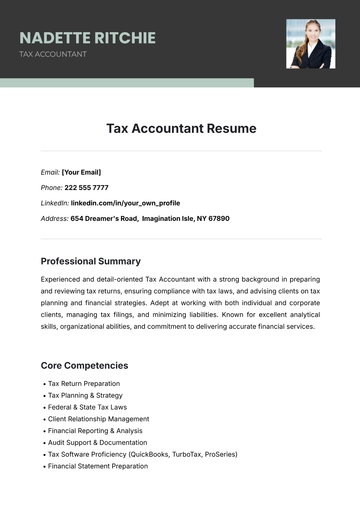

Free Tax Accountant Resume

Email: [Your Email]

Phone: 222 555 7777

LinkedIn: linkedin.com/in/your_own_profile

Address: 654 Dreamer's Road, Imagination Isle, NY 67890

Professional Summary

Experienced and detail-oriented Tax Accountant with a strong background in preparing and reviewing tax returns, ensuring compliance with tax laws, and advising clients on tax planning and financial strategies. Adept at working with both individual and corporate clients, managing tax filings, and minimizing liabilities. Known for excellent analytical skills, organizational abilities, and commitment to delivering accurate financial services.

Core Competencies

Tax Return Preparation

Tax Planning & Strategy

Federal & State Tax Laws

Client Relationship Management

Financial Reporting & Analysis

Audit Support & Documentation

Tax Software Proficiency (QuickBooks, TurboTax, ProSeries)

Financial Statement Preparation

Regulatory Compliance

Excel & Spreadsheet Management

Professional Experience

Tax Accountant

ABC Accounting Firm | City, State

January 2053 – Present

Prepare and review individual and corporate tax returns, ensuring full compliance with federal, state, and local tax regulations.

Advise clients on tax-saving strategies, including deductions, credits, and tax-efficient investment plans.

Review financial records to identify discrepancies and recommend adjustments for tax planning.

Assist clients with IRS audits, providing support in document preparation and representation.

Conduct thorough research on changing tax laws and regulations to keep clients informed and compliant.

Provide clients with timely, clear, and actionable tax reports to guide their financial decisions.

Junior Tax Accountant

XYZ Financial Services | City, State

June 2050 – December 2052

Assisted senior accountants in preparing tax returns for individuals and small businesses.

Ensured accurate record-keeping and documentation of all financial transactions.

Supported clients during the tax filing process, helping with tax form completion and submission.

Provided general tax advice to clients on simple tax matters, including deductions and credits.

Managed a variety of tax-related inquiries and maintained up-to-date client files.

Education

Bachelor of Science in Accounting

University of State | City, State

Graduated: May 2050

Certifications & Licenses

Certified Public Accountant (CPA) – 2050

Enrolled Agent (EA) – May 2050

Technical Skills

Tax Software: Proficient in QuickBooks, TurboTax, ProSeries

Microsoft Office Suite: Advanced Excel, Word, PowerPoint

Accounting Software: SAP, Xero

Tax Research: Thomson Reuters Checkpoint, Bloomberg Tax

Professional Memberships

American Institute of Certified Public Accountants (AICPA)

National Association of Tax Professionals (NATP)

Additional Information

Languages: Fluent in English and Spanish.

Professional Development: Regular participation in tax-related workshops and webinars.

Volunteer Work: Volunteer Tax Preparer for the VITA program.

Awards: 2052 "Tax Professional of the Year" – NATP.

Community Involvement: Active member of the local Chamber of Commerce.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Tax Accountant Resume Template from Template.net. This customizable, downloadable, and printable template is your key to creating a polished resume tailored to your expertise. With the ability to edit in our AI Editor Tool, you have full control to showcase your skills and experience effectively. Streamline your job search and impress potential employers with a professional resume that speaks volumes about your capabilities.

