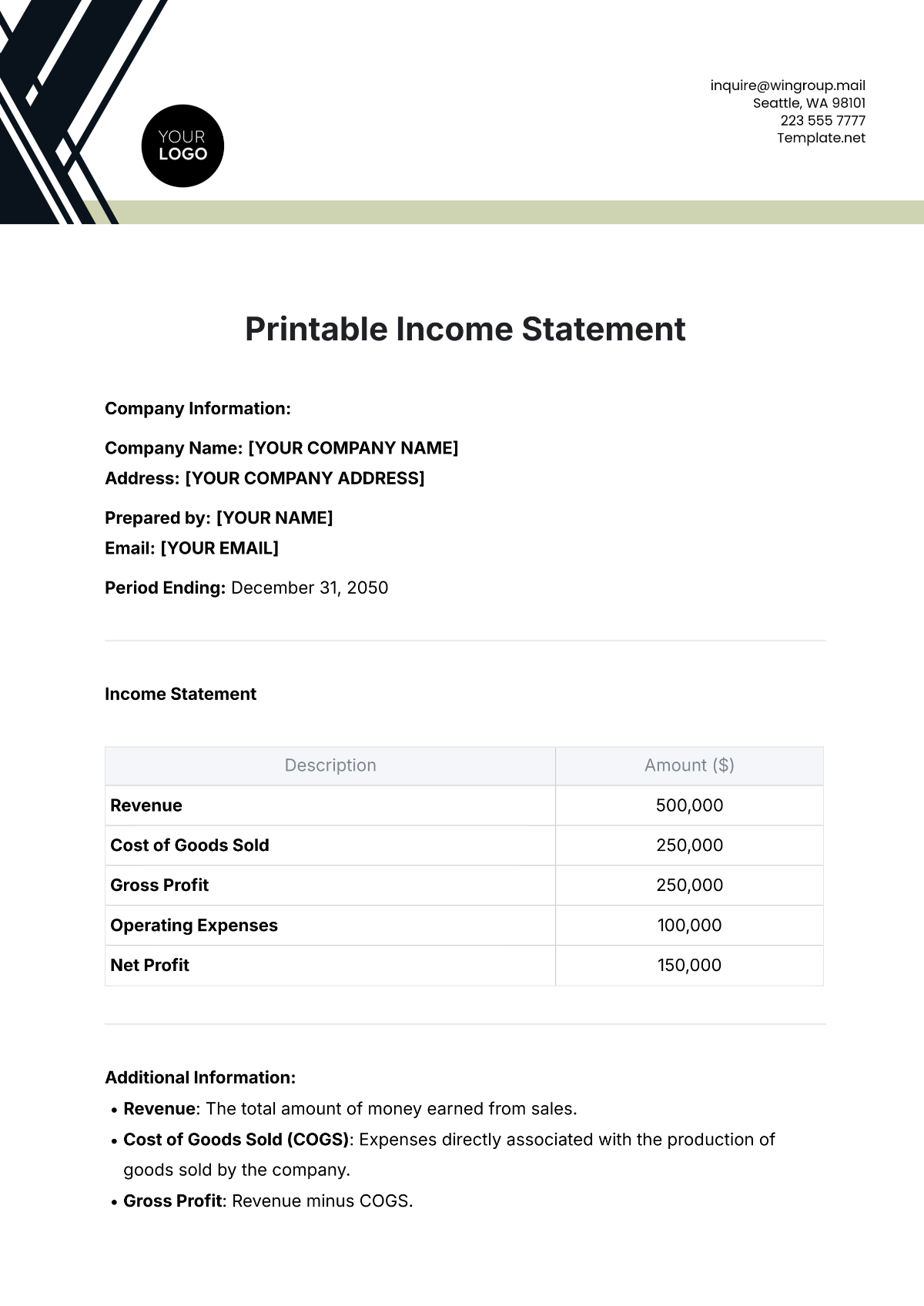

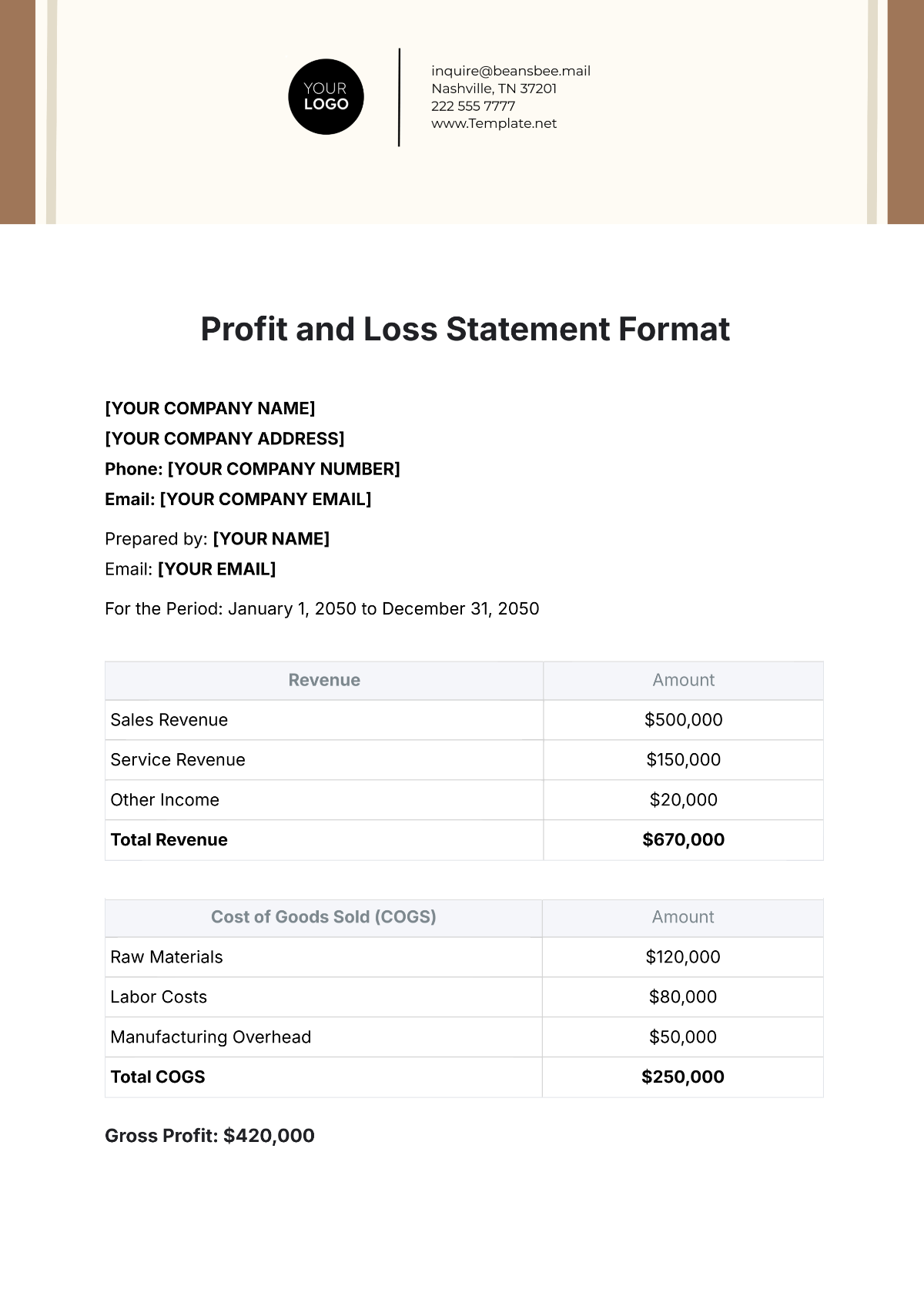

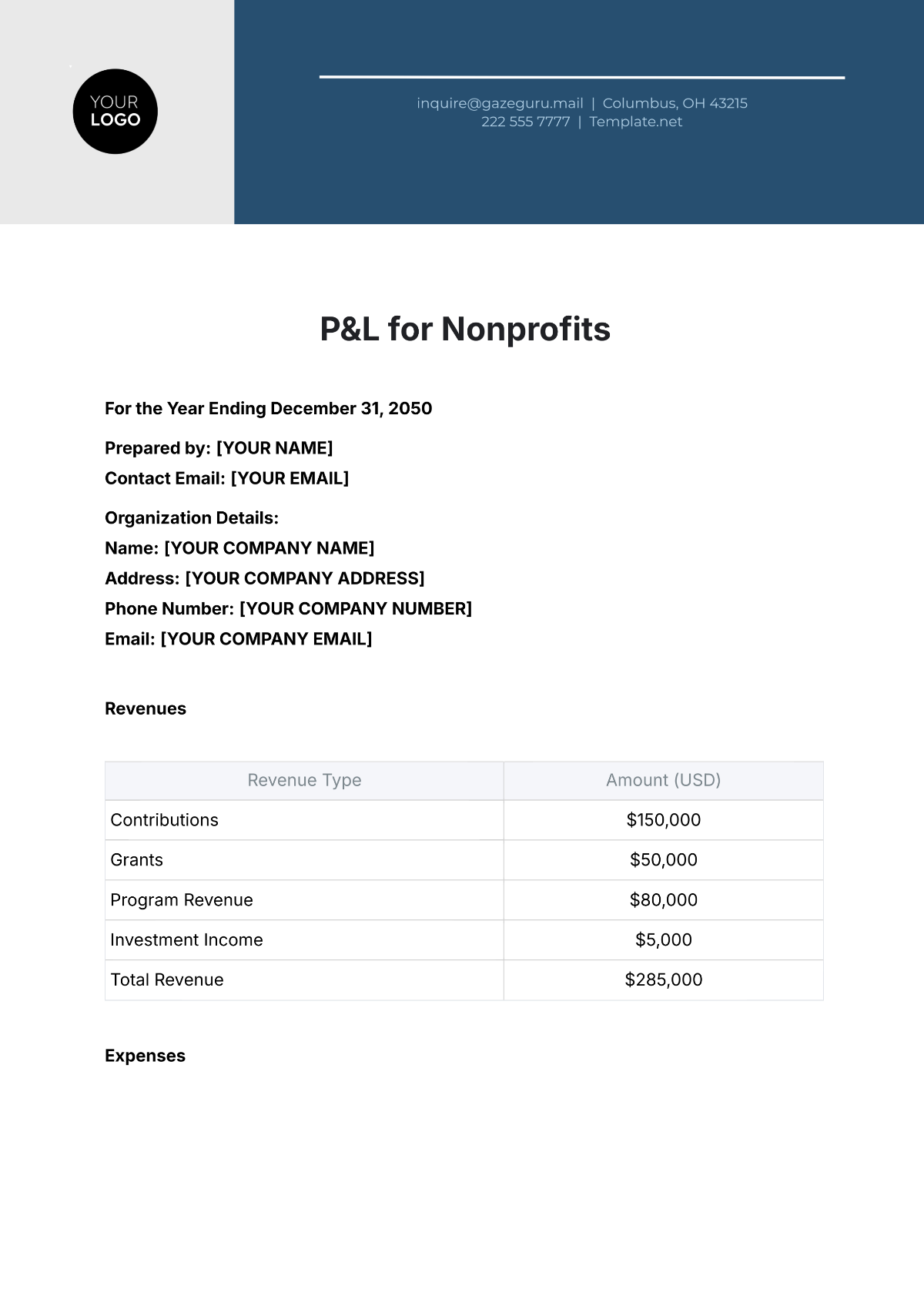

III. Monthly/Quarterly Comparisons

This section compares the financial performance over the last three months to identify trends and changes.

Month | Total Revenue ($) | Total Expenses ($) | Net Profit/Loss ($) |

|---|---|---|---|

January [Year] | [00,000] | [00,000] | [00,000] |

December [Year] | [00,000] | [00,000] | [00,000] |

November [Year] | [00,000] | [00,000] | [00,000] |

IV. Variance Analysis

Variance analysis explains significant differences between budgeted and actual figures.

Food Costs: Increased by 5% due to seasonal price hikes in ingredients, affecting overall food expenditure.

Labor Costs: Increased by 3% due to additional staff hired for the holiday season, impacting wage expenses.

Utilities: Increased by 2% due to higher usage during winter months, resulting in higher utility bills.

V. Recommendations

Recommendations are provided to help manage costs and improve financial performance.

Cost Control: Negotiate better rates with suppliers to reduce food costs and maintain profit margins.

Labor Management: Optimize staffing schedules to manage labor costs more effectively and avoid overstaffing.

Energy Efficiency: Implement energy-saving practices such as LED lighting and efficient appliances to reduce utility expenses.

VI. Appendix

Supporting documents provide detailed evidence and backup for the figures in the expense statement.

Invoices and Receipts: Detailed list attached for review and verification.

Inventory Count Sheets: Attached to show inventory levels and adjustments.

Payroll Summaries: Attached to provide detailed payroll information.

Utility Bills: Attached to support utility expenses recorded.

VII. Signatures

Verification and approval of the expense statement ensure accuracy and accountability.

Prepared By:

[Your Name]

[Your Job Title]

Approved By:

[Name]

Owner