Architecture Investment Memo

To: All Financial Department Members

From: [Your Name]

Date: [Date]

Subject: Strategic Investment Opportunities in the Architectural Sector

This memo provides a detailed analysis of strategic investment opportunities within the architectural sector that align with [Your Company Name]'s objectives to enhance our market position, drive innovation, and ensure sustainable growth. We have identified several potential projects and partnerships that could significantly benefit our portfolio and operational capabilities. The purpose of this memo is to outline these opportunities, along with a thorough assessment of the associated financial implications, competitive landscape, risks, and strategic recommendations.

Investment Objectives

The primary investment objectives are as follows:

Enhance Our Portfolio: Acquiring innovative projects or entering partnerships that bring new design philosophies and technologies that can elevate our current service offerings.

Optimize Operational Efficiencies: Investing in technologies or methodologies that streamline our project execution processes, reduce costs, and improve project delivery timelines.

Expand Market Reach: Targeting investments that open up new geographical areas or sectors within the architectural industry, broadening our client base.

Drive Sustainable Growth and Long-Term Profitability: Focusing on investments that promise not only immediate returns but also contribute to the long-term strategic goals of the firm.

Investment Options

We are currently evaluating the following investment opportunities:

Project A:

Description: A high-rise commercial development in [City/Location].

Financial Implications: Estimated initial capital of $5 million with a forecasted ROI of 12% over five years.

Risks: Market fluctuations, regulatory changes, and potential construction delays.

Projected Returns: High potential in rental income and property value appreciation.

Project B:

Description: Renovation of historical properties for luxury residential use.

Financial Implications: Initial investment of $3 million with an expected ROI of 15% over three years.

Risks: Historical preservation restrictions and potential cost overruns.

Projected Returns: Premium pricing due to historical significance and prime location.

Partnership C:

Description: Collaborative venture with [Tech Company] to integrate smart technology into sustainable housing projects.

Financial Implications: Capital input of $4 million with a projected ROI of 20% over four years.

Risks: Technological adaptability issues and market acceptance.

Projected Returns: Long-term gains from leading the market in smart, sustainable living solutions.