You may also like

- Simple Resume

- High School Resume

- Actor Resume

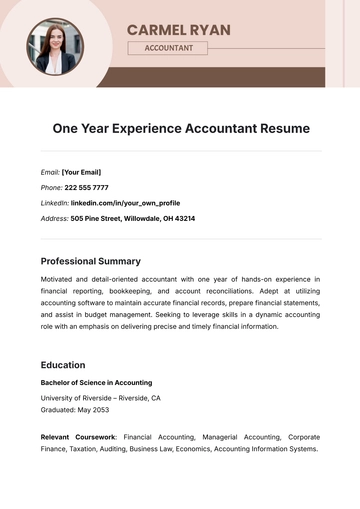

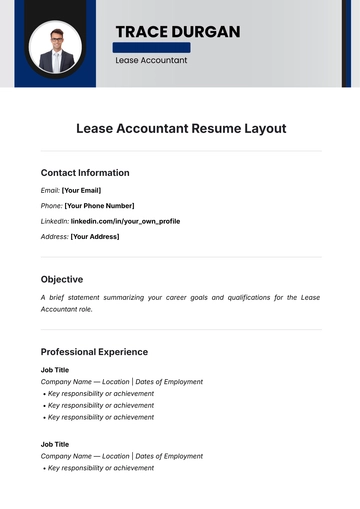

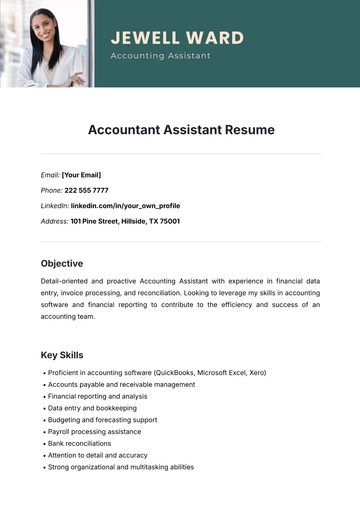

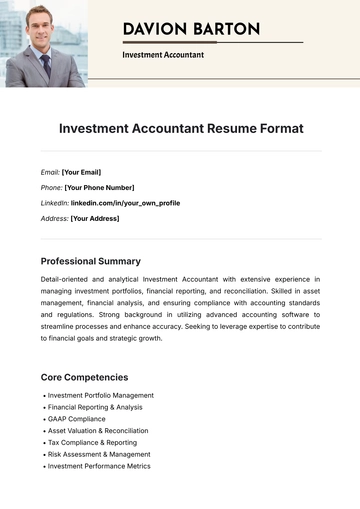

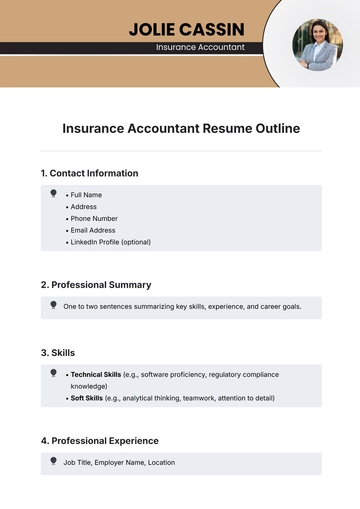

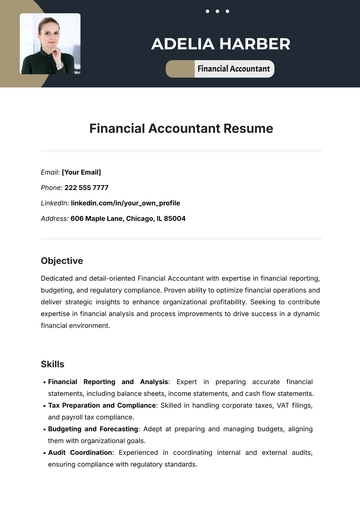

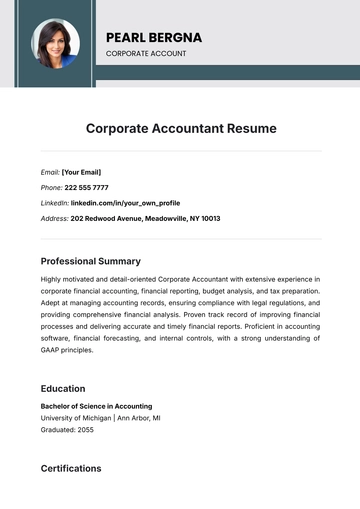

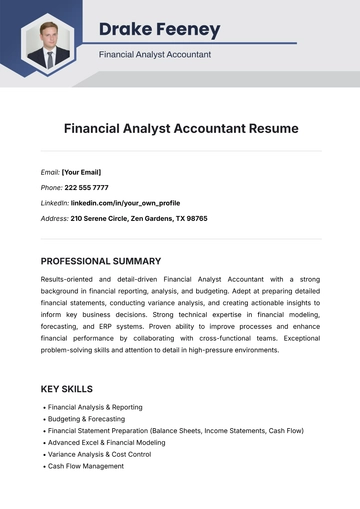

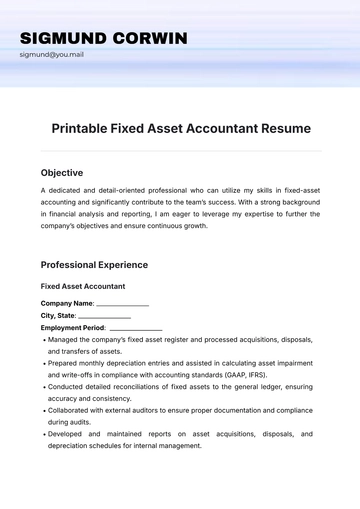

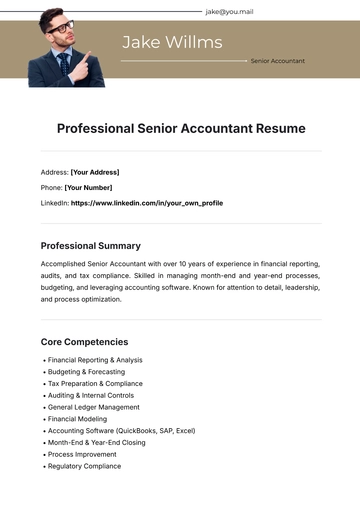

- Accountant Resume

- Academic Resume

- Corporate Resume

- Infographic Resume

- Sale Resume

- Business Analyst Resume

- Skills Based Resume

- Professional Resume

- ATS Resume

- Summary Resume

- Customer Service Resume

- Software Engineer Resume

- Data Analyst Resume

- Functional Resume

- Project Manager Resume

- Nurse Resume

- Federal Resume

- Server Resume

- Administrative Assistant Resume

- Sales Associate Resume

- CNA Resume

- Bartender Resume

- Graduate Resume

- Engineer Resume

- Data Science Resume

- Warehouse Resume

- Volunteer Resume

- No Experience Resume

- Chronological Resume

- Marketing Resume

- Executive Resume

- Truck Driver Resume

- Cashier Resume

- Resume Format

- Two Page Resume

- Basic Resume

- Manager Resume

- Supervisor Resume

- Director Resume

- Blank Resume

- One Page Resume

- Developer Resume

- Caregiver Resume

- Personal Resume

- Consultant Resume

- Administrator Resume

- Officer Resume

- Medical Resume

- Job Resume

- Technician Resume

- Clerk Resume

- Driver Resume

- Data Entry Resume

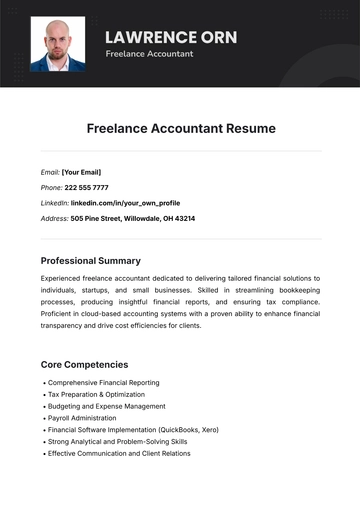

