Installment Payment Plan

I. Parties Involved

This Installment Payment Plan (the "Plan") is entered into between [Your Name], a financial institution or creditor, located at [Your Address], hereinafter referred to as the "Creditor," and [Debtor's Name], residing at [Debtor's Address], hereinafter referred to as the "Debtor," on the 20th Day of January 2050.

II. Overview

The Debtor acknowledges a debt owed to the Creditor, Greenbank Credit Union, in the amount of $5,000, resulting from a personal loan obtained on January 1, 2050, with an outstanding balance of $3,500 after previous payments. This debt originated from financial assistance to cover medical expenses incurred during an emergency surgery. Both parties agree to settle this debt through installment payments according to the terms outlined herein.

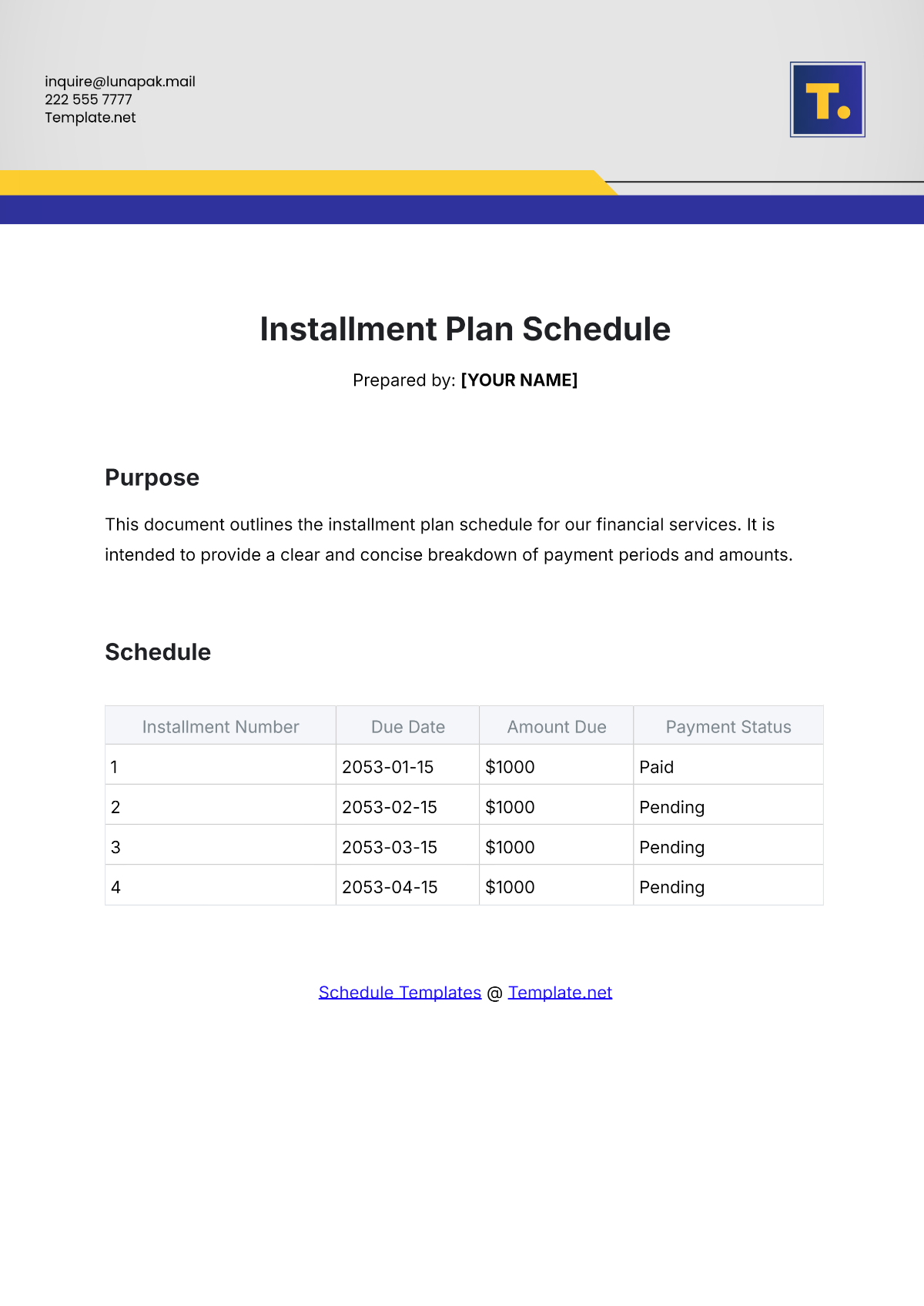

III. Payment Schedule

The Debtor agrees to make the following payments to the Creditor:

Payment Schedule | Details |

|---|---|

Installment Amount | $175 |

Frequency | Bi-weekly |

First Payment Due Date | June 1, 2050 |

Subsequent Payments Due Date | Every other Friday thereafter |

Number of Payments | 10 |

Total Amount of Payments | $1,750 |

IV. Payment Method

All payments shall be made via automatic bank transfer from the Debtor's checking account to the following account:

Account Name: [Account Name]

Account Number: 223436-75698

Bank Name: [Bank Name]

Routing Number: 4537-986

V. Late Payments

Should there be a delay in making a payment when it is due, the individual or entity responsible for the debt (referred to as the Debtor) will incur a penalty. This penalty entails a late payment fee of twenty-five dollars for each occurrence of such late payment. Moreover, it should be noted that allowing a payment to become overdue might also lead to an escalation in the interest rate applicable to the remaining balance of the debt.

VI. Default

If payments are not made following the terms specified in this Plan, it will be considered a default. Should a default occur, the Creditor will maintain the authority to engage in various legal actions aimed at recuperating any debts that remain unpaid. These actions include but are not limited to, initiating collections processes and reporting the default to credit reporting agencies.

VII. Modifications

Any alterations or amendments to this Plan require formal documentation in written form and must obtain mutual consent from both involved parties. Such modifications could potentially encompass adjustments to the timing of payments, alterations to the amount of each payment, or the renegotiation of the terms and conditions in response to unforeseen events or circumstances.

VIII. Governing Law

The provisions and stipulations of this Plan shall be interpreted and governed following the laws and regulations of the State of [State].

IX. Entire Agreement

This Plan embodies the complete and exclusive agreement between the parties concerning the repayment of the debt. It replaces and overrides all previous agreements or understandings between the parties, whether these were in written form or verbally agreed upon.

X. Signatures

Both parties acknowledge their understanding and agreement to the terms of this Installment Payment Plan by signing below:

[Your Name]

[Date]

[Debtor Name]

[Date]