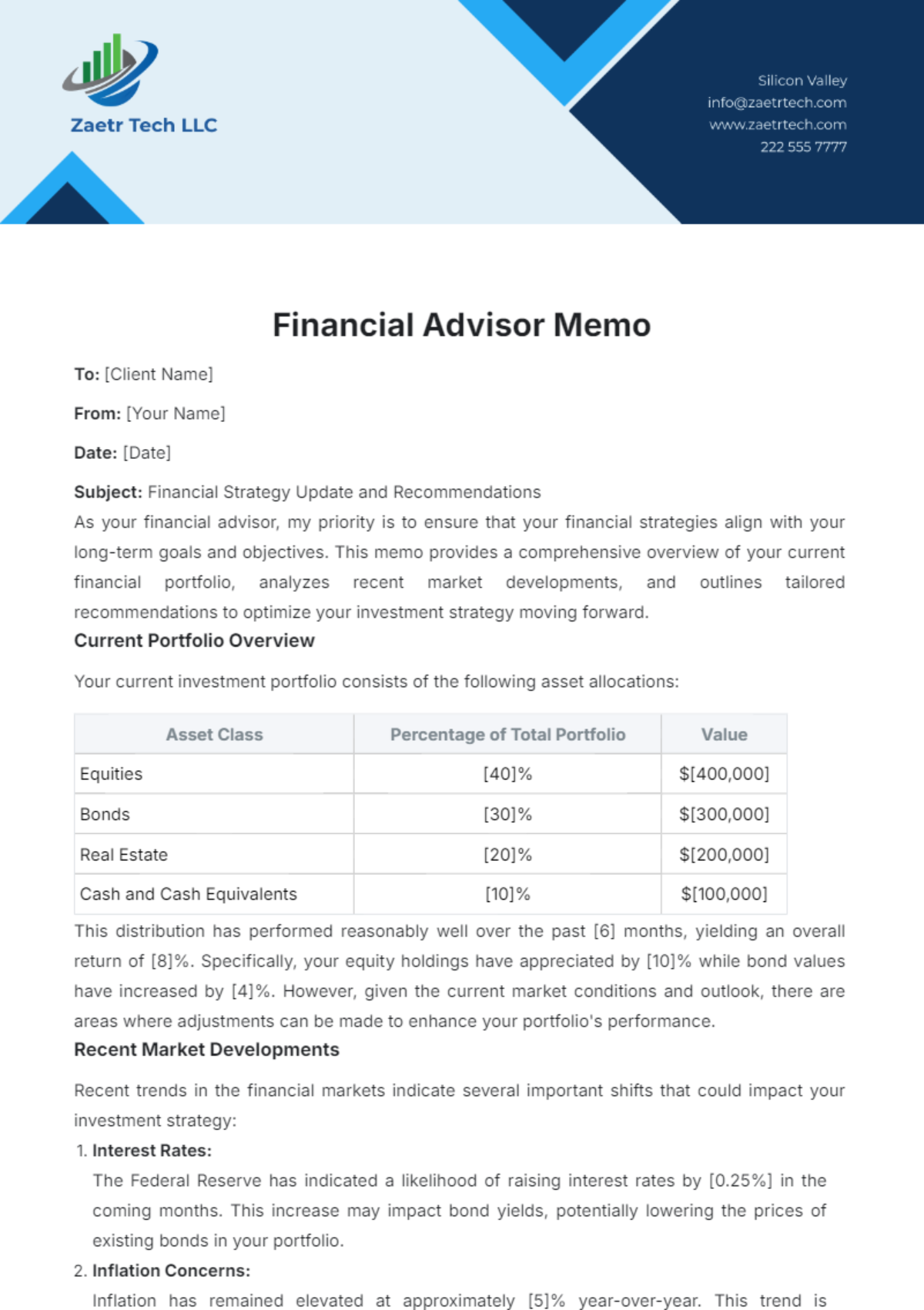

Financial Implications

Detailed financial analysis for each investment option is as follows:

Investment Option | Initial Capital | Annual Maintenance | Projected Returns |

|---|---|---|---|

Project A | $5 million | $200,000 | 12% ROI over 5 years |

Project B | $3 million | $150,000 | 15% ROI over 3 years |

Partnership C | $4 million | $250,000 | 20% ROI over 4 years |

Competitive Landscape

The investments proposed position [Your Company Name] advantageously relative to our competitors. Notable industry players include:

Competitor 1: Focuses primarily on commercial projects in urban areas. Lacks in sustainable and smart building solutions.

Competitor 2: Specializes in residential developments but has not ventured into historical renovations.

Industry Trends: Increasing demand for smart, sustainable living environments and the revitalization of historical sites.

Risk Assessment

Risks associated with these investments include:

Financial Risks: Market volatility affecting real estate values and investment liquidity.

Operational Risks: Challenges in project execution, potentially leading to delays and budget overruns.

Market Risks: Changes in client preferences and potential economic downturns affecting real estate investment.

Recommendations

Based on the analysis provided, the following recommendations are made for informed decision-making:

Primary Recommendation: Proceed with Project A for its high potential in a growing commercial sector.

Secondary Recommendation: Explore further the feasibility of Partnership C, focusing on its long-term benefits in technology integration.

Additional Action: Maintain a close watch on market trends and adjust strategies accordingly to remain competitive and innovative.

This Architecture Investment Memo serves as a comprehensive guide for the executive team to make well-informed decisions that will drive sustainable growth and long-term profitability for [Your Company Name]. For any questions or further discussion, please contact me at [Your Company Email].

Regards,

[Your Name]

[Your Job Title]

[Your Company Name]