- Freelancer Resume

- Operator Resume

- Printable Resume

- Worker Resume

- Student Resume

- Doctor Resume

- Merchandiser Resume

- Architecture Resume

- Photographer Resume

- Chef Resume

- Lawyer Resume

- Secretary Resume

- Customer Support Resume

- Computer Operator Resume

- Programmer Resume

- Pharmacist Resume

- Electrician Resume

- Librarian Resume

- Computer Resume

- IT Resume

- Experience Resume

- Instructor Resume

- Fashion Designer Resume

- Mechanic Resume

- Attendant Resume

- Principal Resume

- Professor Resume

- Safety Resume

- Waitress Resume

- MBA Resume

- Security Guard Resume

- Editor Resume

- Tester Resume

- Auditor Resume

- Writer Resume

- Trainer Resume

- Advertising Resume

- Harvard Resume

- Receptionist Resume

- Buyer Resume

- Physician Resume

- Scientist Resume

- 2 Page Resume

- Therapist Resume

- CEO resume

- General Manager Resume

- Attorney Resume

- Project Coordinator Resume

- Bus Driver Resume

- Cook Resume

- Artist Resume

- Pastor Resume

- Recruiter Resume

- Team Leader Resume

- Apprentice Resume

- Police Resume

- Military Resume

- Personal Trainer Resume

- Contractor Resume

- Dietician Resume

- First Job Resume

- HVAC Resume

- Psychologist Resume

- Public Relations Resume

- Support Specialist Resume

- Computer Technician Resume

- Drafter Resume

- Foreman Resume

- Underwriter Resume

- Photo Resume

- Teacher Resume

- Modern Resume

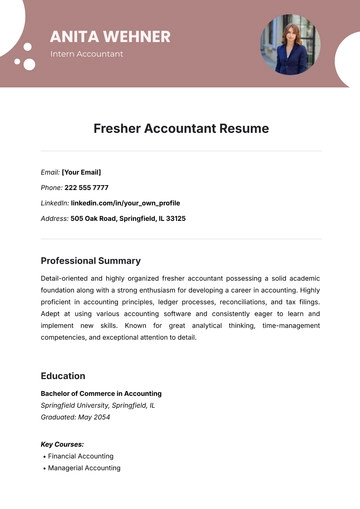

- Fresher Resume

- Creative Resume

- Internship Resume

- Graphic Designer Resume

- College Resume